Struggling to track your money?

Most people feel lost when they look at their bank accounts.

It is stressful to wonder where your cash went every month.

Without a plan, you might never reach your savings goals.

But you do not have to stay confused. Learning how to use Quicken can change everything.

It organizes your bills and spending in one simple place.

Our guide makes it easy to set up your account today.

Stop guessing and start winning with your money right now!

Ready to join over 20 million people who have used Quicken to take control of their money? Users who track their finances can see a 15% increase in their savings within the first year. Don’t leave your financial future to chance.

Quicken Tutorial

Setting up your software is the first big step.

First, link your bank accounts to see all your transactions.

Next, create categories for your spending, like groceries or rent.

This helps you see where money goes.

Finally, set a monthly budget to keep your savings on track.

How to use Debt Management

Getting out of debt is just as important as investing.

High-interest debt eats away at your assets and limits your ability to build wealth.

Using the tools in this software, you can gain total control over your money.

This section covers the basics of managing your liabilities so you can look forward to a brighter financial future.

Step 1: Add All Your Loans and Cards

To get a clear picture of your finances, you must input every debt.

Do not skip this step; your plan won’t work otherwise.

- Log in to the desktop version of the software on your device.

- Select the “Property & Debt” tab to find the right features.

- Use your passwords to connectto loans, credit cards, and mortgage accounts via the web.

- Additionally, you can manually enter debts from family or personal sources that aren’t online.

Once you sign in and link everything, the system will automatically download your gegevens.

This puts all your information right at your fingertips.

Step 2: Set Up the Debt Reduction Planner

Now that your data is ready, you can use the built-in planner.

This task is straightforward and helps customers save thousands in interest.

- Find the “Planning” tab and select “Debt Reduction.”

- Customize your plan by choosing which debts to pay first, for example, the one with the highest interest rate.

- Adjust your preferences to see how adding just $1 a month changes things.

- Recognize that market rates change, so check your loan terms here.

If you are confused, many users watch online videos to learn how to set this up.

It creates a path to cancel out your debt faster.

Step 3: Visualize Your Payoff Date

Seeing the finish line gives you the confidence to keep going.

The software generates a graph that can transform how you feel about money.

- Look at the graph to see your estimated debt-free date.

- See how reducing purchasing and expenses can speed up the timeline, perhaps aiming to be debt-free by next March.

- Compare different versions of your plan to see which one best fits your life.

This visual aid gives you the introduction to a debt-free life you need to stay motivated.

Step 4: Monitor Monthly Progress

You need to check in regularly. You can generated reports to track your progress.

- Check your dashboard monthly to see your balances drop.

- File away or delete old accounts from the view once they are fully paid off.

- Use the reports tab to ensure you aren’t slipping back into old habits.

Checking these numbers improves your market knowledge and financial health.

If you successfully manage this, you will have more cash for investing later.

How to use Investment Tracking

Investing is a massive part of securing your financial future.

If you leave your money scattered across different websites, you might miss important details.

Making Quicken the center of your financial life helps you see the big picture.

This section of our complete guide will show you exactly how to track your stocks and retirement funds.

Step 1: Link Your Brokerage Accounts

You need to get your data into the software first.

This is much easier than typing everything by hand on your computer.

- Sign in to the software and look for the home tab or the specific “Investments” tab.

- Click “Add Account,” then type the name of your brokerage firm, such as Vanguard or Fidelity.

- Enter your username and password to activate Quicken connections with that bank.

- Allow the software a moment to sync your data.

Many users find that automating this step saves hours of work every month.

Step 2: Review Your Portfolio View

Now that your data is there, you need to understand what you own.

This view helps you manage your daily performance.

- Go to the “Portfolio” section inside the Investments tab.

- Look at the “Day Change” column to see how much money you made or lost today.

- Sort your holdings by value to see where most of your money is sitting.

- Check this weekly to stay on top of your personal finances.

People found this helpful because it direct shows which stocks are performing best without having to log in to five different websites.

Step 3: Analyze Your Asset Allocation

It is risky to have all your money in one place. You need to mix it up to keep your portfolio safe.

- Click on the “Allocation” tab to see a visual breakdown.

- Look at the pie chart to see how much you have in stocks, bonds, or cash.

- Check whether you have too much money in a single sector.

- Use this information to rebalance your investments if things look lopsided.

Step 4: Track Investment Income

You want to know how much cash your investments generate.

This includes dividends and interest that count as income.

- Navigate to the “Income” view in the dashboard.

- Check that your dividend payments are showing up correctly.

- Verify that any automatic reinvestments are recorded properly.

- Use Quicken reports to see your total investment earnings for the year.

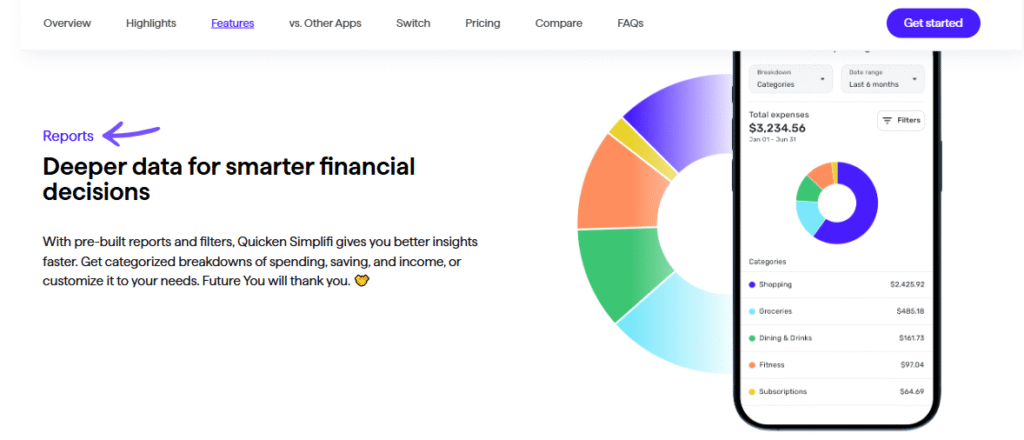

How to use Financial Reporting

Rapportage is where you gain real power over your money.

While tracking expenses is great, analyzing them lets you improve.

Customers who use these features often feel more confidence in their choices.

This section explains the basics of turning data into straightforward answers on your desktop or web device.

Step 1: Access the Reports Center

Finding the right data is the first task. These tools are powerful but easy to find.

- Click on the “Reports” menu to see all available options.

- Select “Banking” to view details on cash and loans.

- Additionally, you can find reports on your market portfolio performance.

- This gives you a clear introduction to where your money is going.

Step 2: Customize Your Date Range

You do not need to see everything at once.

You can customize the view to focus on what matters right now.

- Click “Edit” to change the time frame, for example, viewing data only from March to the present.

- Set your preferences to skip irrelevant categories.

- Identify incorrect transactions and fix them.

- You can even delete or cancel specific filters to broaden your search.

Step 3: Create a Spending Graph

Visuals can transform how you see your budget.

Having this data at your fingertips helps you spot bad habits fast.

- Select the “Spending” tab to see a visual pie chart.

- Hover over slices to see every dollar spent on purchasing.

- Use this to check if you are in control of your budget before the due date.

- Some users learn tricks from online videos to make these graphs even better.

Step 4: Export and Share

Sometimes you need to export your data from the software.

Whether you use different versions of the software or need to share with a pro, this step is vital.

- Click on the icon to download the report as a PDF or Excel file.

- This is useful if you use Quicken Simplifi or the Quicken mobile app and need a hard copy.

- Sharing this with a financial advisor can help improve your credit scores.

- Watch your savings grow as you master these tools.

Alternatives to Quicken

Als Quicken niet de ideale oplossing lijkt, zijn er andere alternatieven voor Quicken die u kunt overwegen voor het beheren van uw geld:

- Puzzel IO: Deze software richt zich op AI-gestuurde financiële planning.

- Dext: Deze tool is uitstekend geschikt voor het vastleggen van documenten en het extraheren van gegevens.

- Xero: Dit is een populair online boekhoudprogramma voor kleine bedrijven.

- Synder: Het is gespecialiseerd in het synchroniseren van e-commerce- en betalingsgegevens met boekhoudsoftware.

- Gemakkelijke maandafsluiting: Deze software is ontworpen om uw financiële taken aan het einde van de maand te stroomlijnen.

- Docyt: Het maakt gebruik van kunstmatige intelligentie voor de boekhouding en automatiseert financiële werkprocessen.

- Verstandig: Dit is een compleet softwarepakket voor bedrijfsvoering en boekhouding.

- Zoho Boeken: Deze online boekhoudtool staat bekend als betaalbaar en zeer geschikt voor kleine bedrijven.

- Golf: Deze optie biedt gratis boekhoudsoftware voor kleine bedrijven.

- Hubdoc: Het is gespecialiseerd in het vastleggen en ordenen van financiële documenten voor de boekhouding.

- Onkosten maken: Deze app is gericht op onkostenbeheer, waardoor het eenvoudig is om bonnetjes bij te houden en in te dienen.

- QuickBooks: Een zeer bekend boekhoudprogramma dat bedrijven helpt met alles, van facturering tot salarisadministratie.

- AutoEntry: Deze tool automatiseert de gegevensinvoer door documenten zoals facturen en bonnen te scannen en te analyseren.

- FreshBooks: Deze software is speciaal ontwikkeld voor freelancers en kleine bedrijven, met een focus op facturering en urenregistratie.

- NetSuite: Een krachtige en complete cloudgebaseerde bedrijfsbeheersuite voor grotere bedrijven.

Quicken vergeleken

- Quicken versus PuzzelDeze software richt zich op AI-gestuurde financiële planning voor startups. De tegenhanger is bedoeld voor persoonlijke financiën.

- Quicken versus DextDit is een zakelijke tool voor het vastleggen van bonnen en facturen. De andere tool houdt persoonlijke uitgaven bij.

- Quicken versus XeroDit is populair online. boekhoudsoftware Voor kleine bedrijven. De concurrent is voor persoonlijk gebruik.

- Quicken versus SynderDeze tool synchroniseert e-commercegegevens met boekhoudsoftware. Het alternatief is gericht op persoonlijke financiën.

- Quicken versus Easy Month EndDit is een zakelijke tool om taken aan het einde van de maand te stroomlijnen. De concurrent is bedoeld voor het beheren van persoonlijke financiën.

- Quicken versus DocytDeze toepassing maakt gebruik van AI voor bedrijfsboekhouding en automatisering. De andere gebruikt AI als persoonlijke financiële assistent.

- Quicken versus SageDit is een uitgebreid softwarepakket voor bedrijfsboekhouding. De concurrent is een gebruiksvriendelijker programma voor persoonlijke financiën.

- Quicken versus Zoho BooksDit is een online boekhoudprogramma voor kleine bedrijven. De concurrent is bedoeld voor persoonlijk gebruik.

- Quicken versus WaveDit biedt gratis boekhoudsoftware voor kleine bedrijven. De tegenhanger is ontworpen voor particulieren.

- Quicken versus HubdocDit programma is gespecialiseerd in het vastleggen van documenten voor de boekhouding. De concurrent is een tool voor persoonlijke financiën.

- Quicken versus ExpensifyDit is een tool voor het beheren van zakelijke uitgaven. De andere is voor het bijhouden van persoonlijke uitgaven en budgettering.

- Quicken versus QuickBooksDit is bekende boekhoudsoftware voor bedrijven. Het alternatief is ontwikkeld voor persoonlijke financiën.

- Quicken versus AutoEntryDit is ontworpen om de gegevensinvoer voor bedrijfsboekhouding te automatiseren. Een alternatief is een tool voor persoonlijke financiën.

- Quicken versus FreshBooksDit is boekhoudsoftware voor freelancers en kleine bedrijven. Het alternatief is voor persoonlijke financiën.

- Quicken versus NetSuiteDit is een krachtige softwarebundel voor bedrijfsbeheer, speciaal ontworpen voor grote bedrijven. De concurrent is een simpele app voor persoonlijke financiën.

Conclusie

Mastering Quicken is a huge win for your money.

You now know how to track investments, handle loans, and run reports.

These steps give you a clear path to a better financial future.

Don’t worry if it feels like a big task at first.

Just take it one step at a time on your desktop or device.

As you gain more confidence, you will see your savings grow.

Stop guessing about your bank balance today.

Start using these tools to take control and reach your goals faster!

Veelgestelde vragen

What is Quicken and how does it work?

Quicken is a comprehensive personal finance management tool designed to track spending, budgeting, and investments. It works by connecting directly to your bank accounts, credit cards, and investment portfolios to automatically download and categorize transactions. You get a dashboard view of your entire financial life in one place.

Do I need to pay for Quicken every year?

Yes. Quicken shifted to a subscription model in 2017. You must pay an annual membership fee to maintain access to online services, bank downloads, and software updates. Prices typically range from $3.99 to $11.99 per month, billed annually.

Which one is better, QuickBooks or Quicken?

It depends on your goal. Quicken is superior for personal finance, family budgeting, and managing verhuur properties. QuickBooks is built specifically for bedrijf boekhouding, payroll, and inventory management. If you are a solopreneur, Quicken might suffice; if you are scaling a bedrijf, choose QuickBooks.

Is Quicken no longer owned by Intuit?

Correct. Intuit sold Quicken in 2016. It is currently owned by Aquiline Capital Partners (since 2021). While it shares DNA with its former sibling QuickBooks, it is now a completely separate entity focusing strictly on personal and vereenvoudigd business finance.

Has Quicken been discontinued?

No, Quicken is active and regularly updated. However, older “year-specific” versions (like Quicken 2017) are discontinued and no longer supported. The current product is known as “Quicken Classic” (for desktop) or “Quicken Simplifi” (cloud-based), both of which are fully supported.

Can I still use Quicken without a subscription?

Technically, yes, but with severe limitations. If your subscription expires, you enter “Data Access Mode.” You can view your data and edit manually, but you lose all online syncing, bank downloads, and support. Plus, aggressive renewal banners will appear on your screen.

Is Quicken easy to learn?

Yes, it is widely considered very beginner-friendly. Unlike professional boekhoudsoftware, Quicken uses intuitive dashboards and simple terminology. Most users can set up their bank feeds and create a basic budget within minutes of installation.

More Facts about Quicken

- To start using Quicken, you must sign in with a Quicken ID or make a new one.

- You can set up reminders for bills and paychecks so you don’t miss payments or run out of money.

- Quicken can build a budget for you by analyzing the bills you pay each month.

- The “Home” tab is where you can see all your money and bills in one place.

- You can sync your info to your phone or a web browser to see your money anywhere.

- Quicken Simplifi analyzes your spending to identify recurring bills and income.

- You can add or change monthly bills in the Settings menu whenever you want.

- Quicken Simplifi can guess how much money you will have in the future based on your bills.

- You can match your bank transactions to your reminders to keep your records neat.

- There is a course for everyone, from beginners to experts, that teaches how to use Quicken.

- This course teaches you how to save money, balance your accounts, and read money reports.

- Quicken has a phone app so you can track your spending while you are out.

- You can link Quicken to more than 14,000 different banks.

- It is smart to check your Quicken list against your bank records to make sure they match.

- Quicken tells you when bills are due and shows you what your balance might look like later.

- You can make a budget that fits the bills you pay over and over again.

- The dashboard on the Home tab helps you keep an eye on your spending and bills.

- You can use Quicken to print paper checks and pay your bills in a modern way.