Merasa kewalahan dengan tagihan bulanan Anda akuntansi tugas?

Membayangkan the stress of scrambling to find receipts, reconcile accounts, and meet deadlines.

Semua itu sambil mencoba menjalankan milikmu bisnis.

Artikel ini membahas dua hal populer akuntansi solusi.

Kami akan menguraikan fitur Easy Month End vs FreshBooks untuk membantu Anda memutuskan mana yang benar-benar akan menyederhanakan proses Anda. akuntansi.

Tinjau

Untuk memberikan gambaran yang paling jelas.

Kami melakukan pengujian secara ekstensif. Akhir Bulan yang Mudah dan FreshBooks, meneliti fitur-fiturnya, kemudahan penggunaan, dan nilai keseluruhannya.

Akhir bulan Easy ini, bergabunglah dengan 1.257 pengguna yang telah menghemat rata-rata 3,5 jam dan mengurangi kesalahan hingga 15%. Mulai uji coba gratis Anda!

Harga: Tersedia masa uji coba gratis. Paket premium dimulai dari $45/bulan.

Fitur Kunci:

- Rekonsiliasi Otomatis

- Alur Kerja yang Efisien

- Antarmuka Ramah Pengguna

Siap menyederhanakan pembuatan faktur Anda dan mendapatkan pembayaran lebih cepat? Lebih dari 30 juta orang telah menggunakan FreshBooks. Jelajahi lebih lanjut!

Harga: Tersedia uji coba gratis. Paket berbayar dimulai dari $2,10/bulan.

Fitur Kunci:

- Pencatatan Waktu

- Penagihan

- Pembukuan

Apa itu Easy Month End?

Mari kita bahas tentang Easy Month End. Apa itu?

Ini adalah alat yang dirancang untuk membuat pengeluaran bulanan Anda lebih mudah. akuntansi Tutup sederhana.

Anggap saja ini sebagai panduan Anda melalui proses yang seringkali menakutkan itu.

Juga, mengeksplorasi favorit kita Alternatif Mudah di Akhir Bulan…

Our Take

Tingkatkan akurasi keuangan dengan Easy Month End. Manfaatkan rekonsiliasi otomatis dan pelaporan siap audit. Jadwalkan demo yang dipersonalisasi untuk menyederhanakan proses akhir bulan Anda.

Manfaat Kunci

- Alur kerja rekonsiliasi otomatis

- Manajemen dan pelacakan tugas

- Analisis varians

- Manajemen dokumen

- Alat kolaborasi

Harga

- Starter: $24/bulan.

- Kecil: $45/bulan.

- Perusahaan: $89/bulan.

- Perusahaan: Penetapan Harga Khusus.

Pro

Kons

Apa itu FreshBooks?

Sekarang, mari kita bahas tentang FreshBooks. Apa sebenarnya FreshBooks itu?

Ini populer perangkat lunak akuntansiBanyak pekerja lepas dan bisnis kecil Gunakanlah.

Ini membantu dalam pembuatan faktur, pelacakan pengeluaran, dan pengelolaan proyek.

Juga, mengeksplorasi favorit kita Alternatif FreshBooks…

Our Take

Bosan dengan akuntansi yang rumit? Lebih dari 30 juta bisnis mempercayai FreshBooks untuk membuat faktur profesional. Sederhanakan akuntansi Anda. perangkat lunak akuntansi Hari ini!

Manfaat Kunci

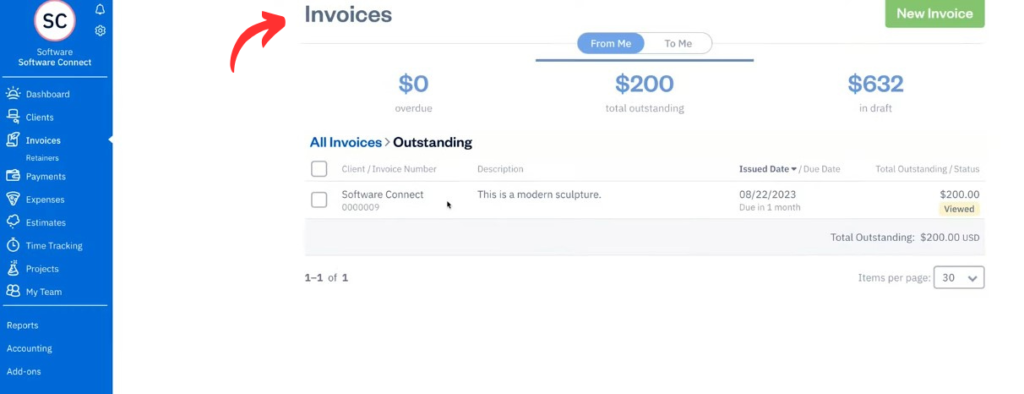

- Pembuatan faktur profesional

- Pengingat pembayaran otomatis

- Pencatatan waktu

- Alat manajemen proyek

- Pelacakan pengeluaran

Harga

- Ringan: $2,10/bulan.

- Plus: $3,80/bulan.

- Premi: $6,50/bulan.

- Memilih: Penetapan Harga Khusus.

Pro

Kons

Perbandingan Fitur

Berikut adalah uraian detail tentang perbandingan antara Easy Month End dan FreshBooks.

Kami akan mengeksplorasi fitur-fitur utama untuk membantu Anda memahami platform mana yang lebih sesuai.

Kebutuhan bisnis unik Anda saat Anda menavigasi pilihan akuntansi perangkat lunak.

1. Tujuan Inti

- Akhir Bulan yang MudahTujuan utama alat ini adalah untuk membantu tim keuangan menangani proses penutupan akhir bulan dengan lebih efisien. Ini adalah solusi khusus untuk tugas-tugas spesifik tim keuangan.

- FreshBooksIni adalah platform solusi perangkat lunak akuntansi yang lebih luas untuk usaha kecil pemilik. Sistem ini menangani semuanya, mulai dari pembuatan faktur hingga pelacakan pengeluaran dan pelaporan dasar.

2. Penagihan & Pembayaran

- Akhir Bulan yang MudahAlat ini tidak memiliki fitur pembuatan faktur.

- FreshBooksFreshBooks unggul dalam hal ini. Anda dapat membuat faktur profesional, mengatur penagihan berulang, dan bahkan menerima pembayaran di muka seperti kartu kredit dan pembayaran ACH secara langsung. Ini memudahkan untuk menerima pembayaran dan dibayar lebih cepat.

3. Penutupan Akhir Bulan & Rekonsiliasi

- Akhir Bulan yang MudahInilah kekuatan utamanya. Ia menyediakan alur kerja terstruktur untuk mengelola semua rekonsiliasi Anda. Ini membantu Anda mengumpulkan audit memberikan bukti dan menyederhanakan proses, sehingga menghasilkan penutupan akhir bulan yang lebih lancar serta mengurangi kesalahan dan keterlambatan.

- FreshBooksAplikasi ini menangani rekonsiliasi bank dasar, tetapi tidak dirancang sebagai alat khusus untuk rekonsiliasi neraca formal atau menyediakan dokumentasi untuk auditor.

4. Kolaborasi Tim & Alur Kerja

- Akhir Bulan yang MudahAplikasi ini dirancang untuk manajemen tim. Anda dapat menetapkan tugas tim keuangan, melacak persetujuan, dan memberikan komentar pada tiket untuk memastikan tugas diselesaikan dengan benar.

- FreshBooksPlatform ini memungkinkan banyak pengguna untuk berkolaborasi dalam proyek. Namun, fitur alur kerjanya tidak sedalam atau sekhusus Easy Month End dalam hal proses penutupan.

5. Pelaporan & Akuntansi

- Akhir Bulan yang MudahPelaporan terbatas pada proses penutupan itu sendiri. Ini bukan pelaporan lengkap. perangkat lunak akuntansi.

- FreshBooksLayanan ini menyediakan laporan akuntansi standar seperti laporan laba rugi. Pada paket yang lebih tinggi, layanan ini menawarkan akuntansi double-entry dan membantu dalam pelacakan profitabilitas proyek.

6. Harga & Paket

- Akhir Bulan yang MudahMemiliki tiga paket harga utama yang disesuaikan dengan ukuran tim Anda.

- FreshBooksMenawarkan empat paket, termasuk paket Lite dan paket Plus, yang disesuaikan dengan jumlah klien yang ditagih dan fitur yang Anda butuhkan. Harga biasanya dihitung per bulan.

7. Kemudahan Penggunaan & Platform

- Akhir Bulan yang MudahPlatform ini mudah digunakan tetapi dirancang khusus untuk para profesional akuntansi yang memahami alur kerja penutupan laporan keuangan. Ini adalah platform tunggal untuk tujuan spesifiknya.

- FreshBooksDikenal karena dasbor FreshBooks yang mudah digunakan. Perangkat lunak ini dianggap sebagai salah satu pilihan perangkat lunak akuntansi terbaik untuk para profesional yang bekerja sendiri. usaha kecil pemiliknya karena desainnya yang intuitif.

8. Data & Integrasi

- Akhir Bulan yang MudahTerintegrasi dengan perangkat lunak akuntansi lainnya seperti QuickBooks dan Xero untuk mengimpor data untuk rekonsiliasi.

- FreshBooksTerintegrasi dengan lebih dari 100 aplikasi. Ini menjadikannya pusat yang tepat untuk mengelola keuangan, khususnya untuk bisnis berbasis layanan yang menggunakan perangkat lunak lain untuk mengelola proyek dan klien.

9. Kemampuan Seluler

- Akhir Bulan yang MudahIni adalah aplikasi berbasis web. Aplikasi ini tidak memiliki aplikasi seluler khusus.

- FreshBooks: Memiliki aplikasi seluler FreshBooks yang berperingkat tinggi untuk iOS dan Android perangkatAnda dapat mengelola bisnis Anda di mana saja dengan koneksi internet sederhana.

Apa yang Harus Diperhatikan Saat Memilih Perangkat Lunak Akuntansi?

- Jenis Bisnis Anda: Apakah kamu seorang pekerja lepasBerbasis layanan, atau berbasis produk? Kebutuhan spesifik Anda akan menentukan pilihan terbaik.

- Skalabilitas: Bisakah perangkat lunak tersebut berkembang seiring dengan bisnis Anda? Pertimbangkan masa depan. kebutuhan bisnis.

- Kebutuhan Integrasi: Apakah ini terhubung dengan alat-alat Anda yang lain (misalnya, gerbang pembayaran, CRM)?

- Akses Seluler: Apakah Anda perlu mengelola keuangan saat bepergian?

- Dukungan Pelanggan: Bantuan apa yang tersedia jika Anda mengalami masalah?

- Melaporkan Kedalaman: Apakah Anda memerlukan gambaran umum yang sederhana atau analisis keuangan yang detail?

- Keamanan: Bagaimana platform ini melindungi informasi sensitif Anda? data keuangan?

- Antarmuka Pengguna: Apakah mudah bagi Anda dan anggota tim untuk mempelajari dan menggunakannya? Ini sangat penting bagi pengguna baru.

Keputusan Akhir

Setelah mencoba keduanya, kami merekomendasikan FreshBooks.

Meskipun Easy Month End sangat bagus karena proses akhir bulannya yang khusus.

FreshBooks adalah solusi yang lebih lengkap untuk bisnis kecil.

Platformnya menangani segala hal mulai dari mengirim faktur hingga mengelola manajemen proyek dan pelacakan waktu.

Dengan harga yang sama, FreshBooks memberikan nilai lebih setiap harinya.

Paket premium dan paket harga lainnya menawarkan berbagai fitur seperti faktur berulang dan FreshBooks Payments, yang menyederhanakan keuangan Anda dan memberikan tim keuangan Anda alat yang layak mereka dapatkan.

Bagi sebagian besar pemilik usaha kecil, menyederhanakan hidup dan mengelola keuangan tanpa kerumitan adalah pilihan yang lebih cerdas.

Lebih Banyak Tips Mudah di Akhir Bulan

Berikut perbandingan singkat Easy Month End dengan beberapa alternatif terkemuka lainnya.

- Easy Month End vs Puzzle io: Meskipun Puzzle.io ditujukan untuk akuntansi perusahaan rintisan, Easy Month End secara khusus berfokus pada penyederhanaan proses penutupan bulan.

- Easy Month End vs Dext: Dext terutama digunakan untuk pengambilan dokumen dan tanda terima, sedangkan Easy Month End adalah alat manajemen penutupan akhir bulan yang komprehensif.

- Easy Month End vs Xero: Xero adalah platform akuntansi lengkap untuk usaha kecil, sedangkan Easy Month End menyediakan solusi khusus untuk proses penutupan bulan.

- Easy Month End vs Synder: Synder berspesialisasi dalam mengintegrasikan data e-commerce, tidak seperti Easy Month End yang merupakan alat alur kerja untuk keseluruhan proses penutupan keuangan.

- Easy Month End vs Docyt: Docyt menggunakan AI untuk pembukuan dan entri data, sementara Easy Month End mengotomatiskan langkah-langkah dan tugas-tugas penutupan keuangan.

- Easy Month End vs RefreshMe: RefreshMe adalah platform pelatihan keuangan, yang berbeda dari fokus Easy Month End pada manajemen penutupan transaksi.

- Easy Month End vs Sage: Sage adalah rangkaian perangkat lunak manajemen bisnis skala besar, sedangkan Easy Month End menawarkan solusi yang lebih khusus untuk fungsi akuntansi yang penting.

- Easy Month End vs Zoho Books: Zoho Books adalah perangkat lunak akuntansi lengkap, sedangkan Easy Month End adalah alat yang dirancang khusus untuk proses akhir bulan.

- Easy Month End vs Wave: Wave menyediakan layanan akuntansi gratis untuk usaha kecil, sementara Easy Month End menawarkan solusi yang lebih canggih untuk manajemen penutupan bulan.

- Easy Month End vs Quicken: Quicken adalah alat keuangan pribadi, sehingga Easy Month End menjadi pilihan yang lebih baik bagi bisnis yang perlu mengelola penutupan akhir bulan.

- Easy Month End vs Hubdoc: Hubdoc mengotomatiskan pengumpulan dokumen, tetapi Easy Month End dirancang untuk mengelola alur kerja penutupan penuh dan tugas tim.

- Easy Month End vs Expensify: Expensify adalah perangkat lunak manajemen pengeluaran, yang merupakan fungsi berbeda dari fokus utama Easy Month End pada penutupan keuangan.

- Perbandingan Easy Month End vs QuickBooks: QuickBooks adalah solusi akuntansi komprehensif, sedangkan Easy Month End adalah alat yang lebih spesifik untuk mengelola proses penutupan akhir bulan itu sendiri.

- Easy Month End vs AutoEntry: AutoEntry adalah alat pengumpulan data, sedangkan Easy Month End adalah platform lengkap untuk manajemen tugas dan alur kerja selama proses penutupan.

- Easy Month End vs FreshBooks: FreshBooks ditujukan untuk pekerja lepas dan usaha kecil, sedangkan Easy Month End menawarkan solusi khusus untuk penutupan akhir bulan.

- Easy Month End vs NetSuite: NetSuite adalah sistem ERP berfitur lengkap, yang cakupannya lebih luas daripada fokus khusus Easy Month End pada penutupan keuangan.

Selengkapnya tentang FreshBooks

- FreshBooks vs Puzzle IOPerangkat lunak ini berfokus pada perencanaan keuangan berbasis AI untuk perusahaan rintisan. Versi pasangannya ditujukan untuk keuangan pribadi.

- FreshBooks vs DextIni adalah alat bisnis untuk mencatat tanda terima dan faktur. Alat lainnya melacak pengeluaran pribadi.

- FreshBooks vs XeroIni adalah perangkat lunak akuntansi online populer untuk usaha kecil. Pesaingnya ditujukan untuk penggunaan pribadi.

- FreshBooks vs SynderAlat ini menyinkronkan data e-commerce dengan perangkat lunak akuntansi. Alternatifnya berfokus pada keuangan pribadi.

- FreshBooks vs Easy Month EndIni adalah alat bisnis untuk menyederhanakan tugas akhir bulan. Pesaingnya adalah untuk mengelola keuangan pribadi.

- FreshBooks vs DocytYang satu menggunakan AI untuk pembukuan dan otomatisasi bisnis. Yang lainnya menggunakan AI sebagai asisten keuangan pribadi.

- FreshBooks vs SageIni adalah paket perangkat lunak akuntansi bisnis yang komprehensif. Pesaingnya adalah alat yang lebih mudah digunakan untuk keuangan pribadi.

- FreshBooks vs Zoho BooksIni adalah alat akuntansi online untuk usaha kecil. Pesaingnya ditujukan untuk penggunaan pribadi.

- FreshBooks vs WaveIni menyediakan perangkat lunak akuntansi gratis untuk usaha kecil. Versi lainnya dirancang untuk individu.

- FreshBooks vs QuickenKeduanya adalah alat keuangan pribadi, tetapi yang satu ini menawarkan pelacakan investasi yang lebih mendalam. Yang lainnya lebih sederhana.

- FreshBooks vs HubdocIni khusus untuk pengambilan data dokumen untuk pembukuan. Pesaingnya adalah alat keuangan pribadi.

- FreshBooks vs ExpensifyIni adalah alat manajemen pengeluaran bisnis. Yang lainnya untuk pelacakan pengeluaran pribadi dan penganggaran.

- FreshBooks vs QuickBooksIni adalah perangkat lunak akuntansi yang terkenal untuk bisnis. Alternatifnya dirancang untuk keuangan pribadi.

- FreshBooks vs AutoEntryIni dirancang untuk mengotomatiskan entri data untuk akuntansi bisnis. Alternatifnya adalah alat keuangan pribadi.

- FreshBooks vs NetSuiteIni adalah rangkaian perangkat lunak manajemen bisnis yang andal untuk perusahaan besar. Pesaingnya adalah aplikasi keuangan pribadi yang sederhana.

Pertanyaan Yang Sering Muncul

Apa perbedaan utama antara Easy Month End dan FreshBooks?

Easy Month End berfokus terutama pada penyederhanaan proses penutupan akhir bulan akuntansi dan alur kerja rekonsiliasi. Sebaliknya, FreshBooks vs menyediakan solusi akuntansi berbasis cloud yang lebih luas, unggul dalam pembuatan faktur, pelacakan pengeluaran, dan hal-hal dasar lainnya. pembukuan untuk pekerja lepas dan usaha kecil.

Bisakah FreshBooks menggantikan Xero atau QuickBooks?

FreshBooks dapat menjadi alternatif yang kuat bagi bisnis yang memprioritaskan pembuatan faktur dan pelacakan proyek. Namun, untuk kebutuhan inventaris, penggajian, atau pembukuan tingkat lanjut yang lebih kompleks, beberapa bisnis mungkin masih lebih memilih solusi khusus seperti Xero atau QuickBooks.

Apakah Easy Month End cocok untuk usaha kecil atau pekerja lepas?

Easy Month End lebih bermanfaat bagi usaha kecil atau tim yang memiliki proses penutupan akhir bulan yang terstruktur. Para pekerja lepas atau usaha yang sangat kecil dengan kebutuhan yang lebih sederhana mungkin menganggap FreshBooks lebih komprehensif untuk manajemen keuangan mereka secara keseluruhan.

Apakah platform-platform ini membantu dalam persiapan pajak?

Kedua platform tersebut menyediakan laporan yang dapat membantu dalam persiapan pajak, seperti laporan laba rugi. Namun, keduanya tidak menawarkan layanan pengajuan pajak secara langsung. Anda biasanya akan menggunakan data keuangan mereka untuk akuntan pajak atau perangkat lunak Anda.

Apakah ada biaya tersembunyi pada FreshBooks dibandingkan dengan harga Easy Month End?

Keduanya secara jelas menjabarkan tingkatan harga mereka. FreshBooks mengenakan biaya per pengguna untuk anggota tim tambahan dan memiliki biaya transaksi untuk pembayaran online. Harga Easy Month End disesuaikan dengan ukuran tim dan entitas, jadi selalu periksa detail paket spesifik untuk semua pertanyaan yang sering diajukan.