Escolher o certo software de contabilidade feels like a huge task.

E se você fazer the wrong choice?

A bad fit can cause real headaches.

You might waste precious time, miss tracking important expenses, or mess up your books.

That’s where we come in. We’re looking at two popular names: Puzzle IO vs Expensify.

Visão geral

Through rigorous feature-by-feature analysis and hands-on testing of core functionalities like receipt scanning and report generation.

Pronto para simplificar suas finanças? Veja como o Puzzle IO pode te economizar até 20 horas por mês. Experimente a diferença.

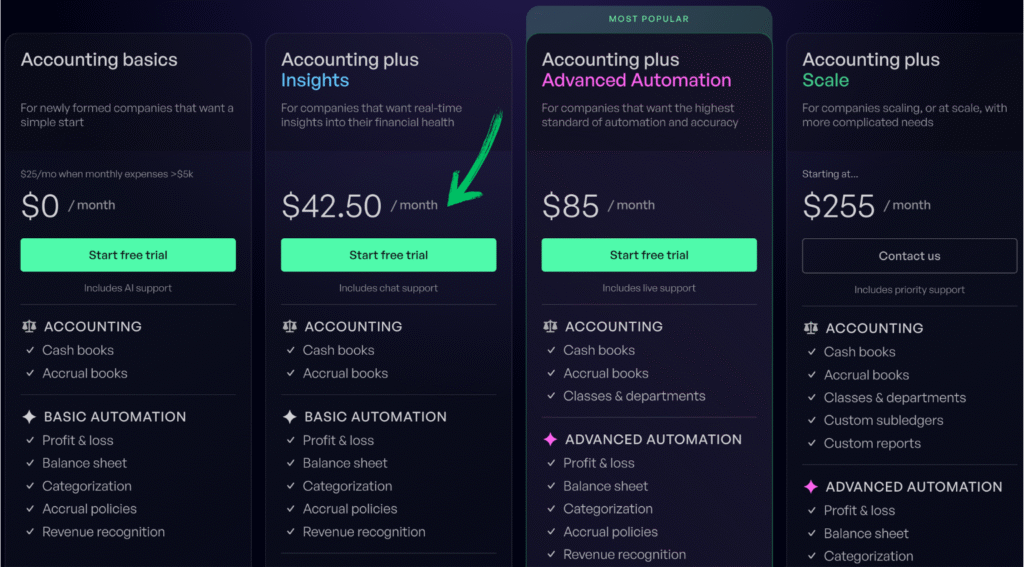

Preços: Plano gratuito disponível. Plano pago a partir de US$ 42,50/mês.

Principais características:

- Planejamento Financeiro

- Previsão

- Análises em tempo real

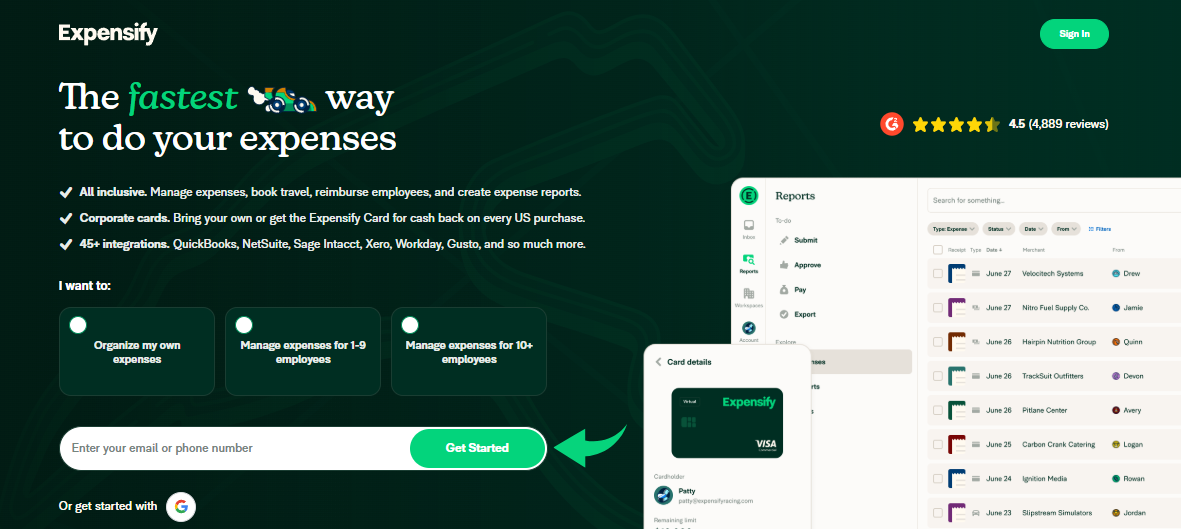

Junte-se a mais de 15 milhões de usuários que confiam no Expensify para simplificar suas finanças. Economize até 83% do tempo gasto em relatórios de despesas.

Preços: Oferece um período de teste gratuito. O plano premium custa a partir de US$ 5 por mês.

Principais características:

- Captura de recibos SmartScan

- Conciliação de Cartões Corporativos

- Fluxos de trabalho de aprovação avançados.

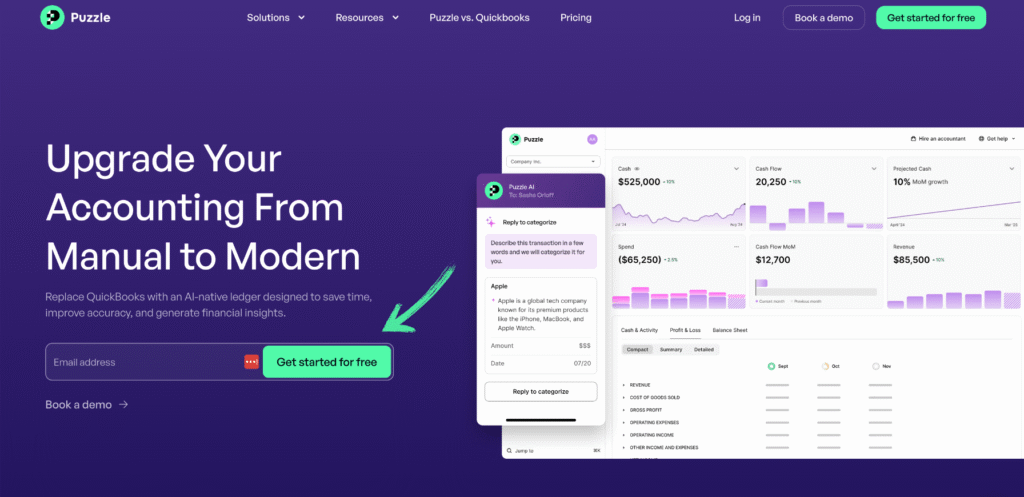

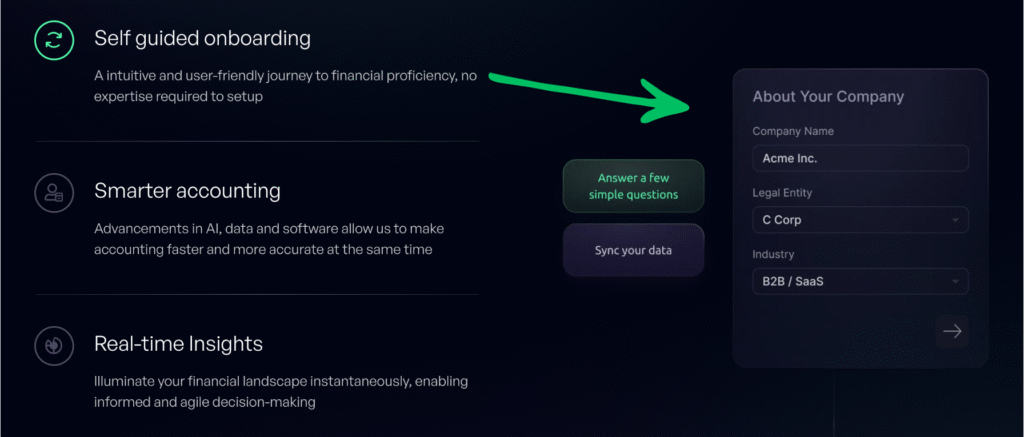

O que é Puzzle IO?

Hey, so Puzzle IO, right? It’s an expense management tool.

It seems pretty focused on project costs. Good for keeping tabs on budgets.

Explore também os nossos favoritos. Alternativas ao Puzzle IO…

Nossa opinião

Pronto para simplificar suas finanças? Veja como o Puzzle io pode te economizar até 20 horas por mês. Experimente a diferença hoje mesmo!

Principais benefícios

O Puzzle IO realmente se destaca quando se trata de ajudar você a entender para onde seu negócio está caminhando.

- 92% de Usuários relatam maior precisão nas previsões financeiras.

- Obtenha informações em tempo real sobre seu fluxo de caixa.

- Crie facilmente diferentes cenários financeiros para planejar.

- Colabore perfeitamente com sua equipe para atingir metas financeiras.

- Acompanhe os principais indicadores de desempenho (KPIs) em um só lugar.

Preços

- Noções básicas de contabilidade: $0 por mês.

- Informações da Accounting Plus: US$ 42,50 por mês.

- Contabilidade Plus Automação Avançada: US$ 85 por mês.

- Escala Accounting Plus: US$ 255 por mês.

Prós

Contras

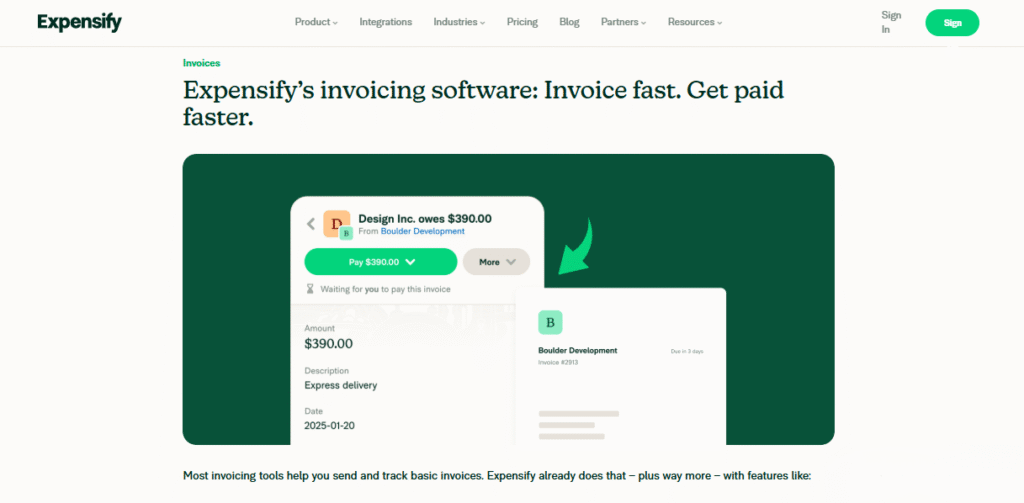

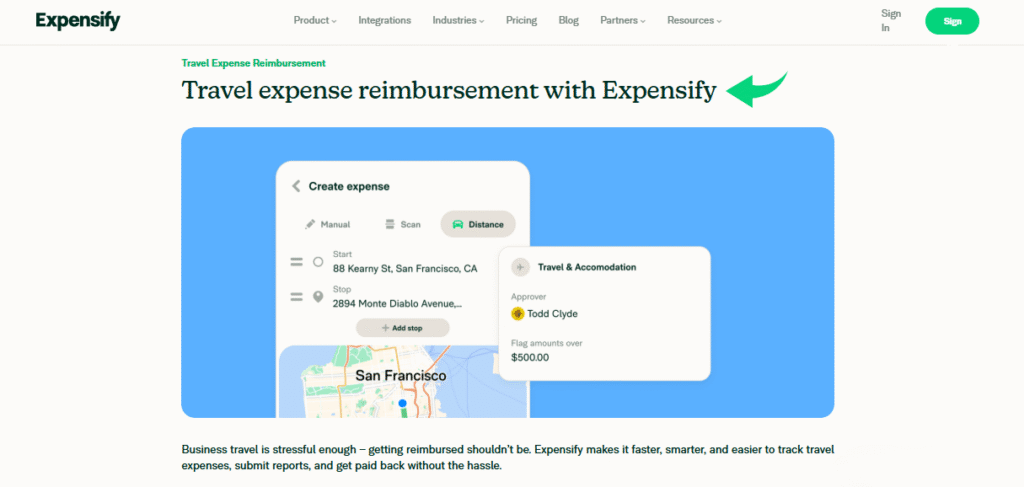

O que é Expensify?

Okay, so Expensify is another option.

It feels really strong on receipt handling. Their SmartScan seems pretty slick.

Good if you deal with lots of individual expenses.

Explore também os nossos favoritos. Alternativas ao Expensify…

Principais benefícios

- A tecnologia SmartScan escaneia os detalhes do recibo e os extrai com mais de 95% de precisão.

- Os funcionários recebem o reembolso rapidamente, geralmente em apenas um dia útil, via ACH.

- O cartão Expensify pode te ajudar a economizar até 50% na sua assinatura com o programa de cashback.

- Não é oferecida nenhuma garantia; os termos estipulam que a responsabilidade é limitada.

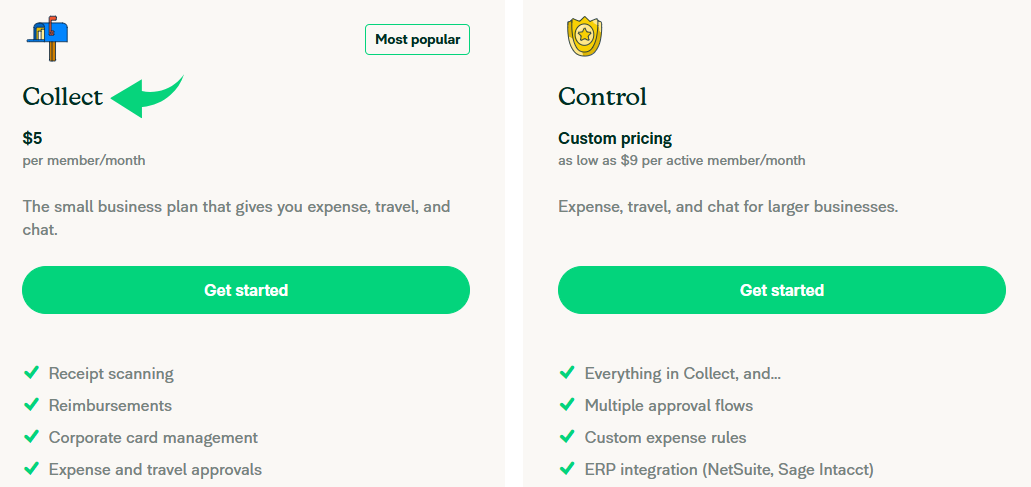

Preços

- Coletar: US$ 5 por mês.

- Controlar: Preços personalizados.

Prós

Contras

Comparação de recursos

Navegação pequenas empresas finances can be challenging.

This comparison highlights key features of Puzzle IO and Expensify.

Examining how each platform addresses contabilidade, expense reports, and automation to help you simplify financial management.

1. Core Audience & Focus

- Puzzle IO is a game-changer built for early-stage startups and co-founder teams, focusing on up-to-date financial statements and key metrics right out of the box.

- Despesar focuses on an efficient expense management process for employees and contractors, making it easy for them to file and for employers to reimburse.

2. Automated Bookkeeping

- Puzzle IO is designed for autônomo bookkeeping, using AI to automate tedious tasks and provide an accurate picture of the current state of the company quickly.

- Despesar automação is concentrated on receipts and expense report creation, aiming to simplify the process for the user and their manager’s approval.

3. Startup Financial Health Metrics

- Puzzle IO provides startup founders with instant access to key metrics like cash pista, burn rate, and MRR, offering clear insights into their financial health.

- Despesar focuses on spending, helping companies control spending and reconcile the Expensify Card, but does not natively provide comprehensive startup metrics.

4. Complex Accrual Accounting

- Puzzle IO includes built-in accrual automation to handle complex items like revenue recognition and prepaid expenses automatically, which is vital for providing a true and accurate picture of revenue.

- Despesar does not focus on the underlying accrual contabilidade logic for things like fixed assets and deferred revenue; its strength is expense capture.

5. Expense Reporting Experience

- Puzzle IO permite for transaction categorization and expense tracking, but does not specialize in complex, multi-level expense management processes and reimbursement workflows.

- Despesar makes it easy for the team to log mileage, snap a photo of a receipt in a few seconds, and get reimbursed quickly, which is a game-changer for employees.

6. AI-Powered Functionality

- Puzzle IO uses AI for smart transaction categorization, continuous accuracy checks, and streamlining the setup for non-accountants.

- Despesar uses its SmartScan technology for receipt dados extraction and AI-powered automation to match transactions, making the process less time-consuming.

7. Focus on Financial Statements

- Puzzle IO’s primary goal is to generate real-time, audit-ready financial statements, helping startup founders stay up to date and prepare for investors or tax time.

- Despesar is a pre-accounting tool that passes expense data to other tools like QuickBooks or Xero for final statement generation by a finance expert.

8. Corporate Card Management

- Puzzle IO integrates with various cards, focusing on getting data into the books quickly.

- Despesar offers the Expensify Card, which links seamlessly to its system, automates reconciliation, and allows employers to set smart spending limits.

9. Ease of Setup

- Puzzle IO oferecers an easy setup and a modern interface, minimizing errors and making it simple for the co founder who may be a non contadores.

- Despesar also offers a quick and easy setup for the expense management process, which helps employees and contractors submit expenses and reports in less time.

O que levar em consideração ao escolher um software de contabilidade?

- Look beyond basic Expensify reviews to see how the software handles the complete general ledger and organization.

- The software needs a reliable connection to your bank accounts to avoid manual data entry and reduce errors.

- Ensure the platform gives you a clear cash runway and not just a summary of past data—don’t wait for insights.

- The ability to manage expenses must be flexible, supporting phone, desktop, and web access.

- Check the speed of completing reports and the ease of exporting data to your clients or accountant.

- It should allow users to create and submit requests immediately, and managers to approve them quickly.

- The system must reliably respond to inputs and not be blocked by simple issues.

- All financial details should be securely stored in a digital pocket for easy review.

- The software should offer automated code assignment and customizable categories and tags.

- Your final thoughts should confirm that the system can scale with your future organization, moving you away from spreadsheets.

- A key insight is whether the platform is structured for a small number of users or a growing organization.

- An efficient system should trigger notifications when action is expected, simplifying the single-view page workflow.

- Consider why others chose Puzzle or a similar full-stack tool over a pure expense manager.

Veredicto final

Picking between Puzzle IO and Expensify depends on your main needs.

Expensify is tops for expense reports and receipts.

But Puzzle IO does more for overall money tracking, invoices, and connecting with payroll (even like QuickBooks).

Both are cloud-based.

If you want a wider view of your negócios, money, and something that can grow.

Puzzle IO wins. We checked them out carefully.

So our advice should help you choose the right software to save time.

Neither doesn’t really offer free contabilidade for most businesses.

Mais sobre Puzzle IO

Analisamos como o Puzzle IO se compara a outras ferramentas de contabilidade. Aqui está uma breve descrição de seus principais recursos:

- Puzzle IO vs Xero: O Xero oferece amplas funcionalidades de contabilidade com integrações robustas.

- Puzzle IO vs Dext: A Puzzle IO se destaca em análises e previsões financeiras baseadas em IA..

- Puzzle IO vs Snyder: O Synder se destaca na sincronização de dados de vendas e pagamentos.

- Puzzle IO vs Easy Month End: O Easy Month End simplifica o processo de fechamento financeiro.

- Puzzle IO vs Docyt: A Docyt utiliza inteligência artificial para automatizar tarefas de contabilidade.

- Puzzle IO vs RefreshMe: O RefreshMe concentra-se no monitoramento em tempo real do desempenho financeiro.

- Puzzle IO vs Sage: A Sage oferece soluções contábeis robustas para empresas de diversos portes.

- Puzzle IO vs Zoho Books: O Zoho Books oferece contabilidade acessível com CRM integração.

- Puzzle IO vs Wave: A Wave oferece software de contabilidade gratuito para pequenas empresas.

- Puzzle IO vs Quicken: O Quicken é conhecido por sua ferramenta de gestão financeira para pessoas físicas e pequenas empresas.

- Puzzle IO vs Hubdoc: A Hubdoc é especializada em coletar documentos e extrair dados..

- Puzzle IO vs Expensify: Expensify oferece relatórios e gerenciamento de despesas completos.

- Puzzle IO vs QuickBooks: O QuickBooks é uma escolha popular para a contabilidade de pequenas empresas.

- Puzzle IO vs Entrada Automática: O AutoEntry automatiza a entrada de dados a partir de faturas e recibos.

- Puzzle IO vs FreshBooks: O FreshBooks foi desenvolvido especificamente para faturamento de empresas prestadoras de serviços.

- Puzzle IO vs NetSuite: O NetSuite oferece um conjunto completo de soluções para planejamento de recursos empresariais.

Mais do Expensify

- Expensify vs PuzzleEste software foca-se no planeamento financeiro para startups com auxílio de inteligência artificial. Existe uma versão equivalente para finanças pessoais.

- Expensify vs DextEsta é uma ferramenta empresarial para capturar recibos e faturas. A outra ferramenta rastreia despesas pessoais.

- Expensify vs XeroEste é um software de contabilidade online popular para pequenas empresas. Seu concorrente é voltado para uso pessoal.

- Expensify vs SnyderEsta ferramenta sincroniza dados de comércio eletrônico com softwares de contabilidade. Sua alternativa foca em finanças pessoais.

- Expensify vs Easy Month EndEsta é uma ferramenta empresarial para agilizar as tarefas de fechamento mensal. Seu concorrente é voltado para a gestão de finanças pessoais.

- Expensify vs DocytEsta utiliza IA para contabilidade e automação empresarial. A outra utiliza IA como assistente de finanças pessoais.

- Expensify vs SageEste é um pacote completo de software para contabilidade empresarial. Seu concorrente é uma ferramenta mais fácil de usar para finanças pessoais.

- Expensify vs Zoho BooksEsta é uma ferramenta de contabilidade online para pequenas empresas. Seu concorrente é voltado para uso pessoal.

- Expensify vs WaveEsta opção oferece software de contabilidade gratuito para pequenas empresas. Sua versão equivalente é voltada para pessoas físicas.

- Expensify vs HubdocEsta ferramenta é especializada na captura de documentos para contabilidade. Seu concorrente é uma ferramenta de finanças pessoais.

- Expensify vs QuickBooksEste é um software de contabilidade bastante conhecido para empresas. Sua alternativa foi desenvolvida para finanças pessoais.

- Expensify vs. Entrada AutomáticaEsta ferramenta foi projetada para automatizar a entrada de dados na contabilidade empresarial. Sua alternativa é uma ferramenta de finanças pessoais.

- Expensify vs FreshBooksEste é um software de contabilidade para freelancers e pequenas empresas. Existe uma alternativa para finanças pessoais.

- Expensify vs NetSuiteEste é um poderoso pacote de gerenciamento empresarial para grandes empresas. Seu concorrente é um aplicativo simples de finanças pessoais.

Perguntas frequentes

What key features should software for small businesses include?

Essential features are invoicing, expense tracking, bank reconciliation, and reportagem to manage business finances effectively.

Can accounting software help with automation?

Yes, many platforms offer automation for tasks like data entry, bank feeds, and payment reminders, saving time.

Is there free accounting software suitable for small businesses?

Some free options exist with basic features, but they may lack advanced capabilities or scalability for growing businesses.

How can AI-powered features benefit small business accounting?

AI can automate categorization, detect anomalies, and provide insights, improving accuracy and efficiency in financial management.

Which type of accounting software is best for my small business?

The best software depends on your specific business needs, size, and complexity. Consider features, integrations, and scalability.