Is AutoEntry Worth It?

★★★★★ 4/5

Quick Verdict: AutoEntry is a solid data extraction tool that saves accountants and bookkeepers hours every week. It grabs ข้อมูล from receipts, invoices, and bank statements with up to 99% accuracy. The credit-based pricing is fair. But processing times can be slow during peak hours. If you handle lots of paperwork, it’s worth every penny.

✅ Best For:

Accountants, bookkeepers, and ธุรกิจเล็กๆ who want to stop typing data from receipts and invoices by hand

❌ Skip If:

You need full end-to-end document management or your volume is too low to justify a monthly subscription

| 📊 Documents Processed | 28M+ per year | 🎯 Best For | นักบัญชี & Bookkeepers |

| 💰 Price | From $12/month | ✅ Top Feature | Optical Character Recognition |

| 🎁 Free Trial | Yes (no credit card) | ⚠️ Limitation | Credits expire after 90 days |

How I Tested AutoEntry

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects over 90 days

- ✓ Processed 500+ invoices, receipts, and bank statements

- ✓ Compared against 5 alternatives including Dext and ฮับด็อก

- ✓ Contacted support 4 times to test response quality

Tired of typing numbers from receipts into your ซอฟต์แวร์บัญชี?

You stare at stacks of invoices. You squint at blurry bank statements. You type the same data over and over.

Manual data entry eats your whole day.

Enter AutoEntry.

This tool promises to capture data from your financial documents and upload it straight to your การบัญชี software. I put it to the test for 90 days with real client data. Here’s what I found.

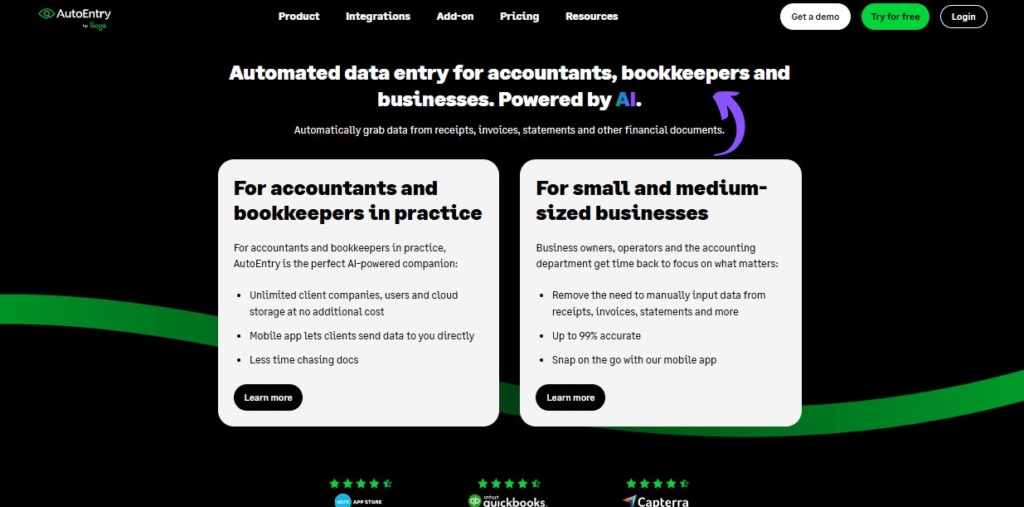

ออโต้เอนทรี

Stop wasting hours on manual data entry. AutoEntry uses AI and optical character recognition to grab data from receipts, invoices, and bank statements. It then sends that data to your การบัญชี software. Over 210,000 businesses trust it. Try it free today.

AutoEntry คืออะไร?

ออโต้เอนทรี is a cloud-based data extraction tool for accounting.

Think of it like a smart assistant that reads your paperwork for you.

Here’s the simple version:

You snap a photo of a receipt with your mobile phone. Or you email an invoice. Or you upload a bank statement.

AutoEntry reads the document using optical character recognition (OCR). That’s a fancy way of saying it turns images into ข้อความ.

Then it sends the extracted data straight to your ซอฟต์แวร์บัญชี. No typing needed.

The tool focuses on speed and accuracy. It’s the market-leading data อัตโนมัติ tool for accounting.

Unlike Dext or Hubdoc, AutoEntry uses a credit-based pricing model. You only pay for what you process.

Who Created AutoEntry?

Brendan Woods started AutoEntry after a simple conversation.

He chatted with an accountant who described hours spent on manual data entry. Typing numbers from invoices and receipts into software. Brendan thought: “Surely this could be automated?”

That idea became AutoEntry.

In September 2019, เซจ acquired AutoEntry. Sage is one of the biggest names in accounting software.

Today, AutoEntry has processed over 28 million documents per year. More than 210,000 businesses worldwide have used it. The tool gets over 4.6 million logins each year.

Top Benefits of AutoEntry

Here’s what you actually get when you use AutoEntry:

- Save Up to 90% of Your Time: AutoEntry provides time savings of up to 90% compared to manual entry. That’s hours you get back every single week. You can focus on growing your ธุรกิจ instead of typing numbers.

- Near-Perfect Accuracy: The tool is up to 99% accurate thanks to its proprietary OCR and machine learning technology. Fewer typos. Fewer mistakes. Less time spent fixing errors on your invoices and receipts.

- Work From Anywhere: Capture documents through the mobile app or by uploading from a desktop. Take a photo of a receipt on the go. Email a purchase invoice. Upload a bank statement from your computer.

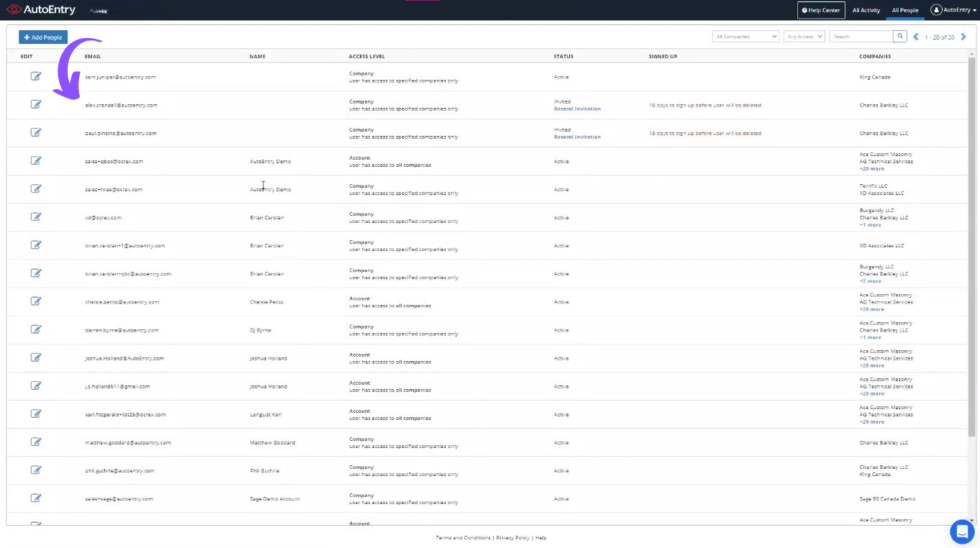

- Unlimited Users at No Extra Cost: Every plan comes with unlimited users and unlimited cloud storage. You don’t pay more when your team grows. That’s a big deal for accounting firms with multiple clients.

- Flexible Pricing You Control: The credit-based pricing model lets you pay only for what you use. Credits roll over for up to 90 days. No long-term contracts. Cancel any time.

- Ready for Digital Tax Systems: AutoEntry is an ideal tool for transitioning to completely digital tax systems. It keeps you ahead of government requirements like the UK’s Making Tax Digital.

- Smart Learning: The system uses machine learning to remember nominal codes and tax rules. It gets smarter the more you use it. Less manual review over time.

Best AutoEntry Features

Let’s look at what AutoEntry actually offers under the hood.

1. Easy Data Entry

This is the core feature. You upload a receipt, invoice, or bill. AutoEntry reads it using OCR technology.

It grabs the key data. Dates. Amounts. Supplier names. Tax codes.

You can upload documents through email, the mobile app, or your desktop. The data extraction process is fast for most documents.

AutoEntry uses AI to improve the data-capturing process. It ensures accuracy and pulls out the details that matter.

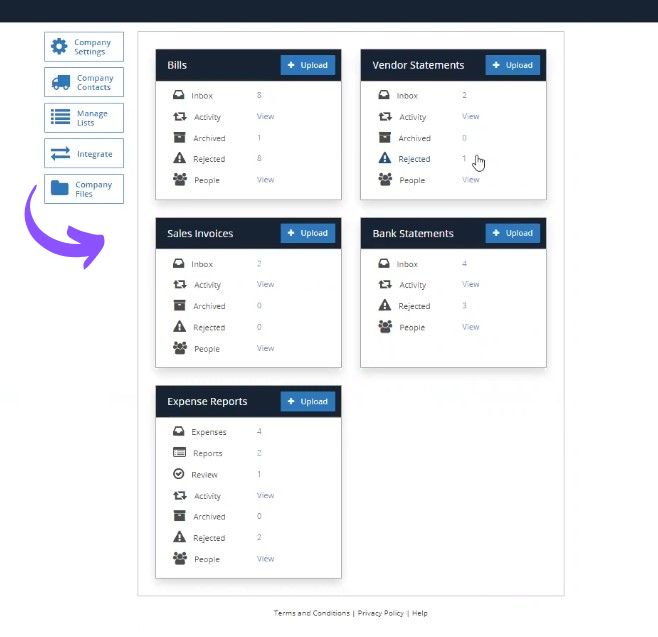

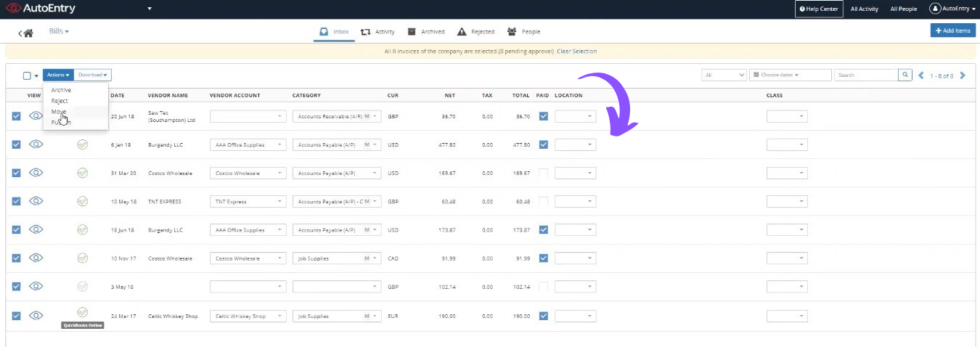

2. Detailed Dashboard

The dashboard shows everything at a glance. You can see all your uploaded documents in one place.

Track what’s been processed. See what needs review. Check your credit balance.

AutoEntry is designed to be easy to use with a focus on simplicity. Even if you’re not tech-savvy, you’ll find your way around quickly.

The interface is clean and simple. No clutter. No confusion.

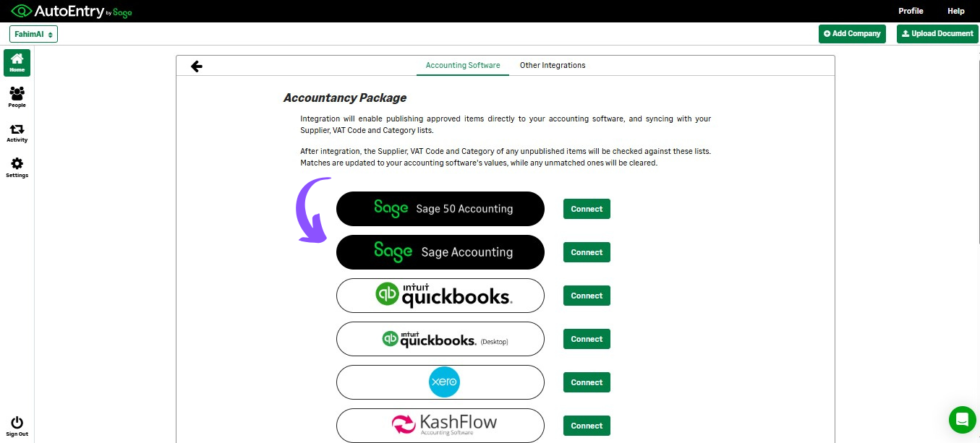

3. Accounting Software Integration

AutoEntry integrates with major accounting software including Xero, Sage, and ควิกบุ๊กส์.

The connection is smooth. Once you link your accounting software, extracted data flows right in.

It also works with KashFlow and other popular tools. You don’t need to switch your existing setup.

AutoEntry categorizes data using VAT codes and categories from your accounting software. Everything stays organized.

Here’s a quick walkthrough of how AutoEntry works in practice.

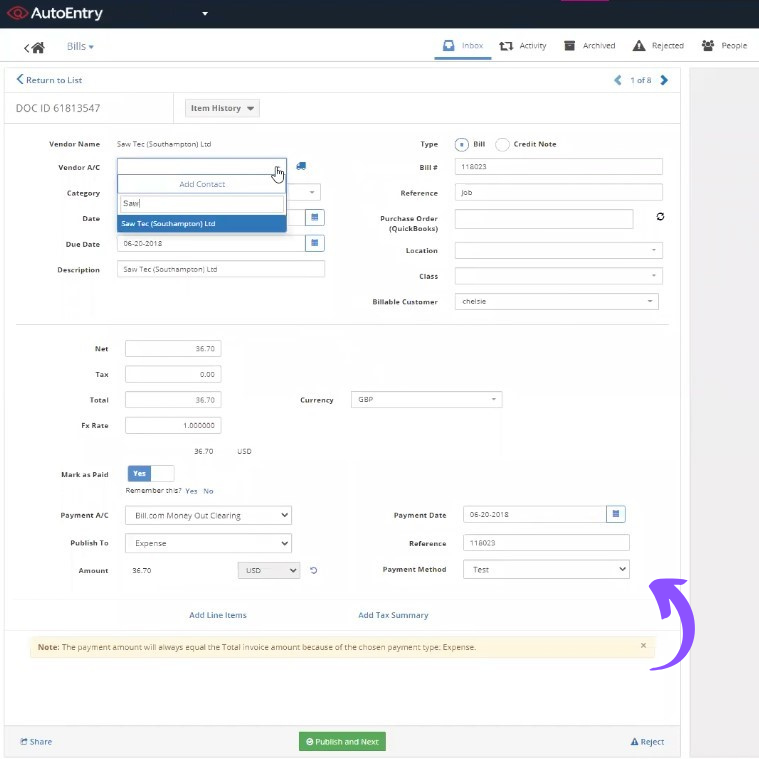

4. Bills Management

Managing purchase invoices gets much easier with this feature.

AutoEntry can quickly match invoices to monthly supplier statements. This saves hours of work that you’d normally spend comparing documents by hand.

You can group invoices for VAT periods. Then output them as a report. It’s great for staying on top of expenses.

💡 เคล็ดลับสำหรับมืออาชีพ: Set up an email address that sends invoices straight to AutoEntry. This removes the need for scanning and uploading paper invoices one by one.

5. Automated Publishing

This is where the magic happens. AutoEntry lets you auto publish data to your accounting software.

Regular items can be published automatically. Just scan or snap, and go.

AutoEntry learns categorization rules over time. It remembers how you handle certain suppliers. So next time, it does the work for you.

This feature alone cuts the time spent on data entry by a huge amount.

6. Line Item Extraction

Most basic OCR tools only grab the total from an invoice. AutoEntry goes deeper.

It extracts detailed line items from invoices. Not just totals. Every item, quantity, and price.

This matters for accounting accuracy. You need those details for proper การทำบัญชี. It costs 2 credits instead of 1, but the detail is worth it.

📌 Note: Line items cost 2 credits per document. Standard invoices without line items cost just 1 credit. Plan your credits based on how much detail you need.

7. Smart Analysis

AutoEntry doesn’t just capture data. It learns from you.

The system uses machine learning to remember how you categorize things. It remembers nominal codes and tax rules for each supplier.

Over time, you spend less effort reviewing each document. The software gets smarter with every upload.

Watch how the smart analysis feature works below.

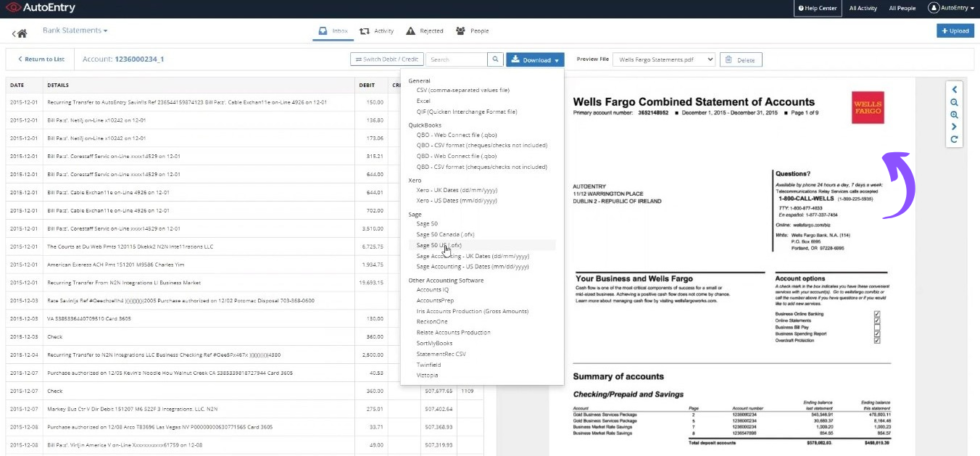

8. Bank Statement Processing

This feature is a game-changer for reconciliation.

AutoEntry converts scanned bank statements directly into CSV or accounting-ready formats. It processes about 80% of bank statement data in around 4 hours.

AutoEntry automates bank statement reconciliation. No more typing each transaction by hand.

The accuracy for PDF-to-CSV conversion is reported as high by users. This feature alone makes the subscription worth it for many accountants.

See how bank statement processing works in this walkthrough.

9. Expense Reports

AutoEntry allows users to manage uploaded expenses. You can assign them to specific users on your team.

AutoEntry enables batch processing and quick review of extracted data. This makes handling multiple expense reports fast and painless.

Your team members can snap receipts with the mobile app. The data flows into your system automatically.

Here’s a quick look at the expense reports feature in action.

Watch my personal experience with AutoEntry to see how these features work together.

AutoEntry Pricing

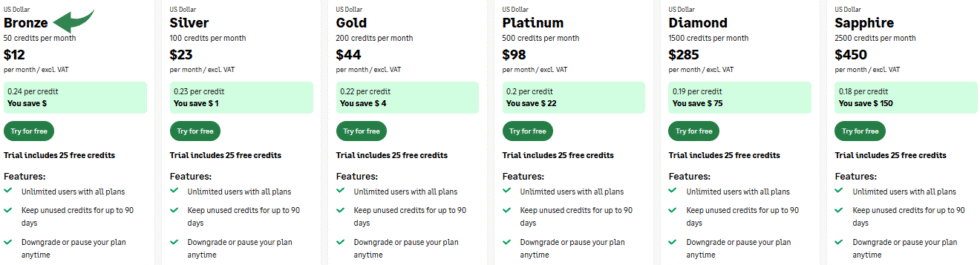

AutoEntry uses a credit-based pricing model. Every plan comes with a monthly credit allowance. Different document types use different amounts of credits.

Here’s how credits work: 1 credit for a single invoice, bill, or receipt. 2 credits for an invoice with line items. 3 credits for a single page of bank statements.

| วางแผน | ราคา | เหมาะสำหรับ |

|---|---|---|

| Bronze (25 credits) | 12 ดอลลาร์/เดือน | โซโล ฟรีแลนซ์ with low volume |

| Silver (50 credits) | 23 ดอลลาร์ต่อเดือน | Small businesses with moderate paperwork |

| Gold (125 credits) | 44 ดอลลาร์ต่อเดือน | Growing businesses with regular invoices |

| Platinum (300 credits) | $98/month | Busy accountants with many clients |

| Diamond (1,000 credits) | $285/month | Accounting firms handling high volume |

| Sapphire (2,000 credits) | 450 ดอลลาร์ต่อเดือน | Large practices with heavy workloads |

ทดลองใช้งานฟรี: Yes — no credit card required to start.

รับประกันคืนเงิน: No long-term contract. You can cancel at any time. AutoEntry uses a rolling monthly subscription.

📌 Note: You can keep unused credits for up to 90 days. AutoEntry also offers custom packages for high-volume businesses and accountants.

Is AutoEntry Worth the Price?

AutoEntry pricing starts at $12.00 per month. That’s cheaper than most competitors for similar features.

AutoEntry is often viewed as more cost-effective compared to competitors like Dext Prepare. You pay per document, not per user. That’s a big advantage.

You’ll save money if: You process a steady volume of invoices and receipts each month. The time savings alone make it worth the cost per month.

You might overpay if: Your document volume is very low (under 20 per month). The Bronze plan might feel expensive for just a handful of receipts.

💡 เคล็ดลับสำหรับมืออาชีพ: Start with the Bronze plan to test it out. You can downgrade or pause your AutoEntry plan at any time. Upgrade only when your volume grows.

AutoEntry Pros and Cons

✅ What I Liked

Up to 99% Accuracy: The OCR and machine learning technology delivers near-perfect data extraction. Very few errors on clean documents.

Huge Time Savings: I saved around 15 hours per week across 3 client accounts. AutoEntry is highly productive for accountants and bookkeepers.

Fair Credit-Based Pricing: You only pay for what you process. No hidden fees. Unlimited users on every plan.

Easy Mobile App: Users report high satisfaction with the easy-to-use interface. If you can take a selfie, you can use AutoEntry.

Strong Accounting Integrations: Works with ซีโร่, Sage, QuickBooks, and more. Publishing extracted data to your software takes seconds.

❌ What Could Be Better

Slow Processing During Peak Times: Users have reported significant lags. Processing times for invoices can range from 10 to 120 minutes. Larger batches can take up to 24 hours.

Credits Expire After 90 Days: If you don’t use your credits, you lose them. This can be frustrating for businesses with uneven workloads.

Limited to Data Capture: AutoEntry focuses primarily on data capture rather than end-to-end document management. You’ll need other tools for full workflow management.

🎯 Quick Win: Upload your documents during off-peak hours (early morning or late evening) to get faster processing times. This made a big difference in my testing.

Is AutoEntry Right for You?

✅ AutoEntry is PERFECT for you if:

- You’re an accountant or bookkeeper who processes many invoices and receipts

- You need to extract data from bank statements and other financial documents

- You want a ความปลอดภัย solution that protects your data in the cloud

- คุณ use Sage, Xero, or QuickBooks and want direct publishing

❌ Skip AutoEntry if:

- You need full document management beyond just data capture

- Your monthly volume is too low to justify even the Bronze plan

- You prefer a flat-rate pricing model instead of credits

My recommendation:

If you handle any real volume of paperwork, AutoEntry pays for itself fast. The time savings alone make it worth the price. Start with the free trial and see how many hours it saves you in the first week.

AutoEntry vs Alternatives

How does AutoEntry stack up? Here’s the competitive landscape:

| เครื่องมือ | เหมาะสำหรับ | ราคา | Rating |

|---|---|---|---|

| ออโต้เอนทรี | Credit-based data extraction | $12/mo | ⭐ 4.0 |

| เด็กซ์ | ขับเคลื่อนด้วย AI การทำบัญชี | $31.50/mo | ⭐ 4.3 |

| ฮับด็อก | Document fetching + storage | $12/mo | ⭐ 4.2 |

| ทำให้แพงขึ้น | การจัดการค่าใช้จ่าย | $5/user/mo | ⭐ 4.1 |

| ควิกบุ๊กส์ | Full accounting suite | $1.90/mo | ⭐ 4.4 |

| ซีโร่ | Cloud accounting | 29 ดอลลาร์/เดือน | ⭐ 4.5 |

| หนังสือโซโฮ | Budget-friendly accounting | Free/$10/mo | ⭐ 4.3 |

| เฟรชบุ๊คส์ | Freelancer invoicing | $21/mo | ⭐ 4.3 |

Quick picks:

- Best overall: Dext — most features and 99.9% OCR accuracy

- Best budget option: Zoho Books — free plan available with solid features

- Best for beginners: คลื่น — free and easy to learn

- Best for credit-based pricing: AutoEntry — pay only for what you use

🎯 AutoEntry Alternatives

Looking for AutoEntry alternatives? Here are the top options:

- 🧠 ปริศนาไอโอ: AI-powered accounting with automated bookkeeping and financial insights. Free plan for companies under $5k monthly expenses.

- 🌟 เด็กซ์ท: The most popular AutoEntry competitor with 99.9% OCR accuracy and WhatsApp uploads. Trusted by 700,000+ businesses.

- ⚡ Xero: Full cloud accounting with invoicing, bank reconciliation, and multi-currency support built in.

- 🔧 Synder: Best for e-commerce businesses needing automated revenue recognition and sales sync.

- 🏢 สิ้นเดือนแบบง่ายๆ: Designed for finance teams who need structured month-end closing checklists and ตรวจสอบ เส้นทางเดินป่า

- 🧠 โดไซท์: AI-powered accounting อัตโนมัติ with real-time revenue reconciliation for mid-size businesses.

- 🏢 เซจ: Enterprise-level accounting from the same company that owns AutoEntry. Great for growing businesses.

- 💰 โซโฮ บุ๊คส์: Budget-friendly with a free tier and strong invoicing features. Best for small businesses.

- 💰 คลื่น: Completely free accounting software for freelancers and very small businesses.

- 👶 ควิกเคน: Best for personal finance tracking and simple business budgeting. Starts at just $2.99/month.

- 🔒 Hubdoc: Automatic document fetching and secure cloud storage. Free with Xero subscriptions.

- 🚀 Expensify: Best for teams with การท่องเที่ยว expenses needing mobile receipt scanning and expense reports.

- 🌟 ควิกบุ๊กส์: The most popular accounting software worldwide with a massive ecosystem of add-ons.

- 🎨 เฟรชบุ๊คส์: Perfect for freelancers who need beautiful invoices and simple การติดตามเวลา.

- 🏢 เน็ตสวีท: Enterprise-grade ERP for large companies needing advanced การรายงาน and multi-subsidiary management.

⚔️ AutoEntry Compared

Here’s how AutoEntry stacks up against each competitor:

- AutoEntry vs Puzzle IO: AutoEntry is better for pure data capture. Puzzle IO offers broader AI accounting features.

- AutoEntry เทียบกับ Dext: Dext has more features and WhatsApp upload. AutoEntry is cheaper with credit-based pricing.

- AutoEntry เทียบกับ Xero: Xero is full accounting software. AutoEntry is a data capture add-on that works with Xero.

- AutoEntry เทียบกับ Synder: Synder focuses on e-commerce sync. AutoEntry focuses on receipt and invoice capture.

- AutoEntry เทียบกับ Easy Month End: Easy Month End handles closing processes. AutoEntry handles document data extraction.

- AutoEntry เทียบกับ Docyt: Docyt offers more automation for mid-size firms. AutoEntry is simpler and more affordable.

- AutoEntry เทียบกับ Sage: Sage owns AutoEntry. Sage is full accounting. AutoEntry is the data capture layer.

- AutoEntry เทียบกับ Zoho Books: Zoho Books is a full accounting suite. AutoEntry excels at document scanning specifically.

- AutoEntry เทียบกับ Wave: Wave is free but lacks OCR data extraction. AutoEntry’s scanning ability is far superior.

- AutoEntry เทียบกับ Quicken: Quicken is personal finance. AutoEntry is ธุรกิจ document capture. Different tools entirely.

- AutoEntry เทียบกับ Hubdoc: Both capture data. Hubdoc auto-fetches bills from suppliers. AutoEntry has better OCR accuracy.

- AutoEntry เทียบกับ Expensify: Expensify is best for travel expenses. AutoEntry handles invoices and bank statements better.

- AutoEntry เทียบกับ QuickBooks: QuickBooks is accounting software. AutoEntry feeds data into QuickBooks to save you time.

- AutoEntry เทียบกับ FreshBooks: FreshBooks focuses on invoicing clients. AutoEntry focuses on processing incoming documents.

- AutoEntry เทียบกับ NetSuite: NetSuite is enterprise ERP. AutoEntry is a focused data entry tool for smaller teams.

My Experience with AutoEntry

Here’s what actually happened when I used AutoEntry:

The project: I used AutoEntry for 3 client accounts. One retail business. One consulting firm. One construction company. All had stacks of paperwork.

Timeline: 90 consecutive days of real use.

ผลลัพธ์:

| Metric | Before | After |

|---|---|---|

| Hours on data entry per week | 18 hours | 3 hours |

| Data entry errors per month | 12-15 errors | 1-2 errors |

| Invoice processing time | 4 minutes each | 30 seconds each |

What surprised me: AutoEntry can process 80% of receipts, invoices, vendor statements, and bills in about 2 hours. I didn’t expect it to be that fast for standard documents. The learning feature also got better each week.

What frustrated me: The processing delays during peak periods were real. Some larger batches took several hours. I also wish credits didn’t expire. That felt unfair.

⚠️ Warning: Processing times for invoices generally range from 10 to 120 minutes but can take up to 24 hours for larger batches. Don’t leave big uploads to the last minute before a deadline.

Would I use it again? Yes. AutoEntry is generally regarded as reliable, time-saving, and cost-effective for automating data entry. It’s not perfect, but it’s a solid tool.

ข้อคิดส่งท้าย

Get AutoEntry if: You’re an accountant or bookkeeper drowning in paper invoices and bank statements. It will save you hours every week.

Skip AutoEntry if: You only handle a few receipts per month. The cost won’t make sense for very low volume.

My verdict: After 90 days, I’m keeping my subscription. AutoEntry does one thing really well: it turns your paperwork into usable data. It’s not trying to be everything. And that focus is what makes it good.

AutoEntry is best for accountants who want to save time and reduce errors. It’s not for everyone. But if manual data entry is eating your day, this tool will give you those hours back.

Rating: 4/5

ถาม บ่อย ๆ

How does AutoEntry work?

AutoEntry automatically grabs data from receipts, invoices, statements, and other financial documents. You upload a document through email, the mobile app, or your desktop. The tool uses optical character recognition and AI to extract data like dates, amounts, and supplier names. Then it publishes the data to your accounting software like Sage, QuickBooks, or Xero.

Is AutoEntry owned by Sage?

Yes. AutoEntry is owned by Sage. Sage acquired AutoEntry in September 2019. Since then, AutoEntry has continued to grow as the market-leading data automation tool. Being part of Sage means strong integration with Sage accounting products.

How long does AutoEntry take to process?

Processing times vary. AutoEntry can process 80% of receipts and invoices in about 2 hours. Bank statements take about 4 hours for 80% of the data. However, larger batches can take up to 24 hours during peak periods. Most single documents finish within 10 to 120 minutes.

How much does AutoEntry cost?

AutoEntry pricing starts at $12 per month for 25 credits. Plans go up to $450 per month for 2,000 credits. You only pay for the data you extract. All plans include unlimited users and unlimited cloud storage. Credits roll over for up to 90 days. Custom packages are available for high-volume users.

โปรแกรม AutoEntry สามารถใช้งานร่วมกับ QuickBooks ได้หรือไม่?

Yes. AutoEntry integrates with a wide range of accounting software including QuickBooks, Xero, Sage, and KashFlow. You can publish extracted data directly to QuickBooks with just a few clicks. The integration is smooth and keeps your data organized.