Утопаете в квитанциях и счетах?

Ручной ввод данных отнимает много времени, которое можно было бы потратить на развитие своего бизнеса. бизнес или просто отдыхать.

Застрять в бумажной волоките — это ужасно.

А что, если есть более простой способ?

А что если бы вы могли автоматизировать большую часть ввода данных?

АвтоВвод Это хорошо, но мир интеллектуального управления данными постоянно меняется.

В этой статье представлены 9 лучших альтернатив AutoEntry, которые помогут вам более эффективно вводить данные, уменьшить количество ошибок и сэкономить время.

Какие существуют лучшие альтернативы системе автоматического доступа?

Выбрать подходящее решение для ввода данных может быть непросто из-за огромного количества вариантов.

Мы уже сделали за вас всю сложную работу!

В этом списке представлены лучшие альтернативы AutoEntry, доступные сегодня.

So you can easily find your perfect fit for your бизнес and say goodbye to manual data entry headaches.

1. Xero (⭐4.8)

Xero — популярная облачная платформа. бухгалтерское программное обеспечение.

Это действительно очень удобно в использовании. малый бизнесXero предназначен не только для ввода данных.

Это поможет вам с выставлением счетов, квитанций и сверкой банковских счетов.

Кроме того, он отлично работает с Хабдок для управления документами.

Раскройте его потенциал с помощью нашего Учебное пособие по Xero.

Также ознакомьтесь с нашими AutoEntry против Xero сравнение!

Наше мнение

Присоединяйтесь к более чем 2 миллионам компаний! используя Xero Бухгалтерское программное обеспечение. Оцените его мощные функции выставления счетов прямо сейчас!

Основные преимущества

- Автоматизированная сверка банковских счетов

- Онлайн-выставление счетов и платежи

- Управление счетами

- Интеграция с системой расчета заработной платы

- Отчетность и аналитика

Цены

- Стартер: 29 долларов в месяц.

- Стандарт: 46 долларов в месяц.

- Премиум: 69 долларов в месяц.

Плюсы

Минусы

2. Головоломка IO (⭐4.5)

Puzzle IO — это новая игра, созданная специально для искусственного интеллекта. бухгалтерский учет платформа.

Вместо этого, она предоставляет вам предельно ясное представление о ваших деньгах в режиме реального времени, без всей этой запутанной терминологии.

Воспринимайте это как вашу финансовую панель управления, которая точно показывает, что происходит с вашими деньгами.

Раскройте его потенциал с помощью нашего Учебное пособие по Puzzle IO.

Также ознакомьтесь с нашими AutoEntry против Puzzle IO сравнение!

Наше мнение

Готовы упростить свои финансы? Узнайте, как Puzzle io может сэкономить вам до 20 часов в месяц. Почувствуйте разницу уже сегодня!

Основные преимущества

Puzzle IO действительно блестяще помогает понять, куда движется ваш бизнес.

- 92% Пользователи отмечают повышение точности финансового прогнозирования.

- Получайте актуальную информацию о движении денежных средств в режиме реального времени.

- Легко создавайте различные финансовые сценарии для планирования.

- Обеспечьте бесперебойное сотрудничество со своей командой для достижения финансовых целей.

- Отслеживайте ключевые показатели эффективности (KPI) в одном месте.

Цены

- Основы бухгалтерского учета: 0 долларов в месяц.

- Аналитические материалы Accounting Plus: 42,50 долларов в месяц.

- Бухгалтерский учет плюс расширенная автоматизация: 85 долларов в месяц.

- Шкала Accounting Plus: 255 долларов в месяц.

Плюсы

Минусы

3. Декст (⭐4.0)

Dext упрощает управление квитанциями и счетами-фактурами.

Просто сделайте снимок или перешлите электронное письмо; Dext извлечет ключевую информацию, ускоряя ввод данных в вашу систему. бухгалтерский учет программное обеспечение.

Это помогает поддерживать порядок и точность во всем.

Раскройте его потенциал с помощью нашего Учебное пособие Dext.

Также ознакомьтесь с нашими AutoEntry против Dext сравнение!

Наше мнение

Готовы сэкономить более 10 часов в месяц? Узнайте, как автоматизированный ввод данных, отслеживание расходов и отчетность Dext могут оптимизировать ваши финансы.

Основные преимущества

Dext действительно превосходно справляется с задачей упрощения управления расходами.

- 90% пользователей отмечают значительное уменьшение количества бумажных документов.

- Его точность превышает 98%. при извлечении данных из документов.

- Создание отчетов о расходах становится невероятно быстрым и простым.

- Беспроблемно интегрируется с популярными бухгалтерскими платформами, такими как QuickBooks и Xero.

- Помогает гарантировать, что вы никогда не потеряете важные финансовые документы.

Цены

- Годовая подписка: $24

Плюсы

Минусы

4. Снайдер (⭐3.8)

Synder связывает ваши онлайн-продажи с бухгалтерский учет программное обеспечение.

Если вы продаете товары на Shopify или используете Stripe, данные о продажах отправляются напрямую в QuickBooks или Xero.

Это обеспечивает точность ваших данных о онлайн-продажах.

Раскройте его потенциал с помощью нашего Synder tutorial.

Также ознакомьтесь с нашими AutoEntry против Synder сравнение!

Наше мнение

Synder автоматизирует ваш бухгалтерский учет, обеспечивая бесшовную синхронизацию данных о продажах с QuickBooks. Ксерои многое другое. Компании, использующие Synder, сообщают об экономии в среднем более 10 часов в неделю.

Основные преимущества

- Автоматическая синхронизация данных о продажах

- Отслеживание продаж по нескольким каналам

- Сверка платежей

- Интеграция системы управления запасами

- Подробная отчетность о продажах

Цены

Все планы будут Оплата производится ежегодно..

- Базовый: 52 доллара в месяц.

- Существенный: 92 доллара в месяц.

- Плюсы: 220 долларов в месяц.

- Премиум: Индивидуальное ценообразование.

Плюсы

Минусы

5. Простой конец месяца (⭐3.6)

Easy Month End — это инструмент, разработанный для упрощения ежемесячного закрытия финансовой отчетности.

Он создан для финансовых отделов и помогает отслеживать задачи и управлять сверками.

Больше никаких запутанных электронных таблиц и бесконечных согласований.

Это позволяет поддерживать порядок и обеспечивает возможность проведения аудита.

Раскройте его потенциал с помощью нашего Простой учебник по завершению месяца.

Также ознакомьтесь с нашими Автоматический ввод против упрощенного закрытия месяца сравнение!

Наше мнение

Повысьте точность финансовых данных с помощью Easy Month End. Воспользуйтесь автоматической сверкой и отчетностью, готовой к аудиту. Закажите индивидуальную демонстрацию, чтобы оптимизировать процесс закрытия месяца.

Основные преимущества

- Автоматизированные процессы сверки

- Управление задачами и отслеживание

- Дисперсионный анализ

- Управление документами

- Инструменты для совместной работы

Цены

- Стартер: 24 доллара в месяц.

- Маленький: 45 долларов в месяц.

- Компания: 89 долларов в месяц.

- Предприятие: Индивидуальное ценообразование.

Плюсы

Минусы

6. Шалфей (⭐️3.4)

Таким образом, Sage — это известное имя в этой сфере. бухгалтерский учет мир. Они существуют уже довольно давно.

Их программное обеспечение использует искусственный интеллект для решения таких задач, как выставление счетов и сверка банковских выписок.

Это отличный вариант для крупных компаний, которым необходима комплексная система.

Оно также взаимодействует с другими бухгалтерский учет программное обеспечение.

Раскройте его потенциал с помощью нашего Учебное пособие Sage.

Также ознакомьтесь с нашими Autoentry против Sage сравнение!

Наше мнение

Готовы значительно улучшить свои финансы? Пользователи Sage сообщают о повышении производительности в среднем на 73% и сокращении времени выполнения процессов на 75%.

Основные преимущества

- Автоматизированное выставление счетов и платежи

- Финансовые отчеты в режиме реального времени

- Надежная защита данных

- Интеграция с другими бизнес-инструментами

- Решения для расчета заработной платы и управления персоналом.

Цены

- Профессиональный бухгалтерский учет: 66,08 долларов в месяц.

- Премиум-бухгалтерия: 114,33 долларов в месяц.

- Квантовый учет: 198,42 долларов в месяц.

- Пакеты услуг по управлению персоналом и расчету заработной платы: Индивидуальное ценообразование, основанное на ваших потребностях.

Плюсы

Минусы

7. RefreshMe (⭐3.2)

RefreshMe Это менее известный, но вполне жизнеспособный вариант для малых предприятий.

Он разработан таким образом, чтобы быть простым и доступным.

Этот инструмент может избавить вас от множества проблем и обеспечить вашу безопасность. данные Это точно.

Это полезное дополнение к вашему бухгалтерский учет рутина.

Раскройте его потенциал с помощью нашего Обновите руководство.

Также ознакомьтесь с нашими Автоматический ввод против обновления сравнение!

Наше мнение

Сильная сторона RefreshMe заключается в предоставлении актуальной и полезной информации в режиме реального времени. Однако отсутствие публичной информации о ценах и потенциально менее полный набор основных функций бухгалтерского учета могут стать препятствием для некоторых пользователей.

Основные преимущества

- Финансовые панели мониторинга в режиме реального времени

- Обнаружение аномалий с помощью ИИ

- Настраиваемые отчеты

- Прогнозирование денежных потоков

- Сравнительный анализ производительности

Цены

- Индивидуальный (3B): 24,99 долларов в месяц.

- Пара (3B): 44,99 долларов в месяц.

Плюсы

Минусы

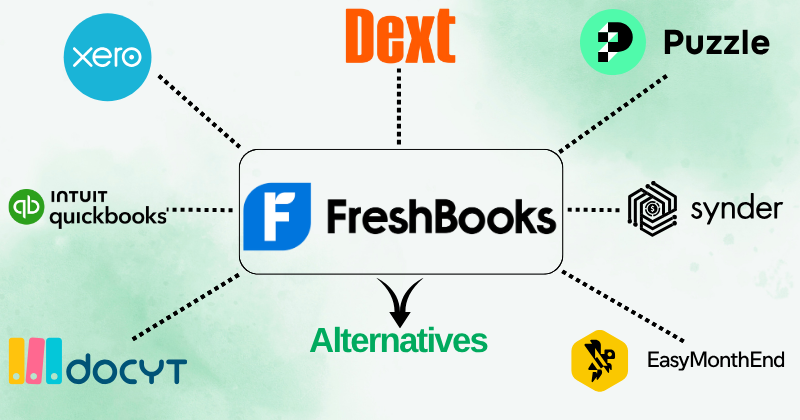

8. FreshBooks (⭐3.0)

FreshBooks — популярная программа для ведения бухгалтерского учета, особенно для фрилансеры и малых предприятий.

Это значительно упрощает выставление счетов.

Вы также можете отслеживать время, управлять расходами и контролировать платежи.

Это упрощает выставление счетов клиентам и учет рабочего времени, а также призвано сэкономить ваше время на административных задачах.

Раскройте его потенциал с помощью нашего Учебное пособие по FreshBooks.

Также ознакомьтесь с нашими AutoEntry против FreshBooks сравнение!

Наше мнение

Устали от сложной бухгалтерии? Более 30 миллионов компаний доверяют FreshBooks создание профессиональных счетов-фактур. Упростите свой учет. бухгалтерское программное обеспечение сегодня!

Основные преимущества

- Профессиональное создание счетов-фактур

- Автоматические напоминания об оплате

- Отслеживание времени

- Инструменты управления проектами

- Отслеживание расходов

Цены

- Лайт: 2,10 доллара в месяц.

- Кроме того: 3,80 доллара в месяц.

- Премиум: 6,50 долларов в месяц.

- Выбирать: Индивидуальное ценообразование.

Плюсы

Минусы

9. QuickBooks (⭐2.8)

QuickBooks — это очень известная компания в сфере... бухгалтерский учет программное обеспечение.

Его используют многие малые и средние предприятия. Это универсальный инструмент.

Это отличное решение для управления всеми финансовыми задачами, такими как выставление счетов, отслеживание расходов и даже расчет заработной платы.

Оно даже позволяет фотографировать чеки.

Раскройте его потенциал с помощью нашего Учебное пособие по QuickBooks.

Также ознакомьтесь с нашими AutoEntry против QuickBooks сравнение!

Основные преимущества

- Автоматизированная категоризация транзакций

- Создание и отслеживание счетов-фактур.

- Управление расходами

- услуги по расчету заработной платы

- Отчетность и информационные панели

Цены

- Простой старт: 1,90 доллара в месяц.

- Существенный: 2,80 доллара в месяц.

- Кроме того: 4 доллара в месяц.

- Передовой: 7,60 долларов в месяц.

Плюсы

Минусы

Руководство для покупателей

При проведении исследования для поиска наилучшей альтернативы AutoEntry мы использовали следующие факторы, чтобы определить оптимальный вариант, отвечающий конкретным потребностям наших клиентов:

- Цены: Сколько стоил каждый продукт? Мы оценили, является ли ценообразование экономически выгодным решением для различных предприятий.

- Функции: Каковы были ключевые особенности каждого продукта? Мы сосредоточились на том, как каждый из вариантов представлял собой комплексное решение для управления финансовыми документами. Это включало возможность легко собирать, обрабатывать и извлекать соответствующие данные, включая структурированные данные и данные документов, из счетов-фактур, квитанций, банковских выписок в формате PDF и других финансовых документов. Мы также искали удобный интерфейс и конкретные функции, такие как возможность извлечения позиций и точность сбора данных. Мы учитывали возможности интеграции с популярными инструментами, такими как QuickBooks Online и другими бизнес-системами, чтобы обеспечить бесперебойную передачу данных и повысить операционную эффективность и финансовое управление. Мы также сосредоточились на функциях искусственного интеллекта Atera, таких как IT Autopilot и AI Copilot, которые помогают автоматизировать задачи и повысить эффективность. IT Autopilot — это агент ИИ, который может обрабатывать рутинные задачи и автономно решать проблемы, а AI Copilot — это интеллектуальный помощник для технических специалистов, который предоставляет мгновенные рекомендации и контекстно-зависимые предложения.

- Недостатки: Чего не хватало каждому продукту? Мы выявили любые недостающие функции или потенциальные недостатки, которые могли бы... влияние Процесс обработки счетов к оплате или общее финансовое управление. Мы также отметили любые проблемы, которые могли повлиять на точность извлечения данных из больших объемов документов.

- Поддержка или возврат средств: Предлагают ли они сообщество, поддержку и политику возврата средств? Мы оценили уровень предлагаемой поддержки клиентов, ища поставщиков с лучшей поддержкой и полезными ресурсами для пользователей других инструментов. Мы также учитывали наличие правил для автоматизации процесса и повышения эффективности.

Подведение итогов

В этом руководстве мы рассмотрели ключевые факторы при выборе альтернативы AutoEntry.

Мы рассмотрели ценообразование и важные функции, такие как обработка документов и обработка счетов-фактур.

Мы также учитывали возможность обработки товарных накладных и квитанций, а также банковских выписок из различных источников.

Правильный инструмент будет обладать различными функциями, отвечающими вашим конкретным требованиям.

Лучшее программное обеспечение для управления личными финансами или бизнес-инструмент должны точно создавать и обрабатывать данные.

Существует множество отличных вариантов, но важно найти тот, который подходит именно вам.

Надеемся, это руководство вам поможет. делать Разумный выбор.

Нахождение популярного варианта, отвечающего вашим потребностям, может существенно повлиять на вашу работу.

Часто задаваемые вопросы

What is AutoEntry by Sage?

AutoEntry is an intelligent автоматизация tool that digitizes financial paperwork. It captures data from scanned receipts, invoices, and bank statements, then publishes it directly to your бухгалтерское программное обеспечение. It essentially eliminates manual data entry for bookkeepers.

How much does Sage AutoEntry cost?

AutoEntry uses a credit-based pricing model rather than a strict monthly subscription. Plans typically start around $12 to $15 per month for a bundle of credits (e.g., 50 credits). One standard invoice usually costs one credit, while bank statements cost more per page.

Is AutoEntry free?

No, it is not a free tool. However, it offers a free trial so you can test its accuracy before committing. Unlike many competitors that force high-tier subscriptions, its pay-as-you-go credit system is often more cost-effective for fluctuating workloads.

Работает ли функция автоматического ввода данных с QuickBooks?

Yes, it integrates seamlessly with both QuickBooks Online and QuickBooks Desktop. You can snap a photo of a receipt, and AutoEntry will extract the data and push it directly into QuickBooks as a transaction.

What is the alternative to AutoEntry?

Top competitors include Dext Prepare (formerly Receipt Bank) and Hubdoc. Dext is highly regarded for its mobile app and volume handling, while Hubdoc is a strong contender often favored by Xero users for its direct integration.

When did Sage buy AutoEntry?

Sage acquired AutoEntry in 2019. This acquisition allowed Sage to embed powerful data automation directly into its ecosystem, though AutoEntry continues to integrate with other platforms like Xero and QuickBooks.

Does AutoEntry work with Sage 200?

AutoEntry integrates natively with Sage 50 and Sage Business Cloud Accounting. For Sage 200, integration is often achieved through specific connectors or by exporting data as CSV files and importing them, as direct native syncing is less standard than with Sage 50.

More Facts about Autoentry Alternatives

- Expensify is a tool that helps you track your spending and generate reports.

- DocuClipper is a tool that reads текст from financial papers. It can pull information from bank statements, tax forms, and receipts with 99% accuracy. It is very fast and turns that information into Excel or CSV files.

- Хабдок is a website that stores your documents in the cloud. It organizes your bills and receipts by automatically reading the important numbers on them. It usually costs $12 USD a month.

- Docparser is a tool that extracts specific data from various file types, such as PDFs, Word documents, and Excel sheets.

- Dext Prepare uses the cloud to help businesses handle their money paperwork. It captures, reads, and organizes bills and receipts to speed up the process.

- MoneyThumb is built to turn PDF bank statements into special files that accounting software can understand.

- Datamolino reads invoices quickly and accurately. It can read the detailed list of items on a bill, not just the total price, and it has real people ready to help if the computer makes a mistake.

- АвтоВвод is software that automates data entry for businesses. It works with many types of papers, including invoices, receipts, and bank statements.

- Comparing Dext and AutoEntry: Both tools read receipts and invoices to save time and stop mistakes. They both connect easily with popular accounting programs like Xero and QuickBooks Online. However, some users think Dext is easier for new users.

- Служба поддержки клиентов: Both Dext and AutoEntry offer help through articles or by speaking with a support representative. Many people say AutoEntry’s support team is very helpful.

- AutoEntry Performance: Users say AutoEntry saves them a lot of time. However, some people have had technical trouble with the app that syncs their data.

- Why People Switch: Some users look for alternatives to AutoEntry due to price or missing features. For example, switching to Datamolino has helped some businesses improve their data entry processes.

- Zoho Expense automatically handles spending reports and integrates with other apps in the Zoho family.

- DataSnipper is made to help with the “accounts payable” process (paying bills). It helps check invoices and fix mistakes.

- Enterprise Tools: Kofax Capture and ABBYY FlexiCapture are powerful tools designed for large companies with large volumes of unorganized documents to process.

- Запьер is a tool that connects different apps. It helps them “talk” and do work automatically so you don’t have to do it by hand.

- Cost Differences: DocuClipper costs about 5 cents per page. In comparison, AutoEntry can cost around 54 cents for the same amount of work.

- SaasAnt Transactions is a tool for moving long lists of transactions into or out of QuickBooks and Xero all at once.

- Rossum uses smart Artificial Intelligence (AI) to read and process large amounts of documents quickly.