どれが 会計ソフトウェア あなたのビジネスに最適なものは何ですか?

Xero と Wave のどちらを選ぶか迷ってしまいますよね。

どちらもお金の管理を手助けしてくれると言われています。

この記事では、両方の機能について詳しく説明します。

Xero と Wave の重要な詳細を検証し、どちらのソフトウェアがあなたに適しているかを明確に確認します。

概要

私たちは、Xero と Wave の両方をクリックして時間を費やしました。

請求書の送信や経費の追跡などの機能を試しています。

この実践的な経験により、私たちは各人が日々どのように働いているかを実際に感じることができました。

選択に役立つよう、このわかりやすい比較をご紹介します。

200万社以上の企業がXeroのクラウドベース会計ソフトウェアをご利用いただいています。強力な請求書作成機能を今すぐお試しください!

価格: 無料トライアルがあります。有料プランは月額 29 ドルから始まります。

主な特徴:

- 銀行照合

- 請求書発行

- 報告

400万以上 中小企業 財務管理はWaveにお任せください。Waveのプランを詳しくご確認いただき、最適なプランを見つけてください。

価格: 無料プランをご利用いただけます。有料プランは月額19ドルからとなります。

主な特徴:

- 請求書発行

- 銀行業務

- 給与計算アドオン。

Xero とは何ですか?

Xero を検討されているのですか?多くの企業に人気の選択肢です。

お金を管理するためのオンラインハブと考えてください。

請求書の送信、支払い、ビジネスのパフォーマンスの監視に役立ちます。

また、私たちのお気に入りを探索してください Xeroの代替品…

私たちの見解

200万以上の企業にご参加ください Xeroを使用 会計ソフトウェア。強力な請求書作成機能を今すぐお試しください!

主なメリット

- 自動銀行照合

- オンライン請求と支払い

- 請求書管理

- 給与計算統合

- レポートと分析

価格

- スターター: 月額29ドル。

- 標準: 月額46ドル。

- プレミアム: 月額69ドル。

長所

短所

Waveとは何ですか?

さて、Waveについてお話しましょう。Waveは無料であることで知られています 会計 ソフトウェア。

これは、創業したばかりの多くの中小企業にとって大きな魅力です。

請求書の処理、収入と支出の追跡、キャッシュフローの管理を、基本機能については月額料金なしで行うことができます。

また、私たちのお気に入りを探索してください Waveの代替…

私たちの見解

妥協はやめましょう!Wave の強力で無料のコア会計機能を活用して財務を効率化している 200 万以上の中小企業にぜひご参加ください。

主なメリット

Wave の強みは次のとおりです。

- 100% 無料のコア会計プラン。

- 200 万以上の中小企業にサービスを提供しています。

- 請求書の作成と支払い処理が簡単。

- 長期契約や保証はありません。

価格

- スタータープラン: 月額$0。

- プロプラン: 月額19ドル。

長所

短所

機能比較

最良のものを選ぶ 会計 ソフトウェアを選ぶということは、価格だけでなく、各ツールが実際にビジネスにどのような効果をもたらすかを考えることを意味します。

This detailed comparison cuts through the noise, showing you where each cloud-based 会計ソフトウェア truly shines.

1. 成長に合わせた価格設定と拡張性

- ゼロ: ビジネスの成長に合わせて設計された段階的な価格プランを提供しています。初期プランには制限がありますが、拡張プランでは高度な機能が利用可能になるため、Xero会計ソフトウェアは既存のビジネスや成長中のビジネスにとって長期的な選択肢として最適です。

- 波: 無料の会計ソフトウェアのコアは、 中小企業 オーナーや独立請負業者向け。Wave Payrollや決済処理などのアドオン機能のみ追加費用が発生するため、予算に優しい選択肢となります。

2. 銀行業務と自動取引

- ゼロ: Xeroは、財務記録を更新する銀行フィードにより、銀行取引を簡単にします。Xeroでは、リアルタイムで データ 自動銀行フィードにより、手動によるデータ入力が大幅に削減され、キャッシュフロー管理が改善されます。

- 波: Waveは銀行取引の自動インポート機能を提供し、 中小企業 所有者は最新の情報を把握しています。Waveのレビューによると、銀行取引を連携させることで、最小限の労力で財務情報を最新の状態に保つことができることが示されています。

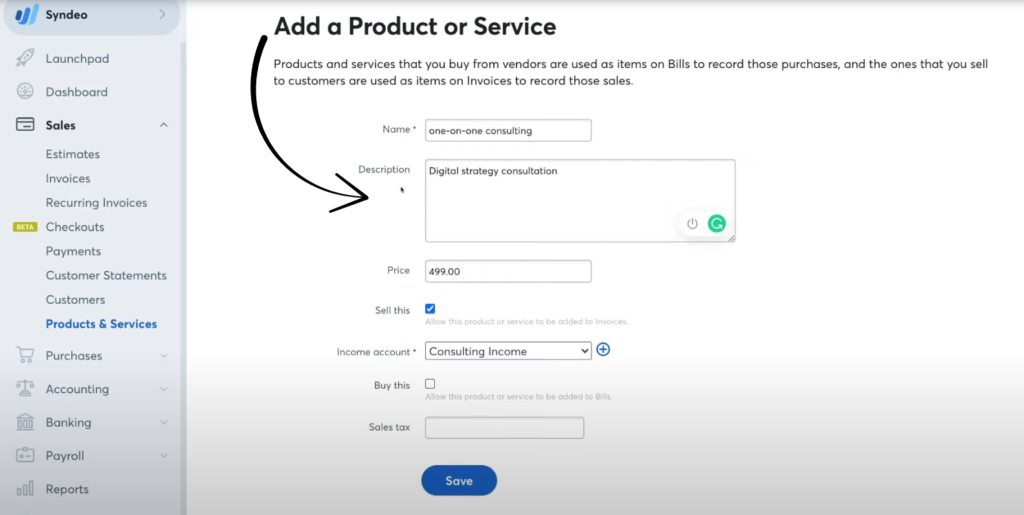

3. 請求と支払い

- ゼロ: オンライン請求書発行は、この分野での強みです。自動支払いリマインダーを設定し、プラットフォームを使用して未払い請求書を簡単に追跡することで、売掛金の健全な維持に役立ちます。

- 波: 無料版には、強力なオンライン請求書発行機能が搭載されています。Waveはクレジットカードまたは銀行振込によるオンライン決済に対応しており、支払いの迅速化に貢献し、中小企業の経営者にとって優れた資金管理機能を提供します。

4. 在庫とプロジェクトの追跡

- ゼロ: Xeroは、上位プランに在庫管理機能が組み込まれていることで優れています。この機能は、複数の拠点やプロジェクト(プロジェクト追跡を含む)にわたる在庫管理と在庫データの追跡を必要とする既存ビジネスにとって非常に重要です。

- 波: Waveには在庫管理モジュールが組み込まれていません。在庫管理やプロジェクト追跡を行うには、サードパーティ製アプリと連携するWaveの限定的な機能を使用する必要があります。

5. 財務報告と分析

- ゼロ: ゼロの 報告 豊富な機能を備え、カスタマイズ可能なレポート機能により、財務状況と業績を明確に把握できます。売掛金と買掛金の機能に関する包括的なレポートを作成できます。

- 波: Waveは損益計算書や貸借対照表といった基本的な財務レポートを提供します。便利な一方で、Xero会計ソフトウェアと比較すると、詳細度とカスタマイズ性は限られています。

6. 経費と請求書の管理

- ゼロ: Xeroを使用すると、請求書のキャプチャ、注文書の入力、支払管理機能を使用した支払いのスケジュールを簡単に行うことができます。y. これは支出を管理し、財務管理を改善するための鍵となります。

- 波: Waveは経費管理を効率化しており、外出先でもデジタル領収書をキャプチャできるオプションも備えています。その主要機能は、企業の基本的な買掛金管理に役立ちます。

7. グローバルビジネスの準備

- ゼロ: Xeroは複数の通貨に対応し、為替差損益を自動管理するため、国際的に事業を展開する企業に最適です。この機能は、既存のプランに標準装備されています。

- 波: Wave は主に米国とカナダ国内で事業を展開する企業に重点を置いており、複数の通貨や国際的な事業に対するサポートは限定的です。

8. エンタープライズリソースプランニング(ERP)機能

- ゼロ: Xero会計ソフトウェアは完全な企業資源計画システムではありませんが、特にその広範な統合により、ERP機能は 作る 単純な会計処理だけでなく、多くのタスクに拡張可能です。グラム。

- 波: Waveは中小企業向け会計ソフトウェアに特化しており、ERP機能を提供するようには設計されていません。小規模事業に必要な総勘定元帳と基本的な財務業務を提供します。

9. ユーザーサポートとリソース

- ゼロ: ユーザーはXero Centralからヘルプや情報を入手できます。充実したドキュメントと強力なパートナーサポートを重視する企業には、Xeroをおすすめします。

- 波: Waveは、ヘルプセンターとオンラインチケットを通じてサポートを提供しています。より基本的なサポート体制のため、セルフサービスのオンラインリソースをご利用いただける方にはWaveをおすすめします。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

以下に、留意すべき追加事項をいくつか示します。

- モバイルアプリは iOS レシートのスキャンなどのタスクには Android デバイスを使用しますか?

- 1 つの無料プラットフォームまたはアカウントから複数の企業を管理できるかどうかを確認します。

- 無料のスターター プランまたはスターター プランがニーズに合わない場合は、データ移行によってプロバイダーを簡単に切り替えられるかどうかを検討してください。

- 物事を理解するのに時間を無駄にしないために、ユーザーフレンドリーなインターフェースを探しましょう。

- システムは銀行取引を自動的に分類し、効率化のために自動マージを提供する必要があります。

- チームがある場合は、無制限のユーザーと複数のユーザーをサポートしているかどうかを確認してください。

- Wave Financial は無料ですが、より多くの機能を必要とする成長中のビジネスの場合は、Xero の価格または Xero のコストを確認してください。

- 安心できる多要素認証などの強力なセキュリティ機能を探してください。

- 専門サービスの請求対象時間を追跡し、それを定期請求に使用できますか?

- 低いクレジットカード取引手数料で、銀行支払いとクレジットカード支払いを迅速に入力できますか?

- 請求書発行ソフトウェアが定期的な請求書を提供し、Apple Pay のような支払いをサポートしているかどうかを確認します。

- 消費税の管理に役立ち、選択した日付範囲にわたって適切な財務レポートを提供できることを確認します。

- 独立請負業者に直接入金で支払いを受けるのはどれくらい簡単ですか?

- 主要機能には、ビジネスの財務健全性をサポートするために必要なすべてのツールが含まれていますか?

最終評決

この詳細な比較を検討し、完全なウェーブアカウンティングレビューを実行した後。

私たちの選択はあなたのステージによって異なります。

あなたが フリーランサー 無制限の請求書が作成できる基本的なシステムが必要な場合は、Wave が最適です。

無料版では個人の財務管理とシンプルな 簿記 記録。

しかし、本格的に成長を目指すビジネスの場合は、xero をご利用ください。

初期プランでは請求書が最大 5 件までに制限されますが、銀行口座の管理や顧客データの統合に関する Xero の強力な機能は優れています。

Xero ダッシュボードを使用すると、財務データをより詳細に把握できます。

xero をテストしてその威力を確認しましょう。

ただし、Wave には給与計算処理などの高度な機能を備えた有料のプロ プランがあり、税金申告に最適です。

Xero は強力な顧客サポートと拡張性を備えているため、事業拡大を目指す企業に最適です。

Xeroの詳細

適切な会計ソフトウェアを選択するには、いくつかの選択肢を検討する必要があります。

Xero と他の人気製品を簡単に比較してみましょう。

- Xero vs QuickBooks: QuickBooksは主要な競合製品です。どちらも同様のコア機能を提供していますが、Xeroは洗練されたインターフェースと無制限のユーザー数で高く評価されています。QuickBooksはより複雑な機能を備えていますが、非常に強力なレポート機能を備えています。

- Xero vs FreshBooks: FreshBooksは、特にフリーランサーやサービスベースのビジネスに人気の選択肢です。請求書発行と勤怠管理に優れています。Xeroは、より包括的な会計ソリューションを提供します。

- Xero vs Sage: SageとXeroはどちらも中小企業向けのソリューションを提供しています。しかし、Sageはより包括的なエンタープライズ・リソース・プランニング(ERP)ツールも、大企業向けに提供しています。

- Xero vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。在庫管理のための高度な機能を備えていることが多く、非常に費用対効果が高いのが特徴です。一方、Xeroはシンプルさと使いやすさの点で優れた選択肢です。

- Xero vs Wave: Waveは無料プランで知られています。小規模企業や予算が限られているフリーランサーにとって最適な選択肢です。Xeroはより幅広い機能を提供しており、ビジネスの成長に適しています。

- Xero vs Quicken: Quickenは主に個人の財務管理に使用されます。ビジネス向けの機能もいくつか備えていますが、真のビジネス会計ソリューションではありません。Xeroは、ビジネス会計の複雑な処理に特化して設計されています。

- Xero vs Hubdocこれらは直接的な競合ではありません。DextとHubdocはどちらも、文書のキャプチャとデータ入力を自動化するツールです。Xeroと直接連携することで、簿記をより迅速かつ正確に行うことができます。

- ゼロ vs シンダー: Synderは、販売チャネルと決済ゲートウェイを会計ソフトウェアに接続するプラットフォームです。ShopifyやStripeなどのプラットフォームからXeroへのデータ入力を自動化します。

- Xero vs. ExpensifyExpensifyは経費管理に特化しています。Xeroにも経費管理機能はありますが、Expensifyは従業員の経費と払い戻しを管理するためのより高度なツールを提供しています。

- Xero vs. NetSuite: Netsuiteは、大企業向けの包括的なERPシステムです。ビジネス管理ツールをフルスイートで提供しています。XeroはERPではありませんが、中小企業向けの優れた会計ソリューションです。

- Xero vs Puzzle IO: Puzzle IO は、リアルタイムの財務諸表と自動データ入力に重点を置いた、スタートアップ向けに設計された金融プラットフォームです。

- Xero vs イージー・マンスエンド: このソフトウェアは、月末処理プロセスを自動化し、照合と監査証跡の作成を支援するための専用ツールです。Xero と連携するように設計されており、Xero を置き換えるものではありません。

- Xero vs Docyt: DocytはAIを活用してバックオフィス業務と簿記業務を自動化します。すべての財務書類とデータを一か所で閲覧できる手段を提供します。

- Xero vs RefreshMe: RefreshMe は、基本的な機能を備えたシンプルな会計ソフトウェアで、個人の財務や小規模企業でよく使用されます。

- Xero vs AutoEntry: Dext や Hubdoc と同様に、AutoEntry は領収書や請求書からのデータ抽出を自動化するツールで、Xero などの会計ソフトウェアと統合して強化するように設計されています。

Waveの詳細

- ウェーブ vs パズル IOこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- ウェーブ vs デクスト: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- Wave vs Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- ウェーブ vs シンダーこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- ウェーブ vs イージー・エンド: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- Wave vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- ウェーブ vs セージ: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- Wave vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- Wave vs Quickenどちらも個人向け財務ツールですが、こちらの方がより詳細な投資追跡機能を備えています。一方、こちらはよりシンプルです。

- Wave vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- Wave vs Expensifyこれはビジネス経費管理ツールです。もう1つは、個人の経費追跡と予算管理のためのツールです。

- Wave vs QuickBooks: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- Wave vs AutoEntry: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- Wave vs FreshBooks: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- Wave vs. NetSuite大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

Wave は本当に無料ですか、それとも隠れたコストがかかりますか?

Waveの基本的な会計、請求書発行、経費追跡機能は無料です。ただし、給与計算、支払い、アドバイザーサービスは有料です。

非常に小規模な企業に適したソフトウェアはどれですか?

非常に小規模な企業やフリーランサーは、無料のコア会計機能を備えているため、Wave を好むことが多いです。

Xero には無料トライアルがありますか?

はい、Xero は通常、無料試用期間を提供しているので、有料プランに加入する前に機能をテストすることができます。

後で Wave から Xero に簡単に切り替えることができますか?

はい、データを移行することは可能ですが、情報の量に応じてプロセスの複雑さが増す可能性があります。

Xero は電子商取引プラットフォームとも統合できますか?

はい、Xero は、販売データの管理に役立つ多くの一般的な電子商取引プラットフォームとの統合を提供しています。