あなたは 仕事 オーナーはあなたのお金を整理しようとしていますか?

適切なツールを選ぶのは難しい場合があります。

さまざまなアプリを使いこなす 会計 これらを接続すると貴重な時間が無駄になる可能性があります。

エラーが発生し、重要な財務詳細を見逃してしまう可能性があります。

幸いなことに、 作る これなら簡単!

これを読み終えると、Xero と Synder のどちらのアプローチがビジネス ニーズに最も適しているかがよく分かるようになります。

概要

私たちは Xero と Synder の両方を徹底的にテストしました。

それぞれの機能と、他のビジネス ツールとの接続性について調査します。

私たちの実践的なテストは使いやすさに重点を置きました。

統合機能と全体的な効率により、詳細な比較が実現します。

200万社以上の企業がXeroのクラウドベース会計ソフトウェアをご利用いただいています。強力な請求書作成機能を今すぐお試しください!

価格: 無料トライアルがあります。有料プランは月額 29 ドルから始まります。

主な特徴:

- 銀行照合

- 請求書発行

- 報告

Synderは会計業務を自動化し、売上データをQuickBooks、Xeroなどとシームレスに同期します。ぜひ今すぐお試しください!

価格: 無料トライアルがあります。プレミアムプランは月額52ドルからです。

主な特徴:

- マルチチャネル販売同期

- 自動調整

- 詳細なレポート

Xero とは何ですか?

それで、Xero ですね?多くの企業に人気の選択肢です。

あらゆるもののオンラインハブとして考えてください 会計.

収入と支出を追跡するのに役立ちます。

請求書の送信や請求書の管理もできます。かなり便利ですよね?

また、私たちのお気に入りを探索してください Xeroの代替品…

私たちの見解

200万以上の企業にご参加ください Xeroを使用 会計ソフトウェア。強力な請求書作成機能を今すぐお試しください!

主なメリット

- 自動銀行照合

- オンライン請求と支払い

- 請求書管理

- 給与計算統合

- レポートと分析

価格

- スターター: 月額29ドル。

- 標準: 月額46ドル。

- プレミアム: 月額69ドル。

長所

短所

Synderとは何ですか?

さて、Synderについて話しましょう。

Synderはコネクタのようなものと考えてください。Synderは、さまざまなビジネスプラットフォームとXeroの連携をサポートします。

これは売上、支払い、そして 会計 データは自動的に同期されます。

手動での作業が省けます データ エントリー。かなり賢いでしょ?

また、私たちのお気に入りを探索してください シンダーの代替品…

私たちの見解

Synderは会計を自動化し、売上データをQuickBooksにシームレスに同期します。 ゼロなど。Synder を使用している企業は、平均して週 10 時間以上を節約していると報告しています。

主なメリット

- 自動販売データ同期

- マルチチャネル販売追跡

- 支払い調整

- 在庫管理統合

- 詳細な売上レポート

価格

すべての計画は 年払い.

- 基本: 月額52ドル。

- 不可欠: 月額92ドル。

- プロ: 月額220ドル。

- プレミアム: カスタム価格設定。

長所

短所

機能比較

これら 2 つのツールは、企業にとって異なるものの、互いに補完し合う役割を果たします。

ここでは、コア機能と、企業の財務管理を支援する方法を理解するのに役立つ、機能ごとの直接比較を示します。

1. コア機能

- ゼロ 会計 ソフトウェアは、包括的な財務管理ツールを提供するクラウドベースの会計ソフトウェアです。 中小企業 オーナーと成長中の企業は帳簿のバランスを保ちます。

- シンダーは主に 自動化ツール すべての販売チャネル (Etsy、Square、Clover など) と支払いゲートウェイを既存の Xero アカウントまたはその他の簿記ソフトウェアに接続することで、自動会計を容易にします。

2. 電子商取引と販売データ

- Xeroは総合的な財務管理に優れています 報告 ただし、マルチチャネル販売を完全に管理し、すべての販売チャネルを統合するには、サードパーティのアプリが必要です。

- Synderは、大量のeコマース取引を処理するために構築されています。SquareやEtsyなどのプラットフォームから売上、割引、送料、支払い、手数料を自動的に同期し、会計システムに正確でリアルタイムなデータを提供します。

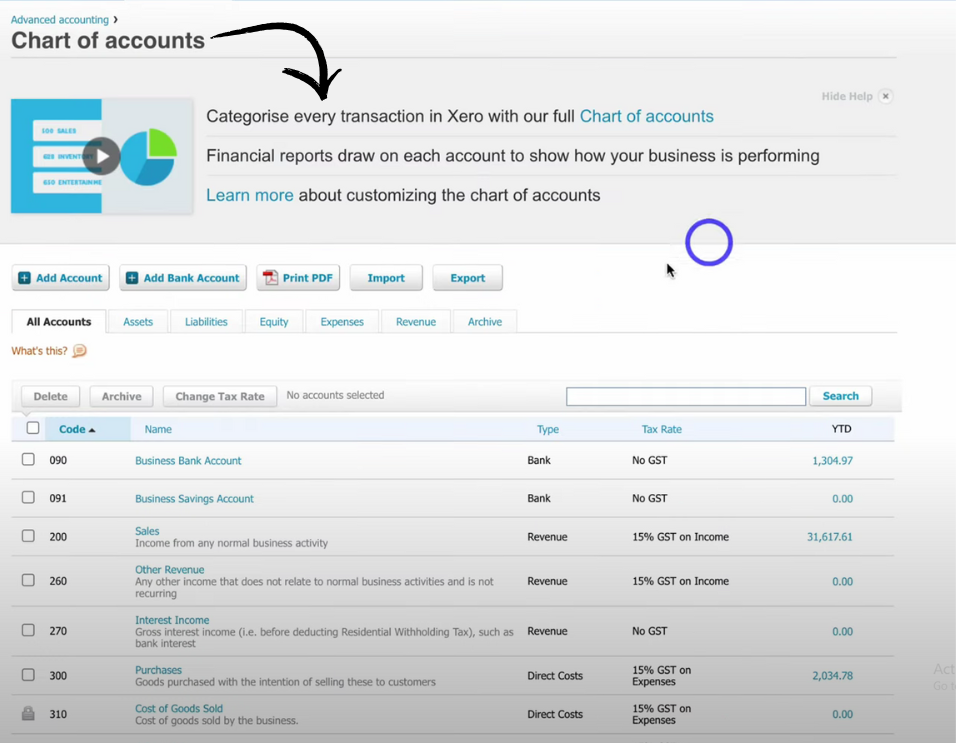

3. 銀行残高照合

- Xeroでは、自動銀行フィードを介して銀行口座を接続し、銀行取引をインポートできます。その後、ユーザーはこれらのエントリを手動で照合し、帳簿のバランスを維持します。

- Synder は、決済処理業者からの複雑な支払い (複数の売上、手数料、返金を組み合わせることが多い) を適切な銀行口座に自動的に振り替え、毎日の銀行預金をワンクリックで振り替えられるようにします。

4. 価格と拡張性

- Xeroの料金プランには、早期プランと既存プランといった段階的な料金プランがあります。早期プランは中小企業に最適ですが、処理できる請求書の数が月に最大5件に制限されています。

- Synder の価格は取引量に基づいて調整されるため、すべての販売チャネルで大量販売を行う小規模企業と成長中の企業の両方に適しています。

5. 高度な機能とERP

- Xero会計ソフトウェアは、上位層では発注書、経費精算、基本的な在庫管理オプションといった高度な機能を提供しています。完全なERPシステムではありませんが、NetSuiteなどの専用ERPソリューションと統合できます。 セージ 一致しました。

- Synder は、マルチプラットフォームのデータ処理、分類のスマートなルール、間違いや問題を解決するための元に戻す機能などの高度な機能に重点を置いており、財務チームがストレスを軽減しながら帳簿のバランスを保てるよう支援します。

6. ユーザーエクスペリエンスとアクセシビリティ

- xeroは、シンプルで使いやすいインターフェースと、モバイルアプリからアクセスできる直感的なxeroダッシュボードで財務タスクを簡単にします。 iOS および Android デバイス。

- Synderは、履歴トランザクションと進行中のデータフローを自動化するためにバックグラウンドで使用されます。そのインターフェースは、同期プロセス、クライアントデータフロー、および問題のトラブルシューティングを管理するために設計されています。

7. 財務報告と洞察

- Xeroのレポート機能は、損益計算書、貸借対照表、キャッシュフロー計算書など、堅牢な財務レポートを提供します。カスタマイズ可能なレポート機能は、既存のプランでご利用いただけます。

- Synderのコア機能は、手数料や税金を含む売上データを正確に分類することです。これにより、Xeroのレポート機能でより正確なデータが得られ、ビジネスパフォーマンスと財務状況に関するより明確なインサイトが得られます。

8. 買掛金および売掛金

- Xeroでは、顧客が支払うべき請求書(売掛金)を追跡し、請求書の支払いスケジュール(買掛金機能)を設定できます。また、統合ツールを使用して請求書をキャプチャすることもできます。

- Synder は主に売掛金側に重点を置いており、Stripe、Square、Clover などのソースからの販売データと支払いデータを正確に同期し、財務状況の販売側が最新であることを保証します。

9. サポートとリソース

- Xeroは、豊富なオンラインリソースライブラリと、技術サポートのための集中ヘルプセンターであるXero Centralを提供しています。多くのプロフェッショナルサービス企業がXeroを推奨しています。

- Synderは、ユーザーが同期モードオプション(概要または取引ごとの詳細)を設定して切り替えて最適な状態を維持できるように、ウェブサイトでサポートと包括的なガイドも提供しています。 簿記.

会計ソフトウェアで考慮すべきことは何ですか?

- コアニーズ: 完全な会計処理が必要かどうかを決定します( クイックブックス または QuickBooks Online) またはデータ同期ツールを使用します。

- 電子商取引の統合: eBay や他のサイトで販売する場合は、ソフトウェアに互換性があるかどうか、またマルチチャネル販売をどれだけ簡単に処理できるかを確認してください。

- スケーラビリティと機能: ビジネスの成長に合わせて、プロジェクト追跡、在庫管理、売上税ツールなどの機能の価格プランを検討してください。

- データの整合性: ソフトウェアが正確な財務記録を維持できること、および履歴取引のデータ移行が容易であることを確認します。

- コンプライアンス: 特にサブスクリプションを扱っている場合や既存のビジネスの場合は、ツールが GAAP コンプライアンスをサポートしているかどうかを確認してください。

- コストと価値: Xero のコストと、無制限の請求書などの主要な機能と支払額を比較評価します。

- グローバルリーチ: 世界中に顧客がいる場合や複数の拠点がある場合は、真の複数通貨サポートがあるかどうかを確認してください。xero は上位プランでこれを提供しています。

- 使いやすさ: インターフェースは直感的ですか?Xero や他のアプリを素早くセットアップしてテストできる必要があります。

- 専門家による使用: あなたの 会計士 Xero または選択したプラットフォームを使用して簡単に帳簿のバランスをとることができますか?

- 支払い処理: PayPal などの支払い処理業者の扱いやすさと経費追跡のしやすさを重視してください。

- 財務洞察: キャッシュフロー管理を明確に把握できますか?

- モバイルアクセス: 外出先での管理に適したモバイル アプリはありますか?

最終評決

Xero 会計ソフトウェアのレビューを実施した後。

単純な真実は、Xero はほとんどの独立請負業者や財務状況全体を管理している企業にとってより良い選択肢だということです。

It stands out as the best accounting software because it provides robust online invoicing, strong security, and great customer support.

Xero は完全な ERP ではありませんが、複数の通貨と詳細な在庫データを処理できる強固な基盤を提供します。

Synder は、データの同期を自動化したいマルチチャネル販売を行う人にとって最適ですが、Xero のような会計プラットフォームに依存しています。

簡単にセットアップできる完全なプライマリシステムが必要な場合は、Xero をお勧めします。

Xeroの詳細

適切な会計ソフトウェアを選択するには、いくつかの選択肢を検討する必要があります。

Xero と他の人気製品を簡単に比較してみましょう。

- Xero vs QuickBooks: QuickBooksは主要な競合製品です。どちらも同様のコア機能を提供していますが、Xeroは洗練されたインターフェースと無制限のユーザー数で高く評価されています。QuickBooksはより複雑な機能を備えていますが、非常に強力なレポート機能を備えています。

- Xero vs FreshBooks: FreshBooksは、特にフリーランサーやサービスベースのビジネスに人気の選択肢です。請求書発行と勤怠管理に優れています。Xeroは、より包括的な会計ソリューションを提供します。

- Xero vs Sage: SageとXeroはどちらも中小企業向けのソリューションを提供しています。しかし、Sageはより包括的なエンタープライズ・リソース・プランニング(ERP)ツールも、大企業向けに提供しています。

- Xero vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。在庫管理のための高度な機能を備えていることが多く、非常に費用対効果が高いのが特徴です。一方、Xeroはシンプルさと使いやすさの点で優れた選択肢です。

- Xero vs Wave: Waveは無料プランで知られています。小規模企業や予算が限られているフリーランサーにとって最適な選択肢です。Xeroはより幅広い機能を提供しており、ビジネスの成長に適しています。

- Xero vs Quicken: Quickenは主に個人の財務管理に使用されます。ビジネス向けの機能もいくつか備えていますが、真のビジネス会計ソリューションではありません。Xeroは、ビジネス会計の複雑な処理に特化して設計されています。

- Xero vs Hubdocこれらは直接的な競合ではありません。DextとHubdocはどちらも、文書のキャプチャとデータ入力を自動化するツールです。Xeroと直接連携することで、簿記をより迅速かつ正確に行うことができます。

- ゼロ vs シンダー: Synderは、販売チャネルと決済ゲートウェイを会計ソフトウェアに接続するプラットフォームです。ShopifyやStripeなどのプラットフォームからXeroへのデータ入力を自動化します。

- Xero vs. ExpensifyExpensifyは経費管理に特化しています。Xeroにも経費管理機能はありますが、Expensifyは従業員の経費と払い戻しを管理するためのより高度なツールを提供しています。

- Xero vs. NetSuite: Netsuiteは、大企業向けの包括的なERPシステムです。ビジネス管理ツールをフルスイートで提供しています。XeroはERPではありませんが、中小企業向けの優れた会計ソリューションです。

- Xero vs Puzzle IO: Puzzle IO は、リアルタイムの財務諸表と自動データ入力に重点を置いた、スタートアップ向けに設計された金融プラットフォームです。

- Xero vs イージー・マンスエンド: このソフトウェアは、月末処理プロセスを自動化し、照合と監査証跡の作成を支援するための専用ツールです。Xero と連携するように設計されており、Xero を置き換えるものではありません。

- Xero vs Docyt: DocytはAIを活用してバックオフィス業務と簿記業務を自動化します。すべての財務書類とデータを一か所で閲覧できる手段を提供します。

- Xero vs RefreshMe: RefreshMe は、基本的な機能を備えたシンプルな会計ソフトウェアで、個人の財務や小規模企業でよく使用されます。

- Xero vs AutoEntry: Dext や Hubdoc と同様に、AutoEntry は領収書や請求書からのデータ抽出を自動化するツールで、Xero などの会計ソフトウェアと統合して強化するように設計されています。

シンダーの詳細

- シンダー vs パズル io: Puzzle.ioは、スタートアップ向けに開発されたAI搭載の会計ツールで、バーンレートやランウェイといった指標に重点を置いています。Synderは、より幅広いビジネス向けに、マルチチャネルの販売データを同期することに重点を置いています。

- シンダー vs デクスト: Dextは、請求書や領収書からデータを取得・管理することに優れた自動化ツールです。一方、Synderは販売取引フローの自動化に特化しています。

- シンダー vs ゼロ: Xero はフル機能を備えたクラウド会計プラットフォームです。 シンダー Xero と連携して販売チャネルからのデータ入力を自動化し、Xero が請求書発行やレポート作成などのオールインワンの会計タスクを処理します。

- シンダー vs イージー・マンスエンド: Easy Month Endは、企業の月末処理プロセスを整理・効率化するために設計されたツールです。Synderは、日々の取引データフローの自動化に重点を置いています。

- シンダー vs ドサイト: Docytは、請求書の支払いや経費管理など、幅広い簿記業務にAIを活用しています。Synderは、複数のチャネルからの売上データと支払いデータの自動同期に重点を置いています。

- Synder vs RefreshMe: RefreshMeは個人の財務管理とタスク管理アプリケーションです。Synderはビジネス会計自動化ツールであるため、直接的な競合ではありません。

- シンダー vs セージ: Sageは、在庫管理などの高度な機能を備えた、長年実績のある総合的な会計システムです。Synderは、Sageなどの会計システムへのデータ入力を自動化する専用ツールです。

- Synder vs Zoho Books: Zoho Books は完全な会計ソリューションです。 シンダー さまざまな電子商取引プラットフォームから販売データをインポートするプロセスを自動化することで、Zoho Books を補完します。

- シンダー vs ウェーブ: Waveは、フリーランサーや小規模企業に多く利用されている、無料で使いやすい会計ソフトウェアです。Synderは、多チャネルで大量販売を行う企業向けに設計された有料の自動化ツールです。

- シンダー vs クイッケン: Quickenは主に個人向けの財務管理ソフトウェアですが、中小企業向けの機能もいくつか備えています。Synderは、特にビジネス会計の自動化を目的として開発されています。

- シンダー vs ハブドック: HubdocはDextに似たドキュメント管理およびデータキャプチャツールです。請求書や領収書のデジタル化に重点を置いています。Synderはオンライン販売と支払いデータの同期に重点を置いています。

- Synder vs Expensify: Expensifyは経費報告書と領収書を管理するためのツールです。Synderは販売取引データを自動化するためのツールです。

- Synder vs QuickBooks: QuickBooks は総合的な会計ソフトウェアです。 シンダー QuickBooks と統合して詳細な販売データを取り込むプロセスを自動化し、直接的な代替手段ではなく貴重なアドオンになります。

- Synder vs AutoEntry: AutoEntryは、請求書、領収書、領収書から情報を取得するデータ入力自動化ツールです。Synderは、eコマースプラットフォームからの売上データと支払いデータの自動化に重点を置いています。

- Synder vs FreshBooks: FreshBooksは、請求書作成に特化した、フリーランサーや小規模サービス企業向けに設計された会計ソフトウェアです。Synderは、複数のオンラインチャネルから大量の売上を上げている企業に最適です。

- Synder vs. NetSuite: NetSuiteは包括的なエンタープライズ・リソース・プランニング(ERP)システムです。Synderは、eコマースデータをNetSuiteのようなより広範なプラットフォームに同期するための専用ツールです。

よくある質問

Synder は払い戻しを処理できますか?

はい、Synder は接続された販売プラットフォームからの払い戻し情報を追跡し、会計ソフトウェアに同期して、明確な記録を提供します。

Xero は Shopify と統合できますか?

はい、Xero はアプリ ストアを通じて Shopify と直接統合されており、販売データと財務情報を同期できます。

Synder は Xero のような会計ソフトウェアの代替になりますか?

いいえ、Synder は Xero などの会計ソフトウェアと連携して、他のプラットフォームからのデータ転送を自動化するように設計された統合ツールです。

Synder の利用により最も利益を得られるビジネスはどのようなものですか?

複数のオンライン プラットフォームや決済ゲートウェイで販売を行う企業にとって、Synder は財務データの合理化に特に役立ちます。

Xero または Synder の無料トライアルはありますか?

はい、Xero と Synder は通常どちらも無料試用期間を提供しており、有料プランに加入する前に機能をテストすることができます。