どれが 会計ソフトウェア あなたのビジネスに最適なものは何ですか?

Xero と Sage のどちらを選ぶかは難しい問題です。

どちらもお金の管理に役立ちますが、それぞれ長所が異なります。

この記事では、Xero と Sage を簡単に比較します。

それぞれの最も優れた点を検討し、どれがあなたのニーズに最適かを判断するのに役立ちます。

概要

私たちは Xero と Sage の両方を調査するのに時間を費やしました。

彼らが日々どのように働いているかを感じ取る。

私たちは実践的な経験を通じて、各ソフトウェアの優れた点と欠点を把握することができました。

詳細な比較により、選択に役立ちます。

200万社以上の企業がXeroのクラウドベース会計ソフトウェアをご利用いただいています。強力な請求書作成機能を今すぐお試しください!

価格: 無料トライアルがあります。有料プランは月額 29 ドルから始まります。

主な特徴:

- 銀行照合

- 請求書発行

- 報告

600万人以上のお客様がSageを信頼しています。顧客満足度は100点満点中56点と高く、その堅牢な機能は実証済みのソリューションです。

価格: 無料トライアルをご利用いただけます。プレミアムプランは月額66.08ドルです。

主な特徴:

- 請求書発行

- 給与計算統合

- 在庫管理

Xero とは何ですか?

それで、Xero を見ているんですね?

多くの人にとって人気のある選択肢です 中小企業.

お金に関するあらゆる情報のオンラインハブとしてお考えください。

また、私たちのお気に入りを探索してください Xeroの代替品…

私たちの見解

200万以上の企業にご参加ください Xeroを使用 会計ソフトウェア。強力な請求書作成機能を今すぐお試しください!

主なメリット

- 自動銀行照合

- オンライン請求と支払い

- 請求書管理

- 給与計算統合

- レポートと分析

価格

- スターター: 月額29ドル。

- 標準: 月額46ドル。

- プレミアム: 月額69ドル。

長所

短所

Sageとは何ですか?

さて、Sageについてお話しましょう。Sageはかなり前から存在しています。

多くの企業が信頼している 会計.

請求書や支払いなどの処理を行えます。さらに、在庫管理にも役立ちます。

また、私たちのお気に入りを探索してください セージの代替品…

私たちの見解

財務を大幅に強化する準備はできていますか? Sage ユーザーは、生産性が平均 73% 向上し、プロセス サイクル時間が 75% 短縮されたと報告しています。

主なメリット

- 自動請求と支払い

- リアルタイムの財務レポート

- データを保護する強力なセキュリティ

- 他のビジネスツールとの統合

- 給与計算および人事ソリューション

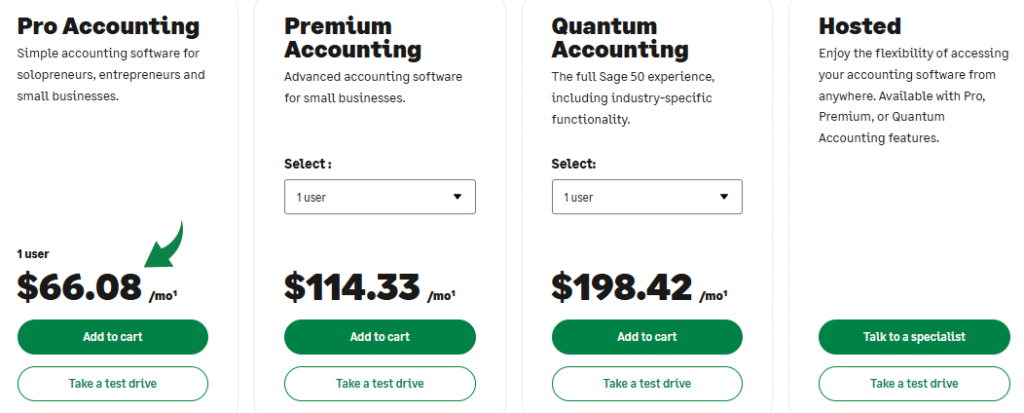

価格

- プロ会計: 月額66.08ドル。

- プレミアム会計: 月額114.33ドル。

- 量子会計: 月額198.42ドル。

- HR および給与計算バンドル: ニーズに基づいたカスタム価格設定。

長所

短所

機能比較

各ツールの特定の機能についてさらに詳しく調べる必要があります。

この比較により、 会計 どのプラットフォームが既存のワークフロー管理と最もよく適合するか、また、Xero 会計ソフトウェアと Sage ビジネス クラウド会計のどちらが財務状況に適しているかを判断します。

1. クラウドベースのアクセスと設計

- ゼロ: これは真のクラウドベースのソリューションです。Xeroのダッシュボードはシンプルで直感的なため、 中小企業 オーナーの負担を軽減し、大規模なトレーニングの必要性を軽減します。Xeroは、財務業務に不慣れな方でも、最新の使いやすいエクスペリエンスを提供することに優れています。

- セージSage Business Cloud Accountingはクラウドオプションを提供していますが、Sageにはデスクトップソフトウェア(Sage 50など)もあり、制限がある場合があります。 リモートアクセス 追加の設定は不要です。その設計は、より伝統的で詳細なアプローチを好むユーザーに適しています。

2. 銀行業務と調整

- ゼロXeroは、自動銀行フィードを使用して銀行口座を接続できます。日々の銀行取引における迅速かつ高度に自動化された銀行照合プロセスは、Xeroの強みの一つであり、手作業による作業を大幅に削減します。 データ エントリ。

- セージSage Business Cloudは銀行口座の連携や銀行取引のインポートもサポートしています。しかし、Xeroの オートメーション ルール設定機能により、未調整の差異をより効率的に削減できます。

3. 買掛金

- ゼロ: The xero 会計ソフトウェア includes strong accounts payable functionality. The early and growing plans allow you to track up to five bills and then unlimited invoices (bills). You can also capture bills and receipts easily.

- セージSageビジネスクラウド会計には、請求書追跡機能と買掛金管理機能が含まれています。これにより、企業は請求書を管理し、支払いスケジュールを設定できますが、Xeroの方がこのプロセスをよりスムーズに自動化できる場合が多いです。

4. 在庫管理

- ゼロXero会計ソフトウェアの上位プランには基本的な在庫管理機能が含まれており、単純な製品追跡に適しています。ただし、完全なERP(エンタープライズ・リソース・プランニング)ツールとは言えません。

- セージSageは、より高度なプランで強力な在庫管理機能を提供しており、商品のバリエーション作成、在庫データの追跡、在庫切れアラートの発行、複数の拠点の管理などが可能です。そのため、Sageは商品中心のビジネスや成長中のビジネスにとって最適な選択肢となります。

5. 請求書と売掛金

- ゼロXeroを使えば、オンラインで請求書を送信したり、未払いの請求書(売掛金)を追跡したりするのが簡単になります。XeroのGrowingプランとEstablishedプランでは、請求書の送信枚数が無制限なので、専門サービスや独立請負業者に最適です。

- セージSage Business Cloudは、プロフェッショナルな売上請求書の作成と送信に最適です。このシステムは、財務情報を管理し、未払い金を追跡することで、売掛金管理を強化します。

6. 経費と請求書のキャプチャ

- ゼロXeroは経費の追跡とコスト管理に優れています。モバイルアプリを使えば請求書や領収書を簡単に取得できるため、中小企業の経営者は手作業でデータを入力する手間をかけずに正確な財務記録を維持できます。

- セージSage Business Cloudは経費管理ツールや次のような機能を提供します。 自動入力 (多くの場合、アドオンとして、または Sage Marketplace 経由で利用可能) を使用すると、請求書や領収書の取得を自動化して、記録をより簡単に保存できます。

7. 財務報告

- Xero: Xeroの 報告 強力な機能を備え、ビジネスパフォーマンスに関するリアルタイムデータを提供し、財務状況の評価に役立ちます。レポートは視覚的にわかりやすく、ユーザーフレンドリーなので、会計業務に携わらないユーザーにも最適です。

- Sage:Sageはレポート生成のための幅広いオプションを提供し、経験豊富な会計チームが好む、より詳細で伝統的な財務レポートを作成することができます。この豊富な機能は、複雑な分析を必要とする既存のビジネスにとって不可欠です。

8. モバイルアプリのエクスペリエンス

- Xero: モバイルアプリ iOS Androidデバイスとの連携も優れています。Xeroを使えば、請求書、経費、銀行取引を外出先でも管理できます。この利便性は、忙しい中小企業の経営者にとって大きなメリットです。

- Sage: Sage ビジネス クラウドは専用のモバイル アプリを提供していますが、完全なデスクトップ ソリューションや Xero のより合理化されたアプリと比較すると、モバイル アクセスの機能に制限があると報告するユーザーもいます。

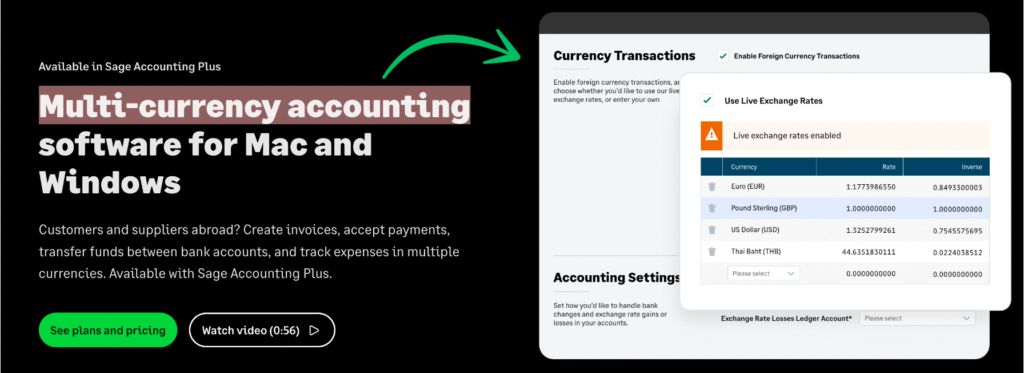

9. 多通貨とERP

- Xero:Xero会計ソフトウェアの既存プランには複数通貨のサポートが含まれており、事業拡大に最適です。Xeroはコア会計ツールとして十分に機能しますが、完全なエンタープライズ・リソース・プランニング(ERP)ソリューションとして機能するには、統合が必要です。

- Sage:上位のSage製品は、多通貨対応を強力にサポートします。Sageのより強力な製品(Sage 200やIntacctなど)は、複雑な販売管理や在庫管理を必要とする既存企業に必要なエンタープライズ・リソース・プランニング(ERP)機能の提供により近づいています。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

財務管理とビジネスの成長に最適なツールを選ぶには、基本的な要素にとどまらず、さらに深く考える必要があります。潜在的な欠点を回避し、最適なソリューションを確実に選択するために、以下の重要なポイントを検討してください。

- Xeroの料金とプランXero は無制限のユーザー数を提供していますが、Xero の価格とコストを慎重に確認する必要があります。 初期プランおよびその他の料金プランでは、処理できる請求書の数などの主要な機能が制限されます。

- Sageの学習曲線Sageは、原価コードを使った作業原価計算などの高度な機能を必要とする中規模企業に最適ですが、インターフェースはXeroほど使いやすくありません。必要な学習期間が長すぎることが、潜在的な欠点となる可能性があります。

- 在庫自動化商品を販売している場合は、ソフトウェアが在庫を自動同期できるかどうかを確認してください。Sageは、Xero会計ソフトウェアのERPアドオンよりも強力な在庫管理機能を内蔵していることが多いです。

- リアルタイムデータとレポート常にリアルタイムのレポートを要求してください。Xeroは、ビジネスの財務状況とキャッシュフローをチェックするための、高度にカスタマイズ可能なレポートを提供します。

- サポートと学習Sageは、詳細なトレーニングを提供するSage Universityと、質問に答えたり問題を解決したりするためのコミュニティハブを提供しています。これは、さらなるサポートが必要な場合に非常に役立ちます。

- 接続とバックアップ: どちらもクラウドベースの会計ソフトウェアであり、安定したインターネット接続が必要です。システムにオンラインバックアップと強力なセキュリティ対策が含まれていることを確認してください。 安全 あなたの財務データのために。

- 給与計算ソリューション給与計算ソフトウェアは含まれていますか?Sage PayrollとXeroのアドオンを比較して、どちらのシステムが給与計算と税務申告をより簡単に行えるかを確認しましょう。

- データ移行既存の会計データをお持ちですか?ベンダーに問い合わせて、独自の記録を安全かつ簡単に移行し、時間を節約できるかどうかを確認してください。

- プロジェクトと購入の追跡プロジェクトを管理する場合は、プロジェクト追跡機能を確認し、プラットフォーム内で簡単に注文書を作成および管理できるかどうかを確認します。

最終評決

ここまで徹底的に調査した結果、私たちは自信を持ってXeroを成長中のほとんどの企業に推奨します。なぜでしょうか?

Xero 会計ソフトウェアのレビューでは、キャッシュフロー管理の容易さとユーザー エクスペリエンスが一貫して高く評価されています。

クラウド接続用に構築されているため、複雑な手動タスクなしで財務を効果的に管理できます。

Sage はプロ向けの会計機能を提供し、複雑なシナリオをより適切に処理しますが、シンプルさとシームレスな操作を目標としている場合は Xero を使用してください。

サポートについては心配する必要はありません。Xero Central やその他のオンライン リソースは優れています。

一部の上級プランは価格が高くなりますが、その価値は明らかです。

トライアルで Xero を自分でテストすることができます。

これは、次のような選択肢よりも賢い選択です。 クイックブックス メニューに迷うことなくスケールアップすることに重点を置いた、現代の機敏なチームのためのオンラインです。

Xeroの詳細

適切な会計ソフトウェアを選択するには、いくつかの選択肢を検討する必要があります。

Xero と他の人気製品を簡単に比較してみましょう。

- Xero vs QuickBooks: QuickBooksは主要な競合製品です。どちらも同様のコア機能を提供していますが、Xeroは洗練されたインターフェースと無制限のユーザー数で高く評価されています。QuickBooksはより複雑な機能を備えていますが、非常に強力なレポート機能を備えています。

- Xero vs FreshBooks: FreshBooksは、特にフリーランサーやサービスベースのビジネスに人気の選択肢です。請求書発行と勤怠管理に優れています。Xeroは、より包括的な会計ソリューションを提供します。

- Xero vs Sage: SageとXeroはどちらも中小企業向けのソリューションを提供しています。しかし、Sageはより包括的なエンタープライズ・リソース・プランニング(ERP)ツールも、大企業向けに提供しています。

- Xero vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。在庫管理のための高度な機能を備えていることが多く、非常に費用対効果が高いのが特徴です。一方、Xeroはシンプルさと使いやすさの点で優れた選択肢です。

- Xero vs Wave: Waveは無料プランで知られています。小規模企業や予算が限られているフリーランサーにとって最適な選択肢です。Xeroはより幅広い機能を提供しており、ビジネスの成長に適しています。

- Xero vs Quicken: Quickenは主に個人の財務管理に使用されます。ビジネス向けの機能もいくつか備えていますが、真のビジネス会計ソリューションではありません。Xeroは、ビジネス会計の複雑な処理に特化して設計されています。

- Xero vs Hubdocこれらは直接的な競合ではありません。DextとHubdocはどちらも、文書のキャプチャとデータ入力を自動化するツールです。Xeroと直接連携することで、簿記をより迅速かつ正確に行うことができます。

- ゼロ vs シンダー: Synderは、販売チャネルと決済ゲートウェイを会計ソフトウェアに接続するプラットフォームです。ShopifyやStripeなどのプラットフォームからXeroへのデータ入力を自動化します。

- Xero vs. ExpensifyExpensifyは経費管理に特化しています。Xeroにも経費管理機能はありますが、Expensifyは従業員の経費と払い戻しを管理するためのより高度なツールを提供しています。

- Xero vs. NetSuite: Netsuiteは、大企業向けの包括的なERPシステムです。ビジネス管理ツールをフルスイートで提供しています。XeroはERPではありませんが、中小企業向けの優れた会計ソリューションです。

- Xero vs Puzzle IO: Puzzle IO は、リアルタイムの財務諸表と自動データ入力に重点を置いた、スタートアップ向けに設計された金融プラットフォームです。

- Xero vs イージー・マンスエンド: このソフトウェアは、月末処理プロセスを自動化し、照合と監査証跡の作成を支援するための専用ツールです。Xero と連携するように設計されており、Xero を置き換えるものではありません。

- Xero vs Docyt: DocytはAIを活用してバックオフィス業務と簿記業務を自動化します。すべての財務書類とデータを一か所で閲覧できる手段を提供します。

- Xero vs RefreshMe: RefreshMe は、基本的な機能を備えたシンプルな会計ソフトウェアで、個人の財務や小規模企業でよく使用されます。

- Xero vs AutoEntry: Dext や Hubdoc と同様に、AutoEntry は領収書や請求書からのデータ抽出を自動化するツールで、Xero などの会計ソフトウェアと統合して強化するように設計されています。

セージの詳細

Sage が他の一般的なソフトウェアと比べてどうなっているかを知ることは役に立ちます。

以下に競合他社製品との簡単な比較を示します。

- セージ対パズルIO: どちらも会計を扱いますが、Puzzle IO はスタートアップ向けに特別に設計されており、リアルタイムのキャッシュフローとバーンレートなどの指標に重点を置いています。

- セージ vs デクスト: Dextは主に領収書や請求書からのデータ取得を自動化するツールです。簿記処理の高速化のため、Sageと連携して使用されることがよくあります。

- Sage vs Xero: Xeroは、特に中小企業にとってユーザーフレンドリーなクラウドベースのソリューションとして知られています。Sageは、ビジネスの成長に合わせてより強力な機能を提供できます。

- セージ対シンダー: Synder は、電子商取引プラットフォームと支払いシステムを Sage などの会計ソフトウェアと同期することに重点を置いています。

- Sage vs Easy Month End: このソフトウェアは、月末に帳簿を閉じるために必要なすべての手順を追跡するのに役立つタスク マネージャーです。

- セージ対ドサイト: Docyt は AI を使用して簿記を自動化し、手動によるデータ入力を排除することで、従来のシステムに代わる高度に自動化されたシステムを提供します。

- Sage vs RefreshMe: RefreshMeは会計業界の直接的な競合ではありません。従業員の評価とエンゲージメントに重点を置いています。

- Sage vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。そのすっきりとしたデザインと、他のZoho製品との強力な連携が高く評価されています。

- セージ vs ウェーブ: Wave は、基本的な会計機能と請求書発行機能を備えた無料プランで知られており、フリーランサーや小規模企業に人気があります。

- Sage vs Quicken: Quicken は、個人または小規模企業の財務に適しています。 セージ 給与計算や高度な在庫管理など、成長中のビジネス向けに、より強力な機能を提供します。

- Sage vs Hubdoc: Hubdoc は、Dext と同様に財務文書を自動的に収集して整理し、会計プラットフォームと統合できる文書管理ツールです。

- Sage vs Expensify: Expensifyは経費管理のエキスパートです。領収書のスキャンや従業員の経費精算書の自動化に最適です。

- Sage vs QuickBooks: QuickBooksは、中小企業向け会計ソフトの分野では大手企業です。ユーザーフレンドリーなインターフェースと幅広い機能で知られています。

- Sage vs AutoEntry: これは領収書や請求書からのデータ入力を自動化するツールです。会計ソフトのアドオンとして最適です。 セージ.

- Sage vs FreshBooks: FreshBooks は、シンプルな請求書発行と時間追跡に重点を置いており、フリーランサーやサービスベースのビジネスに特に適していています。

- Sage vs. NetSuite: NetSuite は、大企業向けの本格的な ERP システムです。 セージ さまざまな製品があり、このレベルで競合するものもありますが、NetSuite はより大規模で複雑なソリューションです。

よくある質問

中小企業にとって、Xero は Sage よりも優れていますか?

Xeroは、ユーザーフレンドリーなインターフェースと小規模企業向けの拡張性から、多くの企業に支持されています。Sageは、複雑なニーズを持つ大企業に適しています。

私の会計士は Xero と Sage の両方を扱えますか?

はい、ほとんどの会計士はXeroとSageの両方に精通しています。最適な選択肢は、貴社の具体的な要件と会計士の好みによって異なります。

より優れた顧客サポートを提供する会計ソフトウェアはどれですか?

カスタマーサポートに関するユーザーレビューは、どちらも異なります。最近のフィードバックを確認し、お住まいの地域で各社が提供するサポートレベルを検討することをお勧めします。

ある会計ソフトウェアから別の会計ソフトウェアに切り替えるのは難しいですか?

移行には時間と計画が必要です。XeroとSageはどちらもデータ移行ツールを提供していますが、プロセスには会計士を関与させることをお勧めします。

他のビジネス アプリとの統合が最も多い会計ソフトウェアはどれですか?

一般的に、Xero は Sage と比較して、さまざまなサードパーティのビジネス アプリケーションとの統合のマーケットプレイスがより広いことを誇っています。