汚い領収書にうんざりして、領収書の記録に苦労していませんか? 仕事 支出?

本当に頭が痛くなるような気がしますよね?

適切なソフトウェアを選択するのは難しい場合があります。

おそらく聞いたことがある 2 つの有名企業は、Xero と Expensify です。

両者とも約束する 作る お金の管理が簡単になりますが、実際どれがあなたにとって良いのでしょうか?

概要

私たちは Xero と Expensify の両方をテストし、それぞれの機能と日常のビジネスタスクの処理方法を調べました。

この実践的なテストにより、それぞれの長所と短所を明確に比較することができます。

財務を簡素化する準備はできていますか?

200万社以上の企業がXeroのクラウドベース会計ソフトウェアをご利用いただいています。強力な請求書作成機能を今すぐお試しください!

価格: 無料トライアルがあります。有料プランは月額 29 ドルから始まります。

主な特徴:

- 銀行照合

- 請求書発行

- 報告

1,500万人以上のユーザーがExpensifyを信頼し、財務管理を簡素化しています。経費精算書の作成時間を最大83%節約できます。

価格: 無料トライアルがあります。プレミアムプランは月額5ドルからです。

主な特徴:

- SmartScanレシートキャプチャ

- 法人カード照合

- 高度な承認ワークフロー。

Xero とは何ですか?

それで、Xero とは何でしょうか?

基本的にはオンラインです 会計ソフトウェア.

ビジネスに関わるお金のすべてを一箇所で管理できる方法だと考えてください。とても便利ですよ。

また、私たちのお気に入りを探索してください Xeroの代替品…

私たちの見解

200万以上の企業にご参加ください Xeroを使用 会計ソフトウェア。強力な請求書作成機能を今すぐお試しください!

主なメリット

- 自動銀行照合

- オンライン請求と支払い

- 請求書管理

- 給与計算統合

- レポートと分析

価格

- スターター: 月額29ドル。

- 標準: 月額46ドル。

- プレミアム: 月額69ドル。

長所

短所

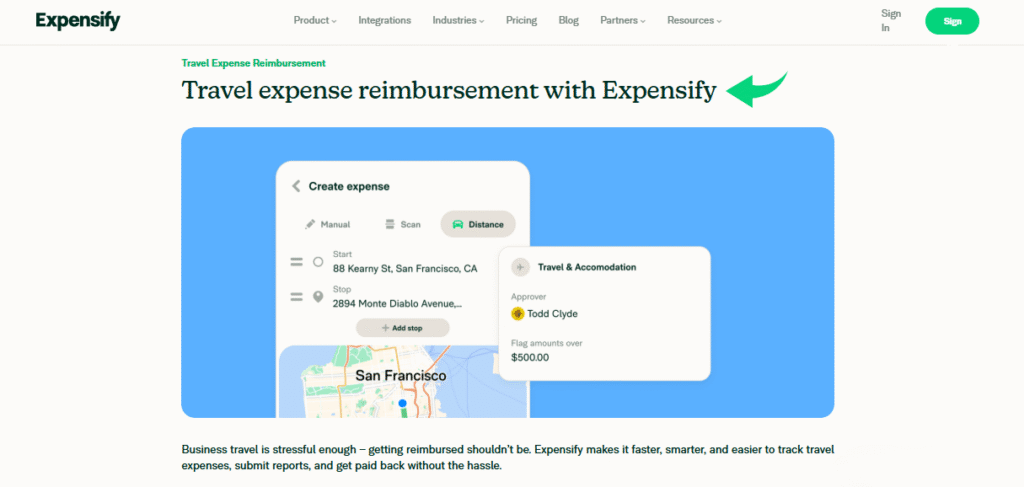

Expensifyとは何ですか?

さて、Expensifyについてはどうですか?

このツールは経費に特化しています。領収書の写真を撮って経費報告書を超簡単に作成できます。

面倒なコストによる時間と手間を省くことがすべてです。

また、私たちのお気に入りを探索してください Expensifyの代替品…

主なメリット

- SmartScan テクノロジーは領収書の詳細をスキャンし、95% 以上の精度で抽出します。

- 従業員は ACH 経由で 1 営業日以内に迅速に払い戻しを受けることができます。

- Expensify カードのキャッシュバック プログラムを利用すると、サブスクリプション料金を最大 50% 節約できます。

- 保証は提供されません。利用規約には責任が制限されていると記載されています。

価格

- 集める: 月額5ドル。

- コントロール: カスタム価格設定。

長所

短所

機能比較

これら 2 つの製品を比較してみましょう。

主要な機能を検討し、お客様のビジネスに最適なものを決定します。

特に中小企業経営者で、最高のものを求めているなら 会計 ソフトウェア。

1. コア会計と経費管理

- ゼロこれは完全なエンタープライズ・リソース・プランニング(ERP)ツールです。Xeroです。 会計 ソフトウェアは、すべての財務タスクと全体的な財務状況を処理する、真のクラウドベースの会計ソフトウェアです。

- エクスペンシファイ: 主な機能は経費管理プロセスです。経費を迅速に管理するのに役立ちますが、完全な会計機能は提供していません。

2. 請求と支払い

- ゼロXeroでは、上位プランで無制限に請求書を作成できます。未払い請求書の売掛金管理を完全サポートし、発注書やその他の支払関連機能も処理します。

- エクスペンシファイ: 請求書発行は基本的なもので、包括的な販売請求書発行ではなく、特定の費用に対するクライアントへの請求を対象としています。

3. 銀行の統合と調整

- ゼロ: 自動銀行フィードを提供し、銀行取引をリアルタイムで照合することに優れています。 データ. これにより、財務記録が正確になります。

- エクスペンシファイ: 銀行口座に接続して取引を取得します。特にExpensifyカードとの連携により、取引と領収書の照合が主な業務となります。

4. レポートと分析

- ゼロ: ゼロの 報告 機能が充実しています。キャッシュフロー管理のためのレポートと、事業実績の明確な把握が可能です。Xeroダッシュボードでは、財務状況のスナップショットを確認できます。

- エクスペンシファイ: レポートは支出の傾向と概要に焦点を絞り、経費管理プロセスをサポートします。

5. プロジェクトの追跡と管理

- ゼロ: Xero を使用すると、プロジェクトの時間とコストを追跡し、専門的なサービスに対してクライアントに請求書を発行できます。 これはビジネスの成長に役立ちます。

- エクスペンシファイ: タグを使用してプロジェクトごとに経費を記録できますが、専用のプロジェクト管理ツールがありません。

6. モバイルアプリ

- ゼロ: モバイルアプリはiOSとAndroidで動作します デバイス. 請求書の発行や調整など、多くの財務タスクを外出先でも処理できます。

- エクスペンシファイ: モバイルアプリは経費管理に最適です。領収書を数秒で撮影して送信できます。

7. ユーザビリティとインターフェース

- ゼロXeroはユーザーフレンドリーなインターフェースで会計処理を簡素化します。 中小企業 所有者。

- エクスペンシファイ: 非常にシンプルなインターフェースを備えているため、エンドユーザーにとって経費管理プロセスが高速かつ簡単になります。

8. 高度な機能と拡張性

- ゼロ: 既存プランでは、在庫管理や複数通貨対応といった高度な機能をご利用いただけます。既存のビジネスにも柔軟に対応し、事業拡大にも最適です。

- エクスペンシファイ: 大規模な組織向けの機能を提供しますが、完全なエンタープライズ リソース プランニング ソリューションを提供するのではなく、経費管理プロセスに重点を置いています。

9. 価格と価値

- ゼロXeroの料金体系は、初期プランと同様に構造化された料金プランを採用しています。あらゆる財務情報に包括的な価値を提供します。

- エクスペンシファイ: 価格はユーザーベースなので、堅牢な経費報告を必要とする独立請負業者や少数の雇用主にとって手頃な価格です。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

適切なソフトウェアの選択は、ビジネスの財務状況に影響を与えます。考慮すべきポイントを簡単にご紹介します。

- オートメーション: ソフトウェアは手作業によるデータ入力を削減しますか? Xero は銀行口座の照合と請求書の取得の自動化に優れています。

- 承認フロー: 経費精算には、柔軟な承認プロセスが必要です。Expensify を使えば、従業員は簡単に報告書を提出でき、管理者は申請を迅速に確認・承認できます。

- エコシステム: ゼロ 会計ソフトウェア ERP offers a full suite, but check its connection to other tools you use.

- サポートと学習: 問題解決に役立つ、迅速なサポート (電話またはチャット) とわかりやすいオンライン リソース (Xero Central) はありますか?

- データ管理: 乗り換える場合は、データ移行のしやすさを重視しましょう。顧客データや財務管理記録を簡単にエクスポートできる機能も必要です。

- コアタスク: 企業は複数の拠点の在庫(在庫データ)を効果的に管理し、消費税の計算を処理できますか?

- 予算編成と成長: Xero のコストは要因ですが、適切なツールは、企業が成長するための財務管理に役立ちます。

- カスタマイズ: ニーズに応じてカスタマイズ可能なレポートを設定し、支払いをスケジュールできますか?

- 経費の払い戻し: 会社は従業員にどれくらい早く払い戻しをしてくれるのでしょうか?Expensifyのレビューでは、このスピードが強調されています。

- 試乗: 必ず無料トライアルで Xero または Expensify をテストし、インターフェースと機能がニーズを満たしていることを確認してください。

最終評決

機能を確認した後、主なニーズに応じて選択が変わります。

フルサービスの会計が必要な場合は、包括的な会計ソフトウェア ソリューションを提供する Xero をお勧めします。

オンライン請求書と買掛金を処理し、請求書を取得して中核事業の財務を管理できるようにします。

たとえば、エントリーレベルのプランでは最大 5 件の請求書が許可されます。

ただし、経費報告書の効率化が主な目的である場合は、Expensify が最適なツールです。

これにより、チームはポケットまたはデスクトップ ビューから領収書をすばやくコーディングして送信できるようになります。

どちらを選択しても、どちらも財務データのセキュリティが十分に確保されます。

私たちは徹底的に調査したので、長いセットアップをすることなく、情報に基づいた決定を下すことができます。

Xeroの詳細

適切な会計ソフトウェアを選択するには、いくつかの選択肢を検討する必要があります。

Xero と他の人気製品を簡単に比較してみましょう。

- Xero vs QuickBooks: QuickBooksは主要な競合製品です。どちらも同様のコア機能を提供していますが、Xeroは洗練されたインターフェースと無制限のユーザー数で高く評価されています。QuickBooksはより複雑な機能を備えていますが、非常に強力なレポート機能を備えています。

- Xero vs FreshBooks: FreshBooksは、特にフリーランサーやサービスベースのビジネスに人気の選択肢です。請求書発行と勤怠管理に優れています。Xeroは、より包括的な会計ソリューションを提供します。

- Xero vs Sage: SageとXeroはどちらも中小企業向けのソリューションを提供しています。しかし、Sageはより包括的なエンタープライズ・リソース・プランニング(ERP)ツールも、大企業向けに提供しています。

- Xero vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。在庫管理のための高度な機能を備えていることが多く、非常に費用対効果が高いのが特徴です。一方、Xeroはシンプルさと使いやすさの点で優れた選択肢です。

- Xero vs Wave: Waveは無料プランで知られています。小規模企業や予算が限られているフリーランサーにとって最適な選択肢です。Xeroはより幅広い機能を提供しており、ビジネスの成長に適しています。

- Xero vs Quicken: Quickenは主に個人の財務管理に使用されます。ビジネス向けの機能もいくつか備えていますが、真のビジネス会計ソリューションではありません。Xeroは、ビジネス会計の複雑な処理に特化して設計されています。

- Xero vs Hubdocこれらは直接的な競合ではありません。DextとHubdocはどちらも、文書のキャプチャとデータ入力を自動化するツールです。Xeroと直接連携することで、簿記をより迅速かつ正確に行うことができます。

- ゼロ vs シンダー: Synderは、販売チャネルと決済ゲートウェイを会計ソフトウェアに接続するプラットフォームです。ShopifyやStripeなどのプラットフォームからXeroへのデータ入力を自動化します。

- Xero vs. ExpensifyExpensifyは経費管理に特化しています。Xeroにも経費管理機能はありますが、Expensifyは従業員の経費と払い戻しを管理するためのより高度なツールを提供しています。

- Xero vs. NetSuite: Netsuiteは、大企業向けの包括的なERPシステムです。ビジネス管理ツールをフルスイートで提供しています。XeroはERPではありませんが、中小企業向けの優れた会計ソリューションです。

- Xero vs Puzzle IO: Puzzle IO は、リアルタイムの財務諸表と自動データ入力に重点を置いた、スタートアップ向けに設計された金融プラットフォームです。

- Xero vs イージー・マンスエンド: このソフトウェアは、月末処理プロセスを自動化し、照合と監査証跡の作成を支援するための専用ツールです。Xero と連携するように設計されており、Xero を置き換えるものではありません。

- Xero vs Docyt: DocytはAIを活用してバックオフィス業務と簿記業務を自動化します。すべての財務書類とデータを一か所で閲覧できる手段を提供します。

- Xero vs RefreshMe: RefreshMe は、基本的な機能を備えたシンプルな会計ソフトウェアで、個人の財務や小規模企業でよく使用されます。

- Xero vs AutoEntry: Dext や Hubdoc と同様に、AutoEntry は領収書や請求書からのデータ抽出を自動化するツールで、Xero などの会計ソフトウェアと統合して強化するように設計されています。

Expensifyの詳細

- Expensify vs Puzzleこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- Expensify vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- Expensify vs. Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- Expensify vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- Expensify vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- Expensify vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- Expensify vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- Expensify vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- Expensify vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- Expensify vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- ExpensifyとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- Expensify vs AutoEntry: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- Expensify vs FreshBooks: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- Expensify vs. NetSuite大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

総合的な会計処理に関しては、Xero は Expensify よりも優れていますか?

はい、Xero は請求書発行、銀行照合、財務報告などの包括的な会計機能を提供しており、より完全なソリューションとなっています。

Expensify は Xero のような会計ソフトウェアの代わりになりますか?

いいえ、Expensifyは経費管理に重点を置いています。Xeroと連携はしますが、会計機能を完全には提供していません。

経費追跡には Xero と Expensify のどちらが使いやすいでしょうか?

Expensify は、ユーザーフレンドリーな領収書スキャン機能とレポート機能を備えているため、経費管理が簡単であると一般的に考えられています。

Xero と Expensify は連携して動作しますか?

はい、Expensify と Xero には強力な統合機能があり、経費データを会計システムにシームレスに転送できます。

予算が限られている中小企業に適したプラットフォームはどれですか?

Expensify の開始プランは一般的に安価ですが、Xero は成長中の中小企業にとって価値のある、より包括的な機能を提供します。