Quick Start

This guide covers every QuickBooks feature:

- Getting Started — Create account and basic setup

- How to Use Bank Feeds — Connect bank accounts and auto-import transactions

- How to Use Cloud Accounting Software — Access your books from any device

- How to Use Project Profitability — Track income and costs per project

- How to Use Accounting Reports — Run profit and loss, balance sheets, and more

- How to Use Expense Tracker — Categorize and track every business expense

- How to Use Invoicing and Pay Bills — Send invoices and manage bill payments

- How to Use Inventory Management — Track stock levels and product costs

- How to Use VAT & GST Tracker — Calculate and file sales tax automatically

- How to Use Mobile Accounting App — Manage finances on your phone

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used QuickBooks for over two years and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

QuickBooks is one of the most popular accounting tools for small businesses today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

QuickBooks Tutorial

This complete QuickBooks tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

QuickBooks

Stop wrestling with spreadsheets and manual bookkeeping. QuickBooks automates your accounting, invoicing, and expense tracking so you can focus on growing your business. Plans start at just $1.90/month.

Getting Started with QuickBooks

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to quickbooks.intuit.com and click “Start Free Trial.”

Enter your email address and create a strong password.

Choose the plan that fits your business size.

✓ Checkpoint: Check your inbox for a confirmation email from Intuit.

Step 2: Set Up Your Company Profile

Click the gear icon and select “Account and Settings.”

Enter your business name, address, and tax ID number.

Choose your industry and fiscal year start month.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see the main QuickBooks dashboard with your company name.

Step 3: Connect Your Bank Accounts

Go to Banking and click “Connect Account.”

Search for your bank and enter your online banking credentials.

QuickBooks will start downloading your recent transactions.

✅ Done: You’re ready to use any feature below.

How to Use QuickBooks Bank Feeds

Bank Feeds lets you auto-import and categorize transactions from your bank.

Here’s how to use it step by step.

Step 1: Navigate to the Banking Page

Click “Banking” in the left menu or use the navigation bar.

You’ll see all connected accounts and pending transactions.

Step 2: Review and Categorize Transactions

Click on any downloaded transaction to see its details.

QuickBooks AI suggests categories based on vendor name and amount.

Accept the suggestion or choose a different category from your chart of accounts.

Here’s what this looks like:

✓ Checkpoint: The transaction moves from “For Review” to “Categorized.”

Step 3: Match Transactions to Existing Records

If QuickBooks finds a matching invoice or bill, click “Match.”

This links the bank transaction to the record you already created.

✅ Result: Your bank transactions are categorized and matched to invoices or bills.

💡 Pro Tip: Spend 10–15 minutes weekly reviewing AI-suggested categories. This prevents compounding errors in your financial data.

How to Use QuickBooks Cloud Accounting Software

Cloud Accounting Software lets you access your books from any device with internet.

Here’s how to use it step by step.

Step 1: Log In From Any Browser

Go to qbo.intuit.com from any web browser on your computer or tablet.

Enter your Intuit account email and password to access your dashboard.

Step 2: Invite Your Team and Accountant

Click the gear icon, then select “Manage Users.”

Click “Add User” and enter their email address.

Set permissions so each person only sees what they need.

Here’s what this looks like:

✓ Checkpoint: Your team member receives an invitation email from QuickBooks.

Step 3: Sync Your Data Across Devices

All changes save automatically to the cloud in real time.

Your accountant sees the same data you do — no file sharing needed.

✅ Result: Your entire team can access and work on your books from anywhere.

💡 Pro Tip: Invite your accountant for free. They get their own login and can review your books without affecting your user count.

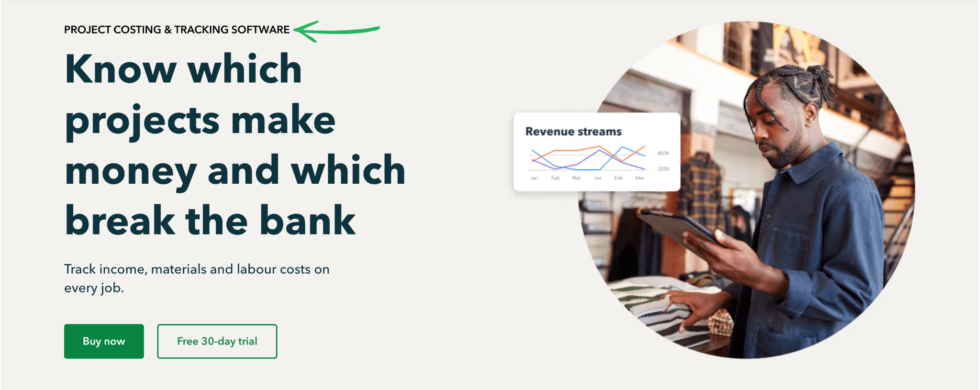

How to Use QuickBooks Project Profitability

Project Profitability lets you track income and expenses for each project separately.

Here’s how to use it step by step.

Step 1: Create a New Project

Go to “Projects” in the left menu and click “New Project.”

Name the project and assign it to a customer.

Step 2: Add Income and Expenses to the Project

Create invoices, expenses, or time entries linked to this project.

QuickBooks tracks all income and costs in one project view.

Here’s what this looks like:

✓ Checkpoint: You see a project summary with total income and total costs side by side.

Step 3: Review Your Profit Margins

Open the project and check the profitability summary at the top.

Compare estimated costs vs actual costs to spot budget overruns.

✅ Result: You know exactly which projects make money and which ones don’t.

💡 Pro Tip: Use classes or locations for deeper reporting on different business segments beyond individual projects.

How to Use QuickBooks Accounting Reports

Accounting Reports lets you generate profit and loss, balance sheets, and custom reports.

Here’s how to use it step by step.

Step 1: Open the Reports Center

Click “Reports” in the left navigation menu.

Browse standard reports or search by name at the top.

Step 2: Run a Profit and Loss Report

Click “Profit and Loss” from the Favorites section.

Set the date range and click “Run Report.”

Filter by customer, class, or location for deeper insights.

Here’s what this looks like:

✓ Checkpoint: You see income, expenses, and net profit for your chosen period.

Step 3: Save and Schedule Reports

Click “Save Customization” to keep your filter settings.

Set up email delivery to get reports sent to you automatically each month.

✅ Result: You have clear financial reports ready for tax time and business decisions.

💡 Pro Tip: QuickBooks Advanced users can export reports directly to Google Sheets for deeper custom analysis.

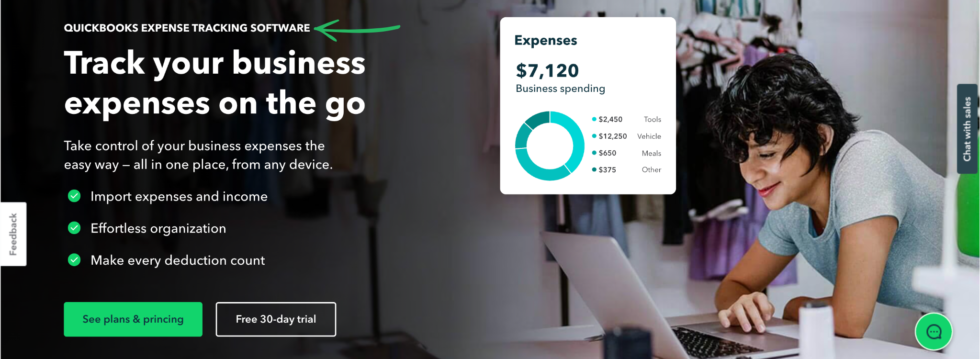

How to Use QuickBooks Expense Tracker

Expense Tracker lets you record, categorize, and monitor all business spending.

Here’s how to use it step by step.

Step 1: Record a New Expense

Click “+ New” and select “Expense.”

Choose the payment account and enter the vendor name.

Step 2: Categorize and Attach Receipts

Select the correct expense category from your chart of accounts.

Drag and drop a receipt image to attach it to the transaction.

Here’s what this looks like:

✓ Checkpoint: The expense appears in your Expense list with the receipt attached.

Step 3: Review Spending by Category

Go to Reports and run “Expenses by Vendor Summary.”

See where your money goes each month at a glance.

✅ Result: Every business expense is tracked, categorized, and backed by receipts.

💡 Pro Tip: Use the QuickBooks mobile app to snap receipt photos on the go. They auto-match to transactions.

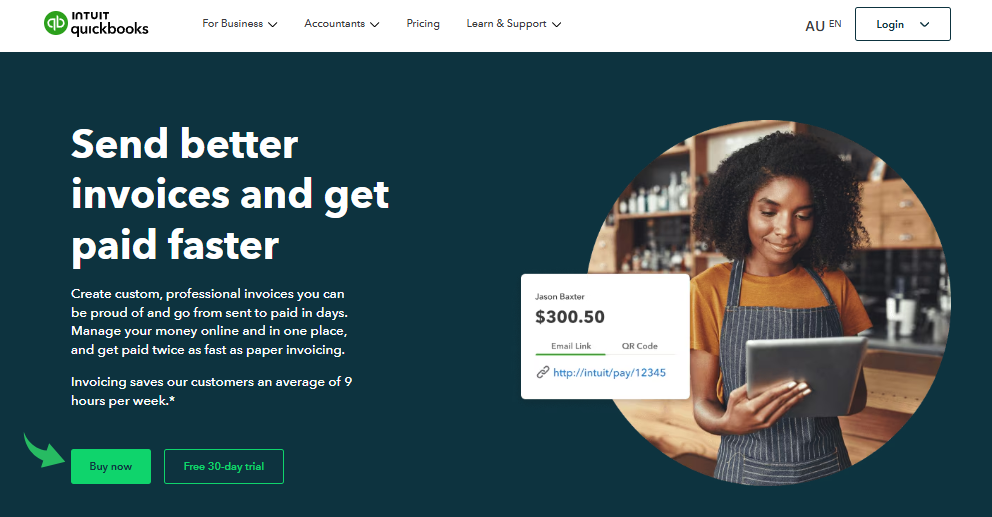

How to Use QuickBooks Invoicing and Pay Bills

Invoicing and Pay Bills lets you send professional invoices and manage bill payments.

Here’s how to use it step by step.

Step 1: Create a New Invoice

Click “+ New” and select “Invoice.”

Choose the customer and add your products or services with prices.

Step 2: Send the Invoice and Accept Payment

Click “Send” to email the invoice directly to your customer.

Customers can pay with one click using credit card, Apple Pay, or ACH transfer.

Here’s what this looks like:

✓ Checkpoint: The invoice shows as “Sent” and payment status updates automatically.

Step 3: Record and Pay Bills

Click “+ New” and select “Bill” to record what you owe a vendor.

When ready, click “Pay Bills” to schedule the payment.

✅ Result: Invoices are sent, payments collected, and bills paid — all from one place.

💡 Pro Tip: Set up recurring invoices for repeat clients. QuickBooks sends them automatically each billing cycle.

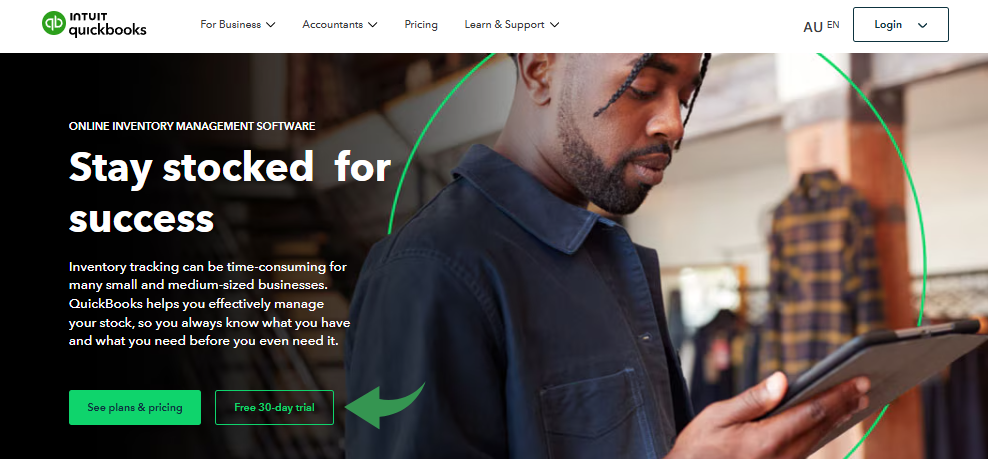

How to Use QuickBooks Inventory Management

Inventory Management lets you track stock levels, costs, and product sales in real time.

Here’s how to use it step by step.

Step 1: Enable Inventory Tracking

Go to Settings, then “Account and Settings,” then “Sales.”

Turn on “Track quantity and price/rate” under the Products section.

Step 2: Add Products to Your Inventory

Click “+ New” and select “Product/Service.”

Enter the product name, SKU, quantity on hand, and cost per unit.

Here’s what this looks like:

✓ Checkpoint: Your product appears in the Products and Services list with stock count.

Step 3: Monitor Stock Levels and Reorder

Set reorder points so QuickBooks alerts you when stock runs low.

Run the Inventory Valuation Summary report for a full stock overview.

✅ Result: You know exactly what’s in stock, what’s selling, and when to reorder.

💡 Pro Tip: Use the Moving Average Cost (MAC) method for smoother cost tracking if your prices fluctuate frequently.

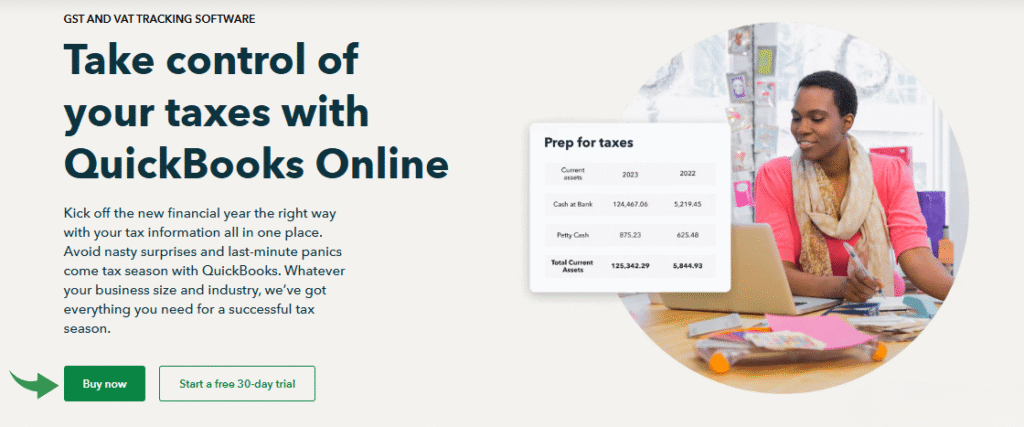

How to Use QuickBooks VAT & GST Tracker

VAT & GST Tracker lets you calculate, track, and file sales tax automatically.

Here’s how to use it step by step.

Step 1: Enable Sales Tax

Go to “Taxes” in the left menu and click “Set Up Sales Tax.”

Enter your business address so QuickBooks applies the correct tax rates.

Step 2: Apply Tax Rates to Transactions

QuickBooks automatically applies the right tax rate to invoices and sales.

Check the tax column on each line item to verify accuracy.

Here’s what this looks like:

✓ Checkpoint: Tax amounts appear on your invoices and in the Taxes center.

Step 3: File Your Tax Return

Go to “Taxes” and review the tax summary for your filing period.

Click “File” to submit directly or export the data for your accountant.

✅ Result: Sales tax is tracked, calculated, and ready to file on time.

💡 Pro Tip: The Sales Tax Agent in QuickBooks Plus and above helps automate filing. Let it handle the heavy lifting.

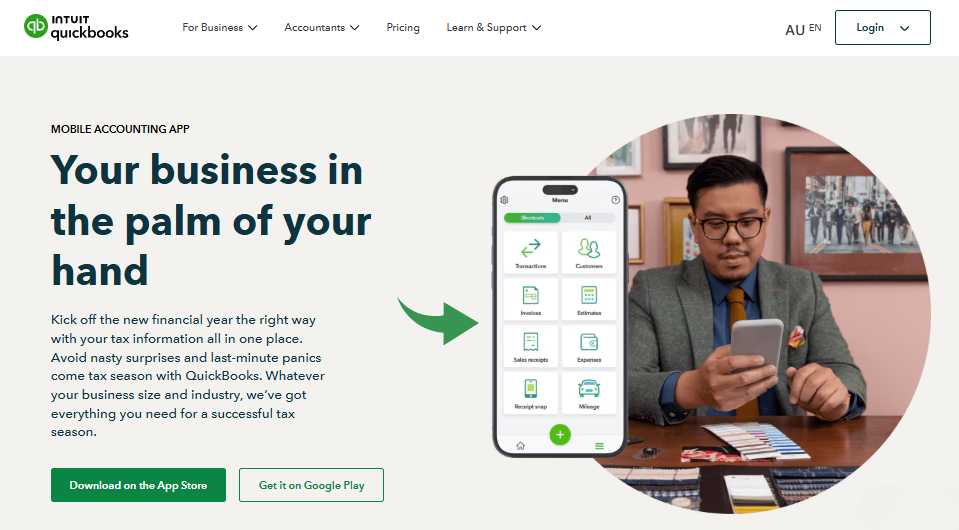

How to Use QuickBooks Mobile Accounting App

Mobile Accounting App lets you manage invoices, expenses, and reports from your phone.

Here’s how to use it step by step.

Step 1: Download the App

Search “QuickBooks” on the App Store or Google Play and install it.

Log in with your Intuit account credentials.

Step 2: Capture Receipts and Create Invoices

Tap the camera icon to snap a receipt photo.

QuickBooks extracts the details and matches it to a transaction.

You can also create and send invoices right from your phone.

Here’s what this looks like:

✓ Checkpoint: Your receipt appears in the app and links to the matching expense.

Step 3: Accept Payments on the Go

Use the “New Sale” feature to accept payments without an invoice.

Enter the amount or pick a product, and charge your customer instantly.

✅ Result: You can manage your entire business finances from your phone.

💡 Pro Tip: Enable push notifications so you know the moment a customer pays an invoice.

QuickBooks Pro Tips and Shortcuts

After testing QuickBooks for over two years, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| Create Invoice | Ctrl + Alt + I |

| Create Expense | Ctrl + Alt + X |

| Open Search | Ctrl + Alt + F |

| Go to Dashboard | Ctrl + Alt + D |

Hidden Features Most People Miss

- Practice Company File: Create a test company to experiment with transactions without affecting your live data. Go to Settings and look for the demo option.

- Bank Rules: Set up automatic categorization rules. QuickBooks applies them to future transactions matching your criteria — saving hours each month.

- Intuit Assist AI Sidebar: Ask natural language questions like “What were my top expenses last month?” and get instant answers without running a report.

QuickBooks Common Mistakes to Avoid

Mistake #1: Mixing Personal and Business Accounts

❌ Wrong: Connecting your personal bank account and trying to filter out personal transactions.

✅ Right: Use a separate business bank account and credit card. Connect only those to QuickBooks.

Mistake #2: Never Reconciling Accounts

❌ Wrong: Assuming downloaded transactions are always correct and skipping reconciliation.

✅ Right: Reconcile every account monthly. Compare your QuickBooks balance to your bank statement.

Mistake #3: Accepting All AI Category Suggestions Blindly

❌ Wrong: Clicking “Accept All” on bank feed suggestions without reviewing each one.

✅ Right: Review each suggestion weekly. Fix errors early before they compound across months of data.

QuickBooks Troubleshooting

Problem: Bank Feed Stops Downloading Transactions

Cause: Your bank changed its login process or security requirements. The connection token expired.

Fix: Go to Banking, click “Update” next to the account. If that fails, disconnect and reconnect the bank account with fresh credentials.

Problem: Reconciliation Balance Doesn’t Match

Cause: A transaction was edited or deleted after a previous reconciliation. Or a duplicate entry exists.

Fix: Run the Reconciliation Discrepancy report. Look for edited or deleted transactions. Correct them and try reconciling again.

Problem: QuickBooks Runs Slowly or Pages Won’t Load

Cause: Browser cache is full, or you have too many browser extensions running.

Fix: Clear your browser cache and cookies. Try using an incognito window. Chrome or Edge work best with QuickBooks Online.

📌 Note: If none of these fix your issue, contact QuickBooks support.

What is QuickBooks?

QuickBooks is an accounting tool that automates bookkeeping, invoicing, and financial reporting for small businesses.

Think of it like a smart financial assistant that records every dollar coming in and going out of your business.

Watch this quick overview:

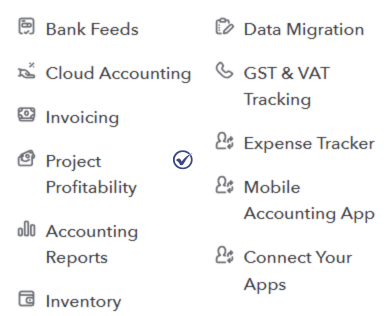

It includes these key features:

- Bank Feeds: Auto-import and categorize bank transactions with AI suggestions

- Cloud Accounting Software: Access your books from any device, invite your team and accountant

- Project Profitability: Track income and costs per project to see what’s profitable

- Accounting Reports: Generate profit and loss, balance sheets, and custom financial reports

- Expense Tracker: Record, categorize, and attach receipts to every expense

- Invoicing and Pay Bills: Send invoices, accept online payments, and manage vendor bills

- Inventory Management: Track stock levels, costs, and reorder points in real time

- VAT & GST Tracker: Automatically calculate and file sales tax

- Mobile Accounting App: Manage finances, snap receipts, and send invoices from your phone

For a full review, see our QuickBooks review.

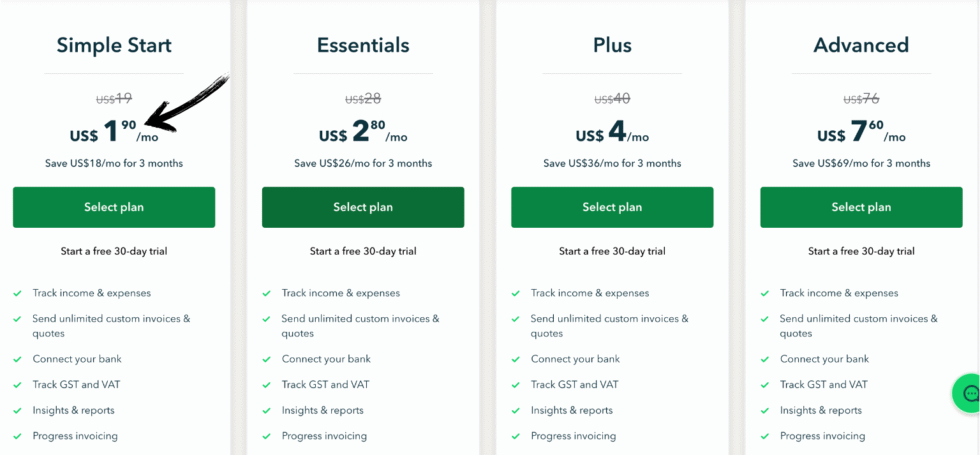

QuickBooks Pricing

Here’s what QuickBooks costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Simple Start | $1.90/month | Freelancers and sole proprietors needing basic accounting |

| Essentials | $2.80/month | Small teams that need multi-user access and bill management |

| Plus | $4/month | Growing businesses with inventory and project tracking needs |

| Advanced | $7.60/month | Established businesses needing custom reports and 25 users |

Free trial: Yes — 30 days free on all plans, no credit card required.

Money-back guarantee: No formal guarantee, but you can cancel anytime with no contract.

See the pricing breakdown here:

💰 Best Value: Plus — it includes inventory tracking, project profitability, and 5 users at an unbeatable price point.

QuickBooks vs Alternatives

How does QuickBooks compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| QuickBooks | All-in-one small business accounting | $1.90/mo | ⭐ 4.4 |

| Xero | Clean interface and global invoicing | $29/mo | ⭐ 4.5 |

| FreshBooks | Service businesses and freelancers | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly with free plan | $0/mo | ⭐ 4.3 |

| Wave | Free accounting for startups | $0/mo | ⭐ 4.0 |

| Sage | Growing businesses needing scalability | $7/mo | ⭐ 4.2 |

| NetSuite | Enterprise-level ERP and accounting | Custom | ⭐ 4.5 |

| Expensify | Expense management and reporting | $5/user/mo | ⭐ 4.1 |

Quick picks:

- Best overall: QuickBooks — deepest feature set with 800+ app integrations

- Best budget: Wave — completely free accounting with no hidden fees

- Best for beginners: FreshBooks — simplest interface with great invoicing

- Best for enterprise: NetSuite — full ERP system for large companies

🎯 QuickBooks Alternatives

Looking for QuickBooks alternatives? Here are the top options:

- 🚀 Puzzle IO: AI-powered accounting built for startups. Free plan available with real-time financial insights and automated categorization.

- 💰 Dext: Automates receipt capture and data extraction. Pairs perfectly with your accounting software at $24/month.

- 🎨 Xero: Clean, modern interface with strong multi-currency support. Top pick for global businesses starting at $29/month.

- ⚡ Synder: Syncs e-commerce and payment platform data directly into your books. Great for online sellers from $52/month.

- 🔒 Easy Month End: Speeds up month-end close with automated checklists. Perfect for accountants from $45/month.

- 🧠 Docyt: AI-driven back-office accounting for multi-location businesses. Handles high-volume transactions from $299/month.

- 👶 Sage: Scalable accounting with payroll and HR features built in. Free plan available for solo users.

- 🏢 Zoho Books: Feature-rich accounting with a generous free plan. Best for budget-conscious small businesses.

- 🔧 Wave: Completely free invoicing and accounting. Ideal for freelancers and early-stage startups.

- 🌟 Quicken: Best for personal finance tracking that blends with small business needs. Starts at $2.99/month.

- ⭐ Hubdoc: Auto-fetches bills and receipts from vendors and banks. Integrates with Xero and QuickBooks at $12/month.

- 🎯 Expensify: Industry-leading expense reporting and receipt scanning. Best for teams tracking employee spending from $5/user/month.

- 💼 AutoEntry: Automates data entry for invoices, receipts, and bank statements. Saves hours of manual bookkeeping from $12/month.

- 📊 FreshBooks: Beautiful invoicing with strong time tracking and project management. Loved by service businesses from $21/month.

- 🔥 NetSuite: Full enterprise ERP with accounting, CRM, and inventory. The go-to for large businesses needing custom solutions.

For the full list, see our QuickBooks alternatives guide.

⚔️ QuickBooks Compared

Here’s how QuickBooks stacks up against each competitor:

- QuickBooks vs Puzzle IO: QuickBooks wins on features and integrations. Puzzle IO wins on AI-native accounting for tech startups.

- QuickBooks vs Dext: Dext is a receipt tool, not full accounting. Use Dext alongside QuickBooks for best results.

- QuickBooks vs Xero: QuickBooks has more integrations and US support. Xero has a cleaner interface and better multi-currency tools.

- QuickBooks vs Synder: Synder excels at e-commerce syncing. QuickBooks is better as a full accounting system.

- QuickBooks vs Easy Month End: Easy Month End focuses only on closing processes. QuickBooks covers the entire accounting workflow.

- QuickBooks vs Docyt: Docyt wins for multi-location, high-volume businesses. QuickBooks is better for typical small businesses.

- QuickBooks vs Sage: Both offer full accounting. QuickBooks has more third-party apps. Sage has stronger payroll and HR features.

- QuickBooks vs Zoho Books: Zoho Books is cheaper with a free tier. QuickBooks has deeper reporting and more integrations.

- QuickBooks vs Wave: Wave is free but limited. QuickBooks offers far more features, reporting, and scalability.

- QuickBooks vs Quicken: Quicken is for personal finance. QuickBooks is purpose-built for business accounting.

- QuickBooks vs Hubdoc: Hubdoc is a document-fetching add-on, not standalone accounting. It pairs well with QuickBooks.

- QuickBooks vs Expensify: Expensify wins on expense management. QuickBooks wins on full-spectrum accounting and invoicing.

- QuickBooks vs AutoEntry: AutoEntry automates data entry only. QuickBooks handles the entire accounting process end to end.

- QuickBooks vs FreshBooks: FreshBooks is simpler and better for solo service providers. QuickBooks is more powerful for growing teams.

- QuickBooks vs NetSuite: NetSuite is enterprise-grade ERP. QuickBooks is the better fit for small to mid-sized businesses.

Start Using QuickBooks Now

You learned how to use every major QuickBooks feature:

- ✅ Bank Feeds

- ✅ Cloud Accounting Software

- ✅ Project Profitability

- ✅ Accounting Reports

- ✅ Expense Tracker

- ✅ Invoicing and Pay Bills

- ✅ Inventory Management

- ✅ VAT & GST Tracker

- ✅ Mobile Accounting App

Next step: Pick one feature and try it now.

Most people start with Bank Feeds.

It takes less than 5 minutes.

Frequently Asked Questions

Can I teach myself how to use QuickBooks?

Yes, most people learn QuickBooks on their own using free tutorials and guides like this one. QuickBooks also offers built-in help, video walkthroughs, and a free ProAdvisor training program. Start with the dashboard and learn one feature at a time.

Is QuickBooks easy to use for beginners?

QuickBooks is designed for non-accountants. The dashboard is simple, and AI helps categorize transactions automatically. Beginners can get comfortable within a few hours. Creating a practice company file helps you experiment without risk.

Why do accountants not like QuickBooks Online?

Some CPAs prefer desktop software for advanced customization and offline access. QuickBooks Online has improved greatly with AI features, modern reports, and better integrations. Many accountants now recommend QBO for the majority of small business clients.

What are the 5 basic functions of QuickBooks?

The five core functions are: tracking income and expenses, sending invoices and collecting payments, running financial reports, managing bank feeds and reconciliation, and handling payroll. These cover what most small businesses need to manage their finances.

Is there a free way to learn QuickBooks?

Yes. QuickBooks offers free tutorials on their website and YouTube channel. The 30-day free trial lets you practice with real features. Intuit also provides free ProAdvisor training courses. This guide covers every major feature at no cost.

How many days will it take to learn QuickBooks?

Most beginners get comfortable with the basics in 1–2 days. Mastering advanced features like project profitability and custom reports takes about a week of regular practice. Following structured guides like this one helps you learn faster.

Does the IRS look at QuickBooks?

The IRS does not directly access your QuickBooks account. However, they may request your financial records during an audit. QuickBooks makes this easy — you can export reports and attach receipts to transactions. Keeping accurate books in QuickBooks helps you stay audit-ready.

![What Is QuickBooks and How Does It Work? [QuickBooks Explained]](https://www.fahimai.com/wp-content/cache/flying-press/0LNss0gjgfQ-hqdefault.jpg)