Are you tired of month-end closing taking forever?

It can feel like a huge headache, right?

All those papers and numbers can get confusing.

Two of these are Dext vs Easy Month End.

Let’s take a look at how these tools can help you say goodbye to month-end stress!

Aperçu

We looked closely at both Dext and Easy Month End.

Nous les avons testés pour voir comment ils fonctionnent.

This helped us understand what each one is good at.

Now we can compare them and show you what we found.

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment Dext automatise la saisie de données, le suivi des dépenses et la gestion de vos finances.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 24 $/mois.

Caractéristiques principales :

- Numérisation des reçus

- Notes de frais

- Rapprochement bancaire

En cette fin de mois, rejoignez les 1 257 utilisateurs d'Easy qui ont économisé en moyenne 3,5 heures et réduit leurs erreurs de 15 %. Commencez votre essai gratuit !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 45 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

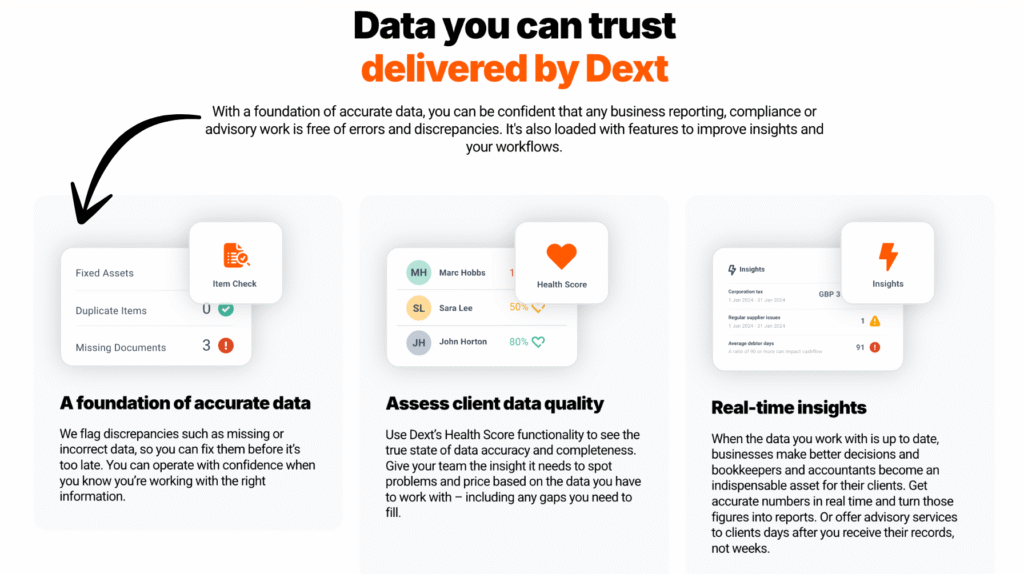

Qu'est-ce que Dext ?

Alors, Dext, c'est quoi ?

Considérez-le comme un assistant ultra-intelligent pour vos travaux.

Il sert principalement à gérer les factures et les reçus.

Il suffit de prendre une photo, et Dext récupère toutes les informations importantes.

Libérez son potentiel grâce à notre Alternatives à Dext…

Notre avis

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment la saisie de données automatisée, le suivi des dépenses et les rapports de Dext peuvent simplifier vos finances.

Principaux avantages

Dext excelle vraiment lorsqu'il s'agit de simplifier au maximum la gestion des dépenses.

- 90 % des utilisateurs font état d'une diminution significative de l'encombrement de papiers.

- Il affiche un taux de précision supérieur à 98 %. dans l'extraction de données à partir de documents.

- Créer des notes de frais devient incroyablement rapide et facile.

- S'intègre parfaitement aux plateformes comptables populaires, telles que QuickBooks et Xero.

- Permet de ne jamais perdre la trace de documents financiers importants.

Tarification

- Abonnement annuel : $24

Avantages

Cons

Qu'est-ce qu'une fin de mois facile ?

Easy Month End est donc comme une aide précieuse lorsque le mois se termine.

Il essaie de faire Clôturer vos livres plus facilement.

Considérez cela comme un moyen de regrouper toutes vos informations financières au même endroit à la fin du mois.

Cela vous permet de voir quels sont les revenus et les dépenses.

Libérez son potentiel grâce à notre Alternatives faciles pour la fin du mois…

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

We looked at both Dext and Easy Month End closely.

This comparison shows what each tool is best at doing for your finance team.

1. Capture des reçus et extraction des données

- Dext is an expert at automating données entry. It gives you multiple ways to capture receipts and other financial documents. You can use the Dext mobile app, send an email, or have it get receipts and invoices straight from suppliers.

- It uses OCR technology to quickly extract data and removes the need for manual entry.

- Fin de mois facile does not focus on the first step of data collection from documents.

2. Data Extraction Accuracy

- Dext (formerly Receipt Bank) is known for its high accuracy when using its optical character recognition to extract data. This helps you avoid errors.

- Fin de mois facile is a workflow tool, so data extraction is not its main job.

3. Intégrations directes avec les logiciels de comptabilité

- Dext has deep integration with all major comptabilité software, like QuickBooks Online and Xero. This helps with a secure data flow of all your cost and sales data.

- Fin de mois facile also connects with QuickBooks Online and Xero. Its main goal is to pull balance sheets for reconciliation.

4. Supplier Rules and Categorisation

- Dext lets you set up supplier rules. You can tell the system how to handle documents from a certain word or supplier automatically. This makes comptabilité workflows more efficient.

- Fin de mois facile does not have a feature for setting up these specific supplier rules.

5. Balance Sheet Reconciliation

- Fin de mois facile is made to handle the month-end process. It is excellent at balance sheet reconciliation. It connects to your comptabilité data, shows balances, and helps you get sign offs on all your reconciliations in one spot.

- Dext Prepare focuses on pre-accounting, but it supports bank reconciliation with its accurate data extraction and bank feeds.

6. Team Collaboration and Workflow Management

- Fin de mois facile is a strong workflow management tool for the finance team. It lets you make task checklists for the month-end process, assign work, leave comments, and track sign offs. This helps with team collaboration.

- Dext focuses more on the collaboration needed between small entreprise owners and their accountants for submitting and processing documents quickly.

7. Audit Evidence and Compliance

- Fin de mois facile helps you collect audit evidence. It keeps a log of tasks, documents, preparer and reviewer sign-offs, and all in a single platform. This ensures compliance for auditors.

- Dext helps by keeping all your original documents and extracted data stored securely in the cloud.

8. Expense Claims and Management

- Dext gives employees an easy way to submit receipts and expense claims using the Dext mobile app. This makes it easy to track expenses and manage expenses.

- Fin de mois facile can track the task of reviewing expense claims, but it does not handle the initial receipt capture receipts and submission part.

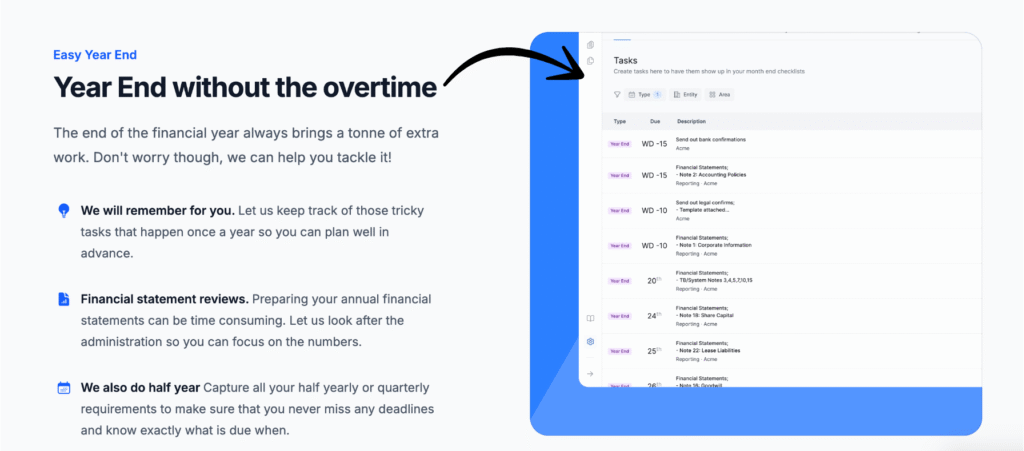

9. Year End and Quarter-End Support

- Fin de mois facile works as a checklist for the month-end process, quarter-end, and year-end. You can manage all your recurring accounting and comptabilité workflows from one spot.

- Dext provides consistent, accurate, and timely data, which is key for all those reportage periods.

10. System Dependability and Security

- Both tools offer a sécurité solution for secure data flow.

- Dext has a strong reputation for system dependability in its data collection and extraction.

- Fin de mois facile offers a high level of security service and compliance features in its top pricing plans to protect financial data.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

Here are the key things to look at when choosing the right tool to handle month-end for your finance team:

- Team Management and Efficiency: Look for features that support team management and make your finance team more efficient finance team. The goal is a smoother month-end close and an easier life for everyone.

- Reconciliation Speed: Does the tool help you achieve faster balance sheet reconciliations? This ability is a must-have to reconcile accounts quickly and stay on top of your balances.

- Flexibilité du flux de travail : Make sure the system can handle more than just monthly tasks. Can it manage ad hoc tasks and recurring items? This expanded scope improves efficiency.

- Payment and Contract Terms: Check how you pay. Can you cancel easily? Is the price clear, or are there hidden fees? Avoid being locked into long contracts.

- Ease of Use for Your Team: The platform should be easy for your team to access and use. If your team is stuck using Excel and Outlook for tracking, you need a modern solution to reduce delays.

- Préparation à l'audit : The tool must reduce hassle with manual confirmations. It should keep track of every completed task and all supporting documents you upload or import.

- Support for Multiple Entities: If you manage several companies, you need the ability to handle multiple entities easily from one place.

- Support and Communication: Can you quickly answer questions or submit a support ticket? Good support makes your first month-end a breeze.

Verdict final

After looking closely at both tools, we choose Dext as the better platform for your team. Why?

Dext works best at removing hassle from the start of your comptabilité.

C'est automation of manual data entry is top-notch.

You can collect receipts and invoices using mobile scanning or email submission in just a few minutes.

This helps your whole finance team save time. Dext saves hours every week!

Additionally, the accurate data it extracts makes expense management much easier.

Easy Month End is great for tracking finance team tasks, but Dext is better at getting the data in right away.

Your finance team deserves the efficiency Dext provides. Try Dext with their free trial today.

Plus de Dext

Nous avons également examiné comment Dext se compare à d'autres outils de gestion des dépenses et de comptabilité :

- Dext contre Xero: Xero propose une comptabilité complète avec des fonctionnalités intégrées de gestion des dépenses.

- Dext contre Puzzle IO: Puzzle IO excelle dans l'analyse et la prévision financières grâce à l'IA..

- Dext contre Synder: Synder se concentre sur la synchronisation des données de vente e-commerce et le traitement des paiements.

- Dext vs Easy Fin de mois: Easy Month End simplifie les procédures de clôture financière de fin de mois.

- Dext contre Docyt: Docyt utilise l'IA pour automatiser les tâches de comptabilité et de gestion documentaire.

- Dext contre RefreshMe: RefreshMe fournit des informations en temps réel sur les performances financières des entreprises.

- Dext contre Sage: Sage propose une gamme de solutions comptables avec des fonctionnalités de suivi des dépenses.

- Dext contre Zoho Books: Zoho Books propose une comptabilité intégrée avec des fonctionnalités de gestion des dépenses.

- Dext contre Wave: Wave propose un logiciel de comptabilité gratuit avec des fonctionnalités de base de suivi des dépenses.

- Dext contre Quicken: Quicken est un logiciel populaire pour la gestion des finances personnelles et le suivi des dépenses professionnelles de base.

- Dext vs Hubdoc: Hubdoc est spécialisé dans la collecte automatisée de documents et l'extraction de données.

- Dext contre Expensify: Expensify propose des solutions robustes de gestion et de reporting des dépenses.

- Dext contre QuickBooks: QuickBooks est un logiciel de comptabilité largement utilisé, doté d'outils de gestion des dépenses.

- Dext vs AutoEntry: AutoEntry automatise la saisie des données à partir des factures, des reçus et des relevés bancaires.

- Dext contre FreshBooks: FreshBooks est conçu pour les entreprises de services avec facturation et suivi des dépenses.

- Dext contre NetSuite: NetSuite offre un système ERP complet avec des fonctionnalités de gestion des dépenses.

Plus de fins de mois faciles

Voici une brève comparaison d'Easy Month End avec quelques-unes des principales alternatives.

- Fin de mois facile vs Puzzle io: Alors que Puzzle.io est destiné à la comptabilité des startups, Easy Month End se concentre spécifiquement sur la simplification du processus de clôture.

- Fin de mois facile vs Dext: Dext est principalement destiné à la capture de documents et de reçus, tandis qu'Easy Month End est un outil complet de gestion de la clôture de fin de mois.

- Easy Month End vs Xero: Xero est une plateforme comptable complète pour les petites entreprises, tandis qu'Easy Month End propose une solution dédiée au processus de clôture.

- Fin de mois facile vs Synder: Synder est spécialisé dans l'intégration des données de commerce électronique, contrairement à Easy Month End qui est un outil de flux de travail pour l'ensemble de la clôture financière.

- Fin de mois facile vs Docyt: Docyt utilise l'IA pour la comptabilité et la saisie de données, tandis qu'Easy Month End automatise les étapes et les tâches de la clôture financière.

- Easy Month End vs RefreshMe: RefreshMe est une plateforme de coaching financier, différente de Easy Month End qui se concentre sur la gestion des clôtures.

- Easy Month End vs Sage: Sage est une suite logicielle de gestion d'entreprise à grande échelle, tandis qu'Easy Month End offre une solution plus spécialisée pour une fonction comptable essentielle.

- Easy Month End vs Zoho Books: Zoho Books est un logiciel de comptabilité tout-en-un, tandis qu'Easy Month End est un outil spécialement conçu pour le processus de clôture mensuelle.

- Fin de mois facile vs vague: Wave propose des services de comptabilité gratuits pour les petites entreprises, tandis qu'Easy Month End offre une solution plus avancée pour la gestion des clôtures.

- Easy Month End vs Quicken: Quicken est un outil de gestion de finances personnelles, ce qui fait d'Easy Month End un meilleur choix pour les entreprises qui doivent gérer leur clôture de fin de mois.

- Easy Month End vs Hubdoc: Hubdoc automatise la collecte de documents, mais Easy Month End est conçu pour gérer l'intégralité du flux de travail de clôture et les tâches d'équipe.

- Easy Month End vs Expensify: Expensify est un logiciel de gestion des dépenses, ce qui est une fonction différente de l'objectif principal d'Easy Month End, qui est la clôture financière.

- Easy Month End vs QuickBooks: QuickBooks est une solution comptable complète, tandis qu'Easy Month End est un outil plus spécifique pour la gestion de la clôture de fin de mois.

- Fin de mois simplifiée vs saisie automatique: AutoEntry est un outil de saisie de données, tandis qu'Easy Month End est une plateforme complète pour la gestion des tâches et des flux de travail lors de la clôture.

- Easy Month End vs FreshBooks: FreshBooks est destiné aux travailleurs indépendants et aux petites entreprises, tandis qu'Easy Month End offre une solution dédiée à la clôture de fin de mois.

- Easy Month End vs NetSuite: NetSuite est un système ERP complet, dont la portée est plus large que celle d'Easy Month End, spécialisé dans la clôture financière.

Foire aux questions

What is the main difference between Dext and Easy Month End?

Dext focuses more on automation like receipt and invoice processing and integrates with many logiciel de comptabilité options. Easy Month End is simpler and mainly helps organize the month-end closing process.

Lequel est le mieux adapté aux petites entreprises ?

Dext is often better for a petite entreprise wanting to automate tasks like expense reports and data entry, saving valuable time and improving accuracy.

Does Dext or Easy Month End offer a free trial?

Yes, Dext offers a free trial so you can test its features before committing. Easy Month End may also have a trial, but it’s good to check their website for details.

Can my accountant use Dext or Easy Month End?

Yes, accountants often find Dext very useful due to its advanced features and integration capabilities. Easy Month End can also be helpful for basic bookkeeping tasks.

Is Dext or Easy Month End easy to use?

Dext is generally considered very user-friendly with a well-designed mobile app. Easy Month End aims for simplicity, but some users find Dext’s interface more intuitive.