¿Estás tratando de averiguar cuál? software de contabilidad ¿Es lo mejor para tu negocio?

Puede resultar difícil elegir entre Xero y Wave, ¿verdad?

Ambos dicen que pueden ayudarle a administrar su dinero.

Este artículo desglosará lo que ambos ofrecen.

Examinaremos los detalles importantes de Xero vs Wave para que pueda ver claramente qué software podría ser más adecuado para usted.

Descripción general

Hemos dedicado tiempo a hacer clic en Xero y Wave.

Probar sus funciones, como el envío de facturas y el seguimiento de gastos.

Esta experiencia práctica nos ha dado una idea real de cómo funciona cada uno día a día.

Lo que nos lleva a esta sencilla comparación para ayudarte a elegir.

Únase a más de 2 millones de empresas que utilizan el software de contabilidad en la nube de Xero. ¡Explore sus potentes funciones de facturación ahora!

Precios: Tiene una prueba gratuita. El plan pago comienza en $29/mes.

Características principales:

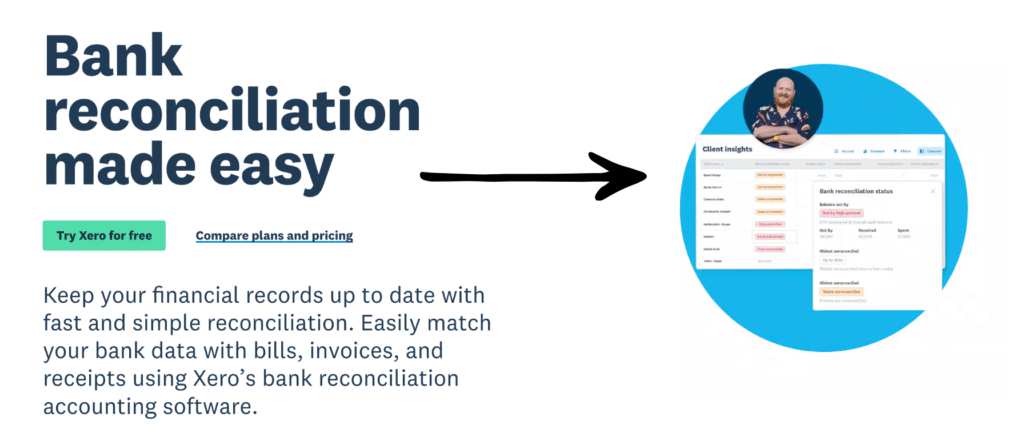

- Conciliación bancaria

- Facturación

- Informes

Más de 4 millones pequeñas empresas Confíe en Wave para administrar sus finanzas. Explore los planes de Wave y encuentre el ideal.

Precios: Plan gratuito disponible. Plan de pago desde $19 al mes.

Características principales:

- Facturación

- Bancario

- Complemento de nómina.

¿Qué es Xero?

¿Estás considerando Xero? Es una opción popular para muchas empresas.

Piense en ello como un centro en línea para administrar su dinero.

Le ayuda a enviar facturas, pagar facturas y supervisar el rendimiento de su negocio.

Además, explora nuestros favoritos Alternativas a Xero…

Nuestra opinión

Únase a más de 2 millones de empresas usando Xero Software de contabilidad. ¡Explora sus potentes funciones de facturación ahora!

Beneficios clave

- Conciliación bancaria automatizada

- Facturación y pagos en línea

- Gestión de facturas

- Integración de nóminas

- Informes y análisis

Precios

- Motor de arranque: $29/mes.

- Estándar: $46/mes.

- De primera calidad: $69/mes.

Ventajas

Contras

¿Qué es Wave?

Ahora, hablemos de Wave. Es conocido por ser gratuito. contabilidad software.

Este es un gran atractivo para muchas pequeñas empresas que recién comienzan.

Le ayuda a gestionar la facturación, realizar un seguimiento de los ingresos y gastos y administrar su flujo de caja sin una tarifa mensual por lo básico.

Además, explora nuestros favoritos Alternativas de olas…

Nuestra opinión

¡No te conformes con menos! Únete a los más de 2 millones de pequeñas empresas que confían hoy mismo en las potentes funciones de contabilidad gratuitas de Wave para optimizar sus finanzas.

Beneficios clave

Los puntos fuertes de Wave incluyen:

- Un plan de contabilidad básico 100% gratuito.

- Sirviendo a más de 2 millones de pequeñas empresas.

- Fácil creación de facturas y procesamiento de pagos.

- Sin contratos a largo plazo ni garantías.

Precios

- Plan de inicio: $0 al mes.

- Plan Pro: $19 al mes.

Ventajas

Contras

Comparación de características

Elegir lo mejor contabilidad El software implica mirar más allá del precio para ver lo que cada herramienta realmente hace por su negocio.

This detailed comparison cuts through the noise, showing you where each cloud-based software de contabilidad truly shines.

1. Precios y escalabilidad para el crecimiento

- Xero: Ofrece una estructura de planes de precios escalonados, diseñada para el crecimiento empresarial. El plan inicial tiene limitaciones, pero el plan consolidado desbloquea funciones avanzadas, lo que convierte al software de contabilidad Xero en una mejor opción a largo plazo para empresas consolidadas y en expansión.

- Ola: El software de contabilidad gratuito básico es excelente para pequeña empresa Propietarios y contratistas independientes. Solo incurre en costos adicionales por complementos como Wave Payroll o procesamiento de pagos, lo que lo convierte en una excelente opción económica.

2. Banca y transacciones automatizadas

- Xero: Xero facilita las transacciones bancarias con información bancaria que actualiza sus registros financieros. Xero le permite obtener información en tiempo real. datos a través de alimentaciones bancarias automáticas, reduciendo significativamente la entrada manual de datos y mejorando la gestión del flujo de caja.

- Ola: Wave ofrece transacciones bancarias de importación automática para ayudar pequeña empresa Los propietarios se mantienen al día. La revisión de Wave demuestra que conectar sus transacciones bancarias ayuda a mantener sus datos financieros actualizados con el mínimo esfuerzo.

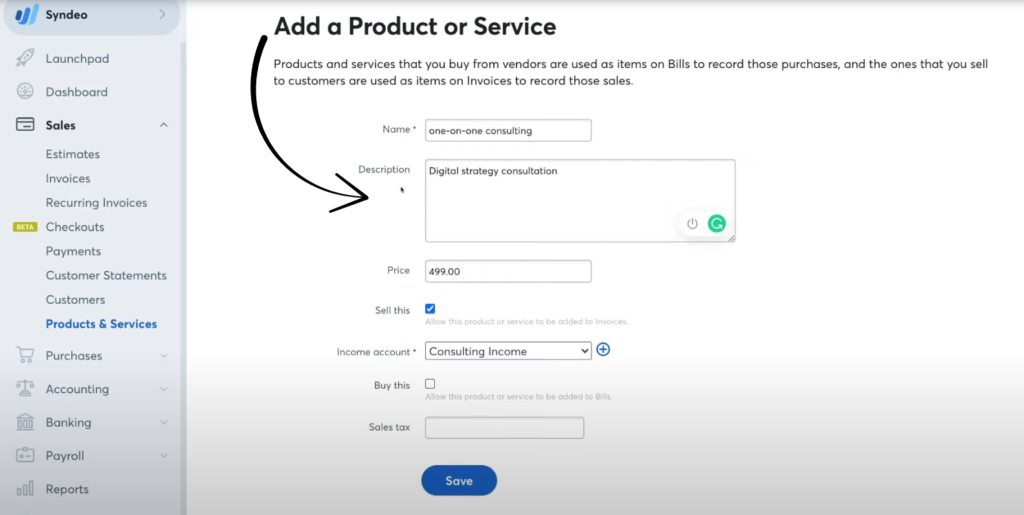

3. Facturación y pagos

- Xero: La facturación en línea es una ventaja. Puede configurar recordatorios de pago automáticos y usar la plataforma para realizar un seguimiento fácil de las facturas pendientes, lo que ayuda a mantener sus cuentas por cobrar en orden.

- Ola: La versión gratuita incluye potentes funciones de facturación en línea. Wave permite aceptar pagos en línea con tarjeta de crédito o transferencia bancaria, lo que agiliza el cobro y ofrece a los pequeños negocios excelentes funciones de gestión financiera.

4. Inventario y seguimiento de proyectos

- Xero: Xero destaca por su gestión de inventario integrada en sus niveles superiores. Esta función es crucial para empresas consolidadas que necesitan gestionar el inventario y realizar un seguimiento de sus datos en múltiples ubicaciones o proyectos, lo que incluye el seguimiento de proyectos.

- Ola: Wave no cuenta con un módulo de gestión de inventario integrado. Para ello, o para el seguimiento de proyectos, deberá usar una de las limitadas integraciones de Wave con aplicaciones de terceros.

5. Financial Reporting and Analysis

- Xero: Xero's reportando Las funciones son completas y ofrecen informes personalizables para obtener una visión clara de su situación financiera y el rendimiento de su negocio. Puede generar informes completos sobre las funciones de cuentas por cobrar y cuentas por pagar.

- Ola: Wave proporciona informes financieros esenciales, como el de Pérdidas y Ganancias y el Balance General. Si bien es útil, el nivel de detalle y personalización es limitado en comparación con el análisis del software de contabilidad Xero.

6. Gestión de gastos y facturas

- Xero: Xero le permite capturar facturas, ingresar órdenes de compra y programar pagos fácilmente utilizando la funcionalidad de cuentas por pagar.y. Esto es clave para administrar sus gastos y mejorar la gestión financiera.

- Ola: Wave gestiona eficazmente el seguimiento de gastos, incluyendo la opción de captura digital de recibos sobre la marcha. Sus funciones principales ayudan a las empresas a gestionar sus necesidades básicas de cuentas por pagar.

7. Preparación empresarial global

- Xero: Xero es ideal para empresas con operaciones internacionales porque admite múltiples divisas y gestiona automáticamente las ganancias y pérdidas por cambio de divisas. Esta función está incluida de serie en el plan establecido.

- Ola: Wave se centra principalmente en empresas que operan en EE. UU. y Canadá, con soporte limitado para múltiples monedas y operaciones internacionales.

8. Funcionalidad de planificación de recursos empresariales (ERP)

- Xero: Si bien no es un sistema completo de planificación de recursos empresariales, las capacidades ERP del software de contabilidad Xero, especialmente con sus amplias integraciones, hacer Es altamente escalable para muchas tareas más allá de la simple contabilidad.gramo.

- Ola: Wave se centra exclusivamente en software de contabilidad para pequeñas empresas y no está diseñado para ofrecer funciones de planificación de recursos empresariales. Proporciona el libro mayor y las tareas financieras básicas necesarias para una pequeña empresa.

9. User Support and Resources

- Xero: Los usuarios pueden confiar en Xero Central para obtener ayuda e información. Recomiende Xero a las empresas que valoran una documentación completa y un sólido soporte de socios.

- Ola: Wave ofrece soporte a través de un centro de ayuda y tickets en línea. Recomiendo Wave a quienes se sienten cómodos con los recursos en línea de autoservicio debido a su estructura de soporte más básica.

¿Qué tener en cuenta al elegir un software de contabilidad?

Aquí hay algunas cosas adicionales que debes tener en cuenta:

- ¿Funciona bien la aplicación móvil en? iOS ¿Y dispositivos Android para tareas como escanear recibos?

- Comprueba si puedes gestionar varias empresas desde una plataforma o cuenta gratuita.

- Considere lo fácil que es cambiar de proveedor con la migración de datos si el plan inicial gratuito o el plan inicial no se adaptan a sus necesidades.

- Busque una interfaz fácil de usar para no perder tiempo tratando de entender cómo funcionan las cosas.

- El sistema debería categorizar automáticamente las transacciones bancarias y permitir una fusión automática para lograr mayor eficiencia.

- Si tienes un equipo, verifica si admiten usuarios ilimitados y múltiples.

- Wave Financial es gratuito, pero consulte los precios de Xero o el costo de Xero para empresas en crecimiento que necesitan más.

- Busque funciones de seguridad sólidas, como autenticación multifactor, que le brinden tranquilidad.

- ¿Puede realizar un seguimiento de las horas facturables de servicios profesionales y utilizarlas para la facturación recurrente?

- ¿Permite el ingreso rápido de pagos bancarios y pagos con tarjeta de crédito con bajas tarifas de transacción con tarjeta de crédito?

- Compruebe si el software de facturación ofrece facturas recurrentes y admite pagos como Apple Pay.

- Asegúrese de que ayude a administrar el impuesto sobre las ventas y proporcione buenos informes financieros durante un rango de fechas elegido.

- ¿Qué tan sencillo es pagarle a un contratista independiente mediante depósito directo?

- ¿Las características clave proporcionan todas las herramientas que necesita para respaldar la salud financiera de su empresa?

Veredicto final

Después de recorrer esta comparación detallada y realizar una revisión contable de ondas completa.

Nuestra elección depende de tu etapa.

Si eres un persona de libre dedicación y necesitas un sistema básico con facturas ilimitadas, Wave es perfecto.

Su nivel gratuito maneja tus finanzas personales y sencillas teneduría de libros archivos.

Sin embargo, para una empresa que aspira a un crecimiento serio, utilice Xero.

Si bien el plan inicial lo limita a un máximo de cinco facturas, las sólidas funciones de Xero para administrar cuentas bancarias e integrar datos de clientes son superiores.

El panel de control de Xero le ofrece una mejor visibilidad de sus datos financieros.

Pruebe xero para ver su potencia.

Aunque Wave tiene un plan profesional pago para funciones avanzadas como el procesamiento de nóminas y es excelente para la presentación de impuestos.

Xero ofrece mayor soporte al cliente y escalabilidad, lo que lo convierte en nuestra opción para empresas que desean expandirse.

Más de Xero

Elegir el software de contabilidad adecuado implica considerar varias opciones.

He aquí una rápida comparación entre Xero y otros productos populares.

- Xero frente a QuickBooks: QuickBooks es un competidor importante. Si bien ambos ofrecen funciones básicas similares, Xero suele ser elogiado por su interfaz clara y su número ilimitado de usuarios. QuickBooks puede ser más complejo, pero ofrece informes muy eficaces.

- Xero frente a FreshBooks: FreshBooks es una opción popular, especialmente para autónomos y empresas de servicios. Destaca por su facturación y control de horas trabajadas. Xero ofrece una solución de contabilidad más completa.

- Xero frente a Sage: Tanto Sage como Xero ofrecen soluciones para pequeñas empresas. Sin embargo, Sage también proporciona herramientas de planificación de recursos empresariales (ERP) más completas para empresas más grandes.

- Xero vs. Zoho Books: Zoho Books forma parte de una amplia gama de aplicaciones empresariales. Suele ofrecer funciones de inventario más avanzadas y es muy rentable. Xero, por su parte, es una opción líder por su simplicidad y facilidad de uso.

- Xero frente a Wave: Wave es conocido por su plan gratuito. Es una excelente opción para pequeñas empresas o autónomos con un presupuesto ajustado. Xero ofrece una gama más amplia de funciones y es ideal para el crecimiento empresarial.

- Xero frente a Quicken: Quicken se centra principalmente en finanzas personales. Si bien ofrece algunas funciones empresariales, no es una auténtica solución de contabilidad empresarial. Xero está diseñado específicamente para gestionar las complejidades de la contabilidad empresarial.

- Xero frente a HubdocEstos no son competidores directos. Tanto Dext como Hubdoc son herramientas que automatizan la captura de documentos y la entrada de datos. Se integran directamente con Xero para agilizar y hacer más precisa la contabilidad.

- Xero frente a Synder: Synder es una plataforma que conecta canales de venta y pasarelas de pago con software de contabilidad. Ayuda a automatizar la entrada de datos desde plataformas como Shopify y Stripe directamente a Xero.

- Xero frente a ExpensifyExpensify se centra específicamente en la gestión de gastos. Si bien Xero cuenta con funciones de gastos, Expensify ofrece herramientas más avanzadas para gestionar los gastos y reembolsos de los empleados.

- Xero frente a Netsuite: Netsuite es un sistema ERP integral para grandes corporaciones. Ofrece un conjunto completo de herramientas de gestión empresarial. Xero no es un ERP, pero es una excelente solución de contabilidad para pequeñas empresas.

- Xero frente a Puzzle IO: Puzzle IO es una plataforma financiera diseñada para empresas emergentes, centrada en estados financieros en tiempo real y entrada de datos automatizada.

- Xero vs. Easy Month End: Este software es una herramienta especializada para automatizar el proceso de cierre de mes, facilitando la conciliación y los registros de auditoría. Está diseñado para funcionar con Xero, no para reemplazarlo.

- Xero frente a Docyt: Docyt utiliza IA para automatizar las tareas administrativas y de contabilidad. Permite consultar todos sus documentos y datos financieros en un solo lugar.

- Xero frente a RefreshMe: RefreshMe es un software de contabilidad más simple con funciones básicas, a menudo utilizado para finanzas personales o empresas muy pequeñas.

- Xero frente a AutoEntry: Similar a Dext y Hubdoc, AutoEntry es una herramienta que automatiza la extracción de datos de recibos y facturas, diseñada para integrarse y mejorar el software de contabilidad como Xero.

Más de Wave

- Ola vs. Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Wave contra DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Wave frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave contra SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Ola vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Wave vs. DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Wave vs SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Wave frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Wave frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Wave frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Wave frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Onda vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Wave frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Wave frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Wave es realmente gratuito o tiene costos ocultos?

La contabilidad básica, la facturación y el seguimiento de gastos de Wave son gratuitos. Sin embargo, se cobran por la nómina, los pagos y los servicios de asesoría.

Which software is better for very small businesses?

Las empresas muy pequeñas y los trabajadores autónomos a menudo prefieren Wave debido a sus funciones de contabilidad básicas gratuitas.

Does Xero offer a free trial?

Sí, Xero normalmente ofrece un período de prueba gratuito para que puedas probar sus funciones antes de comprometerte con un plan pago.

¿Puedo cambiar fácilmente de Wave a Xero más adelante?

Sí, es posible migrar sus datos, pero el proceso puede depender en complejidad de la cantidad de información.

¿Xero también se integra con plataformas de comercio electrónico?

Sí, Xero ofrece integraciones con muchas plataformas de comercio electrónico populares para ayudar a administrar sus datos de ventas.