Do you struggle to buy enough inventory to keep up with your sales?

Many ecommerce sellers hit a wall where they have plenty of customers but not enough cash to fill orders.

This growth gap is frustrating because it stops you from making the money you deserve.

Without a steady supply of funds, you might lose your spot in the market to faster competitors.

This 8fig Review dives into how it aims to solve these critical problems for e-commerce businesses.

Ready to unlock your e-commerce potential? 8fig has funded over 93,000 inventory orders and helped businesses achieve an average growth rate of 470%.

What is 8fig?

8fig is a growth partner that helps online sellers secure funding for their ecommerce businesses.

Unlike a bank, it looks at your supply chain to see when you need help with supply chain costs.

มันใช้ ข้อมูล analysis of your historical performance to offer funding solutions for sustainable growth. 8fig.

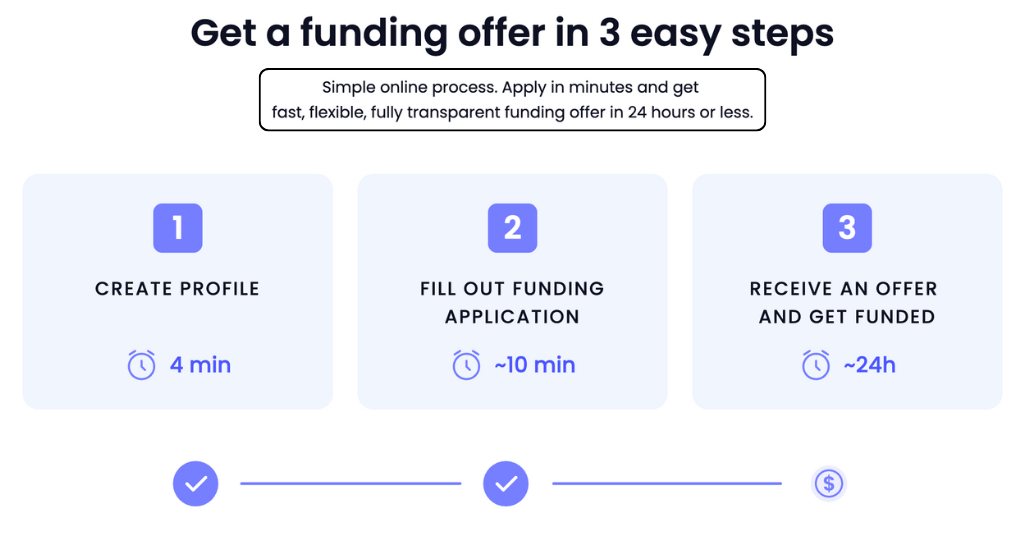

- The approval process is straightforward and offers fast funding.

- It provides continuous capital to help with cash flow management.

- You get growth capital with no hidden fees and reasonable rates.

- The funding process is built to match your potential growth.

- You can use this ecommerce funding to make informed decisions for your own ธุรกิจ.

This revenue-based financing helps established businesses reach their growth plans.

It covers the capital required for inventory and shipping through flexible remittance schedules.

Their support team gives personalized assistance to e-commerce businesses and e-commerce stores.

With 8fig, the initial funding is just the start of your cash flow. 8fig.

Who Created 8fig?

Yaron Shapira, Assaf Dagan, and Roei Yellin started 8fig in 2020.

These three experts wanted to help small stores reach their full potential.

They noticed that big banks were too slow for online shops.

Their vision was to be a calming force for sellers who need working capital to grow.

They made a simple process so everyone can succeed.

Top benefits

8fig is a game-changer for online sellers who want to scale without the stress of traditional loans.

The company offers more than just money; it provides a platform built for the specific needs of your ecommerce ธุรกิจ.

- You can get a real offer with fast approval times, often in just a few days.

- The system gives you a great forecast so you can buy inventory fast and stay ahead.

- Their user-friendly dashboard gives you clear insights and top-notch product info at a glance.

- You get a preapproved offer that serves as an outside perspective to help you plan your growth.

- The flexible repayment terms mean you only pay what you can afford based on your sales.

- The service team is very responsive and will answer all my questions quickly.

- You can connect your Shopify site or Amazon account in a simple way to get started.

- Many users leave positive Google reviews because the team acts as a calming force.

- There are no hidden fees or extra interest to worry about when you access your funds.

- The platform provides resources that help Amazon sellers manage their payments.

- Clients love the quick response from the support team—thanks juan for the help!

- It helps you keep your business running even when idiots pull other funding sources.

- Your overall experience stays positive because the capital is always there when you need it.

คุณสมบัติเด่น

8fig isn’t just about funding; it’s a complete platform with powerful tools designed to help e-commerce businesses thrive.

Its unique features integrate funding with smart planning.

Giving you a comprehensive approach to managing your operations and accelerating growth.

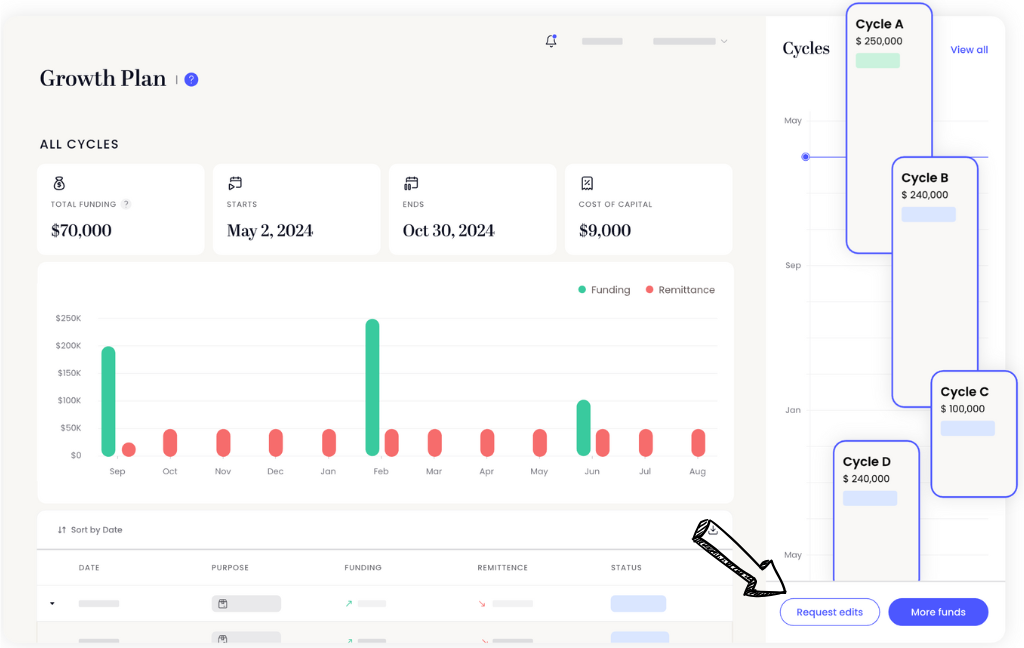

1. Funding

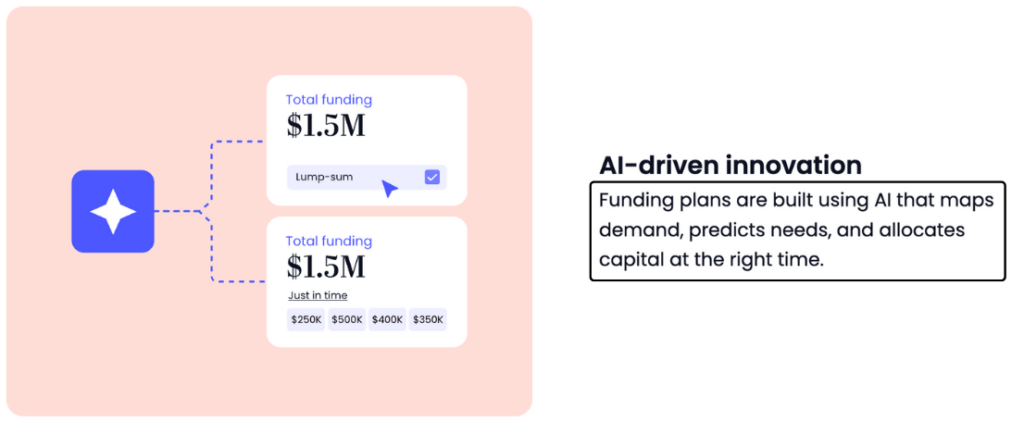

8fig provides flexible, continuous funding that adapts to your e-commerce business’s specific needs.

Instead of a single, rigid loan, they offer capital in “tranches” that align with your supply chain, like paying for manufacturing or shipping.

This ensures you have cash when you need it most, without tying up capital unnecessarily.

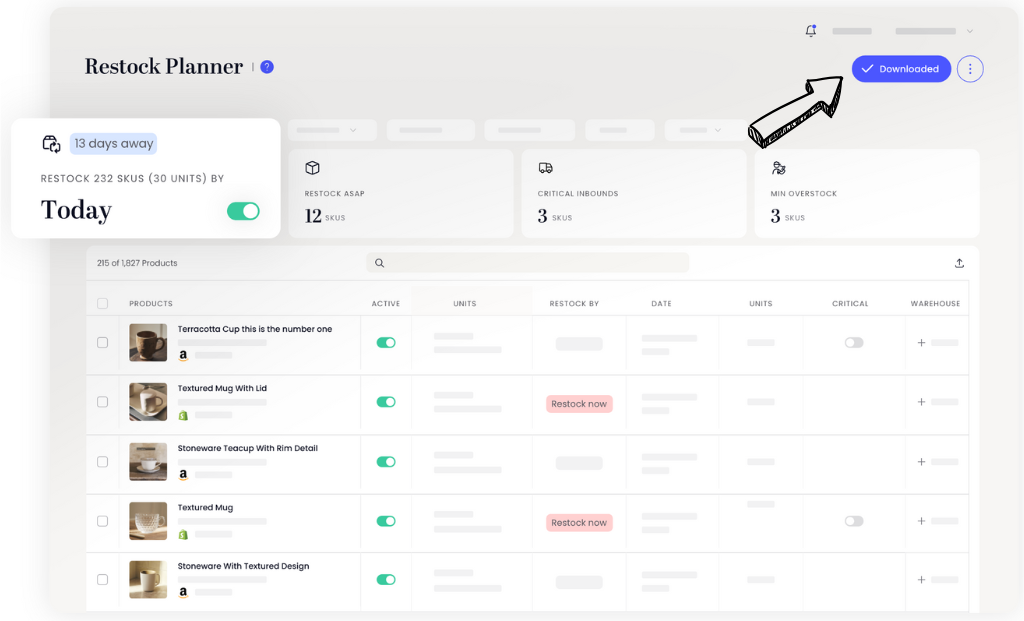

2. Restock Planner

This free tool helps you master inventory management by predicting when and how much you need to reorder.

It uses advanced algorithms to analyze your sales data.

Taking into account seasonal trends and demand spikes.

The Restock Planner even adjusts for shipment delays to keep your inventory flowing smoothly.

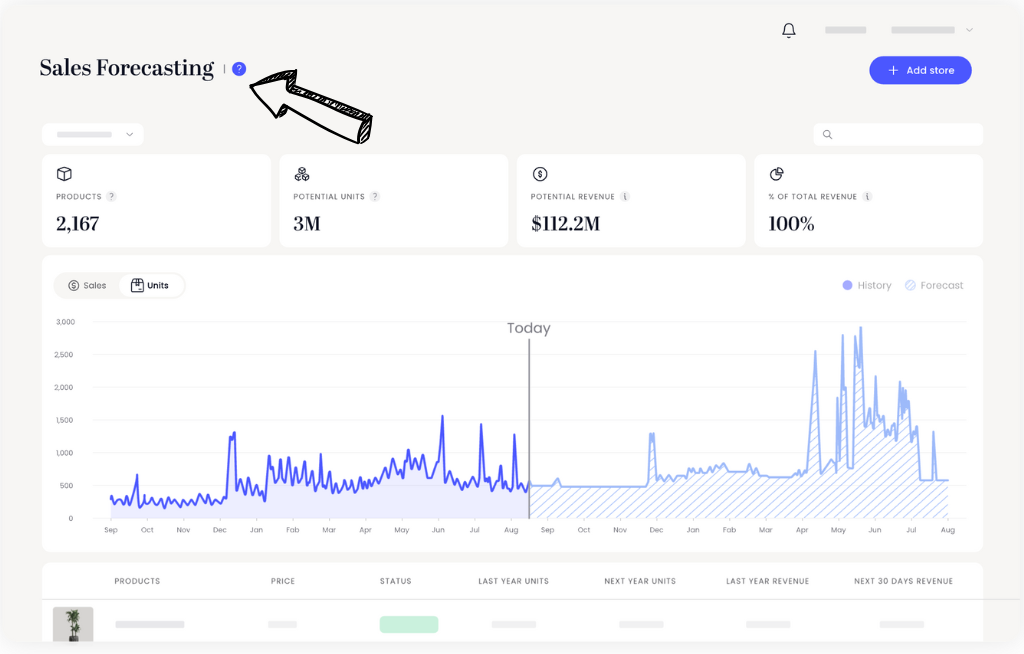

3. Sales Forecasting

Knowing your future sales is key to smart business decisions, and 8fig’s Sales Forecasting tool gives you that clarity.

It precisely predicts future sales for each product.

Helping you understand potential revenue and optimize your budget.

You can identify seasonal trends and make informed choices about inventory and marketing efforts.

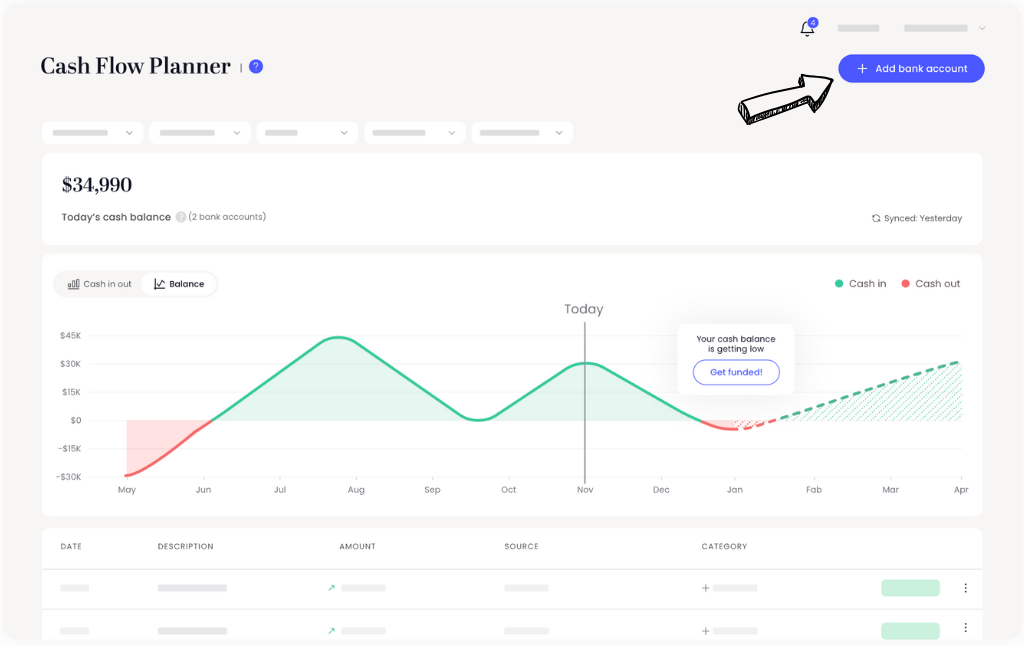

4. Cash Flow Planner

Managing your money is crucial, and the Cash Flow Planner helps you visualize your financial health.

It automatically categorizes transactions and projects your cash balance.

Allowing you to spot potential cash crunches before they happen.

This tool helps you plan for different scenarios, like new investments or marketing campaigns.

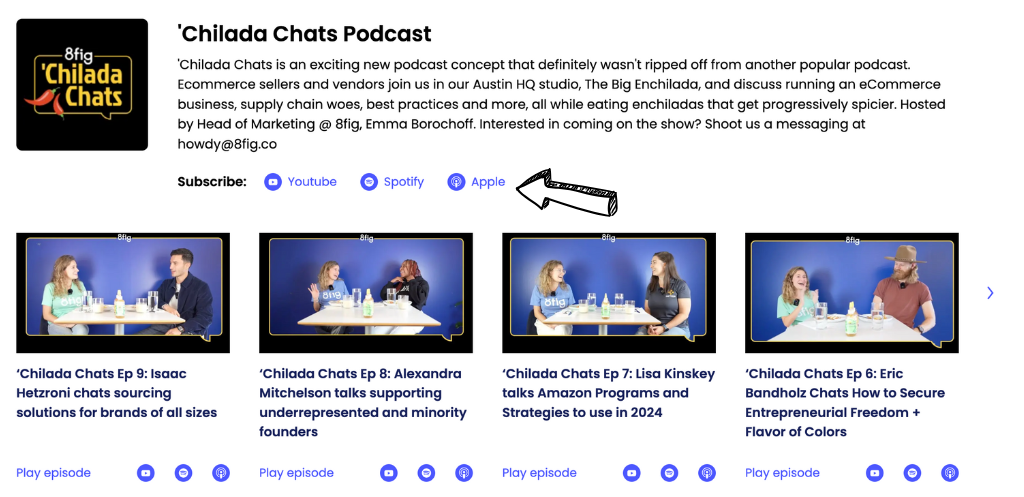

5. Podcasts

8fig also offers educational podcasts like “eComm Unfiltered” and “‘Chilada Chats.”

These podcasts feature candid conversations with e-commerce experts, successful sellers, and industry leaders.

They share valuable insights, strategies, and real-world experiences.

Helping you learn from others and stay ahead of the curve in the dynamic e-commerce world.

6. Inventory Financing Integration

For businesses in the industry directly, Aire offers specialized modules like inventory financing.

This helps ธุรกิจเล็กๆ manage their cash flow and stock levels within their custom business applications.

It connects your software to real-world financial needs.

7. AI-Driven Innovation

The core of the platform is its AI engine. It doesn’t just copy-paste code; it understands your natural language requests.

This allows citizen developers to build advanced features and advanced business process workflows that used to require technically experienced app developers.

9. Adaptive Funding Adjuster

Market conditions can shift in an instant, and 8fig allows your business to change with them.

If a product goes viral or a shipping delay occurs, you can update your plan to get more capital or move your payment dates.

This tool ensures your funding is always aligned with your store’s real-time needs.

ความละเอียด

Contact for the Exact pricing.

ข้อดีและข้อเสีย

พร

ตั้งค่า

Alternatives of 8fig

While 8fig offers a strong solution, several other options exist for e-commerce businesses seeking funding or growth support.

ต่อไปนี้คือตัวเลือกที่น่าสนใจบางส่วน:

- Clearco: This company offers revenue-share financing, providing capital for e-commerce and other businesses in exchange for a percentage of future revenue. They are known for not requiring equity or personal guarantees.

- Wayflyer: Specializing in e-commerce, Wayflyer provides flexible funding for inventory, marketing, and growth. They also offer data insights to help businesses scale.

- SellersFi: SellersFi provides a suite of financial solutions specifically for e-commerce, including working capital, payment processing, and business insurance. It targets marketplace sellers and DTC brands.

- Payability: For e-commerce sellers, Payability offers daily payouts and lump-sum advances. This helps businesses on platforms like Amazon and Shopify access their sales revenue more quickly.

- Shopify Capital: If you’re a Shopify merchant, Shopify Capital offers business loans and cash advances directly through the platform. Repayment is often tied to a percentage of your daily sales.

- Traditional Bank Loans: Due to strict collateral and credit requirements, traditional banks offer conventional term loans, which can provide larger sums but often come with fixed repayment schedules. These loans are often harder to secure for rapidly growing e-commerce businesses.

- Lines of Credit: Offered by various lenders, a business line of credit provides flexible access to funds up to a certain limit. You only pay interest on the amount you actually use, making it good for managing short-term cash flow needs.

- Crowdfunding: Platforms like Kickstarter or Indiegogo allow businesses to raise capital from a large number of individuals. This can also serve as a way to validate your product or idea.

Personal Experience with 8fig

We had a clear growth target, but faced the typical e-commerce dilemma of needing cash to buy more stock ก่อน the sales came in.

This is where 8fig truly stepped in.

Here’s how we used 8fig and the features that made a real difference:

- Funding tailored to our supply chain: Instead of a single, large sum, 8fig released funds in stages that matched our actual manufacturing and shipping timelines. This meant we only had capital deployed when it was directly needed for specific inventory milestones, optimizing our cash flow.

- Restock Planner: We utilized their Restock Planner to accurately forecast when we’d run out of stock and how much to reorder. This proactive approach minimized the risk of stockouts during peak seasons and ensured we never missed a sales opportunity.

- Sales Forecasting: Their Sales Forecasting tool gave us a clear picture of future demand for our product. This insight was crucial in confidently committing to larger inventory orders, knowing the sales were projected to follow.

- Cash Flow Planner: The Cash Flow Planner helped us visualize our incoming and outgoing funds. We could see how the 8fig funding integrated with our existing cash flow, allowing us to confidently plan for marketing campaigns and other operational expenses without stress.

- Avoided delays: By having the right funding at the right time, we completely avoided the usual delays associated with waiting for sales to clear or seeking traditional loans. Our products were in transit and ready for customers exactly when expected.

Ultimately, 8fig empowered us to scale our inventory by 150% in a quarter.

Directly contributing to a significant revenue increase without diluting equity or taking on restrictive debt.

It felt like a true partnership, providing both the capital and the intelligent tools to make informed, data-driven decisions.

บทสรุปสุดท้าย

8fig is a great choice for online stores that need help with cash flow.

It is more than just a loan because it acts as a growth partner.

The platform uses smart tools, such as an AI CFO, to track your supply chain.

This helps you get funding that fits your sales.

It is a simple process that offers fast funding without hidden fees.

If you have an established business, this is a smart way to reach your growth plans.

ถาม บ่อย ๆ

What does 8fig do?

8fig serves as a “growth partner” for eCommerce sellers, providing continuous, equity-free capital. Unlike traditional lenders, they align funding with your supply chain stages—covering inventory, freight, and marketing costs as they arise. It’s designed to optimize cash flow, allowing you to scale without the pressure of lump-sum repayments.

How much does 8fig cost?

Forget compounding interest rates. 8fig charges a fixed “Cost of Capital” fee, typically ranging from $6,000 to $10,000 for every $100,000 funded (6-10%). You see the total cost upfront before signing. There are no hidden fees, and they do not take any equity in your business.

Is 8fig legitimate?

Yes, 8fig is a legitimate, highly-rated financial technology company. They boast a strong reputation on platforms like Trustpilot (4.4+ stars) and are backed by significant venture capital. Thousands of eCommerce sellers use their platform to manage supply chains and secure funding without giving up ownership.

How do you qualify for 8fig?

Qualification is performance-based, not credit-score dependent. Generally, you need to be a US or Canada-based eCommerce seller (Amazon, Shopify, etc.) in business for at least 6-12 months. 8fig typically requires annual revenue exceeding $100,000 and consistent monthly revenue of at least $8,000 to $12,000.

How does 8fig work?

You start by mapping your supply chain in their planning tool. Once your “Growth Plan” is approved, 8fig releases funds in continuous batches aligned with your specific needs (e.g., a deposit for suppliers). You repay the funds ภายหลัง based on your sales revenue, ensuring your cash flow remains healthy during production.

How does 8fig compare to traditional loans?

Traditional loans dump a lump sum of cash on you with immediate, rigid repayment structures and interest. 8fig offers continuous capital that adapts to your supply chain timeline. Additionally, 8fig is equity-free and focuses on your store’s projected growth rather than just your personal credit history.

Does 8fig require collateral?

8fig is generally an unsecured funding option, meaning you don’t pledge personal assets like your house. Instead, they leverage the inventory and future revenue of your business. This “inventory-based” approach allows them to fund you without requiring the strict collateral demands of traditional bank loans.

More Facts about 8fig

- Paperwork: Getting started can feel slow because there are many forms to fill out before you get approved.

- ลดการใช้: Once your account is ready, the platform is simple and easy to navigate.

- Screen Layout: Some users believe the screen layout could be improved to improve usability.

- แอปพลิเคชันมือถือ: There is an app for your phone so you can check your sales and growth plan while you are away.

- Clear Fees: People prefer costs and repayment terms to be transparent and honest.

- เครื่องมือที่เป็นประโยชน์: The software includes tools to help map out your product delivery, track sales, and estimate future demand.

- Smart Planning: 8fig uses smart computer programs (AI) to create a funding plan that fits your specific needs.

- Visual Charts: Instead of confusing spreadsheets, the system uses clear lines and charts to show your business plan.

- Product Tracking: You can create a separate plan for every product you sell to see exactly how much money it costs to make and ship.

- Flat Fee: You pay a flat fee for the money you borrow instead of paying interest, which can save money.

- High Ratings: The company has a high score (around 4.5 stars) from hundreds of user reviews on Trustpilot.

- Continuous Money: Users prefer receiving money over time when they need it, rather than a single large check.

- Fast Approval: Many people report that getting approved by 8fig is faster than getting a loan from a traditional bank.

- Busy Seasons: Store owners report that the funding helps them cover expenses during their busiest times of the year.

- Big Business Limits: Some very large businesses feel that funding options are overly restrictive.

- Mixed Opinions: While most reviews are positive, some users have reported issues.

- Revenue Rule: Your business must make more than $100,000 a year to qualify for funding.

- No Ownership Taken: 8fig does not take any ownership of your company, and they do not check your personal credit score.