Вы пытаетесь выбрать подходящий инструмент для управления своими финансами? бизнес?

Это может показаться сложной головоломкой!

Возможно, вы слышали два названия: Dext и Wave.

В этой статье мы подробно рассмотрим сравнение Dext и Wave.

Мы подробно расскажем, чем они занимаются и как могут помочь вашему бизнесу процветать.

Давайте начнём!

Обзор

Мы протестировали и Dext, и Wave, и вы бы тоже могли их опробовать.

Мы протестировали их основные функции.

Мы оценили, насколько легко ими пользоваться.

Это поможет нам показать вам, как они соотносятся друг с другом.

Готовы сэкономить более 10 часов в месяц? Узнайте, как Dext автоматизирует ввод данных, отслеживание расходов и оптимизирует ваши финансы.

Цены: Доступен бесплатный пробный период. Премиум-план стоит от 24 долларов в месяц.

Основные характеристики:

- Сканирование чеков

- Отчеты о расходах

- Сверка банковских счетов

Более 4 миллионов малый бизнес Доверьте управление своими финансами компании Wave. Изучите тарифные планы Wave и найдите подходящий вариант.

Цены: Доступен бесплатный тарифный план. Платный план начинается от 19 долларов в месяц.

Основные характеристики:

- Выставление счетов

- Банковское дело

- Дополнение для расчета заработной платы.

Что такое Dext?

Итак, что же такое Dext?

Воспринимайте это как суперумного помощника для ваших работ.

В основном, это касается таких вещей, как счета и квитанции.

Вы просто делаете снимок, и Декст получает всю важную информацию.

Довольно круто, правда?

Также ознакомьтесь с нашими любимыми Альтернативы Дексту…

Наше мнение

Готовы сэкономить более 10 часов в месяц? Узнайте, как автоматизированный ввод данных, отслеживание расходов и отчетность Dext могут оптимизировать ваши финансы.

Основные преимущества

Dext действительно превосходно справляется с задачей упрощения управления расходами.

- 90% пользователей отмечают значительное уменьшение количества бумажных документов.

- Его точность превышает 98%. при извлечении данных из документов.

- Создание отчетов о расходах становится невероятно быстрым и простым.

- Беспроблемно интегрируется с популярными бухгалтерскими платформами, такими как QuickBooks и Xero.

- Помогает гарантировать, что вы никогда не потеряете важные финансовые документы.

Цены

- Годовая подписка: $24

Плюсы

Минусы

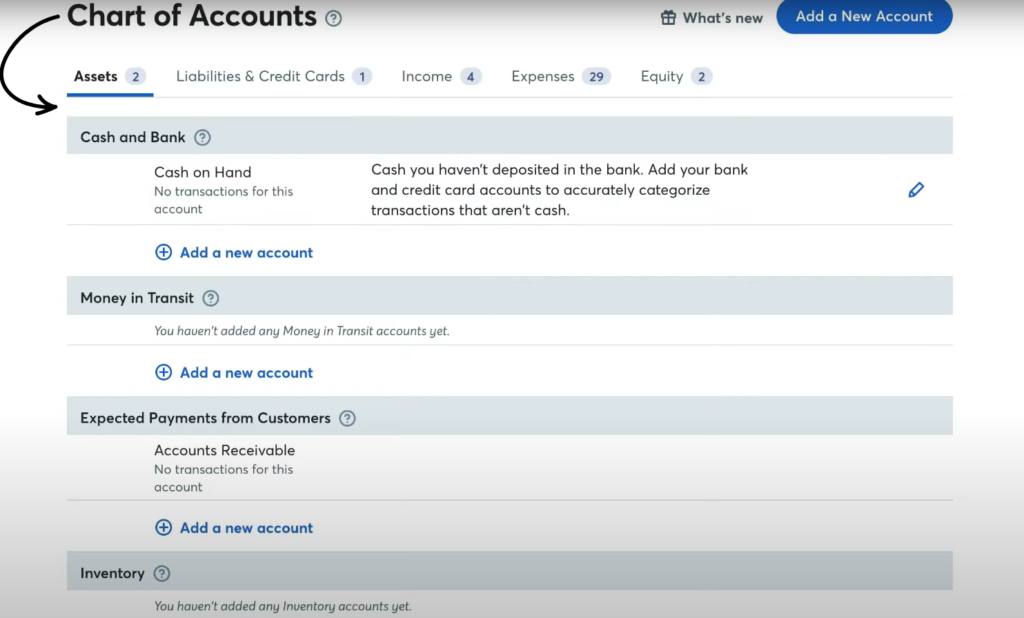

Что такое Wave?

Итак, давайте поговорим о Wave.

Воспринимайте это как полезного друга для ваших деловых денег.

Это позволяет, например, выставлять счета и отслеживать поступления и расходы денежных средств.

Это поможет вам увидеть общую картину финансового положения вашего бизнеса.

Также ознакомьтесь с нашими любимыми Альтернативы волнам…

Наше мнение

Не соглашайтесь на меньшее! Присоединитесь к более чем 2 миллионам малых предприятий, которые уже сегодня полагаются на мощные и бесплатные основные функции бухгалтерского учета Wave для оптимизации своих финансов.

Основные преимущества

К сильным сторонам Wave относятся:

- Полностью бесплатный базовый план бухгалтерского учета.

- Мы обслуживаем более 2 миллионов малых предприятий.

- Удобное создание счетов-фактур и обработка платежей.

- Никаких долгосрочных контрактов или гарантий.

Цены

- Стартовый план: 0 долларов в месяц.

- План «Про»: 19 долларов в месяц.

Плюсы

Минусы

Сравнение характеристик

Здесь мы подробно рассмотрим все функции.

Мы рассмотрели возможности Dext и Wave, которые могут помочь вам принять решение.

Это простое сравнение «бок о бок» покажет вам основные различия.

1. Бухгалтерские и учетные рабочие процессы

- Учет волн полный малый бизнес Бухгалтерское программное обеспечение. Оно создано для полного цикла. бухгалтерский учет рабочие процессы. Это включает в себя главную книгу, выставление счетов и основные отчетностьВы можете делать всё на одной бесплатной платформе.

- Декст Это, в основном, инструмент для автоматизации ввода данных с целью оптимизации процессов. бухгалтерский учет его задача — эффективно интегрировать финансовые данные, такие как квитанции и счета-фактуры, в ваши существующие рабочие процессы. бухгалтерский учет система, подобная QuickBooks Online.

2. Сокращение ручного ввода данных

- Декст Эта система превосходно сводит к минимуму ручной ввод данных. Она использует мощную технологию оптического распознавания символов (OCR) для извлечения данных из финансовых документов, таких как квитанции, счета-фактуры и платежные поручения. Это значительно сокращает ручной ввод данных о затратах и продажах.

- Волна Бухгалтерская программа также предлагает функцию цифрового захвата чеков, но это скорее встроенная функция бухгалтерского пакета. Хотя она использует оптическое распознавание символов (OCR), основная функция — это полный бухгалтерский учет и бухгалтерский учет рабочие процессы, а не только процесс извлечения данных.

3. Захват и отправка чека

- Декст Предлагается несколько способов отправки квитанций и счетов-фактур. Вы можете использовать мобильное приложение Dext для сканирования, пересылать их по электронной почте или использовать функцию получения счетов-фактур. Это делает сбор данных быстрым и простым, всего за несколько минут.

- Волна также предоставляет мобильное приложение для захвата чеков, что позволяет малый бизнес Владельцы могут фотографировать и хранить чеки. Однако, поскольку Dext уделяет особое внимание этой области, он обычно предлагает более продвинутые функции для хранения чеков и управления расходами.

4. Прямая интеграция с бухгалтерским программным обеспечением.

- Декст Он разработан для глубокой интеграции с популярными бухгалтерскими системами, такими как QuickBooks Online и КсероДанные, извлеченные из документов, напрямую поступают на выбранную вами платформу, где вы занимаетесь остальными аспектами бухгалтерского учета. бухгалтерский учет рабочие процессы.

- Волна Это универсальная система, поэтому она имеет меньше прямых интеграций с другими крупными бухгалтерскими платформами. Однако Wave интегрируется с различными платежными и расчетными сервисами.

5. Банковские операции по автоматическому импорту

- Волна Предлагает функцию загрузки банковских выписок и может автоматически импортировать банковские транзакции с ваших банковских счетов и историю операций по кредитным картам. Это ключевая часть бесплатных функций бухгалтерского учета, которая помогает автоматически сверять и отслеживать расходы.

- Декст Она ориентирована на данные документов. Хотя она может обрабатывать извлечение банковских выписок (подготовка dext), ее основная роль не заключается в управлении ежедневными банковскими транзакциями, как это делает специализированная бухгалтерская система.

6. Функции выставления счетов и платежей

- Волна Предоставляет мощное программное обеспечение для выставления счетов в рамках своей бесплатной платформы. Вы получаете неограниченное количество счетов, можете принимать онлайн-платежи (с комиссией), а также настраивать автоматические напоминания об оплате и регулярные платежи.

- ДекстОсновное внимание уделяется обработке счетов и заказов на покупку (денежные средства, уходящие со счета). Хотя система может обрабатывать данные о продажах, поступающие с торговых платформ, она не создает и не управляет счетами-фактурами для клиентов напрямую.

7. Бесплатная пробная версия и стоимость

- Волна славится своим бесплатным стартовым планом и бесплатным бухгалтерское программное обеспечениеЭто делает его фантастической бесплатной платформой для многих владельцев малого бизнеса. Для основных функций бухгалтерского учета не требуется бесплатная пробная версия, только платный профессиональный план для дополнительных функций.

- Декст Dext — это платная услуга по подписке, но часто предлагает несколько способов попробовать Dext, включая бесплатную пробную версию. Стоимость обычно зависит от количества обрабатываемых документов, поскольку Dext экономит время на ручном вводе данных.

8. Управление несколькими компаниями

- Волна позволяет владельцам малого бизнеса управлять несколькими компаниями и разделять их функции. бухгалтерский учет Записи хранятся на одной бесплатной платформе, что является огромным преимуществом для фрилансеров или тех, кто занимается дополнительными проектами.

- Декст Эта система создана для обслуживания клиентов, которые обычно связаны с бухгалтером или специалистом по ведению бухгалтерского учета. Она значительно упрощает для бухгалтера управление заявками на возмещение расходов и финансовой документацией для нескольких компаний в рамках одного счета.

9. Функции управления расходами

- Декст Это, по сути, специализированный инструмент для управления расходами. Он позволяет пользователям настраивать правила для поставщиков и категории отслеживания, чтобы автоматизировать сортировку и кодирование документов. возможность подробно рассматривает вопросы управления расходами.

- Волна Позволяет отслеживать расходы в рамках главной бухгалтерской книги. Использует правила категоризации и загрузки банковских выписок, но ему не хватает расширенных инструментов автоматизации ввода данных и рабочих процессов, специфичных для отдельных документов, которые предлагает Dext.

10. Служба обеспечения надежности и безопасности системы

- Обе платформы предлагают надежные возможности. безопасностьWave использует такие функции, как многофакторная аутентификация, для обеспечения надежной защиты.

- Декст Особое внимание уделяется безопасному потоку данных, размещение данных на AWS с использованием стандартного отраслевого шифрования. В случае ошибки подключения вы можете увидеть сообщение Cloudflare Ray ID, которое является распространенным идентификатором службы безопасности для устранения неполадок в веб-приложениях. Cloudflare Ray или Cloudflare Ray ID Found не является фактической функцией, а представляет собой примечание службы безопасности.

11. Масштабируемость бизнеса и расширенные функции.

- Волна Идеально подходит для начинающих, но может не обладать расширенными функциями для быстрорастущих или сложных предприятий, такими как детальный учет запасов или комплексное отслеживание классов, для которых может потребоваться платный профессиональный план или альтернативное решение.

- Декст Он хорошо масштабируется, потому что его функция остается неизменной независимо от размера вашего бизнеса: упрощение извлечения данных. По мере роста вашего бизнеса вы просто обрабатываете больше документов, и Dext экономит вам еще больше времени, избавляя от лишних хлопот.

На что следует обратить внимание при выборе бухгалтерской программы?

Когда вы будете готовы выбрать программное обеспечение, обратите внимание на следующие моменты:

- Ваша главная цельВам нужна полная, часто бесплатная версия для базового учета и расчета заработной платы (например, для проверки бухгалтерских данных Wave)? Или вам нужен инструмент, похожий на Dext Account, который помогает фиксировать поступления и экономить время на вводе данных?

- Потребности пользователейПодумайте, нужна ли вам поддержка нескольких пользователей или неограниченное количество пользователей. Wave предназначен для начисления заработной платы независимым подрядчикам или действующим сотрудникам с использованием системы Wave Payroll и прямого перечисления средств (за дополнительную плату).

- Основные функцииПроверьте основные функции. Помогает ли вам это программное обеспечение в управлении финансами и контроле ежедневного денежного потока? Wave упрощает этот процесс благодаря двум тарифным планам и бесплатной версии.

- Обработка транзакцийПосмотрите, как платформа обрабатывает ваши деньги. Может ли она обрабатывать платежи с кредитных карт и банковских счетов? Wave Financial позволяет принимать онлайн-платежи, включая Apple Pay, и предлагает регулярные платежи.

- Управление расходами и даннымиОбратите внимание на удобство управления расходами. Можете ли вы быстро и точно собирать чеки? Учитывайте высокую интенсивность использования и надежность системы, чтобы избежать проблем, таких как некорректные данные или ошибки.

- Отчетность и налогообложениеПредоставляет ли он четкие финансовые отчеты за выбранный период времени? Помогает ли он с подачей налоговой декларации? Платные функции Wave помогают с налоговыми вопросами для вашего независимого подрядчика.

- Поддержка и довериеПосмотрите на центр поддержки клиентов и отзывы пользователей. Хорошая поддержка обеспечивает спокойствие и может помочь в случае сбоя команды SQL или в случае онлайн-атак.

- Ценообразование и ценностьОзнакомьтесь с различными тарифными планами и дополнительными расходами. Узнайте, предлагает ли платный план достаточную выгоду, или же стоит попробовать Dext в рамках бесплатной пробной версии сегодня, чтобы оценить, соответствует ли он вашим потребностям по сниженной цене.

Окончательный вердикт

Если вам нужна бесплатная платформа для ведения полного бухгалтерского учета вашего бизнеса, рекомендуем Wave.

Wave — лучший выбор для владельцев малого бизнеса.

Это предоставляет вам множество основных функций, таких как выставление счетов и базовая обработка платежей, без каких-либо немедленных затрат.

Она автоматически обрабатывает ваши транзакции и управляет такими функциями, как платежи с кредитных карт и дополнительные услуги по обработке заработной платы.

Однако, если у вас уже есть бухгалтер и вам просто нужно сэкономить время и прекратить ручной ввод данных из квитанций и счетов-фактур,

Dext — ваш победитель. Он показал лучшие результаты при извлечении данных по триггерам.

Мы предприняли ряд действий для полного тестирования обоих вариантов.

Владельцам сайтов мы рекомендуем выбирать систему, исходя из того, нужна ли им полноценная бухгалтерская система или инструмент автоматизации данных.

Больше от Dext

Мы также сравнили Dext с другими инструментами для управления расходами и бухгалтерского учета:

- Dext против Xero: Xero предлагает комплексные решения для бухгалтерского учета с интегрированными функциями управления расходами.

- Декст против Головоломка IO: Компания Puzzle IO преуспевает в предоставлении финансовых аналитических данных и прогнозировании на основе искусственного интеллекта..

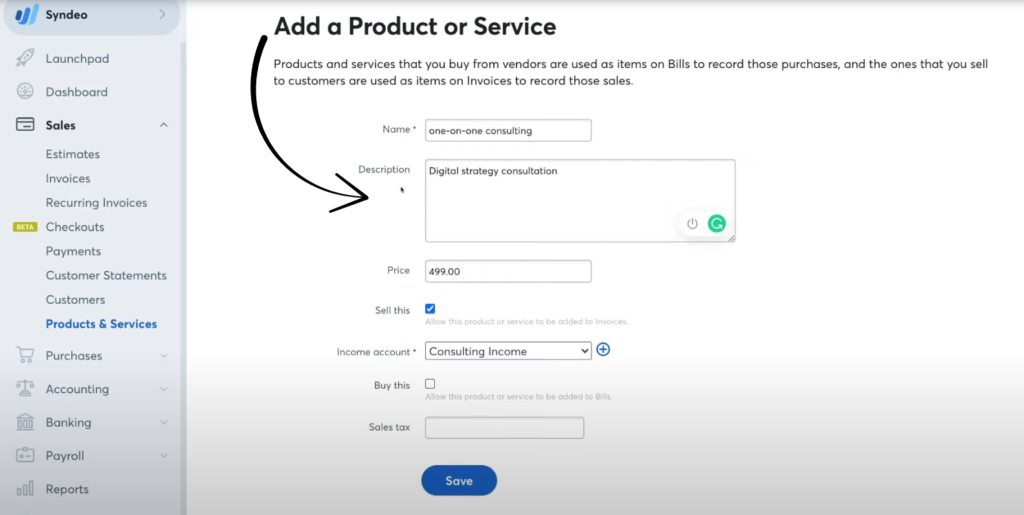

- Декст против Снайдера: Компания Synder специализируется на синхронизации данных о продажах в электронной коммерции и обработке платежей.

- Dext против Easy в конце месяца: Easy Month End упрощает процедуру закрытия финансового месяца.

- Декст против Доцита: Docyt использует искусственный интеллект для автоматизации задач бухгалтерского учета и управления документами.

- Dext против RefreshMe: RefreshMe предоставляет информацию о финансовых показателях бизнеса в режиме реального времени.

- Лекст против Сейджа: Компания Sage предлагает широкий спектр бухгалтерских решений с возможностями отслеживания расходов.

- Dext против Zoho Books: Zoho Books предоставляет интегрированную систему бухгалтерского учета с функциями управления расходами.

- Dext против Wave: Wave предлагает бесплатное бухгалтерское программное обеспечение с базовыми функциями отслеживания расходов.

- Dext против Quicken: Quicken популярен для управления личными финансами и отслеживания основных деловых расходов.

- Dext против Hubdoc: Hubdoc специализируется на автоматизированном сборе документов и извлечении данных.

- Dext против Expensify: Expensify предлагает надежные решения для составления отчетов о расходах и управления ими.

- Dext против QuickBooks: QuickBooks — это широко используемая бухгалтерская программа с инструментами для управления расходами.

- Dext против AutoEntry: AutoEntry автоматизирует ввод данных из счетов-фактур, квитанций и банковских выписок.

- Dext против FreshBooks: FreshBooks предназначен для предприятий сферы услуг и включает в себя функции выставления счетов и отслеживания расходов.

- Dext против NetSuite: NetSuite предлагает комплексную ERP-систему с функциями управления расходами.

Больше о Wave

- Wave vs Puzzle IOЭто программное обеспечение ориентировано на финансовое планирование для стартапов с использованием искусственного интеллекта. Аналогичное программное обеспечение предназначено для управления личными финансами.

- Волна против ДекстаЭто бизнес-инструмент для учета квитанций и счетов-фактур. Другой инструмент отслеживает личные расходы.

- Wave против XeroЭто популярное онлайн-программное обеспечение для бухгалтерского учета, предназначенное для малого бизнеса. Его конкурент предназначен для личного использования.

- Волна против СнайдераЭтот инструмент синхронизирует данные электронной коммерции с бухгалтерским программным обеспечением. Его альтернатива ориентирована на личные финансы.

- Волна против легкого конца месяцаЭто бизнес-инструмент для оптимизации задач по закрытию месяца. Его конкурент предназначен для управления личными финансами.

- Wave vs Docyt: Одна из них использует ИИ для ведения бухгалтерского учета и автоматизации бизнеса. Другая использует ИИ в качестве личного финансового помощника.

- Волна против МудрецаЭто комплексный пакет бухгалтерских программ для бизнеса. Его конкурент — более удобный инструмент для управления личными финансами.

- Wave против Zoho BooksЭто онлайн-инструмент для ведения бухгалтерского учета для малых предприятий. Его конкурент предназначен для личного использования.

- Wave против QuickenОба инструмента предназначены для управления личными финансами, но этот предлагает более детальное отслеживание инвестиций. Другой же проще.

- Wave против HubdocЭтот продукт специализируется на оцифровке документов для ведения бухгалтерского учета. Его конкурентом является инструмент для управления личными финансами.

- Wave против ExpensifyЭто инструмент для управления расходами бизнеса. Другой инструмент предназначен для отслеживания личных расходов и составления бюджета.

- Wave против QuickBooksЭто хорошо известная бухгалтерская программа для бизнеса. Её альтернатива разработана для управления личными финансами.

- Wave против AutoEntryЭто приложение предназначено для автоматизации ввода данных в бухгалтерский учет предприятий. Его альтернативой является инструмент для управления личными финансами.

- Wave против FreshBooksЭто бухгалтерское программное обеспечение для фрилансеров и малых предприятий. Его альтернатива предназначена для управления личными финансами.

- Wave против NetSuiteЭто мощный пакет программного обеспечения для управления бизнесом, предназначенный для крупных компаний. Его конкурентом является простое приложение для управления личными финансами.

Часто задаваемые вопросы

В чём основное различие между Dext и Wave?

Wave — это универсальная бухгалтерская платформа, предлагающая бесплатные базовые функции учета, выставления счетов и отслеживания расходов. Dext ориентирован на эффективный сбор данных из квитанций и счетов-фактур, часто интегрируясь с другим бухгалтерским программным обеспечением.

Wave полностью бесплатен для использования?

Wave предлагает бесплатный тарифный план для основных функций бухгалтерского учета, выставления счетов и сканирования квитанций. Однако за онлайн-платежи, расчет заработной платы и профессиональную бухгалтерскую поддержку взимается плата.

Можно ли использовать Dext как самостоятельное бухгалтерское программное обеспечение?

Нет, Dext в первую очередь предназначен для работы совместно с другими бухгалтерскими программами, такими как QuickBooks или Xero. Он помогает оптимизировать процесс переноса финансовых данных в эти платформы.

Какое программное обеспечение лучше подходит для очень малого бизнеса или фрилансера?

Благодаря бесплатным базовым функциям и простоте использования для выставления счетов и отслеживания расходов, Wave часто является отличной отправной точкой для очень малых предприятий и фрилансеров.

Могу ли я перенести свои данные из Dext в Wave или наоборот?

Прямая передача данных между Dext и Wave может быть не совсем удобной. Вероятно, вам потребуется экспортировать данные с одной платформы и импортировать их на другую, что может потребовать некоторой ручной работы.