Is your software de contabilidade giving you a headache?

Chasing payments or dreading tax season? You’re not alone.

Many pequenas empresas struggle with disorganized finances.

Imagine a system that tracks every penny, sends invoices, and handles overdue payments effortlessly.

This article explores the 9 best FreshBooks alternatives, helping you find the perfect accounting tool to simplify your life.

Ready to take control? Let’s dive in!

What is the Best FreshBooks Alternative?

Escolhendo o certo contabilidade software can feel tricky.

You want something that works for your business, not against it.

We’ve dug deep to find the top tools that offer what FreshBooks does, and often much more.

Ready to find a perfect fit that makes managing your money easy?

Check out our top picks below!

1. Xero

Let’s talk about Xero. It’s a really popular cloud-based contabilidade tool.

Many small businesses love it, especially those who work with an accountant.

Think of it as a friendly helper for your business numbers.

It connects well with many other apps, too, which is super handy.

Libere seu potencial com nosso Tutorial do Xero.

Explore também o nosso FreshBooks vs Xero comparação!

Nossa opinião

Its ease of use & vast integration options make it a powerful tool for small businesses. The real-time financial insights are a huge plus. While its starting price might be a bit higher for some, the features you get more than justify the cost.

Principais benefícios

- Real-time cash flow: You can see exactly where your money stands 24/7, which helps you make smart business decisions.

- Bank reconciliation: Xero connects directly to over 16,000 financial institutions. This makes matching transactions a breeze.

- Invoice management: Send professional invoices & get paid faster. You can track unpaid invoices with ease.

- Expense tracking: Capture receipts on the go. Say goodbye to shoeboxes full of paper.

- Integrações: Xero links with over 1,000 business apps. This expands its capabilities.

- Customer support: They offer 24/7 online support. The software itself does not have a specific warranty, but continuous updates are provided.

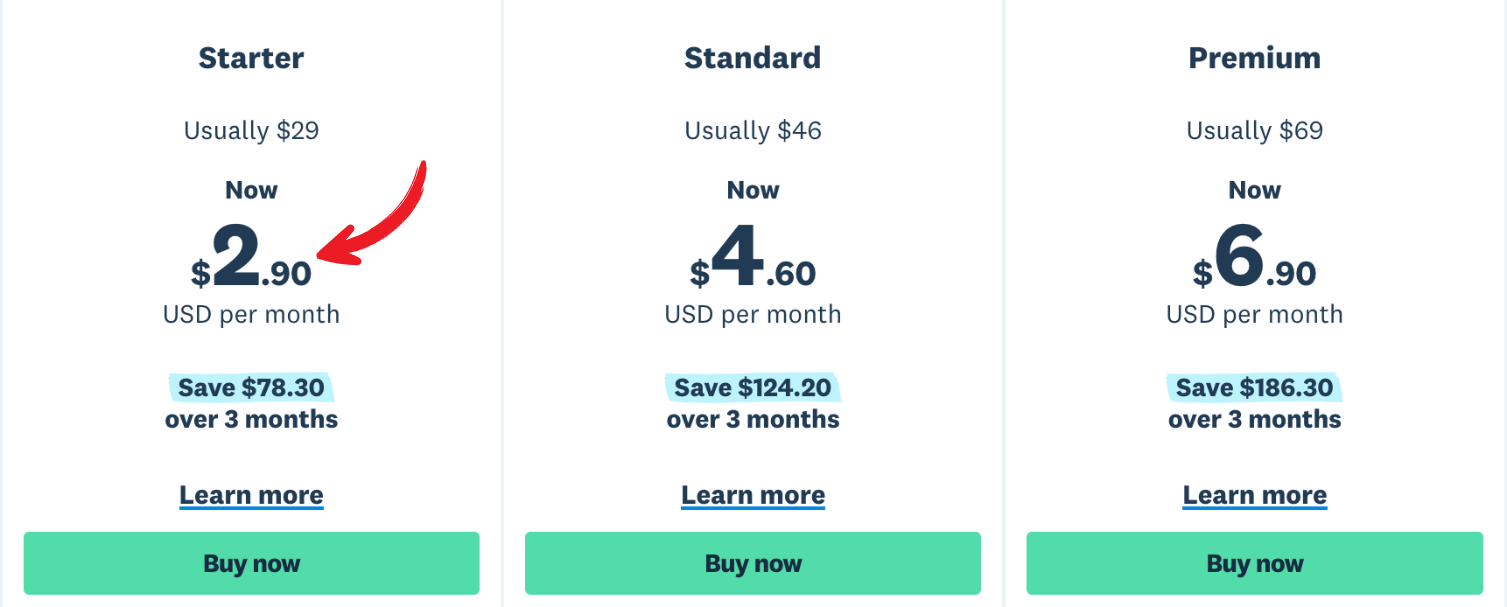

Preços

- Iniciante: $2.90/per month.

- Padrão: $4.60/per month.

- Prêmio: $6.90/per month.

Prós

Contras

2. Dext

Think of it as a smart assistant for receipts and invoices.

It pulls information from your documents fast.

It’s great if you have lots of paperwork and want to go paperless.

It works well with other contabilidade ferramentas.

Libere seu potencial com nosso Tutorial certo.

Explore também o nosso FreshBooks vs Dext comparação!

Nossa opinião

This feature alone is a massive time-saver for any business. The seamless integration with major accounting software also makes it incredibly efficient. While the pricing structure can be a bit less transparent for individual users, its powerful automation capabilities make it a strong contender for expense management.

Principais benefícios

- Effortless Receipt Capture: Take a picture of your receipt. Dext reads the data for you. It supports over 1,400 suppliers.

- Automated Data Extraction: It accurately extracts details like vendor, date, and amount, reducing errors.

- Integration with Accounting Software: Dext seamlessly connects with popular accounting platforms. This includes Xero and QuickBooks.

- Bank Feeds: Connect your bank accounts. This helps match transactions easily.

- Expense Relatórios: Create detailed expense reports with just a few clicks. This simplifies reimbursements.

- Supplier Rules: Set up rules for recurring expenses. This automates categorization.

- Audit Trail: Every document has a clear audit trail, which helps with compliance. The software does not have a specific warranty, but continuous updates are provided.

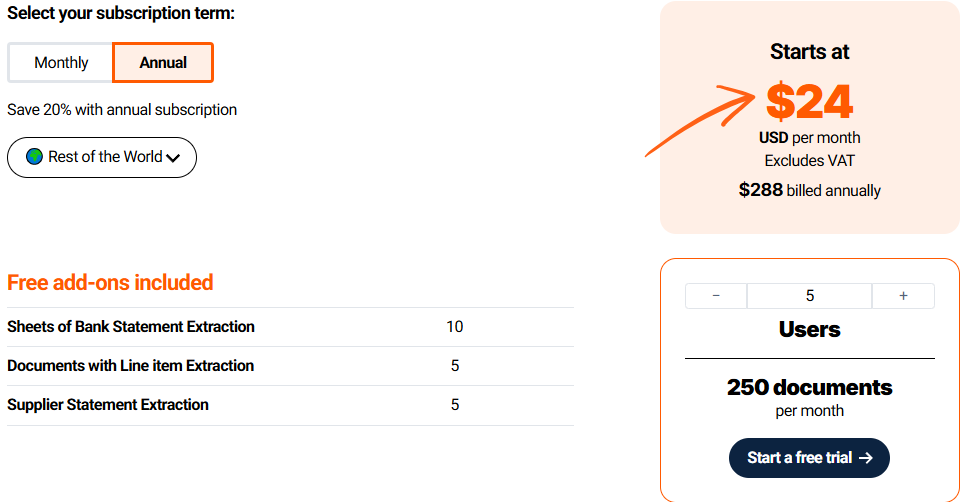

Preços

- Pricing starts at $24/month, with 250 documents per month.

Prós

Contras

3. Puzzle IO

This is a newer accounting tool, especially for startups and tech firms.

It gives you real-time money insights.

Think of it as a smart dashboard showing your business’s exact financial spot.

It helps you make fast, smart choices.

Libere seu potencial com nosso Tutorial de quebra-cabeça IO.

Explore também o nosso FreshBooks vs Puzzle IO comparison!

Nossa opinião

Its focus on real-time cash flow is also a big plus. However, as a newer solution, it might not have the long-standing reputation or as many integrations as some of the more established players, and its pricing model might quickly become expensive for rapidly expanding businesses.

Principais benefícios

Here are some of its best features:

- Integrated spend management: Track and control all company spending.

- Corporate card management: Issue and manage virtual and physical cards.

- Automated expense processing: Capture receipts and categorize expenses easily.

- Invoice management: Handle accounts payable and receivable efficiently.

- Cash flow visibility: Get the real-time insights into your financial health.

- Integration with accounting software: Connects with popular accounting systems like QuickBooks and Xero.

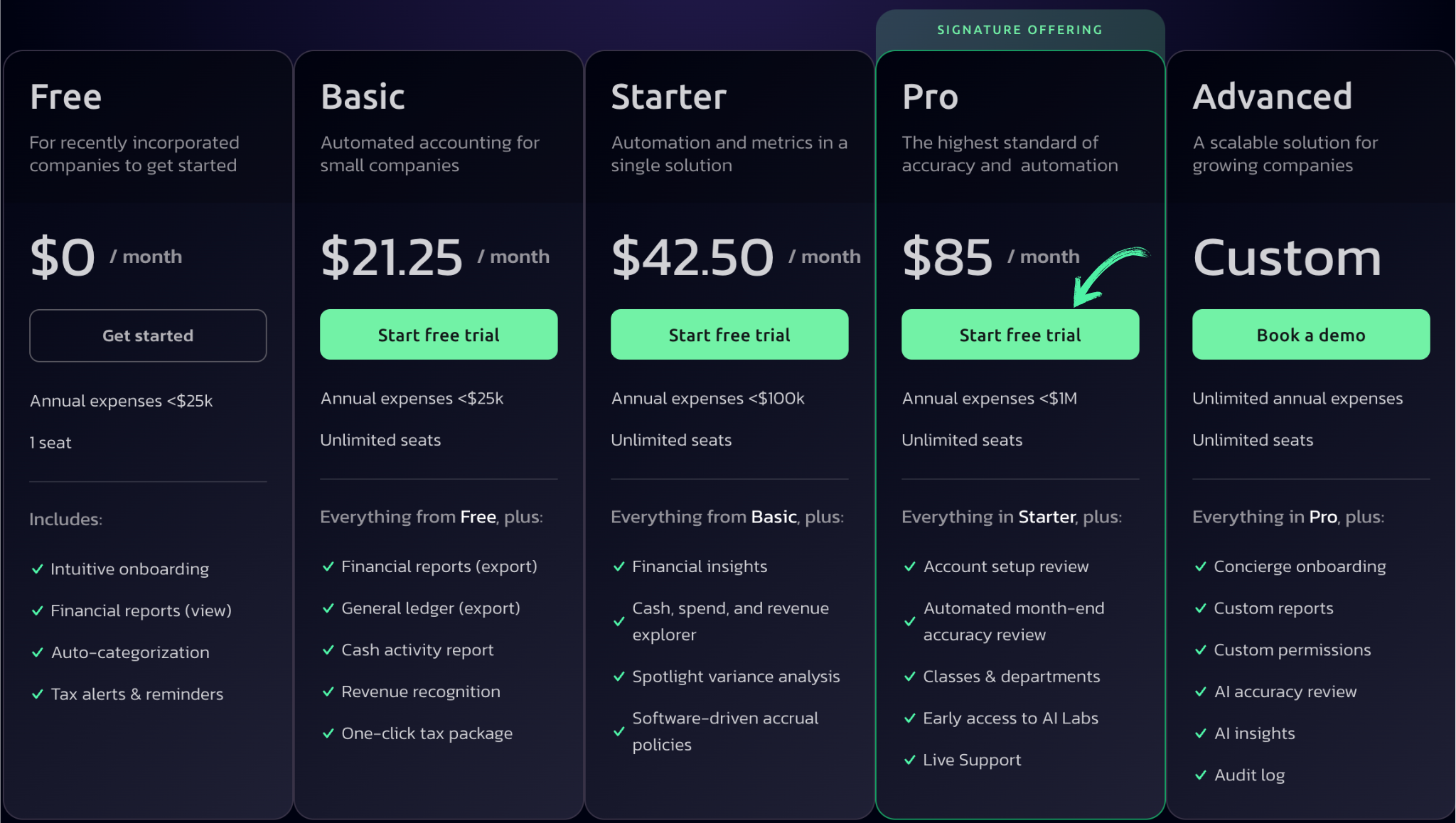

Preços

- Livre: $ 0/mês

- Básico: $21.25/month

- Iniciante: $42.50/month

- Pró: $85/month

- Avançado: Custom Pricing

Prós

Contras

4. Synder

Synder is not a full accounting system. It’s a smart connector.

It syncs your sales data from online platforms like Shopify or Amazon directly to your accounting software.

Think of it as a bridge for your online sales numbers.

This saves time and stops errors.

Libere seu potencial com nosso tutorial do Synder.

Explore também o nosso FreshBooks vs Synder comparação!

Nossa opinião

Synder is awesome for e-commerce businesses. It’s incredibly helpful for managing online sales data. However, its focus is quite specific, so it might not be the best fit for everyone.

Principais benefícios

- Automated Data Sync: Synder automatically records sales data from platforms like Shopify, Amazon, and Stripe directly into your accounting software, saving you hours of manual entry.

- Accurate Reconciliation: It ensures that all your transactions, including fees and refunds, are correctly categorized, making bank reconciliation simple and precise.

- Multi-Platform Support: Synder supports over 20 e-commerce and payment gateways. This covers most online businesses.

- Inventory Management can track inventory levels and the cost of goods sold, providing a clearer financial picture.

- Relatórios: Generate detailed reports on sales, profits, and expenses to gain insights into your business performance.

- Suporte ao cliente: They offer responsive customer support. The software does not have a specific warranty, but continuous updates are provided.

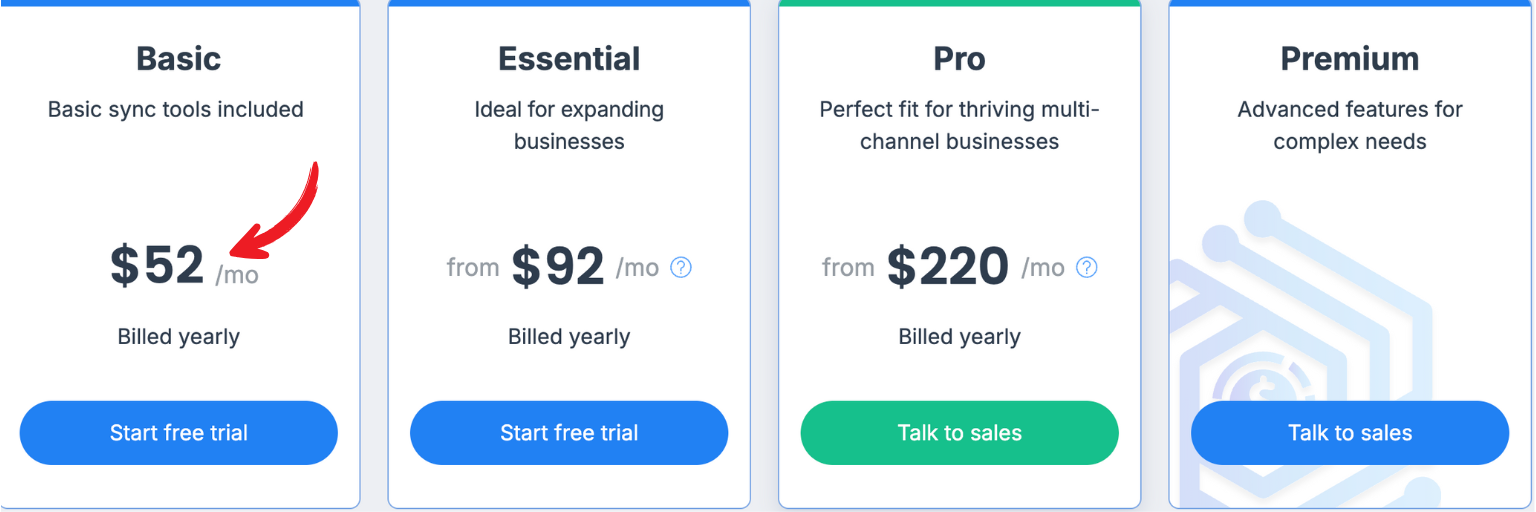

Preços

- Básico: US$ 52/mês.

- Essencial: US$ 92/mês.

- Pró: US$ 220/mês.

- Prêmio: Preços personalizados.

Prós

Contras

5. Easy Month End

Easy Month End is not a full accounting system.

It helps contadores and businesses close their books each month.

Think of it as a checklist for your month-end tasks.

It makes sure you don’t miss anything. It’s for making the monthly closing process easier.

Libere seu potencial com nosso Tutorial fácil de fim de mês.

Explore também o nosso FreshBooks vs Easy Month End comparação!

Nossa opinião

Easy Month End is a valuable tool for businesses looking to optimize their month-end close. However, its specialized focus might not appeal to everyone needing broader AI accounting help.

Principais benefícios

- Automated Reconciliation: Reconcile accounts quickly. It reduces manual effort significantly.

- Centralized Data: All your financial data in one place. No more switching between spreadsheets.

- Workflow Management: Guides you through the month-end process. Ensures no steps are missed.

- Error Detection: Helps identify discrepancies. Catch errors before they become big problems.

- Relatórios: Generate clear reports on your financial close status. This helps with audits.

- Integração: Connects with popular accounting software. This streamlines data flow.

- Economia de tempo: It reduces the time spent on month-end tasks, freeing up valuable time. Although the software itself does not mention a specific warranty, continuous updates are provided.

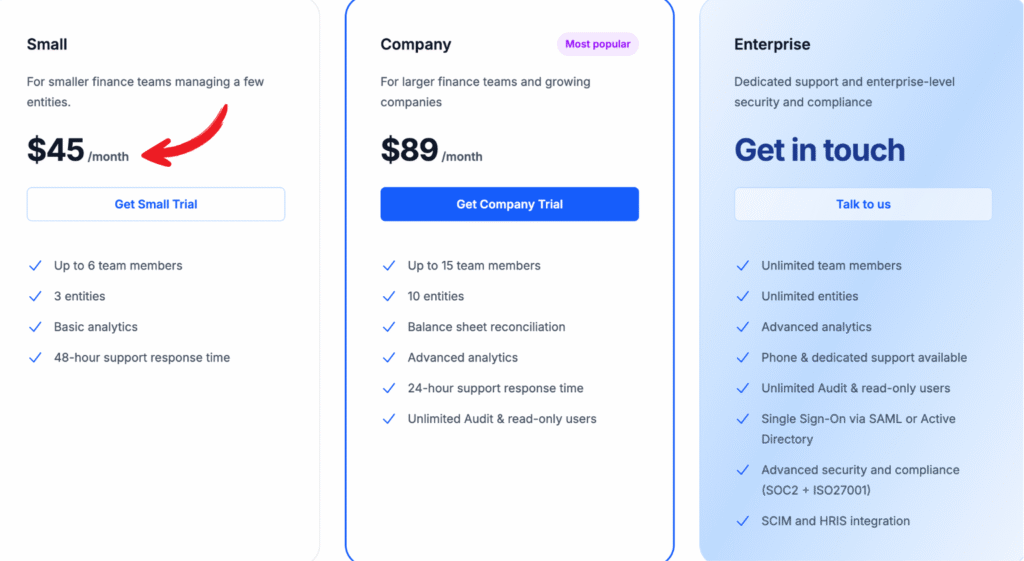

Preços

- Pequeno: US$ 45/mês.

- Empresa: US$ 89/mês.

- Empresa: Preços personalizados.

Prós

Contras

6. QuickBooks

QuickBooks is a very popular accounting software.

Many businesses use it to handle their money.

It tracks income, expenses, and payroll.

It’s a strong tool that can grow with your business.

Libere seu potencial com nosso Tutorial do QuickBooks.

Explore também o nosso FreshBooks vs QuickBooks comparação!

Nossa opinião

QuickBooks is a solid and well-established accounting solution with some helpful AI features. However, if you’re looking for deep AI-powered automation, other options might be stronger.

Principais benefícios

- Expense Tracking: Easily categorize & track all your business expenses. Link bank accounts for automatic imports.

- Invoicing & Payments: Create and send professional invoices. Accept online payments directly.

- Relatórios: Generate a big range of financial reports. This includes profit and loss, balance sheets, and cash flow statements.

- Payroll Management: (Add-on) Manage employee payroll, taxes, and direct deposits.

- Inventory Management: Track inventory levels, costs, and sales. Essential for product-based businesses.

- Rastreamento de tempo: Log billable hours for projects or clients. Integrate with invoices.

- Tax Ready: Organize your books for tax season. It helps simplify filing. The software does not have a specific warranty, but continuous updates are provided.

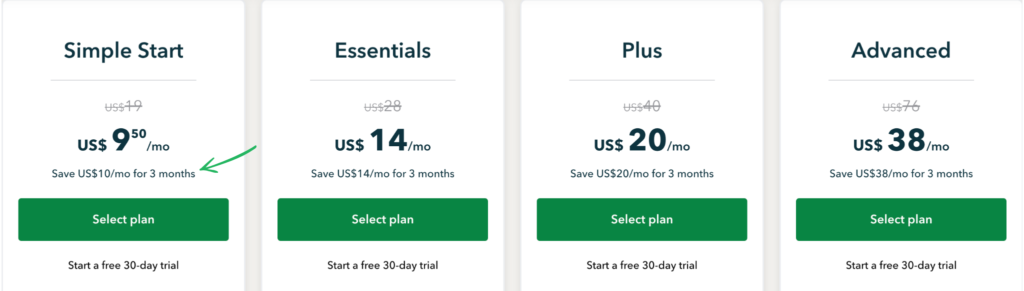

Preços

- Início simples: $9.50/month.

- Essencial: $14/month.

- Mais: US$ 20/mês.

- Avançado: $38/month.

Prós

Contras

7. Docyt

Docyt is an AI-powered platform for business finance.

It automates many money tasks.

Think of it as a smart robot for contabilidade, expenses, and payroll.

It gives you real-time financial views and keeps things accurate.

Libere seu potencial com nosso Tutorial do Docyt.

Explore também o nosso FreshBooks vs Docyt comparação!

Nossa opinião

Docyt’s focus on automating document handling is impressive. However, the lack of clear pricing might be a drawback for some, and it seems best suited for businesses with a larger volume of transactions.

Principais benefícios

- Automação com tecnologia de IA: O Docyt utiliza inteligência artificial. Ele extrai automaticamente dados de documentos financeiros, incluindo detalhes de mais de 100.000 fornecedores.

- Real-time Bookkeeping: Mantém seus livros contábeis atualizados em tempo real. Isso proporciona uma visão financeira precisa a qualquer momento.

- Gestão de Documentos: Centraliza todos os documentos financeiros. Você pode pesquisá-los e acessá-los facilmente.

- Bank & Credit Card Reconciliation: Connects with bank accounts. It helps reconcile transactions faster and with high accuracy (up to 99%).

- Automação de pagamento de contas: Automatize o processo de pagamento de contas. Agende e pague contas facilmente.

- Reembolso de despesas: Simplifica os relatórios de despesas dos funcionários. Envie e aprove despesas rapidamente.

- Integrações perfeitas: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Detecção de fraude: Sua IA pode ajudar a sinalizar transações incomuns. Isso adiciona uma camada de segurança. Não há garantia específica para o software, mas atualizações contínuas são fornecidas.

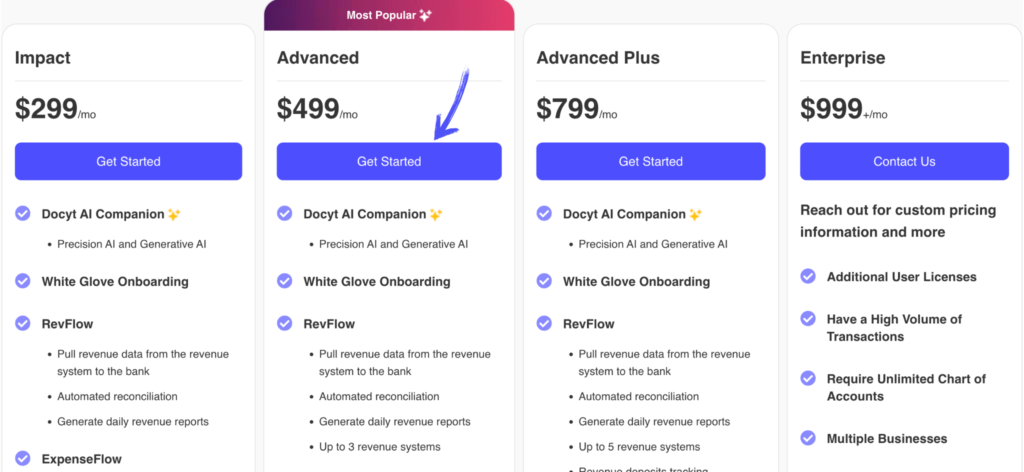

Preços

- Impacto: US$ 299/mês.

- Avançado: US$ 499/mês.

- Avançado Mais: US$ 799/mês.

- Empresa: US$ 999/mês.

Prós

Contras

8. Wave

Wave is a great choice if you want something mostly free.

It’s for small businesses, freelancers, and consultants.

It helps manage your money without big costs.

Think of it as a helpful financial assistant on a budget.

Unlock its potential with our Wave tutorial.

Explore também o nosso FreshBooks vs Wave comparação!

Nossa opinião

It’s straightforward for managing basic finances. However, the limited customer support for free users and the cost of essential add-ons like payment processing and payroll can be a drawback for growing businesses needing more comprehensive features.

Principais benefícios

- Free Core Accounting: Wave provides free invoicing, expense tracking, and basic reporting. This is perfect for startups.

- Unlimited Invoicing: Send as many professional invoices as you need. Customize them easily.

- Receipt Scanning: Capture receipts with your phone. Keep track of all your spending.

- Bank & Credit Card Connections: Connect your accounts. Wave automatically imports transactions.

- Basic Reports: Get essential financial reports. This includes profit & loss and balance sheets.

- Payment Processing: (Paid Add-on) Accept credit card and bank payments directly through invoices. This speeds up getting paid.

- Payroll Services: (Paid Add-on) Manage payroll for your employees. Available in specific regions. No particular warranty for the software, but continuous updates are provided.

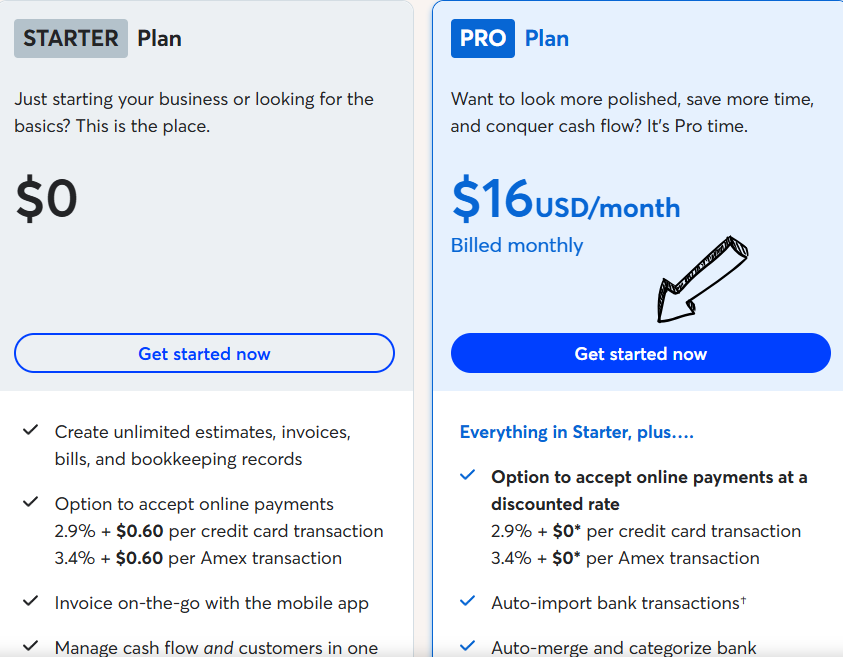

Preços

- Starter Plan: US$ 0/mês.

- Plano Pro: US$ 16/mês.

Prós

Contras

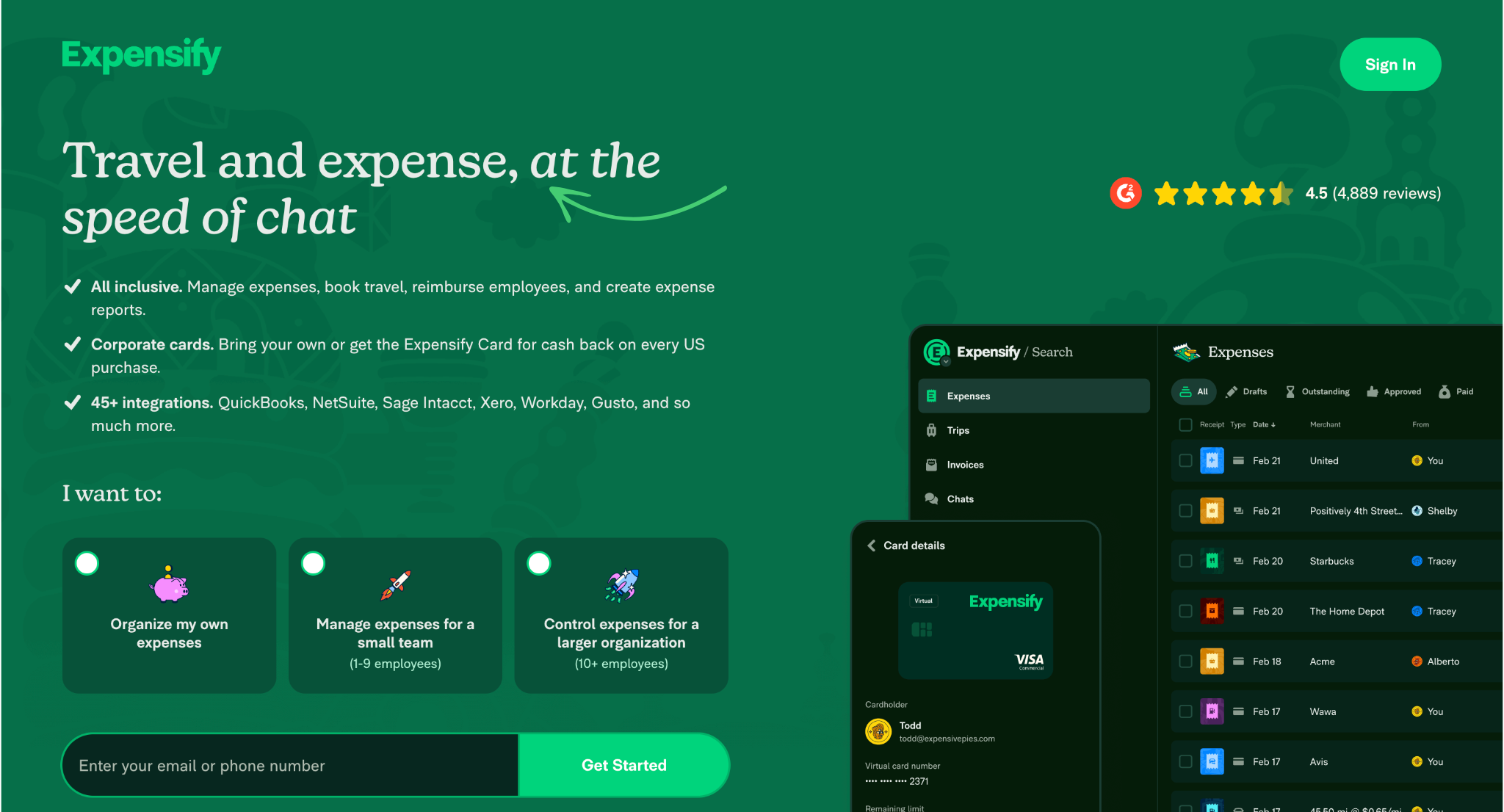

9. Expensify

Let’s talk about Expensify. This tool manages expenses.

It’s like a personal assistant for receipts and spending.

It makes tracking every penny easy, especially for business trips.

It’s not a full accounting system, but it handles expense reports very well.

Libere seu potencial com nosso Expensify tutorial.

Explore também o nosso FreshBooks vs Expensify comparação!

Nossa opinião

It’s a top tool for expense management, with about 90% of users finding it efficient for receipts and reports. But it’s not a complete accounting solution, which limits its use for about 70% of businesses needing broader financial tools. It shines as a complementary tool, doing its specific job very well.

Principais benefícios

Expensify makes expense reporting simple:

- SmartScan Technology: Scan receipts fast. It pulls out key details automatically.

- Expense Reports: Create and submit reports quickly. Approvals are smoother.

- Corporate Cards: Manage company spending easily—link to Expensify Cards.

- Mileage Tracking: Track mileage automatically. Get accurate reimbursements.

- Integrações perfeitas: Connects with QuickBooks, Xero, NetSuite, and more. Data syncs easily.

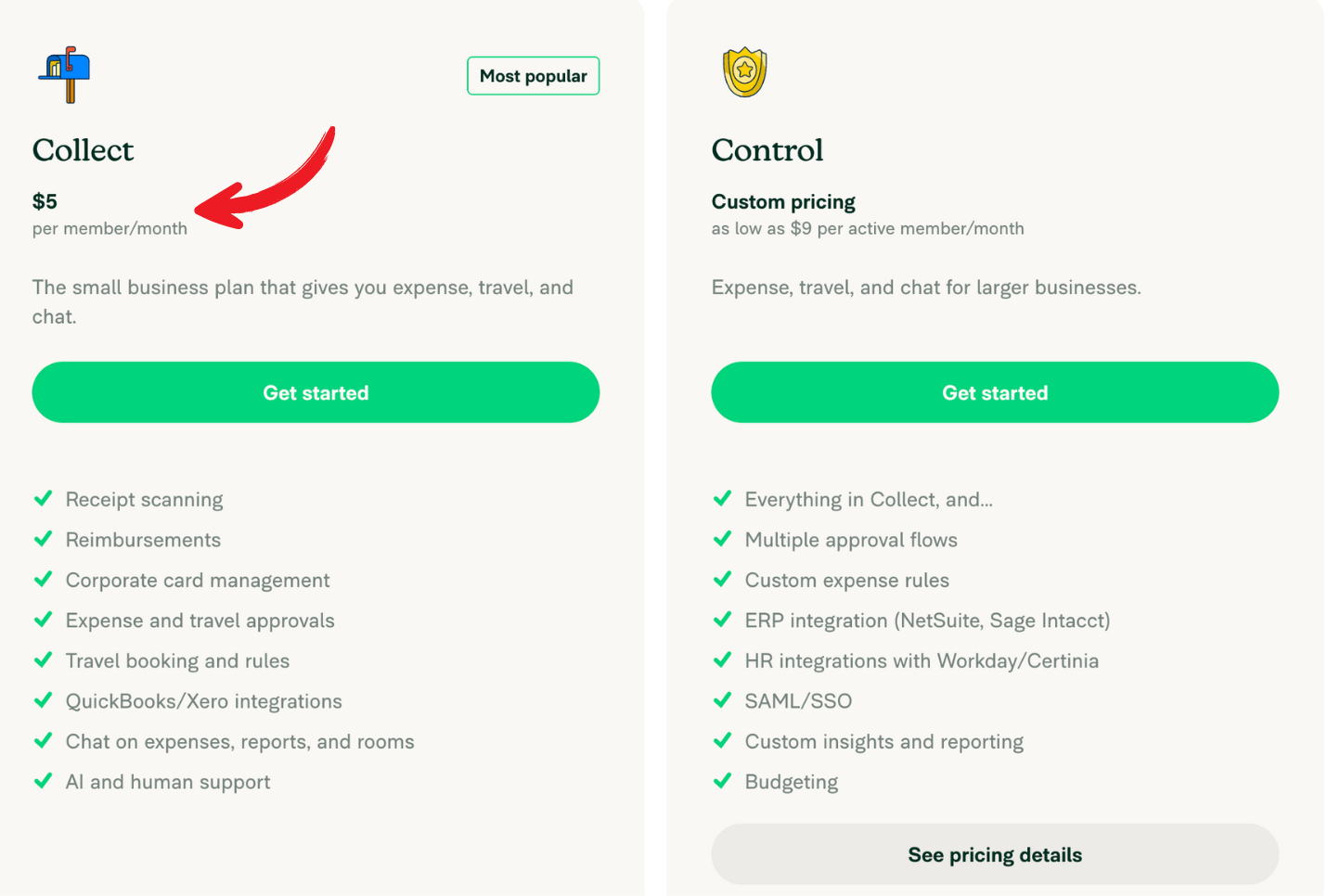

Preços

- Collect: $5/month.

- Control: Custom Pricing as low as $9/month.

Prós

Contras

Guia do comprador

Our aim was to deliver a thorough and fair assessment of FreshBooks alternatives.

Here’s how we approached our research to bring you these insights:

- Keyword Analysis: We began by analyzing exact keywords to understand user search intent and market needs.

- Avaliação de recursos: We rigorously examined each product’s features, identifying its unique strengths and overall capabilities.

- Pricing Transparency: We investigated pricing models, looking for clear costs and evaluating the value offered at each tier.

- User Experience: We assessed the ease of use and overall user-friendliness of each platform.

- Identified Negatives: We highlighted what was missing or could be improved, ensuring a balanced view.

- Support & Resources: We checked for robust customer support, available communities, and transparent refund policies.

- Capacidades de integração: We evaluated how well each product integrated with other essential business tools.

Concluindo

Finding the right alternative to FreshBooks is key.

We’ve explored top options, from Zoho Books with its free plan to robust QuickBooks Online.

We covered essential features like expense tracking, project management, and mobile app access.

Your best choice depends on your accounting needs.

Whether you need inventory management, recurring invoices, or various payment options like Stripe, there’s a solution.

Our goal was to help you choose the perfect invoicing software to boost your cash flow and simplify your finances.

Perguntas frequentes

Why look for an alternative to FreshBooks?

Many seek alternatives for more advanced features like robust inventory, deeper reporting, or a different pricing structure. Some prefer a solution that integrates more seamlessly with their specific business tools or offers a better free plan.

Are there any good free FreshBooks alternatives?

Yes, Wave is a popular free accounting software that offers invoicing, accounting, and receipt scanning. It’s a great option for freelancers and very small businesses on a tight budget, covering basic accounting needs.

What are the best FreshBooks alternatives for small businesses?

For small businesses, top alternatives include QuickBooks Online, Xero, and Zoho Books. These offer a strong feature set with good scalability and cover everything from expense tracking to project management.

Which alternative is best for invoicing and recurring payments?

Many alternatives excel at invoicing. Xero, Zoho Books, and even specialized invoicing software offer excellent invoice templates and robust features for sending and managing recurring invoices efficiently.

Do these alternatives offer good mobile apps?

Most leading alternatives to FreshBooks options like QuickBooks Online, Xero, and Zoho Books, provide powerful mobile app experiences. This lets you manage your finances, track expenses, and send invoices on the go.