어떻게 처리해야 할지 생각해 보세요 사업 돈 문제요? 정말 골칫거리일 수 있어요!

많은 사업주들이 모든 지출 내역을 관리하는 데 어려움을 겪습니다.

도움을 구할 때 자주 언급되는 두 가지 유명 업체는 Expensify와 QuickBooks입니다.

하지만 어떤 것이 나에게 가장 적합할까? 당신의 사업?

이 가이드에서는 Expensify와 QuickBooks의 기능을 비교 분석하여 어떤 프로그램이 더 적합한지 알려드립니다.

개요

저희는 Expensify와 QuickBooks를 모두 꽤 오랜 시간 사용해 봤습니다.

실제 비즈니스 환경에서 그들이 어떻게 대처하는지 알아보기 위해 실전 경험을 시켜봅니다. 회계.

이번 실사용 테스트를 통해 각 제품의 강점과 약점을 명확히 파악할 수 있었고, 이를 바탕으로 상세한 비교 분석을 진행하게 되었습니다.

1,500만 명이 넘는 사용자가 Expensify를 통해 간편하게 재정을 관리하고 있습니다. Expensify로 경비 보고서 작성 시간을 최대 83%까지 절약하세요.

가격: 무료 체험판이 있습니다. 프리미엄 플랜은 월 5달러부터 시작합니다.

주요 특징:

- 스마트스캔 영수증 캡처

- 법인 카드 대조

- 고급 승인 워크플로.

7백만 개 이상의 기업에서 사용하는 QuickBooks는 매달 평균 42시간을 절약해 줄 수 있습니다. 부기.

가격: 무료 체험 기간이 있습니다. 요금제는 월 1.90달러부터 시작합니다.

주요 특징:

- 송장 관리

- 지출 추적

- 보고

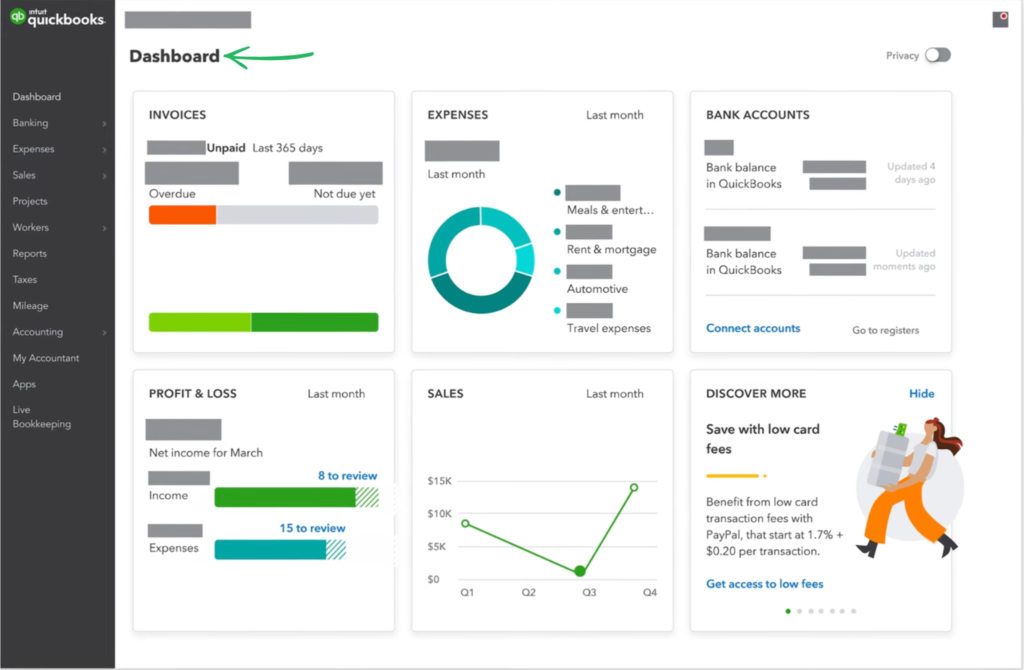

퀵북스란 무엇인가요?

QuickBooks는 매우 인기 있는 프로그램입니다. 회계 도구.

이는 기업, 특히 중소기업이 자금을 관리하는 데 도움이 됩니다.

마치 재정 관리 도구처럼 생각하시면 됩니다.

또한, 저희가 가장 좋아하는 제품들을 살펴보세요. 퀵북스 대안…

주요 이점

- 자동 거래 분류

- 송장 생성 및 추적

- 비용 관리

- 급여 서비스

- 보고 및 대시보드

가격

- 간단한 시작: 월 1.90달러.

- 필수적인: 월 2.80달러.

- 을 더한: 월 4달러.

- 고급의: 월 7.60달러.

장점

단점

Expensify란 무엇인가요?

Expensify는 비용 추적을 간편하게 해주는 데 중점을 두고 있습니다.

특히 사람들이 자주 돈을 쓰는 사업체에 적합합니다. 예를 들어, 여행하다 또는 프로젝트 비용.

영수증 사진만 찍으면 Expensify가 나머지를 알아서 처리해 줍니다.

또한, 저희가 가장 좋아하는 제품들을 살펴보세요. Expenseify 대안…

주요 이점

- 스마트스캔 기술은 영수증 정보를 스캔하여 95% 이상의 정확도로 추출합니다.

- 직원들은 ACH를 통해 신속하게, 대개 영업일 기준 하루 만에 환급받습니다.

- Expensify 카드를 사용하면 캐시백 프로그램을 통해 구독료를 최대 50%까지 절약할 수 있습니다.

- 어떠한 보증도 제공되지 않으며, 약관에 따라 책임이 제한됩니다.

가격

- 모으다: 월 5달러.

- 제어: 맞춤형 가격 책정.

장점

단점

기능 비교

자영업자와 중소기업에게는 적합한 금융 플랫폼을 선택하는 것이 매우 중요합니다.

이 비교에서는 Expensify 리뷰와 QuickBooks 리뷰를 활용하여 전용 경비 관리 기능의 차이점을 강조합니다. 오토메이션 Expensify와 Intuit QuickBooks의 종합 회계 시스템.

1. 핵심 기능 및 중점 사항

- Expensify 이 도구는 기업의 경비 관리를 돕고 환급 절차를 간소화하는 데 특화되어 있습니다. 특히 직원과 계약직 직원을 위한 경비 보고서 작성 및 신속한 승인 워크플로에 중점을 두고 있습니다.

- 퀵북스 완전한 서비스를 제공합니다 회계 기업 재무 관리를 위한 시스템입니다. 주요 기능으로는 계정과목표, 대조, 매출 및 공급업체 관리, 세금 납부, 재무 보고서 생성 등이 있습니다.

2. 경비 입력 및 자동화

- Expensify Expensify 앱을 사용하면 경비 입력 과정을 매우 빠르게 진행할 수 있습니다. 사용자는 주머니 속 Expensify 앱으로 영수증 사진을 찍어 입력하기만 하면 됩니다. 데이터 몇 초 만에 추출되어 승인 제출 준비가 완료됩니다.

- 퀵북스 은행 거래 내역을 자동으로 가져오고 신용카드 데이터를 연결하여 시간을 절약할 수 있도록 도와줍니다. 영수증 스캔 기능과 주행 거리 기록 및 세금 신고를 위한 자금 추적 도구를 간편하게 사용할 수 있습니다.

3. 경비 보고서 및 환급

- Expensify 이 플랫폼은 경비 보고 절차 전반을 관리합니다. 고용주는 정책을 설정하고 요청을 즉시 승인할 수 있습니다. 또한 사용자의 은행 계좌로 직접 입금되는 환급금을 신속하게 처리하는 데 매우 유용합니다.

- 퀵북스 비용을 처리합니다 보고 하지만 이 시스템은 더 광범위한 지급 시스템에 통합됩니다. 비용이 청구서로 지급되거나 직원 복리후생을 위해 QuickBooks 급여 시스템과 연동되기 전에 정확하게 코딩되도록 세심한 설정이 필요합니다.

4. 가격 및 플랫폼

- Expensify Expensify는 사용자 또는 팀 규모에 따라 월별 요금이 책정되는 유연한 가격 구조를 가지고 있습니다. 수수료 절감 및 결제 자동화를 위해 Expensify 카드를 제공합니다. 웹과 모바일 모두에서 사용 가능한 인터페이스를 제공합니다.

- 퀵북스가격은 단계별로 책정되며 일반적으로 더 높습니다. 이는 풀 서비스의 복잡성을 반영한 것입니다. 부기이 제품은 클라우드 기반 온라인 버전(간편한 온라인 접속)과 QuickBooks Desktop(컴퓨터에 로컬로 저장되는 데스크톱 데이터)을 모두 제공합니다.

5. 특수 금융 도구

- Expensify 이 소프트웨어는 프로젝트 및 기업 지출 관리를 위해 설계되었습니다. 복잡한 조직 요구 사항을 충족하기 위해 태그와 카테고리를 사용하여 거래를 분류하는 기능을 제공합니다. 사용자는 데이터를 QuickBooks로 빠르게 내보낼 수 있습니다.

- 퀵북스 QuickBooks Time은 심층적인 비즈니스 데이터 추적, 구매 주문 관리, 판매세 계산, 직원 근무 시간 추적 기능을 제공합니다. 또한 전략적 경영에 필수적인 대차대조표와 같은 강력한 재무 보고서를 제공합니다.

6. 보안 및 규정 준수

- Expensify 해당 제품들은 강력한 보안과 실시간 정책 검사를 통해 회사 자금을 보호합니다. 사용자가 수행한 작업이 차단을 유발할 수 있거나 악의적인 것으로 판단될 경우, 해당 사용자는 차단될 수 있으며, 차단 사유를 해결하기 위해 대응해야 합니다.

- 인튜이트 퀵북스 이 시스템은 수십 년간 사용되어 온 신뢰를 바탕으로 민감한 기업 재무 정보를 보호합니다. 정확한 세금 신고 및 법규 준수를 보장하고 회계사에게 신뢰할 수 있는 보고서를 제공하도록 설계되었습니다.

7. 사용자 인터페이스 및 사용 편의성

- Expensify의 사용자 인터페이스는 깔끔하고 빠르며 최소한의 조작으로 완료할 수 있도록 설계되었습니다. 덕분에 소수의 사용자나 신입 팀원이라도 경비 보고서 작성 과정을 간단하고 직관적으로 진행할 수 있습니다.

- 퀵북스 퀵북은 제공하는 서비스의 범위가 넓고 계정 체계가 복잡하기 때문에 초기 학습 곡선이 가파릅니다. 하지만 일단 숙달하면 퀵북은 사용자가 체계적인 관리를 유지하고 복잡한 워크플로를 간소화하는 데 도움이 됩니다.

8. 다중 사용자 및 관리

- Expensify Expensify는 여러 사용자가 보고서를 제출하고 승인할 수 있도록 하여 고용주가 지출을 관리할 수 있는 통제되고 책임 있는 시스템을 구축합니다. 또한 보고서 해결을 위해 필요한 잦은 전화 통화를 줄여 시간을 절약할 수 있도록 도와줍니다.

- 퀵북스 확장 가능한 사용자 라이선스와 역할 기반 액세스 권한을 제공하여 여러 사용자와 회계 담당자가 회사 데이터에 동시에 접근할 수 있도록 합니다. 이는 내부 통제가 필요한 중소기업에 매우 중요합니다.

9. 기업 금융 및 결제

- 퀵북스 QuickBooks Checking을 통한 비즈니스 뱅킹 서비스를 제공하며, 직원과 계약직 직원을 위한 직접 입금을 포함한 포괄적인 결제 서비스를 제공합니다. 이를 통해 공급업체는 신속하고 정확하게 대금을 받을 수 있습니다.ure 비교

- 그만큼 Expensify 이 카드는 앱과 즉시 연동되는 신용카드로, 기업 결제에 대한 비용 정산 프로세스를 자동화합니다.

회계 소프트웨어 선택 시 고려해야 할 사항은 무엇일까요?

선택을 내릴 때 고려해야 할 주요 사항은 다음과 같습니다.

- 사용 편의성: 배우고 사용하기 쉬운가요?

- 확장성: 비즈니스 성장에 맞춰 확장할 수 있나요?

- 완성: 이 앱은 사용하시는 다른 도구들과 연동되나요?

- 보도: 필요한 재무 정보를 제공합니까?

- 모바일 접속: 이동 중에도 재정 관리가 가능하신가요?

- 고객 지원: 어려움에 처했을 때 도움을 쉽게 받을 수 있나요?

- 보안: 어떻게 금융 정보를 보호하나요?

- 가격 구조: 귀사의 요구 사항에 맞춰 투명하고 예산 친화적인가요?

- 주요 특징: 해당 제품이 귀사의 업계에 중요한 고유한 기능을 갖추고 있습니까?

- 오토메이션: 시간을 절약하고 오류를 줄이기 위해 얼마나 많은 부분을 자동화할 수 있을까요?

최종 판결

QuickBooks와 Expensify를 자세히 살펴본 결과, 어떤 것을 선택할지는 사용자의 주된 필요에 따라 달라집니다.

송장 발행 및 급여 지급과 같은 완전한 회계 서비스가 필요하신 경우.

QuickBooks는 포괄적인 회계 시스템이며 종종 최고의 선택입니다.

이는 전체 경비 관리 프로세스를 간소화합니다.

저희는 두 가지 모두 광범위하게 사용해 봤기 때문에, 여러분의 예산에 맞는 최적의 도구를 선택하는 데 도움이 될 저희의 전문적인 의견을 믿으셔도 좋습니다.

QuickBooks가 더 강력한 기능을 제공할 수도 있지만, Expensify는 특정 분야에서 탁월한 성능을 발휘합니다.

퀵북에 대한 추가 정보

- QuickBooks vs Puzzle IO이 소프트웨어는 스타트업을 위한 AI 기반 재무 계획에 중점을 두고 있습니다. 개인 재무 관리에 대한 버전도 있습니다.

- 퀵북 vs 덱스트이것은 영수증과 송장을 기록하는 업무용 도구입니다. 다른 도구는 개인 경비를 추적하는 데 사용됩니다.

- 퀵북스와 제로 비교이 소프트웨어는 중소기업에서 널리 사용되는 온라인 회계 소프트웨어입니다. 경쟁 제품은 개인용으로 개발되었습니다.

- 퀵북스 vs 스나이더이 도구는 전자상거래 데이터를 회계 소프트웨어와 동기화합니다. 대안으로는 개인 재무 관리에 초점을 맞춘 도구가 있습니다.

- QuickBooks vs Easy Month End이 앱은 월말 업무를 간소화하는 비즈니스 도구입니다. 경쟁 앱으로는 개인 재정 관리 앱이 있습니다.

- QuickBooks와 Docyt 비교하나는 AI를 활용하여 기업 회계 및 자동화를 지원하고, 다른 하나는 AI를 개인 재정 관리 도우미로 활용합니다.

- 퀵북 vs 세이지이 제품은 종합적인 기업 회계 소프트웨어 제품군입니다. 경쟁 제품은 개인 재무 관리에 더 사용하기 쉬운 도구입니다.

- 퀵북스와 조호북스 비교: 이는 소규모 사업체를 위한 온라인 회계 도구입니다. 경쟁 제품은 개인용입니다.

- 퀵북스 vs 웨이브이 서비스는 중소기업을 위한 무료 회계 소프트웨어를 제공합니다. 이와 유사한 서비스는 개인 사용자를 위해 설계되었습니다.

- 퀵북스와 퀵큰 비교둘 다 개인 재무 관리 도구이지만, 이 도구는 보다 심층적인 투자 추적 기능을 제공합니다. 다른 하나는 사용이 더 간편합니다.

- 퀵북스 vs 허브독이 회사는 회계 장부 작성을 위한 문서 캡처를 전문으로 합니다. 경쟁 업체는 개인 재무 관리 도구입니다.

- 퀵북스와 익스펜시파이 비교이것은 업무 경비 관리 도구입니다. 다른 하나는 개인 경비 추적 및 예산 관리 도구입니다.

- 퀵북스와 오토엔트리 비교이 프로그램은 기업 회계 데이터 입력을 자동화하도록 설계되었습니다. 이와 유사한 프로그램으로는 개인 재무 관리 도구가 있습니다.

- 퀵북 vs 프레시북이 소프트웨어는 프리랜서와 소규모 사업자를 위한 회계 소프트웨어입니다. 개인 재무 관리용으로도 사용할 수 있습니다.

- 퀵북스 vs 넷스위트이 제품은 대기업을 위한 강력한 비즈니스 관리 소프트웨어 제품군입니다. 경쟁 제품은 간단한 개인 재무 관리 앱입니다.

Expensify에 대한 추가 정보

- Expensify vs Puzzle이 소프트웨어는 스타트업을 위한 AI 기반 재무 계획에 중점을 두고 있습니다. 개인 재무 관리에 대한 버전도 있습니다.

- Expensify vs Dext이것은 영수증과 송장을 기록하는 업무용 도구입니다. 다른 도구는 개인 경비를 추적하는 데 사용됩니다.

- Expensify vs Xero이 소프트웨어는 중소기업에서 널리 사용되는 온라인 회계 소프트웨어입니다. 경쟁 제품은 개인용으로 개발되었습니다.

- Expensify vs Synder이 도구는 전자상거래 데이터를 회계 소프트웨어와 동기화합니다. 대안으로는 개인 재무 관리에 초점을 맞춘 도구가 있습니다.

- Expensify vs Easy Month End이 앱은 월말 업무를 간소화하는 비즈니스 도구입니다. 경쟁 앱으로는 개인 재정 관리 앱이 있습니다.

- Expensify vs Docyt하나는 AI를 활용하여 기업 회계 및 자동화를 지원하고, 다른 하나는 AI를 개인 재정 관리 도우미로 활용합니다.

- Expensify vs Sage이 제품은 종합적인 기업 회계 소프트웨어 제품군입니다. 경쟁 제품은 개인 재무 관리에 더 사용하기 쉬운 도구입니다.

- Expensify와 Zoho Books 비교: 이는 소규모 사업체를 위한 온라인 회계 도구입니다. 경쟁 제품은 개인용입니다.

- Expensify vs Wave이 서비스는 중소기업을 위한 무료 회계 소프트웨어를 제공합니다. 이와 유사한 서비스는 개인 사용자를 위해 설계되었습니다.

- Expensify vs Hubdoc이 회사는 회계 장부 작성을 위한 문서 캡처를 전문으로 합니다. 경쟁 업체는 개인 재무 관리 도구입니다.

- Expensify vs QuickBooks: 이는 기업용으로 잘 알려진 회계 소프트웨어입니다. 그 대안은 개인 재무 관리에 맞춰 개발되었습니다.

- Expensify vs AutoEntry이 프로그램은 기업 회계 데이터 입력을 자동화하도록 설계되었습니다. 이와 유사한 프로그램으로는 개인 재무 관리 도구가 있습니다.

- Expensify vs FreshBooks이 소프트웨어는 프리랜서와 소규모 사업자를 위한 회계 소프트웨어입니다. 개인 재무 관리용으로도 사용할 수 있습니다.

- Expensify vs NetSuite이 제품은 대기업을 위한 강력한 비즈니스 관리 소프트웨어 제품군입니다. 경쟁 제품은 간단한 개인 재무 관리 앱입니다.

자주 묻는 질문

Expensify와 QuickBooks를 함께 사용할 수 있나요?

네, Expensify와 QuickBooks는 완벽한 통합을 제공합니다. 이를 통해 경비 데이터가 회계 시스템으로 직접 전송되어 재무 관리 시간을 절약하고 오류를 줄일 수 있습니다.

소규모 사업체에 더 적합한 프로그램은 Expensify와 QuickBooks 중 어느 것일까요?

어떤 솔루션이 적합한지는 사업체의 필요에 따라 다릅니다. Expensify는 지출 및 환급 내역 추적에 특화된 경비 관리 솔루션으로 탁월한 성능을 발휘합니다. QuickBooks는 보다 광범위한 재무 업무를 지원하는 종합 회계 소프트웨어입니다.

Expensify는 청구 가능한 비용과 청구 불가능한 비용을 모두 추적하나요?

네, Expensify에서는 청구 가능한 비용과 청구 불가능한 비용을 모두 분류할 수 있습니다. 이 기능을 통해 비용을 고객이나 프로젝트에 정확하게 할당할 수 있습니다.

QuickBooks는 어떤 비용 추적 기능을 제공하나요?

QuickBooks는 영수증 캡처, 분류, 신용 카드 거래 연동 기능 등 강력한 비용 추적 기능을 제공합니다. 이러한 기능은 QuickBooks의 광범위한 재무 관리 도구에 통합되어 있습니다.

퀵북스 온라인과 익스펜시파이 중 어떤 것을 사용해야 할까요?

QuickBooks를 사용하세요 온라인으로 완벽한 회계, 송장 발행 및 급여 관리가 가능합니다. 경비 관리 프로세스 간소화 및 직원 경비 상환이 주요 목표라면 Expensify가 이상적입니다.