正しい選択に迷っていませんか? 会計ソフトウェア あなたのビジネスのために?

それは大変なことかもしれません!

Xero と NetSuite はどちらも人気のある選択肢ですが、かなり異なります。

間違ったソフトウェアを選んでしまい、お金の管理に頭を悩ませる状況を想像してみてください 後で.

この記事では、Xero と NetSuite を簡単に比較します。

概要

正しい選択 会計 ソフトウェアは大きな決断です。

お客様のお役に立てるよう、Xero と NetSuite の両方を詳しく調べました。

私たちのチームは、それらの主な特徴と、さまざまな環境でどのように機能するかを調査しました。 仕事 明確な比較を実現するためのシナリオ。

200万社以上の企業がXeroのクラウドベース会計ソフトウェアをご利用いただいています。強力な請求書作成機能を今すぐお試しください!

価格: 無料トライアルがあります。有料プランは月額 29 ドルから始まります。

主な特徴:

- 銀行照合

- 請求書発行

- 報告

生産性を最大78%向上!NetSuiteの自動化ツールがあなたの仕事のやり方を変革する方法をご覧ください。さらに詳しくはこちら!

価格: 無料トライアルをご利用いただけます。カスタム料金プランもご利用いただけます。

主な特徴:

- ERP統合、

- CRM

- 高度な分析

Xero とは何ですか?

それで、Xeroを見ているんですね?人気があるんですよ。

お金に関するあらゆる情報のオンラインハブとしてお考えください。

小規模から中規模の企業が手間をかけずに財務状況を追跡するのに役立ちます。

また、私たちのお気に入りを探索してください Xeroの代替品…

私たちの見解

200万以上の企業にご参加ください Xeroを使用 会計ソフトウェア。強力な請求書作成機能を今すぐお試しください!

主なメリット

- 自動銀行照合

- オンライン請求と支払い

- 請求書管理

- 給与計算統合

- レポートと分析

価格

- スターター: 月額29ドル。

- 標準: 月額46ドル。

- プレミアム: 月額69ドル。

長所

短所

NetSuite とは何ですか?

さて、NetSuiteについてお話しましょう。

それをビッグブラザーとして考えてください 会計 ソフトウェアの世界。

それは単なる 会計本格的なエンタープライズ リソース プランニング (ERP) システムです。

また、私たちのお気に入りを探索してください NetSuiteの代替品…

私たちの見解

エンタープライズレベルのパワーをお求めですか?NetSuiteは、包括的なプラットフォームで世界3万社以上のお客様にサービスを提供しています。ERPとの完全な統合と高度な分析機能が必要な場合は、NetSuiteでビジネスの成長を加速しましょう。

主なメリット

- 金融を統合し、 CRM、ERP を単一のクラウド システムに統合します。

- 200 か国以上、27 言語のビジネスをサポートします。

- 40,000 を超える組織がこのスケーラブルなプラットフォームを使用しています。

- リアルタイムで可視化できる分析機能が組み込まれています データ.

価格

お客様のご要望に合わせたカスタム料金プランをご用意しております。最適な料金パッケージをご希望の場合は、お気軽にお問い合わせください。

長所

短所

機能比較

詳細を掘り下げてみましょう。

どちらのプラットフォームも多くの機能を備えていますが、それぞれの強みはまったく異なる分野にあります。

以下に、それぞれの機能の詳細を機能ごとに示します。

1. 財務管理

- ゼロ: ゼロ 会計 ソフトウェアは、企業が中核的な財務業務を簡単に管理できるように構築されています。 買掛金、売掛金、オンライン請求書発行の機能が含まれています。

- ネットスイート: クラウドベースの ERP である Oracle NetSuite は、財務管理に対する完全に統合されたアプローチを提供します。 これには、完全な総勘定元帳、高度な買掛金勘定、および経費と収益を追跡するための完全に統合されたシステムが含まれます。

2. 自動化とデータ入力

- ゼロ: Xeroは、自動銀行フィードを使用して銀行取引を直接インポートすることで、業務を簡素化します。これにより、中小企業は手作業によるデータ入力を削減し、財務記録の管理を簡素化できます。

- ネットスイート: Oracle NetSuiteはプロセスの自動化も実現します。ベンダーへの請求書発行から複雑な収益認識まで、あらゆるプロセスを自動化し、基本的な機能をはるかに超える高度な自動化機能を提供します。 簿記.

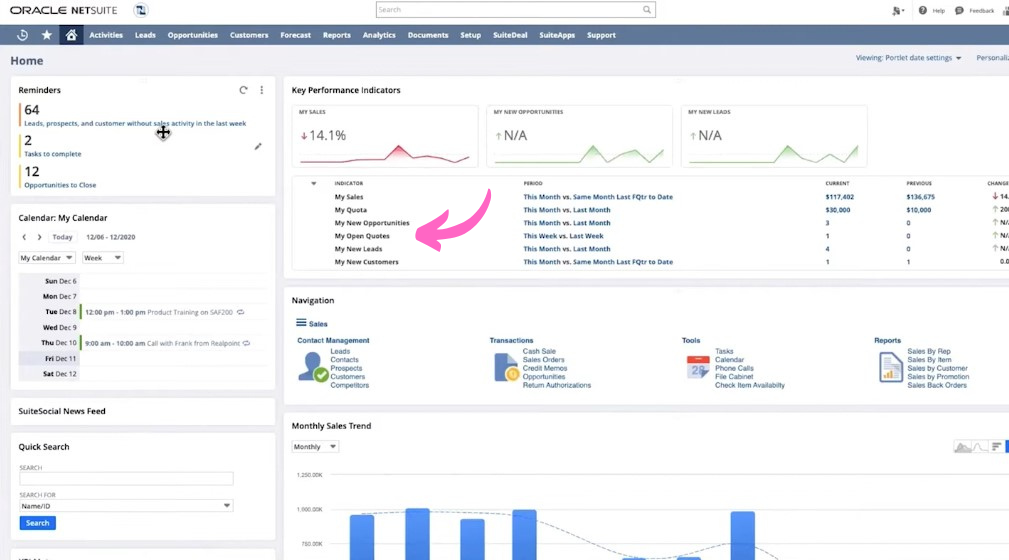

3. レポートとダッシュボード

- ゼロ: Xeroダッシュボードでは、ビジネスの財務状況を一目で確認できます。Xeroの 報告 機能はわかりやすくて使いやすく、財務状況とキャッシュフローに関する標準レポートを提供します。

- ネットスイート: NetSuite ユーザーは、リアルタイム データを使用した強力でカスタマイズ可能なレポートを入手できます。 確立されたビジネスにとって不可欠な、ビジネスの全体像を把握するために、カスタム主要業績評価指標を備えたダッシュボードを作成できます。

4. 在庫管理

- ゼロ: Xeroは基本的な追跡機能を備えた在庫管理が可能です。 中小企業 在庫管理のニーズはシンプルですが、複雑な操作のための高度な機能が欠けています。

- ネットスイート: NetSuiteは、企業の在庫管理に役立つ強力な在庫管理ツールを提供しています。倉庫管理、複数拠点の追跡、需要計画などの機能が含まれています。

5. モバイルアクセシビリティ

- ゼロ: Xeroモバイルアプリは高く評価されており、 iOS および Android デバイス。 中小企業の経営者にとって、外出先でタスクを処理するのに最適です。

- ネットスイート: NetSuiteモバイルアプリは、幅広い機能へのアクセスを提供します。ユーザーは、どこからでも財務データの閲覧、取引の承認、ダッシュボードの確認を行うことができます。

6. 経費と給与

- ゼロ: Xeroは、経費を追跡し、未払いの請求書の数を制限して管理できる早期プランオプションを提供しています。請求書や領収書のキャプチャも可能です。

- ネットスイート: NetSuiteには、経費精算書と給与管理用のモジュールがあります。人材管理やワークフォース管理といった高度な機能も提供しており、人事部門のあらゆるニーズに対応します。

7. スケーラビリティ

- ゼロ: スタートアップ企業には最適ですが、成長著しい企業の中にはXeroでは対応しきれない場合もあります。事業規模が拡大すると、XeroからNetSuiteへの移行が一般的になります。

- ネットスイート: NetSuite ERPは、お客様の成長に合わせて設計されています。複数の拠点と複数の通貨を扱う大規模企業をサポートし、シームレスなビジネス成長を実現します。

8. 統合

- ゼロ: Xeroは幅広いアプリ連携に優れています。他のシステムやソフトウェアと連携し、オールインワンのエクスペリエンスを提供します。

- ネットスイート: Oracle NetSuiteは、他の多くのシステムの必要性を軽減する、完全に統合されたスイートを提供します。カスタム統合を提供し、シームレスな組み込み機能に重点を置いています。

9. 価格とプラン

- ゼロ: Xeroの料金は透明性が高く、お手頃です。標準プランでは、請求書や領収書の発行が無制限に可能です。

- ネットスイート: NetSuiteの価格は高度にカスタマイズされており、企業の規模とニーズによって異なります。価格ははるかに高額ですが、プロジェクト追跡などの高度な機能やその他の強力なビジネスソリューションが付属しています。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

選択のガイドとなる重要な洞察と差別化要因の簡単なチェックリストを以下に示します。

- 複雑さ vs シンプルさ: Xero のようなシンプルなクラウドベースの会計システム、または NetSuite のような完全なエンタープライズ リソース プランニング システムが必要ですか?

- ERPのニーズ: 幅広いニーズに対応するには、ソフトウェアがサプライ チェーン管理、注文管理、顧客関係管理、またはプロフェッショナル サービスの自動化を提供しているかどうかを確認します。

- 監査と 安全: システムに監査証跡と、正確な財務諸表のために監査証跡を強化する機能が含まれていることを確認します。

- グローバルオペレーション: 国際的に事業を展開している場合は、グローバルな会計機能と複数の通貨のサポートを探してください。

- スケーラビリティ: プラットフォームがビジネス ユニットを処理できるかどうか、データ移行をサポートしているかどうか、成長中の企業に推奨されるかどうかを検討します。

- エコシステムと統合: シームレスな統合 (NetSuite の他のモジュールなど) の価値と Xero のマーケットプレイスの柔軟性を比較評価します。

- キャッシュフローの焦点: 強力なキャッシュフロー管理、銀行調整、銀行口座の追跡と支払いのスケジュール設定機能を備えたツールを優先します。

- 財務の可視性: ソフトウェアが財務実績に関する詳細なデータと、企業の財務のリアルタイムの可視性を提供することを確認します。

- サポートとリソース: 提供されるサポート、オンライン リソース、コミュニティ アクセス (Xero Central) を確認します。 NetSuite のレビューと Xero 会計ソフトウェアのレビューをチェックして、ユーザーの満足度を測定してください。

- ユーザーフィット: Decide if you want the best accounting software for independent contractors or a comprehensive suite for established businesses managed by Oracle Corporation.

最終評決

選ぶ際には、あなたのサイズを確認する必要があります。

シンプルで使いやすいインターフェースと強力なクラウドベースの会計ソフトウェアが必要な場合は、Xero をお勧めします。

Xero は手頃な価格の Xero 価格を提供しており、経費追跡や最大 5 件の請求書を簡単に管理するのに最適です。

Xero を使用すると、中核となる財務プロセスを管理し、強力な財務レポートを参照できます。

ただし、詳細な在庫データと完全に統合されたビジネス管理ソフトウェアを必要とする大規模な電子商取引や急速に拡大するビジネスの場合は、NetSuite をお勧めします。

幅広い会計機能を提供し、固定資産を管理し、全体的なビジネス パフォーマンスの向上に役立ちます。

弊社の詳細な比較により、どれがビジネス プロセスに最適かを判断するのに役立ちます。

Xeroの詳細

適切な会計ソフトウェアを選択するには、いくつかの選択肢を検討する必要があります。

Xero と他の人気製品を簡単に比較してみましょう。

- Xero vs QuickBooks: QuickBooksは主要な競合製品です。どちらも同様のコア機能を提供していますが、Xeroは洗練されたインターフェースと無制限のユーザー数で高く評価されています。QuickBooksはより複雑な機能を備えていますが、非常に強力なレポート機能を備えています。

- Xero vs FreshBooks: FreshBooksは、特にフリーランサーやサービスベースのビジネスに人気の選択肢です。請求書発行と勤怠管理に優れています。Xeroは、より包括的な会計ソリューションを提供します。

- Xero vs Sage: SageとXeroはどちらも中小企業向けのソリューションを提供しています。しかし、Sageはより包括的なエンタープライズ・リソース・プランニング(ERP)ツールも、大企業向けに提供しています。

- Xero vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。在庫管理のための高度な機能を備えていることが多く、非常に費用対効果が高いのが特徴です。一方、Xeroはシンプルさと使いやすさの点で優れた選択肢です。

- Xero vs Wave: Waveは無料プランで知られています。小規模企業や予算が限られているフリーランサーにとって最適な選択肢です。Xeroはより幅広い機能を提供しており、ビジネスの成長に適しています。

- Xero vs Quicken: Quickenは主に個人の財務管理に使用されます。ビジネス向けの機能もいくつか備えていますが、真のビジネス会計ソリューションではありません。Xeroは、ビジネス会計の複雑な処理に特化して設計されています。

- Xero vs Hubdocこれらは直接的な競合ではありません。DextとHubdocはどちらも、文書のキャプチャとデータ入力を自動化するツールです。Xeroと直接連携することで、簿記をより迅速かつ正確に行うことができます。

- ゼロ vs シンダー: Synderは、販売チャネルと決済ゲートウェイを会計ソフトウェアに接続するプラットフォームです。ShopifyやStripeなどのプラットフォームからXeroへのデータ入力を自動化します。

- Xero vs. ExpensifyExpensifyは経費管理に特化しています。Xeroにも経費管理機能はありますが、Expensifyは従業員の経費と払い戻しを管理するためのより高度なツールを提供しています。

- Xero vs. NetSuite: Netsuiteは、大企業向けの包括的なERPシステムです。ビジネス管理ツールをフルスイートで提供しています。XeroはERPではありませんが、中小企業向けの優れた会計ソリューションです。

- Xero vs Puzzle IO: Puzzle IO は、リアルタイムの財務諸表と自動データ入力に重点を置いた、スタートアップ向けに設計された金融プラットフォームです。

- Xero vs イージー・マンスエンド: このソフトウェアは、月末処理プロセスを自動化し、照合と監査証跡の作成を支援するための専用ツールです。Xero と連携するように設計されており、Xero を置き換えるものではありません。

- Xero vs Docyt: DocytはAIを活用してバックオフィス業務と簿記業務を自動化します。すべての財務書類とデータを一か所で閲覧できる手段を提供します。

- Xero vs RefreshMe: RefreshMe は、基本的な機能を備えたシンプルな会計ソフトウェアで、個人の財務や小規模企業でよく使用されます。

- Xero vs AutoEntry: Dext や Hubdoc と同様に、AutoEntry は領収書や請求書からのデータ抽出を自動化するツールで、Xero などの会計ソフトウェアと統合して強化するように設計されています。

NetSuiteの詳細

- NetSuiteとPuzzleこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- NetSuiteとDextの比較: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- NetSuiteとXeroの比較: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- NetSuiteとSynderの比較このツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- NetSuiteとEasy Month Endの比較: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- NetSuiteとDocytの比較これはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- NetSuiteとSageの比較: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- NetSuiteとZoho Booksの比較: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- NetSuiteとWaveの比較: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- NetSuiteとQuickenの比較どちらも個人向け財務ツールですが、こちらの方がより詳細な投資追跡機能を備えています。一方、こちらはよりシンプルです。

- NetSuiteとHubdocの比較: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- NetSuiteとExpensifyの比較これはビジネス経費管理ツールです。もう1つは、個人の経費追跡と予算管理のためのツールです。

- NetSuiteとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- NetSuiteとAutoEntryの比較: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

よくある質問

Xero は中小企業に適していますか?

はい、Xero は、ユーザーフレンドリーなダッシュボードと手頃な価格プランにより、一般的に中小企業に最適です。

NetSuite の価格が Xero よりも高いのはなぜですか?

NetSuiteは、基本的な会計機能以外にも、次のような包括的な機能を提供しています。 CRM 在庫管理も必要となるため、コストが高くなります。

後で Xero から NetSuite に切り替えることはできますか?

はい、多くの企業は Xero から始めて、ニーズが複雑になり、より多くの機能が必要になったときに NetSuite に移行します。

NetSuite と Xero の主な違いは何ですか?

Xero は中小企業向けの簡単な会計に重点を置いていますが、NetSuite はより大規模で複雑な組織向けの完全な ERP システムです。

成長中のビジネスに適した会計ソリューションはどれでしょうか?

どちらも成長をサポートできますが、NetSuite は大幅な拡張性を実現するように設計されており、より大規模で成長中の企業向けに、より高度な機能を提供します。