頭を悩ませることなくビジネスの資金管理をしたいとお考えですか?

それは大変ですよね?

でも、どちらが実際良いのでしょうか? あなた?

SynderとWaveの違いとそれぞれの機能について解説し、どちらが優れているか判断するお手伝いをします。 会計ソフトウェア あなたのビジネスにとっての勝利となるかもしれません。

さあ、始めましょう!

概要

私たちはSynderとWaveの両方を詳しく調べました。

どのように機能するか試してみました。

これにより、公平に比較できるようになりました。

さて、私たちが見つけたものをお見せしましょう。

これは最適なものを選択するのに役立ちます。

Synderは会計業務を自動化し、売上データをQuickBooks、Xeroなどとシームレスに同期します。ぜひ今すぐお試しください!

価格: 無料トライアルがあります。プレミアムプランは月額52ドルからです。

主な特徴:

- マルチチャネル販売同期

- 自動調整

- 詳細なレポート

400万以上 中小企業 財務管理はWaveにお任せください。Waveのプランを詳しくご確認いただき、最適なプランを見つけてください。

価格: 無料プランをご利用いただけます。有料プランは月額19ドルからとなります。

主な特徴:

- 請求書発行

- 銀行業務

- 給与計算アドオン。

Synderとは何ですか?

Synderについて話しましょう。

これは、さまざまなビジネス アプリが相互に通信できるようにするツールです。

あなたのお金の情報を必要な場所に移動するヘルパーのようなものだと考えてください。

これにより、多くの時間を節約できます。

また、私たちのお気に入りを探索してください シンダーの代替品…

私たちの見解

Synderは会計を自動化し、売上データをQuickBooksにシームレスに同期します。 ゼロなど。Synder を使用している企業は、平均して週 10 時間以上を節約していると報告しています。

主なメリット

- 自動販売データ同期

- マルチチャネル販売追跡

- 支払い調整

- 在庫管理統合

- 詳細な売上レポート

価格

すべての計画は 年払い.

- 基本: 月額52ドル。

- 不可欠: 月額92ドル。

- プロ: 月額220ドル。

- プレミアム: カスタム価格設定。

長所

短所

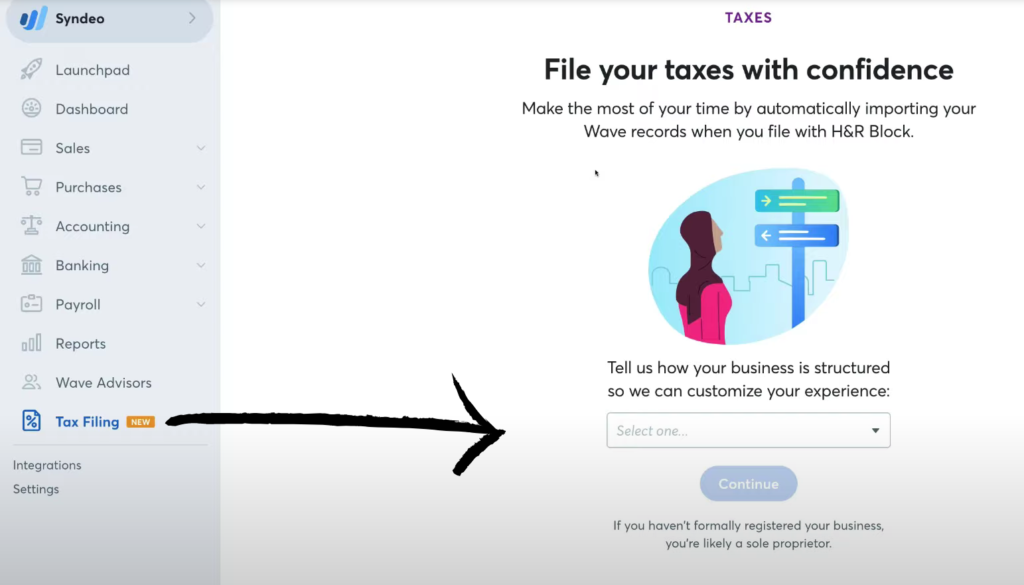

Waveとは何ですか?

さて、Waveについて話しましょう。

ビジネス資金に役に立つ友人のように考えてください。

請求書の送信や入出金の追跡などが可能になります。

ビジネスの財務の全体像を把握するのに役立ちます。

また、私たちのお気に入りを探索してください Waveの代替…

私たちの見解

妥協はやめましょう!Wave の強力で無料のコア会計機能を活用して財務を効率化している 200 万以上の中小企業にぜひご参加ください。

主なメリット

Wave の強みは次のとおりです。

- 100% 無料のコア会計プラン。

- 200 万以上の中小企業にサービスを提供しています。

- 請求書の作成と支払い処理が簡単。

- 長期契約や保証はありません。

価格

- スタータープラン: 月額$0。

- プロプラン: 月額19ドル。

長所

短所

機能比較

正しい選択 会計 システムは大きな問題のように感じられるかもしれません。

SynderとWaveのどちらのプラットフォームがあなたの中小企業に最適かを見極めるために、9つの主要な機能を見てみましょう。 会計.

1. 同期と自動化

- Synderは自動化を目的として構築されており、大量の履歴トランザクションを処理できます。

- 取引を自動で取り込みます。これにより帳簿のバランスを保ち、ストレスを軽減できます。 簿記.

- 単一の同期モードとワンクリック設定で書籍を最新の状態にすることができます。

- Wave では銀行取引を自動インポートする方法も提供していますが、大量の取引には Synder の自動会計の方が適しています。

2. マルチチャネルサポート

- Synderはeコマースに最適です。Shopify、Etsy、eBayなどのあらゆる販売チャネルの管理に役立ちます。

- 返金、手数料、送料、割引など、売上に関するあらゆる詳細情報を取り込むことができます。これにより、問題解決に役立ちます。

- Wave は、単一の店舗またはサービスを提供する企業に重点を置いています。

3. 統合

- Synderは、QuickBooks Online、Xeroなどのトップ会計システムプロバイダーと高い互換性があります。 セージ Intacct および NetSuite。

- また、Stripe、PayPal、Square、Clover などの多くの支払い処理業者とも接続します。

- Wave は支払いや給与計算用の独自のツールと統合しますが、外部のサービスとはそれほど統合しません。

4. 収益追跡

- Synder の収益認識機能は財務チームにとって大きな助けとなります。

- サブスクリプションと収益をバックグラウンドで追跡できます。これにより、GAAPコンプライアンスを確保できます。

- 正確な貸借対照表を作成し、明確な洞察を提供します。

- これに対する Wave のツールはそれほど高度ではありません。

5. 価格とプラン

- Wave is known for its free 会計ソフトウェア. It offers a free starter plan and a paid pro plan.

- 無料版では請求書が無制限に作成でき、中小企業の経営者が経費を追跡するのに役立ちます。

- Synder には有料プランという異なるサブスクリプション レベルがあり、取引量の多いビジネスに適している可能性があります。

6. 請求と支払い

- どちらのプラットフォームでも請求書を作成できます。Waveの請求書作成機能と無制限の請求書作成機能は、多くのユーザーにとって大きな魅力です。

- Waveではオンラインでの支払いも受け付けられます。自動支払いリマインダー機能も搭載されています。

- Synder には、オンライン支払い用の優れた請求ツールもあります。

7. 給与計算

- Wave Payrollは、ご利用いただける標準機能です。独立請負業者や現役従業員への給与支払いを、口座振替で行うことができます。

- Synder には給与計算ツールが組み込まれていません。

8. ユーザーアクセス

- Wave では有料プランで複数のユーザーが許可されます。

- Synder では会計士やその他のユーザーを追加できるため、複数の企業やさまざまな財務チームに適しています。

9. レシートスキャン

- Waveは優れた領収書スキャン機能を提供しています。経費の追跡に役立ちます。

- レシートを写真に撮ると、 簿記 記録。

- Synder には同様のツールはありません。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

- コストと価値Wave Financialのような無料プラットフォームが必要か、それとも有料プランの方が機能が充実しているかを確認してください。特定のクレジットカードや銀行振込手数料などの追加費用にも注意してください。投資したお金に見合ったリターンを得たいと思うはずです。

- コア会計機能: 作る 会計機能が充実していることを確認してください。これには、適切な総勘定元帳、銀行口座の追跡機能、そしてミスを防ぐための適切な照合機能が含まれます。

- 請求と支払い請求書発行ソフトウェアを確認しましょう。定期的な請求書発行と請求処理に対応していますか?クレジットカードやApple Payなどのオンライン決済に対応していますか?これは良好なキャッシュフローの鍵となります。

- プロセス自動化ソフトウェアは取引処理を高速化するのに役立ちます。自動マージ機能を備えたツールを探しましょう。 データ 手入力の手間が省けます。すべてを自分で提出するストレスから解放されます。

- 販売とチャネル複数の販売場所で販売している場合は、マルチチャネル販売に対応しているかどうかを確認してください。Synderはこの点で非常に便利です。すべてのデータを同期し、売上の全体像を把握したいはずです。

- 給与計算と請負業者: 従業員がいる場合は、給与計算処理が必要です。Wave Accountingのレビューでは、会計・給与計算ツールが特に高く評価されています。独立請負業者への支払い期日がシステムによって容易に処理されるかどうかを確認してください。

- 報告明確な財務報告書を確認する必要があります。これは税務申告に不可欠です。このシステムは、あなたの資金管理の特徴を理解するのに役立つはずです。

- ユーザーとセキュリティユーザー数に制限がなくとも、セキュリティを確保できますか?多要素認証と機密データの強力な保護機能をお探しください。モバイルアプリも安全で使いやすいものでなければなりません。

- 高度なニーズ: 世界中の顧客と取引している場合は、複数通貨対応機能があるかどうかを確認してください。時間単位で請求する場合は、請求可能な時間数を追跡できるかどうかを確認してください。実際、ソフトウェアは実際のビジネスニーズに適合している必要があります。

- サポート信頼できるヘルプセンターと、安心して利用できるシステムを探しましょう。Waveのような企業は2つのプランを用意しているので、それぞれのレベルのサポート体制を確認してください。シンプルな会計と請求書発行にはWaveがおすすめです。

最終評決

すべての機能を詳しく検討した結果、Synder が多くのオンライン販売業者にとって最適な選択肢であると断言できます。

Wave のレビューでは、これが基本的なニーズを満たす優れた無料の中小企業向け会計ソフトウェアであることが示されています。

Wave を使用すると、シンプルな請求書を簡単に設定できます。

ただし、ビジネスで多くのクレジットカード取引を処理し、詳細な支払い処理が必要な場合は、Synder の方が適しています。

その高度な機能は価値があります。

あらゆる事実を慎重に確認したので、安心して切り替えることができます。

これにより、在庫を管理し、帳簿を正しく管理することができ、安心できます。

シンダーの詳細

- シンダー vs パズル io: Puzzle.ioは、スタートアップ向けに開発されたAI搭載の会計ツールで、バーンレートやランウェイといった指標に重点を置いています。Synderは、より幅広いビジネス向けに、マルチチャネルの販売データを同期することに重点を置いています。

- シンダー vs デクスト: Dextは、請求書や領収書からデータを取得・管理することに優れた自動化ツールです。一方、Synderは販売取引フローの自動化に特化しています。

- シンダー vs ゼロ: Xero はフル機能を備えたクラウド会計プラットフォームです。 シンダー Xero と連携して販売チャネルからのデータ入力を自動化し、Xero が請求書発行やレポート作成などのオールインワンの会計タスクを処理します。

- シンダー vs イージー・マンスエンド: Easy Month Endは、企業の月末処理プロセスを整理・効率化するために設計されたツールです。Synderは、日々の取引データフローの自動化に重点を置いています。

- シンダー vs ドサイト: Docytは、請求書の支払いや経費管理など、幅広い簿記業務にAIを活用しています。Synderは、複数のチャネルからの売上データと支払いデータの自動同期に重点を置いています。

- Synder vs RefreshMe: RefreshMeは個人の財務管理とタスク管理アプリケーションです。Synderはビジネス会計自動化ツールであるため、直接的な競合ではありません。

- シンダー vs セージ: Sageは、在庫管理などの高度な機能を備えた、長年実績のある総合的な会計システムです。Synderは、Sageなどの会計システムへのデータ入力を自動化する専用ツールです。

- Synder vs Zoho Books: Zoho Books は完全な会計ソリューションです。 シンダー さまざまな電子商取引プラットフォームから販売データをインポートするプロセスを自動化することで、Zoho Books を補完します。

- シンダー vs ウェーブ: Waveは、フリーランサーや小規模企業に多く利用されている、無料で使いやすい会計ソフトウェアです。Synderは、多チャネルで大量販売を行う企業向けに設計された有料の自動化ツールです。

- シンダー vs クイッケン: Quickenは主に個人向けの財務管理ソフトウェアですが、中小企業向けの機能もいくつか備えています。Synderは、特にビジネス会計の自動化を目的として開発されています。

- シンダー vs ハブドック: HubdocはDextに似たドキュメント管理およびデータキャプチャツールです。請求書や領収書のデジタル化に重点を置いています。Synderはオンライン販売と支払いデータの同期に重点を置いています。

- Synder vs Expensify: Expensifyは経費報告書と領収書を管理するためのツールです。Synderは販売取引データを自動化するためのツールです。

- Synder vs QuickBooks: QuickBooks は総合的な会計ソフトウェアです。 シンダー QuickBooks と統合して詳細な販売データを取り込むプロセスを自動化し、直接的な代替手段ではなく貴重なアドオンになります。

- Synder vs AutoEntry: AutoEntryは、請求書、領収書、領収書から情報を取得するデータ入力自動化ツールです。Synderは、eコマースプラットフォームからの売上データと支払いデータの自動化に重点を置いています。

- Synder vs FreshBooks: FreshBooksは、請求書作成に特化した、フリーランサーや小規模サービス企業向けに設計された会計ソフトウェアです。Synderは、複数のオンラインチャネルから大量の売上を上げている企業に最適です。

- Synder vs. NetSuite: NetSuiteは包括的なエンタープライズ・リソース・プランニング(ERP)システムです。Synderは、eコマースデータをNetSuiteのようなより広範なプラットフォームに同期するための専用ツールです。

Waveの詳細

- ウェーブ vs パズル IOこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- ウェーブ vs デクスト: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- Wave vs Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- ウェーブ vs シンダーこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- ウェーブ vs イージー・エンド: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- Wave vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- ウェーブ vs セージ: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- Wave vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- Wave vs Quickenどちらも個人向け財務ツールですが、こちらの方がより詳細な投資追跡機能を備えています。一方、こちらはよりシンプルです。

- Wave vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- Wave vs Expensifyこれはビジネス経費管理ツールです。もう1つは、個人の経費追跡と予算管理のためのツールです。

- Wave vs QuickBooks: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- Wave vs AutoEntry: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- Wave vs FreshBooks: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- Wave vs. NetSuite大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

Synder と Wave の主な違いは何ですか?

Synderは複数の販売拠点をつなぐのに非常に優れています。Waveは基本的な会計と請求書処理に優れています。複数の販売方法がある場合は、Synderの方が適しているかもしれません。

Wave 会計は完全に無料ですか?

Waveには無料プランがあります。請求書の発行と売上金の追跡は可能ですが、給与計算など、より多くの機能を利用したい場合は追加料金が必要です。

Synder は私のオンライン ストアに接続できますか?

はい、Synderは多くのオンラインストアや決済システムに接続できます。Synderを使えば、自分で操作しなくても、すべての売上を一箇所で確認できます。

会計初心者にとって使いやすいソフトウェアはどれですか?

Waveは初心者に優しいと言われています。シンプルなデザインです。Synderはより多くの機能を備えているため、最初は少し複雑に感じるかもしれません。

Synder または Wave を使用するには大企業である必要がありますか?

いいえ、SynderとWaveはどちらも中小企業向けです。現在のビジネスの規模に関わらず、資金管理に役立ちます。