あなたは 仕事 請求書や取引の山に迷いを感じていませんか?

財務をきちんと管理するのは本当に頭の痛い作業ですよね?

まあ、あなたはラッキーです!

この記事では、2つの人気の 会計ソフトウェア オプション: Synder vs Sage。

さあ、始めましょう!

概要

私たちはSynderとSageの両方を詳しく調べました。

皆さんと同じように試してみました。

これにより、各人が何ができるかが分かりました。

今、それらを比較して、何が見つかったかをお伝えすることができます。

Synderは会計業務を自動化し、売上データをQuickBooks、Xeroなどとシームレスに同期します。ぜひ今すぐお試しください!

価格: 無料トライアルがあります。プレミアムプランは月額52ドルからです。

主な特徴:

- マルチチャネル販売同期

- 自動調整

- 詳細なレポート

600万人以上のお客様がSageを信頼しています。顧客満足度は100点満点中56点と高く、その堅牢な機能は実証済みのソリューションです。

価格: 無料トライアルをご利用いただけます。プレミアムプランは月額66.08ドルです。

主な特徴:

- 請求書発行

- 給与計算統合

- 在庫管理

Synderとは何ですか?

Synderについて話しましょう。

これは、さまざまなビジネス アプリが相互に通信できるようにするツールです。

あなたのお金の情報を必要な場所に移動するヘルパーのようなものだと考えてください。

これにより、多くの時間を節約できます。

また、私たちのお気に入りを探索してください シンダーの代替品…

私たちの見解

Synderは会計を自動化し、売上データをQuickBooksにシームレスに同期します。 ゼロなど。Synder を使用している企業は、平均して週 10 時間以上を節約していると報告しています。

主なメリット

- 自動販売データ同期

- マルチチャネル販売追跡

- 支払い調整

- 在庫管理統合

- 詳細な売上レポート

価格

すべての計画は 年払い.

- 基本: 月額52ドル。

- 不可欠: 月額92ドル。

- プロ: 月額220ドル。

- プレミアム: カスタム価格設定。

長所

短所

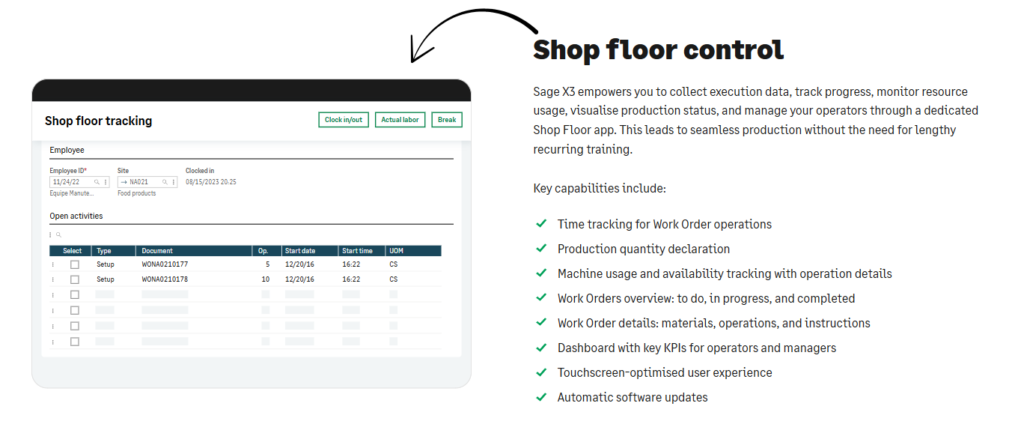

Sageとは何ですか?

Sageについて話しましょう。

それはしばらく前から存在しています。

多くの企業が利用しています。

お金の管理に役立ちます。

ビジネス用のデジタルノートブックのようなものだとお考えください。

また、私たちのお気に入りを探索してください セージの代替品…

私たちの見解

財務を大幅に強化する準備はできていますか? Sage ユーザーは、生産性が平均 73% 向上し、プロセス サイクル時間が 75% 短縮されたと報告しています。

主なメリット

- 自動請求と支払い

- リアルタイムの財務レポート

- データを保護する強力なセキュリティ

- 他のビジネスツールとの統合

- 給与計算および人事ソリューション

価格

- プロ会計: 月額66.08ドル。

- プレミアム会計: 月額114.33ドル。

- 量子会計: 月額198.42ドル。

- HR および給与計算バンドル: ニーズに基づいたカスタム価格設定。

長所

短所

機能比較

適切なツールを選択することは、お金にとって大きな意味を持ちます。

Synder と Sage の両方が何ができるかを詳しく調べました。

主な特徴を見れば、どれがあなたの 簿記 より簡単に。

1. 自動会計と同期

- Synderは自動化の最適な選択肢です 会計Shopify、eBay、Stripe、Squareなどのすべての販売チャネルをシームレスに接続できるように構築されています。 クイックブックス オンラインまたはXero。

- これ オートメーション 手作業がなくなり、帳簿のバランスが簡単に取れるようになります。

- Sage Business Cloud Accountingは銀行フィード機能を備えているものの、販売には手作業が必要になることが多い。 データ 複数のプラットフォームから。

2. マルチチャネル販売管理

- Synderはeコマースとマルチチャネル販売向けに開発されました。複数の場所からの売上、手数料、税金、返金、割引を1つの画面で追跡できます。

- これは大きな助けになります 中小企業 オーナーはどこでも売っています。

- Sageは会計機能を提供しているが、 即座に Synder のように、あらゆる販売チャネルから詳細な取引を取得します。

3. 同期モードのオプション

- Synder では、データを移動する方法として、毎日の合計を整理するサマリー同期と、すべての詳細をまとめるトランザクションごとの同期の 2 種類があります。

- この管理は会計士が帳簿をきれいに保つために不可欠です。

- Sage は通常、銀行取引の直接照合に重点を置いていますが、大量の販売の詳細を処理する際には同様の柔軟性が得られない可能性があります。

4. QuickBooksおよびXeroとの統合

- Synderはブリッジとして機能します。QuickBooks OnlineやXeroなどの主要な会計プラットフォームと直接連携し、データを移行します。

- Sage Intacctとも接続し、 ネットスイート.

- Sage Business Cloud Accounting はスタンドアロン システムですが、Sage Marketplace には互換性のある独自のアドオン セットがあります。

5. 手数料と税金の管理

- Synder は、プラットフォーム料金 (Stripe や PayPal 料金など) と税金を別々の費用として自動的に分離して記録します。

- これにより、最初から財務レポートの精度が大幅に向上します。

- Sage のような完全な会計システムでは、支払い固有の費用を正しく分離するために、追加の設定とルールが必要になる場合があります。

6. 履歴取引のインポート

- 新しいシステムに切り替える際には、古いデータが必要になります。Synderでは、初期設定時にワンクリックで、すべての販売チャネルから最大1年間の取引履歴をインポートできます。

- これは、既存のすべての会計データをすぐに新しいシステムに取り込むのに最適です。

- 古いデータを Sage 製品にインポートするには、追加の手順と手作業が必要になる場合があります。

7. 複数通貨のサポート

- 世界中で販売する場合は、複数通貨のサポートが必要です。Synderは、通貨を自動変換し、為替レートを記録することで、海外での販売に対応します。

- これにより、財務チームのコンプライアンスが維持されます。

- Sage も複数通貨機能を提供していますが、大量の電子商取引の通貨変換におけるシンプルさは Synder が優れている点です。

8. 収益認識

- サブスクリプションや支払い遅延のある企業にとって、収益認識は非常に重要です。Sage Intacctはこうした高度な財務機能で知られており、中規模企業で多く利用されています。

- Synder は、売上データを会計ソフトウェアに正確に取り込んで、そのソフトウェアの収益認識機能を使用できるようにすることに重点を置いています。

9. 経費管理

- Sage Business Cloud Accounting には経費管理機能が組み込まれており、コストを追跡したり領収書をアップロードしたりできます。

- Synder の主な業務は一般的な経費管理ではなく売上データですが、支払い処理手数料を経費として追跡します。

- 全体的な事業経費に関しては、Sage がより包括的な選択肢となることがよくあります。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

財務を効果的に管理するための適切なシステムを選択する際に、考慮すべき重要な点は次のとおりです。

- クラウド接続とアクセス:リアルタイムのアクセスを可能にするクラウド接続ソリューションが必要ですか? 報告 どこからでもアクセス可能でしょうか?それとも、デスクトップソフトウェアやデスクトップソリューションの方が、機能が限られているにもかかわらず、より効果的でしょうか? リモートアクセス? 外出先で使用する場合は専用のモバイル アプリを確認してください。

- 自動化と時間:時間を節約し、ミスを解決するために、高度な自動化機能を求めましょう。これには、支払いの簡単な照合や請求書の自動追跡などが含まれます。適切なソフトウェアには、手作業を削減する機能が搭載されています。

- Integration and Sales Channels: The best accounting software should connect with your bank and all your services, including payroll software and sales invoices. If you sell products, check if it can sync inventory automatically and issue low stock alerts across multiple sales channels.

- 拡張性と価格設定:価格は予算に合っていますか?システムは会社に合わせて拡張できますか? 中小企業 中規模企業向けですか?機能や追加ユーザーに対して隠れた高額な料金がかかるシステムは避けましょう。

- レポートと分析:貸借対照表やキャッシュフロー計算書など、必要なレポートを生成できますか?ほとんどの収益源やジョブステータスに関する詳細な分析情報を提供できますか?GAAPコンプライアンスをサポートするツールを探してください。

- 複雑さと会計チーム:ユーザーが一人の場合や小規模な企業の場合は、使いやすさを重視してください。社内に会計チームや財務チームがある場合は、ワークフロー管理機能や、Sage Universityやコミュニティハブなどの質問への回答など、利用可能な追加サポートを確認してください。

- 高度なニーズ: 給与計算、在庫管理、作業原価計算、製品バリエーションの作成、発注書の作成など、特定の機能が必要ですか?一部のソフトウェアでは、複雑なニーズに対応する専門的な会計機能を提供しています。

- データの安全性:システムがオンラインバックアップと強力なセキュリティを提供していることを確認してください。 安全 データについてストレスを感じる必要はありません。これは、お金に関する明確な真実を把握し、帳簿のバランスを保つための鍵です。

最終評決

この決定プロセスを通してあなたをサポートできたことを嬉しく思います。

私たちはSynderとSageの両方を詳しく調べました。

Synder は、大量のオンライン顧客と Clover のような多くの販売チャネルを持つ企業に最適です。

配送料や手数料などの複雑な取引データを自動的に会計ソフトウェアに直接同期してくれるので、非常に便利です。

これにより、多くの手作業が軽減され、未調整の差異が防止され、財務チームの時間が節約されます。

一方、Sage は高度なプロ会計機能と高度な財務レポート作成に最適です。

Synder は、オンライン ソースからの手動データ送信を排除することに優れています。

私たちは両方について明確な真実を伝えました。これにより、混乱を解消し、オンラインビジネスの背景に最適なツールを選択できます。

シンダーの詳細

- シンダー vs パズル io: Puzzle.ioは、スタートアップ向けに開発されたAI搭載の会計ツールで、バーンレートやランウェイといった指標に重点を置いています。Synderは、より幅広いビジネス向けに、マルチチャネルの販売データを同期することに重点を置いています。

- シンダー vs デクスト: Dextは、請求書や領収書からデータを取得・管理することに優れた自動化ツールです。一方、Synderは販売取引フローの自動化に特化しています。

- シンダー vs ゼロ: Xero はフル機能を備えたクラウド会計プラットフォームです。 シンダー Xero と連携して販売チャネルからのデータ入力を自動化し、Xero が請求書発行やレポート作成などのオールインワンの会計タスクを処理します。

- シンダー vs イージー・マンスエンド: Easy Month Endは、企業の月末処理プロセスを整理・効率化するために設計されたツールです。Synderは、日々の取引データフローの自動化に重点を置いています。

- シンダー vs ドサイト: Docytは、請求書の支払いや経費管理など、幅広い簿記業務にAIを活用しています。Synderは、複数のチャネルからの売上データと支払いデータの自動同期に重点を置いています。

- Synder vs RefreshMe: RefreshMeは個人の財務管理とタスク管理アプリケーションです。Synderはビジネス会計自動化ツールであるため、直接的な競合ではありません。

- シンダー vs セージ: Sageは、在庫管理などの高度な機能を備えた、長年実績のある総合的な会計システムです。Synderは、Sageなどの会計システムへのデータ入力を自動化する専用ツールです。

- Synder vs Zoho Books: Zoho Books は完全な会計ソリューションです。 シンダー さまざまな電子商取引プラットフォームから販売データをインポートするプロセスを自動化することで、Zoho Books を補完します。

- シンダー vs ウェーブ: Waveは、フリーランサーや小規模企業に多く利用されている、無料で使いやすい会計ソフトウェアです。Synderは、多チャネルで大量販売を行う企業向けに設計された有料の自動化ツールです。

- シンダー vs クイッケン: Quickenは主に個人向けの財務管理ソフトウェアですが、中小企業向けの機能もいくつか備えています。Synderは、特にビジネス会計の自動化を目的として開発されています。

- シンダー vs ハブドック: HubdocはDextに似たドキュメント管理およびデータキャプチャツールです。請求書や領収書のデジタル化に重点を置いています。Synderはオンライン販売と支払いデータの同期に重点を置いています。

- Synder vs Expensify: Expensifyは経費報告書と領収書を管理するためのツールです。Synderは販売取引データを自動化するためのツールです。

- Synder vs QuickBooks: QuickBooks は総合的な会計ソフトウェアです。 シンダー QuickBooks と統合して詳細な販売データを取り込むプロセスを自動化し、直接的な代替手段ではなく貴重なアドオンになります。

- Synder vs AutoEntry: AutoEntryは、請求書、領収書、領収書から情報を取得するデータ入力自動化ツールです。Synderは、eコマースプラットフォームからの売上データと支払いデータの自動化に重点を置いています。

- Synder vs FreshBooks: FreshBooksは、請求書作成に特化した、フリーランサーや小規模サービス企業向けに設計された会計ソフトウェアです。Synderは、複数のオンラインチャネルから大量の売上を上げている企業に最適です。

- Synder vs. NetSuite: NetSuiteは包括的なエンタープライズ・リソース・プランニング(ERP)システムです。Synderは、eコマースデータをNetSuiteのようなより広範なプラットフォームに同期するための専用ツールです。

もっと賢者

Sage が他の一般的なソフトウェアと比べてどうなっているかを知ることは役に立ちます。

以下に競合他社製品との簡単な比較を示します。

- セージ対パズルIO: どちらも会計を扱いますが、Puzzle IO はスタートアップ向けに特別に設計されており、リアルタイムのキャッシュフローとバーンレートなどの指標に重点を置いています。

- セージ vs デクスト: Dextは主に領収書や請求書からのデータ取得を自動化するツールです。簿記処理の高速化のため、Sageと連携して使用されることがよくあります。

- Sage vs Xero: Xeroは、特に中小企業にとってユーザーフレンドリーなクラウドベースのソリューションとして知られています。Sageは、ビジネスの成長に合わせてより強力な機能を提供できます。

- セージ対シンダー: Synder は、電子商取引プラットフォームと支払いシステムを Sage などの会計ソフトウェアと同期することに重点を置いています。

- Sage vs Easy Month End: このソフトウェアは、月末に帳簿を閉じるために必要なすべての手順を追跡するのに役立つタスク マネージャーです。

- セージ対ドサイト: Docyt は AI を使用して簿記を自動化し、手動によるデータ入力を排除することで、従来のシステムに代わる高度に自動化されたシステムを提供します。

- Sage vs RefreshMe: RefreshMeは会計業界の直接的な競合ではありません。従業員の評価とエンゲージメントに重点を置いています。

- Sage vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。そのすっきりとしたデザインと、他のZoho製品との強力な連携が高く評価されています。

- セージ vs ウェーブ: Wave は、基本的な会計機能と請求書発行機能を備えた無料プランで知られており、フリーランサーや小規模企業に人気があります。

- Sage vs Quicken: Quicken は、個人または小規模企業の財務に適しています。 セージ 給与計算や高度な在庫管理など、成長中のビジネス向けに、より強力な機能を提供します。

- Sage vs Hubdoc: Hubdoc は、Dext と同様に財務文書を自動的に収集して整理し、会計プラットフォームと統合できる文書管理ツールです。

- Sage vs Expensify: Expensifyは経費管理のエキスパートです。領収書のスキャンや従業員の経費精算書の自動化に最適です。

- Sage vs QuickBooks: QuickBooksは、中小企業向け会計ソフトの分野では大手企業です。ユーザーフレンドリーなインターフェースと幅広い機能で知られています。

- Sage vs AutoEntry: これは領収書や請求書からのデータ入力を自動化するツールです。会計ソフトのアドオンとして最適です。 セージ.

- Sage vs FreshBooks: FreshBooks は、シンプルな請求書発行と時間追跡に重点を置いており、フリーランサーやサービスベースのビジネスに特に適していています。

- Sage vs. NetSuite: NetSuite は、大企業向けの本格的な ERP システムです。 セージ さまざまな製品があり、このレベルで競合するものもありますが、NetSuite はより大規模で複雑なソリューションです。

よくある質問

Synder と Sage の主な違いは何ですか?

Synderは主に、オンラインストアと決済システムを会計システムに接続するのに役立ちます。売上と資金に関する情報を一元管理し、自動的に管理します。Sageは、ビジネスの財務のあらゆる側面を管理するための多くの機能を備えた、包括的な会計ソフトウェアです。

Synder は電子商取引ビジネスに適していますか?

はい、Synderはオンラインで商品を販売する場合に最適な選択肢となることが多いです。ShopifyやEtsyなどのプラットフォームと簡単に連携できるため、多くの手作業をすることなく、オンラインでの売上と支払いを簡単に追跡できます。

Sage はより複雑な会計を処理できますか?

Sageは通常、在庫の詳細な管理や詳細なレポートの取得といった機能が充実しています。より複雑な財務ニーズがある場合は、Sageの方が適しているかもしれません。

Synder は Sage よりも使いやすいですか?

多くの人がSynderのセットアップと使いやすさに満足しています。特にオンライン販売に重点を置いている場合はなおさらです。Synderは様々なものを素早く接続できるように作られています。Sageはより多くの機能を備えていますが、全ての機能を使いこなすには少し時間がかかるかもしれません。

全体的に見てどれが一番良い選択でしょうか?

あなたのビジネスニーズによって大きく異なります。オンラインで販売していて、自動化したいならSynderが最適です。多くの機能を備えた完全な会計システムが必要な場合は、Sageがおすすめです。自分に最適なものを検討してみてください。