Are you tired of piles of receipts and messy expense reports?

It can be a real headache trying to keep track of where your money is going, right?

ええ、ありますよ!

Two popular tools, Synder vs Expensify, aim to simplify expense management.

But which one is the better fit for you?

Let’s take a closer look and help you decide.

概要

We looked closely at both Synder and Expensify.

それぞれの機能を試してみました。

いかに簡単に使用できるかがわかりました。

これにより、それらを並べて比較することができました。

それぞれの最も優れた点をお見せしましょう。

Synderは会計業務を自動化し、売上データをQuickBooks、Xeroなどとシームレスに同期します。ぜひ今すぐお試しください!

価格: 無料トライアルがあります。プレミアムプランは月額52ドルからです。

主な特徴:

- マルチチャネル販売同期

- 自動調整

- 詳細なレポート

1,500万人以上のユーザーがExpensifyを信頼し、財務管理を簡素化しています。経費精算書の作成時間を最大83%節約できます。

価格: 無料トライアルがあります。プレミアムプランは月額5ドルからです。

主な特徴:

- SmartScanレシートキャプチャ

- 法人カード照合

- 高度な承認ワークフロー。

Synderとは何ですか?

Synderについて話しましょう。

これは、さまざまな 仕事 アプリは互いに通信します。

あなたのお金の情報を必要な場所に移動するヘルパーのようなものだと考えてください。

これにより、多くの時間を節約できます。

また、私たちのお気に入りを探索してください シンダーの代替品…

私たちの見解

Synderは会計を自動化し、売上データをQuickBooksにシームレスに同期します。 ゼロなど。Synder を使用している企業は、平均して週 10 時間以上を節約していると報告しています。

主なメリット

- 自動販売データ同期

- マルチチャネル販売追跡

- 支払い調整

- 在庫管理統合

- 詳細な売上レポート

価格

すべての計画は 年払い.

- 基本: 月額52ドル。

- 不可欠: 月額92ドル。

- プロ: 月額220ドル。

- プレミアム: カスタム価格設定。

長所

短所

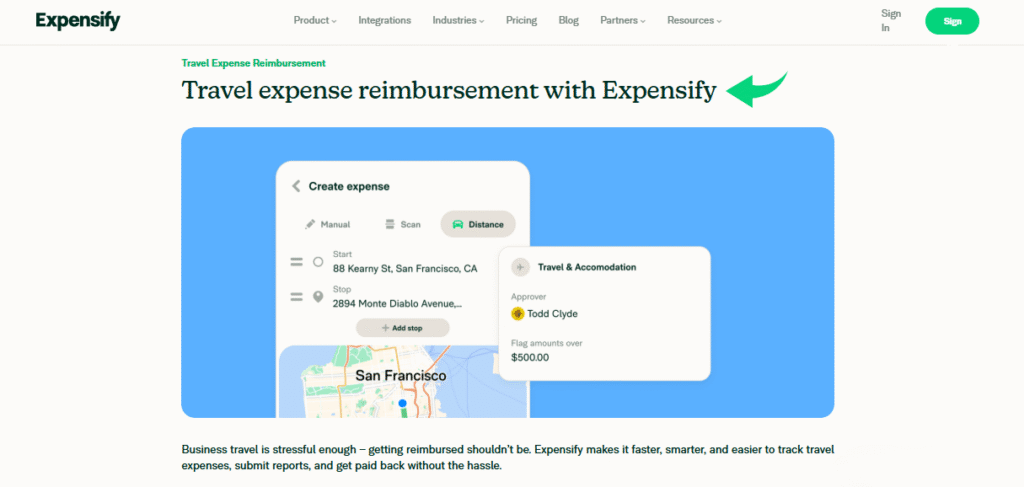

Expensifyとは何ですか?

さて、Expensifyについてお話しましょう。

これは、すべてのビジネス支出を追跡するのに役立つツールです。

お金がどこに行くのかを覚えているヘルパーのようなものだと考えてください。

レシートや銀行の書類から情報を取得できます。とても便利です!

また、私たちのお気に入りを探索してください Expensifyの代替品…

主なメリット

- SmartScan テクノロジーは領収書の詳細をスキャンし、95% 以上の精度で抽出します。

- 従業員は ACH 経由で 1 営業日以内に迅速に払い戻しを受けることができます。

- Expensify カードのキャッシュバック プログラムを利用すると、サブスクリプション料金を最大 50% 節約できます。

- 保証は提供されません。利用規約には責任が制限されていると記載されています。

価格

- 集める: 月額5ドル。

- コントロール: カスタム価格設定。

長所

短所

機能比較

Let’s dive into the details of what each tool offers.

We will look at nine key features to help you see how they are different and which one might work best for you.

1. Sales Channels & Transaction Syncing

Synder is built for ecommerce businesses.

It can connect to all your sales channels like Shopify, Etsy, eBay, Stripe, Square, and PayPal.

This allows it to bring in a high volume of sales データ, including historical transactions.

It can sync mode to keep everything up to date, which helps keep your books balanced in real time.

2. Expense Management

Expensify is a powerful tool for the expense management process.

You can take a photo of a receipt with the app. It will then capture the details in a few seconds.

This makes it easy for employees to submit their costs and manage expenses.

It also has the Expensify card to 作る things even faster.

3. Financial Automation & Bookkeeping

Synder’s main goal is automated 会計.

It helps finance teams with 簿記. It can automatically record sales and expenses from your sales channels.

Expensify is more about automating the expense management process.

It uses AI to simplify submitting and getting approval for reports.

4. Multi-Currency & Payouts

For businesses that sell in different countries, multi-currency support is important.

Synder handles this well. It also helps you track payouts from your different platforms and match them with your bank account.

Expensify also has multi-currency features to handle international spending.

5. 統合

Both platforms are compatible with many other programs.

Expensify can integrate with popular accounting systems like QuickBooks Online, ネットスイート, and Xero.

Synder is also compatible with these and more, including セージ 一致しました。

6. ユーザーエクスペリエンス

Synder is designed to run in the background.

You just do a quick setup, and then it handles things on its own.

Expensify is very easy to use for the user on a phone, web, or desktop.

You can capture a receipt with a quick photo and it is immediately ready.

7. Team Management & Approval

Expensify is perfect for finance teams who need to streamline their approval process.

A manager can review a report in a few seconds and approve it.

You can log mileage and track different projects.

You can also give access to contractors.

8. Real-Time Data & Insights

With Synder, you get real time data. It gives you insights into your sales.

You can see all the details from your sales channels.

Expensify also gives you real-time data for your expenses.

This lets a manager respond to requests right away.

9. Issue Resolution

Sometimes things can go wrong.

Synder can help you resolve issues with fees, taxes, refunds, and discounts.

This helps keep your balance sheets accurate.

Expensify can also help you resolve issues when an expense is blocked or has details that need to be fixed.

会計ソフトウェアを選択する際に注意すべきことは何ですか?

When you’re ready to switch from a manual system, it can be a lot of stress to pick the right tool.

The truth is, the best choice depends on what your organization needs.

Here are some key things to focus on to avoid mistakes and find the best connection.

- Look at the Expensify reviews and other product feedback to see what real employers and 会計士 think.

- Check if it can handle multi-channel sales. You want a tool that can reimburse employees and manage all your sales channels, from your website to Clover.

- A good tool helps keep your books balanced and supports reconciliation to prevent financial mistakes.

- For your team, the tool should be easy to use and not a stress. It should allow employees to capture a photo and file it in a flexible way.

- Make sure it handles subscriptions, shipping, taxes, and refunds automatically. This will help you achieve proper revenue recognition and gaap compliance.

- The tool should make it simple for a small number of users to submit expenses and get them approved with one click.

- Check if the tool allows you to add tags and categories to transactions. This helps with organization and getting expected insights.

- The best tools are compatible with what you already use. It should export data easily to your 会計 システム。

- See how it handles different types of expenses, like inventory or mileage. It should be flexible enough for your unique business needs.

- A connection to all your sales channels like Clover is key for an ecommerce business. It helps keep your inventory and sales records straight.

- Look for a tool that makes it easy for employees to get reimbursed for completing their expense reports. They should be able to file reports and have them stored on a single page.

- A tool should also let you set up triggers or rules. This means a report can be highlighted or approved based on certain details.

最終評決

So, which one should you pick: Synder or Expensify?

It’s easy to use for snapping receipts and managing reimbursements.

However, if you run a 中小企業 and need help with things like invoices, getting paid.

And keeping your books in order with your 会計 software, Synder might be the better fit.

Its ability to integrate and automate many financial tasks can save you a lot of time.

We think Synder offers a bit more for businesses that want to automate more of their money management.

We’ve looked closely at both, so we hope this helps you choose what works best for you!

シンダーの詳細

- シンダー vs パズル io: Puzzle.ioは、スタートアップ向けに開発されたAI搭載の会計ツールで、バーンレートやランウェイといった指標に重点を置いています。Synderは、より幅広いビジネス向けに、マルチチャネルの販売データを同期することに重点を置いています。

- シンダー vs デクスト: Dextは、請求書や領収書からデータを取得・管理することに優れた自動化ツールです。一方、Synderは販売取引フローの自動化に特化しています。

- シンダー vs ゼロ: Xero はフル機能を備えたクラウド会計プラットフォームです。 シンダー Xero と連携して販売チャネルからのデータ入力を自動化し、Xero が請求書発行やレポート作成などのオールインワンの会計タスクを処理します。

- シンダー vs イージー・マンスエンド: Easy Month Endは、企業の月末処理プロセスを整理・効率化するために設計されたツールです。Synderは、日々の取引データフローの自動化に重点を置いています。

- シンダー vs ドサイト: Docytは、請求書の支払いや経費管理など、幅広い簿記業務にAIを活用しています。Synderは、複数のチャネルからの売上データと支払いデータの自動同期に重点を置いています。

- Synder vs RefreshMe: RefreshMeは個人の財務管理とタスク管理アプリケーションです。Synderはビジネス会計自動化ツールであるため、直接的な競合ではありません。

- シンダー vs セージ: Sageは、在庫管理などの高度な機能を備えた、長年実績のある総合的な会計システムです。Synderは、Sageなどの会計システムへのデータ入力を自動化する専用ツールです。

- Synder vs Zoho Books: Zoho Books は完全な会計ソリューションです。 シンダー さまざまな電子商取引プラットフォームから販売データをインポートするプロセスを自動化することで、Zoho Books を補完します。

- シンダー vs ウェーブ: Waveは、フリーランサーや小規模企業に多く利用されている、無料で使いやすい会計ソフトウェアです。Synderは、多チャネルで大量販売を行う企業向けに設計された有料の自動化ツールです。

- シンダー vs クイッケン: Quickenは主に個人向けの財務管理ソフトウェアですが、中小企業向けの機能もいくつか備えています。Synderは、特にビジネス会計の自動化を目的として開発されています。

- シンダー vs ハブドック: HubdocはDextに似たドキュメント管理およびデータキャプチャツールです。請求書や領収書のデジタル化に重点を置いています。Synderはオンライン販売と支払いデータの同期に重点を置いています。

- Synder vs Expensify: Expensifyは経費報告書と領収書を管理するためのツールです。Synderは販売取引データを自動化するためのツールです。

- Synder vs QuickBooks: QuickBooks は総合的な会計ソフトウェアです。 シンダー QuickBooks と統合して詳細な販売データを取り込むプロセスを自動化し、直接的な代替手段ではなく貴重なアドオンになります。

- Synder vs AutoEntry: AutoEntryは、請求書、領収書、領収書から情報を取得するデータ入力自動化ツールです。Synderは、eコマースプラットフォームからの売上データと支払いデータの自動化に重点を置いています。

- Synder vs FreshBooks: FreshBooksは、請求書作成に特化した、フリーランサーや小規模サービス企業向けに設計された会計ソフトウェアです。Synderは、複数のオンラインチャネルから大量の売上を上げている企業に最適です。

- Synder vs. NetSuite: NetSuiteは包括的なエンタープライズ・リソース・プランニング(ERP)システムです。Synderは、eコマースデータをNetSuiteのようなより広範なプラットフォームに同期するための専用ツールです。

Expensifyの詳細

- Expensify vs Puzzleこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- Expensify vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- Expensify vs. Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- Expensify vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- Expensify vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- Expensify vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- Expensify vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- Expensify vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- Expensify vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- Expensify vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- ExpensifyとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- Expensify vs AutoEntry: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- Expensify vs FreshBooks: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- Expensify vs. NetSuite大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

What is the main difference between Synder and Expensify?

Expensify is mostly for tracking expenses and receipts. Synder does that too, but it also helps with invoices, payments, and connects to your 会計ソフトウェア to automate things.

Is Synder better for small businesses?

Can Expensify integrate with my accounting software?

Yes, Expensify can integrate with many accounting software options. This helps you keep your expense information in one place.

Does Synder help with getting paid faster?

Yes, Synder helps you create and send invoices. It can also remind customers to pay, which can help you get paid faster.

Which tool is easier to use for a startup?

Both tools try to be easy to use. Expensify is simple for tracking expenses. Synder might take a little more time to set up all its automation features, but it can save time 後で for a startup.