あなたは 中小企業 owner feeling overwhelmed by managing your finances?

Do you struggle with invoicing, expense tracking, and keeping your books in order?

あなたは一人じゃないよ!

In 2025, two popular options stand out: Sage and FreshBooks.

Both promise to simplify your financial life, but which one is truly the best fit for あなたの 仕事?

This article will break down Sage vs FreshBooks.

さあ、始めましょう!

概要

We tried both Sage and FreshBooks ourselves.

We used them to handle invoices, track money, and see what they were really like.

This hands-on test helped us compare them fairly.

600万人以上のお客様がSageを信頼しています。顧客満足度は100点満点中56点と高く、その堅牢な機能は実証済みのソリューションです。

価格: 無料トライアルをご利用いただけます。プレミアムプランは月額66.08ドルです。

主な特徴:

- 請求書発行

- 給与計算統合

- 在庫管理

請求書作成を簡素化し、より早く支払いを受け取りたいと思いませんか?3,000万人以上がFreshBooksをご利用いただいています。詳しくはこちらをご覧ください!

価格: 無料トライアルがあります。有料プランは月額2.10ドルからです。

主な特徴:

- 時間追跡

- 請求書発行

- 簿記

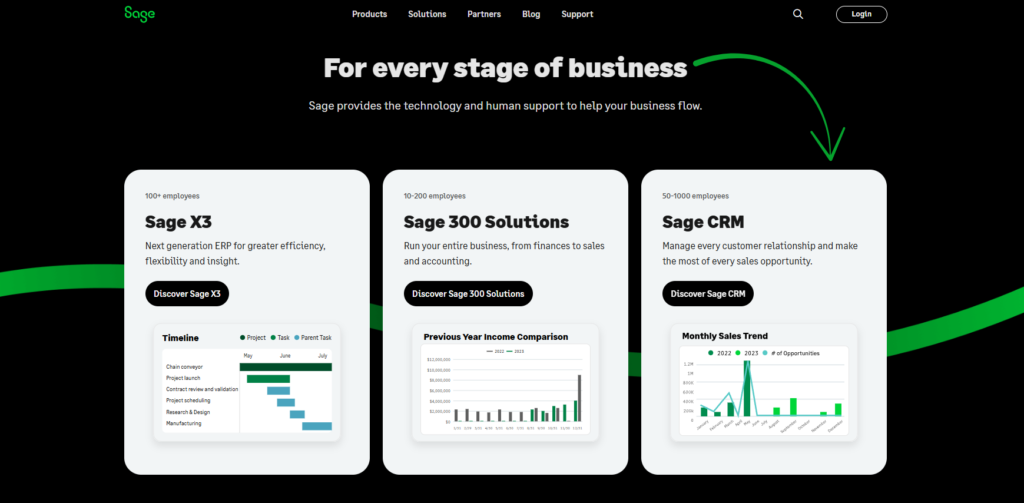

Sageとは何ですか?

Sageについてお話しましょう。Sageはしばらく前から存在しています。

多くの企業が利用しています。お金の管理に役立ちます。

ビジネス用のデジタルノートブックのようなものだとお考えください。

また、私たちのお気に入りを探索してください セージの代替品…

私たちの見解

財務を大幅に強化する準備はできていますか? Sage ユーザーは、生産性が平均 73% 向上し、プロセス サイクル時間が 75% 短縮されたと報告しています。

主なメリット

- 自動請求と支払い

- リアルタイムの財務レポート

- データを保護する強力なセキュリティ

- 他のビジネスツールとの統合

- 給与計算および人事ソリューション

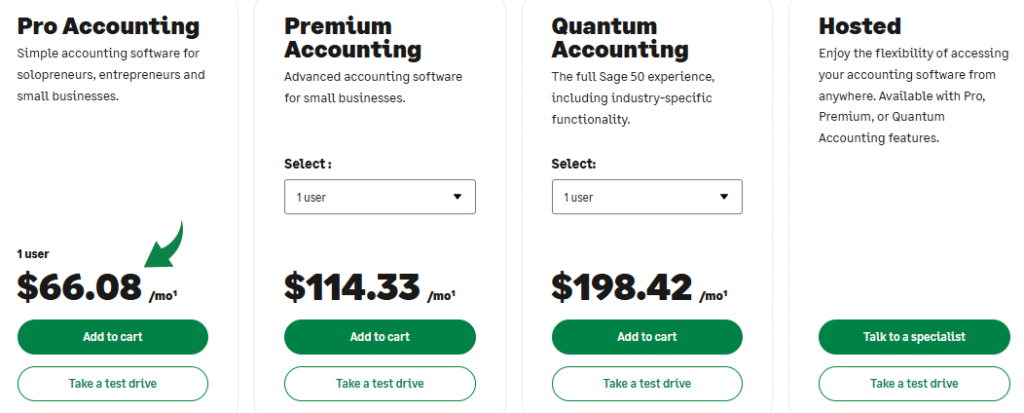

価格

- プロ会計: 月額66.08ドル。

- プレミアム会計: 月額114.33ドル。

- 量子会計: 月額198.42ドル。

- HR および給与計算バンドル: ニーズに基づいたカスタム価格設定。

長所

短所

FreshBooksとは何ですか?

さて、FreshBooks についてお話しましょう。

お金に関することのヘルパーとして考えてください。

走る人のために作られた 中小企業 フリーランスの仕事もします。

請求書(インボイス)を送信したり、入ってくるお金を追跡したり、お金がどこに行くのかを確認したりするのに役立ちます。

それは、ビジネスの財務を管理する簡単な方法を持っているようなものです。

また、私たちのお気に入りを探索してください Freshbooksの代替品…

私たちの見解

複雑な会計処理にうんざりしていませんか?3,000万社以上の企業がFreshBooksを信頼し、プロフェッショナルな請求書を作成しています。 会計ソフトウェア 今日!

主なメリット

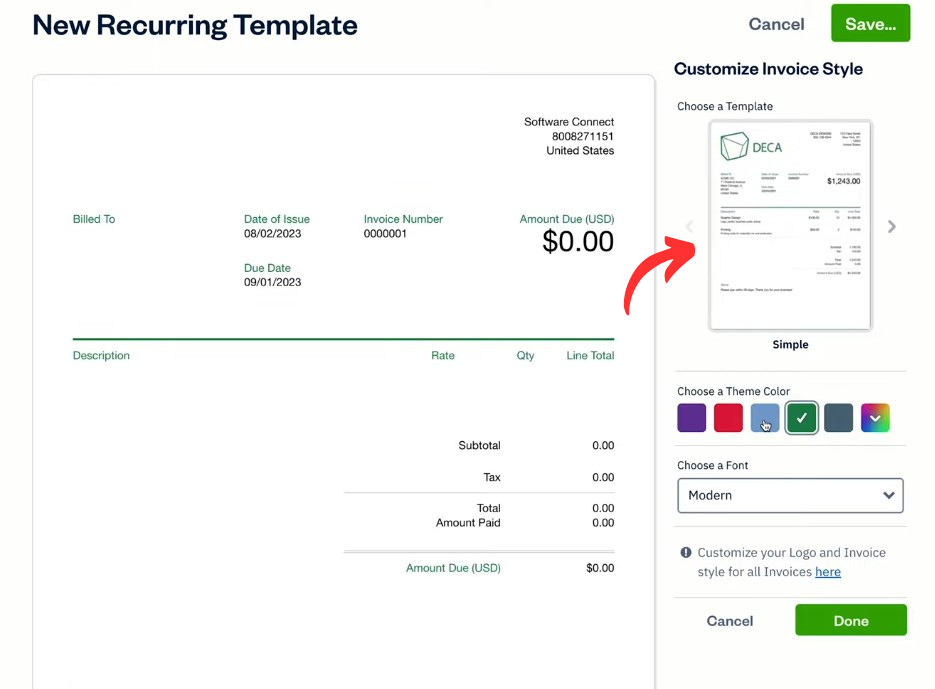

- プロフェッショナルな請求書作成

- 自動支払いリマインダー

- 時間追跡

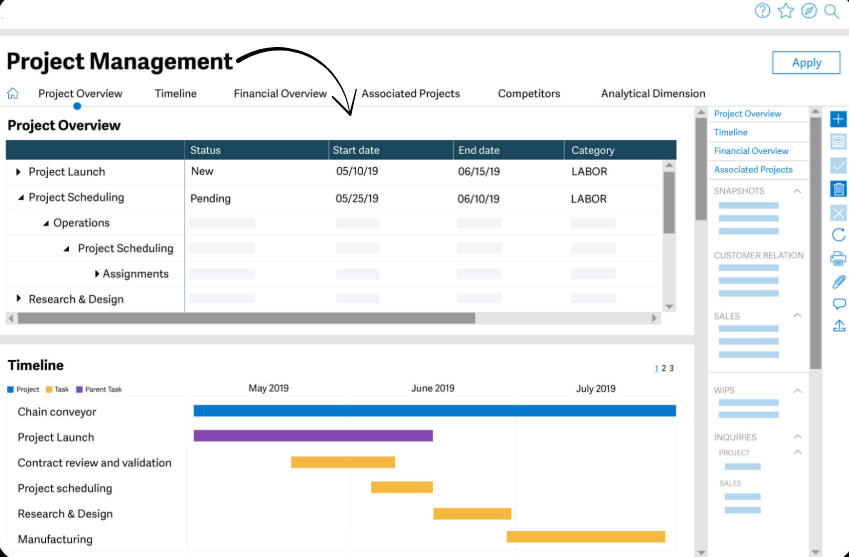

- プロジェクト管理ツール

- 経費追跡

価格

- ライト: 月額2.10ドル。

- プラス: 月額3.80ドル。

- プレミアム: 月額6.50ドル。

- 選択: カスタム価格設定。

長所

短所

機能比較

This comparison provides a brief overview of Sage and FreshBooks, two distinct 会計 ソフトウェア ソリューション。

We analyze how a feature-rich, scalable platform stacks up against an intuitive, invoice-focused solution to help 中小企業 経営者は、事業運営に適した会計ソフトウェアを見つけることができます。

1. Accessibility and Security

- セージ is a powerful desktop solution that has been updated with cloud connectivity. However, some of its older desktop software versions may have mobile access limitations and some potential drawbacks. It offers robust online backups and 安全 特徴。

- フレッシュブックス is a true cloud-based solution that is accessible from anywhere with an stable internet connection via its freshbooks mobile app. The platform provides a strong level of security for bank transfers, ach payments and all other transactions. The platform also helps manage your money with its recurring billing feature and offers a free version for a certain number of clients.

2. プラットフォームの範囲と対象者

- セージ 完全な 会計 platform designed for small business owners and medium sized businesses. The software includes a wide range of services, such as inventory and payroll, making it a robust desktop solution with cloud connectivity. It is a great クイックブックス online alternative.

- フレッシュブックス は 会計ソフトウェア solutions for managing business partners and self employed professionals. Its features are heavily geared toward project management, tracking time and invoicing, making it a top choice for a service-based business.

3. 請求と支払い

- セージ allows you to create professional sales invoices and manage purchase orders. It is built to improve cash flow and helps you manage all aspects of your sales.

- フレッシュブックス has robust invoicing features, including the ability to create professional invoices and set up recurring invoices. The freshbooks platform allows you to accept payments online via freshbooks payments and ach transfers, with its virtual terminal also allowing for in-person payments.

4. 自動化と効率化

- セージ automates many manual tasks, such as bank reconciliation and bill tracking, to help save time. Its workflow management features can be customized to streamline the entire accounting process, and it provides online backups for all existing accounting データ.

- フレッシュブックス 強力なツールです オートメーション, especially for invoicing. The software sends automated payment reminders and can convert estimates into invoices, reducing the need for manual tasks. The freshbooks dashboard provides a clear visual of these automations. It also offers the ability to track your billable time with a mobile device.

5. レポートと分析

- セージ 詳細な財務情報で知られる 報告 and real time reporting. It allows you to plan and generate detailed reports on various aspects of your personal business, from job costing to what products generate the most revenue. The software gives you the tools to analyze and evaluate your performance.

- フレッシュブックス offers a variety of accounting reports, such as profit and loss statements. It also has project profitability tracking to help you understand the cost and profit of only the projects you bill for. You can export any types of csv file of your reports for further analysis.

6. 在庫と給与

- セージ provides a robust inventory management system. You can create product variations, sync inventory automatically, and issue low stock alerts so you never miss a sale. Sage payroll is an optional add-on that offers comprehensive payroll software for your business.

- フレッシュブックス does not have a native inventory management system, which is a major difference. It also does not have built-in payroll software, but it does offer an integration with Gusto payroll for an additional user fee.

7. サポートとリソース

- セージ provides a wealth of educational material through sage university, its community hub, and direct support to answer questions. If a feature or process failed, a user can find resources and tutorials in its articles and other resources to resolve it. The sage marketplace can provide access to further assistance.

- フレッシュブックス provides great customer support and a comprehensive freshbooks faqs section. The positive freshbooks reviews often recommend freshbooks as a reliable option. The platform is designed to 作る it easy for customers to get help.

8. 価格とプラン

- セージ offers a range of pricing, with its desktop solution having higher prices and its sage business cloud accounting being more affordable. It has various add ons for payroll and inventory that come with additional costs.

- フレッシュブックス has four plans and is known for its per month pricing that scales with the number of billable clients. It does not offer a free version, but its lite plan and plus plan are considered to have a great cost to value ratio for フリーランサー. The select plan is a custom enterprise-level plan for large companies.

9. Comparison and Unique Functionality

- セージ, as a full accounting platform, offers advanced features for managing finances effectively, especially for businesses with inventory and complex sales. Its job statuses and cost codes are an example of its in-depth business tools.

- フレッシュブックス, by contrast, is designed for simplicity and efficiency. Its key features for freelancers and self employed professionals include unlimited estimates, tracking time, and the ability to accept online payments easily, making it a great alternative to quickbooks online and other accounting software. It also provides a flat fee for the Lite and Plus plans, so you always know your cost. Its client retainers and exclusive pos systems features are also great.

会計ソフトウェアを選ぶ際に注意すべき点は何ですか?

経費ソフトウェアを選択するときは、次の点を考慮してください。

- あなたのビジネス規模: Are you a one user or a larger team? Some tools fit better for different sizes. For a larger organization, you may need a system that supports an unlimited number of team members and allows for multiple accounting teams. Some versions of freshbooks accounting software offer three plans that scale from freelancers to larger companies, and some even include pro accounting features.

- モバイルアプリの品質: How good is the phone app? You’ll use a dedicated mobile app a lot for snapping receipts. The best software is available on both iOS & android devices, giving you the flexibility to work from any phone. Make sure the app works on your specific android デバイス.

- 承認ワークフロー: Can you set up who needs to approve what? The system should be able to handle unreconciled transactions and identify any unreconciled differences from bank transactions. This is key for managing accounts payable and for setting up late fees for overdue invoices.

- カスタマーサポート: Is help easy to get if you have problems? Check their support options. Some platforms provide exclusive access to support teams, which can be invaluable when you have unlimited number of questions. You should always be able to get help.

- 報告の必要性どのようなレポートが必要ですか?ソフトウェアがそれらのレポートを作成できることを確認してください。優れたシステムは、経費管理から財務状況全体まで、ビジネスのあらゆる側面に関するレポートを作成できる必要があります。優れたソフトウェアは、複式簿記を採用して正確性を確保し、連絡先フィールドや固有のレコードを使用してカスタムレポートを作成できます。

- 将来の成長ソフトウェアはビジネスの成長に合わせて拡張できますか?すぐに乗り換えたいとは思わないでしょう。プロジェクト管理機能など、将来的に役立つ機能を備えたプラットフォームを探しましょう。 時間追跡, and custom invoicing. These advanced payments features are crucial for a growing business. Be aware of any limited リモートアクセス or other drawbacks of a desktop solution.

最終評決

After looking at both, we pick FreshBooks for most small businesses.

Especially those that sell services.

It’s super easy to use, great for sending invoices, and tracks your time well.

If you want less stress with your money and quick ways to get paid.

FreshBooks is likely your best friend.

Sage is good too, especially if your business is getting bigger and needs very detailed reports.

But for many, FreshBooks just makes things simpler.

We tested both, and FreshBooks truly shines for its ease and focus on what small businesses need most.

Trust us, your books will thank you!

セージの詳細

Sage が他の一般的なソフトウェアと比べてどうなっているかを知ることは役に立ちます。

以下に競合他社製品との簡単な比較を示します。

- セージ対パズルIO: どちらも会計を扱いますが、Puzzle IO はスタートアップ向けに特別に設計されており、リアルタイムのキャッシュフローとバーンレートなどの指標に重点を置いています。

- セージ vs デクスト: Dextは主に領収書や請求書からのデータ取得を自動化するツールです。簿記処理の高速化のため、Sageと連携して使用されることがよくあります。

- Sage vs Xero: Xeroは、特に中小企業にとってユーザーフレンドリーなクラウドベースのソリューションとして知られています。Sageは、ビジネスの成長に合わせてより強力な機能を提供できます。

- セージ対シンダー: Synder は、電子商取引プラットフォームと支払いシステムを Sage などの会計ソフトウェアと同期することに重点を置いています。

- Sage vs Easy Month End: このソフトウェアは、月末に帳簿を閉じるために必要なすべての手順を追跡するのに役立つタスク マネージャーです。

- セージ対ドサイト: Docyt は AI を使用して簿記を自動化し、手動によるデータ入力を排除することで、従来のシステムに代わる高度に自動化されたシステムを提供します。

- Sage vs RefreshMe: RefreshMeは会計業界の直接的な競合ではありません。従業員の評価とエンゲージメントに重点を置いています。

- Sage vs Zoho Books: Zoho Booksは、大規模なビジネスアプリスイートの一部です。そのすっきりとしたデザインと、他のZoho製品との強力な連携が高く評価されています。

- セージ vs ウェーブ: Wave は、基本的な会計機能と請求書発行機能を備えた無料プランで知られており、フリーランサーや小規模企業に人気があります。

- Sage vs Quicken: Quicken は、個人または小規模企業の財務に適しています。 セージ 給与計算や高度な在庫管理など、成長中のビジネス向けに、より強力な機能を提供します。

- Sage vs Hubdoc: Hubdoc は、Dext と同様に財務文書を自動的に収集して整理し、会計プラットフォームと統合できる文書管理ツールです。

- Sage vs Expensify: Expensifyは経費管理のエキスパートです。領収書のスキャンや従業員の経費精算書の自動化に最適です。

- Sage vs QuickBooks: QuickBooksは、中小企業向け会計ソフトの分野では大手企業です。ユーザーフレンドリーなインターフェースと幅広い機能で知られています。

- Sage vs AutoEntry: これは領収書や請求書からのデータ入力を自動化するツールです。会計ソフトのアドオンとして最適です。 セージ.

- Sage vs FreshBooks: FreshBooks は、シンプルな請求書発行と時間追跡に重点を置いており、フリーランサーやサービスベースのビジネスに特に適していています。

- Sage vs. NetSuite: NetSuite は、大企業向けの本格的な ERP システムです。 セージ さまざまな製品があり、このレベルで競合するものもありますが、NetSuite はより大規模で複雑なソリューションです。

FreshBooksの詳細

- FreshBooks vs Puzzle IOこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- FreshBooks vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- FreshBooks vs Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- FreshBooks vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- FreshBooks vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- FreshBooks vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- FreshBooks vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- FreshBooksとZoho Booksの比較: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- FreshBooks vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- FreshBooksとQuickenの比較どちらも個人向け財務ツールですが、こちらの方がより詳細な投資追跡機能を備えています。一方、こちらはよりシンプルです。

- FreshBooks vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- FreshBooks vs Expensifyこれはビジネス経費管理ツールです。もう1つは、個人の経費追跡と予算管理のためのツールです。

- FreshBooksとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- FreshBooksとAutoEntryの比較: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- FreshBooksとNetSuiteの比較大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

Is FreshBooks good for product-based businesses?

While FreshBooks is great for service businesses, it can work for product-based ones too. It handles invoicing and expense tracking well, but its inventory management features are more basic compared to other software.

Can I switch from Sage to FreshBooks easily?

Switching is possible, but it takes some effort. You’ll need to export your data from Sage and import it into FreshBooks. It’s often best to do this at the start of a new financial year.

Do both Sage and FreshBooks have mobile apps?

Yes, both Sage and FreshBooks offer mobile apps. This lets you manage your finances on the go, whether you’re sending invoices or tracking expenses from your phone or tablet.

Which software is better for tax time?

Both can help with taxes by keeping your financial records organized. FreshBooks provides clear reports like profit and loss. Sage can offer more detailed reports that might be useful for complex tax situations.

How much do Sage and FreshBooks cost?

Both offer different pricing plans depending on the features you need and the size of your business. FreshBooks often has simpler, more predictable pricing, while Sage’s pricing can vary more based on specific modules.