どれが 会計ソフトウェア あなたのビジネスに最適なものは何ですか?

選択肢が多すぎると大変です!

Puzzle IO と FreshBooks は 2 つの人気のある選択肢です。

しかし、どれを選ぶべきでしょうか?

この記事では、Puzzle IO と FreshBooks を詳しく比較し、どちらがあなたに最適かを判断できるようにします。

概要

私たちは、Puzzle IO と FreshBooks の両方を調査し、テストするのにかなりの時間を費やしました。

実際の体験を通して、その機能や特徴を詳しく理解します。

この詳細な比較の基礎を形成し、各プラットフォームが提供するものを実際に理解できるようにします。

家計管理をシンプルにしませんか?Puzzle IOを使えば、毎月最大20時間も節約できます。その違いをぜひ実感してください。

価格: 無料プランをご利用いただけます。有料プランは月額42.50ドルからとなります。

主な特徴:

- 財務計画

- 予測

- リアルタイム分析

請求書作成を簡素化し、より早く支払いを受け取りたいと思いませんか?3,000万人以上がFreshBooksをご利用いただいています。詳しくはこちらをご覧ください!

価格: 無料トライアルがあります。有料プランは月額2.10ドルからです。

主な特徴:

- 時間追跡

- 請求書発行

- 簿記

Puzzle IOとは何ですか?

それで、Puzzle IOって? 会計 ソフトウェア。

かなりプロジェクトに重点を置いているようです。

それらを管理するためのツールがたくさんあります。

また、私たちのお気に入りを探索してください パズルIOの代替品…

私たちの見解

家計管理をシンプルにしませんか?Puzzle ioを使えば、月に最大20時間も節約できます。今すぐその違いを実感してください!

主なメリット

Puzzle IO は、ビジネスの方向性を理解する上で非常に役立ちます。

- 92%の ユーザーは財務予測の精度が向上したと報告しています。

- キャッシュフローをリアルタイムで把握できます。

- さまざまな財務シナリオを簡単に作成して計画できます。

- 財務目標についてチームとシームレスに共同作業を行います。

- 主要業績評価指標 (KPI) を 1 か所で追跡します。

価格

- 会計の基礎: 月額0ドル。

- 会計プラスの洞察: 月額42.50ドル。

- 会計プラス高度な自動化: 月額85ドル。

- 会計プラススケール: 月額255ドル。

長所

短所

FreshBooksとは何ですか?

さて、FreshBooksについて話しましょう。

それは 会計 ソフトウェアもそうです。しかし、どちらかというとサービスベースのビジネス向けだと感じます。

考える フリーランサー そしてコンサルタント。

また、私たちのお気に入りを探索してください FreshBooksの代替品…

私たちの見解

複雑な会計処理にうんざりしていませんか?3,000万社以上の企業がFreshBooksを信頼し、プロフェッショナルな請求書を作成しています。 会計ソフトウェア 今日!

主なメリット

- プロフェッショナルな請求書作成

- 自動支払いリマインダー

- 時間追跡

- プロジェクト管理ツール

- 経費追跡

価格

- ライト: 月額2.10ドル。

- プラス: 月額3.80ドル。

- プレミアム: 月額6.50ドル。

- 選択: カスタム価格設定。

長所

短所

機能比較

適切な会計ソフトウェアソリューションを選択することは、中小企業にとって大きな変化をもたらす可能性があります。 仕事 所有者。

重要なのは、どのプラットフォームがあなたの会社のニーズに本当に合致しているかを見つけることです。

時間を節約し、お金を管理するのに役立つ主要なツールを比較してみましょう。

1. AIを活用した自動化とエラー削減

- パズルIO: AI搭載のソルですu取引の分類のような面倒な作業に取り組むために構築されたシステムです。1 システムは、潜在的なエラーが発生する前にそれを捕捉するために、継続的に精度チェックを実行します。 インパクト バランスシート。これは オートメーション is a game-changer for startup founders and non-accountants.

- フレッシュブックス: FreshBooksは、定期的な請求書発行と経費追跡のためのスマートな自動化機能も提供しています。特に請求書発行におけるワークフローの簡素化に重点を置いており、ユーザーが手作業にかかる時間を節約しやすくなっています。

2. 財務分析と主要指標

- パズルIO: バーンレートやキャッシュランウェイなど、アーリーステージのスタートアップにとって重要な主要指標に関するリアルタイムのインサイトを提供します。これにより、創業者は現状をより正確に把握し、 作る 迅速な財務上の決定。

- フレッシュブックス: 堅実な 会計 損益計算書や売上税概要といったレポート。確かに有用ではあるものの、スタートアップの主要指標よりも、標準的な会計の観点から見た全体的な健全性に重点を置いています。

3. 収益認識

- パズルIO: スタートアップ向けに特別に構築されたこのツールは、Stripeサブスクリプションなどのソースから収益(発生額と現金)を自動認識します。これは複雑な機能であり、真の収益に関する明確なインサイトを提供し、スプレッドシートでの作業時間を短縮します。

- フレッシュブックス: 上位層では複式簿記を採用していますが、一般的にはよりシンプルな現金主義または修正発生主義のニーズに対応しています。Puzzle IOのような、サブスクリプション中心の自動化された収益認識機能は提供していません。.

4. プロジェクトの収益性の追跡

- パズルIO: プロジェクトで優秀 簿記詳細なプロジェクト追跡機能により、予算と経費に対するプロジェクトの真の収益性を把握できます。これは、プロジェクトごとに時間と材料を請求する場合に最適です。

- フレッシュブックス: プレミアムプラン以上では、プロジェクトの収益性追跡機能が提供されます。これは優れた機能ですが、コア設計はプロジェクトの詳細な財務分析よりも、クライアント管理と請求書発行に重点を置いています。

5. モバイルアクセシビリティ

- パズルIO: 最新の財務情報へのモバイルアクセスを提供し、創業者や共同創業者が外出先で主要な指標を確認できるようにします。.

- フレッシュブックス: FreshBooksのモバイルアプリは強力で、広く利用可能 iOS Androidデバイスにも対応しています。これにより、請求書の送信、勤務時間の追跡、経費の管理がインターネット接続のあるあらゆるモバイルデバイスから簡単に行えます。.

6. 固定資産と前払費用の管理

- パズルIO: 固定資産や前払費用といった複雑な項目の自動化機能が組み込まれています。これにより、会計担当者以外の方でもコンプライアンスを維持し、正確な状況把握が容易になります。

- フレッシュブックス: 会計士や人間が担当する、会計のこの特定の複雑な領域にはあまり焦点を当てていません。uすべてのジャーナルエントリ。

7. 銀行照合と取引

- パズルIO: 自動化された銀行調整と高度な取引分類機能により、銀行口座が常に最新の状態に保たれ、面倒な作業を回避できます。

- フレッシュブックス: Plusプラン以上では、銀行口座との照合機能をご利用いただけます。これにより、記録と銀行口座の一致を確認できます。また、経費の自動分類機能もご利用いただけます。

8. 買掛金管理のサポート

- パズルIO: 請求書の追跡と支払いを行うコア買掛金機能をサポートし、現金残高を予測する上で重要な、出金の完全なビューを提供します。

- フレッシュブックス: プレミアムプランから支払勘定の追跡が可能になり、 中小企業 所有者が請求書とベンダーを管理します。

9. 投資家および資金調達報告

- パズルIO: バーンレートやキャッシュランウェイなどの指標に関するレポートを即座に生成するため、将来についての議論を待つ必要がなく、スタートアップの創設者や投資家に最適です。

- フレッシュブックス: 優れた財務報告を提供しているが、特定の分野にはあまり焦点を当てていない。 報告 企業の初期段階で投資家から頻繁に要求される重要な指標です。

10. 料金プランと拡張性

- パズルIO: 同社の料金プランは、専門的な会計を求めるスタートアップ企業向けに作られていることが多く、コストは高いかもしれないが、最初から高度な機能を提供している。.

- フレッシュブックス: Lite プランや Plus プランなど、複数の料金プランが用意されており、フリーランサーから成長中のビジネスまで対応可能です。ただし、プロジェクトの収益性追跡などの機能には Premium プランが必要です。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

- FreshBooks のレビューをチェックして、中小企業の経営者が FreshBooks プラットフォームについて実際にどう思っているかを確認してください。

- さまざまな料金プラン (Lite、Plus、Premium、Select プラン) を確認し、毎月どれだけの課金対象クライアントを獲得できるかを確認します。

- カスタム請求書、定期請求書の送信機能、見積書を請求書に簡単に変換できるかどうかなどの請求書発行機能を評価します。

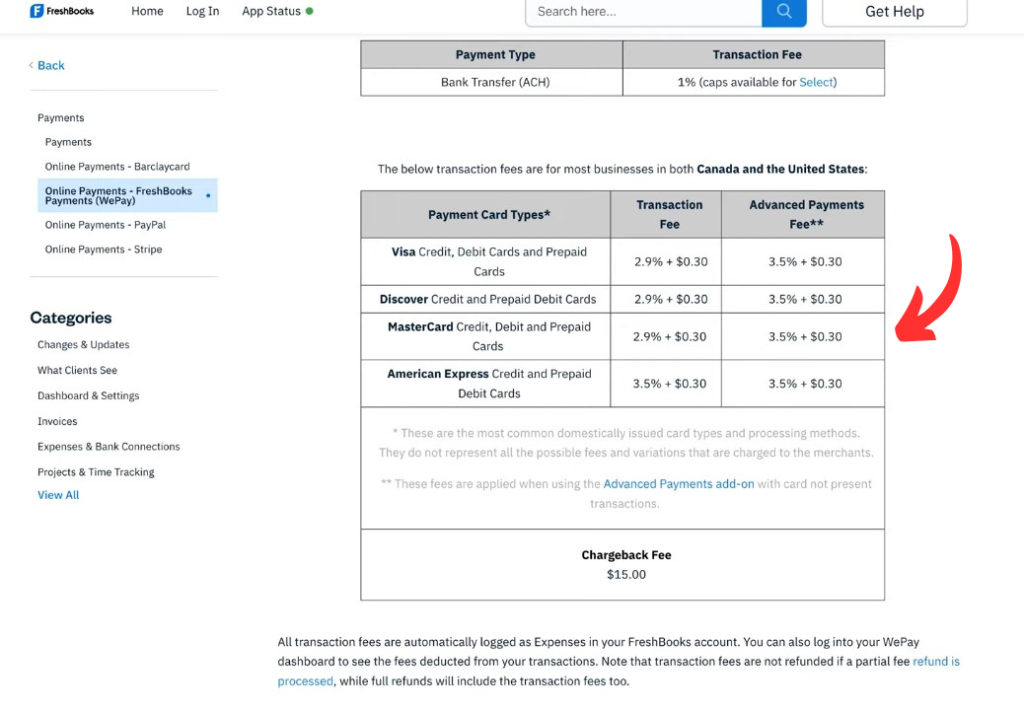

- プラットフォームで、オンライン支払い、前払い、クレジットカード、ACH 支払い、銀行振込などのさまざまな種類の FreshBooks 支払いを含む支払いを簡単に受け入れることができることを確認します。

- 対面販売する場合は、ソフトウェアが仮想端末または POS システムとの統合をサポートしているかどうかを確認してください。

- 組み込みのツールでプロジェクト管理と請求可能な時間追跡をどれだけうまく行えるか確認しましょう 時間追跡.

- Freshbooks ダッシュボードを調べて、必要なリアルタイムの洞察が一目でわかるかどうかを確認します。

- 支払いが遅れている顧客に延滞料金が自動的に請求されるかどうかを確認します。

- 選択したプランのチーム メンバーまたは追加ユーザー アカウントに対する制限を理解します。

- 見てください FreshBooksに関するよくある質問 決定を確定する前に、具体的な質問についてお問い合わせください。

- 特に下位層の場合、顧客サポートとその内容について問い合わせてください。

- Lite プランの課金対象クライアント数の制限で十分かどうか、または無制限の数のクライアントに対応する Plus プラン以上がすぐに必要になるかどうかを検討してください。

- Select プランでは排他的なアクセスが提供されることが多く、複数のビジネス パートナーを持つ企業に最適です。

- 他の会計ソフトウェアとの統合エコシステムを確認する。 クイックブックス オンライン、または現在使用しているその他のツール。

- クライアントの維持費や未調整取引の処理、エクスポートなどの機能に注目してください。 データ csv ファイル経由。

- 無料版または試用版を利用すると、月額定額料金を支払う前にコア機能をテストできます。

- プラットフォームが必要なレポートを提供することで、納税の準備に役立つことを確認してください。

- FreshBooks が自営業者としてのあなたのニーズを満たしていることを確認した後にのみ、他の人に FreshBooks を推奨してください。

最終評決

両方を詳しく検討した結果、私たちの最終的な考えは明確になりました。

If you are an individual or small service-based business, FreshBooks 会計ソフトウェア is the winner.

直感的なデザインで、プロフェッショナルな請求書や無制限の見積りを簡単に作成できます。

財務管理を支援し、税務コンプライアンスを簡素化するために設定されています。

FreshBooksは4つのプランを提供しており、下位の3つのプランでも、財務状況を整えるのに最適です。 簿記.

一方、Puzzle IO は、プロジェクトのみの追跡とスタートアップの詳細な財務分析に優れています。

FreshBooks は一般的に、財務の専門家ではない中小企業の経営者に適しています。

他のほとんどのソフトウェアよりも使いやすく、箱から出してすぐに簡単にセットアップできます。

スタートアップの財務をより深く調べるために、私たちはパズルを選択しましたが、堅実なプロジェクト管理と請求ツールを必要とするほとんどの企業にとって、FreshBooks は信頼できる選択肢です。

パズルIOの詳細

Puzzle IOを他の会計ツールと比較してみました。Puzzle IOの優れた機能を簡単にご紹介します。

- Puzzle IO vs Xero: Xeroは強力な統合機能を備えた幅広い会計機能を提供します

- パズルIO vs デクスト: Puzzle IOはAIを活用した金融分析と予測に優れています.

- パズルIO vs シンダー: Synder は、売上データと支払いデータの同期に優れています。

- パズルIO vs イージー・マンスエンド: Easy Month End は財務決算プロセスを簡素化します。

- Puzzle IO vs Docyt: Docyt は AI を使用して簿記タスクを自動化します。

- Puzzle IO vs RefreshMe: RefreshMe は、財務パフォーマンスのリアルタイム監視に重点を置いています。

- パズルIO vs Sage: Sage は、さまざまな規模の企業向けに堅牢な会計ソリューションを提供します。

- Puzzle IO vs Zoho Books: Zoho Booksは手頃な価格で会計サービスを提供しています CRM 統合。

- パズルIO vs Wave: Wave は中小企業向けに無料の会計ソフトウェアを提供しています。

- Puzzle IO vs Quicken: Quicken は個人および中小企業の財務管理で知られています。

- パズルIO ハブドック対: Hubdocは文書の収集とデータの抽出を専門としています.

- Puzzle IO vs Expensify: Expensify は包括的な経費報告と管理を提供します。

- Puzzle IO vs QuickBooks: QuickBooks は中小企業の会計に人気の選択肢です。

- Puzzle IO vs AutoEntry: AutoEntry は、請求書や領収書からのデータ入力を自動化します。

- Puzzle IO vs FreshBooks: FreshBooks は、サービスベースのビジネス請求書作成向けにカスタマイズされています。

- Puzzle IO vs NetSuite: NetSuite は、エンタープライズ リソース プランニングのための包括的なスイートを提供します。

FreshBooksの詳細

- FreshBooks vs Puzzle IOこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- FreshBooks vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- FreshBooks vs Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- FreshBooks vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- FreshBooks vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- FreshBooks vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- FreshBooks vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- FreshBooksとZoho Booksの比較: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- FreshBooks vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- FreshBooksとQuickenの比較どちらも個人向け財務ツールですが、こちらの方がより詳細な投資追跡機能を備えています。一方、こちらはよりシンプルです。

- FreshBooks vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- FreshBooks vs Expensifyこれはビジネス経費管理ツールです。もう1つは、個人の経費追跡と予算管理のためのツールです。

- FreshBooksとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- FreshBooksとAutoEntryの比較: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- FreshBooksとNetSuiteの比較大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

中小企業に最適な会計ソフトウェアは何ですか?

「ベスト」なものはニーズによって異なりますが、FreshBooks のようなクラウドベースのオプションは、使いやすさと小規模な業務に合わせた機能で人気があります。

これらのオンライン会計ソフトウェアオプションを使用して貸借対照表を表示できますか?

はい、Puzzle IO と FreshBooks はどちらも貸借対照表を生成する機能を提供していますが、機能はプランによって異なる場合があります。

クラウドベースの会計ソフトウェアは財務データに対して安全ですか?

評判の良いクラウドベースの会計ソフトウェアプロバイダーは、お客様の財務データを保護するためのセキュリティ対策に多額の投資を行っています。プロバイダーのセキュリティプロトコルをご確認ください。

これらのオンライン会計ソフトウェア オプションは他のビジネス ツールと統合されますか?

はい、Puzzle IO と FreshBooks はどちらもさまざまなビジネス アプリケーションとの統合を提供していますが、統合の範囲は異なります。

中小企業にとって最も習得しやすい会計ソフトウェアはどれですか?

FreshBooks はユーザーフレンドリーなインターフェースが高く評価されており、オンライン会計ソフトウェアを初めて使用する人にとって最適な選択肢となっています。