正しい選択 会計ソフトウェア feels like a huge task.

もしあなたが 作る the wrong choice?

A bad fit can cause real headaches.

You might waste precious time, miss tracking important expenses, or mess up your books.

That’s where we come in. We’re looking at two popular names: Puzzle IO vs Expensify.

概要

Through rigorous feature-by-feature analysis and hands-on testing of core functionalities like receipt scanning and report generation.

家計管理をシンプルにしませんか?Puzzle IOを使えば、毎月最大20時間も節約できます。その違いをぜひ実感してください。

価格: 無料プランをご利用いただけます。有料プランは月額42.50ドルからとなります。

主な特徴:

- 財務計画

- 予測

- リアルタイム分析

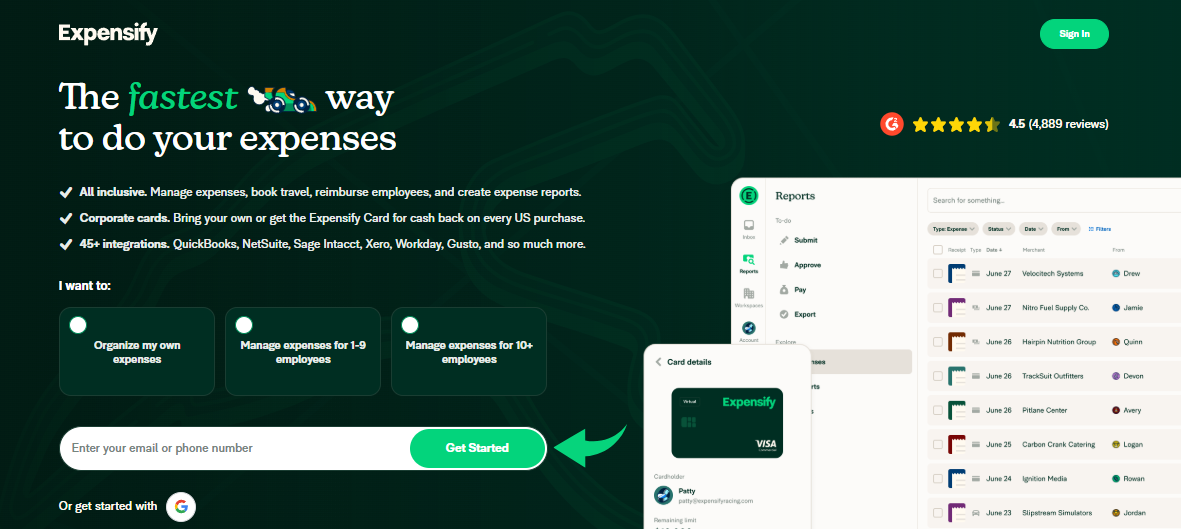

1,500万人以上のユーザーがExpensifyを信頼し、財務管理を簡素化しています。経費精算書の作成時間を最大83%節約できます。

価格: 無料トライアルがあります。プレミアムプランは月額5ドルからです。

主な特徴:

- SmartScanレシートキャプチャ

- 法人カード照合

- 高度な承認ワークフロー。

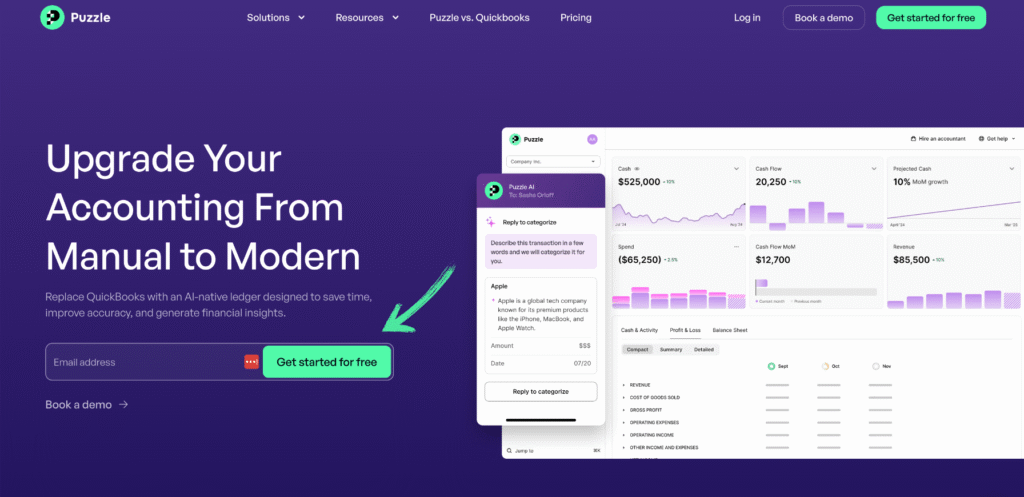

Puzzle IOとは何ですか?

Hey, so Puzzle IO, right? It’s an expense management tool.

It seems pretty focused on project costs. Good for keeping tabs on budgets.

また、私たちのお気に入りを探索してください パズルIOの代替品…

私たちの見解

家計管理をシンプルにしませんか?Puzzle ioを使えば、月に最大20時間も節約できます。今すぐその違いを実感してください!

主なメリット

Puzzle IO は、ビジネスの方向性を理解する上で非常に役立ちます。

- 92%の ユーザーは財務予測の精度が向上したと報告しています。

- キャッシュフローをリアルタイムで把握できます。

- さまざまな財務シナリオを簡単に作成して計画できます。

- 財務目標についてチームとシームレスに共同作業を行います。

- 主要業績評価指標 (KPI) を 1 か所で追跡します。

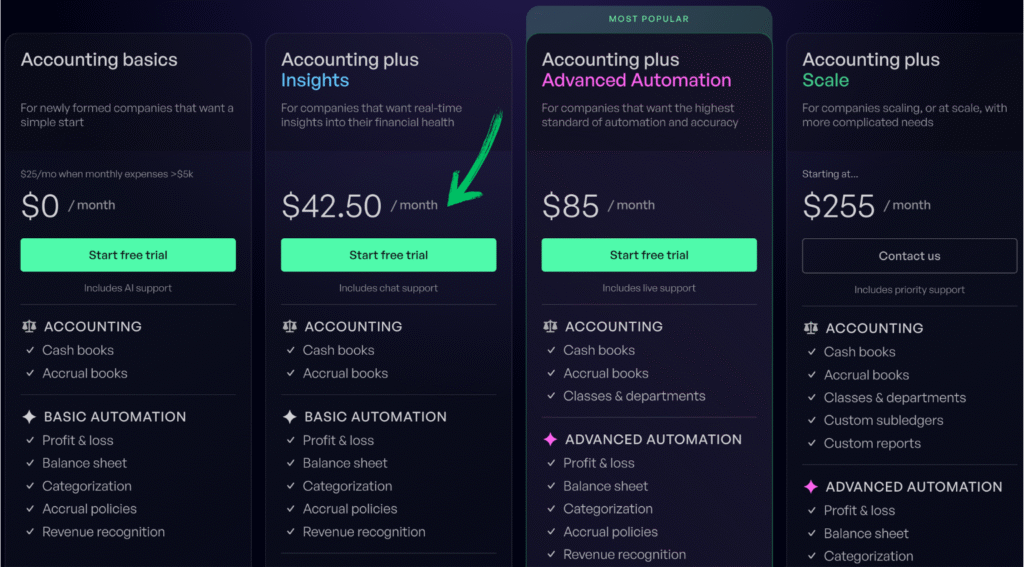

価格

- 会計の基礎: 月額0ドル。

- 会計プラスの洞察: 月額42.50ドル。

- 会計プラス高度な自動化: 月額85ドル。

- 会計プラススケール: 月額255ドル。

長所

短所

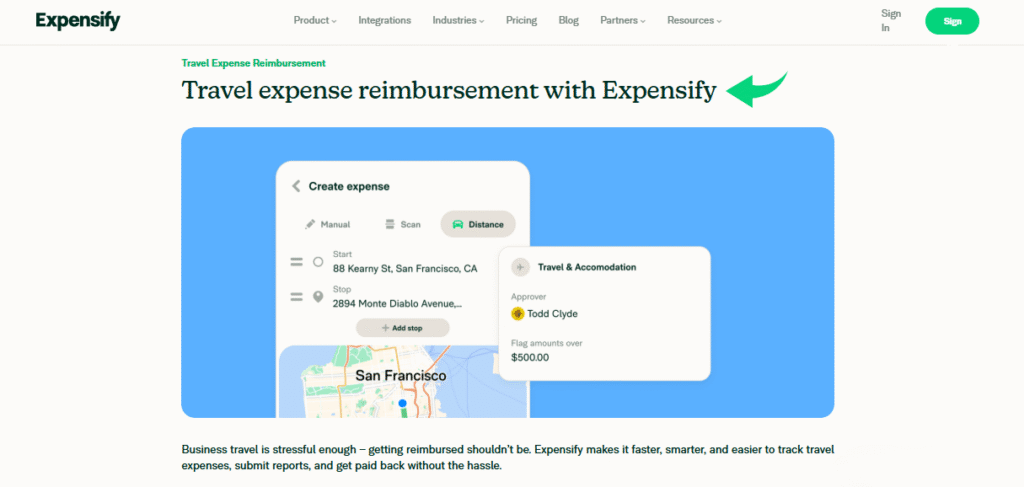

Expensifyとは何ですか?

Okay, so Expensify is another option.

It feels really strong on receipt handling. Their SmartScan seems pretty slick.

Good if you deal with lots of individual expenses.

また、私たちのお気に入りを探索してください Expensifyの代替品…

主なメリット

- SmartScan テクノロジーは領収書の詳細をスキャンし、95% 以上の精度で抽出します。

- 従業員は ACH 経由で 1 営業日以内に迅速に払い戻しを受けることができます。

- Expensify カードのキャッシュバック プログラムを利用すると、サブスクリプション料金を最大 50% 節約できます。

- 保証は提供されません。利用規約には責任が制限されていると記載されています。

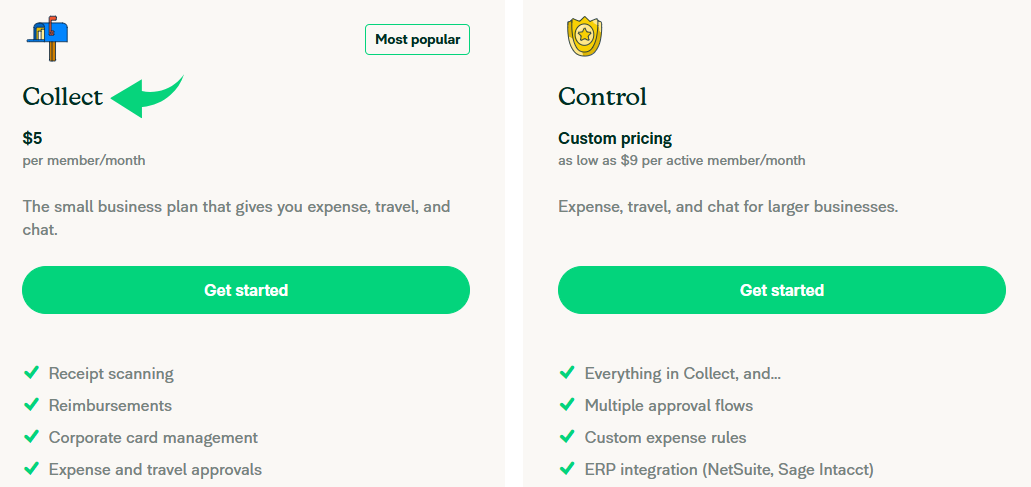

価格

- 集める: 月額5ドル。

- コントロール: カスタム価格設定。

長所

短所

機能比較

ナビゲート 中小企業 finances can be challenging.

This comparison highlights key features of Puzzle IO and Expensify.

Examining how each platform addresses 簿記, expense reports, and automation to help you simplify financial management.

1. Core Audience & Focus

- パズルIO is a game-changer built for early-stage startups and co-founder teams, focusing on up-to-date financial statements and key metrics right out of the box.

- エクスペンシファイ focuses on an efficient expense management process for employees and contractors, making it easy for them to file and for employers to reimburse.

2. Automated Bookkeeping

- パズルIO is designed for 自律的な bookkeeping, using AI to automate tedious tasks and provide an accurate picture of the current state of the company quickly.

- エクスペンシファイ オートメーション is concentrated on receipts and expense report creation, aiming to simplify the process for the user and their manager’s approval.

3. Startup Financial Health Metrics

- パズルIO provides startup founders with instant access to key metrics like cash 滑走路, burn rate, and MRR, offering clear insights into their financial health.

- エクスペンシファイ focuses on spending, helping companies control spending and reconcile the Expensify Card, but does not natively provide comprehensive startup metrics.

4. Complex Accrual Accounting

- パズルIO includes built-in accrual automation to handle complex items like revenue recognition and prepaid expenses automatically, which is vital for providing a true and accurate picture of revenue.

- エクスペンシファイ does not focus on the underlying accrual 会計 logic for things like fixed assets and deferred revenue; its strength is expense capture.

5. Expense Reporting Experience

- パズルIO 許可する for transaction categorization and expense tracking, but does not specialize in complex, multi-level expense management processes and reimbursement workflows.

- エクスペンシファイ makes it easy for the team to log mileage, snap a photo of a receipt in a few seconds, and get reimbursed quickly, which is a game-changer for employees.

6. AI-Powered Functionality

- パズルIO uses AI for smart transaction categorization, continuous accuracy checks, and streamlining the setup for non-accountants.

- エクスペンシファイ uses its SmartScan technology for receipt データ extraction and AI-powered automation to match transactions, making the process less time-consuming.

7. Focus on Financial Statements

- パズルIO’s primary goal is to generate real-time, audit-ready financial statements, helping startup founders stay up to date and prepare for investors or tax time.

- エクスペンシファイ is a pre-accounting tool that passes expense data to other tools like クイックブックス or Xero for final statement generation by a finance expert.

8. Corporate Card Management

- パズルIO integrates with various cards, focusing on getting data into the books quickly.

- エクスペンシファイ offers the Expensify Card, which links seamlessly to its system, automates reconciliation, and allows employers to set smart spending limits.

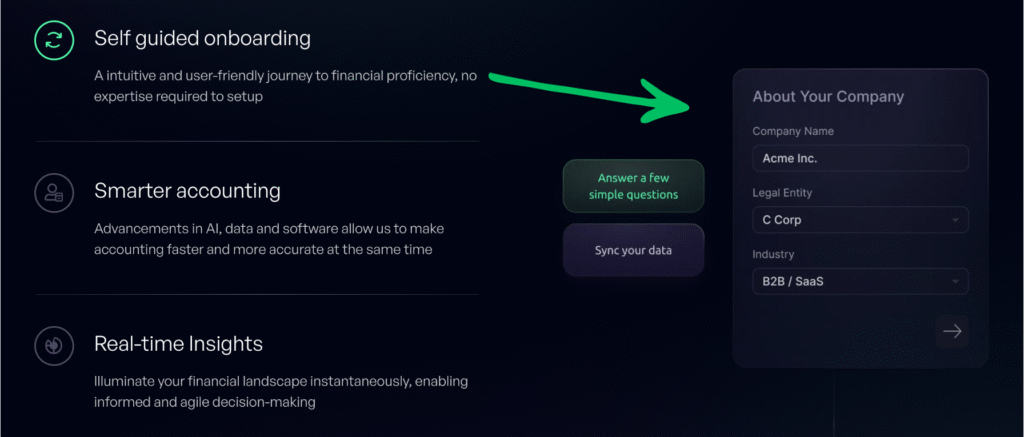

9. Ease of Setup

- パズルIO オファーs an easy setup and a modern interface, minimizing errors and making it simple for the co founder who may be a non 会計士.

- エクスペンシファイ also offers a quick and easy setup for the expense management process, which helps employees and contractors submit expenses and reports in less time.

会計ソフトウェアを選択する際に注意すべきことは何ですか?

- Look beyond basic Expensify reviews to see how the software handles the complete general ledger and organization.

- The software needs a reliable connection to your bank accounts to avoid manual data entry and reduce errors.

- Ensure the platform gives you a clear cash runway and not just a summary of past data—don’t wait for insights.

- The ability to manage expenses must be flexible, supporting phone, desktop, and web access.

- Check the speed of completing reports and the ease of exporting data to your clients or accountant.

- It should allow users to create and submit requests immediately, and managers to approve them quickly.

- The system must reliably respond to inputs and not be blocked by simple issues.

- All financial details should be securely stored in a digital pocket for easy review.

- The software should offer automated code assignment and customizable categories and tags.

- Your final thoughts should confirm that the system can scale with your future organization, moving you away from spreadsheets.

- A key insight is whether the platform is structured for a small number of users or a growing organization.

- An efficient system should trigger notifications when action is expected, simplifying the single-view page workflow.

- Consider why others chose Puzzle or a similar full-stack tool over a pure expense manager.

最終評決

Picking between Puzzle IO and Expensify depends on your main needs.

Expensify is tops for expense reports and receipts.

But Puzzle IO does more for overall money tracking, invoices, and connecting with payroll (even like QuickBooks).

Both are cloud-based.

If you want a wider view of your 仕事, money, and something that can grow.

Puzzle IO wins. We checked them out carefully.

So our advice should help you choose the right software to save time.

Neither doesn’t really offer free 会計 for most businesses.

パズルIOの詳細

Puzzle IOを他の会計ツールと比較してみました。Puzzle IOの優れた機能を簡単にご紹介します。

- Puzzle IO vs Xero: Xeroは強力な統合機能を備えた幅広い会計機能を提供します

- パズルIO vs デクスト: Puzzle IOはAIを活用した金融分析と予測に優れています.

- パズルIO vs シンダー: Synder は、売上データと支払いデータの同期に優れています。

- パズルIO vs イージー・マンスエンド: Easy Month End は財務決算プロセスを簡素化します。

- Puzzle IO vs Docyt: Docyt は AI を使用して簿記タスクを自動化します。

- Puzzle IO vs RefreshMe: RefreshMe は、財務パフォーマンスのリアルタイム監視に重点を置いています。

- パズルIO vs Sage: Sage は、さまざまな規模の企業向けに堅牢な会計ソリューションを提供します。

- Puzzle IO vs Zoho Books: Zoho Booksは手頃な価格で会計サービスを提供しています CRM 統合。

- パズルIO vs Wave: Wave は中小企業向けに無料の会計ソフトウェアを提供しています。

- Puzzle IO vs Quicken: Quicken は個人および中小企業の財務管理で知られています。

- パズルIO ハブドック対: Hubdocは文書の収集とデータの抽出を専門としています.

- Puzzle IO vs Expensify: Expensify は包括的な経費報告と管理を提供します。

- Puzzle IO vs QuickBooks: QuickBooks は中小企業の会計に人気の選択肢です。

- Puzzle IO vs AutoEntry: AutoEntry は、請求書や領収書からのデータ入力を自動化します。

- Puzzle IO vs FreshBooks: FreshBooks は、サービスベースのビジネス請求書作成向けにカスタマイズされています。

- Puzzle IO vs NetSuite: NetSuite は、エンタープライズ リソース プランニングのための包括的なスイートを提供します。

Expensifyの詳細

- Expensify vs Puzzleこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- Expensify vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- Expensify vs. Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- Expensify vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- Expensify vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- Expensify vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- Expensify vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- Expensify vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- Expensify vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- Expensify vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- ExpensifyとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- Expensify vs AutoEntry: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- Expensify vs FreshBooks: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- Expensify vs. NetSuite大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

What key features should software for small businesses include?

Essential features are invoicing, expense tracking, bank reconciliation, and 報告 to manage business finances effectively.

Can accounting software help with automation?

Yes, many platforms offer automation for tasks like data entry, bank feeds, and payment reminders, saving time.

Is there free accounting software suitable for small businesses?

Some free options exist with basic features, but they may lack advanced capabilities or scalability for growing businesses.

How can AI-powered features benefit small business accounting?

AI can automate categorization, detect anomalies, and provide insights, improving accuracy and efficiency in financial management.

Which type of accounting software is best for my small business?

The best software depends on your specific business needs, size, and complexity. Consider features, integrations, and scalability.