対処する 仕事 出費は本当に頭の痛い問題ですよね?

領収書を追跡して、 作る 数字の感覚、そして納税の時期にすべてがうまくいくことを願うこと。

これは、規模の大小を問わず、多くの企業に共通する問題です。

しかし、このプロセス全体をよりシンプルかつ迅速にできたらどうなるでしょうか?

私たちは、Expensify と AutoEntry のどちらがあなたのビジネスに最適かを判断するお手伝いをします。

概要

ExpensifyとAutoEntryをテストし、その機能、使いやすさ、そしてさまざまなニーズへの対応力を検証しました。 会計 タスク。

私たちの目標は、これらのツールがどのように機能するかを直接確認し、ビジネスにとって賢い選択をしていただくことです。

1,500万人以上のユーザーがExpensifyを信頼し、財務管理を簡素化しています。経費精算書の作成時間を最大83%節約できます。

価格: 無料トライアルがあります。プレミアムプランは月額5ドルからです。

主な特徴:

- SmartScanレシートキャプチャ

- 法人カード照合

- 高度な承認ワークフロー。

週10時間以上を手作業でデータ入力する手間を省きましょう。Autoentryが請求書処理時間を40%削減した方法をご覧ください。 セージ ユーザー。

価格: 無料トライアルがあります。有料プランは月額12ドルからです。

主な特徴:

- データ抽出

- レシートスキャン

- サプライヤー自動化

Expensifyとは何ですか?

では、Expensifyとは一体何でしょうか?経費管理に人気のツールです。

支出の追跡を非常に簡単にすることを目的としています。

領収書の写真を撮ることもできます。そこからすべてが自動的に処理されます。あらゆる規模のビジネス向けに設計されています。

また、私たちのお気に入りを探索してください Expensifyの代替品…

主なメリット

- SmartScan テクノロジーは領収書の詳細をスキャンし、95% 以上の精度で抽出します。

- 従業員は ACH 経由で 1 営業日以内に迅速に払い戻しを受けることができます。

- Expensify カードのキャッシュバック プログラムを利用すると、サブスクリプション料金を最大 50% 節約できます。

- 保証は提供されません。利用規約には責任が制限されていると記載されています。

価格

- 集める: 月額5ドル。

- コントロール: カスタム価格設定。

長所

短所

AutoEntryとは何ですか?

では、AutoEntryとは何でしょうか?これは自動化するために設計されたツールです。 データ エントリ。

ドキュメント用のスマート スキャナーと考えてください。

請求書や領収書から情報を取得します。

また、私たちのお気に入りを探索してください 自動入力の代替…

私たちの見解

簿記の時間を短縮しませんか?AutoEntryは年間2,800万件以上の書類を処理し、最大99%の精度を実現しています。今すぐ導入して、世界中の21万社以上の企業がデータ入力時間を最大80%削減している事例に加わりましょう!

主なメリット

AutoEntry の最大の利点は、退屈な作業時間を節約できることです。

多くの場合、ユーザーは手動によるデータ入力に費やす時間を最大 80% 削減できます。

データ抽出の精度は最大 99% を約束します。

AutoEntry では特に返金保証はありませんが、月額プランではいつでもキャンセルできます。

- データの精度は最大 99% です。

- すべての有料プランでユーザー数は無制限です。

- 請求書から完全な明細項目を取得します。

- レシートスナップ用の簡単なモバイルアプリ。

- 未使用のクレジットが繰り越されるまでの期間は 90 日間です。

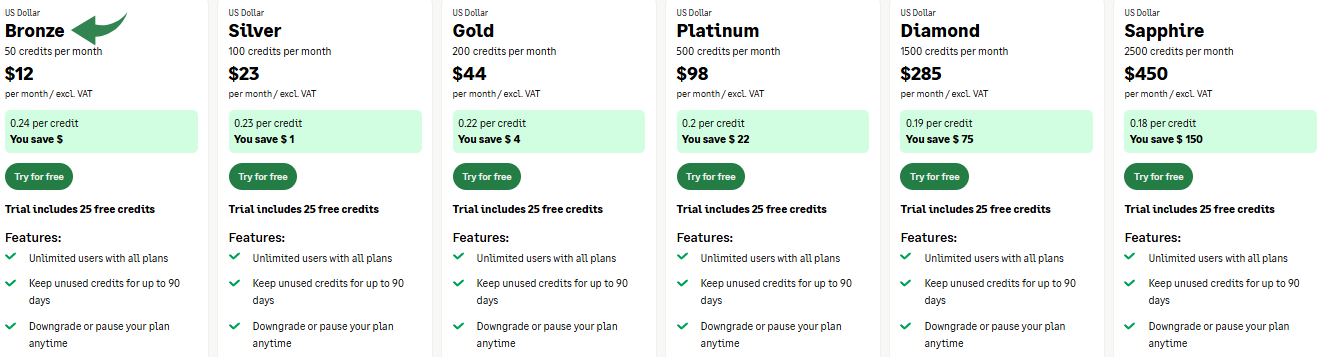

価格

- ブロンズ: 月額 12 ドル。

- 銀: 月額 23 ドル。

- 金: 月額44ドル。

- 白金: 月額98ドル。

- ダイヤモンド: 月額 285 ドル。

- サファイア: 月額450ドル。

長所

短所

機能比較

ドキュメントの世界をナビゲートする オートメーション 特定のタスク用に構築されたプラットフォームを選択する必要があります。

この比較では、経費報告の専門業者であるExpensifyと、データキャプチャエンジンであるAutoEntryを比較し、それぞれの機能の違いを詳しく説明して、最も重要な問題を解決します。 会計 課題。

1. 中核目的と焦点

- エクスペンシファイ 経費管理プロセス全体をシンプルにします。従業員が経費報告書を提出し、迅速に払い戻しを受けられるように設計された、ユーザー中心のツールです。雇用主のためのリアルタイムの経費管理プロセスと承認ワークフローに重点を置いています。

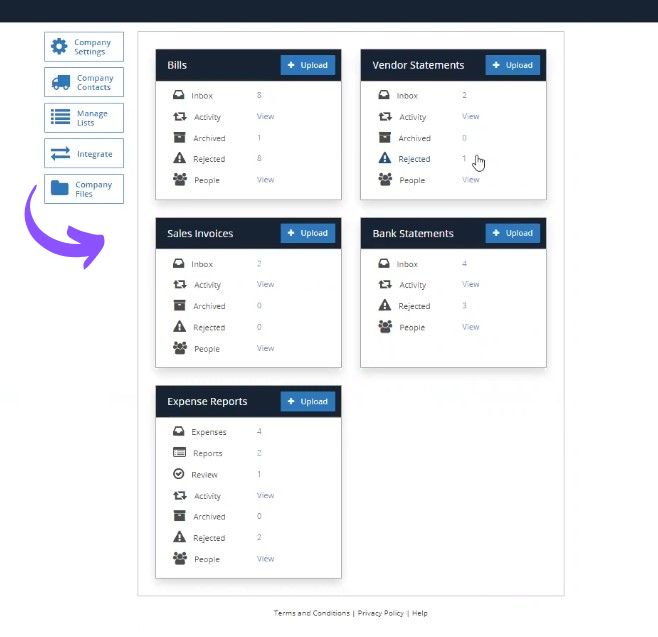

- 自動入力 書類や財務文書からデータを自動的に抽出するために構築された自動化セキュリティソリューションです。その目的は、 会計 手動によるデータ入力にかかる労力と時間を削減し、無制限のユーザーにシームレスな統合を提供します。

2. レシートキャプチャとデータ抽出

- エクスペンシファイ キャプチャ機能に優れています。ポケットの中のモバイルアプリでレシートを撮影するだけで、Expensifyが数秒でデータをログに記録する準備を整えます。これは、従業員がWebやモバイルで支出を即座に追跡するために不可欠です。

- 自動入力 光学文字認識技術を用いて、購入請求書、銀行取引明細書、その他の財務書類をアップロードします。取引の明細とすべての詳細を取得し、大量の書類を迅速に処理できるように設計されています。

3. ワークフローと承認プロセス

- エクスペンシファイ 堅牢な承認ワークフローを備えており、マネージャーまたは財務チームが申請を確認し承認することができます。このシステムにより、雇用主は従業員や請負業者に直接入金して払い戻しを行い、報告にリアルタイムで対応することができます。

- 自動入力の ワークフローは、データの自動エクスポートに重点を置いています。主にステージングプラットフォームとして機能し、データが自動的に抽出、コード化され、自動公開用にマーク付けされて直接公開されます。 会計ソフトウェアデータ入力プロセスが大幅に簡素化されます。

4. 価格と利用モデル

- エクスペンシファイ 月額料金は柔軟で、アクティブユーザー数や提出されたレポートの量に基づいて決定されます。Expensifyカードは、従業員向けの経費管理と精算ワークフローを自動化します。

- 自動入力 料金は使用量に基づいており、クレジットシステムで販売されます。プラットフォームはユーザー数に制限がなく、柔軟な価格設定を提供しているため、クライアントは毎月処理する必要がある書類や銀行取引明細書の量に応じて料金を支払うことができます。

5. 統合とデータフロー

- エクスペンシファイ 会計ソフトウェアと強力に連携 クイックブックスこの接続により、クライアントは経費報告書、走行距離記録、その他の詳細や取引を財務システムにエクスポートして税務申告を行うことができます。

- 自動入力の 強みは、多くの会計ソフトウェアソリューション( ゼロ または QuickBooks)。購入請求書と経費データを別のシステムに効率的に転送するために特別に構築されています。

6. セキュリティとオンラインの脅威

- エクスペンシファイ Expensifyはセキュリティを重視し、ユーザーデータと企業ポリシーを保護しています。場合によっては、セキュリティトリガーが発生する可能性があります。Expensifyは、電話またはチャットサポートを通じて、これらのセキュリティリクエストの解決に努めます。

- 自動入力 Cloudflareなどのセキュリティサービスを使用することで、オンライン攻撃から保護されています。特定の単語やフレーズ、SQLコマンドや不正なデータ、特定の単語を含むファイルの送信など、ブロックのトリガーとなる可能性のあるいくつかのアクションにより、実行したアクションがブロックされ、サイト所有者がページへのアクセスを許可する必要がある場合があります。その場合、IPアドレスとCloudflare Ray IDを記載したメールをサイト所有者にお送りください。

7. 特殊な機能

- エクスペンシファイ 堅牢である 旅行 プロジェクト管理も可能。走行距離を自動記録し、経費を特定のプロジェクトやカテゴリーにタグ付けすることで、複雑な経費管理が可能になります。経費報告書を迅速に管理するための専用ツールも提供しています。

- 自動入力の 正確なデータキャプチャに特化しています。請求書の全項目を処理し、過去の入力に基づいて取引を自動コード化できるため、簿記とのシームレスな統合が可能です。

8. ユーザーインターフェースとアクセス

- エクスペンシファイの シンプルで直感的なインターフェースは、モバイル端末での迅速な操作性を考慮して設計されています。ウェブとモバイルアプリの両方から、経費レポートや保留中の申請にリアルタイムでアクセスできます。

- 自動入力の Webインターフェースは、ドキュメントフローと抽出された詳細の編集に重点を置いています。ドキュメントのアップロードは簡単ですが、主なアクセスは、マネージャーまたは会計担当者が会計システムに送信する前にファイルをレビューすることに重点を置いています。

9. 管理と制御

- エクスペンシファイ 雇用主は、ポリシーを即座に作成・適用することで支出を管理できます。クレジットカードの利用限度額を設定したり、経費を精算前に承認したりできるため、財務部門の時間とコストを節約できます。

- 自動入力 仕入請求書と明細書のデータ入力を自動化することで、財務チームの時間と労力を削減します。このプロセスは、簿記業務を効率化し、最小限の確認で取引を適切なカテゴリに分類するように設計されています。

会計ソフトウェアを選ぶ際に注意すべき点は何ですか?

正しい選択 会計 ソフトウェアは機能の比較だけではありません。以下の重要なポイントを検討してください。

- 統合が鍵: QuickBooks、Xeroなどの既存の会計ソフトウェアと同期できますか? フレッシュブックス? シームレスな接続により時間を節約できます。

- 自動化機能: 強力な自動化機能を探してください。財務データにおける手作業によるデータ入力をどの程度削減できるでしょうか?

- ユーザーインターフェース: システムは毎日使いやすいですか?使いにくいインターフェースは作業の妨げになることがあります。

- スケーラビリティ: ソフトウェアはビジネスの成長に合わせて成長できますか?数年ごとにプラットフォームを切り替える必要はありません。

- サポート: どのようなカスタマーサポートが受けられますか?問題が発生した場合、タイムリーなサポートが不可欠です。

- 安全: 機密性の高い財務データはどのように保護されるのでしょうか? データセキュリティは最優先事項です。

- 報告: 必要なレポートは提供されていますか? 優れたレポートは貴重な洞察を提供します。

最終評決

では、どちらが勝つでしょうか?完全な経費管理を必要とするほとんどの企業にとって、Expensify が最適です。

完全な経費追跡と承認を提供します。

モバイルアプリは領収書を素早くスキャンするのに最適です。

しかし、請求書や領収書の自動データ入力が主なニーズである場合、特に 会計 取引量の多い企業。

AutoEntryは強力です。財務データをあなたの口座に取り込むのに本当に優れています。 会計 ソフトウェア。

私たちの洞察を信頼していただけるよう、両方を徹底的にテストしました。

Expensifyの詳細

- Expensify vs Puzzleこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- Expensify vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- Expensify vs. Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- Expensify vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- Expensify vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- Expensify vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- Expensify vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- Expensify vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- Expensify vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- Expensify vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- ExpensifyとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- Expensify vs AutoEntry: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- Expensify vs FreshBooks: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- Expensify vs. NetSuite大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

AutoEntryの詳細

- 自動入力 vs パズルこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- AutoEntry vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- AutoEntry vs Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- AutoEntry vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- 自動入力 vs 簡単月末処理: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- AutoEntryとDocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- AutoEntry vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- AutoEntry vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- AutoEntryとWave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- AutoEntryとQuickenどちらも個人向け財務ツールですが、こちらの方がより詳細な投資追跡機能を備えています。一方、こちらはよりシンプルです。

- AutoEntryとHubdocの比較: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- AutoEntry vs Expensifyこれはビジネス経費管理ツールです。もう1つは、個人の経費追跡と予算管理のためのツールです。

- AutoEntryとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- AutoEntryとFreshBooksの比較: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- AutoEntryとNetSuiteの比較大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

Expensify は中小企業に適していますか?

はい、Expensifyは一般的に非常に優れています 中小企業SmartScan 機能と自動経費報告により、財務追跡が簡素化され、小規模チームの時間を節約できます。

AutoEntry は QuickBooks で動作しますか?

はい、AutoEntryはQuickBooks(デスクトップ版とオンライン版の両方)とシームレスに統合されています。これにより、請求書や領収書のデータをQuickBooks会計ソフトウェアに直接自動転送できます。

Expensify と AutoEntry の両方を使用できますか?

一部重複する機能もありますが、コア業務において両方を同時に使用することは、一般的には不要であり、費用対効果も低くなります。会計・経費管理の主要ニーズに最適なものをお選びください。

これらのツールの OCR の精度はどのくらいですか?

ExpensifyとAutoEntryはどちらも高いOCR精度を誇ります。ExpensifyのSmartScanは領収書の読み取り精度が通常約95%ですが、AutoEntryは様々な種類の文書で98%に達することもあります。

領収書をデジタル化するだけならどちらが良いでしょうか?

領収書や請求書からデータをデジタル化して抽出することだけに焦点を当てているとします。その場合、自動データ抽出と高い精度に特化しているAutoEntryの方がわずかに有利かもしれません。