Avez-vous du mal à gérer votre argent ?

Beaucoup de gens ont du mal à suivre leurs dépenses.

Vous avez besoin d'une manière claire de visualiser vos revenus et vos dépenses.

Cet article vous aidera à comprendre deux outils populaires : Zoho Books et Quicken.

Découvrons lequel remportera la bataille pour votre tranquillité d'esprit financière !

Aperçu

Nous avons examiné de près Zoho Books et Quicken.

Nous avons testé leurs fonctionnalités.

Cela nous a permis de comprendre comment ils fonctionnent.

Maintenant, nous pouvons les comparer équitablement pour vous.

Avec son offre gratuite pour les entreprises dont le chiffre d'affaires annuel est inférieur à 50 000 $, Zoho Books constitue un excellent point d'entrée accessible.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 10 $/mois.

Caractéristiques principales :

- Portail client

- Facturation du projet

- Gestion des stocks

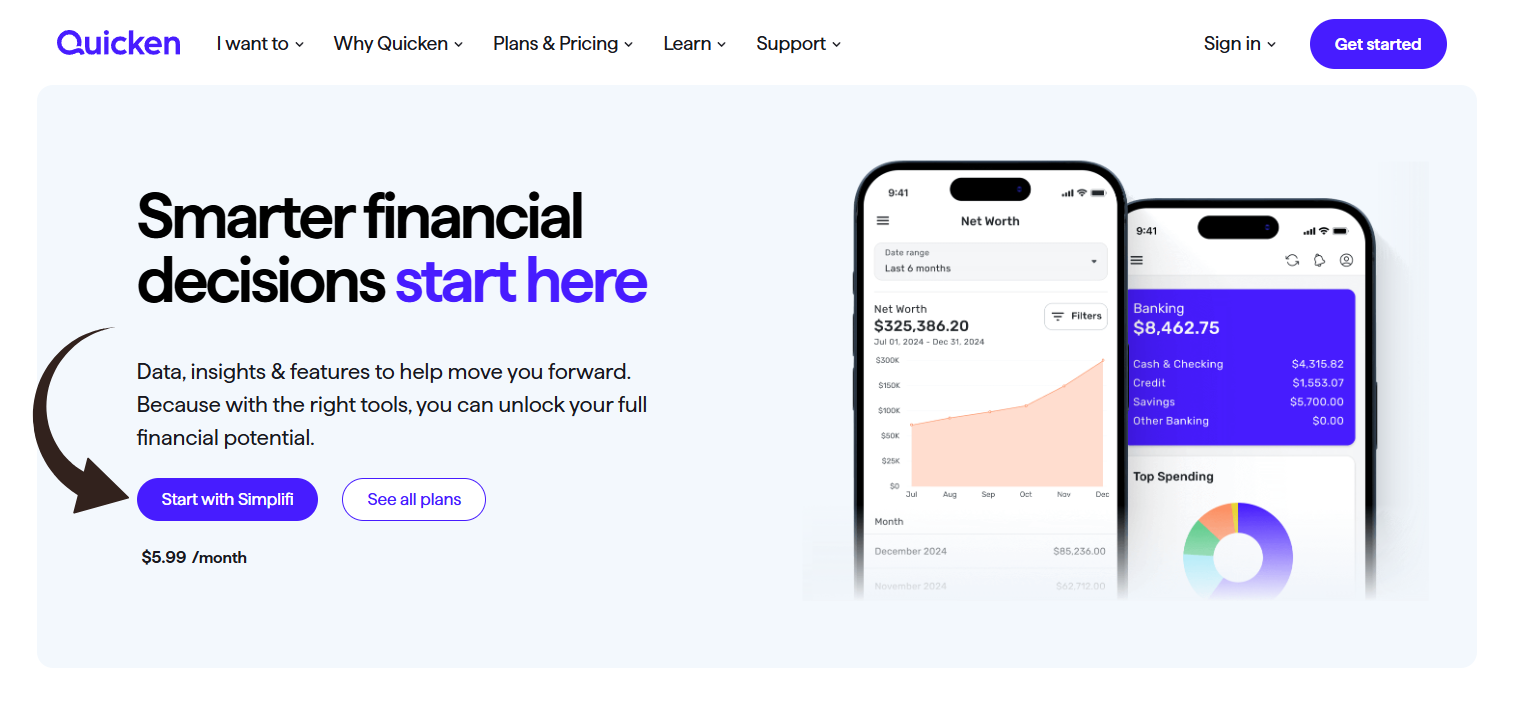

Envie de maîtriser vos finances ? Avec Quicken, connectez-vous à des milliers d’établissements financiers. Découvrez-en plus !

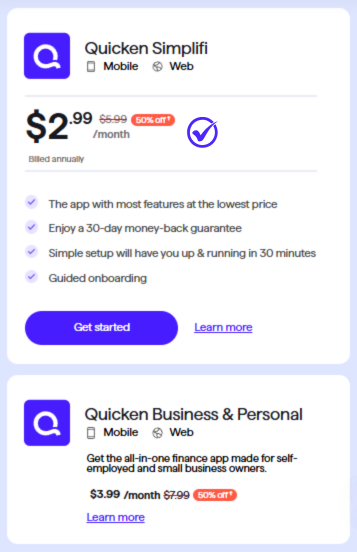

Tarification : Il propose un essai gratuit. L'abonnement premium est à 5,59 $/mois.

Caractéristiques principales :

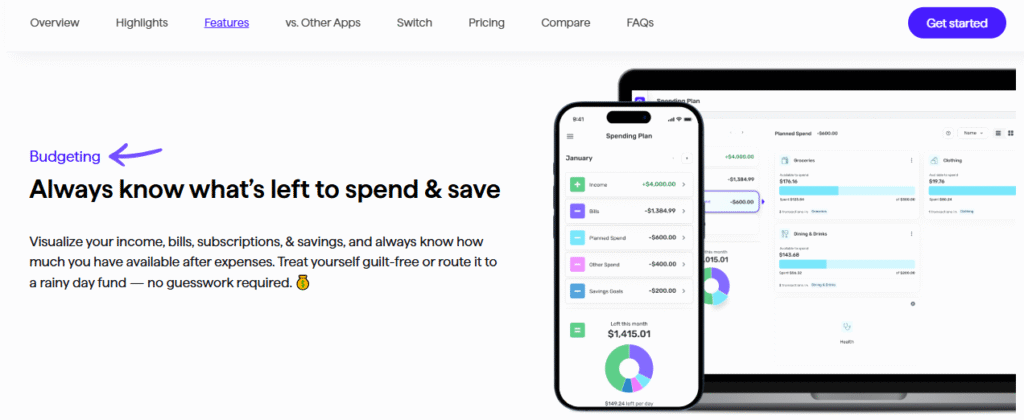

- Outils budgétaires

- Gestion des factures

- Suivi des investissements

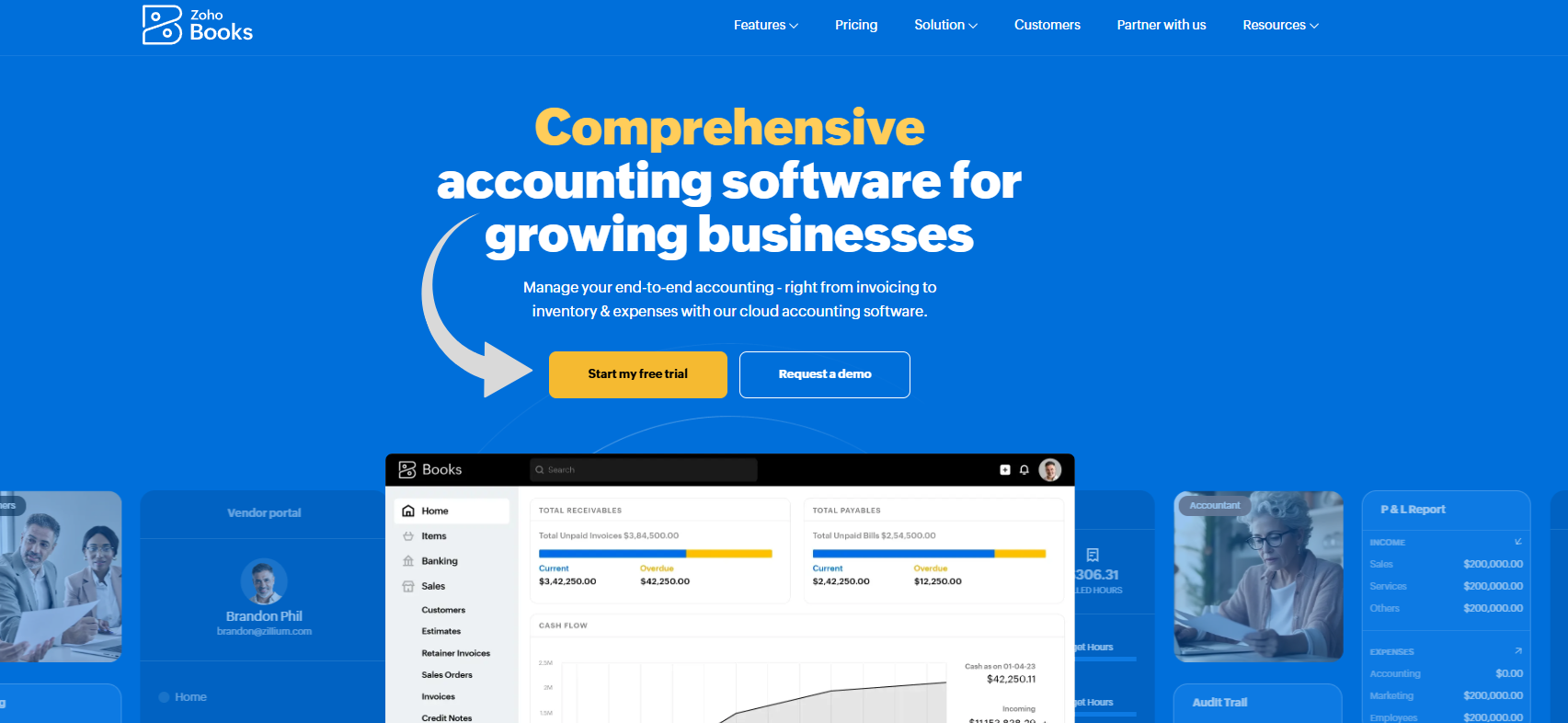

Qu'est-ce que Zoho Books ?

Vous êtes donc curieux de découvrir Zoho Books ?

C'est comme un outil utile pour gérer les finances de votre entreprise.

Cela vous aide à suivre vos revenus et vos dépenses.

Considérez-le comme votre comptable numérique !

Découvrez également nos favoris Alternatives à Zoho Books…

Principaux avantages

- Offre un forfait gratuit pour les entreprises dont le chiffre d'affaires est inférieur à 50 000 $.

- S'intègre à plus de 40 applications Zoho.

- Propose plus de 50 rapports financiers prédéfinis.

- Dispose d'un portail client qui augmente le recouvrement des paiements de 30 %.

- Aucune garantie.

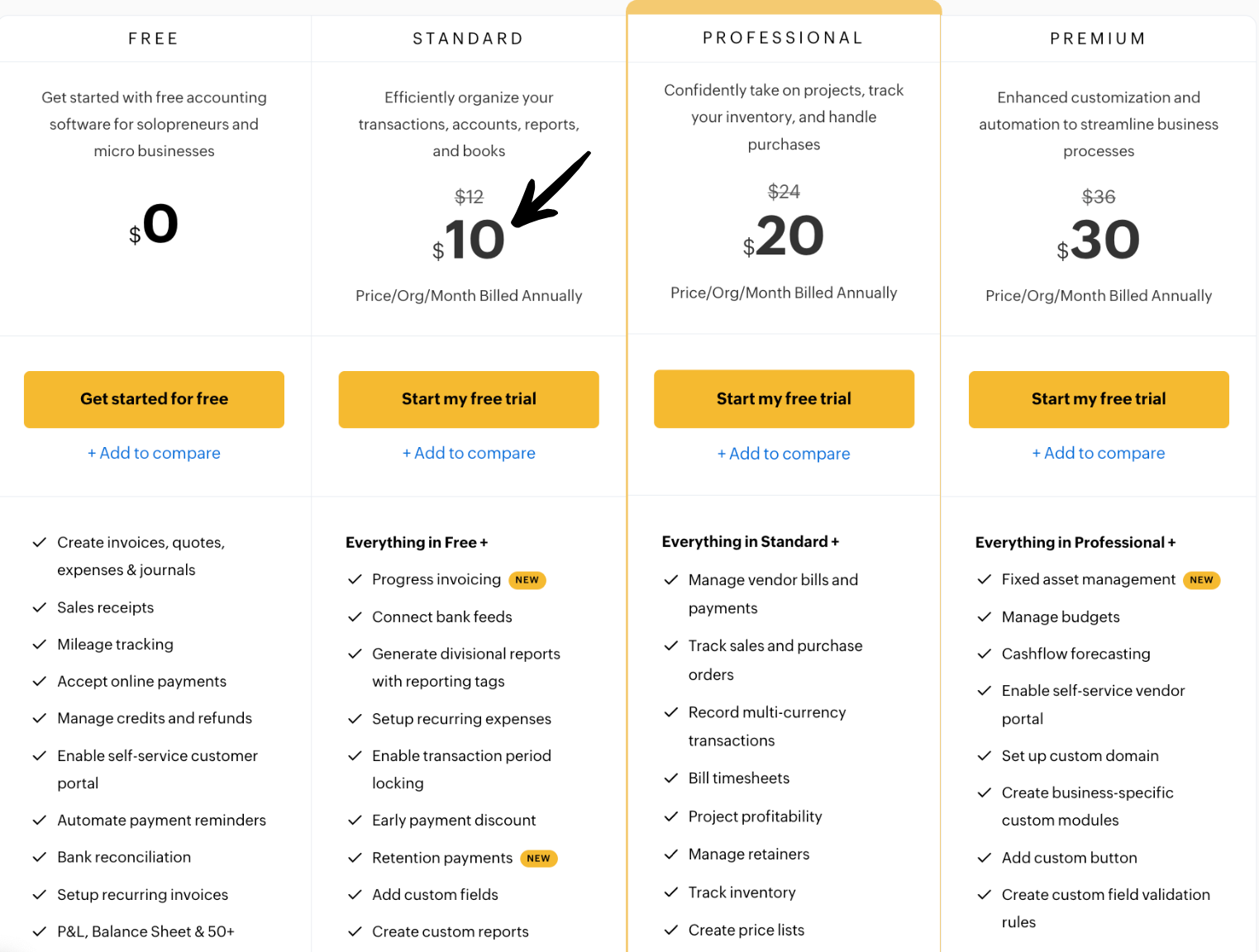

Tarification

- Gratuit: 0 $/mois.

- Standard: 10 $/mois.

- Professionnel: 20 $/mois.

- Prime: 30 $/mois.

Avantages

Cons

Qu'est-ce que Quicken ?

Alors, vous vous interrogez sur Quicken ?

C'est comme un outil qui vous permet de voir toutes vos informations financières au même endroit.

Considérez-le comme votre gestionnaire d'argent numérique.

Il peut vous aider à suivre vos comptes bancaires, vos factures et même vos investissements.

Plutôt pratique.

Découvrez également nos favoris Alternatives à Quicken…

Principaux avantages

Quicken est un outil puissant pour mettre de l'ordre dans vos finances.

Ils se targuent de plus de 40 ans d'expérience et leur produit est numéro 1 des ventes.

Leurs différents forfaits permettent de se connecter à plus de 14 500 institutions financières.

Vous pouvez également bénéficier d'une garantie de remboursement de 30 jours pour l'essayer sans risque.

- Compatible avec des milliers de banques et de cartes de crédit.

- Élabore des budgets détaillés.

- Suivi des investissements et du patrimoine net.

- Offre des outils de planification de la retraite.

Tarification

- Quicken Simplifi : 2,99 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Faire le bon choix entre comptabilité Le choix des logiciels est crucial pour les chefs d'entreprise.

Ce comparatif des fonctionnalités de Zoho Books et de Quicken vous aidera à déterminer lequel choisir. comptabilité Ce programme offre les fonctionnalités adéquates pour gérer efficacement votre santé financière et les finances de votre entreprise.

1. Fonctionnalités comptables de base

- Livres Zoho est un logiciel de comptabilité en ligne complet, conçu spécifiquement pour les petites entreprises. Il offre une gamme complète de fonctionnalités essentielles, notamment la création et l'envoi de factures professionnelles, le suivi des dépenses, la gestion des comptes clients et la génération de rapports financiers détaillés. Il comprend également un portail client et un portail fournisseur pour une collaboration optimale.

- AccélérerQuicken, initialement conçu comme un logiciel de finances personnelles, propose une version appelée Quicken Home & Business offrant certaines fonctionnalités de comptabilité d'entreprise. Sa principale fonction est de centraliser le suivi et la catégorisation des transactions financières personnelles et professionnelles. Ses fonctionnalités essentielles sont axées sur la gestion budgétaire, le suivi des factures et le contrôle des comptes d'investissement, avec une prise en charge plus limitée des opérations commerciales complètes.

2. Facturation et paiements

- Livres Zoho Ce logiciel excelle dans la facturation. Vous pouvez créer des factures, configurer des factures récurrentes et envoyer des rappels automatiques. Il s'intègre à diverses plateformes de paiement et prend en charge Zoho Payments pour faciliter les paiements en ligne et vous permettre d'être payé plus rapidement.

- Accélérer La plateforme Quicken Home & Business propose des fonctionnalités de facturation plus basiques. Elle permet aux utilisateurs d'envoyer des factures à leurs clients, mais ne dispose pas du même niveau de fonctionnalités avancées. automation ou la grande variété d'options de paiement en ligne comme Zoho Books.

3. Fonctionnalités d'automatisation

- Livres Zoho offre des fonctionnalités d'automatisation robustes pour réduire le travail manuel données Il simplifie la saisie et les tâches répétitives. Il propose des flux bancaires automatiques, le rapprochement des transactions, la comptabilisation automatisée des revenus et des flux de travail personnalisés. Ces outils d'automatisation contribuent à rationaliser les tâches comptables et à réaliser un gain de temps considérable.

- Le Accélérer La marque propose également des fonctionnalités d'automatisation. Elle télécharge et catégorise automatiquement les transactions des comptes bancaires et d'investissement connectés. Cette fonctionnalité est essentielle pour ceux qui souhaitent simplifier leur analyse financière et obtenir une vue d'ensemble complète de leurs finances sans intervention manuelle.

4. Dépenses et suivi des dépenses

- Livres Zoho Cette plateforme offre une fonctionnalité performante de suivi des dépenses. Les utilisateurs peuvent enregistrer leurs dépenses en téléchargeant leurs reçus, qui sont ensuite automatiquement numérisés pour créer les transactions correspondantes. Elle aide ainsi les chefs d'entreprise à gérer efficacement leurs factures fournisseurs et leurs dépenses récurrentes.

- Accélérer Quicken offre un suivi détaillé des dépenses professionnelles et personnelles. Le logiciel permet de catégoriser les dépenses des comptes professionnels et personnels, ce qui en fait un excellent choix pour ceux qui ont besoin de séparer leurs finances professionnelles et personnelles. Il est également parfaitement adapté au suivi des biens locatifs.

5. Tarification et forfaits

- Livres Zoho propose différents forfaits tarifaires, dont un forfait gratuit pour les entreprises dont le chiffre d'affaires annuel est plus faible. Cette version gratuite et un essai gratuit permettent petite entreprise Les propriétaires peuvent évaluer le logiciel. Les formules payantes (Standard, Professionnel, Premium et Elite) offrent une personnalisation poussée et des prix compétitifs.

- Accélérer Quicken est principalement vendu par abonnement. Les versions Quicken Deluxe et Quicken Premier sont destinées à la gestion des finances personnelles et aux investissements, tandis que Quicken Home & Business est la solution idéale pour les chefs d'entreprise. Le tarif est abordable pour un usage personnel, mais l'abonnement professionnel nécessite un téléchargement et un achat séparés.

6. Intégrations

- Livres Zoho s'intègre parfaitement aux autres produits de l'écosystème Zoho, tels que Zoho CRM et Zoho Inventory. Cela permet de disposer d'une plateforme d'entreprise connectée. Elle prend également en charge les intégrations tierces avec d'autres applications et logiciels d'entreprise.

- Accélérer Zoho Books se concentre moins sur les intégrations tierces. Ses fonctionnalités sont principalement autonomes, mais il peut se connecter à des milliers d'institutions financières pour le rapprochement bancaire automatique et le suivi des soldes de comptes.

7. Rapport

- Livres Zoho Il offre des analyses avancées et une vaste gamme de rapports financiers permettant aux chefs d'entreprise d'avoir une vision claire de leur santé financière. Vous pouvez analyser et générer des rapports détaillés sur tous les aspects, des ventes aux dépenses en passant par la conformité fiscale.

- Accélérer offre des offres solides reportage Les fonctionnalités de Quicken sont particulièrement appréciées pour la gestion des finances personnelles et des comptes d'investissement. De nombreux utilisateurs soulignent sa capacité à générer des rapports détaillés sur les dépenses, les budgets et les performances des investissements, ce qui constitue une fonctionnalité essentielle.

8. Accessibilité et plateforme

- Livres Zoho Il s'agit d'une plateforme cloud accessible via un navigateur web et une application mobile dédiée pour iOS et Android. Cela permet à plusieurs utilisateurs d'accéder à la plateforme et d'effectuer des tâches comptables depuis n'importe où, à condition de disposer d'une connexion internet stable.

- Accélérer est disponible sous forme de programme de bureau pour Windows et MacBien qu'une application mobile soit disponible, elle est complémentaire au logiciel de bureau principal. Ce dernier, Quicken, se télécharge et s'installe sur votre ordinateur, vous offrant ainsi un contrôle plus direct du programme.

9. Gestion et suivi des stocks

- Livres Zoho Ses formules payantes offrent des fonctionnalités robustes de gestion et de suivi des stocks. Il s'agit d'un atout majeur pour les entreprises qui vendent des produits et qui doivent gérer efficacement leurs niveaux de stock, leurs commandes et suivre leurs inventaires.

- Accélérer Quicken Business ne propose pas de gestion intégrée des stocks. Son objectif principal est la gestion des transactions et des soldes financiers, et non le suivi physique des marchandises. Cette distinction est essentielle et permet de différencier Quicken Business d'un simple outil de planification financière. Leader incontesté de la finance personnelle depuis des décennies, Quicken Business permet aux utilisateurs de gérer leurs finances personnelles et professionnelles au sein d'une plateforme unique.

Quels sont les critères à prendre en compte pour choisir un logiciel de comptabilité ?

- Caractéristiques et fonctionnalitésVous devez identifier les fonctionnalités essentielles au fonctionnement quotidien de votre entreprise. Cela inclut les tâches comptables de base telles que le suivi des dépenses, la gestion des comptes fournisseurs et clients, et la génération de rapports financiers. Pour de nombreuses petites entreprises, des fonctionnalités comme la possibilité de créer des factures et de gérer les paiements en ligne sont cruciales. Recherchez des fonctionnalités avancées et des outils d'automatisation qui peuvent vous aider à rationaliser les tâches répétitives et à gagner du temps. Certains logiciels proposent la gestion des stocks, des services de paie, ou suivi du tempsce qui peut s'avérer nécessaire selon votre modèle d'entreprise.

- Facilité d'utilisationL'interface utilisateur de base doit être intuitive et facile à utiliser. Un logiciel de comptabilité complexe à prendre en main peut engendrer des erreurs et de la frustration, même s'il offre de nombreuses fonctionnalités. Privilégiez un design épuré et une navigation simple. De nombreuses plateformes proposent un essai gratuit ou une version gratuite : c'est le moyen idéal de tester l'interface avant de souscrire un abonnement payant. Un bon logiciel doit également proposer des ressources utiles, comme une FAQ complète ou un service client.

- Coût et évolutivitéExaminez les différentes formules tarifaires et assurez-vous que le logiciel propose des prix abordables adaptés à votre budget. De nombreux fournisseurs proposent différents niveaux de service, de la formule standard à la formule premium ou professionnelle, avec des tarifs compétitifs et une personnalisation poussée. Cette évolutivité est essentielle, car elle garantit que le logiciel pourra évoluer avec votre entreprise. Vous recherchez une solution capable de répondre à vos besoins actuels et futurs, en permettant l'ajout d'utilisateurs ou de fonctionnalités à mesure que votre chiffre d'affaires annuel augmente.

- Sécurité et accessibilitéVos données financières sont sensibles ; leur sécurité est donc primordiale. Privilégiez les fournisseurs de logiciels proposant des mesures de sécurité robustes, telles que le chiffrement des données et des sauvegardes régulières. Pensez également à l’accessibilité. Une application mobile et un accès cloud vous permettent de gérer vos comptes où que vous soyez, un atout majeur pour les entreprises modernes.

- Intégrations et assistance: Faire Assurez-vous que le logiciel s'intègre aux autres plateformes que vous utilisez, comme votre banque ou une passerelle de paiement. Cela vous évitera de nombreuses saisies manuelles de données. Enfin, évaluez le service client proposé. Une équipe d'assistance réactive et compétente est essentielle en cas de problème.

- Bien que cette solution puisse convenir à une petite entreprise en début d'activité, de nombreuses entreprises finissent par se tourner vers une solution professionnelle plus adaptée, comme… QuickBooksUn développement récent sur le marché est l'acquisition de Quicken par Aquiline Capital Partners, ce qui pourrait impact Découvrez l'orientation et les fonctionnalités futures du produit, et comment il pourrait protéger l'avenir de vos données financières et de votre planification de retraite.

Verdict final

Alors, lequel choisir ?

Si vous gérez un petite entreprise et ont besoin d'outils performants pour la facturation et le suivi des dépenses professionnelles.

Zoho Books is our top choice. It’s built for businesses and makes managing your finances simpler.

Cependant, si vous recherchez de l'aide pour gérer votre argent, comme l'établissement d'un budget, le suivi des investissements et les dépenses générales du ménage.

Quicken est donc le grand gagnant.

Il est conçu pour aider les individus et les familles à maîtriser leurs finances.

Vous pouvez donc faire confiance à nos conseils pour prendre la meilleure décision en fonction de vos besoins financiers.

Plus de livres Zoho

Lors du choix d'une solution comptable, il est judicieux de comparer les meilleures options.

Nous avons effectué les recherches nécessaires pour vous aider à comparer Zoho Books à ses principaux concurrents.

- Zoho Books contre QuickBooksQuickBooks est un leader du marché, reconnu pour ses nombreuses fonctionnalités et intégrations. Zoho Books, quant à lui, est souvent apprécié pour son interface épurée et ses tarifs plus abordables et évolutifs, notamment pour les petites et moyennes entreprises.

- Zoho Books contre XeroXero est une plateforme de comptabilité en ligne populaire, axée sur la simplicité d'utilisation. Bien que les deux offrent des fonctionnalités de base solides, Zoho Books propose une gestion des stocks plus performante dans ses formules supérieures.

- Zoho Books contre FreshBooksFreshBooks est un excellent choix pour les travailleurs indépendants et les entreprises de services, notamment pour la facturation. Zoho Books offre un logiciel de comptabilité plus complet, avec un plus large éventail de fonctionnalités allant au-delà de la simple facturation.

- Zoho Books contre SageSage cible généralement les grandes entreprises aux structures plus complexes. Zoho Books, quant à lui, convient mieux aux petites et moyennes entreprises et est reconnu pour son interface intuitive et ses tarifs compétitifs.

- Zoho Books contre NetSuiteNetSuite est une solution ERP puissante pour les grandes entreprises. Zoho Books est une excellente alternative pour les petites entreprises qui ont besoin d'une plateforme robuste, abordable et flexible, capable d'évoluer avec elles.

- Zoho Books vs WaveWave est une option populaire grâce à sa version gratuite. Bien que Wave soit idéal pour les très petites entreprises et les indépendants, Zoho Books offre un ensemble de fonctionnalités plus complet et constitue une solution plus évolutive pour les entreprises en pleine croissance.

- Zoho Books vs DextDext est avant tout un outil d'extraction de données, axé sur l'automatisation du traitement des reçus et des factures. Zoho Books, en revanche, est un logiciel de comptabilité complet qui inclut la gestion des dépenses parmi ses nombreuses fonctionnalités.

- Zoho Books contre SnyderSynder est spécialisé dans la synchronisation des transactions financières provenant de diverses sources avec les logiciels comptables. Zoho Books intègre cette fonctionnalité à sa plateforme complète, aux côtés de la facturation, des rapports et d'autres fonctions comptables essentielles.

- Zoho Books contre ExpensifyExpensify est un outil performant de gestion et de reporting des dépenses. Zoho Books intègre une fonction de gestion des dépenses, mais Expensify est une solution plus spécialisée, adaptée aux entreprises aux politiques de dépenses complexes.

- Zoho Books vs DocytDocyt utilise l'IA pour automatiser la saisie de données à partir de reçus et de relevés bancaires. Zoho Books propose également des fonctionnalités d'automatisation, mais Docyt se concentre principalement sur cette automatisation spécifique.

- Zoho Books vs HubdocHubdoc est un outil de gestion documentaire qui automatise l'extraction de données à partir de factures et de reçus. Zoho Books propose une fonction similaire, mais la vocation principale de Hubdoc est d'alimenter d'autres systèmes comme QuickBooks ou Xero.

- Zoho Books vs AutoEntryAutoEntry est un autre outil de saisie automatisée de données à partir de documents. Zoho Books est un logiciel de comptabilité complet, tandis qu'AutoEntry est un outil spécialisé qui peut être utilisé en complément.

- Zoho Books contre Puzzle ioPuzzle.io est une solution de comptabilité basée sur l'IA pour les startups, offrant des informations financières en temps réel.

- Zoho Books vs Easy Month EndEasy Month End n'est pas une alternative directe, car il s'agit d'une fonctionnalité de Zoho Books qui simplifie le processus de clôture.

- Zoho Books contre QuickenQuicken est principalement destiné aux finances personnelles et aux très petites entreprises, tandis que Zoho Books est une solution complète conçue pour les tâches de comptabilité d'entreprise.

- Zoho Books vs RefreshMeIl ne s'agit pas d'une comparaison directe ; RefreshMe est une ressource ou une fonctionnalité qui peut être associée à Zoho Books.

Plus de Quicken

- Quicken contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Quicken contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Quicken contre XeroC'est populaire en ligne. logiciel de comptabilité pour les petites entreprises. Son concurrent est destiné à un usage personnel.

- Quicken contre SnyderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Quicken vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Quicken contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Quicken contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Quicken contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Quicken contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Quicken contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Quicken contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Quicken contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Quicken vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Quicken contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Quicken contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Zoho Books est-il plus adapté à un usage personnel ?

Non, Zoho Books est conçu pour les entreprises. Il facilite la gestion des factures et des dépenses professionnelles. Pour la gestion de votre budget personnel et le suivi de vos finances, Quicken est plus adapté.

Quicken peut-il gérer la comptabilité d'entreprise ?

Quicken propose une version « Particuliers et Entreprises ». Elle permet d'effectuer certaines tâches commerciales de base, comme la facturation simple. Cependant, pour une gestion comptable complète, Zoho Books est plus performant et plus complet.

Quel logiciel est le plus facile à apprendre ?

Les deux sont assez faciles à prendre en main. Zoho Books est simple pour les tâches professionnelles. Quicken est facile pour la gestion des finances personnelles. Votre choix dépendra de vos besoins les plus fréquents.

Ai-je besoin d'internet pour les utiliser ?

Zoho Books est un logiciel en nuage ; une connexion Internet est donc nécessaire pour l’utiliser pleinement. Quicken propose des versions de bureau fonctionnant hors ligne, mais une connexion Internet est requise pour les mises à jour et certaines fonctionnalités en ligne.

Ces programmes sont-ils coûteux ?

Zoho Books et Quicken proposent tous deux différents abonnements à des prix variés. Certains sont mensuels, d'autres annuels. Vous trouverez généralement un abonnement adapté à votre budget et à vos besoins.