Vous vous sentez perdu dans le monde de la finance d'entreprise ?

Suivre les entrées et sorties d'argent peut être un vrai casse-tête.

Vous recherchez une façon plus simple de tout gérer.

C’est pourquoi nous allons procéder à une comparaison directe de deux options populaires : Xero et Docyt.

Découvrons-le ensemble !

Aperçu

Nous avons examiné de près Xero et Docyt.

Les mettre à l'épreuve avec des exercices typiques petite entreprise tâches.

Nos tests pratiques se sont concentrés sur la facilité d'utilisation et les fonctionnalités essentielles. comptabilité caractéristiques.

Automation leurs fonctionnalités et leur capacité d'intégration avec les autres outils de l'entreprise.

Rejoignez plus de 2 millions d'entreprises qui utilisent le logiciel de comptabilité en ligne Xero. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 29 $/mois.

Caractéristiques principales :

- Rapprochement bancaire

- Facturation

- Signalement

Fatigué du manuel comptabilitéDocyt AI automatise la saisie et le rapprochement des données, permettant aux utilisateurs d'économiser en moyenne 40 heures.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 299 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Qu'est-ce que Xero ?

Alors, Xero, hein ? C'est populaire. Beaucoup de petites entreprises Utilisez-le.

Considérez-le comme votre plateforme en ligne pour tout ce qui concerne l'argent.

Cela vous permet de suivre vos ventes et vos factures. Vous pouvez également connecter vos comptes bancaires.

Cela permet de voir plus facilement où va votre argent.

Découvrez également nos favoris Alternatives à Xero…

Notre avis

Rejoignez plus de 2 millions d'entreprises utilisation de Xero Logiciel de comptabilité. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Principaux avantages

- Rapprochement bancaire automatisé

- Facturation et paiements en ligne

- Gestion des factures

- Intégration de la paie

- Rapports et analyses

Tarification

- Démarreur: 29 $/mois.

- Standard: 46 $/mois.

- Prime: 69 $/mois.

Avantages

Cons

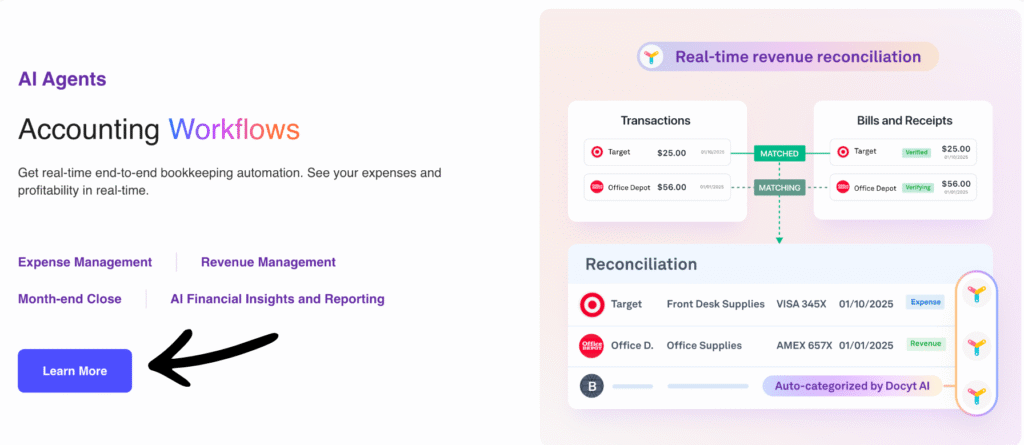

Qu'est-ce que Docyt ?

Parlons maintenant de Docyt. Celui-ci est un peu différent.

L'accent est vraiment mis sur l'automatisation. Moins de travail manuel, c'est la clé. données entrée.

Elle utilise l'IA pour traiter les documents. Cela peut vous faire gagner un temps précieux.

Il est conçu pour rationaliser vos flux de travail financiers.

Découvrez également nos favoris Alternatives à Docyt…

Principaux avantages

- Automatisation basée sur l'IA : Docyt utilise l'intelligence artificielle. Elle extrait automatiquement des données de documents financiers, notamment des informations provenant de plus de 100 000 fournisseurs.

- Comptabilité en temps réel : Vos comptes sont mis à jour en temps réel. Vous disposez ainsi d'une image financière précise à tout moment.

- Gestion documentaire : Centralise tous les documents financiers. Vous pouvez facilement les rechercher et y accéder.

- Automatisation du paiement des factures : Automatisez le processus de paiement des factures. Programmez et payez vos factures facilement.

- Remboursement des frais : Simplifiez le traitement des notes de frais des employés. Soumettez et approuvez les dépenses rapidement.

- Intégrations transparentes : S'intègre aux logiciels de comptabilité les plus courants. Cela inclut QuickBooks et Xero.

- Détection des fraudes : Son IA peut aider à repérer les transactions inhabituelles. Cela ajoute une couche de sécurité. sécuritéIl n'existe aucune garantie spécifique pour le logiciel, mais des mises à jour continues sont fournies.

Tarification

- Impact: 299 $/mois.

- Avancé: 499 $/mois.

- Avancé Plus: 799 $/mois.

- Entreprise: 999 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Entrons maintenant dans le vif du sujet concernant ces deux plateformes.

Ce Xero logiciel de comptabilité L'analyse approfondit les détails.

Nous comparerons ces options pour vous aider à déterminer celle qui correspond le mieux à vos besoins.

1. Fonctionnalités comptables de base

- Xero: En tant que solution basée sur le cloud comptabilité Le logiciel Xero excelle dans les fonctions de base. Il gère les principales tâches financières pour petite entreprise propriétaires. Cela inclut la création d'un nombre illimité de factures et la gestion des comptes clients.

- DocytIl est davantage conçu comme un logiciel d'automatisation basé sur l'IA. Docyt se concentre sur l'automatisation de… comptabilité Il ne s'agit plus seulement de saisie de données manuelle et traditionnelle.

2. Capacités d'automatisation et d'IA

- XeroXero offre une automatisation performante des tâches courantes. Il intègre la synchronisation bancaire automatique et le rapprochement bancaire intelligent. C'est pourquoi de nombreux dirigeants de petites entreprises utilisent Xero pour leur gestion administrative quotidienne.

- DocytC'est là que Docyt AI change la donne. Grâce à des fonctionnalités basées sur l'IA, comme un comptable virtuel, elle prend en charge les tâches fastidieuses. Elle automatise des tâches telles que la numérisation des reçus et la catégorisation des dépenses, pour une vie plus simple.

3. Information financière

- Xero: Xero reportage Ses fonctionnalités sont robustes. Il offre plus de 50 options de reporting financier. Le logiciel permet de personnaliser les rapports sur le tableau de bord Xero, offrant ainsi une vision claire de la situation financière.

- Docyt : Fournit des rapports financiers en temps réel. Offre une visibilité instantanée sur la situation financière et des informations sur les indicateurs clés de performance. Est conçu pour la prise de décisions stratégiques basées sur des données en temps réel.

4. Adéquation du système de planification des ressources de l'entreprise (ERP)

- XeroBien qu'il ne s'agisse pas d'un système de planification des ressources d'entreprise (ERP) complet, les capacités ERP du logiciel de comptabilité Xero sont importantes grâce aux intégrations. Il constitue le noyau financier des entreprises en croissance et permet de gérer les stocks.

- DocytDocyt ne remplace pas un ERP complet. Il prend plutôt en charge les tâches chronophages liées à la gestion financière. Il peut fournir une vue d'ensemble consolidée pour les entreprises multi-sites ou multi-entités.

5. Gestion des comptes fournisseurs et des factures

- XeroXero vous permet de suivre facilement les factures dues et les bons de commande. Vous pouvez saisir les factures et programmer les paiements. La gestion des paiements est performante quel que soit l'abonnement choisi.

- DocytDocyt simplifie le paiement des factures. Son IA peut lire et traiter automatiquement les factures. Cela s'inscrit dans sa stratégie d'automatisation des tâches administratives et comptables.

6. Évolutivité et utilisateurs cibles

- XeroXero propose une structure tarifaire flexible, allant de l'offre de base à l'offre supérieure. Elle est idéale pour les travailleurs indépendants, les entreprises établies et les cabinets comptables.

- DocytSon automatisation poussée en fait une solution parfaitement adaptée aux entreprises établies et en pleine expansion. Elle est particulièrement utile pour les services professionnels et les entreprises qui doivent gérer plusieurs entreprises ou sites d'exploitation.

7. Connectivité bancaire et données

- XeroSa force réside dans la synchronisation et l'automatisation des transactions bancaires. Cela garantit l'exactitude de vos données financières. Cette fonctionnalité est très performante et constitue le fondement du logiciel de comptabilité Xero.

- DocytDocyt utilise également le rapprochement bancaire automatisé, mais l'associe à une analyse documentaire basée sur l'IA. Cela permet d'assurer un contrôle financier constant en détectant rapidement les erreurs de comptabilisation des revenus.

8. Fonctionnalités mobiles

- XeroL'application mobile est disponible pour iOS et les appareils Android. Il est complet et vous permet d'utiliser Xero pour gérer vos finances tout en voyages.

- DocytDocyt propose également une application mobile offrant des fonctionnalités telles que la numérisation de reçus. Elle est principalement conçue pour l'importation de documents dans le système.

9. Fonctionnalités avancées

- XeroLe forfait proposé offre des fonctionnalités avancées telles que le suivi de projet. Il permet également de gérer plusieurs devises et d'utiliser ses outils de gestion financière.

- DocytDocyt apprend les subtilités commerciales de faire Son IA est plus performante. Elle propose une comptabilité par département et simplifie la clôture de fin de mois, offrant ainsi une visibilité en temps réel sur la rentabilité.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Expérience utilisateurL'interface est-elle conviviale ? Une interface claire et conviviale est importante pour une adoption rapide.

- Automatisation axée sur: Déterminez si vous devez éliminer la saisie manuelle de données (Docyt) ou des processus comptables plus larges (Xero).

- Comptabilité IAVérifiez les capacités de comptabilité par IA. La plateforme d'IA de docyt vous permet-elle de gagner un temps significatif en moyenne ?

- Caractéristiques essentielles: Couvre-t-il des fonctionnalités clés comme la facturation en ligne, le calcul de la taxe de vente et la gestion des stocks (Xero) ?

- Visibilité financièreRecherchez des rapports clairs et en temps réel. Vous avez besoin de bons outils de gestion de trésorerie et de gestion des dépenses.

- Portée du rapportAvez-vous besoin d'états financiers individuels ou de la possibilité de générer facilement des états financiers consolidés pour plusieurs établissements commerciaux ?

- ÉvolutivitéLe logiciel peut-il accompagner la croissance de votre entreprise ? Le coût de Xero restera-t-il justifié à mesure que vos données d’inventaire et vos informations financières augmenteront ?

- AccessibilitéVérifiez si la plateforme offre un accès facile aux ressources en ligne et si elle prend en charge vos comptables.

- Données et confianceExaminez les options de migration de données et la façon dont l'outil gère les données de vos clients. Xero simplifie cette tâche.

- Valeur: Don’t pay for features you won’t use. Does the best accounting software truly fit your specific needs? You can test xero or Docyt to be sure.

Verdict final

Pour la plupart des petites et moyennes entreprises qui gèrent l'intégralité de leurs données financières, nous recommandons Xero.

Il offre un meilleur équilibre entre les fonctionnalités comptables essentielles, la facilité d'utilisation et une multitude de ressources en ligne via Xero Central.

Cela fait une énorme différence pour votre équipe.

Docyt excelle quant à elle dans le domaine de l'IA et de l'automatisation pour les industries complexes.

La fiabilité de Xero, son assistance client et ses solides fonctionnalités de sécurité — essentielles pour protéger la santé financière de votre entreprise — en font une base plus intelligente.

La possibilité d'envoyer jusqu'à cinq factures et de s'adapter facilement confère à Xero un avantage certain en termes de performance globale et de sécurité de l'entreprise.

Plus d'informations sur Xero

Choisir le bon logiciel de comptabilité implique d'examiner plusieurs options.

Voici un aperçu rapide de Xero par rapport à d'autres produits populaires.

- Xero contre QuickBooks: QuickBooks est un concurrent majeur. Bien que les deux logiciels offrent des fonctionnalités de base similaires, Xero est souvent apprécié pour son interface épurée et son nombre illimité d'utilisateurs. QuickBooks peut s'avérer plus complexe, mais il propose des outils de reporting très performants.

- Xero contre FreshBooks: FreshBooks est une option populaire, notamment pour les travailleurs indépendants et les entreprises de services. Il excelle dans la facturation et le suivi du temps. Xero offre une solution comptable plus complète.

- Xero contre Sage: Sage et Xero proposent tous deux des solutions pour les petites entreprises. Cependant, Sage fournit également des outils de planification des ressources d'entreprise (ERP) plus complets pour les grandes entreprises.

- Xero contre Zoho Books: Zoho Books fait partie d'une vaste suite d'applications professionnelles. Elle offre souvent des fonctionnalités avancées pour la gestion des stocks et se révèle très économique. Xero, quant à elle, est une solution de choix pour sa simplicité et sa facilité d'utilisation.

- Xero contre Wave: Wave est réputé pour sa version gratuite. C'est une excellente option pour les très petites entreprises ou les indépendants disposant d'un budget limité. Xero offre une gamme de fonctionnalités plus étendue et est mieux adapté à la croissance des entreprises.

- Xero contre Quicken: Quicken est principalement destiné aux finances personnelles. Bien qu'il propose certaines fonctionnalités professionnelles, il ne s'agit pas d'une véritable solution de comptabilité d'entreprise. Xero, quant à lui, est conçu spécifiquement pour gérer la complexité de la comptabilité d'entreprise.

- Xero contre HubdocCes deux outils ne sont pas des concurrents directs. Dext et Hubdoc automatisent la capture de documents et la saisie de données. Ils s'intègrent directement à Xero pour une comptabilité plus rapide et plus précise.

- Xero contre Synder: Synder est une plateforme qui connecte les canaux de vente et les passerelles de paiement aux logiciels de comptabilité. Elle automatise la saisie de données provenant de plateformes comme Shopify et Stripe directement dans Xero.

- Xero contre ExpensifyExpensify se concentre spécifiquement sur la gestion des dépenses. Bien que Xero propose des fonctionnalités de gestion des dépenses, Expensify offre des outils plus avancés pour la gestion des frais et des remboursements des employés.

- Xero contre Netsuite: NetSuite est un système ERP complet destiné aux grandes entreprises. Il offre une suite complète d'outils de gestion. Xero n'est pas un ERP, mais constitue une excellente solution comptable pour les petites entreprises.

- Xero contre Puzzle IO: Puzzle IO est une plateforme financière conçue pour les startups, axée sur les états financiers en temps réel et la saisie automatisée de données.

- Xero vs Easy Month End: Ce logiciel est un outil spécialisé permettant d'automatiser le processus de clôture mensuelle, facilitant le rapprochement bancaire et la traçabilité des opérations. Il est conçu pour fonctionner avec Xero, et non pour le remplacer.

- Xero contre Docyt: Docyt utilise l'IA pour automatiser les tâches administratives et comptables. Elle permet de consulter tous vos documents et données financières au même endroit.

- Xero contre RefreshMe: RefreshMe est un logiciel de comptabilité plus simple, doté de fonctionnalités de base, souvent utilisé pour les finances personnelles ou les très petites entreprises.

- Xero contre AutoEntry: À l'instar de Dext et Hubdoc, AutoEntry est un outil qui automatise l'extraction de données à partir de reçus et de factures, conçu pour s'intégrer et améliorer les logiciels comptables tels que Xero.

Plus de Docyt

Lorsqu'on recherche le logiciel comptable adapté, il est utile de voir comment se comparent les différentes plateformes.

Voici une brève comparaison entre Docyt et plusieurs de ses alternatives.

- Docyt contre Puzzle IO: Bien que les deux solutions facilitent la gestion financière, Docyt se concentre sur la comptabilité des entreprises basée sur l'IA, tandis que Puzzle IO simplifie la facturation et les dépenses des travailleurs indépendants.

- Docyt contre Dext: Docyt propose une plateforme complète de comptabilité basée sur l'IA, tandis que Dext est spécialisé dans la capture automatisée de données à partir de documents.

- Docyt contre Xero: Docyt est réputé pour son automatisation poussée grâce à l'IA. Xero propose un système comptable complet et convivial, adapté aux besoins courants des entreprises.

- Docyt contre Synder: Docyt est un outil de comptabilité basé sur l'IA pour l'automatisation des tâches administratives. Synder se concentre sur la synchronisation des données de vente e-commerce avec votre logiciel comptable.

- Docyt contre Easy Fin de mois: Docyt est une solution comptable complète basée sur l'IA. Easy Month End est un outil spécialisé conçu spécifiquement pour rationaliser et simplifier le processus de clôture de fin de mois.

- Docyt contre RefreshMe: Docyt est un outil de comptabilité d'entreprise, tandis que RefreshMe est une application de finances personnelles et de gestion budgétaire.

- Docyt contre Sage: Docyt utilise une approche moderne axée sur l'IA. Sage est une entreprise établie de longue date qui propose une vaste gamme de solutions comptables traditionnelles et en nuage.

- Docyt contre Zoho Books: Docyt se spécialise dans l'automatisation comptable par l'IA. Zoho Books est une solution tout-en-un offrant une gamme complète de fonctionnalités à un prix compétitif.

- Docyt contre Wave: Docyt propose une automatisation IA performante pour les entreprises en pleine croissance. Wave est une plateforme comptable gratuite idéale pour les indépendants et les micro-entreprises.

- Docyt contre Quicken: Docyt est conçu pour la comptabilité d'entreprise. Quicken est principalement un outil de gestion des finances personnelles et de budgétisation.

- Docyt vs Hubdoc: Docyt est un système de comptabilité entièrement basé sur l'IA. Hubdoc est un outil de capture de données qui collecte et traite automatiquement les documents financiers.

- Docyt contre Expensify: Docyt prend en charge l'ensemble des tâches comptables. Expensify est spécialisé dans la gestion et le reporting des notes de frais des employés.

- Docyt contre QuickBooks: Docyt est une plateforme d'automatisation basée sur l'IA qui optimise QuickBooks. QuickBooks est un logiciel de comptabilité complet adapté aux entreprises de toutes tailles.

- Docyt vs AutoEntry: Docyt est une solution de comptabilité IA complète. AutoEntry se concentre spécifiquement sur l'extraction et l'automatisation des données documentaires.

- Docyt contre FreshBooks: Docyt utilise une intelligence artificielle avancée pour l'automatisation. FreshBooks est une solution conviviale très appréciée des indépendants pour ses fonctionnalités de facturation et de suivi du temps.

- Docyt contre NetSuite: Docyt est un outil d'automatisation comptable. NetSuite est un système de planification des ressources d'entreprise (ERP) complet destiné aux grandes entreprises.

Foire aux questions

Xero est-il adapté à la gestion des factures clients ?

Oui, Xero propose des fonctionnalités de facturation performantes. Vous pouvez créer et envoyer facilement des factures professionnelles à vos clients.

Docyt s'intègre-t-il à mon logiciel de comptabilité existant ?

Docyt s'intègre aux plateformes populaires comme Xero et QuickBooks Online. Vérifiez sa compatibilité avec votre système actuel.

Quel logiciel est le meilleur pour le suivi des dépenses par carte de crédit ?

Xero et Docyt gèrent tous deux les transactions par carte bancaire. Docyt propose une automatisation plus poussée pour le traitement des reçus.

Puis-je gérer efficacement mes budgets avec Xero ?

Xero propose des outils pour créer et suivre les budgets des différents comptes de votre entreprise.

Docyt est-il une solution comptable complète comme Xero ?

Docyt privilégie l'automatisation et la gestion documentaire. Xero offre une suite plus complète de fonctionnalités comptables pour répondre aux besoins de vos clients.