Vous avez du mal à choisir le bon choix ? comptabilité Un outil pour votre entreprise ?

Vous n'êtes pas seul.

Tous deux promettent de faire simplifier votre vie financière, mais lequel répond le mieux à vos besoins spécifiques ?

Ce guide détaillera la différence entre Wave et Autoentry.

Découvrons lequel est le meilleur !

Aperçu

Nous avons mis Wave et AutoEntry à l'épreuve.

Nous les avons utilisés comme de vrais entreprise Cela nous a permis de voir les points forts de chaque outil.

Maintenant, comparons-les côte à côte.

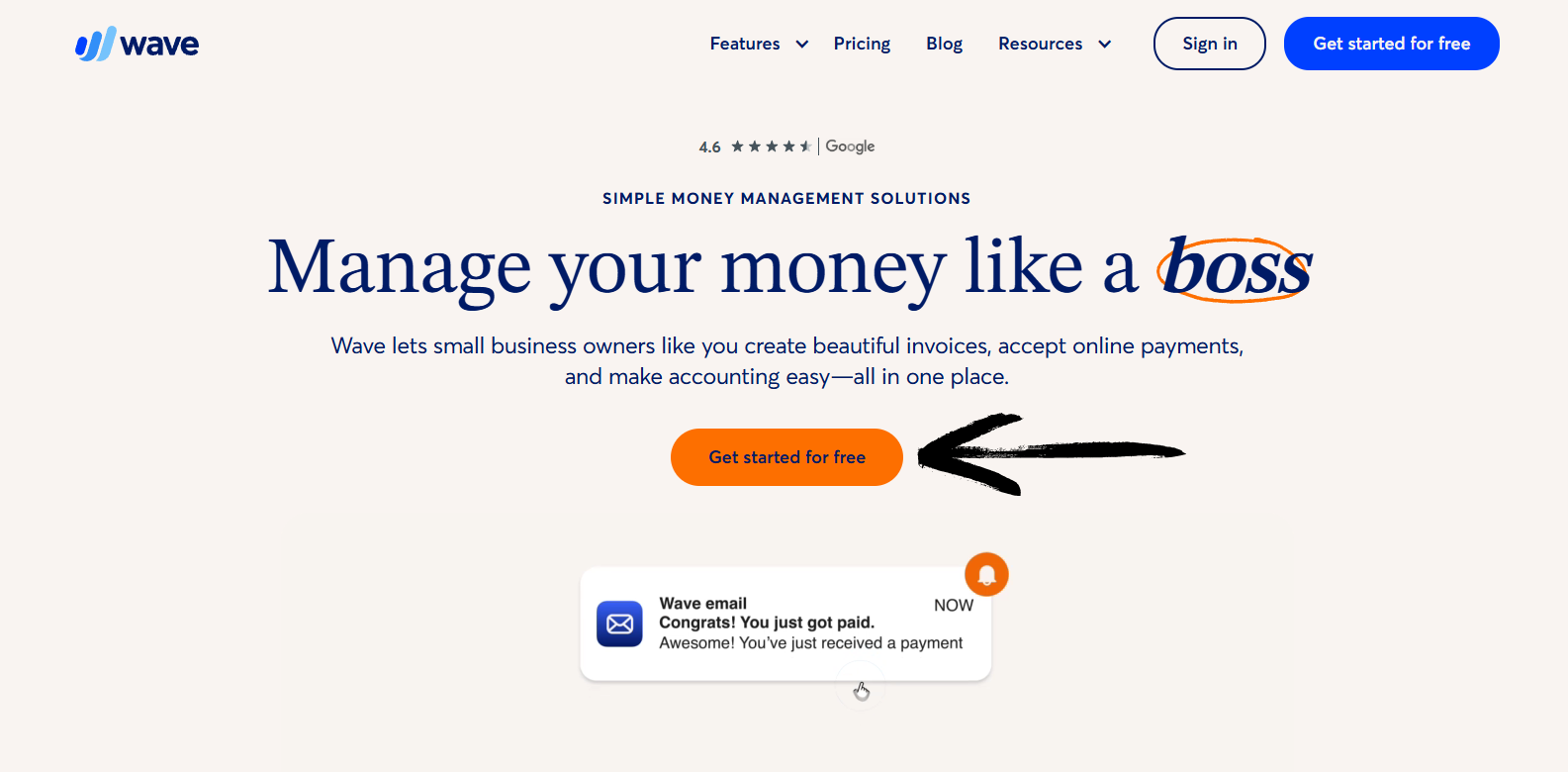

Plus de 4 millions petites entreprises Confiez la gestion de vos finances à Wave. Découvrez les offres de Wave et trouvez celle qui vous convient.

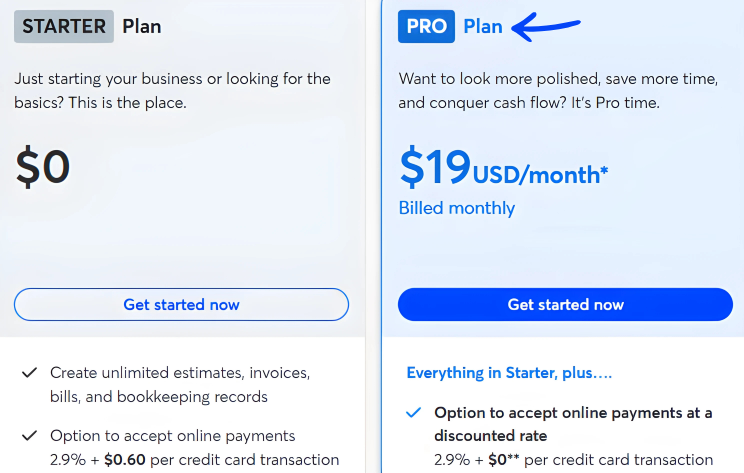

Tarification : Formule gratuite disponible. Formule payante à partir de 19 $/mois.

Caractéristiques principales :

- Facturation

- Bancaire

- Module complémentaire de paie.

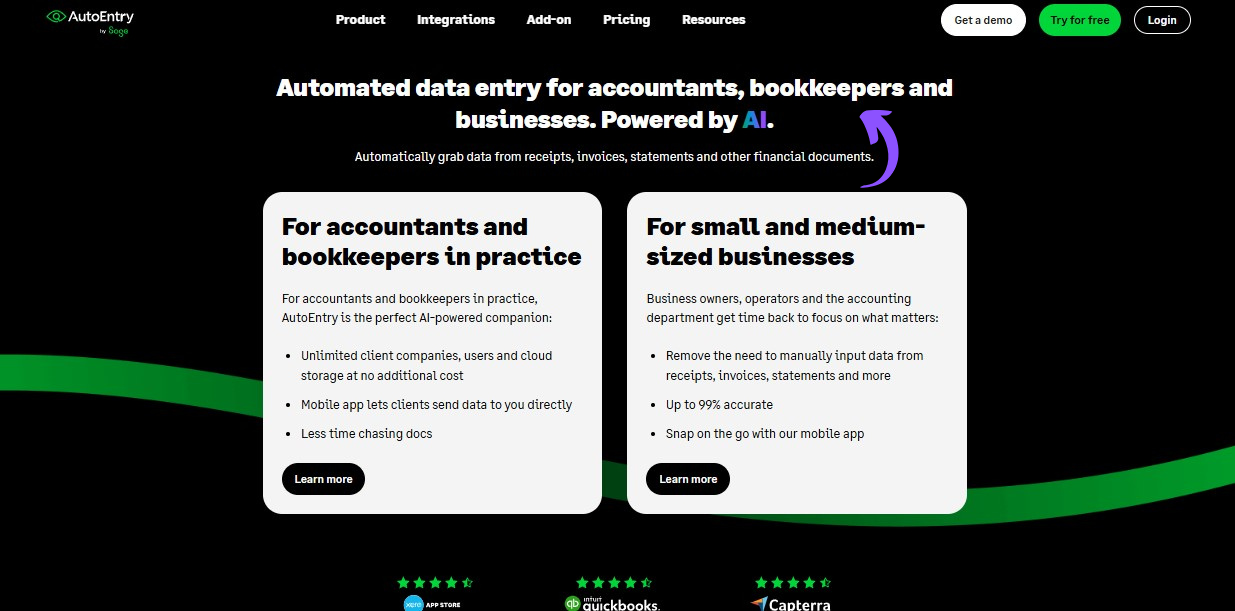

Arrêtez de perdre plus de 10 heures par semaine à saisir manuellement des données. Découvrez comment la saisie automatique a réduit de 40 % le temps de traitement des factures. Sage utilisateurs.

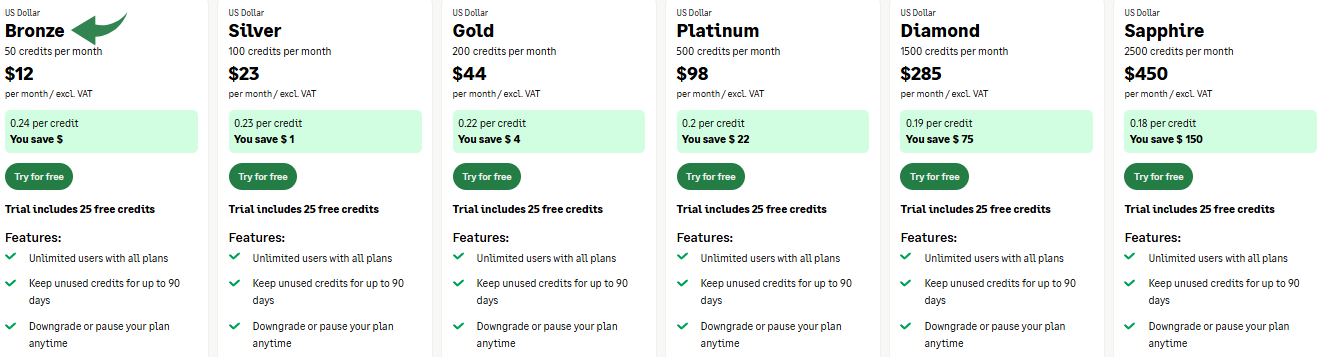

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 12 $/mois.

Caractéristiques principales :

- Extraction de données

- Numérisation des reçus

- Automatisation des fournisseurs

Qu'est-ce qu'une vague ?

Bon, parlons de Wave.

Considérez-le comme un ami précieux pour les finances de votre entreprise.

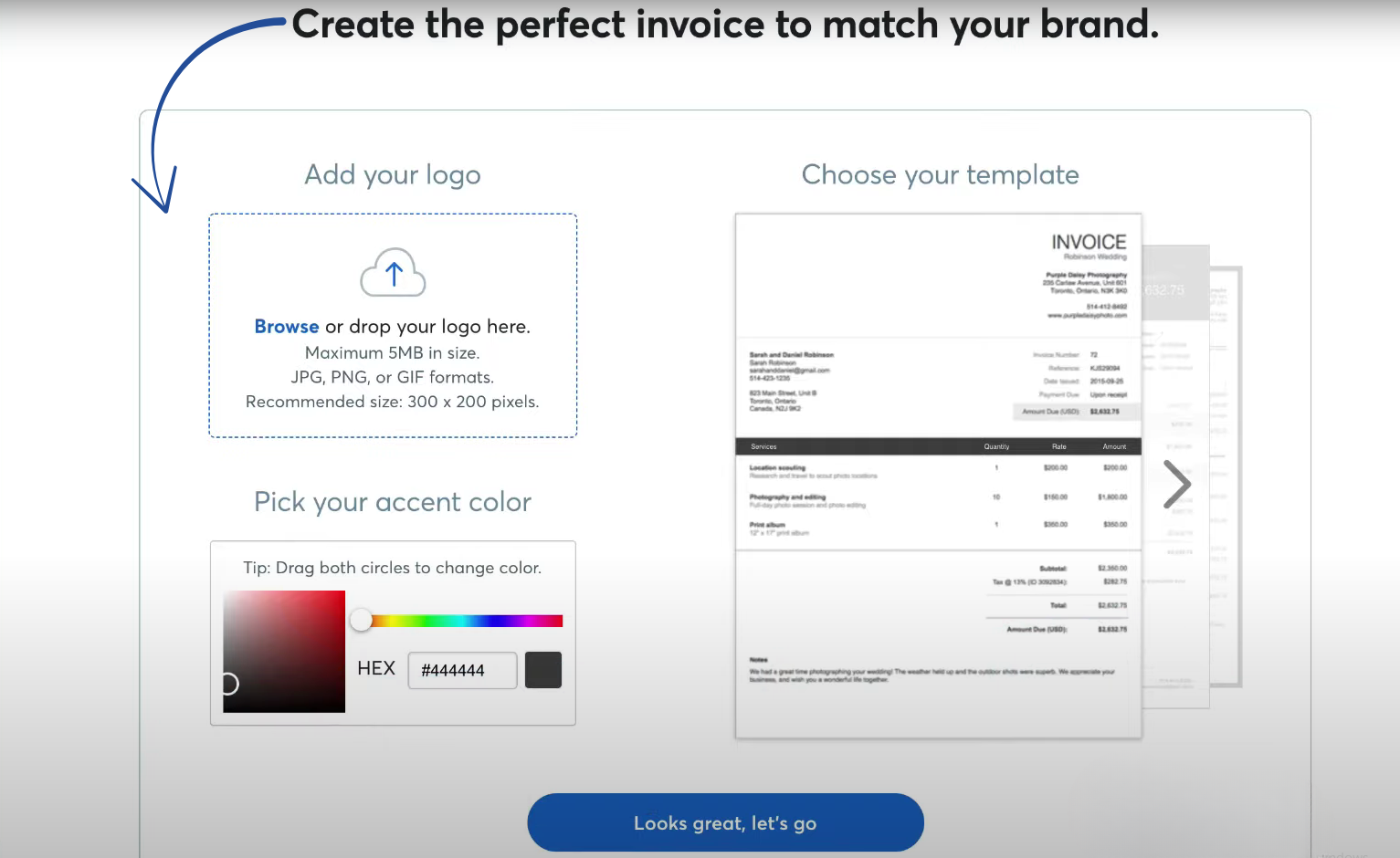

Il vous permet notamment d'envoyer des factures et de suivre les entrées et sorties d'argent.

Cela peut vous aider à avoir une vision d'ensemble des finances de votre entreprise.

Découvrez également nos favoris Alternatives aux vagues…

Notre avis

N’acceptez pas moins ! Rejoignez les plus de 2 millions de petites entreprises qui font confiance dès aujourd’hui aux puissantes fonctionnalités comptables gratuites de Wave pour optimiser leurs finances.

Principaux avantages

Les points forts de Wave incluent :

- Un plan de comptabilité de base 100% gratuit.

- Au service de plus de 2 millions de petites entreprises.

- Création de factures et traitement des paiements simplifiés.

- Aucun contrat ni garantie à long terme.

Tarification

- Plan de démarrage : 0 $ par mois.

- Formule Pro : 19 $ par mois.

Avantages

Cons

Qu'est-ce que l'AutoEntry ?

Bon, parlons donc d'AutoEntry.

C'est un outil qui vous aide à transférer vos documents sur votre ordinateur sans avoir à tout saisir vous-même.

Considérez-le comme un assistant intelligent pour vos factures et reçus.

Il les lit et place l'information là où elle doit aller.

Découvrez également nos favoris Alternatives à AutoEntry…

Notre avis

Prêt à réduire votre temps de comptabilité ? AutoEntry traite plus de 28 millions de documents chaque année et offre une précision jusqu’à 99 %. Commencez dès aujourd’hui et rejoignez les plus de 210 000 entreprises dans le monde qui ont réduit leur temps de saisie de données jusqu’à 80 % !

Principaux avantages

Le plus grand atout d'AutoEntry est de nous faire gagner des heures de travail fastidieux.

Les utilisateurs constatent souvent une réduction de jusqu'à 80 % du temps consacré à la saisie manuelle de données.

Elle promet une précision allant jusqu'à 99 % dans l'extraction de données.

AutoEntry n'offre pas de garantie de remboursement spécifique, mais ses forfaits mensuels vous permettent d'annuler à tout moment.

- Précision des données jusqu'à 99 %.

- Utilisateurs illimités sur tous les forfaits payants.

- Extrait les lignes complètes des factures.

- Application mobile simple pour photographier les reçus.

- Les crédits non utilisés sont reportés sous 90 jours.

Tarification

- Bronze: 12 $/mois.

- Argent: 23 $/mois.

- Or: 44 $/mois.

- Platine: 98 $/mois.

- Diamant: 285 $/mois.

- Saphir: 450 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Choisir la bonne plateforme financière nécessite de connaître son objectif principal. La comparaison des avis sur Wave et AutoEntry mettra en évidence une solution entièrement gratuite. comptabilité logiciel doté d'un service spécialisé d'extraction de données.

Vous aider à trouver l'outil qui résoudra votre problème le plus chronophage. comptabilité problèmes.

1. Objectif et priorités principaux

- Vague Le secteur financier est dédié petite entreprise Logiciel de comptabilité offrant un système complet de comptabilité en partie double, incluant un grand livre. La version gratuite comprend les fonctionnalités comptables essentielles pour la gestion d'une petite entreprise de services ou de plusieurs sociétés.

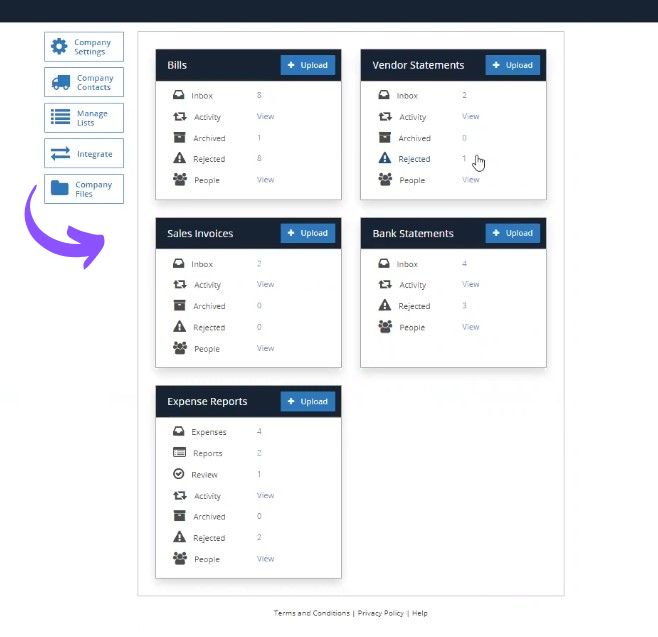

- Saisie automatique est un outil d'automatisation dont le seul objectif est d'éliminer le manuel données Ce logiciel utilise la reconnaissance optique de caractères pour extraire tout type de données de documents financiers, tels que les factures d'achat et les relevés bancaires, afin de les publier automatiquement dans d'autres systèmes. Il ne s'agit pas d'un logiciel de comptabilité complet.

2. Tarification et abonnement

- Wave La version gratuite (plateforme gratuite) inclut la comptabilité de base et la facturation illimitée pour tous les utilisateurs. Ses deux formules (formule Starter et formule Pro payante) proposent des tarifs avantageux, avec un excellent prix réduit pour les travailleurs indépendants.

- Saisie automatique La tarification repose sur un modèle flexible, souvent avec une facturation mensuelle ou par document. Il n'existe pas de formule entièrement gratuite, mais le coût est justifié par le gain de temps considérable réalisé en évitant la saisie manuelle de données, un point essentiel souligné dans de nombreux avis sur AutoEntry.

3. Saisie des dépenses et des documents

- Vague Wave propose la numérisation de reçus via son application mobile, mais la capture numérique des reçus est une option payante du forfait de base. La méthode principale de Wave pour le suivi des dépenses consiste à lier directement les comptes bancaires afin d'importer les transactions bancaires.

- Saisie automatique est conçu pour la gestion de documents en grande quantité. Vous pouvez télécharger des documents via un téléphone mobile, un e-mail ou un ordinateur, et il capture avec précision les lignes et les détails des relevés bancaires et autres documents financiers. C'est un avantage majeur pour comptabilité disques.

4. Intégration et intégration transparente

- Wave Son point fort réside dans sa suite intégrée (Wave Payroll, traitement des paiements). Bien que Wave s'intègre à certains autres systèmes, son intégration avec les logiciels de comptabilité et de paie centraux n'est pas aussi fluide que celle offerte par les outils d'automatisation dédiés.

- AutoEntry Sa principale valeur réside dans son intégration transparente avec les logiciels comptables populaires (comme QuickBooks et XeroIl est conçu pour servir de passerelle automatisée permettant d'extraire rapidement des données et de minimiser les efforts de transfert d'informations.

5. Automatisation des transactions

- Wave L'abonnement Pro payant vous permet d'importer automatiquement vos transactions bancaires et de les fusionner avec vos enregistrements. Vous pouvez également configurer automatiquement les factures et transactions récurrentes pour une facturation simplifiée.

- Saisie automatique Ce système automatise l'intégralité du processus de transformation des documents en données. Il vous suffit de télécharger le document, et le système de reconnaissance optique de caractères prépare automatiquement les données pour la publication, ce qui vous permet de gagner un temps précieux habituellement consacré à la saisie manuelle.

6. Gestion des utilisateurs et des accès

- Vague offers unlimited users on its paid pro plan and supports multiple users for your business or multiple companies at once, giving peace of mind to small business logiciel de comptabilité utilisateurs.

- Saisie automatique Il prend également en charge un nombre illimité d'utilisateurs, ce qui permet aux comptables d'accorder facilement à leurs clients l'accès au téléchargement de documents. Le processus est axé sur la circulation des documents plutôt que sur la gestion des autorisations multi-utilisateurs au sein d'un grand livre comptable complet.

7. Sécurité et gestion des erreurs

- Vague Ce service utilise l'authentification multifacteurs et un chiffrement robuste pour protéger vos comptes bancaires et vos données. En cas de problème, vous pouvez consulter leur centre d'aide en ligne.

- Saisie automatique Ce service met en œuvre des mesures robustes pour se protéger des attaques en ligne. La sécurité de son site est une préoccupation majeure : plusieurs actions susceptibles de déclencher un blocage, comme la saisie de certains mots ou expressions, d'une commande SQL ou de données malformées, sont bloquées. Si votre action a déclenché le système de sécurité et qu'un identifiant Cloudflare a été détecté, vous ne pourrez plus accéder à la page et devrez contacter le propriétaire du site par e-mail en indiquant votre adresse IP pour résoudre le problème.

8. Facturation et paiements

- Vague Ce logiciel offre des fonctionnalités de facturation avancées permettant d'accepter les paiements en ligne par carte bancaire et virement bancaire. Des frais de transaction s'appliquent pour les paiements par carte bancaire, mais le logiciel de facturation de base est gratuit. Vous pouvez également configurer plusieurs rappels de paiement automatiques.

- Saisie automatique Ce logiciel ne propose pas de fonctionnalités de facturation et ne permet ni de recevoir de paiements en ligne ni de gérer les rappels de paiement. Il est principalement destiné à la saisie des documents relatifs aux dépenses, et non aux ventes.

9. Paie et fonctionnalités avancées

- Vague La gestion de la paie est une extension payante intégrée qui vous permet de payer vos employés ou travailleurs indépendants et de gérer le traitement de la paie. Wave ajoute régulièrement des fonctionnalités avancées, comme l'option de paiement Apple Pay.

- Saisie automatique Il s'agit d'un outil spécialisé. Il ne propose pas de traitement de la paie ni d'autres fonctionnalités de gestion financière telles que les rapports financiers budgétaires ou le suivi des heures facturables.

Quels sont les critères à prendre en compte pour choisir un logiciel de comptabilité ?

- ÉvolutivitéLe logiciel peut-il évoluer avec votre entreprise ? L’évolutivité, c’est la capacité de l’outil à gérer votre croissance future sans vous imposer un changement complet. Wave simplifie les choses avec une formule de base gratuite, idéale pour un travailleur indépendant rémunéré par quelques clients. Lorsque votre activité se développe, vous pouvez passer à une formule payante pour accéder à des fonctionnalités comme le suivi de plusieurs entreprises et l’ajout de plusieurs utilisateurs. Une plateforme proposant différents niveaux d’abonnement est conçue pour s’adapter à l’évolution de vos besoins.

- SoutienQuel type d'assistance est disponible en cas de questions ? Un bon support est essentiel pour gagner en confiance. Les avis sur Wave Accounting soulignent souvent l'étendue de son centre d'aide et de ses ressources en ligne. Privilégiez les canaux de support clairement identifiés et vérifiez que Wave s'engage à répondre dans un délai raisonnable, par exemple quelques jours ouvrables. Une assistance fiable est indispensable pour tenir une comptabilité rigoureuse, et c'est pourquoi de nombreux entrepreneurs recommandent Wave aux nouveaux dirigeants de petites entreprises.

- Facilité d'utilisationEst-ce un outil que vous et votre équipe pouvez maîtriser rapidement ? La simplicité de l’interface utilisateur est essentielle. Wave rend la gestion financière accessible à tous, même sans formation comptable. Son design doit être suffisamment intuitif pour que vous et votre équipe puissiez rapidement apprendre à suivre les dépenses et à générer des rapports. Moins vous passerez de temps à apprendre à utiliser le logiciel, plus vous pourrez vous concentrer sur vos activités.

- Besoins spécifiquesCe logiciel est-il adapté aux spécificités de votre activité ? Assurez-vous qu’il réponde à vos besoins particuliers. Par exemple, si vous dépendez de revenus immédiats, vérifiez la rapidité de traitement des paiements par carte bancaire. Vous devriez pouvoir personnaliser les rapports en fonction d’une période donnée ou séparer facilement vos transactions financières personnelles de celles de votre entreprise au sein du même système.

- SécuritéVos données financières sont-elles bien protégées avec ce logiciel ? La protection de vos informations sensibles, telles que vos coordonnées bancaires et les données de vos transactions par carte de crédit, est primordiale. Privilégiez des mesures de sécurité robustes, comme l’authentification multifacteurs, pour tous les niveaux d’abonnement. Savoir que le logiciel s’engage à protéger vos données est un gage de tranquillité d’esprit.

Verdict final

Quel est le meilleur choix : Wave ou AutoEntry ? Cela dépend de vos besoins.

Si vous gérez un petite entreprise Ou si vous venez d'en créer un, Wave est votre meilleure option.

C'est un système comptable complet et gratuit. Il vous aide à gérer toutes vos tâches financières de base.

Mais vous utilisez peut-être déjà un logiciel de comptabilité.

Pense QuickBooks ou Xero. Et vous avez de nombreux reçus et factures papier.

AutoEntry est donc le grand gagnant. C'est un outil puissant qui automatise la saisie fastidieuse des données.

Nous vous avons montré les deux en détail.

Choisissez celui qui résout les problèmes de votre entreprise.

Plus de Wave

- Wave vs Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Wave contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Wave contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Vague contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Wave vs Easy Fin de moisIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Wave vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Vague contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Wave vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Wave vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- Wave vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Wave contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Wave contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Wave vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Wave contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Wave contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Plus d'informations sur AutoEntry

- Saisie automatique vs PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Saisie automatique vs DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- AutoEntry vs XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- AutoEntry vs SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Saisie automatique vs Fin de mois simplifiéeIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- AutoEntry vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- AutoEntry vs SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- AutoEntry vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Saisie automatique vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- AutoEntry vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- AutoEntry vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- AutoEntry vs ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- AutoEntry vs QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- AutoEntry vs FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- AutoEntry vs NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Le logiciel de comptabilité Wave est-il vraiment gratuit pour les propriétaires de petites entreprises ?

Oui, le logiciel de comptabilité Wave propose ses fonctionnalités essentielles, comme la facturation et la comptabilité de base, entièrement gratuitement. C'est pourquoi il est une solution comptable populaire auprès de nombreuses startups et très petites entreprises qui souhaitent gérer leur trésorerie sans frais initiaux.

Comment AutoEntry se compare-t-il à Hubdoc pour le suivi des dépenses ?

Saisie automatique et Hubdoc Ces deux solutions visent à simplifier le suivi des dépenses en automatisant la saisie des données issues des reçus et des factures. AutoEntry se distingue souvent par une plus grande intégration logicielle et des capacités d'extraction de données plus poussées, ce qui en fait un choix judicieux pour les entreprises ayant besoin d'une automatisation poussée.

Wave Accounting peut-il gérer la paie ?

Oui, Wave Accounting propose des services de paie. Cependant, il s'agit d'une option payante. Ce service permet aux dirigeants de petites entreprises de gérer les paiements des employés, les virements bancaires et les déclarations de cotisations sociales, centralisant ainsi leurs besoins financiers au sein d'une solution comptable unique.

AutoEntry est-il une solution comptable complète à lui seul ?

Non, AutoEntry n'est pas une solution comptable autonome. Elle est conçue pour s'intégrer aux logiciels comptables existants tels que QuickBooks ou Xero. Sa fonction principale est de simplifier la saisie des données relatives aux dépenses, aux factures et aux notes de frais, facilitant ainsi le suivi des dépenses pour les autres systèmes.

Quel outil est le plus efficace pour améliorer la trésorerie des petites entreprises ?

Pour améliorer votre trésorerie, ces deux outils sont utiles, mais de manières différentes. Wave Accounting vous offre une vue d'ensemble complète de vos finances, vous aidant à suivre vos entrées et sorties d'argent. AutoEntry simplifie la saisie des données, vous fournissant des informations financières plus rapides et plus précises pour une meilleure gestion de votre trésorerie.