Are you tired of piles of receipts and messy expense reports?

It can be a real headache trying to keep track of where your money is going, right?

Eh bien, si !

Two popular tools, Synder vs Expensify, aim to simplify expense management.

But which one is the better fit for you?

Let’s take a closer look and help you decide.

Aperçu

We looked closely at both Synder and Expensify.

Nous avons testé leurs fonctionnalités.

Nous avons constaté leur facilité d'utilisation.

Cela nous a permis de les comparer côte à côte.

Nous pouvons maintenant vous montrer ce que chacun fait de mieux.

Synder automatise votre comptabilité en synchronisant automatiquement vos données de vente avec QuickBooks, Xero et bien d'autres logiciels. Découvrez-le dès aujourd'hui !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 52 $/mois.

Caractéristiques principales :

- Synchronisation des ventes multicanaux

- Rapprochement automatisé

- Rapport détaillé

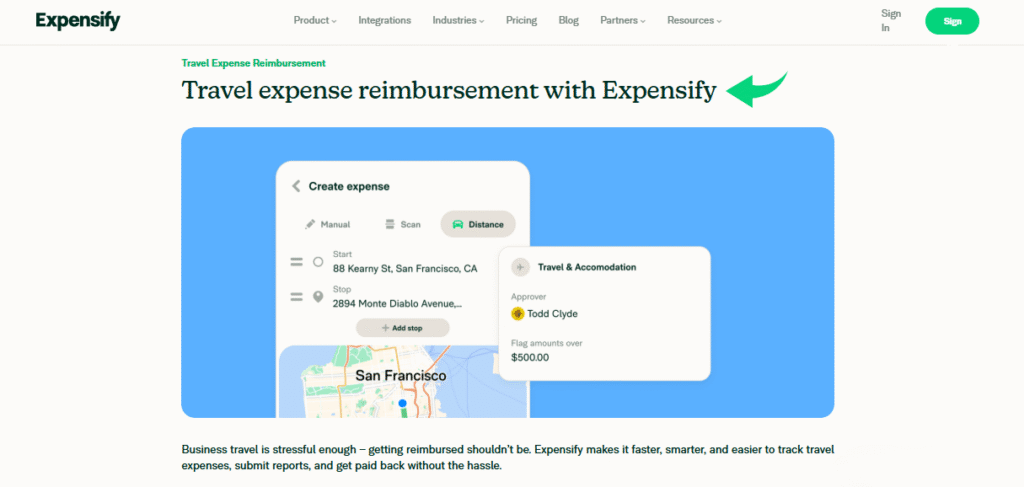

Rejoignez plus de 15 millions d'utilisateurs qui font confiance à Expensify pour simplifier leurs finances. Économisez jusqu'à 83 % sur le temps consacré aux notes de frais.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 5 $/mois.

Caractéristiques principales :

- Capture de reçus SmartScan

- Rapprochement des cartes d'entreprise

- Flux de travail d'approbation avancés.

Qu'est-ce que Synder ?

Parlons de Snyder.

C'est un outil qui vous aide à divers entreprise Les applications communiquent entre elles.

Considérez cela comme un assistant qui déplace vos informations financières là où elles doivent aller.

Cela peut vous faire gagner beaucoup de temps.

Découvrez également nos favoris Alternatives à Synder…

Notre avis

Synder automatise votre comptabilité en synchronisant de manière transparente les données de vente avec QuickBooks. Xeroet bien plus encore. Les entreprises utilisant Synder déclarent économiser en moyenne plus de 10 heures par semaine.

Principaux avantages

- Synchronisation automatique des données de vente

- Suivi des ventes multicanaux

- Rapprochement des paiements

- Intégration de la gestion des stocks

- Rapports de vente détaillés

Tarification

Tous les plans seront Facturé annuellement.

- Basique: 52 $/mois.

- Essentiel: 92 $/mois.

- Pro: 220 $/mois.

- Prime: Tarification personnalisée.

Avantages

Cons

Qu'est-ce qu'Expensify ?

Bon, parlons d'Expensify.

C'est un outil qui vous aide à suivre toutes vos dépenses professionnelles.

Considérez cela comme un assistant qui se souvient où va votre argent.

Il peut récupérer des informations à partir de vos reçus et de vos relevés bancaires. Plutôt pratique !

Découvrez également nos favoris Alternatives Expensify…

Principaux avantages

- La technologie SmartScan scanne les détails des reçus et les extrait avec une précision supérieure à 95 %.

- Les employés sont remboursés rapidement, souvent en un seul jour ouvrable via ACH.

- La carte Expensify peut vous faire économiser jusqu'à 50 % sur votre abonnement grâce à son programme de remboursement.

- Aucune garantie n'est offerte ; leurs conditions générales stipulent que la responsabilité est limitée.

Tarification

- Collecter: 5 $/mois.

- Contrôle: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

Let’s dive into the details of what each tool offers.

We will look at nine key features to help you see how they are different and which one might work best for you.

1. Sales Channels & Transaction Syncing

Synder is built for ecommerce businesses.

It can connect to all your sales channels like Shopify, Etsy, eBay, Stripe, Square, and PayPal.

This allows it to bring in a high volume of sales données, including historical transactions.

It can sync mode to keep everything up to date, which helps keep your books balanced in real time.

2. Expense Management

Expensify is a powerful tool for the expense management process.

You can take a photo of a receipt with the app. It will then capture the details in a few seconds.

This makes it easy for employees to submit their costs and manage expenses.

It also has the Expensify card to faire things even faster.

3. Financial Automation & Bookkeeping

Synder’s main goal is automated comptabilité.

It helps finance teams with comptabilité. It can automatically record sales and expenses from your sales channels.

Expensify is more about automating the expense management process.

It uses AI to simplify submitting and getting approval for reports.

4. Multi-Currency & Payouts

For businesses that sell in different countries, multi-currency support is important.

Synder handles this well. It also helps you track payouts from your different platforms and match them with your bank account.

Expensify also has multi-currency features to handle international spending.

5. Intégrations

Both platforms are compatible with many other programs.

Expensify can integrate with popular accounting systems like QuickBooks Online, NetSuite, and Xero.

Synder is also compatible with these and more, including Sage Intacct.

6. Expérience utilisateur

Synder is designed to run in the background.

You just do a quick setup, and then it handles things on its own.

Expensify is very easy to use for the user on a phone, web, or desktop.

You can capture a receipt with a quick photo and it is immediately ready.

7. Team Management & Approval

Expensify is perfect for finance teams who need to streamline their approval process.

A manager can review a report in a few seconds and approve it.

You can log mileage and track different projects.

You can also give access to contractors.

8. Real-Time Data & Insights

With Synder, you get real time data. It gives you insights into your sales.

You can see all the details from your sales channels.

Expensify also gives you real-time data for your expenses.

This lets a manager respond to requests right away.

9. Issue Resolution

Sometimes things can go wrong.

Synder can help you resolve issues with fees, taxes, refunds, and discounts.

This helps keep your balance sheets accurate.

Expensify can also help you resolve issues when an expense is blocked or has details that need to be fixed.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

When you’re ready to switch from a manual system, it can be a lot of stress to pick the right tool.

The truth is, the best choice depends on what your organization needs.

Here are some key things to focus on to avoid mistakes and find the best connection.

- Look at the Expensify reviews and other product feedback to see what real employers and comptables think.

- Check if it can handle multi-channel sales. You want a tool that can reimburse employees and manage all your sales channels, from your website to Clover.

- A good tool helps keep your books balanced and supports reconciliation to prevent financial mistakes.

- For your team, the tool should be easy to use and not a stress. It should allow employees to capture a photo and file it in a flexible way.

- Make sure it handles subscriptions, shipping, taxes, and refunds automatically. This will help you achieve proper revenue recognition and gaap compliance.

- The tool should make it simple for a small number of users to submit expenses and get them approved with one click.

- Check if the tool allows you to add tags and categories to transactions. This helps with organization and getting expected insights.

- The best tools are compatible with what you already use. It should export data easily to your comptabilité système.

- See how it handles different types of expenses, like inventory or mileage. It should be flexible enough for your unique business needs.

- A connection to all your sales channels like Clover is key for an ecommerce business. It helps keep your inventory and sales records straight.

- Look for a tool that makes it easy for employees to get reimbursed for completing their expense reports. They should be able to file reports and have them stored on a single page.

- A tool should also let you set up triggers or rules. This means a report can be highlighted or approved based on certain details.

Verdict final

So, which one should you pick: Synder or Expensify?

It’s easy to use for snapping receipts and managing reimbursements.

However, if you run a petite entreprise and need help with things like invoices, getting paid.

And keeping your books in order with your comptabilité software, Synder might be the better fit.

Its ability to integrate and automate many financial tasks can save you a lot of time.

We think Synder offers a bit more for businesses that want to automate more of their money management.

We’ve looked closely at both, so we hope this helps you choose what works best for you!

Plus de Snyder

- Synder contre Puzzle io: Puzzle.io est un outil de comptabilité basé sur l'IA, conçu pour les startups et axé sur des indicateurs tels que le taux de consommation de trésorerie et l'autonomie financière. Synder, quant à lui, se concentre davantage sur la synchronisation des données de vente multicanaux pour un plus large éventail d'entreprises.

- Synder contre Dext: Dext est un outil d'automatisation qui excelle dans la capture et la gestion des données issues des factures et des reçus. Synder, quant à lui, est spécialisé dans l'automatisation du flux des transactions de vente.

- Synder contre Xero: Xero est une plateforme de comptabilité en nuage complète. Synder Il fonctionne avec Xero pour automatiser la saisie des données provenant des canaux de vente, tandis que Xero gère les tâches comptables globales telles que la facturation et les rapports.

- Synder vs Easy Fin de mois: Easy Month End est un outil conçu pour aider les entreprises à organiser et à simplifier leur processus de clôture de fin de mois. Synder, quant à lui, se concentre davantage sur l'automatisation du flux de données transactionnelles quotidiennes.

- Synder contre Docyt: Docyt utilise l'IA pour de nombreuses tâches comptables, notamment le paiement des factures et la gestion des dépenses. Synder, quant à lui, se concentre davantage sur la synchronisation automatique des données de vente et de paiement provenant de multiples canaux.

- Synder contre RefreshMe: RefreshMe est une application de gestion des finances personnelles et des tâches. Ce n'est pas un concurrent direct, car Synder est un outil d'automatisation de la comptabilité d'entreprise.

- Synder contre Sage: Sage est un système comptable complet et éprouvé, doté de fonctionnalités avancées telles que la gestion des stocks. Synder est un outil spécialisé qui automatise la saisie de données dans les systèmes comptables comme Sage.

- Synder contre Zoho Books: Zoho Books est une solution comptable complète. Synder Il complète Zoho Books en automatisant le processus d'importation des données de vente provenant de diverses plateformes de commerce électronique.

- Synder contre Wave: Wave est un logiciel de comptabilité gratuit et intuitif, souvent utilisé par les indépendants et les très petites entreprises. Synder est un outil d'automatisation payant conçu pour les entreprises réalisant un volume important de ventes multicanales.

- Synder contre Quicken: Quicken est principalement un logiciel de gestion des finances personnelles, bien qu'il propose également quelques fonctionnalités pour les petites entreprises. Synder, quant à lui, est conçu spécifiquement pour l'automatisation de la comptabilité des entreprises.

- Synder vs Hubdoc: Hubdoc est un outil de gestion de documents et de saisie de données, similaire à Dext. Il est principalement destiné à la numérisation des factures et des reçus. Synder, quant à lui, se concentre sur la synchronisation des données de vente et de paiement en ligne.

- Synder contre Expensify: Expensify est un outil de gestion des notes de frais et des reçus. Synder permet d'automatiser le traitement des données de transactions de vente.

- Synder contre QuickBooks: QuickBooks est un logiciel de comptabilité complet. Synder Il s'intègre à QuickBooks pour automatiser le processus d'importation de données de vente détaillées, ce qui en fait un complément précieux plutôt qu'une alternative directe.

- Synder vs AutoEntry: AutoEntry est un outil d'automatisation de la saisie de données qui capture les informations des factures et des reçus. Synder se concentre sur l'automatisation des données de vente et de paiement issues des plateformes de commerce électronique.

- Synder contre FreshBooks: FreshBooks est un logiciel de comptabilité conçu pour les travailleurs indépendants et les petites entreprises de services, axé sur la facturation. Synder, quant à lui, s'adresse aux entreprises réalisant un volume important de ventes via plusieurs canaux en ligne.

- Synder contre NetSuite: NetSuite est un système de planification des ressources d'entreprise (ERP) complet. Synder est un outil spécialisé qui synchronise les données de commerce électronique avec des plateformes plus larges comme NetSuite.

Plus d'informations sur Expensify

- Expensify contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Expensify contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Expensify contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Expensify contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Expensify vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Expensify contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Expensify contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Expensify contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Expensify vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Expensify vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Expensify contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Expensify vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Expensify contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Expensify contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

What is the main difference between Synder and Expensify?

Expensify is mostly for tracking expenses and receipts. Synder does that too, but it also helps with invoices, payments, and connects to your logiciel de comptabilité to automate things.

Is Synder better for small businesses?

Synder can be very helpful for a petite entreprise. It helps with getting paid and keeping your financial records organized by integrateing with tools like Zoho and FreshBooks.

Can Expensify integrate with my accounting software?

Yes, Expensify can integrate with many accounting software options. This helps you keep your expense information in one place.

Does Synder help with getting paid faster?

Yes, Synder helps you create and send invoices. It can also remind customers to pay, which can help you get paid faster.

Which tool is easier to use for a startup?

Both tools try to be easy to use. Expensify is simple for tracking expenses. Synder might take a little more time to set up all its automation features, but it can save time plus tard for a startup.