Êtes-vous un petite entreprise Vous êtes propriétaire ou travailleur indépendant et recherchez le meilleur logiciel de comptabilité ?

Il est difficile de choisir le bon, surtout lorsqu'on a des options comme Sage et Wave.

Les deux sont populaires, mais elles offrent des choses différentes.

Ne vous inquiétez pas, nous sommes là pour vous aider à comprendre les principales différences.

Nous allons comparer Sage et Wave pour vous aider à choisir. logiciel de comptabilité est le meilleur.

Aperçu

Nous avons examiné de près Sage et Wave.

Nous avons testé leurs fonctionnalités, leur facilité d'utilisation et leur prix.

Cela nous a permis de déterminer quelle solution est la mieux adaptée aux différents types d'entreprises.

Plus de 6 millions de clients font confiance à Sage. Avec un taux de satisfaction client de 56 sur 100, ses fonctionnalités robustes constituent une solution éprouvée.

Tarification : Essai gratuit disponible. Abonnement premium à 66,08 $/mois.

Caractéristiques principales :

- Facturation

- Intégration de la paie

- Gestion des stocks

Plus de 4 millions petites entreprises Confiez la gestion de vos finances à Wave. Découvrez les offres de Wave et trouvez celle qui vous convient.

Tarification : Formule gratuite disponible. Formule payante à partir de 19 $/mois.

Caractéristiques principales :

- Facturation

- Bancaire

- Module complémentaire de paie.

Qu'est-ce que Sage ?

Parlons de Sage.

Ça existe depuis un certain temps.

De nombreuses entreprises l'utilisent. Cela permet de suivre les flux financiers.

Considérez-le comme un carnet numérique pour votre entreprise truc.

Découvrez également nos favoris Alternatives à la sauge…

Notre avis

Prêt à booster vos finances ? Les utilisateurs de Sage ont constaté une augmentation moyenne de 73 % de leur productivité et une réduction de 75 % du temps de cycle de traitement.

Principaux avantages

- Facturation et paiements automatisés

- Rapports financiers en temps réel

- Un système de sécurité renforcé pour protéger les données

- Intégration avec d'autres outils d'entreprise

- Solutions de paie et de RH

Tarification

- Comptabilité professionnelle : 66,08 $/mois.

- Comptabilité premium : 114,33 $/mois.

- Comptabilité quantique : 198,42 $/mois.

- Solutions RH et paie groupées : Tarification personnalisée en fonction de vos besoins.

Avantages

Cons

Qu'est-ce qu'une vague ?

Bon, parlons de Wave.

Considérez-le comme un ami précieux pour les finances de votre entreprise.

Il vous permet notamment d'envoyer des factures et de suivre les entrées et sorties d'argent.

Cela peut vous aider à avoir une vision d'ensemble des finances de votre entreprise.

Découvrez également nos favoris Alternatives aux vagues…

Notre avis

N’acceptez pas moins ! Rejoignez les plus de 2 millions de petites entreprises qui font confiance dès aujourd’hui aux puissantes fonctionnalités comptables gratuites de Wave pour optimiser leurs finances.

Principaux avantages

Les points forts de Wave incluent :

- Un plan de comptabilité de base 100% gratuit.

- Au service de plus de 2 millions de petites entreprises.

- Création de factures et traitement des paiements simplifiés.

- Aucun contrat ni garantie à long terme.

Tarification

- Plan de démarrage : 0 $ par mois.

- Formule Pro : 19 $ par mois.

Avantages

Cons

Comparaison des fonctionnalités

Cette comparaison offre un bref aperçu de Sage et Wave, deux logiciels de pointe. comptabilité options de plateforme.

Nous analysons comment une plateforme riche en fonctionnalités et évolutive se compare à un logiciel de comptabilité gratuit, ce qui permet de… petite entreprise Les propriétaires trouvent le produit qui correspond à leurs besoins.

1. Portée de la plateforme et public cible

- Sage cloud d'entreprise comptabilité Il s'agit d'une plateforme comptable complète conçue pour les petites et moyennes entreprises. Ce logiciel inclut des fonctionnalités permettant de gérer les ventes, les stocks et la paie, aidant ainsi les entreprises à gérer efficacement leurs finances et à se développer.

- Vague est en ligne comptabilité solution designed for small business owners and freelancers. Its free logiciel de comptabilité and free platform are ideal for those just starting out or with very simple accounting needs, offering a straightforward way to manage their finances.

2. Accessibilité et fonctionnalités uniques

- Sage Il s'agit d'une solution de bureau performante dotée d'une connectivité cloud robuste, bien que certaines versions présentent des limitations d'accès mobile. Elle propose également une application mobile dédiée et performante pour un accès en mobilité. La plateforme est conçue pour les équipes comptables et les professionnels de la comptabilité.

- Vague Elle simplifie la gestion financière grâce à son interface intuitive. Cette plateforme gratuite propose une application mobile dédiée performante et des fonctionnalités de facturation robustes, pour une tranquillité d'esprit assurée. petite entreprise Les propriétaires. La possibilité d'utiliser le logiciel pour plusieurs entreprises sur le même compte est une fonctionnalité précieuse.

3. Fonctionnalités comptables de base

- Sage Business Cloud offre un ensemble complet de fonctionnalités comptables, incluant la comptabilité professionnelle, la gestion des dépenses et les outils financiers. reportageIl vous aide à gérer votre flux de trésorerie et vous fournit des outils performants pour gérer efficacement vos finances.

- Vague Les analyses et les retours des utilisateurs montrent que ses fonctionnalités comptables de base sont performantes. Il gère efficacement la facturation, les dépenses et les transactions bancaires. La version gratuite comptabilité Ce logiciel propose un nombre illimité de factures, ce qui est très avantageux, mais il lui manque certaines des fonctionnalités avancées présentes dans Sage.

4. Automatisation et efficacité

- Sage Il automatise de nombreuses tâches manuelles grâce à des fonctionnalités telles que le suivi des factures et l'identification des écarts entre vos relevés bancaires et comptables, permettant ainsi à vos équipes comptables de gagner du temps. Il est conçu pour une gestion efficace des flux de travail et la production de rapports en temps réel.

- Vague Ce logiciel simplifie la gestion financière en automatisant les processus. Il importe automatiquement les transactions bancaires et fusionne les écritures, réduisant ainsi les interventions manuelles. La version gratuite permet aux entreprises de gérer leurs rapports financiers quotidiens plus facilement et plus efficacement.

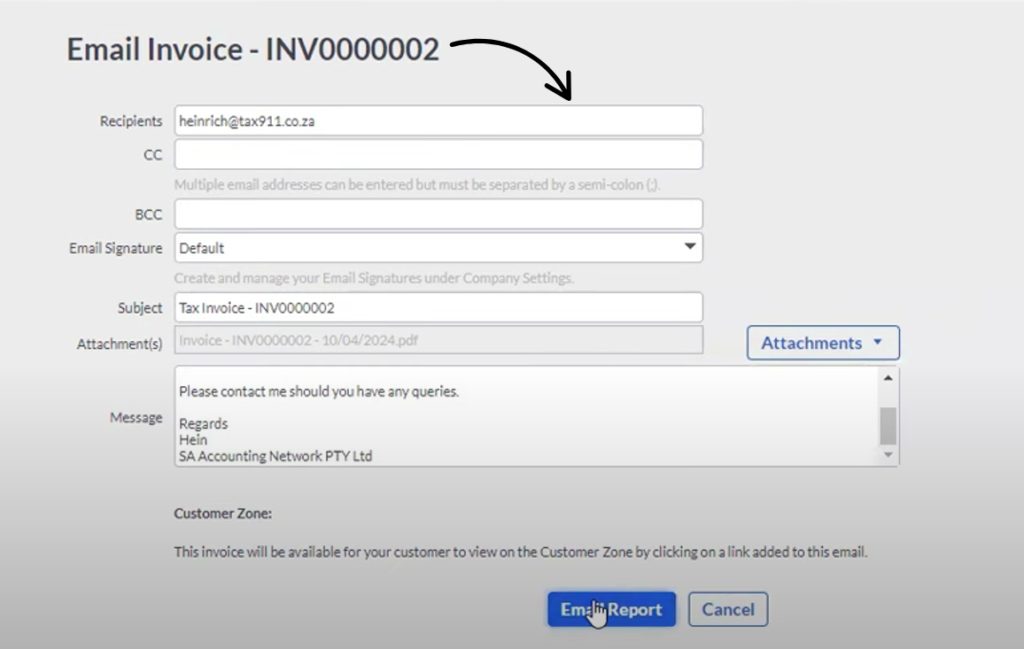

5. Facturation et paiements

- Sage Ce logiciel vous permet de créer des factures de vente professionnelles, de gérer les bons de commande et d'accepter différents modes de paiement. Il est conçu pour optimiser votre trésorerie et vous aider à gérer tous les aspects de vos ventes.

- Vague Wave propose un excellent logiciel de facturation avec un nombre illimité de factures dans sa version gratuite. Il envoie des rappels de paiement automatiques et permet d'accepter plusieurs modes de paiement en ligne, notamment par carte bancaire et virement bancaire. Wave offre également la facturation récurrente avec son abonnement Pro, une fonctionnalité essentielle pour de nombreux dirigeants de petites entreprises.

6. Gestion des stocks et calcul des coûts par commande

- Sage Il offre un système de gestion des stocks performant. Il permet de créer des variantes de produits, de synchroniser automatiquement les stocks et d'émettre des alertes de stock faible pour ne rater aucune vente. Il intègre également le calcul des coûts par projet et des codes de coûts pour suivre la rentabilité de chaque projet.

- Vague Wave ne propose pas d'outils natifs de gestion des stocks ni de calcul des coûts par projet. Cela peut constituer un inconvénient pour les entreprises qui doivent gérer un stock physique. Wave s'intègre à des applications tierces pour répondre à certains de ces besoins, mais il ne s'agit pas d'une fonctionnalité intégrée.

7. Traitement de la paie

- Le module complémentaire Sage Payroll offre une solution logicielle complète de gestion de la paie et de la comptabilité. Il aide les entreprises à gérer les paiements de leurs employés et prestataires, garantissant ainsi la conformité et l'exactitude des déclarations fiscales.

- Wave Payroll est une extension optionnelle pour la comptabilité et la paie. Elle facilite la gestion de la paie et garantit le paiement correct de chaque travailleur indépendant. Cependant, il s'agit d'une extension payante, et non d'une fonctionnalité de base gratuite de la version comptable.

8. Soutien et ressources

- Sage Sage University offre un soutien complet via sa plateforme communautaire et une assistance directe pour répondre à vos questions. Si vous avez besoin d'aide supplémentaire, vous trouverez de nombreux articles et tutoriels pour résoudre tous vos problèmes.

- Vague Il propose une assistance via son centre d'aide contenant des articles, et son espace communautaire permet aux utilisateurs de répondre aux questions et de partager leurs bonnes pratiques. Son modèle d'assistance est moins personnalisé que celui de Sage, mais ses formules gratuite et payante offrent toutes deux un certain niveau de support.

9. Tarification et forfaits

- Sage Il s'agit d'une plateforme de comptabilité professionnelle aux tarifs élevés. Elle propose différents niveaux d'abonnement, dont le prix varie en fonction des fonctionnalités et du nombre d'utilisateurs. Cela peut représenter un inconvénient pour les très petites entreprises.

- Le Vague Les avis mettent souvent en avant la gratuité de son logiciel de comptabilité comme un atout majeur. Wave propose une formule de base gratuite avec ses fonctionnalités comptables essentielles, ainsi qu'une formule Pro payante offrant des outils plus avancés, comme la gestion de la paie. Cela en fait une solution idéale pour un utilisateur indépendant.

Quels sont les critères à prendre en compte pour choisir un logiciel de comptabilité ?

- ÉvolutivitéLe meilleur logiciel de comptabilité pour petites entreprises devrait gérer votre comptabilité existante. données En toute simplicité. Un abonnement payant performant permet souvent l'utilisation par plusieurs utilisateurs, voire un nombre illimité, vous évitant ainsi des frais supplémentaires à mesure que votre équipe s'agrandit. Vous devriez pouvoir suivre vos revenus et gérer votre comptabilité générale sans aucune limite.

- SoutienQuel type d'assistance est disponible si vous avez des questions ? Un bon fournisseur comme Wave Financial propose de nombreuses ressources. Vous trouverez des articles et des tutoriels expliquant les fonctionnalités clés et vous aidant à générer des rapports. L'assistance optimale est disponible les jours ouvrables et offre un tarif préférentiel pour les services professionnels via sa plateforme Sage ou son réseau de partenaires.

- Facilité d'utilisationEst-ce quelque chose que vous et votre équipe pouvez apprendre rapidement ? Une interface intuitive est essentielle pour tout logiciel financier. Elle doit vous permettre de suivre vos dépenses en un clic et proposer des outils de numérisation et de fusion automatique des reçus pour vous faire gagner du temps. Le logiciel doit gérer les transactions automatiquement et vous offrir un moyen simple de suivre vos finances personnelles et professionnelles.

- Besoins spécifiquesVotre logiciel de comptabilité est-il adapté aux spécificités de votre activité ? Un bon logiciel vous permet d’accepter les paiements en ligne par virement bancaire et de suivre les heures facturables de vos clients. Vous devriez pouvoir créer des fiches personnalisées et adapter les champs de contact à vos besoins. Le système devrait également gérer facilement les transactions par carte bancaire et les dépenses récurrentes.

- SécuritéVos données financières sont-elles bien protégées par ce logiciel ? La sécurité des données est une priorité absolue. Privilégiez des fonctionnalités telles que l’authentification multifacteur et les sauvegardes en ligne pour protéger vos informations financières sensibles. Pour les entreprises, des fournisseurs comme Wave Financial sont souvent considérés comme une alternative sûre et fiable à des concurrents plus importants. QuickBooks En ligne, et de nombreux utilisateurs recommandent Wave comme une option sûre.

Verdict final

Alors, quel est le meilleur logiciel de comptabilité ? Cela dépend vraiment de vos besoins.

Pour les travailleurs indépendants ou les très petites entreprises, Wave est souvent la solution idéale.

C'est gratuit et facile d'utilisation, parfait pour gérer les revenus et les dépenses de base.

Cependant, si votre entreprise est en pleine croissance ou a besoin d'outils plus complexes, Sage est probablement le meilleur choix.

Il offre des fonctionnalités plus avancées, comme de meilleures options de gestion des stocks et de la paie.

Nous avons examiné les deux en détail, en comparant tout, de la facturation à l'évolutivité.

Faites confiance à nos recherches pour vous aider à choisir l'outil adapté à votre entreprise.

Plus de Sage

Il est utile de voir comment Sage se compare aux autres logiciels populaires.

Voici une brève comparaison avec certains de ses concurrents.

- Sage contre Puzzle IO: Bien que les deux logiciels gèrent la comptabilité, Puzzle IO est conçu spécifiquement pour les startups, en se concentrant sur les flux de trésorerie en temps réel et des indicateurs comme le taux d'épuisement des ressources.

- Sage contre Dext: Dext est avant tout un outil d'automatisation de la saisie des données issues des reçus et des factures. Il est souvent utilisé conjointement avec Sage pour accélérer la comptabilité.

- Sage contre Xero: Xero est une solution cloud réputée pour sa simplicité d'utilisation, notamment auprès des petites entreprises. Sage, quant à elle, offre des fonctionnalités plus avancées pour accompagner la croissance de l'entreprise.

- Sage contre Snyder: Synder se concentre sur la synchronisation des plateformes de commerce électronique et des systèmes de paiement avec des logiciels comptables comme Sage.

- Sage vs Easy Fin de mois: Ce logiciel est un gestionnaire de tâches qui vous aide à suivre toutes les étapes nécessaires à la clôture de vos comptes à la fin du mois.

- Sage contre Docyt: Docyt utilise l'IA pour automatiser la comptabilité et éliminer la saisie manuelle des données, offrant ainsi une alternative hautement automatisée aux systèmes traditionnels.

- Sage contre RefreshMe: RefreshMe n'est pas un concurrent direct des services comptables. L'entreprise se concentre davantage sur la reconnaissance et l'engagement des employés.

- Sage contre Zoho Books: Zoho Books fait partie d'une vaste suite d'applications professionnelles. Elle est souvent saluée pour son design épuré et ses fortes connexions avec les autres produits Zoho.

- Sage contre vague: Wave est connu pour son forfait gratuit, qui offre des fonctionnalités de comptabilité et de facturation de base, ce qui en fait un choix populaire auprès des indépendants et des très petites entreprises.

- Sage contre Quicken: Quicken est plutôt destiné aux finances personnelles ou aux très petites entreprises. Sage offre des fonctionnalités plus robustes pour une entreprise en pleine croissance, comme la gestion de la paie et des stocks avancés.

- Sage vs Hubdoc: Hubdoc est un outil de gestion documentaire qui collecte et organise automatiquement les documents financiers, similaire à Dext, et peut s'intégrer aux plateformes comptables.

- Sage contre Expensify: Expensify est un expert en gestion des dépenses. C'est idéal pour numériser les reçus et automatiser les notes de frais des employés.

- Sage contre QuickBooks: QuickBooks est un acteur majeur du secteur de la comptabilité pour les petites entreprises. Il est réputé pour son interface conviviale et sa large gamme de fonctionnalités.

- Sage vs AutoEntry: Voici un autre outil qui automatise la saisie des données à partir des reçus et des factures. Il fonctionne parfaitement comme module complémentaire aux logiciels de comptabilité tels que… Sage.

- Sage contre FreshBooks: FreshBooks est particulièrement adapté aux travailleurs indépendants et aux entreprises de services, car il met l'accent sur la facturation simple et le suivi du temps.

- Sage contre NetSuite: NetSuite est un système ERP complet destiné aux grandes entreprises. Sage propose une gamme de produits, dont certains sont concurrents à ce niveau, mais NetSuite est une solution plus vaste et plus complexe.

Plus de Wave

- Wave vs Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Wave contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Wave contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Vague contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Wave vs Easy Fin de moisIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Wave vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Vague contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Wave vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Wave vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- Wave vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Wave contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Wave contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Wave vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Wave contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Wave contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Wave est-il vraiment gratuit pour les petites entreprises ?

Oui, Wave propose une formule entièrement gratuite pour la comptabilité de base, la facturation et la numérisation des reçus. faire les revenus provenant des services de traitement des paiements et de paie, qui sont des options supplémentaires.

Sage peut-il s'intégrer à d'autres outils d'entreprise ?

Oui, Sage propose diverses intégrations avec d'autres logiciels d'entreprise. Cela vous permet de le connecter à des outils pour CRM, le commerce électronique et plus encore, selon votre produit et votre forfait Sage spécifiques.

Quel logiciel est le plus adapté aux freelances, Sage ou Wave ?

Pour la plupart des travailleurs indépendants, Wave est généralement plus avantageux. Son forfait gratuit et son interface intuitive sont parfaits pour gérer facilement ses revenus et ses dépenses sans frais supplémentaires.

Wave propose-t-il des services de paie ?

Oui, Wave propose des services de paie en option payante. Ce service est disponible pour les entreprises aux États-Unis et au Canada et vous aide à gérer les paiements des employés, les impôts et les dépôts directs.

Sage est-il plus complexe que QuickBooks ?

Sage peut être considéré comme plus complexe que certaines versions d'entrée de gamme de QuickBooks. Bien que les deux logiciels offrent des fonctionnalités performantes, Sage s'adresse souvent aux entreprises ayant besoin de solutions comptables plus avancées ou spécifiques à leur secteur d'activité.