Vous avez du mal à gérer des notes de frais désordonnées ?

Avez-vous l'impression de vous noyer sous les reçus, en essayant de comprendre où est passé votre argent ?

Et s'il existait une meilleure solution ?

Les logiciels de gestion des dépenses comme Sage et Expensify promettent de résoudre ces problèmes.

Mais choisir le bon peut s'avérer délicat.

Comparons Sage et Expensify pour vous aider à choisir l'outil le mieux adapté à vos besoins. entreprise.

Aperçu

Nous avons testé en profondeur Sage et Expensify.

Nous les avons utilisés pour suivre les dépenses, télécharger les reçus et créer des rapports.

Cette expérience pratique nous a permis de voir comment ils se comparent les uns aux autres.

Plus de 6 millions de clients font confiance à Sage. Avec un taux de satisfaction client de 56 sur 100, ses fonctionnalités robustes constituent une solution éprouvée.

Tarification : Essai gratuit disponible. Abonnement premium à 66,08 $/mois.

Caractéristiques principales :

- Facturation

- Intégration de la paie

- Gestion des stocks

Rejoignez plus de 15 millions d'utilisateurs qui font confiance à Expensify pour simplifier leurs finances. Économisez jusqu'à 83 % sur le temps consacré aux notes de frais.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 5 $/mois.

Caractéristiques principales :

- Capture de reçus SmartScan

- Rapprochement des cartes d'entreprise

- Flux de travail d'approbation avancés.

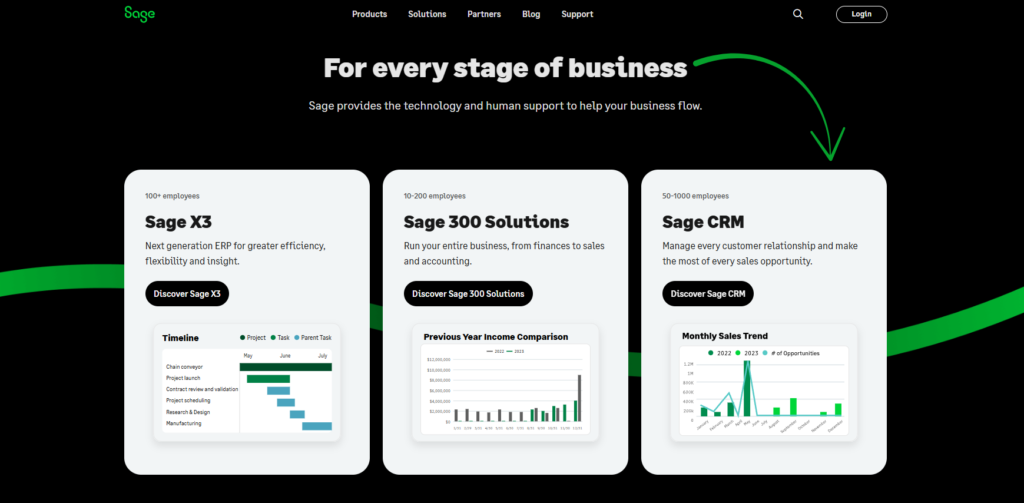

Qu'est-ce que Sage ?

Parlons de Sage.

Ça existe depuis un certain temps.

De nombreuses entreprises l'utilisent. Cela permet de suivre les flux financiers.

Considérez-le comme un carnet numérique pour vos documents professionnels.

Découvrez également nos favoris Alternatives à la sauge…

Notre avis

Prêt à booster vos finances ? Les utilisateurs de Sage ont constaté une augmentation moyenne de 73 % de leur productivité et une réduction de 75 % du temps de cycle de traitement.

Principaux avantages

- Facturation et paiements automatisés

- Rapports financiers en temps réel

- Un système de sécurité renforcé pour protéger les données

- Intégration avec d'autres outils d'entreprise

- Solutions de paie et de RH

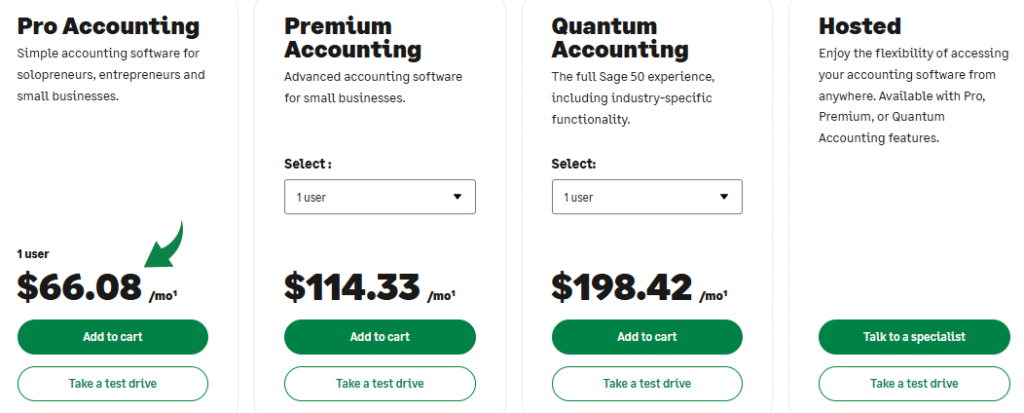

Tarification

- Comptabilité professionnelle : 66,08 $/mois.

- Comptabilité premium : 114,33 $/mois.

- Comptabilité quantique : 198,42 $/mois.

- Solutions RH et paie groupées : Tarification personnalisée en fonction de vos besoins.

Avantages

Cons

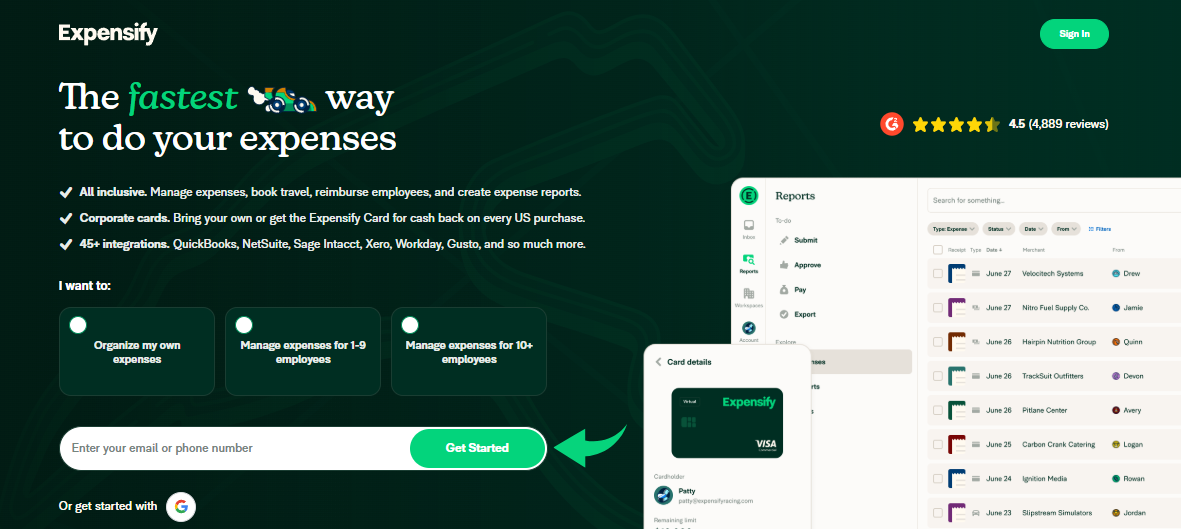

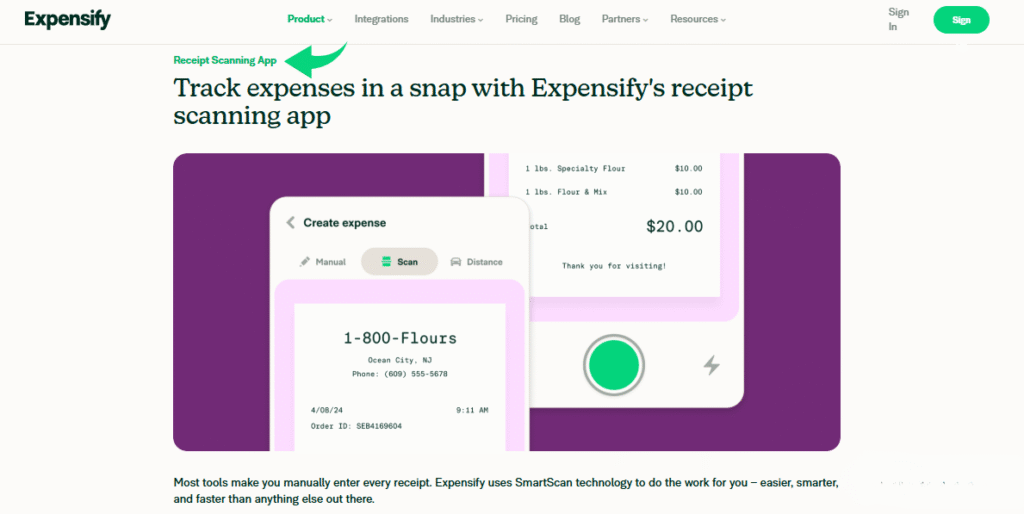

Qu'est-ce qu'Expensify ?

Bon, parlons d'Expensify.

C'est un outil qui vous aide à suivre toutes vos dépenses professionnelles.

Considérez cela comme un assistant qui se souvient où va votre argent.

Il peut récupérer des informations à partir de vos reçus et de vos relevés bancaires. Plutôt pratique !

Découvrez également nos favoris Alternatives Expensify…

Principaux avantages

- La technologie SmartScan scanne les détails des reçus et les extrait avec une précision supérieure à 95 %.

- Les employés sont remboursés rapidement, souvent en un seul jour ouvrable via ACH.

- La carte Expensify peut vous faire économiser jusqu'à 50 % sur votre abonnement grâce à son programme de remboursement.

- Aucune garantie n'est offerte ; leurs conditions générales stipulent que la responsabilité est limitée.

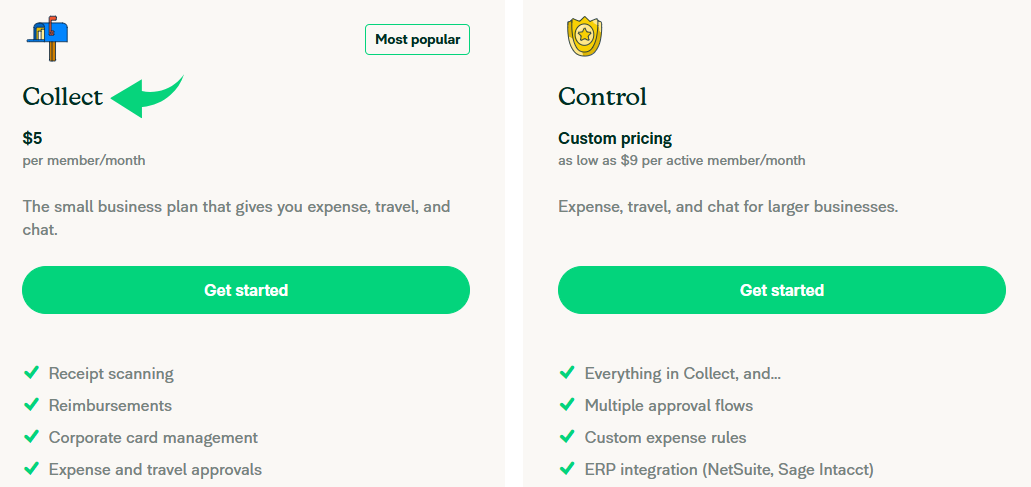

Tarification

- Collecter: 5 $/mois.

- Contrôle: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

Cette comparaison offre un bref aperçu de Sage et Expensify, deux solutions distinctes. comptabilité solutions.

Nous analysons comment une plateforme comptable complète se compare à un outil spécialisé de gestion des dépenses, ce qui permet de… petite entreprise Les propriétaires choisissent la taille qui leur convient.

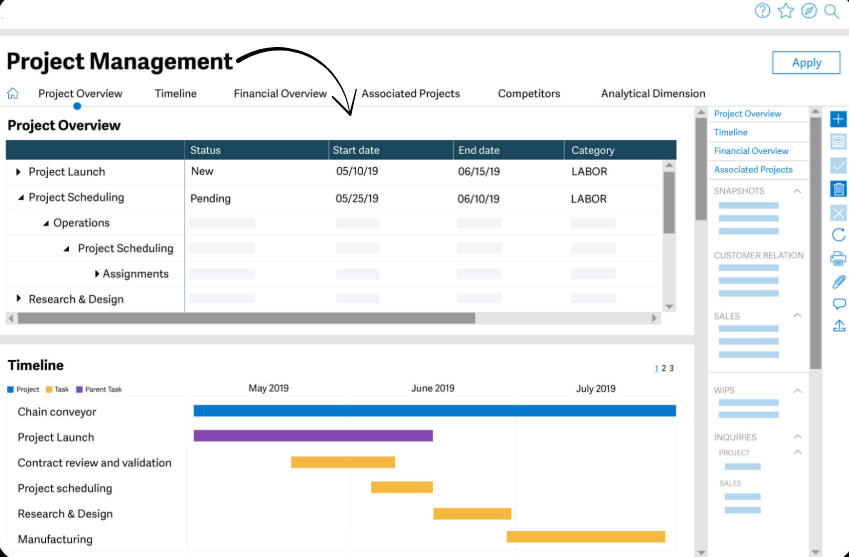

1. Portée et objectifs de la plateforme

- Sage Business Cloud Accounting est une plateforme comptable complète conçue pour petite entreprise Ce logiciel s'adresse aux propriétaires d'entreprises et aux PME. Il comprend une large gamme de services, tels que la gestion des stocks et la paie, ce qui en fait une solution de bureau robuste avec connectivité au cloud.

- Expensify est un outil spécialisé dans la gestion des dépenses. Son objectif principal est de simplifier et d'automatiser l'ensemble du processus de gestion des dépenses, du début à la fin, ce qui le distingue d'une plateforme comptable complète.

2. Automatisation et tâches manuelles

- Sage Ce logiciel automatise de nombreuses tâches manuelles grâce à des fonctionnalités telles que le rapprochement bancaire et le suivi des factures. Ses fonctions de gestion des flux de travail sont personnalisables afin d'optimiser l'ensemble du processus comptable. C'est un système performant qui permet aux équipes comptables de gagner un temps précieux.

- Expensify simplifie la gestion des dépenses. Il utilise une technologie de reconnaissance optique de caractères (OCR) nouvelle génération pour extraire les données d'un reçu ou d'une facture, puis les publier automatiquement sur votre compte. logiciel de comptabilitéLes avis sur Expensify et d'autres articles soulignent le gain de temps considérable qu'il permet, vous évitant ainsi la saisie manuelle de données.

3. Tarification et coûts

- Sage Ses prix sont plus élevés que ceux de nombreuses autres plateformes. Sa tarification est échelonnée et peut être mensuelle ou par utilisateur. Elle propose également divers modules complémentaires pour la paie et la gestion des stocks, moyennant des frais supplémentaires.

- Expensify La tarification est flexible et basée sur un système de crédits mensuels : chaque facture, reçu ou relevé bancaire consomme un certain nombre de crédits. Vous ne payez que pour l’extraction de données dont vous avez besoin et bénéficiez gratuitement d’un nombre illimité d’utilisateurs et d’un espace de stockage cloud illimité. La carte Expensify est également gratuite.

4. Intégration et connectivité

- Sage Il propose une application mobile dédiée et une connectivité au cloud, malgré certaines limitations d'accès mobile. Il s'intègre à d'autres applications professionnelles via sa plateforme Sage Marketplace. Sa solution de bureau, avec connectivité au cloud et sauvegardes en ligne, offre une solution complète aux entreprises souhaitant une plateforme unique.

- Expensify est conçu pour une intégration transparente avec les logiciels comptables tels que Sage, QuickBooks Online et XeroSon fonctionnement repose sur le téléchargement d'une facture d'achat ou d'autres documents depuis un téléphone mobile ou un ordinateur, ce qui déclenche ensuite l'extraction des données. Les avis sur Expensify mentionnent souvent sa simplicité d'utilisation. QuickBooks Intégration en ligne.

5. Rapports et analyses

- Sage est connu pour ses informations financières détaillées reportage et des rapports en temps réel. Il vous permet de générer des rapports sur différents aspects de votre activité, du calcul des coûts par projet aux produits les plus rentables. Le logiciel vous fournit les outils nécessaires pour analyser et évaluer vos performances.

- Expensify Le logiciel ne permet de générer des rapports que sur les documents traités, car sa fonction principale est l'extraction de données et non l'établissement de rapports financiers. Il facilite le travail des comptables en préparant les données nécessaires à la génération de rapports dans leur plateforme comptable.

6. Stocks et ventes

- Sage Il offre un système de gestion des stocks performant. Vous pouvez créer des variantes de produits, synchroniser automatiquement votre inventaire et recevoir des alertes de stock faible pour ne jamais rater une vente.

- Expensify Il s'agit d'un outil d'extraction de données, et non d'une plateforme comptable complète ; il ne propose donc pas de gestion des stocks ni d'outils de vente. Il peut toutefois extraire des informations d'une facture d'achat, lesquelles peuvent ensuite être utilisées par la plateforme comptable Sage Business Cloud pour gérer les stocks.

7. Soutien et ressources

- Sage Sage propose une multitude de ressources pédagogiques via Sage University, un espace communautaire et une assistance directe pour répondre aux questions. En cas de dysfonctionnement d'une fonctionnalité ou d'un processus, l'utilisateur peut trouver des ressources et des articles pour résoudre le problème. La Marketplace Sage donne accès à une assistance supplémentaire.

- Expensify Expensify propose une assistance, notamment des articles et des vidéos, pour aider les utilisateurs. Les avis sur Expensify soulignent la rapidité et la réactivité de cette assistance, un atout précieux pour les clients rencontrant des difficultés avec une facture d'achat ou d'autres documents.

8. Fonctionnalité unique

- Sage La plateforme propose des fonctionnalités uniques pour les entreprises, notamment la comptabilité professionnelle, le calcul des coûts par projet avec codes de coûts et le suivi de l'état d'avancement des projets. Elle offre également le module complémentaire Sage Payroll.

- Expensify Sa fonctionnalité unique réside dans sa technologie OCR et sa capacité à lire les documents financiers. L'analyse d'Expensify souligne qu'il s'agit d'un service de sécurité protégeant contre les cyberattaques potentielles. Il est conçu pour se prémunir contre les attaques en ligne susceptibles de déclencher une solution de sécurité, comme une erreur « cloudflare ray i » ou « cloudflare ray id found ». Ce type d'erreur peut survenir avec un mot ou une expression spécifique, une commande SQL particulière ou des données malformées pouvant entraîner ce blocage.

9. Comparaison et recommandations

- SageCette plateforme comptable complète offre des fonctionnalités avancées pour une gestion financière efficace, notamment pour les entreprises disposant de stocks et réalisant des ventes complexes. Sa solution de bureau avec connectivité au cloud et sauvegardes en ligne constitue une solution globale pour les entreprises souhaitant une plateforme unique.

- Expensify Cet outil d'extraction de données est idéal et complète parfaitement les autres logiciels comptables. Son intégration fluide avec des produits comme QuickBooks Online en fait un excellent choix pour les entreprises souhaitant automatiser leurs tâches et réduire le temps consacré à la saisie manuelle de données.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

Choisir un logiciel de comptabilité est une décision importante, tout comme choisir le bon équipement pour un projet d'envergure. Voici un guide simple pour vous aider à choisir le bon logiciel !

- Est-ce facile à utiliser ? Vous recherchez un logiciel qui simplifie la prise en main. L’installation doit être simple et vous permettre de connecter vos comptes bancaires en quelques secondes. Certains programmes fonctionnent via une interface web, tandis que d’autres nécessitent l’installation d’un logiciel sur votre ordinateur. Une application mobile performante est très pratique pour numériser vos reçus, par exemple.

- Ce logiciel possède-t-il les fonctionnalités adéquates ? Il doit vous aider à suivre vos finances. Il doit gérer votre trésorerie et vous permettre de créer des factures de vente pour vos clients. La possibilité de créer des bons de commande est également importante. Certains logiciels peuvent même gérer la paie de vos employés ou suivre les paiements aux prestataires. Il doit disposer de tous les outils nécessaires à la gestion de votre argent et de vos paiements.

- Comment cela vous aide-t-il à rester organisé ? Un bon logiciel facilite l’organisation. Vous pouvez utiliser des étiquettes et des catégories pour trier vos transactions bancaires et vos dépenses. Cela simplifie l’enregistrement et la recherche d’informations. plus tardIl devrait également vous aider pour le rapprochement bancaire, c'est-à-dire pour vérifier que votre relevé bancaire et votre comptabilité correspondent. Le logiciel devrait identifier pour vous toute différence non rapprochée.

- Et si vous l'utilisiez en déplacement ? Une connexion internet performante est essentielle pour travailler de n'importe où. Attention aux inconvénients potentiels, comme les limitations. accès à distance Sur certains programmes, une bonne application devrait permettre de photographier les reçus et de tenir un registre de son kilométrage directement depuis son téléphone, qui est toujours sur soi.

- Comment le système gère-t-il votre équipe ? Si vous n’êtes pas une entreprise individuelle, vous avez besoin d’un système adapté au travail d’équipe. Le logiciel doit comporter des fonctionnalités d’approbation. Par exemple, un responsable peut approuver les demandes de remboursement de frais. Il est important que tous les membres de l’équipe, employeurs et employés confondus, puissent répondre à ces demandes et assurer la continuité des processus.

- What about security and reporting? The best accounting software will protect your data. All your information should be stored safely, and it should have strong security features. The program should be able to handle your existing accounting data when you start, and help you generate reports on things like your sales and expenses. You should be able to export these reports to share with others.

- Est-ce adapté à mon entreprise ? Le logiciel doit répondre à vos besoins spécifiques, comme la gestion de dossiers uniques ou le remplissage automatique des champs de contact. Il doit également permettre le remboursement immédiat des frais des employés et des prestataires. Le logiciel doit faire Réaliser vos projets plus facilement. Vous devez avoir la certitude que le logiciel choisi est de la qualité attendue et qu'il sera d'une grande aide pour votre entreprise.

Verdict final

Alors, lequel l'emporte : Sage ou Expensify ?

La plupart des entreprises modernes recherchent la facilité d'utilisation et les fonctionnalités automatisées.

La sauge est notre choix numéro un.

Sa technologie SmartScan et ses remboursements directs permettent réellement de gagner du temps et de l'énergie.

Bien qu'Expensify soit un logiciel fiable, il paraît souvent plus intuitif et accélère l'ensemble du processus de gestion des dépenses.

Nous avons analysé en profondeur les deux outils, testant chaque fonctionnalité pour vous donner une image aussi claire que possible.

Notre objectif est d'aider ton Les affaires se déroulent plus facilement.

Choisir le bon logiciel peut vous éviter bien des soucis et des dépenses, d'après notre test pratique.

Sage se distingue par son approche simplifiée.

Plus de Sage

Il est utile de voir comment Sage se compare aux autres logiciels populaires.

Voici une brève comparaison avec certains de ses concurrents.

- Sage contre Puzzle IO: Bien que les deux logiciels gèrent la comptabilité, Puzzle IO est conçu spécifiquement pour les startups, en se concentrant sur les flux de trésorerie en temps réel et des indicateurs comme le taux d'épuisement des ressources.

- Sage contre Dext: Dext est avant tout un outil d'automatisation de la saisie des données issues des reçus et des factures. Il est souvent utilisé conjointement avec Sage pour accélérer la comptabilité.

- Sage contre Xero: Xero est une solution cloud réputée pour sa simplicité d'utilisation, notamment auprès des petites entreprises. Sage, quant à elle, offre des fonctionnalités plus avancées pour accompagner la croissance de l'entreprise.

- Sage contre Snyder: Synder se concentre sur la synchronisation des plateformes de commerce électronique et des systèmes de paiement avec des logiciels comptables comme Sage.

- Sage vs Easy Fin de mois: Ce logiciel est un gestionnaire de tâches qui vous aide à suivre toutes les étapes nécessaires à la clôture de vos comptes à la fin du mois.

- Sage contre Docyt: Docyt utilise l'IA pour automatiser la comptabilité et éliminer la saisie manuelle des données, offrant ainsi une alternative hautement automatisée aux systèmes traditionnels.

- Sage contre RefreshMe: RefreshMe n'est pas un concurrent direct des services comptables. L'entreprise se concentre davantage sur la reconnaissance et l'engagement des employés.

- Sage contre Zoho Books: Zoho Books fait partie d'une vaste suite d'applications professionnelles. Elle est souvent saluée pour son design épuré et ses fortes connexions avec les autres produits Zoho.

- Sage contre vague: Wave est connu pour son forfait gratuit, qui offre des fonctionnalités de comptabilité et de facturation de base, ce qui en fait un choix populaire auprès des indépendants et des très petites entreprises.

- Sage contre Quicken: Quicken est plutôt destiné aux finances personnelles ou aux très petites entreprises. Sage offre des fonctionnalités plus robustes pour une entreprise en pleine croissance, comme la gestion de la paie et des stocks avancés.

- Sage vs Hubdoc: Hubdoc est un outil de gestion documentaire qui collecte et organise automatiquement les documents financiers, similaire à Dext, et peut s'intégrer aux plateformes comptables.

- Sage contre Expensify: Expensify est un expert en gestion des dépenses. C'est idéal pour numériser les reçus et automatiser les notes de frais des employés.

- Sage contre QuickBooks: QuickBooks est un acteur majeur du secteur de la comptabilité pour les petites entreprises. Il est réputé pour son interface conviviale et sa large gamme de fonctionnalités.

- Sage vs AutoEntry: Voici un autre outil qui automatise la saisie des données à partir des reçus et des factures. Il fonctionne parfaitement comme module complémentaire aux logiciels de comptabilité tels que… Sage.

- Sage contre FreshBooks: FreshBooks est particulièrement adapté aux travailleurs indépendants et aux entreprises de services, car il met l'accent sur la facturation simple et le suivi du temps.

- Sage contre NetSuite: NetSuite est un système ERP complet destiné aux grandes entreprises. Sage propose une gamme de produits, dont certains sont concurrents à ce niveau, mais NetSuite est une solution plus vaste et plus complexe.

Plus d'informations sur Expensify

- Expensify contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Expensify contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Expensify contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Expensify contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Expensify vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Expensify contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Expensify contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Expensify contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Expensify vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Expensify vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Expensify contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Expensify vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Expensify contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Expensify contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Expensify est-il une bonne option pour les petites entreprises ?

Oui, Expensify est souvent idéal pour les petites entreprises. Son interface simple et son application mobile performante facilitent la gestion des dépenses. Ils proposent également des formules adaptées aux équipes réduites.

Sage peut-il gérer les dépenses internationales ?

Sage gère les transactions multidevises, ce qui facilite la gestion des dépenses internationales. Il vous faudra vérifier si ses fonctionnalités spécifiques répondent à tous vos besoins internationaux, notamment en matière de conformité fiscale dans les différentes régions.

Ces outils de suivi des dépenses sont-ils vraiment sécurisés ?

Sage et Expensify utilisent tous deux des mesures de sécurité robustes pour protéger vos données. Ils ont recours au chiffrement et à d'autres protections pour garantir la sécurité de vos informations financières.

Dois-je encore conserver les reçus papier avec ces applications ?

En général, non. Les deux applications permettent de photographier les reçus. Ces copies numériques suffisent souvent pour les archives, mais vérifiez toujours la réglementation fiscale en vigueur dans votre pays par précaution.

Les employés peuvent-ils facilement apprendre à utiliser Expensify ou Sage ?

Expensify est réputé pour sa grande facilité d'apprentissage et d'utilisation. Sage demande peut-être un peu plus de temps d'adaptation, mais les deux logiciels sont conçus pour être intuitifs après une formation.