Avez-vous du mal à gérer votre argent ?

Vous souhaitez prendre le contrôle de vos finances mais vous vous sentez submergé par toutes les options disponibles ?

Nombreuses sont les personnes confrontées à ce problème, et choisir le bon outil peut s'avérer crucial. faire Une énorme différence.

En 2025, deux logiciels financiers populaires se distinguent : Refreshme et Quicken.

Tous deux promettent de vous aider à mieux gérer votre argent, mais ils le font de manières différentes.

Aperçu

Nous avons examiné de très près Refreshme et Quicken.

Nous avons testé leurs fonctionnalités.

Cela nous a permis de voir comment ils se comparent en matière de gestion financière.

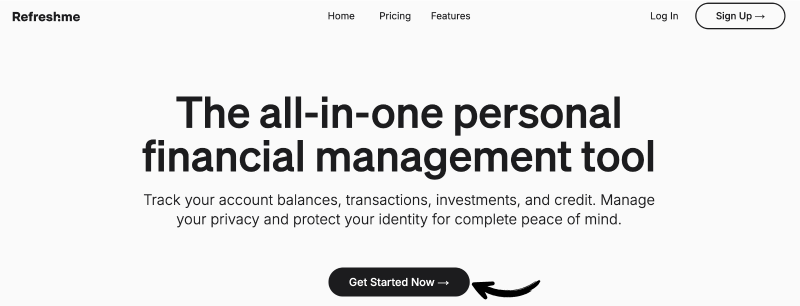

Accédez à des informations financières plus approfondies ! Refresh Me analyse vos dépenses et vous aide à économiser plus intelligemment.

Essayez-le maintenant !

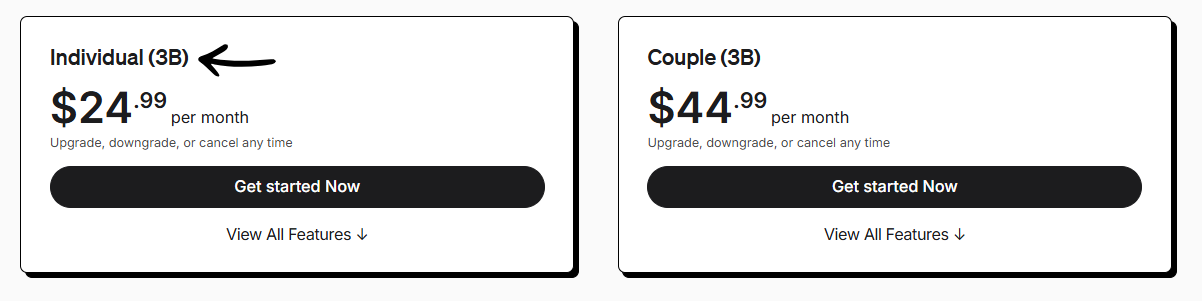

Tarification : Il propose un essai gratuit. L'abonnement premium est à 24,99 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

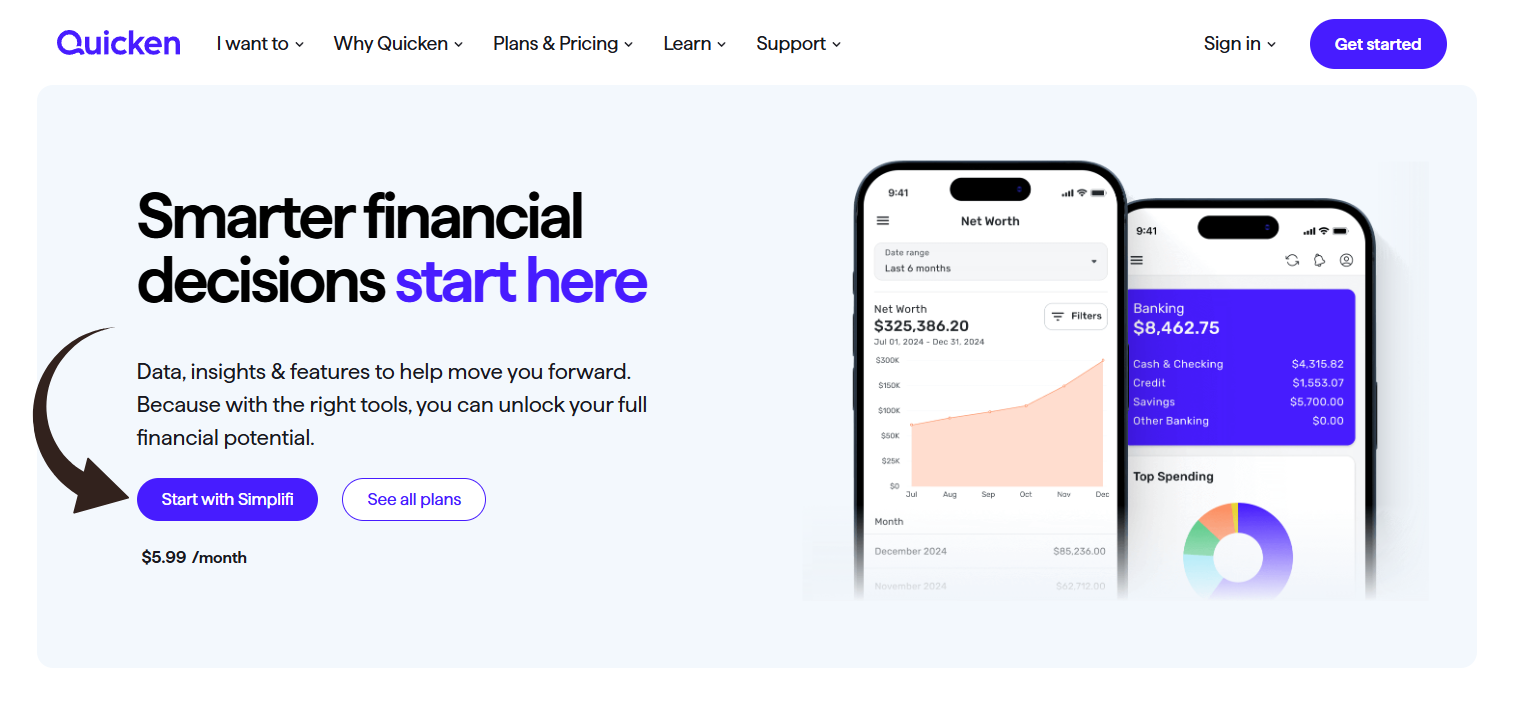

Envie de maîtriser vos finances ? Avec Quicken, connectez-vous à des milliers d’établissements financiers. Découvrez-en plus !

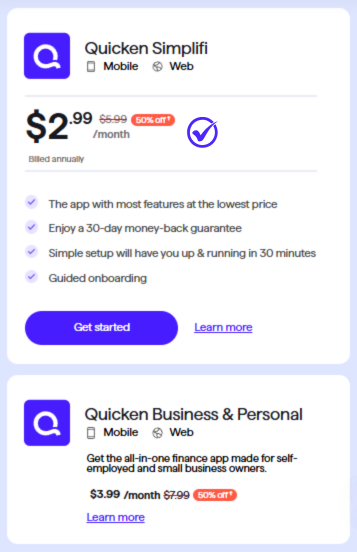

Tarification : Il propose un essai gratuit. L'abonnement premium est à 5,59 $/mois.

Caractéristiques principales :

- Outils budgétaires

- Gestion des factures

- Suivi des investissements

Qu'est-ce que RefreshMe ?

RefreshMe est un outil qui vous aide à suivre vos dépenses.

It can help you keep your receipts in one place. It also helps you see where your money is going.

Elle vise à simplifier le suivi des dépenses pour tous.

Découvrez également nos favoris Alternatives à Refreshme…

Notre avis

Le point fort de RefreshMe réside dans sa capacité à fournir des informations exploitables en temps réel. Toutefois, l'absence de tarification publique et des fonctionnalités comptables de base potentiellement moins complètes pourraient constituer des points à prendre en compte pour certains utilisateurs.

Principaux avantages

- Tableaux de bord financiers en temps réel

- Détection d'anomalies basée sur l'IA

- Rapports personnalisables

- prévision des flux de trésorerie

- Évaluation comparative des performances

Tarification

- Individu (3B) : 24,99 $/mois.

- Couple (3B) : 44,99 $/mois.

Avantages

Cons

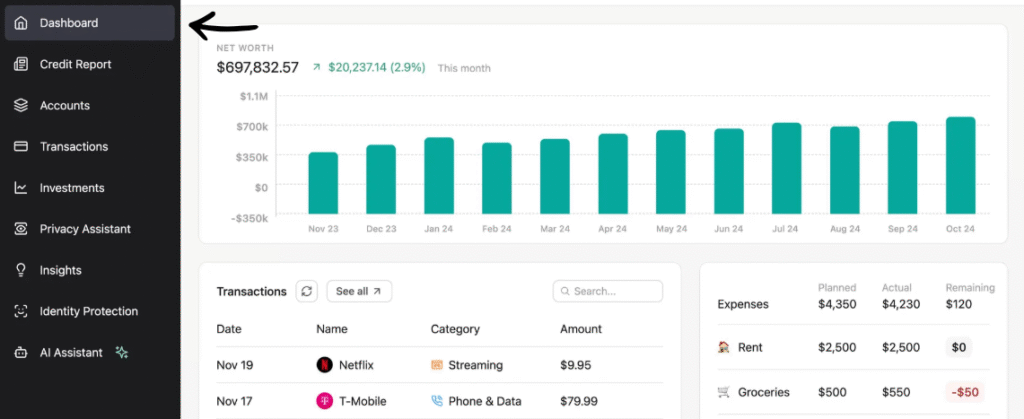

Qu'est-ce que Quicken ?

Alors, vous vous interrogez sur Quicken ?

C'est comme un outil qui vous permet de voir toutes vos finances au même endroit. Considérez-le comme votre organisateur financier numérique.

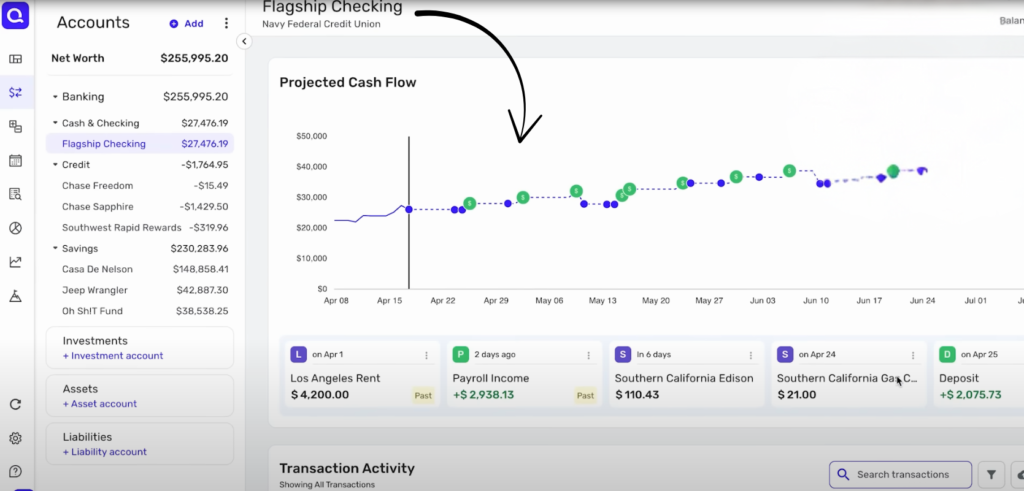

Il peut vous aider à suivre vos comptes bancaires, vos factures et même vos investissements.

Plutôt pratique, non ?

Découvrez également nos favoris Alternatives à Quicken…

Principaux avantages

Quicken est un outil puissant pour mettre de l'ordre dans vos finances.

Ils se targuent de plus de 40 ans d'expérience et leur produit est numéro 1 des ventes.

Leurs différents forfaits permettent de se connecter à plus de 14 500 institutions financières.

Vous pouvez également bénéficier d'une garantie de remboursement de 30 jours pour l'essayer sans risque.

- Compatible avec des milliers de banques et de cartes de crédit.

- Élabore des budgets détaillés.

- Suivi des investissements et du patrimoine net.

- Offre des outils de planification de la retraite.

Tarification

- Quicken Simplifi : 2,99 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Choisir un logiciel de finances personnelles nécessite d'évaluer la profondeur et les services d'une plateforme.

Ce comparatif des fonctionnalités de Refreshme et Quicken détaille la différence entre la simplicité moderne basée sur l'IA et des décennies de fonctionnalités complètes de planification financière.

1. Orientation de la plateforme et utilisation commerciale

- RafraîchirIl s'agit d'un logiciel de finances personnelles qui aide les clients à collecter données pour suivre les dépenses et améliorer leur gestion financière. Il n'est pas conçu pour les petites entreprises. comptabilitémais pour un usage personnel.

- AccélérerLa marque Quicken propose des formules comme Quicken Business et Quicken Personal (et la formule Quicken Business & Personal) qui permettent aux utilisateurs de gérer de location Biens immobiliers et finances d'entreprise, ainsi que comptes personnels. C'est le meilleur comptabilité logiciel pour une image complète.

2. Architecture logicielle et accès

- RafraîchirCe service est basé sur le cloud, accessible via une application mobile et nécessite une connexion internet. Son interface utilisateur est constamment mise à jour afin d'améliorer l'expérience client, et vous pouvez accéder aux services facilement.

- AccélérerIl s'agit historiquement d'un logiciel auto-hébergé/sur site, fonctionnant principalement sous Windows et mac Les systèmes de bureau, bien qu'ils offrent désormais un accès mobile et téléchargeable limité, constituent une différence majeure. Cette ère du design en est une.

3. Planification des investissements et de la retraite

- RafraîchirIl offre un suivi de base des investissements pour vous permettre de consulter régulièrement vos soldes et vos profits.

- AccélérerLes versions Quicken Premier et Quicken Deluxe offrent une planification de retraite avancée et une analyse poussée des portefeuilles d'investissement. Elles sont conçues pour gérer des actifs financiers complexes et prévoir les soldes futurs.

4. Modèle de coûts et de licences

- RafraîchirLe prix correspond généralement à un abonnement économique et peu coûteux, avec des conditions de facturation claires.

- AccélérerLe prix est désormais entièrement basé sur un modèle d'abonnement, souvent assorti de frais supplémentaires. Le logiciel Quicken de base représente un investissement initial important et se décline en différentes versions (Deluxe, Premier) aux fonctionnalités variables.

5. Contenu, avis et assistance

- RafraîchirLes avis soulignent la modernité du contenu et l'efficacité des plans de traitement basés sur l'intelligence artificielle. Le contenu est facile à comprendre et vise à améliorer les connaissances financières de base des clients.

- AccélérerL'évaluation rapide met en avant des décennies de contenu exhaustif et une vaste communauté. Cet historique fournit une mine d'informations, même si certaines évaluations soulignent que la qualité du service client n'est pas à la hauteur de la richesse du logiciel.

6. Suivi et saisie des transactions

- Rafraîchir: Il aide les clients à collecter les transactions bancaires et utilise des cookies pour faciliter la connexion. automation Permet de gagner du temps en saisissant automatiquement les transactions pour actualiser le tableau de bord.

- AccélérerIl possède des fonctionnalités robustes pour la collecte des transactions bancaires et la saisie manuelle des transactions. Le logiciel Quicken permet un historique des transactions plus long et un niveau de détail accru dans les enregistrements financiers.

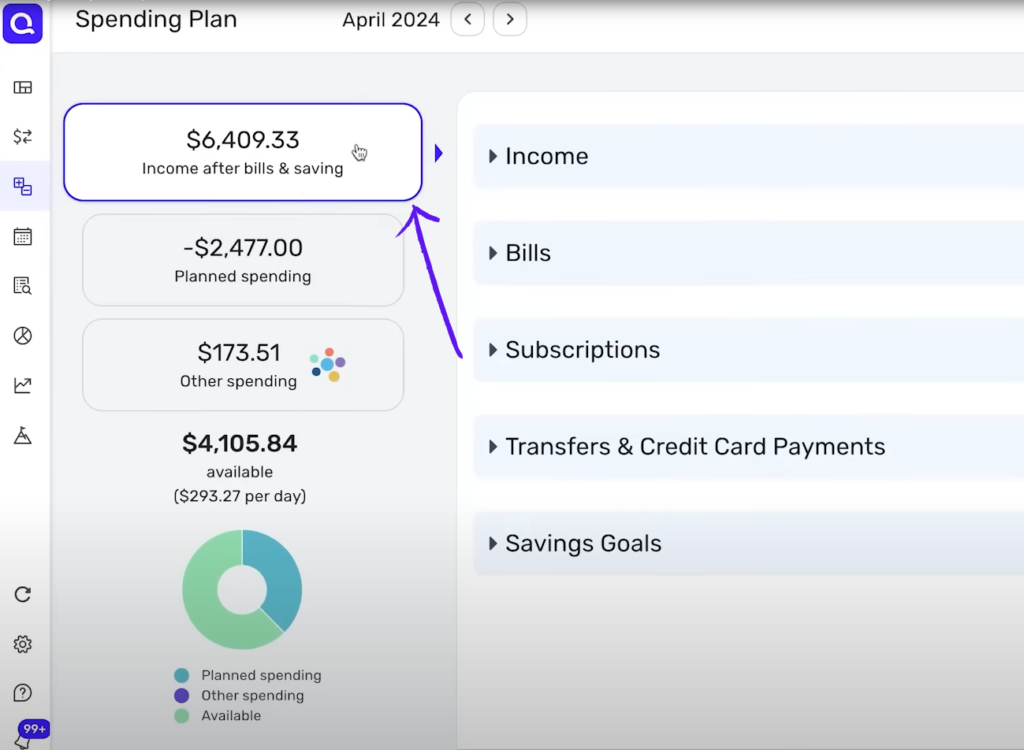

7. Budgétisation et flux de trésorerie

- RafraîchirC'est un outil simple de gestion budgétaire qui permet d'avoir un aperçu rapide des flux de trésorerie. Son objectif principal est d'améliorer les habitudes de consommation.

- AccélérerIl offre des outils de budgétisation plus traditionnels et détaillés permettant à chaque utilisateur d'analyser les données historiques et de prévoir les flux de trésorerie futurs. La version Quicken Deluxe propose des fonctionnalités améliorées. reportage pour une analyse plus approfondie.

8. Fonctionnalités commerciales et fiscales

- RafraîchirIl s'agit d'un logiciel de gestion de finances personnelles uniquement, qui ne permet pas d'envoyer de factures ni de gérer la taxe de vente.

- AccélérerLes formules Quicken Premier et Quicken Business & Personal offrent le suivi de la taxe de vente, la gestion de la paie, l'envoi de factures et des fonctionnalités de gestion des comptes clients, offrant ainsi une vue d'ensemble complète aux travailleurs indépendants.

9. Expérience utilisateur et conception

- Rafraîchissez-moiSon interface utilisateur est souvent décrite comme moderne et épurée, mettant clairement l'accent sur l'évolution de la situation financière personnelle dès le départ.

- AccélérerSon interface utilisateur peut être complexe, mais le logiciel Quicken est conçu pour fournir des fonctionnalités clés répondant à tous les besoins de planification personnelle, offrant des services adaptés à chaque âge et à chaque étape de la vie financière.

10. Gestion des factures et alternatives de marché

- RafraîchirLes services de cette plateforme incluent un suivi et une gestion performants des factures, permettant aux clients de contrôler leurs paiements à venir et d'optimiser leur trésorerie. Elle ambitionne de devenir une alternative moderne aux logiciels de gestion de finances personnelles existants sur le marché.

- AccélérerLes versions Quicken Home et Quicken Deluxe offrent des fonctionnalités dédiées permettant de se connecter aux fournisseurs et de payer les factures directement. Les utilisateurs peuvent facilement créer et prévoir leurs revenus futurs et explorer différentes options de marché pour une planification financière avancée.

Quels sont les critères à prendre en compte pour choisir un logiciel de comptabilité ?

Voici quelques éléments supplémentaires à prendre en compte :

- ÉvolutivitéLes services peuvent-ils évoluer en fonction de vos clients ? Si vous devez suivre les kilomètres parcourus et gérer les bons de commande, le processus doit être irréprochable et sécurisé sur le long terme. Les partenaires d’Aquiline Capital analysent souvent les logiciels en fonction de leur potentiel de croissance à long terme et de leur capacité à gérer les paiements.

- SoutienQuel type d'assistance est disponible en cas de questions ? Il est conseillé d'examiner les fournisseurs et leurs délais d'assistance afin de vérifier leur réactivité face à un incident de transaction. La différence de traitement est flagrante : un bon service d'assistance doit fournir des informations immédiatement aux clients.

- Facilité d'utilisationEst-ce quelque chose que vous et votre équipe pouvez apprendre rapidement ? Expensify Il est facile d'ajouter une photo et d'enregistrer le kilométrage directement depuis sa poche, mais la version de bureau de QuickBooks peut être plus difficile à maîtriser pour un nouveau gestionnaire.

- Besoins spécifiquesCe logiciel prend-il en charge les spécificités de votre activité ? La prise en charge des clients varie-t-elle en fonction de leur âge ? Permet-il de gérer les dépenses d’un petit nombre d’utilisateurs et de suivre les kilomètres parcourus et les bons de commande grâce à des étiquettes ?

- SécuritéVos données financières sont-elles bien protégées avec ce logiciel ? La sécurité est un domaine en constante évolution. La carte Expensify assure une sécurité en temps réel, mais il est toujours conseillé de vérifier les données enregistrées. La différence est flagrante : les interfaces simples sont moins susceptibles de dysfonctionner que les interfaces complexes et facilitent l’approbation des demandes de gestion des dépenses par les employeurs.

Verdict final

Alors, lequel l'emporte : Refreshme ou Quicken ?

Pour la plupart des personnes qui souhaitent une façon simple de gérer leur argent au quotidien, Refreshme est un excellent choix.

Il est plus facile à utiliser et vous permet de voir clairement votre argent sans de nombreuses fonctionnalités compliquées.

Cependant, si vous avez de nombreux investissements ou si vous avez besoin de rapports très détaillés, Quicken pourrait être une meilleure option.

Nous avons tout examiné, de la budgétisation au suivi des factures et des investissements.

Notre objectif est de vous donner les meilleurs conseils pour ton argent.

Choisissez celui qui vous convient le mieux toi Gérez au mieux vos finances.

Plus de Refreshme

- Rafraîchissez-moi contre Puzzle IO: Ce logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Rafraîchissez-moi vs Dext: Il s'agit d'un outil professionnel pour la saisie des reçus et des factures. L'autre outil permet de suivre les dépenses personnelles.

- Rafraîchissez-moi contre Xero: Il s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Rafraîchissez-moi contre Synder: Cet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Rafraîchissez-moi vs Fin de mois facile: Il s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Rafraîchissez-moi vs Docyt: L'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Rafraîchissez-moi contre Sage: Il s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Rafraîchissez-moi vs Zoho Books: Il s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Rafraîchir-moi vs Vague: Ce logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Rafraîchissez-moi vs Quicken: Ce sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- Rafraîchissez-moi vs Hubdoc: Ce logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion des finances personnelles.

- Rafraîchissez-moi vs Expensify: Il s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi et à la gestion du budget des dépenses personnelles.

- Rafraîchissez-moi vs QuickBooks: Il s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Rafraîchir-moi vs AutoEntry: Ce logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Rafraîchissez-moi vs FreshBooks: Il s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Rafraîchissez-moi vs NetSuite: Il s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes sociétés. Son concurrent est une simple application de gestion de finances personnelles.

Plus de Quicken

- Quicken contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Quicken contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Quicken contre XeroC'est populaire en ligne. logiciel de comptabilité pour les petites entreprises. Son concurrent est destiné à un usage personnel.

- Quicken contre SnyderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Quicken vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Quicken contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Quicken contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Quicken contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Quicken contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Quicken contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Quicken contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Quicken contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Quicken vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Quicken contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Quicken contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Refreshme est-il meilleur pour les débutants ?

Oui, Refreshme est souvent plus adapté aux débutants. Son interface simple facilite la configuration et le suivi des dépenses. Il se concentre sur l'essentiel : la gestion financière, sans fonctionnalités superflues.

Quicken propose-t-il un suivi des investissements ?

Oui, Quicken offre un suivi performant des investissements. Il permet de surveiller différents comptes d'investissement, d'analyser leurs performances et d'obtenir des rapports détaillés. Cela le rend idéal pour les investisseurs actifs.

Puis-je lier tous mes comptes bancaires aux deux plateformes ?

En général, oui, vous pouvez connecter la plupart de vos comptes bancaires à Refreshme et à Quicken. Ces applications permettent de centraliser vos données financières pour une vue d'ensemble complète de votre argent.

Existe-t-il des applications mobiles pour Refreshme et Quicken ?

Oui, Refreshme et Quicken proposent tous deux des applications mobiles. Vous pouvez ainsi gérer vos finances où que vous soyez, depuis votre smartphone ou votre tablette. Leurs fonctionnalités sur mobile peuvent différer légèrement des versions pour ordinateur.

Lequel est le plus sûr pour mes données financières ?

Refreshme et Quicken utilisent tous deux des mesures de sécurité pour protéger vos données financières. Ils ont recours au chiffrement et à d'autres protections. Veillez toujours à utiliser des mots de passe robustes et à adopter de bonnes pratiques en matière de confidentialité en ligne.