Avez-vous du mal à gérer vos finances ?

Nombreuses sont les personnes qui se sentent submergées par les reçus, les relevés bancaires et la tâche sans fin de données entrée.

C’est là qu’interviennent les logiciels financiers, promettant de faire les choses plus faciles.

Mais avec autant d'options, comment choisir la bonne ?

Examinons une comparaison clé : Quicken contre AutoEntry.

Aperçu

Nous avons examiné de très près Quicken et AutoEntry.

Nous les avons utilisés nous-mêmes pour voir comment ils fonctionnent.

Cela nous a permis de comprendre leurs points forts et leurs points faibles en matière de tâches financières quotidiennes.

Envie de maîtriser vos finances ? Avec Quicken, connectez-vous à des milliers d’établissements financiers. Découvrez-en plus !

Tarification : Il propose un essai gratuit. L'abonnement premium est à 5,59 $/mois.

Caractéristiques principales :

- Outils budgétaires

- Gestion des factures

- Suivi des investissements

Arrêtez de perdre plus de 10 heures par semaine à saisir manuellement des données. Découvrez comment la saisie automatique a réduit de 40 % le temps de traitement des factures. Sage utilisateurs.

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 12 $/mois.

Caractéristiques principales :

- Extraction de données

- Numérisation des reçus

- Automatisation des fournisseurs

Qu'est-ce que Quicken ?

Alors, vous vous interrogez sur Quicken ?

C'est comme un outil qui vous permet de voir toutes vos informations financières au même endroit.

Considérez-le comme votre gestionnaire d'argent numérique.

Il peut vous aider à suivre vos comptes bancaires, vos factures et même vos investissements.

Plutôt pratique, non ?

Découvrez également nos favoris Alternatives à Quicken…

Principaux avantages

Quicken est un outil puissant pour mettre de l'ordre dans vos finances.

Ils se targuent de plus de 40 ans d'expérience et leur produit est numéro 1 des ventes.

Leurs différents forfaits permettent de se connecter à plus de 14 500 institutions financières.

Vous pouvez également bénéficier d'une garantie de remboursement de 30 jours pour l'essayer sans risque.

- Compatible avec des milliers de banques et de cartes de crédit.

- Élabore des budgets détaillés.

- Suivi des investissements et du patrimoine net.

- Offre des outils de planification de la retraite.

Tarification

- Quicken Simplifi : 2,99 $/mois.

Avantages

Cons

Qu'est-ce que l'AutoEntry ?

Bon, parlons donc d'AutoEntry.

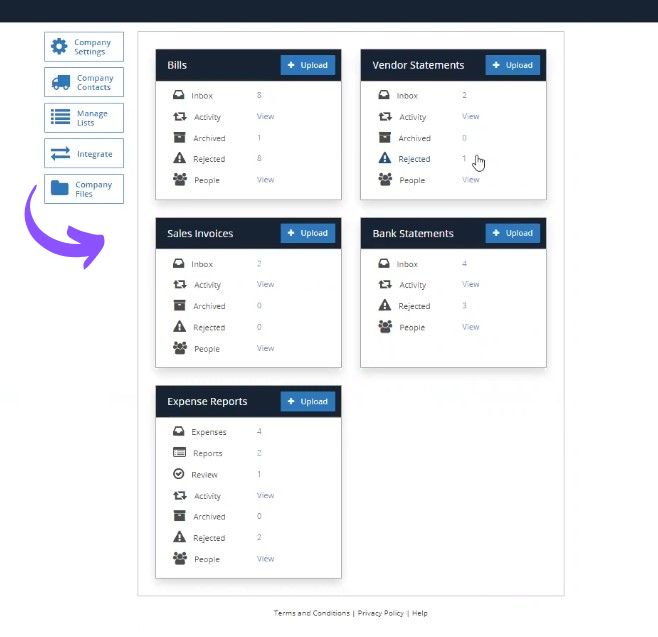

C'est un outil qui vous aide à transférer vos documents sur votre ordinateur sans avoir à tout saisir vous-même.

Considérez-le comme un assistant intelligent pour vos factures et reçus.

Il les lit et place l'information là où elle doit aller.

Découvrez également nos favoris Alternatives à AutoEntry…

Notre avis

Prêt à réduire votre temps de comptabilité ? AutoEntry traite plus de 28 millions de documents chaque année et offre une précision jusqu’à 99 %. Commencez dès aujourd’hui et rejoignez les plus de 210 000 entreprises dans le monde qui ont réduit leur temps de saisie de données jusqu’à 80 % !

Principaux avantages

Le plus grand atout d'AutoEntry est de nous faire gagner des heures de travail fastidieux.

Les utilisateurs constatent souvent une réduction de jusqu'à 80 % du temps consacré à la saisie manuelle de données.

Elle promet une précision allant jusqu'à 99 % dans l'extraction de données.

AutoEntry n'offre pas de garantie de remboursement spécifique, mais ses forfaits mensuels vous permettent d'annuler à tout moment.

- Précision des données jusqu'à 99 %.

- Utilisateurs illimités sur tous les forfaits payants.

- Extrait les lignes complètes des factures.

- Application mobile simple pour photographier les reçus.

- Les crédits non utilisés sont reportés sous 90 jours.

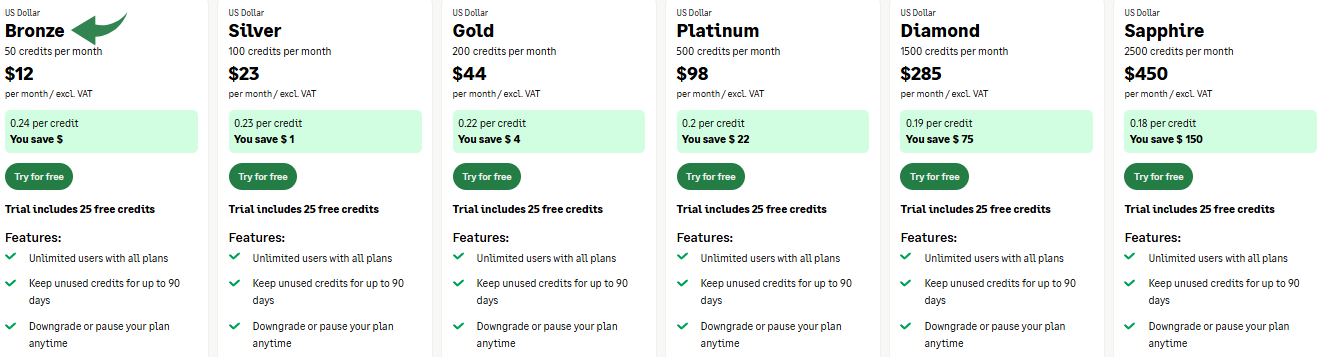

Tarification

- Bronze: 12 $/mois.

- Argent: 23 $/mois.

- Or: 44 $/mois.

- Platine: 98 $/mois.

- Diamant: 285 $/mois.

- Saphir: 450 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Choisir entre comptabilité Les versions logicielles peuvent représenter un défi.

Cette comparaison entre Quicken et AutoEntry vous aidera à évaluer quelle plateforme possède les fonctionnalités et les caractéristiques clés qui correspondent à vos besoins professionnels et personnels.

Nous examinerons chaque option pour déterminer laquelle offre le meilleur rapport qualité-prix et le meilleur contrôle pour votre gestion financière.

1. Objectif et fonctionnalités principaux

- Accélérer Ce logiciel est une marque de confiance dans le domaine des logiciels de finances personnelles depuis des décennies. Son objectif est d'aider les utilisateurs à gérer l'ensemble de leurs finances, de l'établissement du budget au suivi des comptes d'investissement en passant par la planification de la retraite.

- Saisie automatique est une alternative moderne spécialisée dans la capture de données et ne constitue pas une plateforme comptable complète.

2. Capture et automatisation des données

- AutoEntry utilise la reconnaissance optique de caractères pour extraire des données de documents financiers, tels qu'une facture d'achat ou des reçus. Vous pouvez numériser les documents via une application mobile ou par e-mail.

- Les avis des clients sur ce logiciel montrent qu'il permet de gagner beaucoup de temps consacré à la saisie manuelle de données, mais son coût dépend de votre utilisation des crédits.

3. Longévité et propriété

- Accélérer Présente sur le marché depuis des décennies, la marque a été rachetée par Aquiline Capital Partners, un détail important qui influencera son développement futur.

- Saisie automatique Les avis montrent qu'il s'agit d'un produit plus récent et plus spécialisé, et d'un bon choix à évaluer si votre objectif principal est de réduire le temps passé à la saisie de données.

4. Finances professionnelles et personnelles

- Accélérer Business est une application de bureau pour Windows ou Mac qui permet aux utilisateurs de créer des factures et de gérer leurs finances professionnelles et personnelles au même endroit.

- AutoEntry L'accent est mis sur la rationalisation comptabilité pour les entreprises, en publiant automatiquement les données sur des plateformes comme QuickBooks.

5. Sécurité et accès aux données

- Une solution de sécurité est essentielle pour protéger vos documents financiers. Les deux plateformes prennent la sécurité des données très au sérieux. Par exemple, il arrive qu'un service de sécurité, conçu pour vous protéger contre les cyberattaques, bloque une action que vous venez d'effectuer.

- Cela pourrait déclencher une alerte avec un identifiant Cloudflare Ray trouvé, indiquant un blocage lié à la soumission d'un certain mot ou d'une certaine expression, d'une commande SQL ou de données malformées, et vous pourriez ne pas pouvoir accéder à la page.

6. Gestion des finances

- Accélérer Cette plateforme complète permet de gérer tous les aspects de vos finances, du suivi de vos placements à celui de vos dépenses. Leader du marché depuis de nombreuses années, elle propose diverses solutions adaptées à différents besoins.

- AutoEntry La gestion est spécifiquement destinée à l'extraction et à la publication de données, et non à une analyse financière complète.

7. Intégrations

- Le Accélérer La marque est une plateforme indépendante, mais elle peut se connecter à des milliers d'institutions financières.

- AutoEntry Sa valeur réside dans son intégration transparente avec d'autres plateformes comptables comme QuickBooks, éliminant ainsi la nécessité de se connecter à plusieurs applications différentes pour traiter vos factures d'achat et autres documents financiers.

8. Accessibilité et plateforme

- Accélérer Il s'agit principalement d'un téléchargement pour ordinateur de bureau (Windows ou Mac), avec une application mobile pour la surveillance.

- Saisie automatique Il s'agit d'un service basé sur le cloud, vous permettant d'accéder à vos données depuis n'importe quel téléphone mobile ou ordinateur. Au démarrage d'une entreprise, l'accès mobile est souvent indispensable pour le suivi des dépenses et des ventes.

9. Tarification et forfaits

- Le Accélérer La marque propose différentes versions, telles que Quicken Deluxe, Quicken Premier et Quicken Business, avec des prix basés sur l'abonnement.

- Le Saisie automatique Notre modèle tarifaire est un système de crédits flexible pour un nombre illimité d'utilisateurs. Vous pouvez ainsi acheter uniquement ce dont vous avez besoin et maîtriser vos dépenses.

Quels sont les critères à prendre en compte pour choisir un logiciel de comptabilité ?

Voici quelques éléments supplémentaires à prendre en compte :

- ÉvolutivitéL'outil en question peut-il évoluer avec votre entreprise ? À vos débuts, un simple suivi des factures peut suffire, mais vos besoins changeront à mesure que vos finances se développeront. Recherchez des abonnements à plusieurs niveaux et tenez compte du coût mensuel. Par exemple, Quicken propose différentes versions, de Quicken Home à des formules plus complètes capables de gérer des opérations complexes. de location Les biens immobiliers et les sources de revenus complexes nécessitent une évaluation approfondie de la structure tarifaire afin de garantir l'évolutivité du logiciel sans effort excessif ni refonte complète du système.

- SoutienQuel type d'aide est disponible en cas de questions ? Un bon service client est essentiel. Le logiciel doit proposer des ressources facilement accessibles pour vous aider à résoudre vos problèmes. Cela inclut une base de connaissances ou la possibilité de contacter par e-mail le propriétaire du site ou l'équipe d'assistance. Consultez un avis récent sur Quicken pour connaître l'expérience des utilisateurs avec le support. Savoir qu'une équipe est là pour vous aider est crucial pour le bon fonctionnement de votre entreprise.

- Facilité d'utilisationEst-ce quelque chose que vous et votre équipe pouvez apprendre rapidement ? L’interface utilisateur est essentielle à l’adoption. Une interface épurée et intuitive réduit considérablement le temps d’apprentissage. Vous souhaitez vous concentrer sur les finances de votre entreprise, et non sur la maîtrise d’un logiciel complexe. Privilégiez une présentation claire qui facilite la saisie des transactions et la recherche rapide de lignes spécifiques.

- Besoins spécifiquesCe logiciel est-il adapté aux spécificités de votre activité ? Assurez-vous qu'il prenne en charge vos transactions particulières, comme les paiements aux fournisseurs ou le suivi des revenus locatifs. Il doit également gérer facilement différents types de recettes et de dépenses. Choisir le bon outil parmi les solutions disponibles sur le marché vous permettra d'économiser un temps précieux et d'éviter bien des frustrations à long terme.

- SécuritéVos données financières sont-elles en sécurité avec ce logiciel ? La sécurité des données est primordiale. Tout logiciel doit se protéger des menaces en ligne, souvent grâce à un service de sécurité qui protège les comptes utilisateurs. Sachez qu'une action parfaitement légitime que vous venez d'effectuer peut parfois déclencher un blocage par le système de sécurité, notamment lors de la saisie de données financières sensibles. En cas de blocage, un message vous informera du déclenchement du système de sécurité, indiquant généralement votre adresse IP. C'est pourquoi il est essentiel de pouvoir contacter rapidement le propriétaire du site pour l'informer et résoudre le problème. Le logiciel doit également détailler les différentes actions susceptibles de déclencher un blocage de sécurité, comme la soumission de données inhabituelles, afin d'éviter tout blocage injustifié.

Verdict final

Alors, lequel est le meilleur : Quicken ou AutoEntry ?

Cela dépend vraiment de ce dont vous avez besoin.

Si vous souhaitez un seul logiciel pour gérer tous vos finances personnelles, Quicken est la meilleure solution.

Il permet de gérer son budget et de suivre ses investissements. Il offre une vision financière complète.

Cependant, si votre principal besoin est simplement d'intégrer les informations des reçus dans d'autres fichiers, comptabilité En matière de logiciels, AutoEntry est le spécialiste.

C'est parfait pour ce type de tâche. Nous avons utilisé les deux. Nous savons qu'ils aident des personnes différentes.

Choisissez celui qui résout votre plus gros problème financier !

Plus de Quicken

- Quicken contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Quicken contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Quicken contre XeroC'est populaire en ligne. logiciel de comptabilité pour les petites entreprises. Son concurrent est destiné à un usage personnel.

- Quicken contre SnyderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Quicken vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Quicken contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Quicken contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Quicken contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Quicken contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Quicken contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Quicken contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Quicken contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Quicken vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Quicken contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Quicken contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Plus d'informations sur AutoEntry

- Saisie automatique vs PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Saisie automatique vs DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- AutoEntry vs XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- AutoEntry vs SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Saisie automatique vs Fin de mois simplifiéeIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- AutoEntry vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- AutoEntry vs SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- AutoEntry vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Saisie automatique vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- AutoEntry vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- AutoEntry vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- AutoEntry vs ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- AutoEntry vs QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- AutoEntry vs FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- AutoEntry vs NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Quelle est la principale différence entre Quicken et AutoEntry ?

Quicken est un logiciel complet de gestion des finances personnelles, permettant de gérer son budget et ses investissements. AutoEntry, quant à lui, se concentre sur l'extraction de données à partir de documents tels que les reçus. Il simplifie l'intégration des informations dans d'autres logiciels comptables.

AutoEntry peut-il remplacer des programmes comme Hubdoc ou Dext ?

Oui, AutoEntry est un concurrent direct de services comme Hubdoc et Dext. Tous ces outils visent à automatiser la conversion des documents physiques en données numériques à des fins comptables. Ils facilitent tous la numérisation des documents. automation.

Quicken est-il un bon outil pour la catégorisation des dépenses des petites entreprises ?

Quicken peut aider à la catégorisation de base pour petite entreprise Pour les dépenses courantes, un logiciel de comptabilité spécialisé, fonctionnant souvent avec des outils comme la saisie automatique, peut s'avérer plus approprié. Toutefois, pour des besoins plus complexes en matière de comptabilité et de fiscalité, il est préférable d'utiliser un logiciel spécialisé.

Comment AutoEntry facilite-t-il mon flux de travail comptable ?

AutoEntry améliore votre flux de travail en réduisant la saisie manuelle de données. Vous téléchargez des documents, et le logiciel en extrait les informations clés. Ces données peuvent ensuite être synchronisées directement avec votre logiciel comptable, ce qui vous permet de gagner du temps et de réduire les erreurs.

AutoEntry offre-t-il des fonctionnalités d'automatisation performantes ?

Oui, AutoEntry est conçu pour l'automatisation. Il utilise une technologie intelligente pour lire et traiter rapidement les factures et les reçus. Cela permet une extraction efficace des données et contribue à automatiser le transfert des informations financières.