Avez-vous parfois l'impression d'être enseveli sous une montagne de reçus et de factures ?

Pour de nombreuses entreprises, la gestion des documents financiers est un véritable casse-tête.

C’est là qu’interviennent des outils comme QuickBooks et AutoEntry.

Choisir entre QuickBooks et AutoEntry pour votre comptabilité Les besoins impliquent de comprendre ce que chacun offre.

Examinons leurs caractéristiques et voyons laquelle se démarque vraiment pour vous. entreprise.

Aperçu

Nous avons passé beaucoup de temps à tester QuickBooks et AutoEntry.

Notre objectif était d'observer les performances de chaque outil dans un contexte commercial réel. comptabilité, ce qui nous permet d'avoir une image claire pour cette comparaison directe.

Utilisé par plus de 7 millions d'entreprises, QuickBooks peut vous faire gagner en moyenne 42 heures par mois sur comptabilité.

Tarification : Il propose un essai gratuit. L'abonnement commence à 1,90 $/mois.

Caractéristiques principales :

- Gestion des factures

- Suivi des dépenses

- Signalement

Arrêtez de perdre plus de 10 heures par semaine à saisir manuellement des données. Découvrez comment la saisie automatique a réduit de 40 % le temps de traitement des factures. Sage utilisateurs.

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 12 $/mois.

Caractéristiques principales :

- Extraction de données

- Numérisation des reçus

- Automatisation des fournisseurs

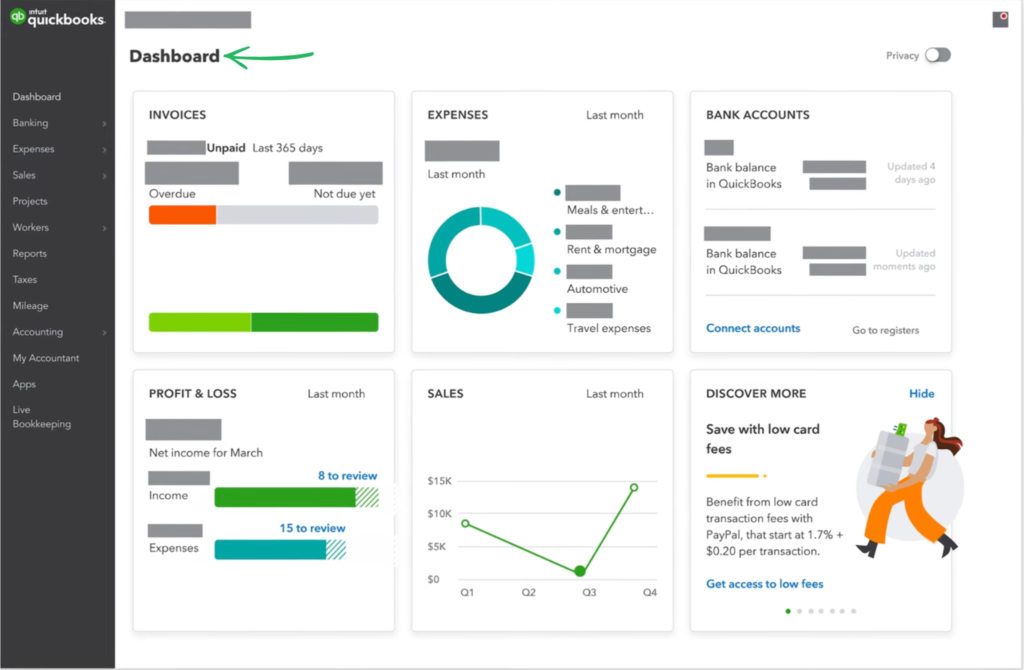

Qu'est-ce que QuickBooks ?

QuickBooks est un nom important dans logiciel de comptabilité.

Il est conçu pour aider toutes sortes d'entreprises, de travailleurs indépendants aux entreprises en pleine croissance, gérer leur argent.

Considérez-le comme votre plateforme centrale pour suivre vos revenus, vos dépenses et tout ce qui se trouve entre les deux.

Découvrez également nos favoris Alternatives à QuickBooks…

Principaux avantages

- Catégorisation automatisée des transactions

- Création et suivi des factures

- Gestion des dépenses

- Services de paie

- Rapports et tableaux de bord

Tarification

- Démarrage simple : 1,90 $/mois.

- Essentiel: 2,80 $/mois.

- Plus: 4 $/mois.

- Avancé: 7,60 $/mois.

Avantages

Cons

Qu'est-ce que l'AutoEntry ?

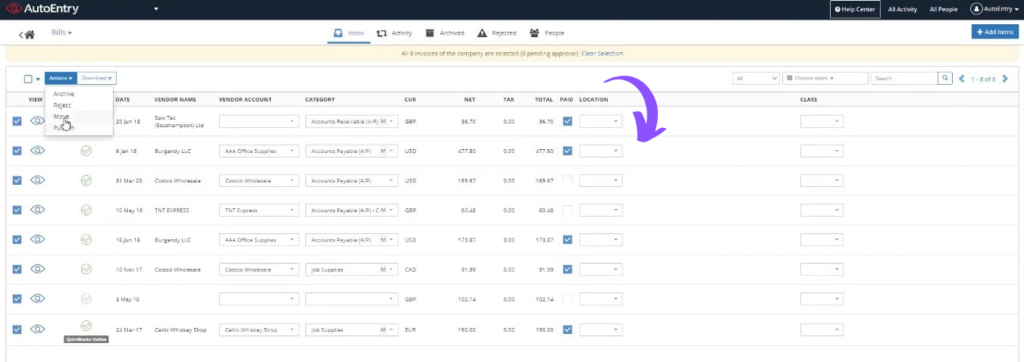

AutoEntry est conçu pour vous faire gagner du temps. Il vise à simplifier au maximum les tâches répétitives. données entrée.

Il vous suffit de prendre une photo ou de télécharger un document.

Ensuite, AutoEntry le lit pour vous et en extrait les informations clés.

Découvrez également nos favoris Alternatives à AutoEntry…

Notre avis

Prêt à réduire votre temps de comptabilité ? AutoEntry traite plus de 28 millions de documents chaque année et offre une précision jusqu’à 99 %. Commencez dès aujourd’hui et rejoignez les plus de 210 000 entreprises dans le monde qui ont réduit leur temps de saisie de données jusqu’à 80 % !

Principaux avantages

Le plus grand atout d'AutoEntry est de nous faire gagner des heures de travail fastidieux.

Les utilisateurs constatent souvent une réduction de jusqu'à 80 % du temps consacré à la saisie manuelle de données.

Elle promet une précision allant jusqu'à 99 % dans l'extraction de données.

AutoEntry n'offre pas de garantie de remboursement spécifique, mais ses forfaits mensuels vous permettent d'annuler à tout moment.

- Précision des données jusqu'à 99 %.

- Utilisateurs illimités sur tous les forfaits payants.

- Extrait les lignes complètes des factures.

- Application mobile simple pour photographier les reçus.

- Les crédits non utilisés sont reportés sous 90 jours.

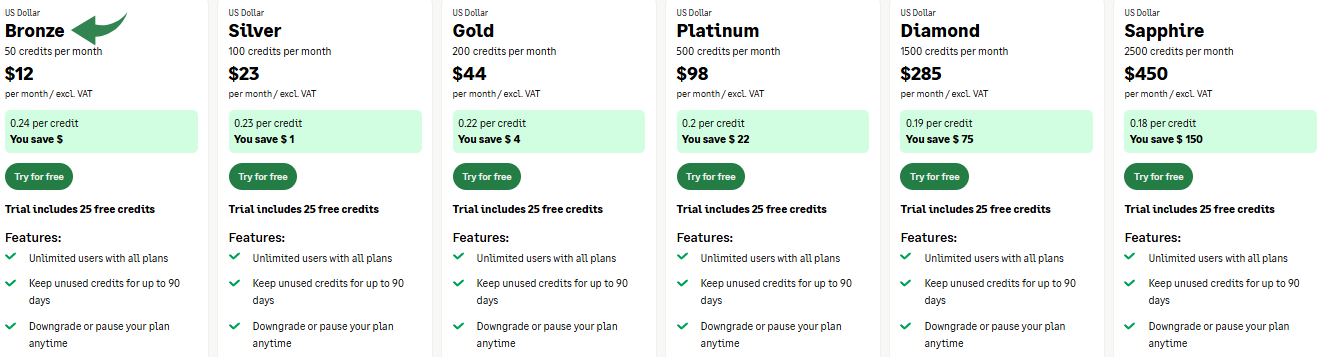

Tarification

- Bronze: 12 $/mois.

- Argent: 23 $/mois.

- Or: 44 $/mois.

- Platine: 98 $/mois.

- Diamant: 285 $/mois.

- Saphir: 450 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

La comparaison de ces outils révèle une différence essentielle.

QuickBooks est la plateforme principale pour la gestion des finances d'entreprise, tandis qu'AutoEntry est un assistant de premier plan axé sur… automation.

Examinons de plus près comment ils gèrent vos documents et votre argent.

1. Comptabilité complète vs. Saisie de documents

- QuickBooksIl s'agit d'un service complet comptabilité plate-forme. Intuit QuickBooks aide les entreprises de taille moyenne et les travailleurs indépendants. Il vous permet de suivre l'argent et de gérer toutes les finances de votre entreprise.

- Saisie automatique: Saisie automatique est un outil dédié. Il est spécialisé dans la réduction de la saisie manuelle de données. Il traite les documents financiers tels que les reçus et les factures d'achat.

2. Technologie de capture de données

- QuickBooksLa version en ligne propose une reconnaissance optique de caractères (OCR) basique pour les images de reçus. L'objectif est de capturer et de conserver des données commerciales exactes.

- Saisie automatiqueIl utilise une reconnaissance optique de caractères de haute précision. AutoEntry est conçu spécifiquement pour l'extraction de données à partir de différents formats, ce qui réduit considérablement le temps consacré à la saisie.

3. Modèle de tarification pour les clients

- QuickBooksLe prix est généralement mensuel et varie en fonction du nombre d'utilisateurs et des fonctionnalités. Les formules supérieures incluent QuickBooks Payroll et des services avancés.

- Saisie automatiqueIl propose une tarification flexible basée sur le nombre de documents facturés par mois. Tous les forfaits permettent un nombre illimité d'utilisateurs, ce qui représente un excellent rapport qualité-prix pour les clients.

4. Paie et paiements directs

- QuickBooksQuickBooks Payroll est un produit intégré. Il gère les virements bancaires pour les employés et les paiements aux prestataires. Il permet également aux utilisateurs de régler leurs factures directement.

- Saisie automatiqueAutoEntry ne propose pas de services de paie intégrés. Son objectif principal est la saisie des données de dépenses, comme une facture d'achat, avant leur traitement pour paiement.

5. Accès et assistance à la plateforme

- QuickBooksQuickBooks Online offre un accès en ligne 24h/24 et 7j/7. Les données de la version bureau sont disponibles via QuickBooks Desktop, mais la version en ligne offre une mobilité optimale.

- Saisie automatiqueElle est hébergée dans le cloud pour un accès en ligne facile. L'application mobile permet aux clients de numériser immédiatement les documents.

6. Préparation des déclarations de revenus et taxe de vente

- QuickBooks: intuition QuickBooks Il facilite le suivi de la taxe de vente et fournit les rapports essentiels à la préparation des déclarations fiscales. La gestion du plan comptable est entièrement intégrée.

- Saisie automatique: Saisie automatique Il extrait les données nécessaires à la préparation des déclarations fiscales. Il ne calcule ni ne déclare lui-même la taxe de vente ; cela se fait par la plateforme comptable associée.

7. Intégration et flux de travail

- QuickBooksOffre une intégration transparente avec de nombreux produits QuickBooks. Inclut des rappels de paiement automatiques et la connexion aux comptes bancaires.

- Saisie automatiqueSon principal atout réside dans son intégration parfaite avec des plateformes comme QuickBooks Online. Il permet la publication automatique des documents après traitement.

8. Gestion du temps et des dépenses

- QuickBooksQuickBooks Time est un outil performant. Il permet un suivi efficace du temps de travail des employés et des paiements des prestataires. Il permet également de créer des bons de commande.

- Saisie automatiqueCet outil gère le processus de saisie des dépenses. Il réduit considérablement le temps consacré à la saisie manuelle des données par les clients ou les employés.

9. Réputation et assistance aux utilisateurs

- QuickBooksLes avis sur QuickBooks soulignent souvent sa richesse fonctionnelle. Les utilisateurs apprécient ses outils complets pour la gestion des finances d'entreprise, même si la configuration peut s'avérer complexe.

- Saisie automatiqueLes avis sur AutoEntry soulignent la précision de son extraction de données. Les utilisateurs apprécient la simplicité d'installation et de résiliation du service.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Sécurité & AccèsLe service de sécurité protège-t-il les données sensibles de l'entreprise contre les attaques en ligne ? Recherchez une solution de sécurité pour éviter d'être bloqué l'accès à votre ordinateur ou à sa version de bureau par un système de détection d'erreurs (comme Cloudflare Ray ID) ou un système similaire, notamment après une action susceptible de déclencher ce blocage, telle qu'une commande SQL incorrecte.

- Traitement des documentsCe logiciel peut-il gérer facilement les relevés bancaires, les cartes de crédit et autres documents financiers ? Vérifiez s’il extrait les lignes de données avec précision et minimise la saisie manuelle.

- Signalement & Insight: Vous permettra-t-il d'obtenir et de disposer de bilans clairs, de tableaux de flux de trésorerie et des informations nécessaires pour rester organisé ?

- Structure des coûtsAu-delà des frais mensuels et du prix global de l'inscription automatique, il est important de comprendre le coût total de la licence et les avantages reçus par mois.

- Correspondance fonctionnellePouvez-vous facilement gérer le rapprochement bancaire et les fournisseurs ? Faire Assurez-vous que la version de bureau (le cas échéant) et les fonctionnalités de vérification de QuickBooks correspondent à votre flux de travail spécifique.

Verdict final

QuickBooks est notre choix comme système comptable principal.

Bien qu'AutoEntry soit un expert en saisie de données — vous épargnant ainsi la saisie manuelle de données à partir de documents financiers —, il s'agit d'un outil spécialisé.

QuickBooks est une plateforme complète ; elle génère vos rapports financiers essentiels, gère la facturation des clients et assure le suivi de chaque date.

Si une action que vous venez d'effectuer a déclenché la solution de sécurité et vous empêche d'accéder à une page, vous devez contacter le propriétaire du site par e-mail pour résoudre le problème.

Puisque QuickBooks gère toutes ces fonctions clés et offre un contrôle total de l'entreprise.

C'est la solution tout-en-un par excellence.

Plus d'informations sur QuickBooks

- QuickBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- QuickBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- QuickBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- QuickBooks contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- QuickBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- QuickBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- QuickBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- QuickBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- QuickBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- QuickBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- QuickBooks contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- QuickBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- QuickBooks contre AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- QuickBooks contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- QuickBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Plus d'informations sur AutoEntry

- Saisie automatique vs PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Saisie automatique vs DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- AutoEntry vs XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- AutoEntry vs SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Saisie automatique vs Fin de mois simplifiéeIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- AutoEntry vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- AutoEntry vs SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- AutoEntry vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Saisie automatique vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- AutoEntry vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- AutoEntry vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- AutoEntry vs ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- AutoEntry vs QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- AutoEntry vs FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- AutoEntry vs NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

AutoEntry peut-il s'intégrer directement à QuickBooks ?

Oui, AutoEntry s'intègre parfaitement à QuickBooks. Il transfère les données extraites directement dans votre compte QuickBooks, simplifiant ainsi votre comptabilité.

QuickBooks est-il adapté aux très petites entreprises ou aux travailleurs indépendants ?

Absolument. QuickBooks propose des formules comme Simple Start, parfaites pour les indépendants et très petites entreprises besoin d'un suivi de base des revenus et des dépenses.

AutoEntry remplace-t-il le besoin d'un comptable ?

Non, AutoEntry automatise la saisie des données, ce qui vous fait gagner du temps, à vous ou à votre comptable. Il ne remplace cependant pas l'expertise d'un comptable en matière d'analyse financière, de planification fiscale ou de conformité.

Quel est le meilleur logiciel de gestion des stocks : QuickBooks ou AutoEntry ?

QuickBooks est bien plus performant pour la gestion des stocks. Ses formules Plus et Advanced offrent des fonctionnalités complètes pour le suivi des stocks, des coûts et des ventes. AutoEntry, quant à lui, ne gère pas les stocks.

Puis-je essayer QuickBooks ou AutoEntry avant d'acheter ?

Oui, QuickBooks et AutoEntry proposent généralement des essais gratuits. Cela vous permet de tester leurs fonctionnalités et de vérifier leur adéquation à vos besoins professionnels avant de souscrire un abonnement.