Choisir le bon logiciel de comptabilité feels like a huge task.

Et si vous faire the wrong choice?

A bad fit can cause real headaches.

You might waste precious time, miss tracking important expenses, or mess up your books.

That’s where we come in. We’re looking at two popular names: Puzzle IO vs Expensify.

Aperçu

Through rigorous feature-by-feature analysis and hands-on testing of core functionalities like receipt scanning and report generation.

Envie de simplifier vos finances ? Découvrez comment Puzzle IO peut vous faire gagner jusqu’à 20 heures par mois. Voyez la différence.

Tarification : Formule gratuite disponible. Formule payante à partir de 42,50 $/mois.

Caractéristiques principales :

- Planification financière

- Prévision

- Analyses en temps réel

Rejoignez plus de 15 millions d'utilisateurs qui font confiance à Expensify pour simplifier leurs finances. Économisez jusqu'à 83 % sur le temps consacré aux notes de frais.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 5 $/mois.

Caractéristiques principales :

- Capture de reçus SmartScan

- Rapprochement des cartes d'entreprise

- Flux de travail d'approbation avancés.

Qu'est-ce que Puzzle IO ?

Hey, so Puzzle IO, right? It’s an expense management tool.

It seems pretty focused on project costs. Good for keeping tabs on budgets.

Découvrez également nos favoris Alternatives à Puzzle IO…

Notre avis

Envie de simplifier vos finances ? Découvrez comment Puzzle io peut vous faire gagner jusqu’à 20 heures par mois. Faites-en l’expérience dès aujourd’hui !

Principaux avantages

Puzzle IO excelle vraiment lorsqu'il s'agit de vous aider à comprendre où votre entreprise se dirige.

- 92% de Les utilisateurs font état d'une meilleure précision des prévisions financières.

- Obtenez des informations en temps réel sur vos flux de trésorerie.

- Créez facilement différents scénarios financiers pour planifier.

- Collaborez harmonieusement avec votre équipe sur les objectifs financiers.

- Suivez les indicateurs clés de performance (KPI) en un seul endroit.

Tarification

- Notions de base en comptabilité : 0 $/mois.

- Perspectives de Accounting Plus : 42,50 $/mois.

- Comptabilité et automatisation avancée : 85 $/mois.

- Échelle Accounting Plus : 255 $/mois.

Avantages

Cons

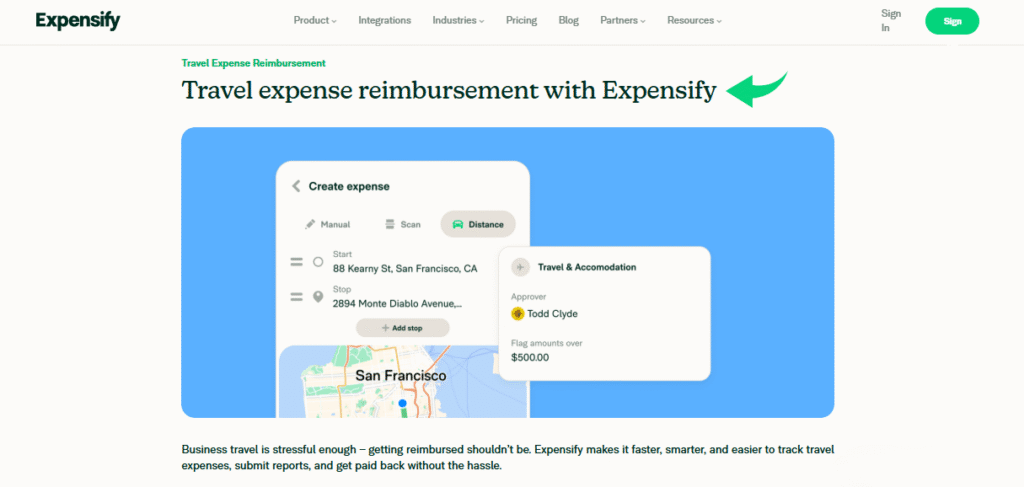

Qu'est-ce qu'Expensify ?

Okay, so Expensify is another option.

It feels really strong on receipt handling. Their SmartScan seems pretty slick.

Good if you deal with lots of individual expenses.

Découvrez également nos favoris Alternatives Expensify…

Principaux avantages

- La technologie SmartScan scanne les détails des reçus et les extrait avec une précision supérieure à 95 %.

- Les employés sont remboursés rapidement, souvent en un seul jour ouvrable via ACH.

- La carte Expensify peut vous faire économiser jusqu'à 50 % sur votre abonnement grâce à son programme de remboursement.

- Aucune garantie n'est offerte ; leurs conditions générales stipulent que la responsabilité est limitée.

Tarification

- Collecter: 5 $/mois.

- Contrôle: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

Navigation petite entreprise finances can be challenging.

This comparison highlights key features of Puzzle IO and Expensify.

Examining how each platform addresses comptabilité, expense reports, and automation to help you simplify financial management.

1. Core Audience & Focus

- Puzzle IO is a game-changer built for early-stage startups and co-founder teams, focusing on up-to-date financial statements and key metrics right out of the box.

- Expensify focuses on an efficient expense management process for employees and contractors, making it easy for them to file and for employers to reimburse.

2. Automated Bookkeeping

- Puzzle IO is designed for autonome bookkeeping, using AI to automate tedious tasks and provide an accurate picture of the current state of the company quickly.

- Expensify automation is concentrated on receipts and expense report creation, aiming to simplify the process for the user and their manager’s approval.

3. Startup Financial Health Metrics

- Puzzle IO provides startup founders with instant access to key metrics like cash piste, burn rate, and MRR, offering clear insights into their financial health.

- Expensify focuses on spending, helping companies control spending and reconcile the Expensify Card, but does not natively provide comprehensive startup metrics.

4. Complex Accrual Accounting

- Puzzle IO includes built-in accrual automation to handle complex items like revenue recognition and prepaid expenses automatically, which is vital for providing a true and accurate picture of revenue.

- Expensify does not focus on the underlying accrual comptabilité logic for things like fixed assets and deferred revenue; its strength is expense capture.

5. Expense Reporting Experience

- Puzzle IO permet for transaction categorization and expense tracking, but does not specialize in complex, multi-level expense management processes and reimbursement workflows.

- Expensify makes it easy for the team to log mileage, snap a photo of a receipt in a few seconds, and get reimbursed quickly, which is a game-changer for employees.

6. AI-Powered Functionality

- Puzzle IO uses AI for smart transaction categorization, continuous accuracy checks, and streamlining the setup for non-accountants.

- Expensify uses its SmartScan technology for receipt données extraction and AI-powered automation to match transactions, making the process less time-consuming.

7. Focus on Financial Statements

- Puzzle IO’s primary goal is to generate real-time, audit-ready financial statements, helping startup founders stay up to date and prepare for investors or tax time.

- Expensify is a pre-accounting tool that passes expense data to other tools like QuickBooks or Xero for final statement generation by a finance expert.

8. Corporate Card Management

- Puzzle IO integrates with various cards, focusing on getting data into the books quickly.

- Expensify offers the Expensify Card, which links seamlessly to its system, automates reconciliation, and allows employers to set smart spending limits.

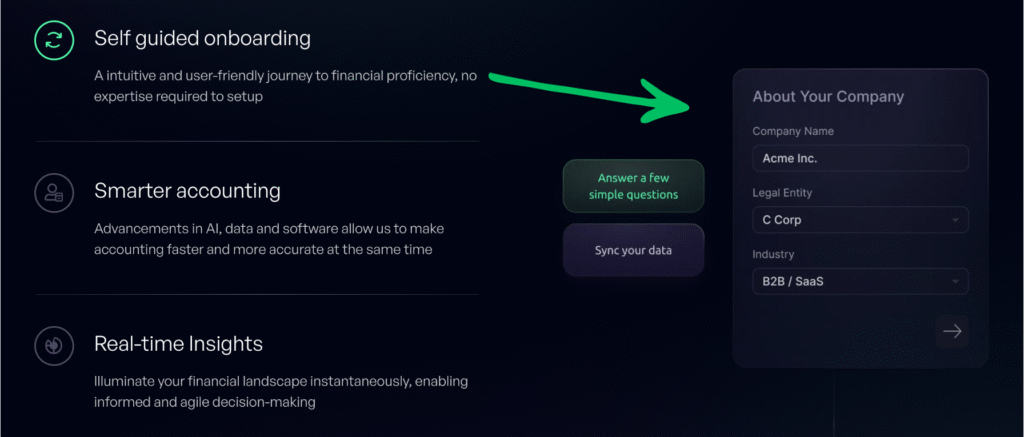

9. Ease of Setup

- Puzzle IO offres an easy setup and a modern interface, minimizing errors and making it simple for the co founder who may be a non comptables.

- Expensify also offers a quick and easy setup for the expense management process, which helps employees and contractors submit expenses and reports in less time.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Look beyond basic Expensify reviews to see how the software handles the complete general ledger and organization.

- The software needs a reliable connection to your bank accounts to avoid manual data entry and reduce errors.

- Ensure the platform gives you a clear cash runway and not just a summary of past data—don’t wait for insights.

- The ability to manage expenses must be flexible, supporting phone, desktop, and web access.

- Check the speed of completing reports and the ease of exporting data to your clients or accountant.

- It should allow users to create and submit requests immediately, and managers to approve them quickly.

- The system must reliably respond to inputs and not be blocked by simple issues.

- All financial details should be securely stored in a digital pocket for easy review.

- The software should offer automated code assignment and customizable categories and tags.

- Your final thoughts should confirm that the system can scale with your future organization, moving you away from spreadsheets.

- A key insight is whether the platform is structured for a small number of users or a growing organization.

- An efficient system should trigger notifications when action is expected, simplifying the single-view page workflow.

- Consider why others chose Puzzle or a similar full-stack tool over a pure expense manager.

Verdict final

Picking between Puzzle IO and Expensify depends on your main needs.

Expensify is tops for expense reports and receipts.

But Puzzle IO does more for overall money tracking, invoices, and connecting with payroll (even like QuickBooks).

Both are cloud-based.

If you want a wider view of your entreprise, money, and something that can grow.

Puzzle IO wins. We checked them out carefully.

So our advice should help you choose the right software to save time.

Neither doesn’t really offer free comptabilité for most businesses.

Plus de Puzzle IO

Nous avons comparé Puzzle IO à d'autres outils comptables. Voici un aperçu de ses principales caractéristiques :

- Puzzle IO contre Xero: Xero offre des fonctionnalités comptables étendues avec de solides intégrations.

- Puzzle IO contre Dext: Puzzle IO excelle dans l'analyse et la prévision financières grâce à l'IA..

- Puzzle IO contre Synder: Synder excelle dans la synchronisation des données de vente et de paiement.

- Puzzle IO contre Easy Month End: Easy Month End simplifie le processus de clôture financière.

- Puzzle IO contre Docyt: Docyt utilise l'IA pour automatiser les tâches comptables.

- Puzzle IO contre RefreshMe: RefreshMe se concentre sur le suivi en temps réel des performances financières.

- Puzzle IO contre Sage: Sage propose des solutions comptables robustes adaptées aux entreprises de toutes tailles.

- Puzzle IO contre Zoho Books: Zoho Books propose une comptabilité abordable avec CRM intégration.

- Puzzle IO contre Wave: Wave propose un logiciel de comptabilité gratuit pour les petites entreprises.

- Puzzle IO contre Quicken: Quicken est connu pour la gestion des finances personnelles et des petites entreprises.

- Puzzle IO vs Hubdoc: Hubdoc se spécialise dans la collecte de documents et l'extraction de données..

- Puzzle IO contre Expensify: Expensify propose des solutions complètes de gestion et de reporting des dépenses.

- Puzzle IO contre QuickBooks: QuickBooks est un choix populaire pour la comptabilité des petites entreprises.

- Puzzle IO vs AutoEntry: AutoEntry automatise la saisie des données à partir des factures et des reçus.

- Puzzle IO contre FreshBooks: FreshBooks est conçu sur mesure pour la facturation des entreprises de services.

- Puzzle IO contre NetSuite: NetSuite propose une suite complète pour la planification des ressources d'entreprise.

Plus d'informations sur Expensify

- Expensify contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Expensify contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Expensify contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Expensify contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Expensify vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Expensify contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Expensify contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Expensify contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Expensify vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Expensify vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Expensify contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Expensify vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Expensify contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Expensify contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

What key features should software for small businesses include?

Essential features are invoicing, expense tracking, bank reconciliation, and reportage to manage business finances effectively.

Can accounting software help with automation?

Yes, many platforms offer automation for tasks like data entry, bank feeds, and payment reminders, saving time.

Is there free accounting software suitable for small businesses?

Some free options exist with basic features, but they may lack advanced capabilities or scalability for growing businesses.

How can AI-powered features benefit small business accounting?

AI can automate categorization, detect anomalies, and provide insights, improving accuracy and efficiency in financial management.

Which type of accounting software is best for my small business?

The best software depends on your specific business needs, size, and complexity. Consider features, integrations, and scalability.