Redoutez-vous la clôture de fin de mois ?

Pour beaucoup petites entreprises, c'est un vrai casse-tête.

Vous en avez probablement assez de jongler avec des feuilles de calcul et d'essayer de faire avoir une bonne compréhension de ses finances.

Deux populaires logiciel de comptabilité Options : Fin de mois simplifiée et vague.

Dans cet article, nous comparerons les fonctionnalités d'Easy Month End et de Wave pour vous aider à choisir la solution la mieux adaptée à vos besoins. comptabilité besoins.

Aperçu

Pour vous donner une image aussi claire que possible, nous avons testé en profondeur Easy Month End et Wave.

Analyse approfondie de leurs fonctionnalités, de l'expérience utilisateur et de leur valeur globale.

Cette approche pratique nous a permis de comparer la façon dont chaque plateforme gère les problèmes courants comptabilité tâches directement.

En cette fin de mois, rejoignez les 1 257 utilisateurs d'Easy qui ont économisé en moyenne 3,5 heures et réduit leurs erreurs de 15 %. Commencez votre essai gratuit !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 45 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Plus de 4 millions petites entreprises Confiez la gestion de vos finances à Wave. Découvrez les offres de Wave et trouvez celle qui vous convient.

Tarification : Formule gratuite disponible. Formule payante à partir de 19 $/mois.

Caractéristiques principales :

- Facturation

- Bancaire

- Module complémentaire de paie.

Qu'est-ce qu'une fin de mois facile ?

Alors, Easy Month End, c'est quoi exactement ?

C'est un outil conçu spécifiquement pour clôturer vos comptes chaque mois.

Considérez-le comme votre assistant pour les tâches de fin de mois.

Découvrez également nos favoris Alternatives faciles pour la fin du mois…

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

Qu'est-ce que Wave ?

Alors, qu'est-ce que Wave ? C'est une application complète. comptabilité logiciel.

On vante souvent sa gratuité. Wave aide les petites entreprises à gérer leur facturation et leurs dépenses.

Vous pouvez également gérer votre paie.

Découvrez également nos favoris Alternatives aux vagues…

Notre avis

N’acceptez pas moins ! Rejoignez les plus de 2 millions de petites entreprises qui font confiance dès aujourd’hui aux puissantes fonctionnalités comptables gratuites de Wave pour optimiser leurs finances.

Principaux avantages

Les points forts de Wave incluent :

- Un plan de comptabilité de base 100% gratuit.

- Au service de plus de 2 millions de petites entreprises.

- Création de factures et traitement des paiements simplifiés.

- Aucun contrat ni garantie à long terme.

Tarification

- Plan de démarrage : 0 $ par mois.

- Formule Pro : 19 $ par mois.

Avantages

Cons

Comparaison des fonctionnalités

Examinons plus en détail la comparaison entre ces deux plateformes.

Voici une analyse détaillée de chaque fonctionnalité pour vous aider à comprendre leurs points forts et leurs points faibles.

1. Clôture mensuelle vs Comptabilité générale

- Easy Month End est un outil hautement spécialisé pour le processus de clôture mensuelle. Il offre à votre équipe financière une liste de contrôle structurée et une gestion des flux de travail pour la collecte des données. audit Des preuves et une clôture de fin de mois plus fluide. Ce n'est pas une solution complète. comptabilité solution.

- Wave est une solution complète petite entreprise Logiciel de comptabilité. Il est conçu pour gérer tous les aspects de votre comptabilité. comptabilitéElle vise à être une plateforme tout-en-un pour vos besoins en comptabilité et en paie, couvrant l'ensemble de vos opérations, des transactions quotidiennes aux rapports financiers.

2. Tarification et valeur

- Easy Month End est disponible à partir de 24 $ par mois. C'est un outil professionnel conçu pour une tâche spécifique. Vous payez pour sa capacité à simplifier le processus de fin de mois.

- Wave propose une formule de base gratuite performante incluant les fonctionnalités essentielles. Moyennant un supplément de 16 $ par mois, la formule Pro débloque des options telles que l'importation automatique des transactions bancaires et un nombre illimité d'utilisateurs. La valeur ajoutée de cette formule est un argument de poids dans de nombreux avis positifs sur le logiciel de comptabilité Wave.

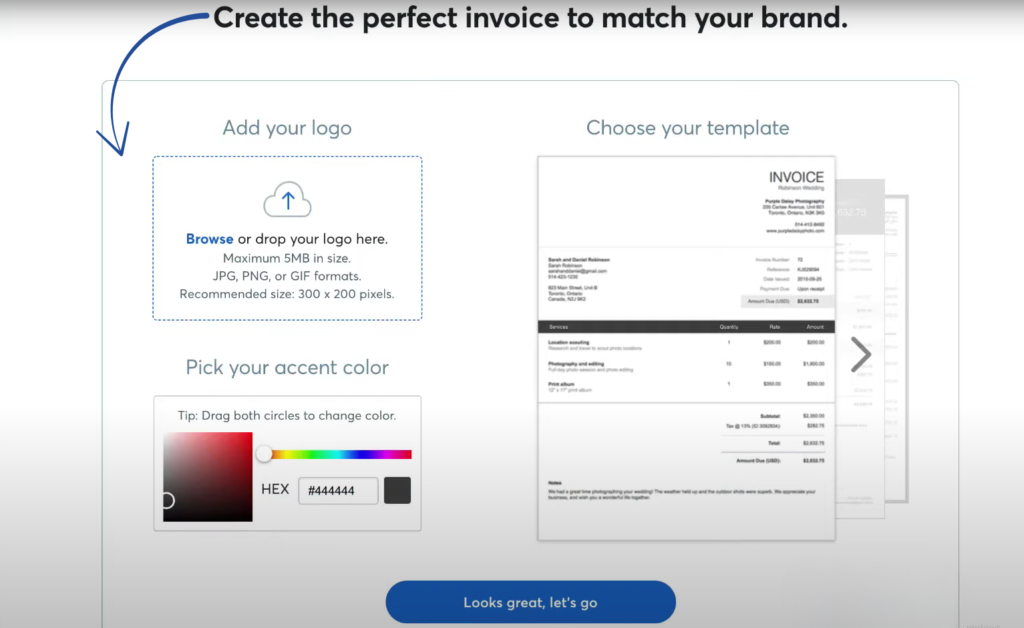

3. Facturation et encaissement

- Easy Month End ne possède aucune fonctionnalité de facturation. Ce n'est pas un logiciel de facturation.

- Wave est un leader dans ce domaine. Vous pouvez créer et envoyer des factures, configurer la facturation récurrente et même utiliser des rappels de paiement automatisés. Vous pouvez également accepter les paiements en ligne par carte bancaire et virement bancaire.

4. Gestion des dépenses et reçus

- Easy Month End ne dispose pas d'un système dédié à la gestion des dépenses. Il est conçu pour le rapprochement bancaire. données que vous téléchargez à partir d'autres sources pendant le processus de fermeture.

- Wave offre un excellent suivi des dépenses grâce à la numérisation des reçus et à la possibilité de lier des comptes bancaires pour importer automatiquement les transactions. La version Pro propose également la capture numérique des reçus et leur fusion automatique pour une efficacité accrue.

5. Collaboration d'équipe et flux de travail

- Easy Month End est conçu pour la collaboration en équipe. Il permet d'attribuer des tâches, de suivre leur avancement et d'obtenir les validations des membres de l'équipe. Vous pouvez ajouter des commentaires aux tâches et les auditeurs peuvent examiner leur progression, ce qui permet de constituer des preuves d'audit solides.

- Wave propose un niveau de collaboration basique avec son abonnement Pro, permettant l'utilisation par plusieurs utilisateurs. Cependant, il ne dispose pas des fonctions de gestion des flux de travail structurés et de révision d'Easy Month End.

6. Rapports et tableau de bord

- Le tableau de bord d'Easy Month End vous permet de suivre l'avancement de votre processus de clôture mensuelle. Il offre une vue d'ensemble claire des tâches terminées et de celles en cours, garantissant ainsi qu'aucun détail ne soit négligé.

- Wave propose un tableau de bord financier classique offrant une vue d'ensemble de vos fonctionnalités de gestion financière. Vous pouvez générer divers rapports, mais les options de personnalisation sont moins avancées que celles de logiciels plus onéreux comme… QuickBooks.

7. Fonctionnalités de base

- Easy Month End possède des fonctionnalités ciblées mais complètes. C'est un outil dédié à la simplification du processus de clôture mensuelle pour une équipe financière.

- Wave offre un large éventail de fonctionnalités comptables de base. Bien qu'il ne propose pas le suivi des stocks ni la facturation des heures, il constitue une solution performante et économique pour les tâches quotidiennes des petites entreprises. entreprise propriétaires.

8. Cas d'utilisation et public cible

- Easy Month End est destiné aux équipes financières professionnelles qui recherchent une solution plus efficace pour gérer les tâches de fin de mois, de trimestre ou d'année. C'est un outil idéal pour remplacer les listes de contrôle manuelles dans Excel ou Outlook.

- Wave est conçu pour les indépendants, les entrepreneurs et les très petites entreprises qui ont besoin d'un outil simple et performant pour gérer leurs finances. Il est idéal pour ceux qui ne souhaitent pas investir dans un système complet.

9. Sécurité

- Easy Month End garantit la conformité grâce à une piste d'audit détaillée. Chaque action est enregistrée, ce qui vous permet d'assurer la responsabilisation et la tranquillité d'esprit lors de la validation par le préparateur et les auditeurs.

- Wave utilise l'authentification multifacteurs et des connexions bancaires sécurisées pour protéger votre argent. Elle offre un niveau de sécurité bancaire. sécurité pour garantir la sécurité de vos données.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Votre entreprise a besoinÊtes-vous un travailleur indépendant qui doit être rémunéré ou gérez-vous une grande équipe financière ? Cela permet de déterminer si vous avez besoin d’une plateforme gratuite ou d’un abonnement professionnel payant.

- Caractéristiques principalesAvez-vous besoin de fonctionnalités de facturation telles que des factures illimitées et des rappels de paiement automatisés, ou de fonctionnalités de gestion telles que les flux de travail et la collaboration d'équipe ?

- TarificationAvez-vous besoin d'une version gratuite ou êtes-vous prêt à souscrire un abonnement avec des frais supplémentaires ? Réfléchissez à la question de savoir si la plateforme gratuite répondra à vos besoins.

- Fonctionnalités généralesAvez-vous besoin d'un grand livre général et de rapprochements de bilan robustes, ou avez-vous simplement besoin de suivre les flux de trésorerie et d'envoyer des factures ?

- Signalement et des idéesLe logiciel peut-il générer les rapports dont vous avez besoin, comme les bilans et les états financiers, pour vous apporter la tranquillité d'esprit et vous faciliter la vie ?

- IntégrationsLe logiciel est-il compatible avec les autres outils que vous utilisez ? Wave s’intègre aux processeurs de paiement, mais qu’en est-il des autres outils utilisés par votre équipe, comme le traitement de la paie ?

- Soutien et ressourcesDisposent-ils d'un centre d'aide ou de tutoriels pour vous aider à comprendre comment utiliser le logiciel et pour répondre à vos questions en cas de retards ou d'erreurs ?

- ÉvolutivitéLe logiciel peut-il gérer plusieurs entreprises ou un nombre accru d'utilisateurs à mesure que votre entreprise se développe ?

- Cas d'utilisationS’agit-il de finances personnelles, d’un travailleur indépendant ou d’une entreprise plus importante avec une équipe ? Cela déterminera si une solution simple ou plus complexe est nécessaire pour gérer les tâches de fin de mois.

Verdict final

Après un examen approfondi des deux plateformes, notre choix pour une équipe financière professionnelle se porte sur Easy Month End.

Wave est une excellente plateforme gratuite pour les travailleurs indépendants qui doivent être payés, et une bonne application mobile pour la facturation en déplacement.

Il n'est pas conçu pour les tâches complexes des équipes financières.

Easy Month End a été conçu précisément dans ce but.

Cela permet à une équipe financière de gérer les confirmations manuelles et d'effectuer des rapprochements de bilan plus rapides, tout en assurant une plus grande tranquillité d'esprit.

Cet outil offre une plateforme unique pour tous vos rapprochements et simplifie ce qui est souvent une période stressante en fin de mois.

Si votre entreprise a besoin d'un outil performant pour gérer son équipe financière.

Nous recommandons Wave pour la comptabilité de base, mais Easy Month End est la solution supérieure pour rendre votre équipe financière plus efficace.

Plus de fins de mois faciles

Voici une brève comparaison d'Easy Month End avec quelques-unes des principales alternatives.

- Fin de mois facile vs Puzzle io: Alors que Puzzle.io est destiné à la comptabilité des startups, Easy Month End se concentre spécifiquement sur la simplification du processus de clôture.

- Fin de mois facile vs Dext: Dext est principalement destiné à la capture de documents et de reçus, tandis qu'Easy Month End est un outil complet de gestion de la clôture de fin de mois.

- Easy Month End vs Xero: Xero est une plateforme comptable complète pour les petites entreprises, tandis qu'Easy Month End propose une solution dédiée au processus de clôture.

- Fin de mois facile vs Synder: Synder est spécialisé dans l'intégration des données de commerce électronique, contrairement à Easy Month End qui est un outil de flux de travail pour l'ensemble de la clôture financière.

- Fin de mois facile vs Docyt: Docyt utilise l'IA pour la comptabilité et la saisie de données, tandis qu'Easy Month End automatise les étapes et les tâches de la clôture financière.

- Easy Month End vs RefreshMe: RefreshMe est une plateforme de coaching financier, différente de Easy Month End qui se concentre sur la gestion des clôtures.

- Easy Month End vs Sage: Sage est une suite logicielle de gestion d'entreprise à grande échelle, tandis qu'Easy Month End offre une solution plus spécialisée pour une fonction comptable essentielle.

- Easy Month End vs Zoho Books: Zoho Books est un logiciel de comptabilité tout-en-un, tandis qu'Easy Month End est un outil spécialement conçu pour le processus de clôture mensuelle.

- Fin de mois facile vs vague: Wave propose des services de comptabilité gratuits pour les petites entreprises, tandis qu'Easy Month End offre une solution plus avancée pour la gestion des clôtures.

- Easy Month End vs Quicken: Quicken est un outil de gestion de finances personnelles, ce qui fait d'Easy Month End un meilleur choix pour les entreprises qui doivent gérer leur clôture de fin de mois.

- Easy Month End vs Hubdoc: Hubdoc automatise la collecte de documents, mais Easy Month End est conçu pour gérer l'intégralité du flux de travail de clôture et les tâches d'équipe.

- Easy Month End vs Expensify: Expensify est un logiciel de gestion des dépenses, ce qui est une fonction différente de l'objectif principal d'Easy Month End, qui est la clôture financière.

- Easy Month End vs QuickBooks: QuickBooks est une solution comptable complète, tandis qu'Easy Month End est un outil plus spécifique pour la gestion de la clôture de fin de mois.

- Fin de mois simplifiée vs saisie automatique: AutoEntry est un outil de saisie de données, tandis qu'Easy Month End est une plateforme complète pour la gestion des tâches et des flux de travail lors de la clôture.

- Easy Month End vs FreshBooks: FreshBooks est destiné aux travailleurs indépendants et aux petites entreprises, tandis qu'Easy Month End offre une solution dédiée à la clôture de fin de mois.

- Easy Month End vs NetSuite: NetSuite est un système ERP complet, dont la portée est plus large que celle d'Easy Month End, spécialisé dans la clôture financière.

Plus de Wave

- Wave vs Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Wave contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Wave contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Vague contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Wave vs Easy Fin de moisIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Wave vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Vague contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Wave vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Wave vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- Wave vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Wave contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Wave contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Wave vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Wave contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Wave contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Wave est-il vraiment gratuit pour la comptabilité ?

Oui, Wave Accounting propose une formule gratuite incluant les fonctionnalités comptables de base telles que la facturation, le suivi des dépenses et la création de rapports. Vous ne payez que pour les services premium comme la gestion de la paie ou le traitement des paiements.

Quel est le meilleur choix pour une entreprise en croissance : Easy Month End ou Wave ?

Wave est généralement plus adapté aux entreprises en pleine croissance qui ont besoin de fonctionnalités comptables complètes. Easy Month End est spécialisé dans la clôture de fin de mois, tandis que Wave offre une solution comptable plus large pour gérer divers besoins d'entreprise.

Puis-je suivre les stocks avec Wave ?

Wave ne propose pas de fonctionnalités robustes de suivi des stocks. Si la gestion des stocks est essentielle pour votre entreprise, envisagez d'autres solutions logicielles comptables ou des intégrations tierces.

Easy Month End propose-t-il des options de personnalisation ?

Easy Month End propose des listes de contrôle et des modèles personnalisables pour s'adapter à votre processus de clôture de fin de mois. Cependant, contrairement à Wave, il n'offre pas d'options de personnalisation aussi poussées pour les fonctions comptables générales.

Comment Wave se compare-t-il aux autres logiciels de comptabilité gratuits ?

Wave se distingue des autres logiciels de comptabilité gratuits par ses fonctionnalités de base complètes et son interface conviviale. Bien que d'autres logiciels existent, Wave offre un ensemble d'outils performants pour vous aider à gérer votre comptabilité. petite entreprise Les propriétaires gèrent efficacement leurs finances.