Gérer comptabilité La fin de chaque mois peut être un vrai casse-tête.

Vous jonglez avec des chiffres, vérifiez des rapports et vous assurez que tout concorde.

Vous avez peut-être entendu parler d'outils qui promettent de faire C'est plus facile.

Cet article compare Easy Month End et Refreshme pour vous aider à choisir le logiciel le plus adapté à vos besoins. comptabilité Cet outil peut vous sauver.

Aperçu

Pour vous donner une idée plus précise, nous avons analysé en profondeur Easy Month End et Refreshme.

Nous avons testé leurs fonctionnalités et examiné leur facilité d'utilisation.

Cette approche pratique nous permet de vous proposer une comparaison équitable.

En cette fin de mois, rejoignez les 1 257 utilisateurs d'Easy qui ont économisé en moyenne 3,5 heures et réduit leurs erreurs de 15 %. Commencez votre essai gratuit !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 45 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Accédez à des informations financières plus approfondies ! Refresh Me analyse vos dépenses et vous aide à économiser plus intelligemment.

Essayez-le maintenant !

Tarification : Il propose un essai gratuit. L'abonnement premium est à 24,99 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Qu'est-ce qu'une fin de mois facile ?

Alors, qu'est-ce que la fin de mois facile exactement ?

Considérez-le comme votre assistant numérique pour la clôture de vos comptes chaque mois.

Il est conçu pour rendre cette période souvent stressante beaucoup plus facile.

Découvrez également nos favoris Alternatives faciles pour la fin du mois…

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

Qu'est-ce que Refreshme ?

Alors, qu'en est-il de Refreshme ?

Cet outil se concentre vraiment sur la fabrication de votre comptabilité Les tâches, notamment la réconciliation, deviennent presque sans effort.

Elle utilise des technologies intelligentes, voire une certaine forme d'IA, pour vous aider à faire correspondre vos chiffres rapidement et avec précision.

Découvrez également nos favoris Alternatives à Refreshme…

Notre avis

Le point fort de RefreshMe réside dans sa capacité à fournir des informations exploitables en temps réel. Toutefois, l'absence de tarification publique et des fonctionnalités comptables de base potentiellement moins complètes pourraient constituer des points à prendre en compte pour certains utilisateurs.

Principaux avantages

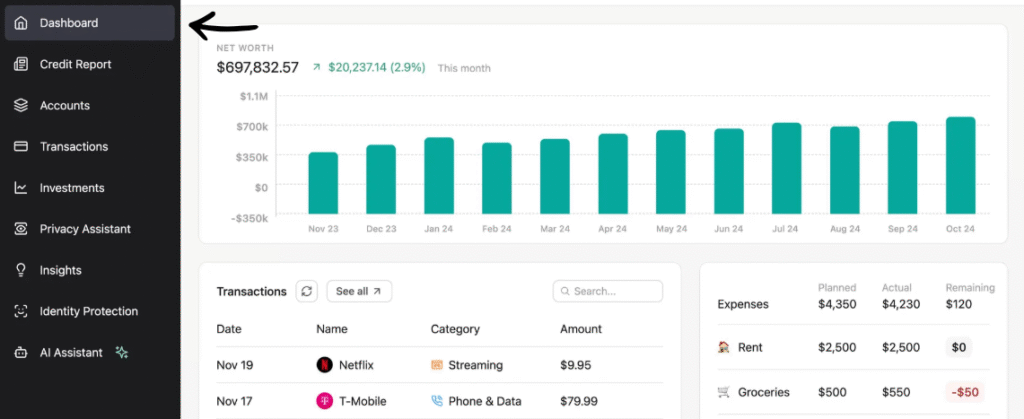

- Tableaux de bord financiers en temps réel

- Détection d'anomalies basée sur l'IA

- Rapports personnalisables

- prévision des flux de trésorerie

- Évaluation comparative des performances

Tarification

- Individu (3B) : 24,99 $/mois.

- Couple (3B) : 44,99 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Examinons de plus près les fonctionnalités principales de chaque plateforme pour voir comment elles se comparent.

Ce comparatif vous aidera à choisir l'outil qui offrira à votre équipe financière l'efficacité qu'elle mérite.

1. Gestion des flux de travail

- Fin de mois facile : Cette plateforme offre une gestion robuste des flux de travail pour les tâches de fin de mois, de trimestre et d'année. Conçue pour s'adapter au mode de fonctionnement d'une équipe financière, elle l'aide à optimiser le suivi de ses tâches et des échéances de ses projets.

- Rafraîchis-moi : Cet outil est davantage axé sur les finances personnelles et la gestion des tâches. Il aide les particuliers à suivre leurs factures et leurs objectifs financiers, et non des opérations complexes. entreprise flux de travail.

2. Réconciliation

- Fin de mois facile : Il est conçu pour le rapprochement des comptes et facilite la réalisation de tous vos rapprochements. Il vise à accélérer les rapprochements de comptes en se connectant directement à vos données. données.

- Rafraîchir-moi : Bien qu'il permette le rapprochement de comptes personnels, il n'est pas adapté aux bilans d'entreprises complexes. Il est destiné aux opérations bancaires et aux cartes de crédit des particuliers.

3. Collaboration d'équipe

- Fin de mois facile : Cet outil constitue une véritable plateforme unique pour une équipe financière. Vous pouvez y attribuer des tâches, laisser des commentaires et suivre leur avancement, le tout au même endroit, afin d'améliorer la collaboration et d'éliminer les retards de communication.

- Rafraîchis-moi : Il s'agit d'un outil monoposte pour la gestion des finances personnelles.9 Il ne dispose pas de fonctionnalités de collaboration en équipe ni de la possibilité pour plusieurs personnes d'accéder à un compte partagé.

4. Automatisation et synchronisation des données

- Fin de mois facile : Cette plateforme permet d'éliminer automatiquement les contraintes liées aux listes de contrôle manuelles. Elle peut également se synchroniser avec les principaux systèmes. comptabilité Un logiciel pour simplifier au maximum le processus de clôture de fin de mois.

- Rafraîchis-moi : Cela vous aide à organiser automatiquement vos dépenses personnelles.11 Elle envoie également des rappels pour que vous n'oubliiez jamais de payer une facture, ce qui vous simplifie la vie.

5. Audit et conformité

- Fin de mois facile : Il vous aide à recueillir les preuves d'audit et fournit un journal d'audit complet pour chaque étape. Vous pouvez accorder un accès en lecture seule aux auditeurs afin qu'ils puissent tout examiner eux-mêmes. Cela favorise la conformité.

- Rafraîchir-moi : Cet outil n'est pas conçu pour les audits d'entreprise formels. Il est destiné à un usage personnel et ne génère pas de preuves d'audit.

6. Tâches ad hoc et flexibilité

- Fin de mois facile : Cette plateforme a étendu ses fonctionnalités pour gérer les tâches ponctuelles et autres éléments non mensuels. Elle peut prendre en charge toutes sortes de tâches d'une équipe financière.

- Rafraîchir-moi : Il est axé sur les tâches financières personnelles récurrentes. Il n'est pas conçu pour suivre un large éventail de tâches professionnelles spécifiques.

7. Objectif principal

- Fin de mois facile : Il s'agit d'un outil spécialisé pour une clôture de fin de mois plus fluide. Il est conçu pour aider une équipe financière à accomplir son travail avec moins d'erreurs.

- Rafraîchir-moi : Son objectif principal est la gestion du budget personnel et la santé financière. Il s'agit de reprendre le contrôle de ses finances, et non de modifier le fonctionnement d'une entreprise.

8. Examen et approbation

- Fin de mois facile : Une fonctionnalité essentielle est la possibilité de gérer les validations de l'équipe de préparation et de l'équipe de révision. Il s'agit d'un élément vital du processus de clôture de fin de mois qui contribue à responsabiliser chacun.

- Rafraîchir-moi : Il n'y a pas de système de révision ni de validation. C'est un outil permettant à un seul utilisateur de gérer ses finances personnelles.

9. Prix et évolutivité

- Fin de mois facile : Vous pouvez choisir parmi différents forfaits pour gérer quelques entités ou étendre votre gestion à un nombre illimité d'utilisateurs. Sans engagement, vous pouvez résilier à tout moment.

- Rafraîchir-moi : Son modèle tarifaire est basé sur un usage personnel, avec des forfaits pour les particuliers, les couples et les familles. Il n'est pas conçu pour s'adapter aux entreprises comportant plusieurs entités.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Pour que Refreshme soit la solution idéale, vérifiez si son traitement des données répond à vos besoins.

- Ses fonctionnalités de gestion d'équipe contribuent-elles à créer une équipe financière plus efficace ?

- Il est important d'analyser comment il gère les virements bancaires et autres confirmations manuelles.

- L'application possède-t-elle une interface conviviale qui facilite votre première clôture de fin de mois ?

- Assurez-vous que le processus de chargement et d'importation de vos données soit simple et rapide, et qu'il permette l'importation de données depuis Excel.

- Les services proposés répondent-ils aux besoins de vos clients ?

- Vérifiez l'âge du logiciel et assurez-vous qu'il a été régulièrement mis à jour.

- Demandez-vous si cela permettra d'épargner du stress à votre équipe, car votre équipe financière le mérite.

- Le service d'assistance peut-il répondre à une question d'une manière qui s'apparente à une forme d'art ?

- Il est essentiel d'avoir une vision claire de la manière dont le logiciel contribuera à améliorer votre entreprise.

- De plus, recherchez un outil qui puisse évoluer avec vous et qui ne soit pas une solution unique et standardisée.

- Évitez d'utiliser un logiciel qui a déjà connu des échecs par le passé et dont l'amélioration n'est pas clairement prévue.

- Vérifiez si vous pouvez accéder à une version de démonstration complète avant de vous engager sur le long terme avec ce logiciel.

- Peut-il gérer des cas complexes ? Que se passe-t-il s’il est confronté à une nouvelle situation financière que vous avez découverte ?

- Si votre entreprise comporte plusieurs entités, les données seront-elles actualisées pour chacune d'elles ?

- Assurez-vous qu'il s'agit de la solution idéale pour votre cas d'utilisation et qu'elle est facile à prendre en main.

- N'oubliez pas d'effacer vos cookies de temps en temps pour garantir une expérience utilisateur optimale.

Verdict final

Après avoir examiné attentivement les deux options, notre verdict final est que la solution Easy Month End est le meilleur choix pour la plupart des entreprises.

Refreshme est excellent pour les finances personnelles.

Easy Month End s'attaque directement aux problèmes de clôture financière des entreprises.

Cela permet à votre comptable de tout recevoir à temps chaque mois.

Sa structure claire pour un processus de fin de mois simplifié et des pistes d'audit lui confèrent un avantage certain.

Nous avons analysé ces outils en profondeur afin que vous puissiez les sélectionner en toute confiance.

Plus de fins de mois faciles

Voici une brève comparaison d'Easy Month End avec quelques-unes des principales alternatives.

- Fin de mois facile vs Puzzle io: Alors que Puzzle.io est destiné à la comptabilité des startups, Easy Month End se concentre spécifiquement sur la simplification du processus de clôture.

- Fin de mois facile vs Dext: Dext est principalement destiné à la capture de documents et de reçus, tandis qu'Easy Month End est un outil complet de gestion de la clôture de fin de mois.

- Easy Month End vs Xero: Xero est une plateforme comptable complète pour les petites entreprises, tandis qu'Easy Month End propose une solution dédiée au processus de clôture.

- Fin de mois facile vs Synder: Synder est spécialisé dans l'intégration des données de commerce électronique, contrairement à Easy Month End qui est un outil de flux de travail pour l'ensemble de la clôture financière.

- Fin de mois facile vs Docyt: Docyt utilise l'IA pour la comptabilité et la saisie de données, tandis qu'Easy Month End automatise les étapes et les tâches de la clôture financière.

- Easy Month End vs RefreshMe: RefreshMe est une plateforme de coaching financier, différente de Easy Month End qui se concentre sur la gestion des clôtures.

- Easy Month End vs Sage: Sage est une suite logicielle de gestion d'entreprise à grande échelle, tandis qu'Easy Month End offre une solution plus spécialisée pour une fonction comptable essentielle.

- Easy Month End vs Zoho Books: Zoho Books est un logiciel de comptabilité tout-en-un, tandis qu'Easy Month End est un outil spécialement conçu pour le processus de clôture mensuelle.

- Fin de mois facile vs vague: Wave propose des services de comptabilité gratuits pour les petites entreprises, tandis qu'Easy Month End offre une solution plus avancée pour la gestion des clôtures.

- Easy Month End vs Quicken: Quicken est un outil de gestion de finances personnelles, ce qui fait d'Easy Month End un meilleur choix pour les entreprises qui doivent gérer leur clôture de fin de mois.

- Easy Month End vs Hubdoc: Hubdoc automatise la collecte de documents, mais Easy Month End est conçu pour gérer l'intégralité du flux de travail de clôture et les tâches d'équipe.

- Easy Month End vs Expensify: Expensify est un logiciel de gestion des dépenses, ce qui est une fonction différente de l'objectif principal d'Easy Month End, qui est la clôture financière.

- Easy Month End vs QuickBooks: QuickBooks est une solution comptable complète, tandis qu'Easy Month End est un outil plus spécifique pour la gestion de la clôture de fin de mois.

- Fin de mois simplifiée vs saisie automatique: AutoEntry est un outil de saisie de données, tandis qu'Easy Month End est une plateforme complète pour la gestion des tâches et des flux de travail lors de la clôture.

- Easy Month End vs FreshBooks: FreshBooks est destiné aux travailleurs indépendants et aux petites entreprises, tandis qu'Easy Month End offre une solution dédiée à la clôture de fin de mois.

- Easy Month End vs NetSuite: NetSuite est un système ERP complet, dont la portée est plus large que celle d'Easy Month End, spécialisé dans la clôture financière.

Plus de Refreshme

- Rafraîchissez-moi contre Puzzle IO: Ce logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Rafraîchissez-moi vs Dext: Il s'agit d'un outil professionnel pour la saisie des reçus et des factures. L'autre outil permet de suivre les dépenses personnelles.

- Rafraîchissez-moi contre Xero: Il s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Rafraîchissez-moi contre Synder: Cet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Rafraîchissez-moi vs Fin de mois facile: Il s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Rafraîchissez-moi vs Docyt: L'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Rafraîchissez-moi contre Sage: Il s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Rafraîchissez-moi vs Zoho Books: Il s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Rafraîchir-moi vs Vague: Ce logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Rafraîchissez-moi vs Quicken: Ce sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- Rafraîchissez-moi vs Hubdoc: Ce logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion des finances personnelles.

- Rafraîchissez-moi vs Expensify: Il s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi et à la gestion du budget des dépenses personnelles.

- Rafraîchissez-moi vs QuickBooks: Il s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Rafraîchir-moi vs AutoEntry: Ce logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Rafraîchissez-moi vs FreshBooks: Il s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Rafraîchissez-moi vs NetSuite: Il s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes sociétés. Son concurrent est une simple application de gestion de finances personnelles.

Foire aux questions

Quelle est la principale différence entre Easy Month End et Refreshme ?

Easy Month End vise à simplifier les tâches de clôture financière de votre entreprise. Refreshme, en revanche, est davantage orienté vers la gestion des finances personnelles et le rapprochement automatisé des transactions individuelles.

Easy Month End peut-il m'aider avec mes impôts ?

Oui, en organisant vos données financières et en fournissant des pistes d'audit claires, Easy Month End contribue à garantir l'exactitude de vos enregistrements et leur préparation pour la déclaration de revenus, facilitant ainsi le travail de votre comptable.

Refreshme s'intègre-t-il à d'autres logiciels de comptabilité comme Dext ?

Bien que Refreshme propose la synchronisation des données, son objectif principal est la gestion des finances personnelles. Il se peut qu'il ne dispose pas d'intégrations aussi poussées avec des solutions professionnelles. comptabilité des outils comme Dext qu'une solution d'entreprise dédiée pourrait proposer.

À quelle fréquence dois-je mettre à jour mes informations financières dans ces outils ?

Pour une précision optimale, il est préférable de mettre à jour régulièrement vos informations financières, idéalement quotidiennement ou hebdomadairement. Cette mise à jour fréquente garantit l'actualité de vos rapports et vous aide à éviter les périodes de rush en fin de mois.