Vous en avez assez des manuels interminables ? données saisie et registres financiers désordonnés ?

Beaucoup comptabilité Les professionnels sont confrontés quotidiennement à la tâche ardue du traitement des reçus et des factures.

Et s'il existait une meilleure solution ?

C'est là que l'intelligence artificielle moderne est utilisée. comptabilité Des solutions comme Docyt et AutoEntry entrent alors en jeu.

Comparons Docyt et AutoEntry pour voir quel outil est le plus performant et le plus rapide. comptabilité.

Aperçu

Nous avons mis Docyt et AutoEntry à l'épreuve, en testant leurs fonctionnalités.

Cette expérience pratique nous a permis de mieux comprendre leurs points forts et leurs points faibles, ce qui nous a conduits à cette comparaison détaillée.

Fatigué du manuel comptabilitéDocyt AI automatise la saisie et le rapprochement des données, permettant aux utilisateurs d'économiser en moyenne 40 heures.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 299 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Arrêtez de perdre plus de 10 heures par semaine à saisir manuellement des données. Découvrez comment la saisie automatique a réduit de 40 % le temps de traitement des factures. Sage utilisateurs.

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 12 $/mois.

Caractéristiques principales :

- Extraction de données

- Numérisation des reçus

- Automatisation des fournisseurs

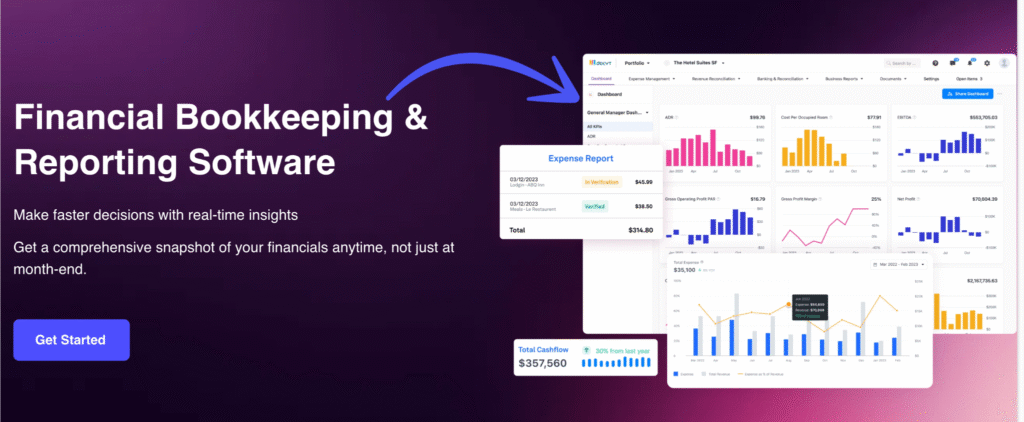

Qu'est-ce que Docyt ?

Alors, Docyt, qu'est-ce que c'est exactement ? Imaginez une plateforme d'IA tout-en-un pour… comptabilité.

Il est conçu pour automatiser une grande partie des tâches fastidieuses. comptabilité.

Cela aide les entreprises et les cabinets comptables à tenir une comptabilité exacte et à jour.

Découvrez également nos favoris Alternatives à Docyt…

Principaux avantages

- Automatisation basée sur l'IA : Docyt utilise l'intelligence artificielle. Elle extrait automatiquement des données de documents financiers, notamment des informations provenant de plus de 100 000 fournisseurs.

- Comptabilité en temps réel : Vos comptes sont mis à jour en temps réel. Vous disposez ainsi d'une image financière précise à tout moment.

- Gestion documentaire : Centralise tous les documents financiers. Vous pouvez facilement les rechercher et y accéder.

- Automatisation du paiement des factures : Automatisez le processus de paiement des factures. Programmez et payez vos factures facilement.

- Remboursement des frais : Simplifiez le traitement des notes de frais des employés. Soumettez et approuvez les dépenses rapidement.

- Intégrations transparentes : S'intègre aux logiciels de comptabilité les plus courants. Cela inclut QuickBooks et Xero.

- Détection des fraudes : Son IA peut aider à repérer les transactions inhabituelles. Cela ajoute une couche de sécurité. sécuritéIl n'existe aucune garantie spécifique pour le logiciel, mais des mises à jour continues sont fournies.

Tarification

- Impact: 299 $/mois.

- Avancé: 499 $/mois.

- Avancé Plus: 799 $/mois.

- Entreprise: 999 $/mois.

Avantages

Cons

Qu'est-ce que l'AutoEntry ?

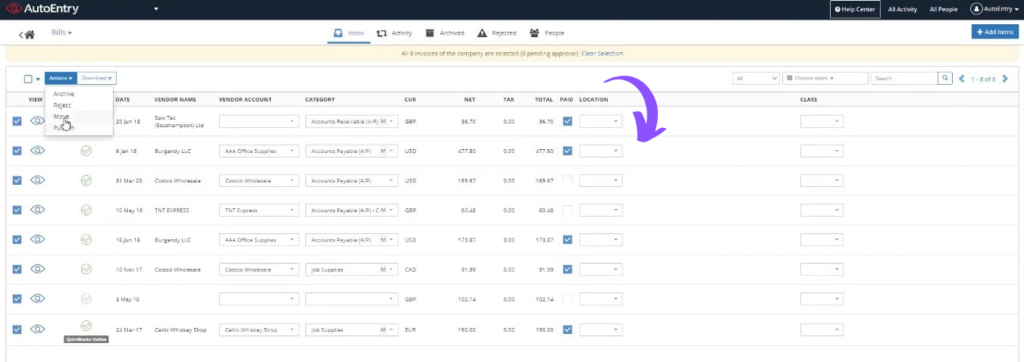

Alors, AutoEntry, c'est quoi exactement ? C'est un outil conçu pour automatiser la saisie de données.

Il capture les données des reçus, des factures et des relevés bancaires.

Ensuite, il les publie directement sur votre logiciel de comptabilité.

Découvrez également nos favoris Alternatives à AutoEntry…

Notre avis

Prêt à réduire votre temps de comptabilité ? AutoEntry traite plus de 28 millions de documents chaque année et offre une précision jusqu’à 99 %. Commencez dès aujourd’hui et rejoignez les plus de 210 000 entreprises dans le monde qui ont réduit leur temps de saisie de données jusqu’à 80 % !

Principaux avantages

Le plus grand atout d'AutoEntry est de nous faire gagner des heures de travail fastidieux.

Les utilisateurs constatent souvent une réduction de jusqu'à 80 % du temps consacré à la saisie manuelle de données.

Elle promet une précision allant jusqu'à 99 % dans l'extraction de données.

AutoEntry n'offre pas de garantie de remboursement spécifique, mais ses forfaits mensuels vous permettent d'annuler à tout moment.

- Précision des données jusqu'à 99 %.

- Utilisateurs illimités sur tous les forfaits payants.

- Extrait les lignes complètes des factures.

- Application mobile simple pour photographier les reçus.

- Les crédits non utilisés sont reportés sous 90 jours.

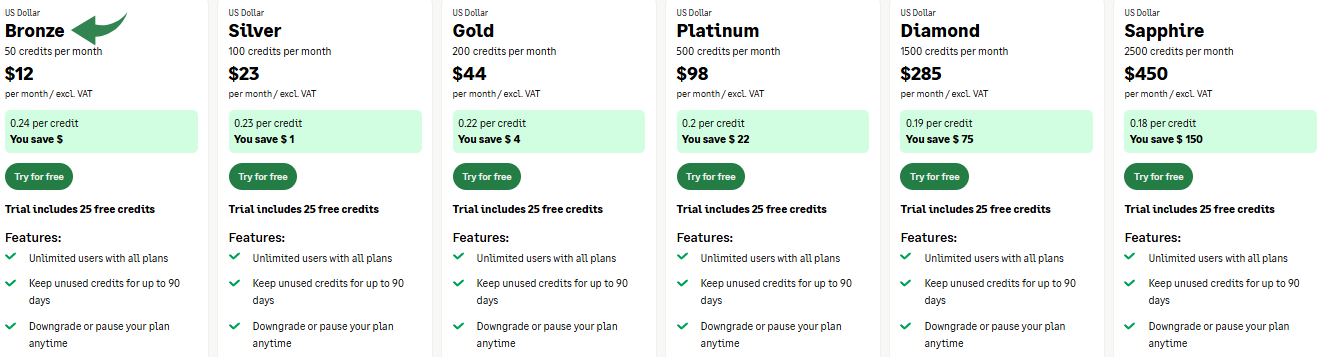

Tarification

- Bronze: 12 $/mois.

- Argent: 23 $/mois.

- Or: 44 $/mois.

- Platine: 98 $/mois.

- Diamant: 285 $/mois.

- Saphir: 450 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Il est temps d'examiner attentivement les outils côte à côte.

Tous deux promettent de faire Ils vous facilitent la vie, mais ils abordent vos opérations financières de manières très différentes.

Voyons comment leurs principales caractéristiques se comparent.

1. IA de comptabilité complète

- DocytC’est là que Docyt AI excelle véritablement. Elle agit comme un comptable IA, gérant l’intégralité du cycle de comptabilité. comptabilité Il est conçu pour tout couvrir, de la gestion des dépenses à la clôture des comptes, en passant par l'automatisation des tâches administratives.

- Saisie automatiqueAutoEntry est un outil spécialisé. Il se concentre sur la première étape : l’élimination de la saisie manuelle de données dans les documents. Il transfère ensuite ces données vers votre logiciel comptable existant, tel que QuickBooks Online, pour le reste des processus comptables.

2. Contrôle financier en temps réel

- DocytLa plateforme offre une visibilité instantanée sur votre situation financière et des informations en temps réel. C'est essentiel pour la prise de décisions stratégiques. Vous bénéficiez d'un contrôle financier constant grâce à la mise à jour continue de vos données comptables.

- Saisie automatiqueL'objectif d'AutoEntry est d'assurer la rapidité et la précision de la saisie des données. Il contribue à éliminer la saisie manuelle, ce qui améliore la qualité de vos données. Cependant, le contrôle financier final et constant reste indispensable. reportage Faites confiance à votre logiciel de comptabilité connecté.

3. Gérer plusieurs entreprises

- DocytDocyt change la donne pour les entreprises multi-sites. La solution permet de générer des rapports consolidés pour toutes vos entités et de suivre facilement leurs indicateurs clés de performance.

- Saisie automatiqueAutoEntry permet un nombre illimité d'utilisateurs et d'entreprises clientes. Il facilite la gestion de la saisie de documents pour plusieurs entreprises, mais ne génère pas de rapports consolidés ni de rapports complexes multi-entités.

4. Rapprochement des dépenses et des recettes

- DocytDocyt propose un système automatisé de rapprochement bancaire et un rapprochement spécialisé des revenus. Il vise à détecter les erreurs de comptabilisation des revenus et à minimiser les écarts entre vos comptes bancaires et votre grand livre.

- Saisie automatiqueL’avantage principal d’AutoEntry réside dans la fourniture de données fiables pour votre rapprochement bancaire. Il extrait les données des relevés bancaires et des factures d’achat, mais le rapprochement bancaire automatisé proprement dit est effectué par votre système comptable principal.

5. Apprentissage et personnalisation des données

- DocytDocyt apprend vos besoins spécifiques et les subtilités de votre entreprise. Son IA automation Le logiciel s'adapte à vos habitudes de catégorisation. Ainsi, votre gestion financière globale devient beaucoup plus intelligente au fil du temps.

- Saisie automatiqueAutoEntry apprend également grâce aux « règles » définies par l'utilisateur pour la catégorisation et les noms des fournisseurs. Une fois une règle configurée, elle peut automatiser des tâches comme la publication automatique, vous simplifiant ainsi la vie et vous faisant gagner du temps sur les étapes répétitives.

6. Rapports et analyses

- DocytDocyt fournit des rapports et des tableaux de bord en temps réel, offrant une visibilité instantanée sur les flux de trésorerie et la comptabilité par département. Vous pouvez consulter les états financiers individuels ou visualiser le rapport consolidé.

- Saisie automatiqueAutoEntry ne propose pas de génération de rapports dédiée. Il garantit l'exactitude et la mise à jour de vos données dans QuickBooks Online ou votre autre logiciel de comptabilité. Vous utilisez ensuite ce logiciel pour générer vos rapports en temps réel.

7. Se concentrer sur le processus comptable

- DocytLa plateforme Docyt, basée sur l'IA, vise à simplifier l'ensemble du processus comptable. Elle prend en charge les tâches chronophages qui vont au-delà de la simple saisie de données, comme la clôture de fin de mois et le paiement des factures.

- Saisie automatiqueAutoEntry se concentre sur la saisie de données dans les processus comptables. Il excelle dans l'automatisation rapide et précise de l'intégration des documents financiers et autres pièces justificatives.

8. Gestion des services administratifs

- DocytIl est conçu pour automatiser les fonctions administratives. Cela inclut l'ensemble des fonctionnalités de gestion financière et de comptabilité départementale, vous offrant ainsi une suite logicielle puissante et intégrée.

- Saisie automatiqueAutoEntry est un outil précieux pour les services administratifs. Il prend en charge une tâche fastidieuse et chronophage : la saisie de données. Votre équipe peut ainsi se concentrer sur d’autres missions comptables.

9. Interface utilisateur et expérience utilisateur

- DocytDocyt est réputé pour son interface relativement conviviale, surtout compte tenu de ses nombreuses fonctionnalités. Il gère la complexité de la gestion financière avancée par IA.

- Saisie automatiqueAutoEntry est simple et intuitif, notamment grâce à son application mobile de téléchargement de documents. Son interface, axée sur la saisie de données, est conviviale et facile d'utilisation.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Sécurité et protectionLa solution de sécurité protège-t-elle contre les attaques en ligne ? Vérifiez si la plateforme utilise un service de sécurité pour protéger vos données et si elle dispose d’un moyen de résoudre les problèmes tels que le blocage dû à des actions susceptibles de déclencher ce blocage (par exemple, la soumission d’une commande SQL ou de données malformées).

- Précision de la saisie des donnéesVérifiez la qualité de la reconnaissance optique de caractères (OCR). Permet-elle d'extraire avec précision et sans effort les lignes de documents financiers ? Consultez les avis sur la saisie automatique pour évaluer ses performances réelles.

- Intégration: Ensure seamless integration with your current logiciel de comptabilité. Can you easily upload using a mobile phone?

- Structure tarifaireLe tarif de l'inscription automatique est-il mensuel ou flexible, avec un système de crédits ? Vérifiez s'ils proposent un nombre d'utilisateurs illimité.

- DépannageComment la plateforme gère-t-elle les erreurs inattendues ? Que faire si une action que vous venez d’effectuer est signalée par le service de sécurité et que vous ne pouvez plus accéder à une page ? Vous devriez pouvoir contacter le propriétaire du site par e-mail pour résoudre le problème, notamment si un message d’erreur relatif à un identifiant Cloudflare Ray s’affiche.

- Fonctionnalités avancéesGère-t-il les situations particulières, comme un mot ou une expression spécifique pouvant déclencher un blocage ? Fournit-il des instructions claires si le système a déclenché une alerte de sécurité ?

Verdict final

Pour une automatisation complète de la comptabilité et un contrôle financier constant, Docyt est notre choix.

Elle va bien au-delà de la simple collecte de données, en offrant des rapports financiers en temps réel pour tous vos sites d'exploitation, et ce sans effort.

Nous avons choisi Docyt car il gère la complexité des finances de votre entreprise et suit la rentabilité en temps réel.

Nous avons testé ces outils dans différents secteurs d'activité afin de vous fournir une évaluation moyenne précise de leurs performances.

Si le système devait bloquer une action, par exemple s'il déclenchait la solution de sécurité après qu'un utilisateur ait tenté de formuler une commande SQL ou de soumettre un certain mot.

L’ensemble de fonctionnalités plus étendu de Docyt est conçu pour gérer toutes vos transactions tout en restant sécurisé et fiable.

Cette approche holistique en fait le choix idéal pour une gestion financière globale.

Plus de Docyt

Lorsqu'on recherche le logiciel comptable adapté, il est utile de voir comment se comparent les différentes plateformes.

Voici une brève comparaison entre Docyt et plusieurs de ses alternatives.

- Docyt contre Puzzle IO: Bien que les deux solutions facilitent la gestion financière, Docyt se concentre sur la comptabilité des entreprises basée sur l'IA, tandis que Puzzle IO simplifie la facturation et les dépenses des travailleurs indépendants.

- Docyt contre Dext: Docyt propose une plateforme complète de comptabilité basée sur l'IA, tandis que Dext est spécialisé dans la capture automatisée de données à partir de documents.

- Docyt contre Xero: Docyt est réputé pour son automatisation poussée grâce à l'IA. Xero propose un système comptable complet et convivial, adapté aux besoins courants des entreprises.

- Docyt contre Synder: Docyt est un outil de comptabilité basé sur l'IA pour l'automatisation des tâches administratives. Synder se concentre sur la synchronisation des données de vente e-commerce avec votre logiciel comptable.

- Docyt contre Easy Fin de mois: Docyt est une solution comptable complète basée sur l'IA. Easy Month End est un outil spécialisé conçu spécifiquement pour rationaliser et simplifier le processus de clôture de fin de mois.

- Docyt contre RefreshMe: Docyt est un outil de comptabilité d'entreprise, tandis que RefreshMe est une application de finances personnelles et de gestion budgétaire.

- Docyt contre Sage: Docyt utilise une approche moderne axée sur l'IA. Sage est une entreprise établie de longue date qui propose une vaste gamme de solutions comptables traditionnelles et en nuage.

- Docyt contre Zoho Books: Docyt se spécialise dans l'automatisation comptable par l'IA. Zoho Books est une solution tout-en-un offrant une gamme complète de fonctionnalités à un prix compétitif.

- Docyt contre Wave: Docyt propose une automatisation IA performante pour les entreprises en pleine croissance. Wave est une plateforme comptable gratuite idéale pour les indépendants et les micro-entreprises.

- Docyt contre Quicken: Docyt est conçu pour la comptabilité d'entreprise. Quicken est principalement un outil de gestion des finances personnelles et de budgétisation.

- Docyt vs Hubdoc: Docyt est un système de comptabilité entièrement basé sur l'IA. Hubdoc est un outil de capture de données qui collecte et traite automatiquement les documents financiers.

- Docyt contre Expensify: Docyt prend en charge l'ensemble des tâches comptables. Expensify est spécialisé dans la gestion et le reporting des notes de frais des employés.

- Docyt contre QuickBooks: Docyt est une plateforme d'automatisation basée sur l'IA qui optimise QuickBooks. QuickBooks est un logiciel de comptabilité complet adapté aux entreprises de toutes tailles.

- Docyt vs AutoEntry: Docyt est une solution de comptabilité IA complète. AutoEntry se concentre spécifiquement sur l'extraction et l'automatisation des données documentaires.

- Docyt contre FreshBooks: Docyt utilise une intelligence artificielle avancée pour l'automatisation. FreshBooks est une solution conviviale très appréciée des indépendants pour ses fonctionnalités de facturation et de suivi du temps.

- Docyt contre NetSuite: Docyt est un outil d'automatisation comptable. NetSuite est un système de planification des ressources d'entreprise (ERP) complet destiné aux grandes entreprises.

Plus d'informations sur AutoEntry

- Saisie automatique vs PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Saisie automatique vs DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- AutoEntry vs XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- AutoEntry vs SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Saisie automatique vs Fin de mois simplifiéeIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- AutoEntry vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- AutoEntry vs SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- AutoEntry vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Saisie automatique vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- AutoEntry vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- AutoEntry vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- AutoEntry vs ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- AutoEntry vs QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- AutoEntry vs FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- AutoEntry vs NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Docyt est-il meilleur qu'AutoEntry pour la comptabilité complète ?

Docyt est conçu pour la comptabilité IA de bout en bout, et prend en charge un plus grand nombre de tâches. AutoEntry se concentre principalement sur la saisie de données. Donc, oui, Docyt est plus adapté à la comptabilité complète.

AutoEntry peut-il répondre à tous mes besoins comptables ?

Non, AutoEntry excelle dans l'extraction de données à partir de documents. Il s'intègre aux logiciels de comptabilité comme QuickBooks ou Xero pour répondre à vos besoins comptables.

L'automatisation par l'IA est-elle fiable pour mes données financières ?

Oui, l'automatisation par IA dans Docyt et AutoEntry est extrêmement fiable. Elle réduit les erreurs humaines et accélère le traitement, ce qui permet d'obtenir des données financières plus précises.

Quel outil est le plus adapté aux petites entreprises ?

Ces deux solutions peuvent être utiles aux petites entreprises. AutoEntry est idéal pour la saisie de données, mais Docyt offre une solution d'automatisation comptable plus complète, parfaitement adaptée à des besoins plus larges.

Ai-je encore besoin d'un comptable avec ces outils ?

Ces outils automatisent de nombreuses tâches, mais l'expertise d'un comptable reste précieuse. Il peut interpréter des données complexes, fournir des conseils stratégiques et garantir la conformité.