Vous en avez assez des piles de reçus et des dépenses excessives ? suivi du temps Vos coûts d'entreprise ?

Cela peut donner l'impression d'une corvée sans fin, n'est-ce pas ?

Deux grands noms que vous avez peut-être déjà entendus sont Dext et Expensify.

Examinons ce que chacun propose et voyons lequel pourrait devenir votre nouvel outil préféré.

Aperçu

Nous avons examiné de près Dext et Expensify.

Nous avons testé leurs fonctionnalités et constaté leur facilité d'utilisation.

Cela nous a permis de voir les points positifs et les points négatifs de chacun.

Nous pouvons maintenant les comparer pour vous !

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment Dext automatise la saisie de données, le suivi des dépenses et la gestion de vos finances.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 24 $/mois.

Caractéristiques principales :

- Numérisation des reçus

- Notes de frais

- Rapprochement bancaire

Rejoignez plus de 15 millions d'utilisateurs qui font confiance à Expensify pour simplifier leurs finances. Économisez jusqu'à 83 % sur le temps consacré aux notes de frais.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 5 $/mois.

Caractéristiques principales :

- Capture de reçus SmartScan

- Rapprochement des cartes d'entreprise

- Flux de travail d'approbation avancés.

Qu'est-ce que Dext ?

Alors, Dext, c'est quoi ?

Considérez-le comme un assistant ultra-intelligent pour vos travaux.

Il sert principalement à gérer les factures et les reçus.

Il suffit de prendre une photo, et Dext récupère toutes les informations importantes.

Plutôt chouette, non ?

Découvrez également nos favoris Alternatives à Dext…

Notre avis

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment la saisie de données automatisée, le suivi des dépenses et les rapports de Dext peuvent simplifier vos finances.

Principaux avantages

Dext excelle vraiment lorsqu'il s'agit de simplifier au maximum la gestion des dépenses.

- 90 % des utilisateurs font état d'une diminution significative de l'encombrement de papiers.

- Il affiche un taux de précision supérieur à 98 %. dans l'extraction de données à partir de documents.

- Créer des notes de frais devient incroyablement rapide et facile.

- S'intègre parfaitement aux plateformes comptables populaires, telles que QuickBooks et Xero.

- Permet de ne jamais perdre la trace de documents financiers importants.

Tarification

- Abonnement annuel : $24

Avantages

Cons

Qu'est-ce qu'Expensify ?

Bon, parlons d'Expensify.

C'est un outil qui vous aide à suivre toutes vos entreprise dépenses.

Considérez cela comme un assistant qui se souvient où va votre argent.

Il peut récupérer des informations à partir de vos reçus et de vos relevés bancaires. Plutôt pratique !

Découvrez également nos favoris Alternatives Expensify…

Principaux avantages

- La technologie SmartScan scanne les détails des reçus et les extrait avec une précision supérieure à 95 %.

- Les employés sont remboursés rapidement, souvent en un seul jour ouvrable via ACH.

- La carte Expensify peut vous faire économiser jusqu'à 50 % sur votre abonnement grâce à son programme de remboursement.

- Aucune garantie n'est offerte ; leurs conditions générales stipulent que la responsabilité est limitée.

Tarification

- Collecter: 5 $/mois.

- Contrôle: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

Dext et Expensify ont tous deux pour objectif de simplifier votre processus de gestion des dépenses.

Entrons dans le détail et voyons ce que chaque système offre et comment ils gèrent les différentes tâches.

1. Extraction des données

- Dext :

- Excellente en données extraction utilisant la technologie OCR.

- Permet d'extraire des données à partir de reçus, de factures, de bons de commande et d'autres documents financiers.

- Capturez les reçus à l'aide de l'application mobile Dext ou par envoi électronique.

- Expensify :

- Utilise sa fonction SmartScan pour une capture rapide des reçus.

- Conçu pour permettre aux employés de prendre des photos rapidement et facilement avec leur téléphone.

- Permet de gagner du temps en minimisant la saisie manuelle des données.

2. Application mobile et expérience utilisateur

- Dext :

- L'application mobile Dext est performante et permet aux clients et aux comptables d'accéder aux données financières.

- Permet d'enregistrer les kilomètres parcourus et de suivre les dépenses lors de vos déplacements.

- Expensify :

- Expensify permet à un petit nombre d'employés de gérer facilement leurs dépenses personnelles.

- L'application est très facile à utiliser pour remplir les rapports et obtenir un remboursement.

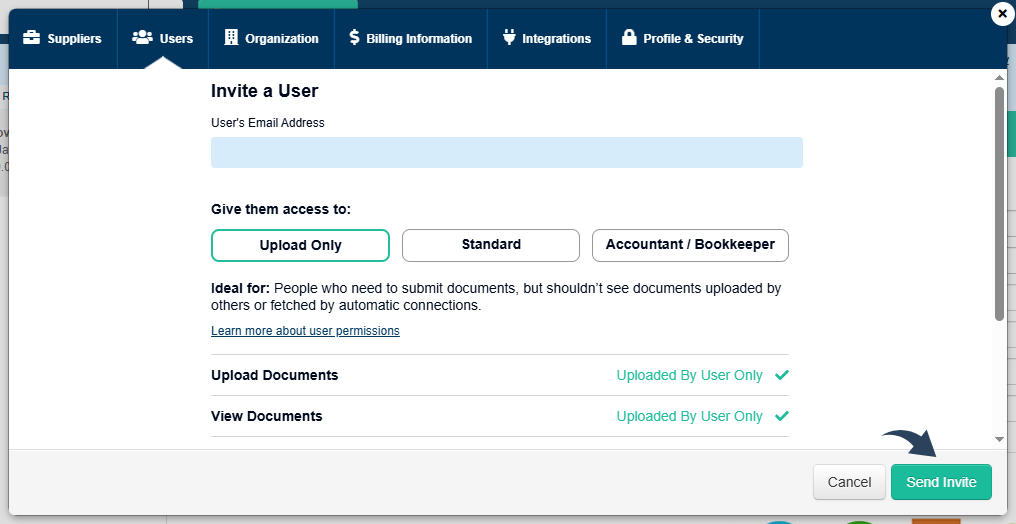

3. Approbations et flux de travail

- Dext :

- Offre un système d'approbation permettant aux comptables ou aux employeurs d'approuver les documents et les demandes de remboursement de frais.

- Offre une méthode flexible pour traiter les approbations.

- Expensify :

- Réputé pour ses processus d'approbation simples.

- Un responsable peut examiner et approuver les demandes de remboursement de frais en quelques minutes seulement.

- Vous pouvez configurer des règles pour répondre automatiquement à certaines demandes de remboursement de frais.

4. Intégration

- Dext :

- Offre une intégration poussée avec des outils populaires comme QuickBooks En ligne.

- Dispose d'intégrations directes permettant un flux de données sécurisé.

- Dext fonctionne bien à l'intérieur comptabilité et les flux de travail comptables.

- Expensify :

- Il possède de nombreuses intégrations pour se connecter à votre banque et logiciel de comptabilité.

- Une relation solide contribue à rationaliser le processus de gestion des dépenses.

5. Gestion des factures et des notes de frais

- Dext :

- Un choix évident pour la gestion des factures.

- Vous pouvez utiliser la fonction de récupération de factures pour les récupérer automatiquement auprès des fournisseurs en ligne.

- Existe-t-il des règles fournisseurs pour coder et traiter les factures entrantes pour comptabilité.

- Expensify :

- Je peux traiter certaines factures, mais ce n'est pas l'objectif principal.

- Dext vous offre plus de puissance si vous devez gérer de nombreuses factures.

6. Cartes d'entreprise

- Dext :

- Compatible avec les cartes d'entreprise, mais ne propose pas sa propre carte.

- Expensify :

- Elle propose sa propre carte Expensify, qui aide les employeurs à gérer leurs dépenses.

- Les transactions effectuées avec cette carte apparaissent immédiatement sur votre page, en temps réel.

7. Audit et sécurité

- Dext :

- Assure un flux de données sécurisé et garantit la sécurité du stockage des documents financiers.

- Utilise un service de sécurité fiable.

- Expensify :

- Elle dispose également d'une solution de sécurité robuste pour se protéger contre les attaques en ligne.

- Contribue à protéger vos données financières. (Par exemple, les messages tels que « Identifiant Cloudflare Ray trouvé » font partie de cette protection).

8. Automatisation des données

- Dext :

- Excellant dans l'automatisation de la saisie de données, il permet de gagner du temps.

- Dext vous sauve la mise petite entreprise à partir d'une tonne de saisie manuelle de données.

- L'accent est mis sur l'automatisation de la saisie des données au début de la comptabilité flux de travail.

- Expensify :

- Contribue à simplifier le processus en automatisant la création des rapports et le remboursement.

9. Assistance clientèle

- Dext :

- Offre un soutien aux clients et aux comptables.

- Contribue à la configuration pour garantir la fiabilité du système.

- Expensify :

- Les avis sur Expensify mentionnent souvent son excellent service client.

- Ils s'efforcent de répondre rapidement aux demandes afin de vous aider à résoudre les problèmes.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Consultez les plans tarifaires pour faire Assurez-vous qu'ils correspondent à votre budget et proposez un essai gratuit dès aujourd'hui pour que vous puissiez essayer Dext ou Expensify.

- Le système doit permettre la numérisation mobile pour collecter et soumettre facilement les reçus depuis votre téléphone afin de gagner du temps.

- Recherchez un système de reconnaissance optique de caractères (OCR) performant afin de minimiser la saisie manuelle et d'empêcher l'introduction de données malformées dans vos dossiers.

- Il devrait proposer plusieurs méthodes de téléchargement de documents, et non une seule. Cela inclut le courrier électronique, la numérisation mobile et la connexion aux comptes bancaires.

- Le logiciel a besoin de flux bancaires fiables pour importer et rapprocher automatiquement les transactions, en les reliant à vos documents bancaires de reçus.

- Assurez-vous qu'il prenne en charge le suivi des catégories afin de pouvoir coder correctement les dépenses et obtenir des informations fiscales précises au moment de la déclaration.

- petite entreprise Les propriétaires ont besoin de données en temps réel pour suivre les coûts et les ventes et gérer efficacement leur flux de trésorerie.

- Renseignez-vous sur l'utilisation et la fiabilité du système : vous avez besoin d'un outil qui fonctionne correctement après la configuration initiale et qui est protégé par un service de sécurité robuste.

- Il devrait permettre de stocker les reçus en toute sécurité, et vous devriez pouvoir exporter ou archiver facilement vos relevés et documents.

- Cherchez une façon simple de gérer les dépenses et d'automatiser les tâches pour faciliter le travail de votre comptable.

- Ce système devrait vous aider à mieux gérer votre entreprise en vous offrant une image précise et complète de vos revenus et de vos bénéfices.

- Vérifiez si votre compte Dext ou Expensify se connecte aux applications professionnelles et autres applications tierces que vous utilisez pour gérer la paie ou envoyer des factures.

- Le système devrait permettre d'effectuer plusieurs actions, déclenchées par un mot ou une règle spécifique, contribuant ainsi à automatiser l'ensemble du processus de gestion des dépenses.

Verdict final

Après avoir examiné attentivement les deux outils, nous choisissons Expensify pour la plupart des petites entreprises. comptabilité. Pourquoi?

Il excelle dans le suivi rapide des dépenses et le traitement des paiements en un temps record.

Son application mobile est idéale pour le suivi des kilomètres parcourus et la soumission des notes de frais, ce qui épargne bien des tracas à vos employés.

Dext Prepare offre un nombre illimité de services. comptabilité Les enregistrements concernent certains plans et Dext offre plusieurs façons de collecter des données.

Expensify simplifie tout simplement le suivi des dépenses pour le propriétaire moyen d'une petite entreprise qui est toujours en déplacement.

Si vous êtes une entreprise et que vous avez Xero Pour les utilisateurs, Dext est une excellente option. Mais pour les opérations commerciales simples.

Expensify est facile en ligne comptabilité vous aide à payer vos factures rapidement.

Nous avons vérifié toutes les fonctionnalités clés et nous savons ce qui fonctionne dans le monde réel de la comptabilité d'entreprise.

Jetez un œil à leur offre de base dès aujourd'hui !

Plus de Dext

Nous avons également examiné comment Dext se compare à d'autres outils de gestion des dépenses et de comptabilité :

- Dext contre Xero: Xero propose une comptabilité complète avec des fonctionnalités intégrées de gestion des dépenses.

- Dext contre Puzzle IO: Puzzle IO excelle dans l'analyse et la prévision financières grâce à l'IA..

- Dext contre Synder: Synder se concentre sur la synchronisation des données de vente e-commerce et le traitement des paiements.

- Dext vs Easy Fin de mois: Easy Month End simplifie les procédures de clôture financière de fin de mois.

- Dext contre Docyt: Docyt utilise l'IA pour automatiser les tâches de comptabilité et de gestion documentaire.

- Dext contre RefreshMe: RefreshMe fournit des informations en temps réel sur les performances financières des entreprises.

- Dext contre Sage: Sage propose une gamme de solutions comptables avec des fonctionnalités de suivi des dépenses.

- Dext contre Zoho Books: Zoho Books propose une comptabilité intégrée avec des fonctionnalités de gestion des dépenses.

- Dext contre Wave: Wave propose un logiciel de comptabilité gratuit avec des fonctionnalités de base de suivi des dépenses.

- Dext contre Quicken: Quicken est un logiciel populaire pour la gestion des finances personnelles et le suivi des dépenses professionnelles de base.

- Dext vs Hubdoc: Hubdoc est spécialisé dans la collecte automatisée de documents et l'extraction de données.

- Dext contre Expensify: Expensify propose des solutions robustes de gestion et de reporting des dépenses.

- Dext contre QuickBooks: QuickBooks est un logiciel de comptabilité largement utilisé, doté d'outils de gestion des dépenses.

- Dext vs AutoEntry: AutoEntry automatise la saisie des données à partir des factures, des reçus et des relevés bancaires.

- Dext contre FreshBooks: FreshBooks est conçu pour les entreprises de services avec facturation et suivi des dépenses.

- Dext contre NetSuite: NetSuite offre un système ERP complet avec des fonctionnalités de gestion des dépenses.

Plus d'informations sur Expensify

- Expensify contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Expensify contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Expensify contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Expensify contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Expensify vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Expensify contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Expensify contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Expensify contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Expensify vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Expensify vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Expensify contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Expensify vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Expensify contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Expensify contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Dext est-il meilleur qu'Expensify ?

Tout dépend de vos besoins ! Expensify est idéal pour simplifier la gestion des notes de frais et les remboursements, notamment grâce à son application mobile. Dext est performant pour gérer un grand nombre de reçus et de factures et facilite la tenue d'une comptabilité détaillée.

Lequel est le plus facile à utiliser, Dext ou Expensify ?

La plupart des utilisateurs trouvent Expensify plus simple à prendre en main, notamment pour la soumission des notes de frais. Son application mobile et la numérisation des reçus sont très intuitives. Dext offre davantage de fonctionnalités ; il faudra donc peut-être un peu plus de temps pour en maîtriser toutes les possibilités.

Expensify propose-t-il une version gratuite ?

Oui, Expensify propose une version gratuite, mais ses fonctionnalités sont limitées et elle est réservée à un seul utilisateur. Dext ne propose généralement pas de version entièrement gratuite, mais il est possible qu'une période d'essai gratuite soit disponible.

Dext et Expensify peuvent-ils s'intégrer à mon logiciel de comptabilité ?

Oui, Dext et Expensify s'intègrent aux logiciels comptables populaires comme QuickBooks et Xero. Cela permet de synchroniser vos données financières et de simplifier votre comptabilité.

Lequel est le plus adapté à la gestion des cartes d'entreprise ?

Expensify est généralement considéré comme plus performant pour la gestion des cartes d'entreprise. Il possède des fonctionnalités spécifiques qui facilitent le suivi des dépenses de l'entreprise et le rapprochement des transactions par carte. Dext peut également gérer ces opérations, mais Expensify offre davantage d'outils à cet effet.