Vous en avez assez de passer trop de temps à saisir des reçus et des factures ?

Cela peut donner l'impression d'être une tâche sans fin, n'est-ce pas ?

Dext et AutoEntry sont deux outils populaires qui peuvent vous aider à résoudre ce problème.

Mais lequel choisir ?

Examinons de plus près ce qui caractérise chacun de ces éléments. logiciel de comptabilité Consultez les options spéciales et déterminez celle qui vous conviendrait le mieux.

Aperçu

Nous avons examiné de près Dext et AutoEntry.

Nous les avons testés pour voir leur efficacité.

Cela nous a permis de les comparer équitablement.

Maintenant, nous pouvons vous montrer ce que nous avons trouvé.

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment Dext automatise la saisie de données, le suivi des dépenses et la gestion de vos finances.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 24 $/mois.

Caractéristiques principales :

- Numérisation des reçus

- Notes de frais

- Rapprochement bancaire

Arrêtez de perdre plus de 10 heures par semaine à saisir manuellement des données. Découvrez comment la saisie automatique a réduit de 40 % le temps de traitement des factures. Sage utilisateurs.

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 12 $/mois.

Caractéristiques principales :

- Extraction de données

- Numérisation des reçus

- Automatisation des fournisseurs

Qu'est-ce que Dext ?

Alors, Dext, c'est quoi ?

Considérez-le comme un assistant ultra-intelligent pour vos travaux.

Il sert principalement à gérer les factures et les reçus.

Il suffit de prendre une photo, et Dext récupère toutes les informations importantes.

Plutôt chouette, non ?

Découvrez également nos favoris Alternatives à Dext…

Notre avis

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment la saisie de données automatisée, le suivi des dépenses et les rapports de Dext peuvent simplifier vos finances.

Principaux avantages

Dext excelle vraiment lorsqu'il s'agit de simplifier au maximum la gestion des dépenses.

- 90 % des utilisateurs font état d'une diminution significative de l'encombrement de papiers.

- Il affiche un taux de précision supérieur à 98 %. dans l'extraction de données à partir de documents.

- Créer des notes de frais devient incroyablement rapide et facile.

- S'intègre parfaitement aux plateformes comptables populaires, telles que QuickBooks et Xero.

- Permet de ne jamais perdre la trace de documents financiers importants.

Tarification

- Abonnement annuel : $24

Avantages

Cons

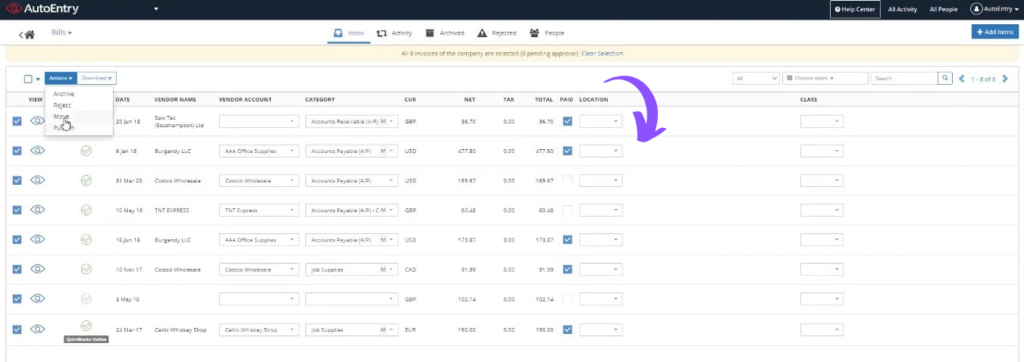

Qu'est-ce que l'AutoEntry ?

Bon, parlons donc d'AutoEntry.

C'est un outil qui vous aide à transférer vos documents sur votre ordinateur sans avoir à tout saisir vous-même.

Considérez-le comme un assistant intelligent pour vos factures et reçus.

Il les lit et place l'information là où elle doit aller.

Découvrez également nos favoris Alternatives à AutoEntry…

Notre avis

Prêt à réduire votre temps de comptabilité ? AutoEntry traite plus de 28 millions de documents chaque année et offre une précision jusqu’à 99 %. Commencez dès aujourd’hui et rejoignez les plus de 210 000 entreprises dans le monde qui ont réduit leur temps de saisie de données jusqu’à 80 % !

Principaux avantages

Le plus grand atout d'AutoEntry est de nous faire gagner des heures de travail fastidieux.

Les utilisateurs constatent souvent une réduction de jusqu'à 80 % du temps consacré à la saisie manuelle de données.

Elle promet une précision allant jusqu'à 99 % dans l'extraction de données.

AutoEntry n'offre pas de garantie de remboursement spécifique, mais ses forfaits mensuels vous permettent d'annuler à tout moment.

- Précision des données jusqu'à 99 %.

- Utilisateurs illimités sur tous les forfaits payants.

- Extrait les lignes complètes des factures.

- Application mobile simple pour photographier les reçus.

- Les crédits non utilisés sont reportés sous 90 jours.

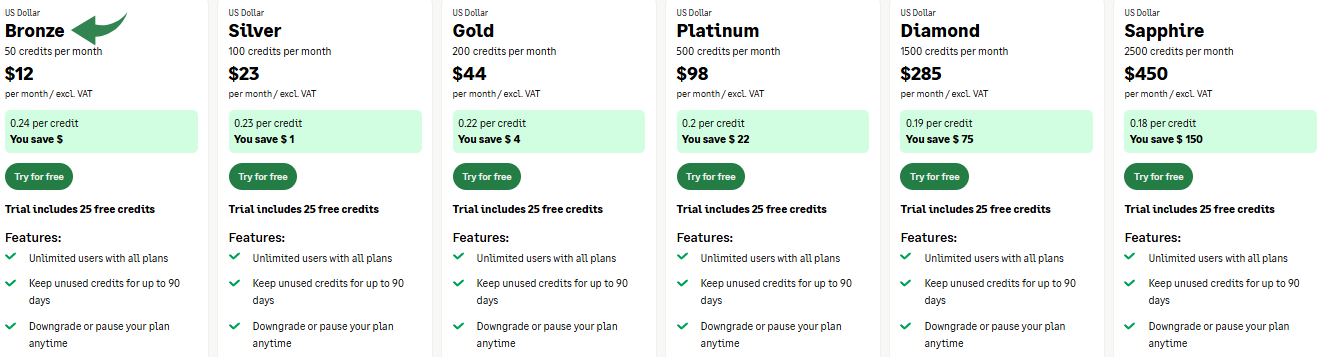

Tarification

- Bronze: 12 $/mois.

- Argent: 23 $/mois.

- Or: 44 $/mois.

- Platine: 98 $/mois.

- Diamant: 285 $/mois.

- Saphir: 450 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Voyons maintenant ce que Dext et AutoEntry peuvent réellement faire.

Nous verrons en quoi ils sont semblables et en quoi ils diffèrent.

Cette comparaison vous aidera à choisir la solution qui correspond le mieux à vos besoins.

1. Technologie d'extraction de données

- Dext et AutoEntry utilisent tous deux une puissante technologie de reconnaissance optique de caractères (OCR) et l'intelligence artificielle.

- Ils travaillent à extraire données à partir de documents financiers avec une grande précision.

- Ce processus d'automatisation de la saisie des données permet de supprimer la saisie manuelle et de transformer rapidement vos reçus en informations numériques.

2. Options de soumission de documents

- Dext propose plusieurs façons de numériser les reçus, comme l'utilisation de l'application mobile Dext pour les photos.

- Vous pouvez également utiliser l'envoi par e-mail, les flux bancaires et la récupération de factures avec Dext.

- AutoEntry propose également une application mobile et une adresse e-mail pour l'envoi des reçus et des factures, l'objectif étant de simplifier la tâche pour les clients.

3. Application mobile pour la gestion des dépenses

- Les deux disposent d'une application mobile qui permet de… petite entreprise propriétaires et leurs équipes.

- L'application mobile Dext est performante pour la gestion des dépenses. Elle permet de suivre les dépenses et de traiter facilement les notes de frais.

- AutoEntry’s app also allows quick receipt capture using your mobile phone.

4. Automatisation et catégorisation des flux de travail

- Dext, et plus particulièrement Dext Prepare, offre des fonctionnalités avancées pour la comptabilité et comptabilité flux de travail.

- Vous pouvez configurer des règles pour les fournisseurs et publier automatiquement les données. utiliser Dext.

- AutoEntry apprend également vos catégories afin d'automatiser le processus pour les fournisseurs réguliers, ce qui simplifie votre processus. comptabilité flux de travail.

5. Saisie des données relatives aux articles et aux ventes

- AutoEntry est conçu pour extraire les lignes de commande des factures et des notes de frais. Cela permet de suivre les données relatives aux produits ou aux ventes.

- Dext propose également l'extraction des articles, mais cela peut engendrer des frais supplémentaires selon votre forfait.

- Les deux vous permettent d'obtenir des données détaillées sur les coûts et les ventes.

6. Intégration avec les logiciels de comptabilité

- Les deux outils vous offrent une intégration transparente avec les principaux logiciels comme QuickBooks En ligne, Xero et Sage.

- Ces intégrations directes garantissent un flux de données sécurisé et permettent de gagner du temps en évitant la saisie manuelle.

7. Modèles de tarification et période d'essai

- AutoEntry utilise un modèle de paiement flexible au document, assorti d'un système de crédits. Ils proposent un essai gratuit avec des crédits offerts.

- Dext (anciennement Receipt Bank) utilise un modèle par client ou par abonnement avec différents plans tarifaires.

- Dext propose également un essai gratuit pour que vous puissiez tester Dext.

8. Fonctionnalités de gestion des dépenses

- Dext est conçu pour répondre à des besoins plus approfondis en matière de gestion des dépenses, notamment les indemnités kilométriques et les demandes de remboursement de frais complexes.

- AutoEntry privilégie la précision de l'extraction de données pour divers documents financiers.

9. Sécurité et fiabilité du système

- Les deux services accordent une grande importance à la sécurité.

- Ils utilisent un service de sécurité et le cryptage pour protéger vos documents financiers et garantir la sécurité des flux de données.

- Ils privilégient une haute fiabilité du système pour protéger vos données contre les attaques en ligne.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Structure tarifaire : Comparez les tarifs d'AutoEntry et les forfaits de Dext pour trouver la solution qui correspond à votre budget. AutoEntry propose des tarifs flexibles et autorise souvent un nombre illimité d'utilisateurs, tandis que les forfaits de Dext sont généralement facturés par client.

- Facilité d'utilisation : Vérifiez le temps nécessaire pour télécharger et traiter les documents. Vous recherchez un outil qui effectue cette tâche en quelques minutes seulement.

- Sécurité et accès : Faire Assurez-vous que la solution de sécurité est robuste. Parfois, des erreurs comme « ID Cloudflare Ray trouvé » indiquent que le service tente de se protéger contre les attaques en ligne. Si vous ne pouvez pas accéder à une page à cause de cette erreur, c'est souvent dû au service de sécurité qui protège le site.

- Gestion des erreurs : Sachez que certaines actions peuvent déclencher un blocage de sécurité. Si le message « Une action que vous venez d'effectuer a déclenché la solution de sécurité » s'affiche, cela peut être dû à une commande SQL ou à des données malformées. Autrement dit, vous avez peut-être effectué une action susceptible de provoquer ce blocage, comme la saisie d'un mot ou d'une expression spécifique dans une commande SQL. Si vous êtes bloqué, vous devrez peut-être contacter le propriétaire du site par e-mail pour résoudre le problème.

- Diversité des documents : Réfléchissez au type de documents que vous devez gérer. Les deux logiciels prennent en charge les reçus et les factures, mais recherchez les fonctionnalités permettant de gérer les factures d'achat et autres documents financiers.

- Caractéristiques des dépenses : Si vous devez gérer les dépenses au-delà de la simple saisie de données, recherchez des fonctionnalités telles que le suivi kilométrique et des flux de travail avancés pour les dépenses. Dext est idéal pour simplifier le suivi.

- Méthodes de capture des données : Découvrez comment collecter les reçus. Les deux solutions proposent la numérisation mobile et la récupération des factures, mais vérifiez laquelle facilite la collecte de données pour votre équipe.

- Perspectives plus approfondies : Dext peut offrir des fonctionnalités supplémentaires pour les détails fiscaux et l'utilisation de catégories de suivi pour une meilleure analyse.

- Fiabilité du système : Vérifiez toujours l'utilisation globale et la fiabilité du système afin de garantir un flux de données sécurisé et d'éviter les problèmes liés à des données malformées.

Verdict final

Après avoir examiné attentivement les deux outils, nous avons choisi Dext.

Il offre une manière légèrement plus simple de gérer vos données financières.

Dext vous fait gagner du temps en éliminant les tracas liés à la gestion des reçus, des factures et des bons de commande.

Si AutoEntry est excellent avec son forfait par document, Dext offre davantage de fonctionnalités, surtout avec un forfait avancé.

Vous pouvez démarrer un essai gratuit dès aujourd'hui pour tester la plateforme. Son intégration poussée avec comptabilité Le logiciel fluidifie votre flux de travail.

Si vous avez des inquiétudes concernant la sécurité, sachez que les deux entreprises utilisent un service de sécurité pour protéger vos données.

Désormais, vous pouvez facilement stocker vos reçus dans votre compte Dext et consacrer votre temps à des choses plus importantes que la saisie de données.

Plus de Dext

Nous avons également examiné comment Dext se compare à d'autres outils de gestion des dépenses et de comptabilité :

- Dext contre Xero: Xero propose une comptabilité complète avec des fonctionnalités intégrées de gestion des dépenses.

- Dext contre Puzzle IO: Puzzle IO excelle dans l'analyse et la prévision financières grâce à l'IA..

- Dext contre Synder: Synder se concentre sur la synchronisation des données de vente e-commerce et le traitement des paiements.

- Dext vs Easy Fin de mois: Easy Month End simplifie les procédures de clôture financière de fin de mois.

- Dext contre Docyt: Docyt utilise l'IA pour automatiser les tâches de comptabilité et de gestion documentaire.

- Dext contre RefreshMe: RefreshMe fournit des informations en temps réel sur les performances financières des entreprises.

- Dext contre Sage: Sage propose une gamme de solutions comptables avec des fonctionnalités de suivi des dépenses.

- Dext contre Zoho Books: Zoho Books propose une comptabilité intégrée avec des fonctionnalités de gestion des dépenses.

- Dext contre Wave: Wave propose un logiciel de comptabilité gratuit avec des fonctionnalités de base de suivi des dépenses.

- Dext contre Quicken: Quicken est un logiciel populaire pour la gestion des finances personnelles et le suivi des dépenses professionnelles de base.

- Dext vs Hubdoc: Hubdoc est spécialisé dans la collecte automatisée de documents et l'extraction de données.

- Dext contre Expensify: Expensify propose des solutions robustes de gestion et de reporting des dépenses.

- Dext contre QuickBooks: QuickBooks est un logiciel de comptabilité largement utilisé, doté d'outils de gestion des dépenses.

- Dext vs AutoEntry: AutoEntry automatise la saisie des données à partir des factures, des reçus et des relevés bancaires.

- Dext contre FreshBooks: FreshBooks est conçu pour les entreprises de services avec facturation et suivi des dépenses.

- Dext contre NetSuite: NetSuite offre un système ERP complet avec des fonctionnalités de gestion des dépenses.

Plus d'informations sur AutoEntry

- Saisie automatique vs PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Saisie automatique vs DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- AutoEntry vs XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- AutoEntry vs SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Saisie automatique vs Fin de mois simplifiéeIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- AutoEntry vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- AutoEntry vs SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- AutoEntry vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Saisie automatique vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- AutoEntry vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- AutoEntry vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- AutoEntry vs ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- AutoEntry vs QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- AutoEntry vs FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- AutoEntry vs NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Quelle est la principale différence entre Dext et AutoEntry ?

Dext est souvent perçu comme légèrement plus convivial grâce à des fonctionnalités supplémentaires telles que le suivi kilométrique. AutoEntry excelle dans la gestion d'une plus large gamme de documents, notamment les factures de vente, et bénéficie d'une excellente reconnaissance des fournisseurs.

Quel logiciel s'intègre le mieux à QuickBooks Online ?

Dext et AutoEntry offrent tous deux une intégration poussée avec QuickBooks Online, permettant un transfert fluide des données traitées directement dans votre système. comptabilité Logiciel pour une comptabilité efficace.

Pour une petite entreprise qui facture peu, lequel des deux est Dext ou AutoEntry ?

Pour un petit entreprise Avec un faible volume de factures, les forfaits d'entrée de gamme de Dext pourraient être plus rentables, tout en offrant des capacités robustes de capture et d'intégration de données.

Puis-je automatiser le traitement des relevés bancaires avec Dext ou AutoEntry ?

Oui, Dext et AutoEntry vous permettent tous deux d'automatiser le traitement des relevés bancaires, en extrayant les données clés des transactions et en réduisant la saisie manuelle des données pour votre comptable.

Quelle plateforme offre le meilleur service client ?

D'après notre expérience, Dext et AutoEntry offrent tous deux un support client efficace via différents canaux, comme des bases de connaissances et une assistance directe en cas de problème.