Vous êtes submergé(e) par la paperasse et fatigué(e) de passer des heures à… comptabilité?

Vous n'êtes pas seul.

C'est là que comptabilité Les outils d'automatisation font leur apparition.

Dext et Docyt sont deux options populaires qui promettent de révolutionner votre façon de gérer vos finances.

Mais lequel est le meilleur pour toi?

Plongeons-nous dans leurs fonctionnalités pour vous aider. faire une décision !

Aperçu

Nous avons examiné de près Dext et Docyt.

Nous avons testé leurs fonctionnalités.

Cela nous a permis de voir comment ils fonctionnent pour différentes tâches.

Nous pouvons maintenant les comparer et vous faire part de nos conclusions.

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment Dext automatise la saisie de données, le suivi des dépenses et la gestion de vos finances.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 24 $/mois.

Caractéristiques principales :

- Numérisation des reçus

- Notes de frais

- Rapprochement bancaire

Fatigué du manuel comptabilitéDocyt AI automatise la saisie et le rapprochement des données, permettant aux utilisateurs d'économiser en moyenne 40 heures.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 299 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

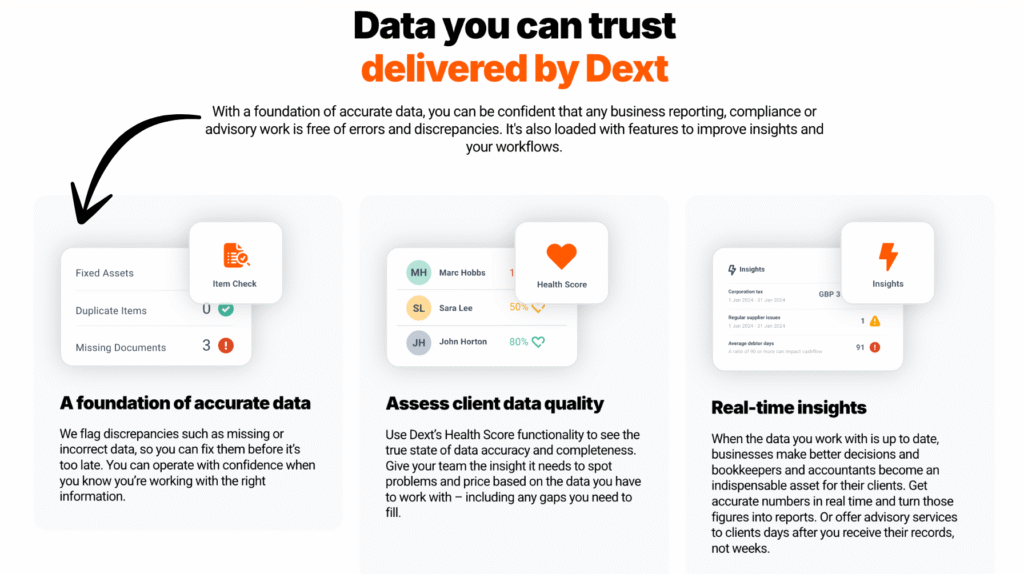

Qu'est-ce que Dext ?

Prenons l'exemple de Dext. Auparavant, cela s'appelait Receipt Bank.

Il est vraiment très efficace pour organiser vos reçus et factures.

Il suffit de prendre une photo ou de transférer un e-mail. Dext récupère ensuite les informations importantes.

Cela permet de garantir que votre données est prêt pour votre comptable.

L'objectif est de simplifier au maximum le suivi de vos dépenses.

Libérez son potentiel grâce à notre Alternatives à Dext…

Notre avis

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment la saisie de données automatisée, le suivi des dépenses et les rapports de Dext peuvent simplifier vos finances.

Principaux avantages

Dext excelle vraiment lorsqu'il s'agit de simplifier au maximum la gestion des dépenses.

- 90 % des utilisateurs font état d'une diminution significative de l'encombrement de papiers.

- Il affiche un taux de précision supérieur à 98 %. dans l'extraction de données à partir de documents.

- Créer des notes de frais devient incroyablement rapide et facile.

- S'intègre parfaitement aux plateformes comptables populaires, telles que QuickBooks et Xero.

- Permet de ne jamais perdre la trace de documents financiers importants.

Tarification

- Abonnement annuel : $24

Avantages

Cons

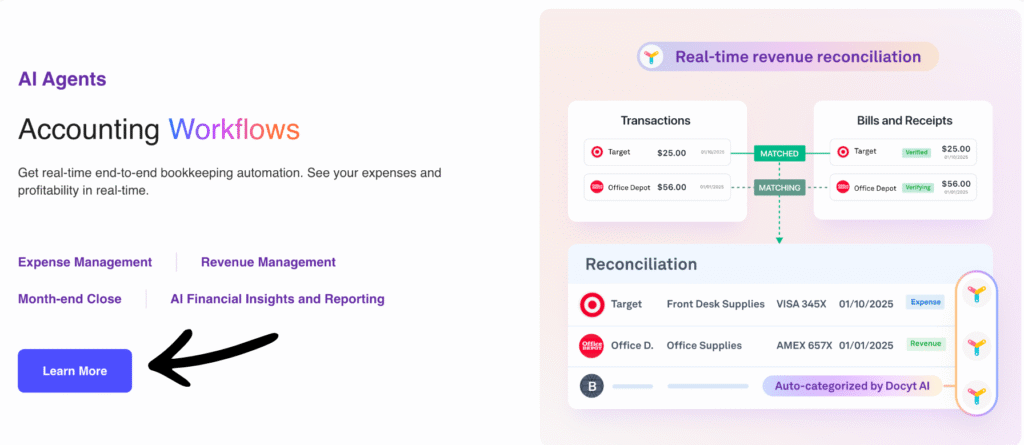

Qu'est-ce que Docyt ?

Docyt est un outil qui aide les entreprises à gérer leur argent.

Elle utilise une technologie intelligente pour lire vos factures et reçus.

Cela signifie beaucoup moins de saisie.

Il vous offre également une vision claire et actualisée de vos finances d'entreprise.

Libérez son potentiel grâce à notre Alternatives à Docyt…

Principaux avantages

- Automatisation basée sur l'IA : Docyt utilise l'intelligence artificielle. Elle extrait automatiquement des données de documents financiers, notamment des informations provenant de plus de 100 000 fournisseurs.

- Comptabilité en temps réel : Vos comptes sont mis à jour en temps réel. Vous disposez ainsi d'une image financière précise à tout moment.

- Gestion documentaire : Centralise tous les documents financiers. Vous pouvez facilement les rechercher et y accéder.

- Automatisation du paiement des factures : Automatisez le processus de paiement des factures. Programmez et payez vos factures facilement.

- Remboursement des frais : Simplifiez le traitement des notes de frais des employés. Soumettez et approuvez les dépenses rapidement.

- Intégrations transparentes : S'intègre aux logiciels de comptabilité les plus courants. Cela inclut QuickBooks et Xero.

- Détection des fraudes : Son IA peut aider à repérer les transactions inhabituelles. Cela ajoute une couche de sécurité. sécuritéIl n'existe aucune garantie spécifique pour le logiciel, mais des mises à jour continues sont fournies.

Tarification

- Impact: 299 $/mois.

- Avancé: 499 $/mois.

- Avancé Plus: 799 $/mois.

- Entreprise: 999 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Voyons comment Dext et Docyt se comparent.

Nous comparerons dix caractéristiques importantes qu'ils proposent.

Cela vous aidera à déterminer quel outil est le mieux adapté à vos besoins. comptabilité et les flux de travail comptables.

1. Capture et extraction des données

- Dext : Il utilise la technologie OCR (reconnaissance optique de caractères) pour extraire les données des reçus, factures et autres documents. L'objectif de Dext Prepare est de numériser les reçus avec une grande précision, éliminant ainsi la saisie manuelle des données des documents sources.

- Docyt : Docyt's alimenté par l'IA Cette plateforme combine la reconnaissance optique de caractères (OCR) et l'apprentissage automatique avancé pour extraire des données. Elle est conçue pour lire et comprendre les documents financiers comme un humain, minimisant ainsi les erreurs de saisie manuelle et prenant en charge l'extraction de données plus complexes.

2. Automatisation complète du flux de travail

- Dext : Il se concentre principalement sur la phase de collecte et de préparation des données. Il contribue à automatiser les étapes initiales de la comptabilité Flux de travail et gestion documentaire.

- Docyt : C'est une IA complète automation Ce logiciel automatise des tâches telles que le rapprochement bancaire, le paiement des factures et même le rapprochement complexe des revenus. Il vise à prendre en charge de nombreuses tâches fastidieuses afin d'éliminer la saisie manuelle de données tout au long du processus.

3. Informations financières en temps réel

- Dext : Fournit un historique clair des dépenses et des achats, vous offrant des données fiables et à jour pour une meilleure prise de décision.

- Docyt : Elle excelle dans l'offre d'informations en temps réel et d'une visibilité instantanée sur la situation financière. Ses rapports et tableaux de bord affichent vos flux de trésorerie et vos indicateurs clés de performance. immédiatement, assurant ainsi un contrôle financier constant.

4. Prise en charge de plusieurs entités

- Dext : Permet de gérer plusieurs comptes clients Dext ou établissements, ce qui est très pratique pour comptabilité entreprises.

- Docyt : Conçu spécifiquement pour les entreprises multi-sites, il permet de générer facilement des rapports consolidés et de gérer sans effort les états financiers individuels des différents sites.

5. Fonctionnalités de l'application mobile

- Dext : L'application mobile Dext est réputée pour ses fonctionnalités de numérisation mobiles intuitives. Elle permet aux utilisateurs de soumettre rapidement des reçus et des notes de frais en déplacement, simplifiant ainsi la capture des reçus.

- Docyt : L'application mobile se concentre sur la fourniture de rapports en temps réel et la possibilité de consulter et d'approuver les transactions, mettant ainsi la visibilité de la gestion financière à portée de main.

6. Intégration et connectivité

- Dext : Offre des intégrations directes avec des plateformes comme QuickBooks Online et Xero, offrant une intégration poussée pour une publication aisée des données financières.

- Docyt : S'intègre également à QuickBooks Online et à d'autres services. logiciel de comptabilitémais sa connectivité est souvent plus étendue, puisant dans les comptes bancaires et divers systèmes d'entreprise pour une vue d'ensemble.

7. Données sur les dépenses et les ventes

- Dext : Idéal pour la gestion des notes de frais et le suivi des dépenses. Il permet de centraliser les documents relatifs aux données de coûts et de ventes.

- Docyt : Il gère les notes de frais, mais fournit également des outils pour le rapprochement des revenus et la gestion des données de vente au niveau d'un département ou de plusieurs entreprises.

8. Gestion de la sécurité et de la fiabilité

- Dext : Offre une sécurité et une fiabilité système élevées pour le stockage des reçus et autres documents financiers.

- Docyt : Ce service se concentre sur la sécurisation des flux de données et constitue une solution de sécurité fiable. Si vous rencontrez un problème mineur, comme une erreur de type « identifiant Ray de Cloudflare trouvé », il s'agit généralement d'un message standard de leur service de sécurité sous-jacent et non d'une faille de sécurité.

9. Essai gratuit et tarification

- Dext : Vous pouvez souvent essayer Dext grâce à un essai gratuit. Il propose des forfaits à prix compétitifs pour les deux. petite entreprise propriétaires et grands cabinets comptables.

- Docyt : Il propose également un essai gratuit aujourd'hui, bien que son prix de départ soit souvent plus élevé car il intègre une IA plus performante. comptabilité et des fonctionnalités d'automatisation complètes.

10. Priorité à l'IA plutôt qu'à la préparation des données

- Dext : Elle se concentre principalement sur l'utilisation de l'IA pour une extraction et une préparation précises des données, éliminant ainsi les difficultés liées à l'interface utilisateur. comptabilité processus.

- Docyt : Utilise sa plateforme d'IA Docyt comme un comptable IA pour effectuer plusieurs actions telles que la catégorisation et le rapprochement, la gestion des tâches chronophages et l'automatisation des tâches administratives.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Temps réel Signalement: Recherchez un logiciel qui fournit des rapports financiers en temps réel et des analyses de rentabilité. C'est essentiel pour la prise de décisions stratégiques.

- Profondeur d'automatisation : Vérifiez siCet outil va au-delà de la simple collecte des reçus et gère également des tâches comptables complexes, comme le paiement des factures et la clôture de fin de mois.

- Apprentissage par IA : Ce système, comme celui que Docyt apprend à maîtriser, s'adapte-t-il aux spécificités de votre entreprise ? Cela simplifie la vie et change véritablement la donne.

- Réduction des erreurs : Cet outil devrait permettre d'éviter les erreurs de comptabilisation des revenus et de signaler les problèmes tels que les données malformées.

- Facilité d'intégration : Assurez-vous que le logiciel est compatible avec vos systèmes actuels, en utilisant des flux bancaires sécurisés et des fonctionnalités d'envoi par e-mail.

- Capture de documents : Le service devrait offrir plusieurs façons de soumettre des documents, à l'instar des méthodes de fonctionnement de Dext ou des fonctions que Dext propose de multiples façons.

- Fiabilité du système : Recherchez la fiabilité d'utilisation et du système pour garantir la sécurité de vos opérations financières contre les problèmes potentiels tels que les attaques en ligne.

- Gestion des dépenses : Cela devrait vous permettre de gagner du temps en récupérant automatiquement les factures et en appliquant les règles fournisseurs avec les informations fiscales correctes.

- Besoins spécifiques : Réfléchissez à la nécessité d'une comptabilité ou d'un suivi détaillé par département pour des secteurs d'activité spécifiques ou pour les bons de commande clients.

- Sécurité des données : Privilégiez un fournisseur qui protège vos données, notamment contre les menaces potentielles signalées par des termes comme la commande sql (bien que cela concerne davantage l'équipe de développement du propriétaire du site).

Verdict final

Nous avons passé en revue les fonctionnalités et analysé ce qui rend ces outils si performants.

Tous deux vous permettent de gagner du temps et de réduire la saisie manuelle de données.

Dext est un excellent choix si votre priorité est la capture rapide des reçus et la préparation des documents en quelques minutes seulement.

Cependant, Docyt est notre choix pour les entreprises modernes.

Elle offre une comptabilité entièrement automatisée par IA, qui automatise l'ensemble des flux de travail comptables.

Cela change la donne pour beaucoup de gens.

Docyt prend en charge une grande partie du travail pour vous, de la réconciliation complexe à la fourniture d'informations en temps réel sur votre rentabilité.

Nous avons déployé les efforts moyens d'un expert pour comparer véritablement ces systèmes, afin que vous puissiez faire confiance à ce choix pour simplifier votre vie financière.

Plus de Dext

Nous avons également examiné comment Dext se compare à d'autres outils de gestion des dépenses et de comptabilité :

- Dext contre Xero: Xero propose une comptabilité complète avec des fonctionnalités intégrées de gestion des dépenses.

- Dext contre Puzzle IO: Puzzle IO excelle dans l'analyse et la prévision financières grâce à l'IA..

- Dext contre Synder: Synder se concentre sur la synchronisation des données de vente e-commerce et le traitement des paiements.

- Dext vs Easy Fin de mois: Easy Month End simplifie les procédures de clôture financière de fin de mois.

- Dext contre Docyt: Docyt utilise l'IA pour automatiser les tâches de comptabilité et de gestion documentaire.

- Dext contre RefreshMe: RefreshMe fournit des informations en temps réel sur les performances financières des entreprises.

- Dext contre Sage: Sage propose une gamme de solutions comptables avec des fonctionnalités de suivi des dépenses.

- Dext contre Zoho Books: Zoho Books propose une comptabilité intégrée avec des fonctionnalités de gestion des dépenses.

- Dext contre Wave: Wave propose un logiciel de comptabilité gratuit avec des fonctionnalités de base de suivi des dépenses.

- Dext contre Quicken: Quicken est un logiciel populaire pour la gestion des finances personnelles et le suivi des dépenses professionnelles de base.

- Dext vs Hubdoc: Hubdoc est spécialisé dans la collecte automatisée de documents et l'extraction de données.

- Dext contre Expensify: Expensify propose des solutions robustes de gestion et de reporting des dépenses.

- Dext contre QuickBooks: QuickBooks est un logiciel de comptabilité largement utilisé, doté d'outils de gestion des dépenses.

- Dext vs AutoEntry: AutoEntry automatise la saisie des données à partir des factures, des reçus et des relevés bancaires.

- Dext contre FreshBooks: FreshBooks est conçu pour les entreprises de services avec facturation et suivi des dépenses.

- Dext contre NetSuite: NetSuite offre un système ERP complet avec des fonctionnalités de gestion des dépenses.

Plus de Docyt

Lorsqu'on recherche le logiciel comptable adapté, il est utile de voir comment se comparent les différentes plateformes.

Voici une brève comparaison entre Docyt et plusieurs de ses alternatives.

- Docyt contre Puzzle IO: Bien que les deux solutions facilitent la gestion financière, Docyt se concentre sur la comptabilité des entreprises basée sur l'IA, tandis que Puzzle IO simplifie la facturation et les dépenses des travailleurs indépendants.

- Docyt contre Dext: Docyt propose une plateforme complète de comptabilité basée sur l'IA, tandis que Dext est spécialisé dans la capture automatisée de données à partir de documents.

- Docyt contre Xero: Docyt est réputé pour son automatisation poussée grâce à l'IA. Xero propose un système comptable complet et convivial, adapté aux besoins courants des entreprises.

- Docyt contre Synder: Docyt est un outil de comptabilité basé sur l'IA pour l'automatisation des tâches administratives. Synder se concentre sur la synchronisation des données de vente e-commerce avec votre logiciel comptable.

- Docyt contre Easy Fin de mois: Docyt est une solution comptable complète basée sur l'IA. Easy Month End est un outil spécialisé conçu spécifiquement pour rationaliser et simplifier le processus de clôture de fin de mois.

- Docyt contre RefreshMe: Docyt est un outil de comptabilité d'entreprise, tandis que RefreshMe est une application de finances personnelles et de gestion budgétaire.

- Docyt contre Sage: Docyt utilise une approche moderne axée sur l'IA. Sage est une entreprise établie de longue date qui propose une vaste gamme de solutions comptables traditionnelles et en nuage.

- Docyt contre Zoho Books: Docyt se spécialise dans l'automatisation comptable par l'IA. Zoho Books est une solution tout-en-un offrant une gamme complète de fonctionnalités à un prix compétitif.

- Docyt contre Wave: Docyt propose une automatisation IA performante pour les entreprises en pleine croissance. Wave est une plateforme comptable gratuite idéale pour les indépendants et les micro-entreprises.

- Docyt contre Quicken: Docyt est conçu pour la comptabilité d'entreprise. Quicken est principalement un outil de gestion des finances personnelles et de budgétisation.

- Docyt vs Hubdoc: Docyt est un système de comptabilité entièrement basé sur l'IA. Hubdoc est un outil de capture de données qui collecte et traite automatiquement les documents financiers.

- Docyt contre Expensify: Docyt prend en charge l'ensemble des tâches comptables. Expensify est spécialisé dans la gestion et le reporting des notes de frais des employés.

- Docyt contre QuickBooks: Docyt est une plateforme d'automatisation basée sur l'IA qui optimise QuickBooks. QuickBooks est un logiciel de comptabilité complet adapté aux entreprises de toutes tailles.

- Docyt vs AutoEntry: Docyt est une solution de comptabilité IA complète. AutoEntry se concentre spécifiquement sur l'extraction et l'automatisation des données documentaires.

- Docyt contre FreshBooks: Docyt utilise une intelligence artificielle avancée pour l'automatisation. FreshBooks est une solution conviviale très appréciée des indépendants pour ses fonctionnalités de facturation et de suivi du temps.

- Docyt contre NetSuite: Docyt est un outil d'automatisation comptable. NetSuite est un système de planification des ressources d'entreprise (ERP) complet destiné aux grandes entreprises.

Foire aux questions

Quelle est la principale différence entre Dext et Docyt ?

Dext est performant pour le suivi des dépenses et la gestion des reçus. Docyt offre une automatisation comptable plus complète, prenant en charge les factures et fournissant des aperçus financiers en temps réel. Docyt vise à simplifier davantage le flux de travail global.

Avec quels logiciels comptables Dext et Docyt s'intègrent-ils ?

Dext et Docyt s'intègrent généralement aux logiciels de comptabilité populaires tels que QuickBooks et Xero. Docyt propose souvent un plus large éventail d'intégrations avec d'autres outils de gestion d'entreprise.

Dext ou Docyt : lequel est le meilleur pour les petites entreprises ?

Dext peut être un bon point de départ pour les très petites entreprises axées sur la gestion des dépenses. Cependant, si un petite entreprise Si vous souhaitez une automatisation comptable plus complète pour rationaliser vos processus, Docyt pourrait constituer un meilleur investissement à long terme.

Mon comptable peut-il utiliser Dext ou Docyt ?

Oui, les deux outils peuvent être utilisés par comptables et les cabinets comptables. Docyt propose des fonctionnalités spécifiques conçues pour aider les comptables à gérer efficacement plusieurs clients.

Quel outil est le meilleur pour automatiser la saisie de données ?

Les deux outils automatisent la saisie de données, mais Docyt a tendance à gérer une plus grande variété de documents au-delà des simples reçus, en utilisant l'IA pour extraire des informations, ce qui peut simplifier davantage le processus par rapport à l'orientation principale de Dext sur les documents de dépenses.