Elegir lo correcto software de contabilidad Puede parecer una gran decisión para tu negocio, ¿verdad?

Probablemente hayas oído hablar de Wave y QuickBooks, dos opciones populares.

Pero, ¿cuál es realmente el más adecuado para usted? su ¿necesidades?

Este artículo analizará Wave frente a QuickBooks.

Descripción general

Ponemos a prueba Wave y QuickBooks.

Utilizamos cada software para gestionar bienes raíces. negocio finanzas.

Estas pruebas prácticas nos ayudaron a ver cómo funcionan.

Ahora podemos compararlos justamente para usted.

Más de 4 millones pequeñas empresas Confíe en Wave para administrar sus finanzas. Explore los planes de Wave y encuentre el ideal.

Precios: Plan gratuito disponible. Plan de pago desde $19 al mes.

Características principales:

- Facturación

- Bancario

- Complemento de nómina.

Utilizado por más de 7 millones de empresas, QuickBooks puede ahorrarle un promedio de 42 horas por mes en teneduría de libros.

Precios: Tiene una prueba gratuita. El plan cuesta desde $1.90 al mes.

Características principales:

- Gestión de facturas

- Seguimiento de gastos

- Informes

¿Qué es Wave?

Bien, hablemos de Wave.

Piense en ello como un amigo útil para el dinero de su negocio.

Le permite hacer cosas como enviar facturas y realizar un seguimiento del dinero que entra y sale.

Puede ayudarle a ver el panorama general de las finanzas de su negocio.

Además, explora nuestros favoritos Alternativas de olas…

Nuestra opinión

¡No te conformes con menos! Únete a los más de 2 millones de pequeñas empresas que confían hoy mismo en las potentes funciones de contabilidad gratuitas de Wave para optimizar sus finanzas.

Beneficios clave

Los puntos fuertes de Wave incluyen:

- Un plan de contabilidad básico 100% gratuito.

- Sirviendo a más de 2 millones de pequeñas empresas.

- Fácil creación de facturas y procesamiento de pagos.

- Sin contratos a largo plazo ni garantías.

Precios

- Plan de inicio: $0 al mes.

- Plan Pro: $19 al mes.

Ventajas

Contras

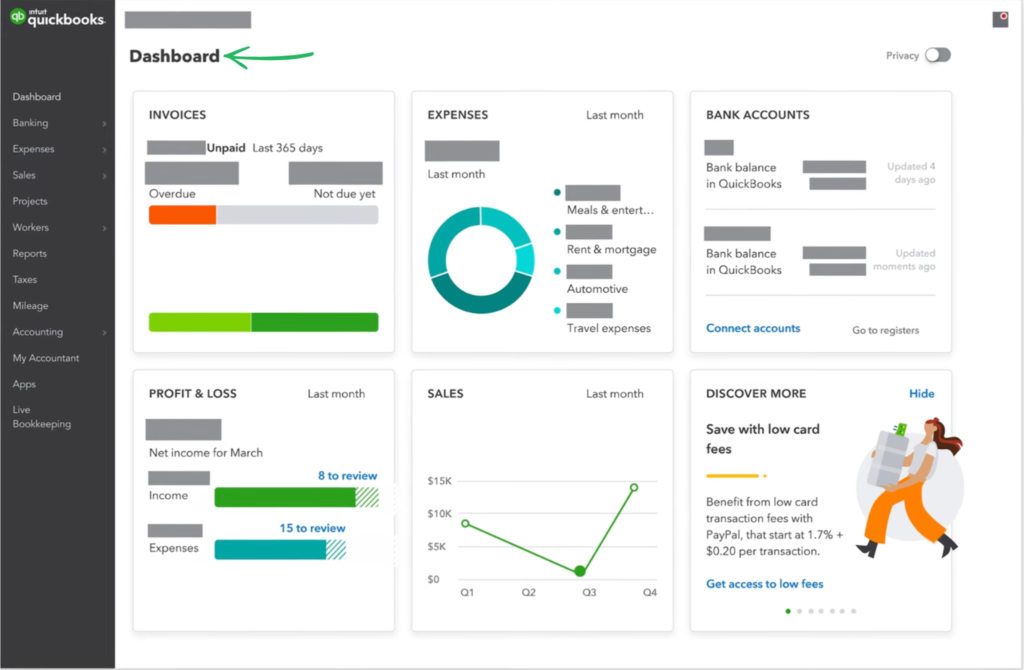

¿Qué es QuickBooks?

QuickBooks es como un amigo útil para las cuestiones financieras de su negocio.

Le ayuda a realizar un seguimiento del dinero que entra y del dinero que sale.

A muchas pequeñas empresas les gusta usarlo.

Además, explora nuestros favoritos Alternativas a QuickBooks…

Beneficios clave

- Categorización automatizada de transacciones

- Creación y seguimiento de facturas

- Gestión de gastos

- Servicios de nómina

- Informes y paneles de control

Precios

- Comienzo sencillo: $1,90/mes.

- Básico: $2.80/mes.

- Más: $4/mes.

- Avanzado: $7.60/mes.

Ventajas

Contras

Comparación de características

Para los propietarios de pequeñas empresas, elegir la opción adecuada contabilidad La solución a menudo se reduce a una cuestión de costo versus funciones completas.

Esta comparación entre la revisión de Wave y la de QuickBooks detallará las diferencias entre una plataforma gratuita y esencial y un servicio de suscripción escalable y repleto de funciones para ayudarlo a realizar un seguimiento del dinero y mantenerse organizado.

1. Nómina y gestión de empleados

- Ola La nómina es un complemento integrado con un costo adicional. Gestiona el procesamiento de nóminas y la declaración de impuestos de empleados activos y contratistas independientes que reciben pagos mediante depósito directo.

- QuickBooks La nómina es un servicio sólido que admite el servicio completo. teneduría de libros, gestión del tiempo de los empleados (QuickBooks Time), pagos a contratistas y todos los impuestos relacionados. Los productos Intuit QuickBooks ofrecen beneficios integrales y soporte para la preparación de impuestos.

2. Fundamentos de contabilidad básica

- Olas gratis contabilidad Las funciones son robustas para tareas esenciales. El sistema incluye registros contables de partida doble e informes financieros como balances generales y pérdidas y ganancias. Permite el seguimiento de varias empresas desde una sola cuenta Wave.

- QuickBooks Es un sistema estándar de la industria que ofrece funciones de contabilidad integrales. Incluye un plan de cuentas detallado y herramientas completas de conciliación que QuickBooks ayuda a mantener una contabilidad empresarial precisa. datos y informes financieros.

3. Facturación y pagos

- Olas Las funciones de facturación son potentes y se incluyen de forma gratuita. Puede planificar y crear facturas profesionales, configurar facturas recurrentes y aceptar pagos en línea con tarjeta de crédito y bancaria (se aplica una comisión por transacción con tarjeta de crédito).

- QuickBooks Ofrece funciones avanzadas para clientes, como la conversión de presupuestos en facturas, y opciones de pago en línea, como Apple Pay. Ofrece recordatorios de pago eficaces y herramientas para gestionar la facturación recurrente de forma eficaz.

4. Gestión de gastos e ingreso de datos

- Ola Le permite controlar sus gastos conectándose a sus cuentas bancarias y tarjetas de crédito. El plan Pro de pago incluye la posibilidad de importar automáticamente transacciones bancarias y captura digital de recibos para facilitar su escaneo.

- QuickBooks Los productos simplifican el seguimiento de gastos al permitir a los usuarios extraer automáticamente las transacciones bancarias de sus cuentas y tarjetas de crédito. QuickBooks ayuda a ahorrar tiempo al ofrecer conciliación y seguimiento automáticos de facturas para proveedores.

5. Precios y acceso

- Ola Financial ofrece un sólido plan básico gratuito que funciona como un sistema de contabilidad completo. La versión gratuita incluye un libro mayor y facturas ilimitadas. Wave facilita la gestión financiera para un número ilimitado de usuarios en el nivel básico.

- Intuir QuickBooks Los productos se basan en una suscripción de pago por niveles. QuickBooks ofrece varios planes, cada uno con diferentes costos adicionales, a partir de una licencia para un solo usuario. QuickBooks ayuda a las empresas en crecimiento a escalar, admitiendo hasta 25 usuarios en su plan de funciones avanzadas.

6. Herramientas empresariales especializadas

- Ola Ofrece funciones esenciales de gestión financiera, pero carece de herramientas para gestionar el inventario o la rentabilidad laboral. Sus funciones clave se centran en las necesidades de autónomos y microempresas que buscan simplicidad y seguimiento del flujo de caja.

- QuickBooks Ofrece funciones más especializadas, como la gestión de inventario, el seguimiento de impuestos sobre las ventas y la gestión de órdenes de compra. Su ecosistema integrado proporciona información sobre datos empresariales e informes orientados a las medianas empresas.

7. Accessibility and Platform

- Ola Es una plataforma nativa en la nube que te brinda acceso en línea a tus informes y datos financieros desde la aplicación móvil. Es una plataforma gratuita ideal para tareas contables sencillas.

- QuickBooks Ofrece una versión en línea basada en la nube y una versión de escritorio (donde los datos de escritorio se almacenan localmente). La versión en línea ofrece mayor flexibilidad y acceso en línea a su contador y usuarios.

8. Atención al cliente y seguridad

- A ola La revisión contable suele indicar que el soporte en vivo generalmente se limita a quienes tienen un plan de pago (o utilizan Wave Payroll o pagos). La seguridad incluye autenticación multifactor para proteger las cuentas bancarias de los usuarios.

- QuickBooks Los productos protegen los datos empresariales con un alto nivel de seguridad y ofrecen un soporte más accesible e integral, que a menudo incluye teléfono y chat. Esta tranquilidad es un punto fuerte en las reseñas de QuickBooks.

9. Automatización y flujo de trabajo

- Ola Ofrece herramientas como la fusión automática para simplificar la conciliación y gestionar automáticamente las transacciones desde su banco. Los productos Wave se centran en los recordatorios automáticos y en la reducción de la entrada manual de datos.

- QuickBooks Ofrece funciones de automatización avanzadas que simplifican flujos de trabajo complejos. Su sistema ayuda a pagar facturas a tiempo, gestionar informes por rango de fechas y realizar un seguimiento del dinero con sofisticadas reglas de conciliación automatizadas.

¿Qué buscar en un software de contabilidad?

Seleccionar lo correcto pequeña empresa El software de contabilidad requiere evaluar algunas áreas clave para garantizar que el programa se adapte a sus operaciones actuales y al crecimiento futuro.

- Modelo de precios y características principalesConsidere más allá del costo inicial. Muchos proveedores ofrecen un plan gratuito o una prueba gratuita, pero a menudo la funcionalidad necesaria está limitada a un plan de pago. Por ejemplo, algunos proveedores ofrecen dos planes para usuarios básicos y empresas en crecimiento, que pueden incluir una tarifa con descuento por un compromiso anual. Evalúe si las funciones principales, como el software de facturación y las herramientas de contabilidad general, se ajustan a sus necesidades.

- Escalabilidad y acceso de usuarios: Consider how the software manages growth. If your team expands, you’ll need a platform that supports multiple users without excessive extra fees. While most small business software de contabilidad can handle basic personal finance tracking, look for systems that allow you to manage multiple entities or fully integrate external data as your business grows.

- Especialización y automatizaciónLos mejores programas destacan por automatizar flujos de trabajo complejos. Si facturas servicios a tus clientes, una función crucial es el seguimiento de las horas facturables. Además, una automatización fiable, como los recordatorios de pago, mejorará significativamente tu flujo de caja. Comprueba si el software ofrece soluciones integradas como contabilidad y nómina, o si el proveedor (wave) se integra a la perfección con otros servicios de terceros necesarios.

- Soporte y facilidad de usoUn diseño intuitivo es esencial. Una revisión de contabilidad de Wave suele destacar plataformas fáciles de usar, por lo que muchos recomiendan Wave a nuevos emprendedores. Asegúrese de que el proveedor ofrezca un centro de ayuda completo con recursos accesibles y tiempos de respuesta claros, idealmente en pocos días hábiles, para resolver rápidamente cualquier pregunta que pueda tener.

Veredicto final

Analizamos ambos con atención. Elegimos QuickBooks.

Es mejor para la mayoría de las empresas en crecimiento.

Wave es gratuito y sencillo. Pero QuickBooks tiene más funciones.

También ofrece mejor soporte. Gestiona tareas complejas. Esto es beneficioso a medida que tu negocio crece.

Probamos ambos con buenos resultados. Nuestras pruebas demuestran que QuickBooks es más potente.

También ofrece mayor flexibilidad. Para administrar tu dinero con seriedad, es más sólido.

Ayudará a que su negocio funcione bien.

Más de Wave

- Ola vs. Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Wave contra DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Wave frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave contra SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Ola vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Wave vs. DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Wave vs SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Wave frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Wave frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Wave frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Wave frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Onda vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Wave frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Wave frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de QuickBooks

- QuickBooks frente a Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- QuickBooks frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- QuickBooks frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- QuickBooks vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- QuickBooks frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- QuickBooks frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- QuickBooks frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- QuickBooks frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- QuickBooks frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- QuickBooks frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- QuickBooks vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- QuickBooks frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- QuickBooks frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Es QuickBooks Online mejor que Wave Accounting?

QuickBooks Online suele ofrecer más funciones y mayor escalabilidad para empresas en crecimiento. Wave Accounting es ideal para empresas muy pequeñas o autónomos que necesitan contabilidad básica gratuita. La mejor opción depende de las necesidades y el presupuesto de su negocio.

¿Puedo realizar la gestión de inventario con Wave?

Wave Accounting no ofrece gestión de inventario integrada. Si necesita realizar un seguimiento del inventario, probablemente necesite usar una aplicación independiente e integrarla. QuickBooks Desktop y algunos planes de QuickBooks Online ofrecen herramientas de inventario más robustas.

¿Cuáles son las principales diferencias entre QuickBooks Desktop y QuickBooks Online?

QuickBooks Desktop se instala en su computadora, mientras que QuickBooks Online está basado en la nube y se accede a través de un navegador web. Online ofrece mayor flexibilidad y accesibilidad. Desktop ofrece mayor control y suele ser una compra única, aunque carece de la comodidad de la nube.

¿Existe realmente un software de contabilidad gratuito como Wave para propietarios de pequeñas empresas?

Sí, Wave Accounting es una opción totalmente gratuita para las necesidades básicas de contabilidad. Si bien es gratuita para las funciones principales, algunos servicios como la nómina o el procesamiento de pagos pueden tener un coste. Es una opción sólida como software para pequeñas empresas con un presupuesto ajustado.

¿Cómo se compara el plan de precios de QuickBooks con Wave?

Las principales funciones de contabilidad de Wave son gratuitas. QuickBooks opera con un plan de suscripción con diferentes niveles que ofrecen diferentes funciones. Si bien Wave ofrece funciones básicas gratuitas, QuickBooks ofrece funciones más completas con un costo, lo que lo hace ideal para empresas dispuestas a invertir.