Thinking about new software de contabilidad ¿para su negocio?

But with so many choices, how do you know which one is a good fit?

Wave and NetSuite are two popular options, but they’re built for very different needs.

One is great for pequeñas empresas, while the other is a powerful tool for bigger companies.

We’ll break down Wave vs NetSuite to help you understand which contabilidad software is best!

Descripción general

We looked closely at both Wave and NetSuite.

Revisamos sus características, lo fáciles que son de usar y a qué tipo de empresas ayudan más.

This helped us see where each one shines.

Más de 4 millones pequeñas empresas Confíe en Wave para administrar sus finanzas. Explore los planes de Wave y encuentre el ideal.

Precios: Plan gratuito disponible. Plan de pago desde $19 al mes.

Características principales:

- Facturación

- Bancario

- Complemento de nómina.

¡Aumenta tu productividad hasta un 78%! Descubre cómo las herramientas de automatización de NetSuite pueden transformar tu jornada laboral. ¡Descubre más!

Precios: Tiene una prueba gratuita. Hay planes de precios personalizados disponibles.

Características principales:

- Integración ERP,

- CRM

- Análisis avanzado

¿Qué es Wave?

Bien, hablemos de Wave.

Piensa en ello como un amigo útil para ti. negocio dinero.

Le permite hacer cosas como enviar facturas y realizar un seguimiento del dinero que entra y sale.

Puede ayudarle a ver el panorama general de las finanzas de su negocio.

Además, explora nuestros favoritos Alternativas de olas…

Nuestra opinión

¡No te conformes con menos! Únete a los más de 2 millones de pequeñas empresas que confían hoy mismo en las potentes funciones de contabilidad gratuitas de Wave para optimizar sus finanzas.

Beneficios clave

Los puntos fuertes de Wave incluyen:

- Un plan de contabilidad básico 100% gratuito.

- Sirviendo a más de 2 millones de pequeñas empresas.

- Fácil creación de facturas y procesamiento de pagos.

- Sin contratos a largo plazo ni garantías.

Precios

- Plan de inicio: $0 al mes.

- Plan Pro: $19 al mes.

Ventajas

Contras

¿Qué es NetSuite?

Entonces, ¿qué pasa con NetSuite?

Piense en ello como una caja de herramientas gigante para todo su negocio.

Te ayuda con cosas como el dinero, los clientes e incluso lo que tienes en stock.

¡Está todo en un solo lugar!

Además, explora nuestros favoritos Alternativas a Netsuite…

Nuestra opinión

¿Busca potencia empresarial? NetSuite presta servicio a más de 30.000 clientes en todo el mundo con su plataforma integral. Si necesita una integración completa de ERP y análisis avanzados, elija NetSuite para impulsar su crecimiento.

Beneficios clave

- Une las finanzas, CRMy ERP en un único sistema en la nube.

- Apoya a empresas en más de 200 países y 27 idiomas.

- Más de 40.000 organizaciones utilizan esta plataforma escalable.

- Obtendrá análisis integrados para una visibilidad en tiempo real de su datos.

Precios

Ofrecen planes de precios personalizados según tus necesidades. Contáctalos para encontrar el paquete perfecto para ti.

Ventajas

Contras

Comparación de características

Comparing Wave Financial and Oracle NetSuite is a comparison between two ends of the spectrum.

This feature comparison will help small business owners evaluate which business management software is the right contabilidad software—a free, easy-to-use option, or a cloud based erp for large-scale operations.

1. Target Audience and Core Features

- Ola Financial is dedicated free contabilidad software and small business accounting software built for the freelancer or micro-business. Its key features are basic accounting features like invoicing, digital receipt capture, and track expenses. A Wave Accounting review will often recommend Wave for an independent contractor.

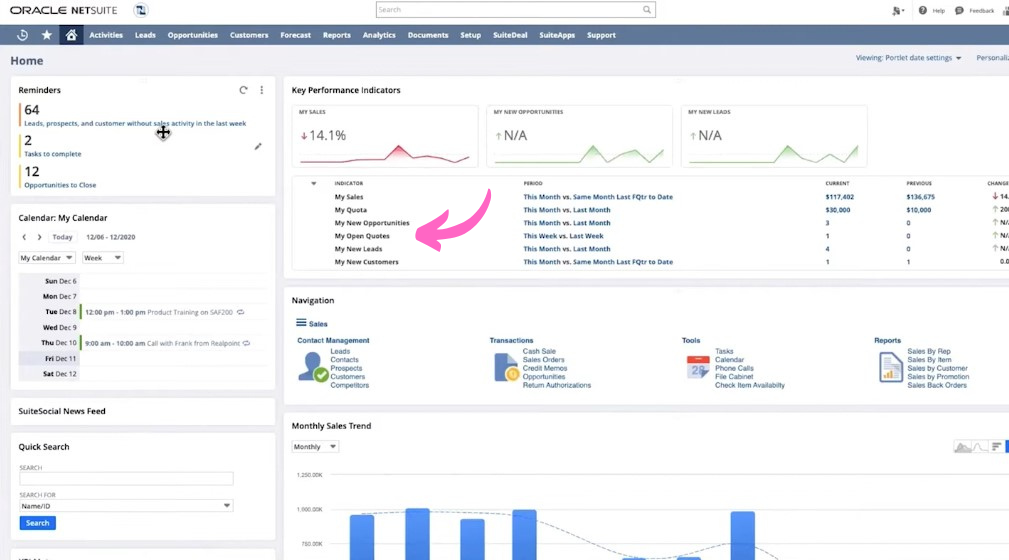

- Oráculo NetSuite is a comprehensive cloud based erp solution from Oracle Corporation, designed for medium sized businesses and large businesses. Its core is financial management, but it also includes customer relationship management (CRM), supply chain management, and warehouse management as other modules.

2. Precios y escalabilidad

- Ola Financial is celebrated for its free platform and free version, which includes unlimited invoices and teneduría de libros records. Paid features like Wave Payroll and payment processing incur additional costs, but it remains highly affordable pricing. The free starter plan is a great entry point.

- Oráculo NetSuite does not publicly disclose entry-level netsuite pricing and is typically an annual subscription level with a one-time implementation fee. The cost is high, but NetSuite is highly scalable for managing multiple currencies, business units, and global accounting.

3. Depth of Financial Management

- Ola Accounting offers strong money management features for tracking cash flow and is good for basic bank reconciliation and managing bank transactions. It provides simple financial reports sufficient for single-user personal finance.

- NetSuite ERP provides sophisticated financial management and accounting capabilities, including fixed assets management and advanced cash management. It allows for real time visibility into financial performance and generates detailed financial statements that enhance audit trails.

4. Enterprise Functionality

- Ola Accounting is focused on core accounting features. It does not offer enterprise-level tools like professional services automation, order management, human capital management, or workforce management. There are no tools to process vendor bills on an enterprise level.

- NetSuite offers a fully advanced integrated suite of business solutions that automate virtually all business processes. It provides a complete view of key performance indicators (KPIs) across all other systems via its single-database architecture.

5. Automation and Transactions

- Ola Financial helps automate tasks with its free accounting features. The paid pro plan includes the ability to auto import bank transactions and transactions automatically with the auto merge feature from your bank accounts and credit card.

- NetSuite’s automation is deep and wide, covering the entire flow from sales team to fulfillment. It netsuite offers seamless integration and automation for complex, multi-step financial processes and supply chain movements.

6. Payroll and Employee Management

- Ola Payroll is an optional add-on that enables payroll processing with direct deposit for both active employee and independent contractor. It is a simpler, budget-friendly option for accounting and payroll.

- NetSuite offers full-fledged payroll management and human capital management systems that handle complex tax filing, workforce management, and detailed expense reports for all employees.

7. Invoicing and Payments

- Ola Accounting provides robust invoicing features and allows you to accept online payments via credit card payments and bank payments. You can easily set up any recurring billing & automated payment reminders.

- NetSuite handles invoicing software as part of its order management and order-to-cash cycle. It supports various payment options and can manage transactions across multiple currencies, which is critical for global accounting.

8. Customization and Integration

- Ola is not highly customizable but wave integrates well with payment processors and payroll. Its general ledger is simple, and it has no native support for custom integrations or open API access.

- NetSuite is built for customization. Its architecture allows for custom integrations with other systems, and NetSuite’s CRM is a natively integrated module for managing customer data and the sales team. NetSuite provides in-depth control over the entire system.

9. Experiencia de usuario y soporte

- Ola Accounting review will generally praise the user friendly and intuitive interface, making it easy for small business owners to get started and manage bookkeeping records. The mobile app is strong for receipt scanning. Support provided is mainly via a help center and online resources.

- NetSuite is a complex system with a steep learning curve, requiring significant training for users. However, it offers detailed real time data dashboards and strong audit trails. NetSuite reviews highlight its extensive support provided and resources but note the initial complexity.

¿Qué buscar en un software de contabilidad?

- Escalabilidad: Can the software grow with any of your business? Scalability is about whether the software, like the two plans offered by Wave, can support your growth. While the free plan is great for an independent contractor paid via a simple invoicing process, larger businesses need to check the paid plan for features like support for multiple companies and unlimited users. Look for software that offers a discounted rate for long-term commitment, ensuring the platform grows with your volume of recurring invoices.

- Apoyo: What kind of help is available if you have questions? Support options should be clear and accessible. Some providers, such as those recommended by a Wave review, offer help via chat or email, resolving issues within a couple of business days. Having reliable support ensures you are giving peace of mind and can quickly deal with any complications arising from a credit card transaction or other financial activities.

- Facilidad de uso: Is it something you and your team can learn quickly? The user interface should be intuitive. Wave makes financial management simple, which is key to quick adoption by multiple users. A straightforward platform means less time spent on training and more time on core business operations. Test the software to see how easily you can customize reports based on a date range or process a new recurring invoice.

- Necesidades específicas: Does it handle the unique things your business does? Evaluate if the software handles your core workflows, such as managing billable hours for service-based businesses or accepting various online payments, including Apple Pay. If your paid plan includes a feature you specifically need, like tracking recurring invoices, you can be confident that the platform meets your requirements.

- Seguridad: How safe is your financial data with this software? Security is non-negotiable. Look for standard features like multi factor authentication to protect multiple users’ accounts. Your software should securely handle sensitive financial information from a credit card transaction and ensure all data is protected against unauthorized access.

Veredicto final

Cual contabilidad software is best? It truly depends on your business.

We looked closely at both. Our pick is Wave for small businesses and freelancers.

NetSuite is for larger, growing companies. Wave is perfect if you need basic, free contabilidad.

It’s easy to start. If your business is bigger, NetSuite is better. It manages complex inventory.

We studied both deeply. You can trust our breakdown.

Más de Wave

- Ola vs. Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Wave contra DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Wave frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave contra SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Ola vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Wave vs. DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Wave vs SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Wave frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Wave frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Wave frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Wave frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Onda vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Wave frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Wave frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de NetSuite

- NetSuite frente a PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- NetSuite frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- NetSuite frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- NetSuite frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- NetSuite vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- NetSuite frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- NetSuite frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- NetSuite frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- NetSuite frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- NetSuite frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- NetSuite frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- NetSuite frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- NetSuite frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- NetSuite frente a AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

Preguntas frecuentes

¿Wave es realmente gratuito para contabilidad?

Yes, Wave offers a free basic accounting plan. This includes invoicing, expense tracking, and basic financial reports. It’s a great option for small businesses or freelancers on a tight budget.

Which is better for a growing business, Wave vs NetSuite?

For a growing business, NetSuite is generally better than Wave. NetSuite provides a full ERP system, offering more advanced features like robust inventory management and extensive customization that growing businesses need.

¿Puedo realizar el seguimiento del inventario con Wave?

No, Wave does not have built-in inventory management features. If your business needs to track products or stock, you will need to use a separate tool or upgrade to a more comprehensive system like NetSuite.

What kind of user reviews do NetSuite and Wave have?

User reviews show that Wave is loved for its ease of use and free basic features, especially by small businesses. NetSuite user reviews praise its deep features and ability to handle complex operations, though it can be more complex to set up.

Is NetSuite an ERP system?

Yes, NetSuite is a comprehensive ERP (Enterprise Resource Planning) system. It integrates various business functions beyond just accounting, such as CRM, inventory, and human resources, making it a powerful all-in-one solution for larger companies.