Luchando por elegir lo correcto contabilidad ¿Una herramienta para su negocio?

No estás solo

Ambos prometen hacer su vida financiera más fácil, pero ¿cuál se adapta a sus necesidades específicas?

Esta guía analizará Wave vs. Autoentry.

¡Descubramos cuál es mejor!

Descripción general

Ponemos a prueba Wave y AutoEntry.

Los usamos como un verdadero negocio Esto nos ayudó a ver qué hace mejor cada herramienta.

Ahora, comparémoslos lado a lado.

Más de 4 millones pequeñas empresas Confíe en Wave para administrar sus finanzas. Explore los planes de Wave y encuentre el ideal.

Precios: Plan gratuito disponible. Plan de pago desde $19 al mes.

Características principales:

- Facturación

- Bancario

- Complemento de nómina.

Deje de perder más de 10 horas semanales ingresando datos manualmente. Vea cómo Autoentry redujo el tiempo de procesamiento de facturas en un 40 %. Sabio usuarios.

Precios: Tiene una prueba gratuita. El plan de pago cuesta desde $12 al mes.

Características principales:

- Extracción de datos

- Escaneo de recibos

- Automatización de proveedores

¿Qué es Wave?

Bien, hablemos de Wave.

Piense en ello como un amigo útil para el dinero de su negocio.

Le permite hacer cosas como enviar facturas y realizar un seguimiento del dinero que entra y sale.

Puede ayudarle a ver el panorama general de las finanzas de su negocio.

Además, explora nuestros favoritos Alternativas de olas…

Nuestra opinión

¡No te conformes con menos! Únete a los más de 2 millones de pequeñas empresas que confían hoy mismo en las potentes funciones de contabilidad gratuitas de Wave para optimizar sus finanzas.

Beneficios clave

Los puntos fuertes de Wave incluyen:

- Un plan de contabilidad básico 100% gratuito.

- Sirviendo a más de 2 millones de pequeñas empresas.

- Fácil creación de facturas y procesamiento de pagos.

- Sin contratos a largo plazo ni garantías.

Precios

- Plan de inicio: $0 al mes.

- Plan Pro: $19 al mes.

Ventajas

Contras

¿Qué es AutoEntry?

Bien, hablemos de AutoEntry.

Es una herramienta que te ayuda a ingresar tu documentación en tu computadora sin tener que escribir todo tú mismo.

Piense en ello como un ayudante inteligente para sus facturas y recibos.

Los lee y coloca la información donde debe ir.

Además, explora nuestros favoritos Alternativas de entrada automática…

Nuestra opinión

¿Listo para reducir tu tiempo de contabilidad? AutoEntry procesa más de 28 millones de documentos al año y ofrece una precisión de hasta el 99 %. ¡Empieza hoy y únete a las más de 210 000 empresas de todo el mundo que han reducido sus horas de entrada de datos hasta en un 80 %!

Beneficios clave

La mayor ventaja de AutoEntry es ahorrar horas de trabajo aburrido.

Los usuarios a menudo ven hasta un 80% menos de tiempo dedicado a la entrada manual de datos.

Promete hasta un 99% de precisión en la extracción de datos.

AutoEntry no ofrece una garantía de devolución de dinero específica, pero sus planes mensuales le permiten cancelar en cualquier momento.

- Hasta un 99% de precisión en los datos.

- Usuarios ilimitados en todos los planes pagos.

- Extrae artículos de línea completos de las facturas.

- Aplicación móvil sencilla para tomar fotografías de recibos.

- 90 días para que los créditos no utilizados se transfieran.

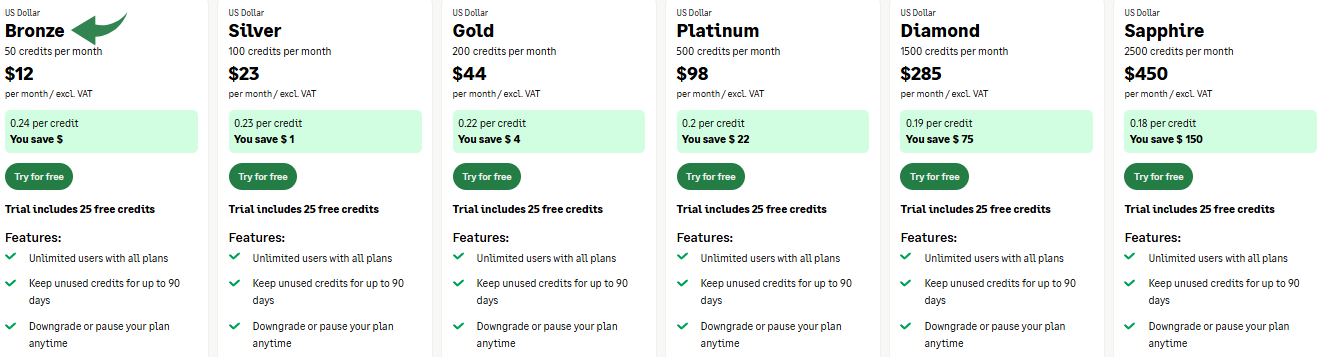

Precios

- Bronce:$12/mes.

- Plata:$23/mes.

- Oro:$44/mes.

- Platino:$98/mes.

- Diamante:$285/mes.

- Zafiro:$450/mes.

Ventajas

Contras

Comparación de características

Seleccionar la plataforma financiera adecuada requiere conocer su enfoque principal. La reseña de Wave y la comparación de reseñas de AutoEntry contrastarán una versión gratuita completa. contabilidad Software con servicio especializado de extracción de datos.

Le ayudamos a encontrar la herramienta para resolver sus problemas que más tiempo le consumen. contabilidad asuntos.

1. Propósito central y enfoque

- Ola Financial es una empresa dedicada pequeña empresa Software de contabilidad que proporciona un sistema completo de partida doble, incluyendo un libro mayor. El plan gratuito incluye funciones contables básicas para gestionar una pequeña empresa de servicios o varias empresas.

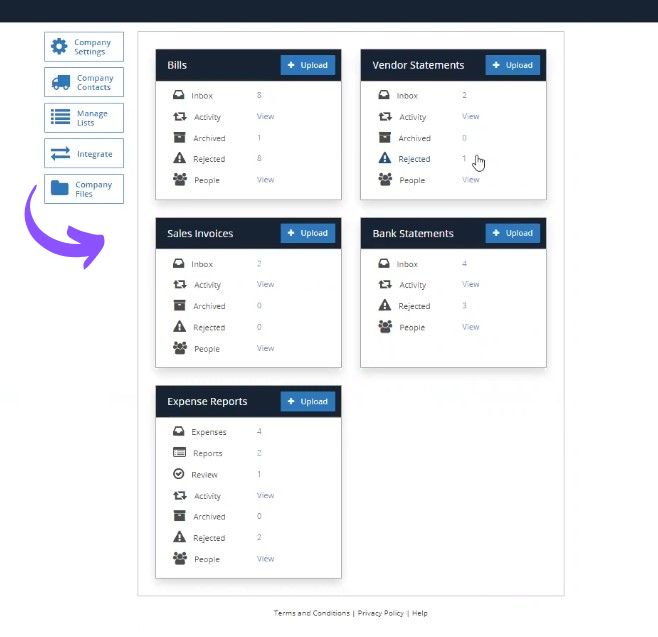

- Entrada automática es una herramienta de automatización con un enfoque singular en eliminar la automatización manual. datos Entrada. Utiliza reconocimiento óptico de caracteres para extraer cualquier tipo de datos de documentos financieros, como facturas de compra y extractos bancarios, para su publicación automática en otros sistemas. No es un programa de contabilidad completo.

2. Precios y suscripción

- Olas La versión gratuita (plataforma gratuita) incluye contabilidad básica y facturas ilimitadas para todos los usuarios. Sus dos planes (plan básico y plan profesional de pago) mantienen una estructura de bajo costo, ofreciendo una excelente tarifa con descuento para contratistas independientes.

- Entrada automática El precio se basa en un modelo flexible, que suele cobrarse por mes o por documento. No existe un plan totalmente gratuito, pero el coste se justifica por el considerable ahorro de tiempo en la entrada manual de datos, un punto clave en muchas reseñas de AutoEntry.

3. Captura de gastos y documentos

- Ola Ofrece escaneo básico de recibos a través de su aplicación móvil, pero la captura digital de recibos es una función con costo adicional en el plan básico. El método principal de Wave para controlar los gastos es vincular directamente las cuentas bancarias con las transacciones bancarias de importación.

- Entrada automática Está diseñado para la gestión de documentos de gran volumen. Puede cargar documentos mediante un teléfono móvil, correo electrónico o computadora de escritorio, y captura con precisión partidas y detalles de extractos bancarios y otros documentos financieros. Esta es una gran ventaja para teneduría de libros archivos.

4. Integración e integración perfecta

- Olas Su punto fuerte es su suite integrada (Wave Payroll, procesamiento de pagos). Si bien Wave se integra con otros sistemas, carece de la integración fluida con el software principal de contabilidad y nóminas que ofrecen las herramientas de automatización especializadas.

- Entradas automáticas Su valor fundamental es su perfecta integración con el software de contabilidad más popular (como QuickBooks y Xero). Está diseñado para ser un puente automatizado para extraer datos rápidamente y minimizar el esfuerzo de transferencia de información.

5. Automatización de transacciones

- Olas El plan Pro de pago te permite importar automáticamente transacciones bancarias y fusionarlas con tus registros. También puedes configurar facturas y transacciones recurrentes automáticamente para simplificar la facturación recurrente.

- Entrada automática Automatiza todo el proceso de conversión de documentos a datos. Simplemente cargue el documento y el sistema de reconocimiento óptico de caracteres prepara automáticamente los datos para su publicación, ahorrando así mucho tiempo en la entrada manual de datos.

6. Gestión de usuarios y accesos

- Ola offers unlimited users on its paid pro plan and supports multiple users for your business or multiple companies at once, giving peace of mind to small business software de contabilidad usuarios.

- Entrada automática También admite un número ilimitado de usuarios, lo que facilita que los contables otorguen acceso a sus clientes para cargar documentos. El proceso se centra en el flujo de documentos, en lugar de en los permisos multiusuario dentro de un libro de contabilidad completo.

7. Seguridad y manejo de errores

- Ola Utiliza autenticación multifactor y cifrado robusto para proteger tus cuentas bancarias y datos. Si tienes algún problema, puedes consultar su centro de ayuda en línea.

- Entrada automática Emplea medidas robustas para protegerse de ataques en línea. Una de las principales preocupaciones de este tipo de servicio es la seguridad para proteger su sitio, ya que se bloquean varias acciones que podrían activar un bloqueo de seguridad, como enviar una palabra o frase, un comando SQL o datos mal formados. Si la acción que acaba de realizar activó la solución de seguridad y se encontró un ID de Ray de Cloudflare, no podrá acceder a la página y deberá enviar un correo electrónico al propietario del sitio con su IP para resolver el problema.

8. Facturación y pagos

- Ola Ofrece funciones avanzadas de facturación que le permiten aceptar pagos en línea con tarjeta de crédito y bancaria. Se aplica una comisión por transacción con tarjeta de crédito, pero el software de facturación principal es gratuito. También puede configurar recordatorios de pago automáticos.

- Entrada automática No cuenta con funciones de facturación y no puede recibir pagos en línea ni gestionar recordatorios de pago. Se centra en la captura de documentos relacionados con gastos, no con ventas.

9. Nómina y funciones avanzadas

- Ola Nómina es un complemento de pago integrado que le permite pagar a sus empleados activos o contratistas independientes y gestionar el procesamiento de nóminas. Wave incorpora continuamente funciones avanzadas, como las opciones de pago de Apple Pay.

- Entrada automática Es una herramienta con un único objetivo. No ofrece procesamiento de nóminas ni otras funciones de gestión financiera, como informes financieros presupuestarios o seguimiento de horas facturables.

¿Qué buscar en un software de contabilidad?

- Escalabilidad¿Puede el software crecer con el crecimiento de su negocio? La escalabilidad se refiere a si la herramienta puede gestionar su crecimiento futuro sin forzar un cambio completo. Wave lo simplifica con un plan básico gratuito, ideal para contratistas independientes que reciben pagos de algunos clientes. A medida que crezca, puede cambiar a un plan de pago para acceder a funciones como la posibilidad de rastrear varias empresas y agregar varios usuarios. Una plataforma que ofrece niveles de suscripción escalonados demuestra que está diseñada para adaptarse a sus necesidades cambiantes.

- Apoyo¿Qué tipo de ayuda está disponible si tiene preguntas? Un buen soporte es clave para brindar confianza. Una reseña de Wave Accounting suele destacar su amplio centro de ayuda y recursos en línea. Busque canales de soporte claros y verifique si se comprometen a responder en un plazo razonable, como unos pocos días hábiles. Una asistencia confiable es esencial para mantener registros financieros precisos, y es por eso que muchos recomiendan Wave a los nuevos propietarios de pequeñas empresas.

- Facilidad de uso¿Es algo que usted y su equipo pueden aprender rápidamente? La simplicidad de la interfaz de usuario es vital. Wave facilita la gestión financiera incluso para quienes no tienen conocimientos de contabilidad. El diseño debe ser lo suficientemente intuitivo como para que usted y los miembros de su equipo puedan aprender rápidamente a registrar gastos y generar informes. Cuanto menos tiempo dediquen a aprender a usar el software, más tiempo podrán dedicar a las operaciones de su negocio.

- Necesidades específicas¿Administra las tareas específicas de su negocio? Asegúrese de que el software cumpla con sus requisitos específicos. Por ejemplo, si depende de ingresos inmediatos, verifique la velocidad de procesamiento de los pagos con tarjeta de crédito. Debería poder personalizar los informes según un rango de fechas para períodos específicos o separar fácilmente las transacciones financieras personales de las finanzas de su negocio dentro del mismo sistema.

- Seguridad¿Qué tan seguros están sus datos financieros con este software? Proteger su información confidencial, como cuentas bancarias y datos de transacciones con tarjetas de crédito, es fundamental. Busque medidas de seguridad sólidas, como la autenticación multifactor, en todos los niveles de suscripción. Saber que el software se compromete a proteger sus datos le brinda tranquilidad.

Veredicto final

¿Qué es mejor, Wave o AutoEntry? Depende de tus necesidades.

Si ejecutas un pequeña empresa o acabas de empezar uno, Wave es tu mejor opción.

Es un sistema de contabilidad completo y gratuito. Te ayuda a gestionar todas tus tareas financieras básicas.

Pero quizás ya utilices un software de contabilidad.

Pensar QuickBooks o Xero. Y tienes muchos recibos y facturas en papel.

Entonces, AutoEntry es el claro ganador. Es una herramienta potente que automatiza la entrada de datos, que suele ser complicada.

Te los mostramos ambos en detalle.

Elige el que solucione los problemas de tu negocio.

Más de Wave

- Ola vs. Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Wave contra DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Wave frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave contra SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Ola vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Wave vs. DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Wave vs SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Wave frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Wave frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Wave frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Wave frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Onda vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Wave frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Wave frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de AutoEntry

- Entrada automática vs. RompecabezasEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Entrada automática frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Entrada automática frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Entrada automática frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Entrada automática vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Entrada automática frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Entrada automática vs. SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Entrada automática frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Entrada automática vs. WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Entrada automática frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Entrada automática frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Entrada automática vs. ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Entrada automática frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Entrada automática frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Entrada automática frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Wave Accounting es realmente gratuito para los propietarios de pequeñas empresas?

Sí, Wave Accounting ofrece sus funciones principales, como la facturación y la contabilidad básica, completamente gratis. Esto la convierte en una solución de contabilidad popular para muchas startups y pequeñas empresas que buscan gestionar su flujo de caja sin costes iniciales.

¿Cómo se compara AutoEntry con Hubdoc para el seguimiento de gastos?

Entrada automática y Hubdoc Ambos buscan optimizar el seguimiento de gastos mediante la automatización de la captura de datos de recibos y facturas. AutoEntry suele ofrecer integraciones de software más amplias y capacidades de extracción de datos más avanzadas, lo que lo convierte en una excelente opción para empresas que necesitan una automatización detallada.

¿Puede Wave Accounting gestionar la nómina?

Sí, Wave Accounting ofrece servicios de nómina. Sin embargo, esta es una función adicional de pago. Ayuda a los propietarios de pequeñas empresas a gestionar los pagos a empleados, los depósitos directos y las declaraciones de impuestos sobre la nómina, consolidando aún más sus necesidades financieras en una única solución contable.

¿Es AutoEntry una solución de contabilidad completa por sí sola?

No, AutoEntry no es una solución de contabilidad independiente. Está diseñada para integrarse con software de contabilidad existente, como QuickBooks o Xero. Su función principal es agilizar la entrada de datos de gastos, facturas y recibos, facilitando el seguimiento de gastos en otros sistemas.

¿Qué herramienta es mejor para mejorar el flujo de caja de las pequeñas empresas?

Para mejorar el flujo de caja, ambas herramientas son útiles, pero de forma diferente. Wave Accounting ofrece una visión general completa de sus finanzas, ayudándole a controlar las entradas y salidas de dinero. AutoEntry agiliza la entrada de datos, brindándole datos financieros más rápidos y precisos para tomar mejores decisiones sobre su flujo de caja.