Are you tired of spending too much time dealing with paperwork for your business?

Puede ser un verdadero dolor, ¿verdad?

Well, there is!

Two popular tools, Dext and Xero, can help.

But which one is the better fit for su ¿negocio?

This article will break down Dext vs Xero.

Descripción general

We looked closely at both Dext and Xero.

Los probamos como lo harías tú.

Esto nos ayudó a ver lo que cada uno puede hacer.

Now we can compare them and tell you what we found.

Esto le ayudará a elegir el mejor.

¿Listo para recuperar más de 10 horas al mes? Descubre cómo Dext automatiza la entrada de datos, el seguimiento de gastos y la optimización de tus finanzas.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $24 al mes.

Características principales:

- Escaneo de recibos

- Informes de gastos

- Conciliación bancaria

Únase a más de 2 millones de empresas que utilizan el software de contabilidad en la nube de Xero. ¡Explore sus potentes funciones de facturación ahora!

Precios: Tiene una prueba gratuita. El plan pago comienza en $29/mes.

Características principales:

- Conciliación bancaria

- Facturación

- Informes

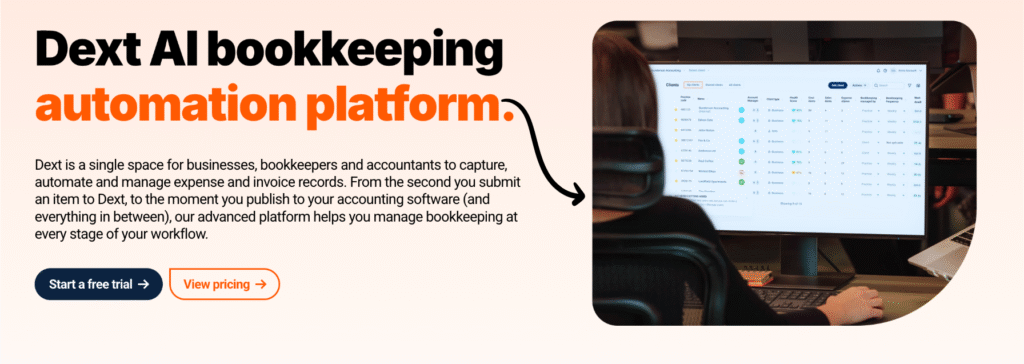

¿Qué es Dext?

Bien, entonces ¿qué es Dext?

Piense en ello como un ayudante súper inteligente para sus papeles.

Se encarga principalmente de cosas como facturas y recibos.

Simplemente toma una fotografía y Dext obtiene toda la información importante.

Desbloquea su potencial con nuestro Alternativas a Dext…

Nuestra opinión

¿Listo para recuperar más de 10 horas al mes? Descubre cómo la entrada de datos automatizada, el seguimiento de gastos y la generación de informes de Dext pueden optimizar tus finanzas.

Beneficios clave

Dext realmente brilla cuando se trata de hacer que la gestión de gastos sea muy sencilla.

- El 90% de los usuarios informan una disminución significativa en el desorden de papeles.

- Cuenta con una tasa de precisión de más del 98%. en la extracción de datos de documentos.

- Crear informes de gastos se vuelve increíblemente rápido y fácil.

- Se integra sin problemas con plataformas de contabilidad populares, como QuickBooks y Xero.

- Ayuda a garantizar que nunca pierda el rastro de documentos financieros importantes.

Precios

- Suscripción anual: $24

Ventajas

Contras

¿Qué es Xero?

Now, let’s talk about Xero.

Think of Xero as your online office for money stuff.

It helps you do lots of things like send bills, pay people, and keep track of your bank account.

It’s like having a digital helper for all your business finances.

Desbloquea su potencial con nuestro Alternativas a Xero…

Nuestra opinión

Únase a más de 2 millones de empresas usando Xero Software de contabilidad. ¡Explora sus potentes funciones de facturación ahora!

Beneficios clave

- Conciliación bancaria automatizada

- Facturación y pagos en línea

- Gestión de facturas

- Integración de nóminas

- Informes y análisis

Precios

- Motor de arranque: $29/mes.

- Estándar: $46/mes.

- De primera calidad: $69/mes.

Ventajas

Contras

Comparación de características

It’s time to see how Dext and Xero truly stack up.

One is a specialist in getting your paper into the cloud, and the other is a complete cloud based contabilidad software.

We’ll compare their core functions to help you decide.

1. Automatización de la entrada de datos

- Destreza: Excellent for automating datos entry. It uses OCR technology and AI to quickly extract data from receipts and invoices (like Dext Prepare), cutting down on manual data entry. You can submit receipts via mobile scanning, email, or fetching.

- Xero: Offers tools to reduce manual data entry, mainly through bank feeds and its integration with Hubdoc, but its core focus is not just on automating data entry.

2. Core Accounting Workflows

- Destreza: Not full cloud-based contabilidad software. It’s a specialist tool that streamlines data collection and feeds it into your main accounting and teneduría de libros flujos de trabajo.

- Xero: A comprehensive cloud-based accounting software that handles your full accounting and teneduría de libros workflows, including general ledger, accounts receivable, and financial reporting.

3. Expense Management

- Destreza: Superior for expense claims and receipt capture. Its dedicated mobile scanning app makes it easy for pequeña empresa owners to capture receipts and manage expense claims.

- Xero: Includes expense claims features, but Dext is generally more efficient and user-friendly for this specific task.

4. Direct Integrations

- Destreza: Built for deep integration with accounting packages like Xero accounting software and QuickBooks Online, ensuring a reliable and secure data flow of financial documents.

- Xero: Features a vast app marketplace for a wide range of direct integrations, allowing connections to other business tools.

5. Supplier Rules and Categorization

- Destreza: Allows users to set specific supplier rules and tracking categories to automate how documents are categorized and processed, helping to save time.

- Xero: Uses bank rules to automate bank reconciliations but relies on the integrated app (like Dext) for most automated document categorization.

6. Financial Reporting and Cash Flow

- Destreza: Essential for accurate reports by ensuring complete data collection of receipts and invoices, but it doesn’t generate the final reports itself.

- Xero: The central hub for financial reportando. It provides dashboards, cash flow forecasts, and customizable reports for a clear view of business performance.

7. Pricing Plans

- Destreza: Pricing plans are typically based on the volume of documents (like receipts and invoices) you process monthly. You can start a free trial.

- Xero: Pricing plans (early plan, established plan) are based on the overall feature set you need, such as unlimited invoices or multi-currency support. You can start a free trial today.

8. Security and System Dependability

- Destreza: Ensures secure data flow and high system dependability during the transfer of financial documents to your main contabilidad sistema.

- Xero: Provides a comprehensive seguridad solution as a full cloud-based accounting software, including strong user permissions and continuous security monitoring.

¿Qué tener en cuenta al elegir un software de contabilidad?

- Financial Tasks y Características principales: Does the software handle all the financial tasks you need, from online invoicing to accounts payable and bank transactions? Look for advanced features that support business growth.

- Facilidad de uso: Does it have a user friendly interface like the Xero dashboard? Is it easy for your team or independent contractors to use Xero?

- ERP Capabilities: Do you need complete enterprise resource planning? Xero contabilidad software erp can offer many functions to help established businesses and growing businesses manage inventory and other complex needs.

- Data Flow: Does it provide automatic bank feeds and help you capture bills easily to see your financial position in real-time data?

- Escalabilidad: Can it support multiple currencies, and is it suitable for expanding businesses or those with multiple locations?

- Support and Learning: Is there good customer support and helpful online resources like Xero Central? Can you test Xero with a free trial?

- Reporting and Insights: Does it offer strong Xero reporting features for cash flow management and tracking a business’s financial health?

- Mobile Access: Can you access your financial records on the go using iOS and Android devices for tasks like project tracking?

Veredicto final

So, what’s the final word?

If your business simply needs to collect receipts, track expenses, and stop the manual entry of invoices owed and bills, then Dext works perfectly.

It dext saves you time and helps your clients by removing hassle.

But for a complete financial solution, we recommend Xero.

Xero excels as the best accounting software because it covers full financial management, inventory management, and features like payable functionality, purchase orders, and handling sales tax.

Even considering the initial xero cost.

Its comprehensive nature and ability to manage all your financial details and inventory data hacer it a better long-term choice for professional services.

Más de Dext

También hemos analizado cómo se compara Dext con otras herramientas de contabilidad y gestión de gastos:

- Dext frente a Xero: Xero ofrece contabilidad integral con funciones integradas de gestión de gastos.

- Dext contra Rompecabezas IO: Puzzle IO destaca por sus perspectivas y previsiones financieras basadas en IA.

- Dext contra Synder: Synder se centra en la sincronización de datos de ventas de comercio electrónico y el procesamiento de pagos.

- Dext vs Easy Month End: Easy Month End agiliza los procedimientos de cierre financiero de fin de mes.

- Dext frente a Docyt: Docyt utiliza IA para automatizar tareas de contabilidad y gestión documental.

- Dext frente a RefreshMe: RefreshMe proporciona información en tiempo real sobre el rendimiento financiero de la empresa.

- Dext contra Sage: Sage ofrece una gama de soluciones de contabilidad con capacidades de seguimiento de gastos.

- Dext frente a Zoho Books: Zoho Books proporciona contabilidad integrada con funciones de gestión de gastos.

- Dext contra Wave: Wave ofrece software de contabilidad gratuito con funciones básicas de seguimiento de gastos.

- Dext frente a Quicken: Quicken es popular para las finanzas personales y el seguimiento de gastos comerciales básicos.

- Dext contra Hubdoc: Hubdoc se especializa en la recopilación automatizada de documentos y la extracción de datos.

- Dext frente a Expensify: Expensify ofrece soluciones sólidas de informes y gestión de gastos.

- Dext frente a QuickBooks: QuickBooks es un software de contabilidad ampliamente utilizado con herramientas de gestión de gastos.

- Dext frente a entrada automática: AutoEntry automatiza la entrada de datos de facturas, recibos y extractos bancarios.

- Dext frente a FreshBooks: FreshBooks está diseñado para empresas de servicios con facturación y seguimiento de gastos.

- Dext frente a NetSuite: NetSuite ofrece un sistema ERP integral con funcionalidades de gestión de gastos.

Más de Xero

Elegir el software de contabilidad adecuado implica considerar varias opciones.

He aquí una rápida comparación entre Xero y otros productos populares.

- Xero frente a QuickBooks: QuickBooks es un competidor importante. Si bien ambos ofrecen funciones básicas similares, Xero suele ser elogiado por su interfaz clara y su número ilimitado de usuarios. QuickBooks puede ser más complejo, pero ofrece informes muy eficaces.

- Xero frente a FreshBooks: FreshBooks es una opción popular, especialmente para autónomos y empresas de servicios. Destaca por su facturación y control de horas trabajadas. Xero ofrece una solución de contabilidad más completa.

- Xero frente a Sage: Tanto Sage como Xero ofrecen soluciones para pequeñas empresas. Sin embargo, Sage también proporciona herramientas de planificación de recursos empresariales (ERP) más completas para empresas más grandes.

- Xero vs. Zoho Books: Zoho Books forma parte de una amplia gama de aplicaciones empresariales. Suele ofrecer funciones de inventario más avanzadas y es muy rentable. Xero, por su parte, es una opción líder por su simplicidad y facilidad de uso.

- Xero frente a Wave: Wave es conocido por su plan gratuito. Es una excelente opción para pequeñas empresas o autónomos con un presupuesto ajustado. Xero ofrece una gama más amplia de funciones y es ideal para el crecimiento empresarial.

- Xero frente a Quicken: Quicken se centra principalmente en finanzas personales. Si bien ofrece algunas funciones empresariales, no es una auténtica solución de contabilidad empresarial. Xero está diseñado específicamente para gestionar las complejidades de la contabilidad empresarial.

- Xero frente a HubdocEstos no son competidores directos. Tanto Dext como Hubdoc son herramientas que automatizan la captura de documentos y la entrada de datos. Se integran directamente con Xero para agilizar y hacer más precisa la contabilidad.

- Xero frente a Synder: Synder es una plataforma que conecta canales de venta y pasarelas de pago con software de contabilidad. Ayuda a automatizar la entrada de datos desde plataformas como Shopify y Stripe directamente a Xero.

- Xero frente a ExpensifyExpensify se centra específicamente en la gestión de gastos. Si bien Xero cuenta con funciones de gastos, Expensify ofrece herramientas más avanzadas para gestionar los gastos y reembolsos de los empleados.

- Xero frente a Netsuite: Netsuite es un sistema ERP integral para grandes corporaciones. Ofrece un conjunto completo de herramientas de gestión empresarial. Xero no es un ERP, pero es una excelente solución de contabilidad para pequeñas empresas.

- Xero frente a Puzzle IO: Puzzle IO es una plataforma financiera diseñada para empresas emergentes, centrada en estados financieros en tiempo real y entrada de datos automatizada.

- Xero vs. Easy Month End: Este software es una herramienta especializada para automatizar el proceso de cierre de mes, facilitando la conciliación y los registros de auditoría. Está diseñado para funcionar con Xero, no para reemplazarlo.

- Xero frente a Docyt: Docyt utiliza IA para automatizar las tareas administrativas y de contabilidad. Permite consultar todos sus documentos y datos financieros en un solo lugar.

- Xero frente a RefreshMe: RefreshMe es un software de contabilidad más simple con funciones básicas, a menudo utilizado para finanzas personales o empresas muy pequeñas.

- Xero frente a AutoEntry: Similar a Dext y Hubdoc, AutoEntry es una herramienta que automatiza la extracción de datos de recibos y facturas, diseñada para integrarse y mejorar el software de contabilidad como Xero.

Preguntas frecuentes

What is a Cloudflare Ray ID, and why is it found?

A Cloudflare Ray ID is a unique code assigned by Cloudflare, a web security service. If you see a blocked message, this cloudflare ray id helps the site owner and support teams track and fix issues like potential online attacks or errors.

How fast does Dext process receipts and invoices?

Dext offers multiple ways to submit receipts and invoices, including email submission. Thanks to its advanced optical character recognition, it only takes just a few minutes for the dext account to extract and process the cost and sales data.

Is Xero’s security strong for client data?

Yes. As shown in any xero accounting software review, Xero uses a strong security service to protect your client data. Xero lets you safely manage finances and schedule payments without worrying about online attacks.

What should I do if Dext shows a certain word error?

If you see an error with a certain word or malformed data, it means Dext’s extraction system needs you to store receipts correctly. You can try dext to see the suggested fix, ensuring high use and system dependability.

How does Dext’s use of OCR technology work?

Dext uses optical character recognition to read the texto on a picture of a receipt or invoice. This technology automatically extracts all the key financial details, saving you time from manual entry when you collect receipts and upload them to your Dext account.