¿Estás tratando de elegir la herramienta de administración de dinero adecuada para tu negocio? negocio?

¡Puede parecer un gran rompecabezas!

Dos nombres que quizás hayas oído son Dext y Wave.

En este artículo, analizaremos en detalle Dext vs Wave.

Desglosaremos lo que hacen y cómo pueden ayudar a que su negocio brille.

¡Comencemos!

Descripción general

Probamos tanto a Dext como a Wave, tal como lo harías tú.

Probamos sus características principales.

Observamos lo fáciles que eran de utilizar.

Esto nos ayuda a mostrarle cómo se comparan entre sí.

¿Listo para recuperar más de 10 horas al mes? Descubre cómo Dext automatiza la entrada de datos, el seguimiento de gastos y la optimización de tus finanzas.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $24 al mes.

Características principales:

- Escaneo de recibos

- Informes de gastos

- Conciliación bancaria

Más de 4 millones pequeñas empresas Confíe en Wave para administrar sus finanzas. Explore los planes de Wave y encuentre el ideal.

Precios: Plan gratuito disponible. Plan de pago desde $19 al mes.

Características principales:

- Facturación

- Bancario

- Complemento de nómina.

¿Qué es Dext?

Bien, entonces ¿qué es Dext?

Piense en ello como un ayudante súper inteligente para sus papeles.

Se encarga principalmente de cosas como facturas y recibos.

Simplemente toma una fotografía y Dext obtiene toda la información importante.

Bastante ordenado, ¿verdad?

Además, explora nuestros favoritos Alternativas a Dext…

Nuestra opinión

¿Listo para recuperar más de 10 horas al mes? Descubre cómo la entrada de datos automatizada, el seguimiento de gastos y la generación de informes de Dext pueden optimizar tus finanzas.

Beneficios clave

Dext realmente brilla cuando se trata de hacer que la gestión de gastos sea muy sencilla.

- El 90% de los usuarios informan una disminución significativa en el desorden de papeles.

- Cuenta con una tasa de precisión de más del 98%. en la extracción de datos de documentos.

- Crear informes de gastos se vuelve increíblemente rápido y fácil.

- Se integra sin problemas con plataformas de contabilidad populares, como QuickBooks y Xero.

- Ayuda a garantizar que nunca pierda el rastro de documentos financieros importantes.

Precios

- Suscripción anual: $24

Ventajas

Contras

¿Qué es Wave?

Bien, hablemos de Wave.

Piense en ello como un amigo útil para el dinero de su negocio.

Le permite hacer cosas como enviar facturas y realizar un seguimiento del dinero que entra y sale.

Puede ayudarle a ver el panorama general de las finanzas de su negocio.

Además, explora nuestros favoritos Alternativas de olas…

Nuestra opinión

¡No te conformes con menos! Únete a los más de 2 millones de pequeñas empresas que confían hoy mismo en las potentes funciones de contabilidad gratuitas de Wave para optimizar sus finanzas.

Beneficios clave

Los puntos fuertes de Wave incluyen:

- Un plan de contabilidad básico 100% gratuito.

- Sirviendo a más de 2 millones de pequeñas empresas.

- Fácil creación de facturas y procesamiento de pagos.

- Sin contratos a largo plazo ni garantías.

Precios

- Plan de inicio: $0 al mes.

- Plan Pro: $19 al mes.

Ventajas

Contras

Comparación de características

Aquí es donde profundizamos en las características.

Analizamos lo que Dext y Wave pueden hacer para ayudarle a decidir.

Esta sencilla comparación le mostrará las diferencias clave.

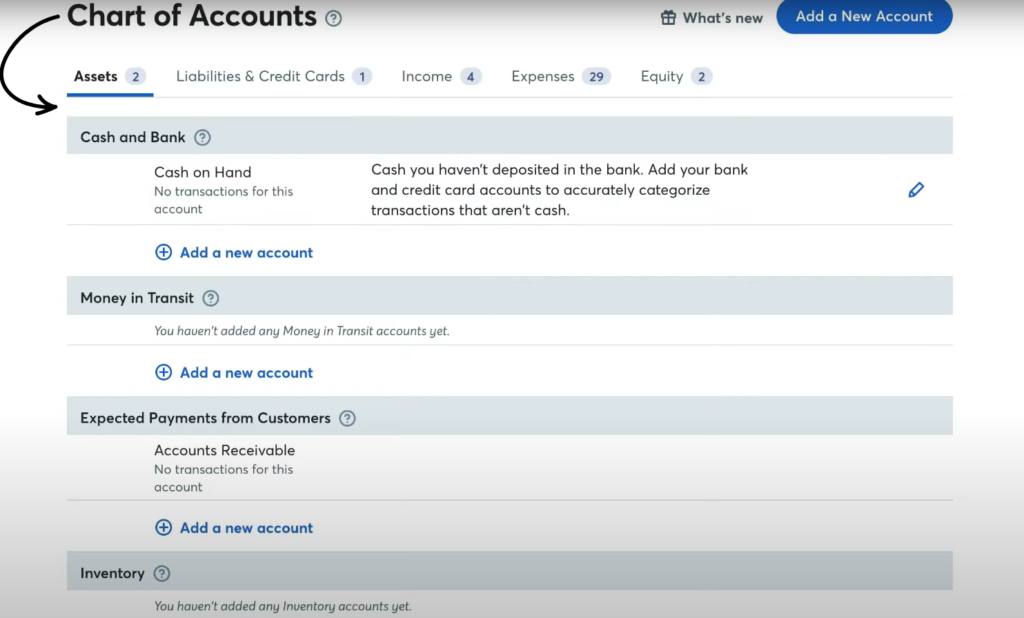

1. Flujos de trabajo de contabilidad y teneduría de libros

- Contabilidad de ondas es un completo pequeña empresa software de contabilidad. Está diseñado para una gestión completa teneduría de libros flujos de trabajo. Esto incluye el libro mayor, la facturación y los flujos de trabajo básicos. reportandoPuedes hacer todo desde una plataforma gratuita.

- Dext Es principalmente una herramienta para automatizar la entrada de datos para agilizar teneduría de libros flujos de trabajo. Su función es incorporar de forma eficiente datos financieros como recibos y facturas a su sistema existente. contabilidad sistema, como QuickBooks Online.

2. Reducción de la entrada manual de datos

- Dext Se destaca por minimizar la entrada manual de datos. Utiliza potente tecnología OCR (reconocimiento óptico de caracteres) para extraer datos de documentos financieros como recibos, facturas y recibos. Esto reduce considerablemente la entrada manual de datos de costos y ventas.

- Ola Contabilidad también ofrece captura digital de recibos, pero es más bien una función integrada en la suite contable. Si bien utiliza OCR, la función principal es la contabilidad completa y teneduría de libros flujos de trabajo, no sólo el proceso de extracción de datos.

3. Captura y envío de recibos

- Dext Ofrece múltiples maneras de enviar recibos y facturas. Puede usar la aplicación móvil de Dext para escanearlos, reenviarlos por correo electrónico o usar su función de obtención de facturas. Esto agiliza y facilita la recopilación de datos en tan solo unos minutos.

- Ola También proporciona una aplicación móvil para la captura de recibos, lo que permite pequeña empresa Los propietarios pueden capturar y almacenar recibos. Sin embargo, el enfoque de Dext en esta área implica que suele contar con funciones más avanzadas de gestión de recibos y gastos.

4. Integraciones directas con software de contabilidad

- Dext está diseñado para una integración profunda con sistemas de contabilidad populares como QuickBooks Online y XeroLos datos que extrae de los documentos fluyen directamente a la plataforma elegida, donde usted maneja el resto de su contabilidad y teneduría de libros flujos de trabajo.

- Ola Es un sistema todo en uno, por lo que tiene menos integraciones directas con otras plataformas de contabilidad importantes. Sin embargo, wave se integra con diversos servicios de pago y nómina.

5. Transacciones bancarias de importación de automóviles

- Ola Ofrece información bancaria y permite importar automáticamente transacciones bancarias desde sus cuentas bancarias y el historial de transacciones de tarjetas de crédito. Esta es una parte fundamental de sus funciones de contabilidad gratuitas para ayudarle a conciliar y controlar gastos automáticamente.

- Dext Se centra en los datos de documentos. Si bien puede gestionar la extracción de extractos bancarios (preparación de dext), su función principal no es la gestión de transacciones bancarias diarias como un sistema de contabilidad especializado.

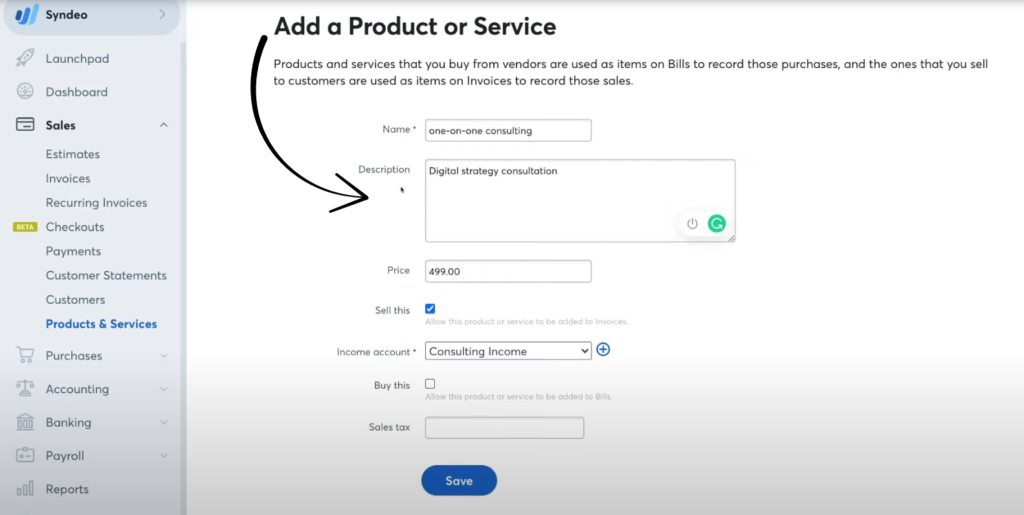

6. Funciones de facturación y pagos

- Ola Ofrece un potente software de facturación como parte de su plataforma gratuita. Obtendrás facturas ilimitadas, podrás aceptar pagos en línea (con comisiones) y configurar recordatorios de pago automáticos y facturas recurrentes.

- DextSe centra en la captura de facturas y órdenes de compra (salidas de dinero). Si bien puede gestionar la captura de datos de ventas desde plataformas de ventas, no crea ni gestiona facturas de clientes directamente.

7. Prueba gratuita y costo

- Ola es famoso por su plan de inicio gratuito y gratuito software de contabilidad, lo que la convierte en una plataforma gratuita fantástica para muchos propietarios de pequeñas empresas. No se requiere una prueba gratuita para las funciones principales de contabilidad, solo un plan profesional de pago para los complementos.

- Dext Es un servicio de suscripción de pago, pero Dext suele ofrecer varias maneras de probarlo con una prueba gratuita. El costo generalmente depende de la cantidad de documentos que procese, ya que Dext le ahorra tiempo en la entrada manual de datos.

8. Gestión multiempresa

- Ola permite a los propietarios de pequeñas empresas administrar varias empresas y separarlas teneduría de libros registros dentro de una única plataforma gratuita, lo que supone un gran beneficio para los trabajadores independientes o aquellos con proyectos paralelos.

- Dext Está diseñado para atender a clientes que suelen tener un contador o tenedor de libros. Facilita la gestión de las declaraciones de gastos y los documentos financieros de varias empresas en una sola cuenta.

9. Funciones de gestión de gastos

- Dext Es esencialmente una herramienta especializada en la gestión de gastos. Permite a los usuarios configurar reglas de proveedores y categorías de seguimiento para automatizar la clasificación y codificación de documentos. capacidad profundiza en la gestión de gastos.

- Ola Permite realizar el seguimiento de gastos dentro de su libro mayor. Utiliza reglas de categorización y alimentación bancaria, pero carece de las herramientas avanzadas de automatización de entrada de datos y flujo de trabajo específicas para cada documento que ofrece Dext.

10. Servicio de Confiabilidad y Seguridad del Sistema

- Both platforms offer robust seguridadWave utiliza funciones como la autenticación multifactor para una buena solución de seguridad.

- Dext Se prioriza el flujo seguro de datos, alojando datos con AWS con cifrado estándar del sector. Si se produce un error de conexión, es posible que aparezca un mensaje de ID de Ray de Cloudflare, un identificador común de servicio de seguridad para la resolución de problemas web. El ID de Ray de Cloudflare encontrado no es una función real, sino una nota de servicio de seguridad.

11. Escalabilidad empresarial y funciones avanzadas

- Ola es perfecto para comenzar, pero puede carecer de funciones avanzadas para empresas de rápido crecimiento o complejas, como seguimiento de inventario profundo o seguimiento de clases integral, lo que puede requerir un plan profesional pago o una alternativa.

- Dext Se escala bien porque su función sigue siendo la misma, independientemente de su tamaño: simplificar la extracción de datos. A medida que su negocio crece, usted procesa más documentos, y dext le ahorra aún más tiempo al eliminar las complicaciones.

¿Qué tener en cuenta al elegir un software de contabilidad?

Cuando esté listo para elegir su software, tenga en cuenta estos puntos:

- Tu objetivo principal¿Necesita una versión completa, a menudo gratuita, para contabilidad básica y nóminas (revisión de contabilidad de Wave)? ¿O necesita una herramienta como Dext Accounting, que se centra en ayudarle a registrar recibos y ahorrar tiempo en la entrada de datos?

- Necesidades del usuarioConsidere si necesita dar soporte a varios usuarios o a un número ilimitado de ellos. Wave está diseñado para la nómina de contratistas independientes o empleados activos mediante Wave Payroll y depósito directo (con costo adicional).

- Características principalesConsulta las funciones principales. ¿El software te ayuda con la gestión financiera y tu flujo de caja diario? Wave lo simplifica con dos planes y una versión gratuita.

- Manejo de transaccionesVea cómo la plataforma gestiona su dinero. ¿Puede procesar pagos con tarjeta de crédito y bancarios? Wave Financial le permite aceptar pagos en línea, incluyendo Apple Pay, y ofrece facturación recurrente.

- Gestión de gastos y datosBusque la facilidad para gestionar los gastos. ¿Puede recopilar recibos con rapidez y precisión? Busque un alto nivel de uso y fiabilidad del sistema para evitar problemas como datos malformados o errores.

- Informes e impuestos¿Te proporciona informes financieros claros para un periodo específico? ¿Te ayuda con tu declaración de impuestos? Las funciones de pago de Wave te ayudan con la información fiscal de tu contratista independiente.

- Apoyo y confianzaConsulta el centro de ayuda al cliente y las opiniones de los usuarios en Wave. Un buen soporte técnico ofrece tranquilidad y puede ayudar cuando falla un comando SQL o en caso de ataques en línea.

- Precios y valorRevisa los diferentes planes de precios y cualquier costo adicional. Comprueba si un plan de pago ofrece suficiente valor o si deberías probar Dext con una prueba gratuita hoy mismo para ver si se adapta a tus necesidades con un descuento.

Veredicto final

Si su necesidad principal es una plataforma gratuita para gestionar la contabilidad completa de su negocio, le recomendamos wave.

Wave es la mejor opción para los propietarios de pequeñas empresas.

Le ofrece muchas funciones básicas, como facturación y procesamiento de pagos básicos, sin costo inmediato.

Maneja sus transacciones automáticamente y administra cosas como pagos con tarjeta de crédito y complementos de procesamiento de nómina.

Sin embargo, si ya tienes un contador y simplemente necesitas ahorrar tiempo y dejar de ingresar manualmente datos de recibos y facturas,

Dext es la mejor opción. Su extracción de datos activada fue mejor.

Hemos tomado varias medidas para probar ambos por completo.

Como propietario del sitio, le recomendamos que elija según si necesita un sistema de contabilidad completo o una herramienta de automatización de datos.

Más de Dext

También hemos analizado cómo se compara Dext con otras herramientas de contabilidad y gestión de gastos:

- Dext frente a Xero: Xero ofrece contabilidad integral con funciones integradas de gestión de gastos.

- Dext contra Rompecabezas IO: Puzzle IO destaca por sus perspectivas y previsiones financieras basadas en IA.

- Dext contra Synder: Synder se centra en la sincronización de datos de ventas de comercio electrónico y el procesamiento de pagos.

- Dext vs Easy Month End: Easy Month End agiliza los procedimientos de cierre financiero de fin de mes.

- Dext frente a Docyt: Docyt utiliza IA para automatizar tareas de contabilidad y gestión documental.

- Dext frente a RefreshMe: RefreshMe proporciona información en tiempo real sobre el rendimiento financiero de la empresa.

- Dext contra Sage: Sage ofrece una gama de soluciones de contabilidad con capacidades de seguimiento de gastos.

- Dext frente a Zoho Books: Zoho Books proporciona contabilidad integrada con funciones de gestión de gastos.

- Dext contra Wave: Wave ofrece software de contabilidad gratuito con funciones básicas de seguimiento de gastos.

- Dext frente a Quicken: Quicken es popular para las finanzas personales y el seguimiento de gastos comerciales básicos.

- Dext contra Hubdoc: Hubdoc se especializa en la recopilación automatizada de documentos y la extracción de datos.

- Dext frente a Expensify: Expensify ofrece soluciones sólidas de informes y gestión de gastos.

- Dext frente a QuickBooks: QuickBooks es un software de contabilidad ampliamente utilizado con herramientas de gestión de gastos.

- Dext frente a entrada automática: AutoEntry automatiza la entrada de datos de facturas, recibos y extractos bancarios.

- Dext frente a FreshBooks: FreshBooks está diseñado para empresas de servicios con facturación y seguimiento de gastos.

- Dext frente a NetSuite: NetSuite ofrece un sistema ERP integral con funcionalidades de gestión de gastos.

Más de Wave

- Ola vs. Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Wave contra DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Wave frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave contra SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Ola vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Wave vs. DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Wave vs SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Wave frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Wave frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Wave frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Wave frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Onda vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Wave frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Wave frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Cuál es la principal diferencia entre Dext y Wave?

Wave es una plataforma de contabilidad integral que ofrece servicios básicos gratuitos de contabilidad, facturación y seguimiento de gastos. Dext se centra en la captura eficiente de datos de recibos y facturas, integrándose a menudo con otros programas de contabilidad.

¿Wave es completamente gratuito?

Wave ofrece un plan gratuito para sus funciones principales de contabilidad, facturación y escaneo de recibos. Sin embargo, cobran comisiones por los pagos en línea, los servicios de nómina y el soporte contable experto.

¿Dext funciona por sí solo como software de contabilidad?

No, Dext está diseñado principalmente para funcionar con otros programas de contabilidad como QuickBooks o Xero. Ayuda a agilizar el proceso de introducción de datos financieros en estas plataformas.

¿Qué software es mejor para una empresa muy pequeña o un profesional autónomo?

Wave suele ser un excelente punto de partida para empresas muy pequeñas y trabajadores autónomos gracias a sus funciones básicas gratuitas y su facilidad de uso para la facturación y el seguimiento de gastos.

¿Puedo cambiar mis datos de Dext a Wave o viceversa?

La transferencia directa de datos entre Dext y Wave podría no ser fluida. Probablemente necesite exportar datos de una plataforma e importarlos a la otra, lo que podría requerir trabajo manual.