Are you tired of month-end closing taking forever?

It can feel like a huge headache, right?

All those papers and numbers can get confusing.

Two of these are Dext vs Easy Month End.

Let’s take a look at how these tools can help you say goodbye to month-end stress!

Descripción general

We looked closely at both Dext and Easy Month End.

We tried them out to see how they work.

This helped us understand what each one is good at.

Now we can compare them and show you what we found.

¿Listo para recuperar más de 10 horas al mes? Descubre cómo Dext automatiza la entrada de datos, el seguimiento de gastos y la optimización de tus finanzas.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $24 al mes.

Características principales:

- Escaneo de recibos

- Informes de gastos

- Conciliación bancaria

Este fin de mes fácil, únete a 1257 usuarios que ahorraron un promedio de 3,5 horas y redujeron los errores en un 15 %. ¡Comienza tu prueba gratuita!

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $45 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

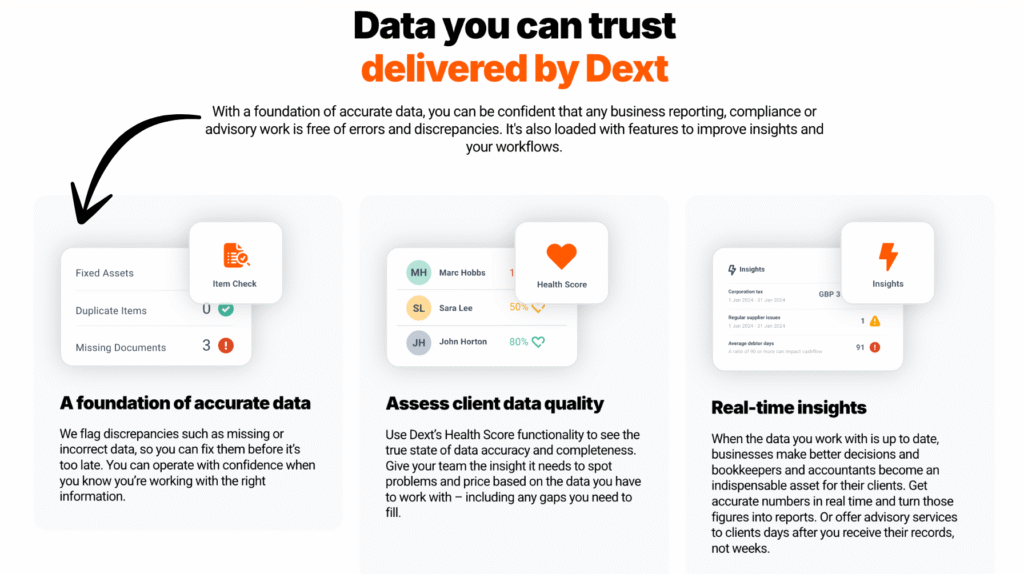

¿Qué es Dext?

Bien, entonces ¿qué es Dext?

Piense en ello como un ayudante súper inteligente para sus papeles.

Se encarga principalmente de cosas como facturas y recibos.

Simplemente toma una fotografía y Dext obtiene toda la información importante.

Desbloquea su potencial con nuestro Alternativas a Dext…

Nuestra opinión

¿Listo para recuperar más de 10 horas al mes? Descubre cómo la entrada de datos automatizada, el seguimiento de gastos y la generación de informes de Dext pueden optimizar tus finanzas.

Beneficios clave

Dext realmente brilla cuando se trata de hacer que la gestión de gastos sea muy sencilla.

- El 90% de los usuarios informan una disminución significativa en el desorden de papeles.

- Cuenta con una tasa de precisión de más del 98%. en la extracción de datos de documentos.

- Crear informes de gastos se vuelve increíblemente rápido y fácil.

- Se integra sin problemas con plataformas de contabilidad populares, como QuickBooks y Xero.

- Ayuda a garantizar que nunca pierda el rastro de documentos financieros importantes.

Precios

- Suscripción anual: $24

Ventajas

Contras

¿Qué es Easy Month End?

Entonces, Easy Month End es como un ayudante para cuando termina el mes.

Intenta hacer cerrar tus libros más fácilmente.

Piense en ello como una forma de mantener todo su dinero en un solo lugar al final del mes.

Le ayuda a ver cuánto dinero entró y cuánto salió.

Desbloquea su potencial con nuestro Alternativas fáciles para el fin de mes…

Nuestra opinión

Aumente la precisión financiera con Easy Month End. Aproveche la conciliación automatizada y los informes listos para auditoría. Programe una demostración personalizada para optimizar su proceso de cierre de mes.

Beneficios clave

- Flujos de trabajo de conciliación automatizados

- Gestión y seguimiento de tareas

- Análisis de varianza

- Gestión de documentos

- Herramientas de colaboración

Precios

- Motor de arranque:$24/mes.

- Pequeño: $45/mes.

- Compañía: $89/mes.

- Empresa: Precios personalizados.

Ventajas

Contras

Comparación de características

We looked at both Dext and Easy Month End closely.

This comparison shows what each tool is best at doing for your finance team.

1. Receipt Capture and Data Extraction

- Dext is an expert at automating datos entry. It gives you multiple ways to capture receipts and other financial documents. You can use the Dext mobile app, send an email, or have it get receipts and invoices straight from suppliers.

- It uses OCR technology to quickly extract data and removes the need for manual entry.

- Fin de mes fácil does not focus on the first step of data collection from documents.

2. Data Extraction Accuracy

- Dext (formerly Receipt Bank) is known for its high accuracy when using its optical character recognition to extract data. This helps you avoid errors.

- Fin de mes fácil is a workflow tool, so data extraction is not its main job.

3. Accounting Software Direct Integrations

- Dext has deep integration with all major contabilidad software, like QuickBooks Online and Xero. This helps with a secure data flow of all your cost and sales data.

- Fin de mes fácil also connects with QuickBooks Online and Xero. Its main goal is to pull balance sheets for reconciliation.

4. Supplier Rules and Categorisation

- Dext lets you set up supplier rules. You can tell the system how to handle documents from a certain word or supplier automatically. This makes teneduría de libros workflows more efficient.

- Fin de mes fácil does not have a feature for setting up these specific supplier rules.

5. Balance Sheet Reconciliation

- Fin de mes fácil is made to handle the month-end process. It is excellent at balance sheet reconciliation. It connects to your contabilidad data, shows balances, and helps you get sign offs on all your reconciliations in one spot.

- Dext Prepare focuses on pre-accounting, but it supports bank reconciliation with its accurate data extraction and bank feeds.

6. Team Collaboration and Workflow Management

- Fin de mes fácil is a strong workflow management tool for the finance team. It lets you make task checklists for the month-end process, assign work, leave comments, and track sign offs. This helps with team collaboration.

- Dext focuses more on the collaboration needed between small negocio owners and their accountants for submitting and processing documents quickly.

7. Audit Evidence and Compliance

- Fin de mes fácil helps you collect auditoría evidence. It keeps a log of tasks, documents, preparer and reviewer sign-offs, and all in a single platform. This ensures compliance for auditors.

- Dext helps by keeping all your original documents and extracted data stored securely in the cloud.

8. Expense Claims and Management

- Dext gives employees an easy way to submit receipts and expense claims using the Dext mobile app. This makes it easy to track expenses and manage expenses.

- Fin de mes fácil can track the task of reviewing expense claims, but it does not handle the initial receipt capture receipts and submission part.

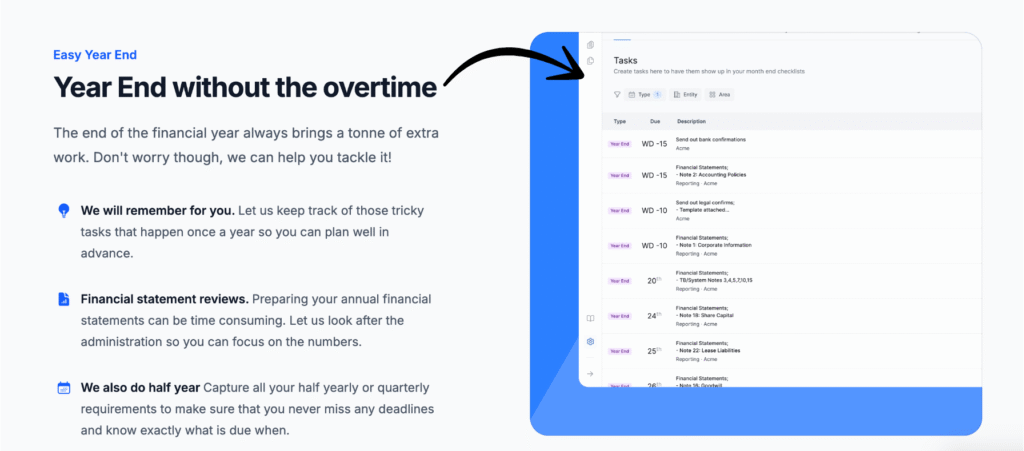

9. Year End and Quarter-End Support

- Fin de mes fácil works as a checklist for the month-end process, quarter-end, and year-end. You can manage all your recurring accounting and teneduría de libros workflows from one spot.

- Dext provides consistent, accurate, and timely data, which is key for all those reportando periods.

10. System Dependability and Security

- Both tools offer a seguridad solution for secure data flow.

- Dext has a strong reputation for system dependability in its data collection and extraction.

- Fin de mes fácil offers a high level of security service and compliance features in its top pricing plans to protect financial data.

¿Qué tener en cuenta al elegir un software de contabilidad?

Here are the key things to look at when choosing the right tool to handle month-end for your finance team:

- Team Management and Efficiency: Look for features that support team management and make your finance team more efficient finance team. The goal is a smoother month-end close and an easier life for everyone.

- Reconciliation Speed: Does the tool help you achieve faster balance sheet reconciliations? This ability is a must-have to reconcile accounts quickly and stay on top of your balances.

- Flexibilidad del flujo de trabajo: Make sure the system can handle more than just monthly tasks. Can it manage ad hoc tasks and recurring items? This expanded scope improves efficiency.

- Payment and Contract Terms: Check how you pay. Can you cancel easily? Is the price clear, or are there hidden fees? Avoid being locked into long contracts.

- Ease of Use for Your Team: The platform should be easy for your team to access and use. If your team is stuck using Excel and Outlook for tracking, you need a modern solution to reduce delays.

- Preparación para auditoría: The tool must reduce hassle with manual confirmations. It should keep track of every completed task and all supporting documents you upload or import.

- Support for Multiple Entities: If you manage several companies, you need the ability to handle multiple entities easily from one place.

- Support and Communication: Can you quickly answer questions or submit a support ticket? Good support makes your first month-end a breeze.

Veredicto final

After looking closely at both tools, we choose Dext as the better platform for your team. Why?

Dext works best at removing hassle from the start of your teneduría de libros.

Es automatización of manual data entry is top-notch.

You can collect receipts and invoices using mobile scanning or email submission in just a few minutes.

This helps your whole finance team save time. Dext saves hours every week!

Additionally, the accurate data it extracts makes expense management much easier.

Easy Month End is great for tracking finance team tasks, but Dext is better at getting the data in right away.

Your finance team deserves the efficiency Dext provides. Try Dext with their free trial today.

Más de Dext

También hemos analizado cómo se compara Dext con otras herramientas de contabilidad y gestión de gastos:

- Dext frente a Xero: Xero ofrece contabilidad integral con funciones integradas de gestión de gastos.

- Dext contra Rompecabezas IO: Puzzle IO destaca por sus perspectivas y previsiones financieras basadas en IA.

- Dext contra Synder: Synder se centra en la sincronización de datos de ventas de comercio electrónico y el procesamiento de pagos.

- Dext vs Easy Month End: Easy Month End agiliza los procedimientos de cierre financiero de fin de mes.

- Dext frente a Docyt: Docyt utiliza IA para automatizar tareas de contabilidad y gestión documental.

- Dext frente a RefreshMe: RefreshMe proporciona información en tiempo real sobre el rendimiento financiero de la empresa.

- Dext contra Sage: Sage ofrece una gama de soluciones de contabilidad con capacidades de seguimiento de gastos.

- Dext frente a Zoho Books: Zoho Books proporciona contabilidad integrada con funciones de gestión de gastos.

- Dext contra Wave: Wave ofrece software de contabilidad gratuito con funciones básicas de seguimiento de gastos.

- Dext frente a Quicken: Quicken es popular para las finanzas personales y el seguimiento de gastos comerciales básicos.

- Dext contra Hubdoc: Hubdoc se especializa en la recopilación automatizada de documentos y la extracción de datos.

- Dext frente a Expensify: Expensify ofrece soluciones sólidas de informes y gestión de gastos.

- Dext frente a QuickBooks: QuickBooks es un software de contabilidad ampliamente utilizado con herramientas de gestión de gastos.

- Dext frente a entrada automática: AutoEntry automatiza la entrada de datos de facturas, recibos y extractos bancarios.

- Dext frente a FreshBooks: FreshBooks está diseñado para empresas de servicios con facturación y seguimiento de gastos.

- Dext frente a NetSuite: NetSuite ofrece un sistema ERP integral con funcionalidades de gestión de gastos.

Más de Fin de Mes Fácil

A continuación se muestra una breve comparación de Easy Month End con algunas de las principales alternativas.

- Fin de mes fácil vs Puzzle io: Mientras que Puzzle.io está destinado a la contabilidad de empresas emergentes, Easy Month End se centra específicamente en agilizar el proceso de cierre.

- Fin de mes fácil vs. Dext: Dext está destinado principalmente a la captura de documentos y recibos, mientras que Easy Month End es una herramienta integral de gestión de cierre de mes.

- Fin de mes fácil vs. Xero: Xero es una plataforma de contabilidad completa para pequeñas empresas, mientras que Easy Month End proporciona una solución dedicada al proceso de cierre.

- Fin de mes fácil vs. Synder: Synder se especializa en la integración de datos de comercio electrónico, a diferencia de Easy Month End, que es una herramienta de flujo de trabajo para todo el cierre financiero.

- Fin de mes fácil vs. Docyt: Docyt utiliza IA para la contabilidad y la entrada de datos, mientras que Easy Month End automatiza los pasos y tareas del cierre financiero.

- Fin de mes fácil vs. RefreshMe: RefreshMe es una plataforma de asesoramiento financiero, que se diferencia del enfoque de Easy Month End en la gestión cercana.

- Fin de mes fácil vs. Sage: Sage es una suite de gestión empresarial a gran escala, mientras que Easy Month End ofrece una solución más especializada para una función contable crítica.

- Fin de mes fácil vs. Zoho Books: Zoho Books es un software de contabilidad todo en uno, mientras que Easy Month End es una herramienta diseñada específicamente para el proceso de fin de mes.

- Fin de mes fácil vs. ola: Wave ofrece servicios de contabilidad gratuitos para pequeñas empresas, mientras que Easy Month End ofrece una solución más avanzada para la gestión cercana.

- Fin de mes fácil vs. Quicken: Quicken es una herramienta de finanzas personales, lo que hace que Easy Month End sea una mejor opción para las empresas que necesitan administrar el cierre de mes.

- Fin de mes fácil vs. Hubdoc: Hubdoc automatiza la recopilación de documentos, pero Easy Month End está diseñado para administrar todo el flujo de trabajo de cierre y las tareas del equipo.

- Fin de mes fácil vs. Expensify: Expensify es un software de gestión de gastos, que es una función diferente del enfoque principal de Easy Month End en el cierre financiero.

- Fin de mes fácil vs. QuickBooks: QuickBooks es una solución de contabilidad integral, mientras que Easy Month End es una herramienta más específica para gestionar el cierre de mes en sí.

- Fin de mes fácil vs. entrada automática: AutoEntry es una herramienta de captura de datos, mientras que Easy Month End es una plataforma completa para la gestión de tareas y flujo de trabajo durante el cierre.

- Fin de mes fácil vs. FreshBooks: FreshBooks está dirigido a autónomos y pequeñas empresas, mientras que Easy Month End ofrece una solución específica para el cierre de mes.

- Fin de mes fácil vs NetSuite: NetSuite es un sistema ERP completo, con un alcance más amplio que el enfoque especializado de Easy Month End en el cierre financiero.

Preguntas frecuentes

What is the main difference between Dext and Easy Month End?

Dext focuses more on automation like receipt and invoice processing and integrates with many software de contabilidad options. Easy Month End is simpler and mainly helps organize the month-end closing process.

¿Cuál es mejor para una pequeña empresa?

Dext is often better for a pequeña empresa wanting to automate tasks like expense reports and data entry, saving valuable time and improving accuracy.

Does Dext or Easy Month End offer a free trial?

Yes, Dext offers a free trial so you can test its features before committing. Easy Month End may also have a trial, but it’s good to check their website for details.

Can my accountant use Dext or Easy Month End?

Yes, accountants often find Dext very useful due to its advanced features and integration capabilities. Easy Month End can also be helpful for basic bookkeeping tasks.

Is Dext or Easy Month End easy to use?

Dext is generally considered very user-friendly with a well-designed mobile app. Easy Month End aims for simplicity, but some users find Dext’s interface more intuitive.