选择合适的 会计软件 feels like a huge task.

如果你 制作 the wrong choice?

A bad fit can cause real headaches.

You might waste precious time, miss tracking important expenses, or mess up your books.

That’s where we come in. We’re looking at two popular names: Puzzle IO vs Expensify.

概述

Through rigorous feature-by-feature analysis and hands-on testing of core functionalities like receipt scanning and report generation.

想简化您的财务管理吗?看看 Puzzle IO 如何每月为您节省多达 20 小时。体验一下它的不同之处。

定价: 提供免费套餐。付费套餐起价为每月 42.50 美元。

主要特点:

- 财务规划

- 预测

- 实时分析

加入超过 1500 万用户的行列,信赖 Expensify 简化您的财务管理。节省高达 83% 的费用报告时间。

定价: 它提供免费试用。高级套餐起价为每月 5 美元。

主要特点:

- SmartScan 收据采集

- 公司信用卡对账

- 高级审批工作流程。

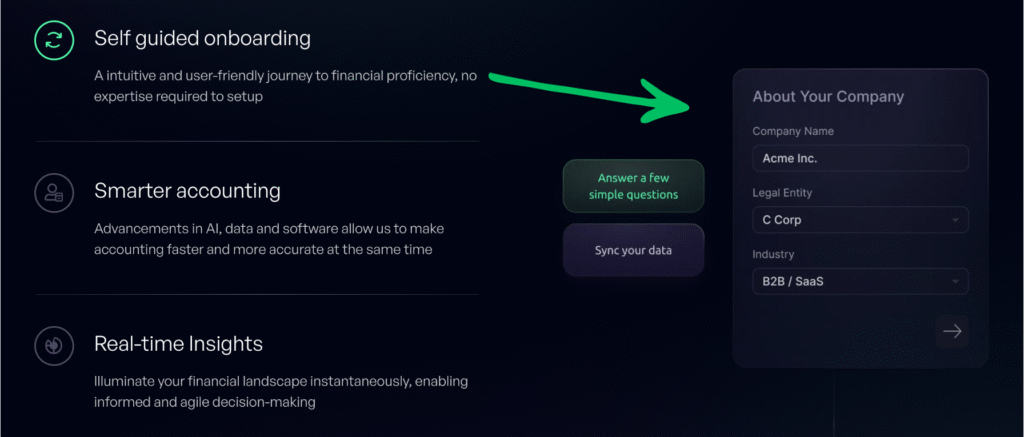

什么是 Puzzle IO?

Hey, so Puzzle IO, right? It’s an expense management tool.

It seems pretty focused on project costs. Good for keeping tabs on budgets.

此外,还可以探索我们最喜欢的 Puzzle IO 的替代方案…

我们的观点

想简化您的财务管理吗?看看 Puzzle io 如何每月为您节省多达 20 小时。立即体验它的与众不同!

主要优势

Puzzle IO 在帮助你了解企业发展方向方面表现出色。

- 92% 用户反馈财务预测准确率有所提高。

- 实时掌握您的现金流状况。

- 轻松创建不同的财务方案进行规划。

- 与团队无缝协作,共同实现财务目标。

- 在一个地方跟踪关键绩效指标(KPI)。

定价

- 会计基础知识: 每月0美元。

- Accounting Plus Insights: 每月 42.50 美元。

- Accounting Plus 高级自动化: 每月85美元。

- Accounting Plus 规模: 每月255美元。

优点

缺点

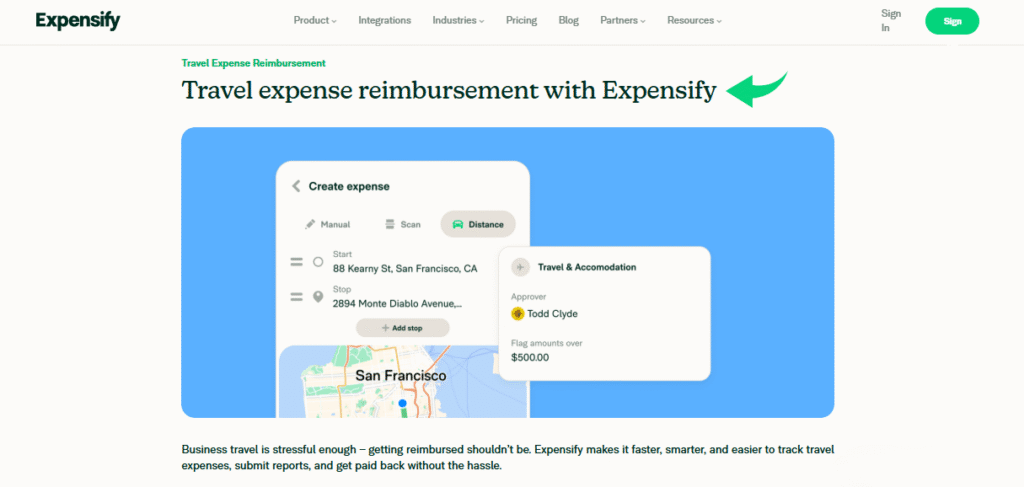

Expensify是什么?

Okay, so Expensify is another option.

It feels really strong on receipt handling. Their SmartScan seems pretty slick.

Good if you deal with lots of individual expenses.

此外,还可以探索我们最喜欢的 昂贵的替代方案…

主要优势

- SmartScan 技术能够扫描收据详情并以超过 95% 的准确率提取出来。

- 员工通常只需一个工作日即可通过 ACH 转账获得报销。

- Expensify 卡的现金返还计划可以帮你节省高达 50% 的订阅费用。

- 不提供任何担保;其条款规定责任有限。

定价

- 收集: 每月5美元。

- 控制: 定制定价。

优点

缺点

功能对比

导航 小型企业 finances can be challenging.

This comparison highlights key features of Puzzle IO and Expensify.

Examining how each platform addresses 簿记, expense reports, and automation to help you simplify financial management.

1. Core Audience & Focus

- Puzzle IO is a game-changer built for early-stage startups and co-founder teams, focusing on up-to-date financial statements and key metrics right out of the box.

- Expensify focuses on an efficient expense management process for employees and contractors, making it easy for them to file and for employers to reimburse.

2. Automated Bookkeeping

- Puzzle IO is designed for 自主 bookkeeping, using AI to automate tedious tasks and provide an accurate picture of the current state of the company quickly.

- Expensify 自动化 is concentrated on receipts and expense report creation, aiming to simplify the process for the user and their manager’s approval.

3. Startup Financial Health Metrics

- Puzzle IO provides startup founders with instant access to key metrics like cash 跑道, burn rate, and MRR, offering clear insights into their financial health.

- Expensify focuses on spending, helping companies control spending and reconcile the Expensify Card, but does not natively provide comprehensive startup metrics.

4. Complex Accrual Accounting

- Puzzle IO includes built-in accrual automation to handle complex items like revenue recognition and prepaid expenses automatically, which is vital for providing a true and accurate picture of revenue.

- Expensify does not focus on the underlying accrual 会计 logic for things like fixed assets and deferred revenue; its strength is expense capture.

5. Expense Reporting Experience

- Puzzle IO 允许 for transaction categorization and expense tracking, but does not specialize in complex, multi-level expense management processes and reimbursement workflows.

- Expensify makes it easy for the team to log mileage, snap a photo of a receipt in a few seconds, and get reimbursed quickly, which is a game-changer for employees.

6. AI-Powered Functionality

- Puzzle IO uses AI for smart transaction categorization, continuous accuracy checks, and streamlining the setup for non-accountants.

- Expensify uses its SmartScan technology for receipt 数据 extraction and AI-powered automation to match transactions, making the process less time-consuming.

7. Focus on Financial Statements

- Puzzle IO’s primary goal is to generate real-time, audit-ready financial statements, helping startup founders stay up to date and prepare for investors or tax time.

- Expensify is a pre-accounting tool that passes expense data to other tools like QuickBooks or Xero for final statement generation by a finance expert.

8. Corporate Card Management

- Puzzle IO integrates with various cards, focusing on getting data into the books quickly.

- Expensify offers the Expensify Card, which links seamlessly to its system, automates reconciliation, and allows employers to set smart spending limits.

9. Ease of Setup

- Puzzle IO 提供s an easy setup and a modern interface, minimizing errors and making it simple for the co founder who may be a non 会计师.

- Expensify also offers a quick and easy setup for the expense management process, which helps employees and contractors submit expenses and reports in less time.

选择会计软件时应该注意哪些方面?

- Look beyond basic Expensify reviews to see how the software handles the complete general ledger and organization.

- The software needs a reliable connection to your bank accounts to avoid manual data entry and reduce errors.

- Ensure the platform gives you a clear cash runway and not just a summary of past data—don’t wait for insights.

- The ability to manage expenses must be flexible, supporting phone, desktop, and web access.

- Check the speed of completing reports and the ease of exporting data to your clients or accountant.

- It should allow users to create and submit requests immediately, and managers to approve them quickly.

- The system must reliably respond to inputs and not be blocked by simple issues.

- All financial details should be securely stored in a digital pocket for easy review.

- The software should offer automated code assignment and customizable categories and tags.

- Your final thoughts should confirm that the system can scale with your future organization, moving you away from spreadsheets.

- A key insight is whether the platform is structured for a small number of users or a growing organization.

- An efficient system should trigger notifications when action is expected, simplifying the single-view page workflow.

- Consider why others chose Puzzle or a similar full-stack tool over a pure expense manager.

最终判决

Picking between Puzzle IO and Expensify depends on your main needs.

Expensify is tops for expense reports and receipts.

But Puzzle IO does more for overall money tracking, invoices, and connecting with payroll (even like QuickBooks).

Both are cloud-based.

If you want a wider view of your 商业, money, and something that can grow.

Puzzle IO wins. We checked them out carefully.

So our advice should help you choose the right software to save time.

Neither doesn’t really offer free 会计 for most businesses.

更多 Puzzle IO 内容

我们已经对比了 Puzzle IO 与其他会计工具的优劣。以下是其主要功能的简要介绍:

- Puzzle IO 对比 Xero: Xero提供功能全面的会计功能和强大的集成能力。

- Puzzle IO 对阵 Dext: Puzzle IO 在人工智能驱动的金融洞察和预测方面表现出色.

- Puzzle IO 对阵 Synder: Synder 在同步销售和支付数据方面表现出色。

- Puzzle IO 对比 Easy Month End: 简易月末结算简化了财务结算流程。

- Puzzle IO 对阵 Docyt: Docyt利用人工智能技术实现记账任务的自动化。

- Puzzle IO 对比 RefreshMe: RefreshMe专注于实时监控财务绩效。

- Puzzle IO 对阵 Sage: Sage 为各种规模的企业提供强大的会计解决方案。

- Puzzle IO 与 Zoho Books 的比较: Zoho Books 提供价格实惠的会计服务 客户关系管理 一体化。

- Puzzle IO 对阵 Wave: Wave 为小型企业提供免费的会计软件。

- Puzzle IO 对比 Quicken: Quicken 以个人和小企业财务管理而闻名。

- Puzzle IO 与 Hubdoc: Hubdoc 专门从事文档收集和数据提取。.

- Puzzle IO 对比 Expensify: Expensify 提供全面的费用报告和管理服务。

- Puzzle IO 对比 QuickBooks: QuickBooks是小型企业会计的热门选择。

- Puzzle IO 对比 AutoEntry: AutoEntry 可自动从发票和收据中录入数据。

- Puzzle IO 对比 FreshBooks: FreshBooks 专为服务型企业的发票处理而设计。

- Puzzle IO 对比 NetSuite: NetSuite 提供了一套全面的企业资源规划解决方案。

Expensify 的更多内容

- Expensify 与 Puzzle这款软件专注于为初创企业提供人工智能驱动的财务规划。它的对应产品则面向个人理财。

- Expensify 与 Dext这是一个用于记录收据和发票的商业工具。另一个工具用于追踪个人支出。

- Expensify 与 Xero 的比较这是面向小型企业的热门在线会计软件。它的竞争对手是面向个人用户的。

- Expensify 与 Synder该工具可将电子商务数据与会计软件同步。其替代版本则专注于个人理财。

- Expensify 与 Easy Month End 对比这是一个用于简化月末工作的商业工具。它的竞争对手是用于管理个人财务的工具。

- Expensify 与 Docyt一个应用人工智能进行企业记账和自动化,另一个应用则将人工智能用作个人理财助手。

- Expensify 与 Sage 的比较这是一个功能全面的企业会计软件。它的竞争对手是一款更易于使用的个人理财工具。

- Expensify 与 Zoho Books 的比较这是一个面向小型企业的在线会计工具。它的竞争对手是面向个人用户的。

- Expensify 与 Wave 的比较这款软件为小型企业提供免费的会计软件。它的对应版本则面向个人用户。

- Expensify 与 Hubdoc 的比较该公司专门从事簿记文档采集。它的竞争对手是一款个人理财工具。

- Expensify 与 QuickBooks 的比较这是知名的企业会计软件。它的替代版本则是为个人理财而设计的。

- Expensify 与 AutoEntry 对比该软件旨在实现企业会计数据录入的自动化。它的替代产品是一款个人理财工具。

- Expensify 与 FreshBooks 的比较这是面向自由职业者和小企业的会计软件。它的替代版本则用于个人理财。

- Expensify 与 NetSuite这是一个功能强大的企业管理套件,适用于大型企业。它的竞争对手是一款简单的个人理财应用。

常见问题解答

What key features should software for small businesses include?

Essential features are invoicing, expense tracking, bank reconciliation, and 报道 to manage business finances effectively.

Can accounting software help with automation?

Yes, many platforms offer automation for tasks like data entry, bank feeds, and payment reminders, saving time.

Is there free accounting software suitable for small businesses?

Some free options exist with basic features, but they may lack advanced capabilities or scalability for growing businesses.

How can AI-powered features benefit small business accounting?

AI can automate categorization, detect anomalies, and provide insights, improving accuracy and efficiency in financial management.

Which type of accounting software is best for my small business?

The best software depends on your specific business needs, size, and complexity. Consider features, integrations, and scalability.