思考如何处理你的 商业 钱?这真让人头疼!

许多企业主都难以追踪每一分钱的去向。

当您寻求帮助时,经常会想到两个大牌:Expensify 和 QuickBooks。

但哪一个才最适合呢? 你的 商业?

本指南将详细介绍 Expensify 和 QuickBooks 的功能,以便您选择最适合自己的产品。

概述

我们花了不少时间研究Expensify和QuickBooks。

对他们进行全面测试,看看他们如何处理实际业务。 会计.

这次实际测试让我们清楚地了解了它们的优势和劣势,从而进行了详细的比较。

加入超过 1500 万用户的行列,信赖 Expensify 简化您的财务管理。节省高达 83% 的费用报告时间。

定价: 它提供免费试用。高级套餐起价为每月 5 美元。

主要特点:

- SmartScan 收据采集

- 公司信用卡对账

- 高级审批工作流程。

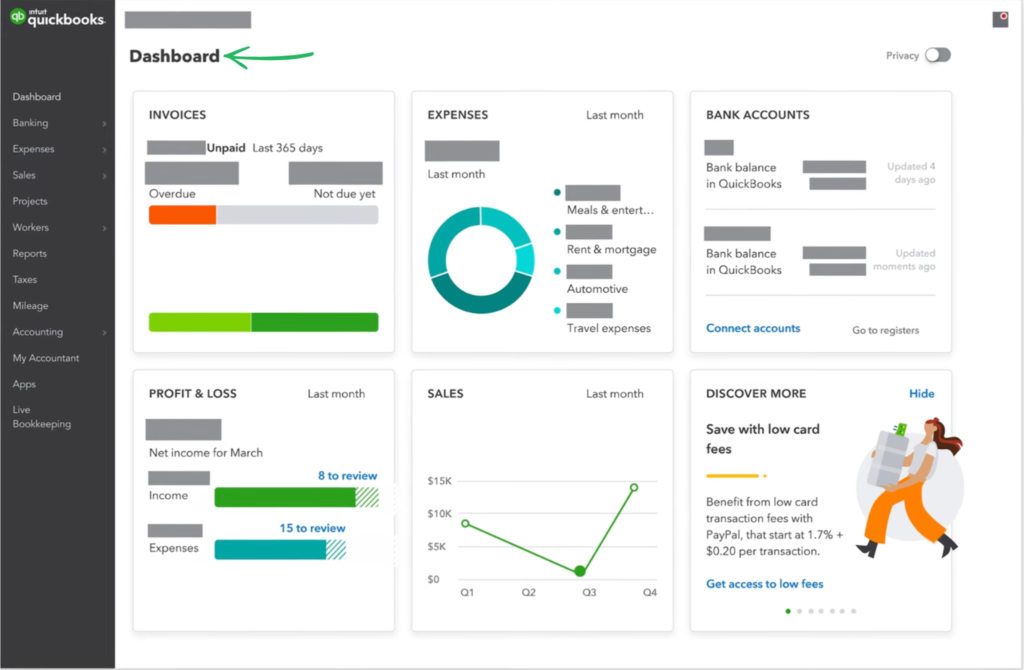

QuickBooks是什么?

QuickBooks是一款非常受欢迎的软件。 会计 工具。

它可以帮助企业,尤其是小型企业,管理资金。

把它想象成你的财务记事本。

此外,还可以探索我们最喜欢的 QuickBooks的替代方案…

主要优势

- 自动交易分类

- 发票创建和跟踪

- 费用管理

- 薪资服务

- 报告和仪表盘

定价

- 简单入门: 每月1.90美元。

- 基本的: 每月 2.80 美元。

- 加: 每月4美元。

- 先进的: 每月7.60美元。

优点

缺点

Expensify是什么?

Expensify 的宗旨就是让费用追踪变得轻松简单。

它尤其适用于人们经常消费的商家,例如…… 旅行 或项目成本。

你只需拍下收据的照片,Expensify 就会处理剩下的事情。

此外,还可以探索我们最喜欢的 昂贵的替代方案…

主要优势

- SmartScan 技术能够扫描收据详情并以超过 95% 的准确率提取出来。

- 员工通常只需一个工作日即可通过 ACH 转账获得报销。

- Expensify 卡的现金返还计划可以帮你节省高达 50% 的订阅费用。

- 不提供任何担保;其条款规定责任有限。

定价

- 收集: 每月5美元。

- 控制: 定制定价。

优点

缺点

功能对比

对于个体经营者和中型企业而言,选择合适的金融平台至关重要。

此对比使用了Expensify和QuickBooks的评论,以突出专用费用管理方面的差异。 自动化 Expensify 和 Intuit QuickBooks 的全功能会计系统。

1. 核心功能和重点

- Expensify 是一款专门帮助公司管理费用并简化报销流程的工具。它的主要功能是为员工和承包商提供费用报告和快速审批工作流程。

- QuickBooks 提供全套服务 会计 用于维护企业财务的系统。其主要功能包括会计科目表、对账、销售和供应商管理、缴税以及生成财务报告。

2. 费用采集和自动化

- Expensify 让费用记录变得极其快捷。用户只需将Expensify应用程序放在口袋里,即可选择并拍摄收据照片,然后…… 数据 提取过程只需几秒钟,即可提交审批。

- QuickBooks 它能自动导入银行交易记录并关联信用卡数据,从而帮助用户节省时间。它还具备收据扫描功能,并提供便捷的里程记录和资金追踪工具,方便用户进行报税。

3. 费用报告和报销

- Expensify 管理端到端的费用报销流程。雇主可以设置政策并立即批准申请。该平台非常适合快速处理直接存入用户银行账户的报销款项。

- QuickBooks 处理费用 报道 但它已集成到更广泛的应付账款系统中。它需要仔细设置,以确保费用在作为账单支付或与 QuickBooks Payroll 关联以用于员工福利之前,已正确编码。

4. 定价和平台

- Expensify 它采用灵活的定价结构,通常根据每月用户或团队规模而定。它提供Expensify卡,可节省费用并实现自动付款。该界面可通过网页和移动设备访问。

- QuickBooks定价采用阶梯式,且通常较高,这反映了全方位服务的复杂性。 簿记它提供基于云的在线版本(方便的在线访问)和 QuickBooks Desktop(本地存储在您计算机上的桌面数据)。

5. 专业金融工具

- Expensify 该软件旨在管理项目费用和企业支出。它包含使用标签和类别对交易进行编码的功能,以满足复杂的组织需求。用户可以快速将数据导出到 QuickBooks。

- QuickBooks QuickBooks Time 提供深入的业务数据跟踪、采购订单管理、销售税计算和员工工时跟踪功能。它还提供强大的财务报告,例如资产负债表,这对战略管理至关重要。

6. 安全与合规

- Expensify 产品采用强大的安全机制和实时策略检查来保护公司资金。如果用户执行的操作可能触发此限制或被怀疑是恶意操作,则用户有时会被阻止,并被强制执行相关操作以消除触发因素。

- 直觉 QuickBooks 数十年来,它一直深受用户信赖,用于保护敏感的商业财务信息。它的设计旨在确保税务申报的准确性和合规性,并为会计师提供可靠的报告。

7. 用户界面和易用性

- Expensify 的 用户界面简洁、快速,设计上力求减少交互操作。这使得即使对于少量用户或新加入的团队成员来说,填写费用报销单的整个过程也简单直观。

- QuickBooks 由于服务范围广、会计科目表复杂,QuickBooks 的初始学习曲线较为陡峭。然而,一旦掌握,QuickBooks 可以帮助用户保持清晰的组织结构并简化复杂的工作流程。

8. 多用户和管理

- Expensify Expensify允许多个用户提交和审批报告,从而为雇主创建一个可控且负责的支出管理系统。Expensify通过减少解决报告所需的来回电话沟通,帮助节省时间。

- QuickBooks 提供可扩展的用户许可和基于角色的访问权限,允许多个用户和会计人员同时处理公司数据。这对于需要内部控制的中型企业至关重要。

9. 商业银行和支付

- QuickBooks 它提供 QuickBooks Checking 企业银行服务,并提供全面的支付服务,包括员工和承包商的直接存款。它帮助供应商快速准确地收到款项。对比

- 这 Expensify 该卡是一张可立即与应用程序集成的信用卡,可自动完成企业支付的费用核对流程。

选择会计软件时应该注意哪些方面?

以下是您在做出选择时需要考虑的关键因素:

- 易用性: 它是否易于学习和操作?

- 可扩展性: 它能随着你的业务发展而成长吗?

- 一体化: 它能与其他你使用的工具连接吗?

- 报道: 它是否能提供您所需的财务信息?

- 移动访问: 您能随时随地管理财务吗?

- 客户支持: 如果遇到困难,能否及时获得帮助?

- 安全: 它如何保护您的财务数据?

- 定价结构: 它是否透明且价格合理,符合您的需求?

- 具体特点: 它是否具备对贵行业至关重要的独特功能?

- 自动化: 它能实现多少自动化,从而节省时间和减少错误?

最终判决

仔细比较了 QuickBooks 和 Expensify 之后,我们认为最终选择哪一款,取决于您的主要需求。

如果您需要完整的会计服务,例如发票和工资单。

QuickBooks 是一款功能全面的会计系统,通常是最佳选择。

它简化了整个费用管理流程。

我们都广泛使用过这两款产品,所以请相信我们的见解,帮助您选择最适合您预算的工具。

QuickBooks 的功能可能更强大,但 Expensify 在其特定领域表现出色。

更多 QuickBooks 内容

- QuickBooks 与 Puzzle IO 对比这款软件专注于为初创企业提供人工智能驱动的财务规划。它的对应产品则面向个人理财。

- QuickBooks 与 Dext这是一个用于记录收据和发票的商业工具。另一个工具用于追踪个人支出。

- QuickBooks 与 Xero 的比较这是面向小型企业的热门在线会计软件。它的竞争对手是面向个人用户的。

- QuickBooks vs Synder该工具可将电子商务数据与会计软件同步。其替代版本则专注于个人理财。

- QuickBooks 与 Easy Month End 的比较这是一个用于简化月末工作的商业工具。它的竞争对手是用于管理个人财务的工具。

- QuickBooks 与 Docyt一个应用人工智能进行企业记账和自动化,另一个应用则将人工智能用作个人理财助手。

- QuickBooks 与 Sage这是一个功能全面的企业会计软件。它的竞争对手是一款更易于使用的个人理财工具。

- QuickBooks 与 Zoho Books 的比较这是一个面向小型企业的在线会计工具。它的竞争对手是面向个人用户的。

- QuickBooks 与 Wave 的比较这款软件为小型企业提供免费的会计软件。它的对应版本则面向个人用户。

- QuickBooks 与 Quicken两者都是个人理财工具,但这款工具提供更深入的投资追踪功能,另一款则更简单易用。

- QuickBooks 与 Hubdoc该公司专门从事簿记文档采集。它的竞争对手是一款个人理财工具。

- QuickBooks 与 Expensify 的比较这是一个企业费用管理工具。另一个是用于个人费用跟踪和预算的工具。

- QuickBooks 与 AutoEntry 的比较该软件旨在实现企业会计数据录入的自动化。它的替代产品是一款个人理财工具。

- QuickBooks 与 FreshBooks这是面向自由职业者和小企业的会计软件。它的替代版本则用于个人理财。

- QuickBooks 与 NetSuite这是一个功能强大的企业管理套件,适用于大型企业。它的竞争对手是一款简单的个人理财应用。

Expensify 的更多内容

- Expensify 与 Puzzle这款软件专注于为初创企业提供人工智能驱动的财务规划。它的对应产品则面向个人理财。

- Expensify 与 Dext这是一个用于记录收据和发票的商业工具。另一个工具用于追踪个人支出。

- Expensify 与 Xero 的比较这是面向小型企业的热门在线会计软件。它的竞争对手是面向个人用户的。

- Expensify 与 Synder该工具可将电子商务数据与会计软件同步。其替代版本则专注于个人理财。

- Expensify 与 Easy Month End 对比这是一个用于简化月末工作的商业工具。它的竞争对手是用于管理个人财务的工具。

- Expensify 与 Docyt一个应用人工智能进行企业记账和自动化,另一个应用则将人工智能用作个人理财助手。

- Expensify 与 Sage 的比较这是一个功能全面的企业会计软件。它的竞争对手是一款更易于使用的个人理财工具。

- Expensify 与 Zoho Books 的比较这是一个面向小型企业的在线会计工具。它的竞争对手是面向个人用户的。

- Expensify 与 Wave 的比较这款软件为小型企业提供免费的会计软件。它的对应版本则面向个人用户。

- Expensify 与 Hubdoc 的比较该公司专门从事簿记文档采集。它的竞争对手是一款个人理财工具。

- Expensify 与 QuickBooks 的比较这是知名的企业会计软件。它的替代版本则是为个人理财而设计的。

- Expensify 与 AutoEntry 对比该软件旨在实现企业会计数据录入的自动化。它的替代产品是一款个人理财工具。

- Expensify 与 FreshBooks 的比较这是面向自由职业者和小企业的会计软件。它的替代版本则用于个人理财。

- Expensify 与 NetSuite这是一个功能强大的企业管理套件,适用于大型企业。它的竞争对手是一款简单的个人理财应用。

常见问题解答

我可以同时使用Expensify和QuickBooks吗?

是的,Expensify 和 QuickBooks 提供无缝集成。这使得费用数据可以直接导入您的会计系统,帮助您节省时间并减少财务管理中的错误。

对于小型企业来说,Expensify 和 QuickBooks 哪个更好?

这取决于您的业务需求。Expensify 是一款优秀的专业费用管理解决方案,可用于跟踪支出和报销。QuickBooks 是一款功能全面的会计软件,涵盖更广泛的财务任务。

Expensify 是否跟踪可计费和不可计费的费用?

是的,Expensify 允许您对可计费和不可计费费用进行分类。此功能可帮助您准确地将成本分配给客户或项目。

QuickBooks还提供哪些费用跟踪功能?

QuickBooks还提供强大的费用跟踪功能,包括收据采集、分类以及关联信用卡交易。它已集成到其更广泛的财务管理工具中。

我应该何时使用 QuickBooks Online,何时使用 Expensify?

使用 QuickBooks Expensify 提供全面的在线会计、发票和工资管理服务。如果您主要关注简化费用管理流程和员工报销,Expensify 是您的理想之选。