Is your current accounting software causing headaches instead of simplifying things?

Xero is popular, but it might not be the perfect match for your business needs or budget.

You deserve software that makes managing money easier, not harder!

Guess what? There are awesome options out there!

This article reveals the 9 best Xero alternatives for 2025.

Read on to find an accounting solution that truly fits your business and helps it grow.

What are the Best Xero Alternatives?

Choosing the right accounting software is a big deal.

We know you want something that truly works for your business.

We’ve dug deep to find the top options out there.

Here’s our ranked list of the best Xero alternatives to help you make a smart choice.

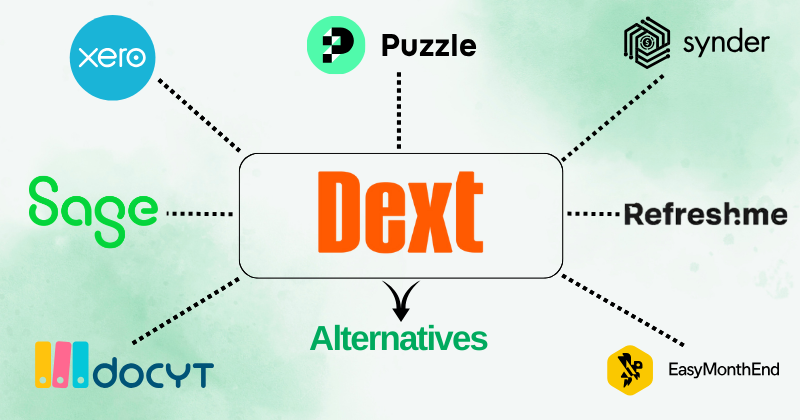

1. Dext (⭐4.8)

Dext is another good tool for your financial tasks.

It helps you get your documents and data in order. It’s a solid solution for expense tracking and getting things ready for your accountant.

It works well with other accounting software, which is a big plus.

It’s really efficient for managing all your business finances.

Unlock its potential with our Dext tutorial.

Also, explore our Xero vs Dext comparison!

Bizim Görüşümüz

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Temel Faydalar

Dext, gider yönetimini kolaylaştırma konusunda gerçekten başarılı.

- Kullanıcıların 'ı kağıt karmaşasında önemli bir azalma olduğunu bildiriyor.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Gider raporları oluşturmak inanılmaz derecede hızlı ve kolay hale geliyor.

- QuickBooks ve Xero gibi popüler muhasebe platformlarıyla sorunsuz bir şekilde entegre olur.

- Önemli finansal belgelerinizi asla kaybetmemenizi sağlar.

Fiyatlandırma

- Annually Subscription: $24

Artıları

Eksileri

2. Puzzle IO (⭐4.5)

Puzzle is a great choice for your business finances.

It’s intuitive accounting software that helps with all your accounting tasks. It even handles cash flow and tax calculations.

Plus, it can automate tax calculations, which is a huge help.

It really makes managing your business expenses simple.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our Xero vs Puzzle IO comparison!

Bizim Görüşümüz

Finansal işlerinizi basitleştirmeye hazır mısınız? Puzzle io'nun size ayda 20 saate kadar nasıl tasarruf sağlayabileceğini görün. Farkı bugün deneyimleyin!

Temel Faydalar

Puzzle IO, işinizin nereye gittiğini anlamanıza yardımcı olmak konusunda gerçekten öne çıkıyor.

- 92% of users report better financial forecasting accuracy.

- Nakit akışınıza ilişkin gerçek zamanlı bilgiler edinin.

- Farklı finansal senaryoları kolayca planlayın.

- Finansal hedefleriniz konusunda ekibinizle kusursuz bir şekilde iş birliği yapın.

- Temel performans göstergelerini (KPI'lar) tek bir yerde takip edin.

Fiyatlandırma

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Artıları

Eksileri

3. Synder (⭐4.0)

Synder is focused on bank payments and syncing transactions.

It makes sure everything is recorded correctly.

It’s a great tool if you want to automate financial tasks and save time.

It works to make your financial management smoother.

Synder eğitimimiz ile potansiyelini ortaya çıkarın.

Also, explore our Xero ve Sinder comparison!

Bizim Görüşümüz

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Temel Faydalar

- Otomatik satış verisi senkronizasyonu

- Çok kanallı satış takibi

- Ödeme mutabakatı

- Envanter yönetimi entegrasyonu

- Ayrıntılı satış raporlaması

Fiyatlandırma

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Artıları

Eksileri

4. Easy Month End (⭐3.8)

Easy Month End is designed to simplify your month-end accounting tasks.

It helps you with financial tasks and makes sure everything is in order.

It’s all about making the end-of-the-month process easy and painless.

It’s a good choice for keeping your business finances on track.

Unlock its potential with our Easy Month End tutorial.

Also, explore our Xero ve Kolay Ay Sonu Karşılaştırması comparison!

Bizim Görüşümüz

Kolay Ay Sonu ile finansal doğruluğu artırın. Otomatik mutabakat ve denetime hazır raporlamadan yararlanın. Ay sonu sürecinizi kolaylaştırmak için kişiselleştirilmiş bir demo planlayın.

Temel Faydalar

- Otomatik mutabakat iş akışları

- Görev yönetimi ve takibi

- Varyans analizi

- Belge yönetimi

- İşbirliği araçları

Fiyatlandırma

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Artıları

Eksileri

5. Sage (⭐3.6)

Sage is a well-known name in the accounting world.

It’s a powerful tool that helps with many business expenses.

It can handle a lot, from managing your cash flow to doing tax calculations.

It’s a strong option for bigger businesses that need a comprehensive system.

It also connects with other accounting software.

Unlock its potential with our Sage tutorial.

Also, explore our Xero ve Sage comparison!

Bizim Görüşümüz

Finansmanınızı güçlendirmeye hazır mısınız? Sage kullanıcıları, ortalama daha yüksek verimlilik ve daha hızlı işlem döngüsü süresi bildirdi.

Temel Faydalar

- Otomatik faturalandırma ve ödemeler

- Gerçek zamanlı finansal raporlar

- Verileri korumak için güçlü güvenlik

- Diğer iş araçlarıyla entegrasyon

- Bordro ve İK çözümleri

Fiyatlandırma

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Artıları

Eksileri

6. RefreshMe (⭐3.4)

RefreshMe helps you keep your books clean.

It works to spot and fix mistakes in your financial tasks.

This tool can save you from a lot of headaches and make sure your data is accurate.

It’s a handy addition to your accounting routine.

Unlock its potential with our Refreshme tutorial.

Also, explore our Xero vs Refreshme comparison!

Bizim Görüşümüz

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Temel Faydalar

- Gerçek zamanlı finansal gösterge panelleri

- Yapay zeka destekli anomali tespiti

- Özelleştirilebilir raporlama

- Nakit akışı tahmini

- Performans kıyaslaması

Fiyatlandırma

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Artıları

Eksileri

7. FreshBooks (⭐3.2)

FreshBooks is popular with freelancers and small businesses.

It’s very user-friendly and great for sending recurring invoices and managing business finances.

It makes it easy to track expenses and get paid.

It’s a simple and effective tool for basic accounting tasks.

Unlock its potential with our FreshBooks tutorial.

Also, explore our Xero ve FreshBooks Karşılaştırması comparison!

Bizim Görüşümüz

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Temel Faydalar

- Profesyonel fatura oluşturma

- Otomatik ödeme hatırlatıcıları

- Zaman takibi

- Proje yönetimi araçları

- Gider takibi

Fiyatlandırma

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Artıları

Eksileri

8. Docyt (⭐3.0)

Docyt uses AI to help with your accounting tasks.

It can read and organize documents for you, which helps with expense tracking.

It helps you automate tax calculations and keep your business expenses organized.

It’s a modern tool for handling your business finances.

Unlock its potential with our Docyt tutorial.

Also, explore our Xero ve Docyt comparison!

Temel Faydalar

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

Fiyatlandırma

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Artıları

Eksileri

9. QuickBooks (⭐2.8)

QuickBooks is one of the most used accounting software options.

It’s a complete package for all your business finances.

It helps you manage bank accounts, track cash flow, and handle a lot of accounting tasks.

It’s a powerful tool, but it can be more complex than some others.

It’s great for creating custom reports and handling recurring invoices.

Unlock its potential with our QuickBooks tutorial.

Also, explore our Xero ve QuickBooks karşılaştırması comparison!

Temel Faydalar

- Otomatik işlem kategorizasyonu

- Fatura oluşturma ve takibi

- Gider yönetimi

- Bordro hizmetleri

- Raporlama ve gösterge panelleri

Fiyatlandırma

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Artıları

Eksileri

Alıcı Rehberi

Here is a list of the steps of how we conducted our research to help small business owners make informed decisions:

- Initial Search and Identification: We started by searching for “Xero alternatives” to find the most popular cloud based accounting software options. We looked for financial tools that offered key functionalities for financial management, such as the ability to track income, track payments, and import expenses.

- Detailed Feature Analysis: For each product, we dug into the specific accounting tools it offered. We looked for professional invoices, personalized invoices, and simple invoicing features. We also examined if they had time tracking and mileage tracking, and if they could send invoices and automated payment reminders. For deeper insights into a business’s financial health, we checked for financial reporting, detailed reports, and the ability to generate reports and create custom reports. We also considered essential features like multi currency transactions and bank reconciliation.

- Pricing and Value Assessment: We carefully analyzed the pricing of each product. This included looking for a free plan or professional plan and evaluating the value of the features offered at each price point. We looked for competitive pricing and whether the software could help small business owners save money and save time. We also noted if there were extra costs for add-ons like project management or specific app integrations.

- Usability and User Experience Review: We evaluated the user interface of each software. We looked for an easy to use interface and an intuitive interface to determine if the software had a manageable learning curve. We considered how user-friendly the experience was, especially for everyday tasks like bank feeds, bank transactions, and customizing settings.

- Strengths and Weaknesses Evaluation: We compiled a list of pros and cons for each product. This included noting standout strengths like powerful workflow automation and cash flow management, as well as any negatives, such as missing payroll integration or a lack of robust app integrations like other zoho apps or zoho crm. We also looked for how each tool handles tax filings, tax deductions, and tax time to ensure a comprehensive solution for business finances.

- Integration and Workflow Automation: We specifically researched how each platform handles app integrations, payment gateways, and custom workflows. This was crucial to understand how well the software can fit into an existing business operation and support a complete financial health picture.

Özet

Finding the right accounting tools is a big step for your business.

Our guide helps you understand the key features of Xero alternatives.

We show you what to look for, from pricing to support.

We cover things like time tracking features and how to create invoices easily.

We did the hard work to research the best options for you.

This means you can trust our advice.

Our goal is to help you pick the right app for online invoicing and managing your financial performance.

You’ll be able to handle payment processing and spend less time tracking time.

Sıkça Sorulan Sorular

What are the main Xero alternatives for small businesses?

Many options exist for small businesses. Top choices include QuickBooks, Zoho Books, and FreshBooks. Wave is also popular for its free core features. These tools offer similar accounting features but with different price points and strengths for various business needs.

Is there a free alternative to Xero?

Yes, Wave is a popular alternative to Xero that offers free accounting, invoicing, and receipt tracking. While it has paid add-ons like payroll, its core features are completely free. This makes it ideal for freelancers and very small businesses on a tight budget.

Which Xero alternative is best for inventory management?

If inventory is key, QuickBooks and Sage are strong options. NetSuite also offers very advanced inventory features. While Xero has some inventory tools, these alternatives often provide more detailed tracking and management for businesses with complex stock needs.

Can I easily switch from Xero to another accounting software?

Yes, most accounting software allows data import. You can usually export your data from Xero and import it into a new platform like QuickBooks or Zoho Books. It might take some effort, but it’s a common process. Consulting an accountant can help make the switch smooth.

Are industry-specific accounting features available in Xero alternatives?

Absolutely. Many Xero alternatives offer or integrate with solutions that have industry-specific features. For example, FreshBooks is great for service-based businesses, while NetSuite is highly customizable for various complex industries. Some also connect with specialized tools for specific sectors.