Tired of spending too much time on бухгалтерский учет?

Это может казаться бесконечной рутиной, не правда ли?

Imagine if there were a way to делать it faster and easier.

Two popular options are Dext and Synder.

But which one is the better fit for you in 2025?

This article will break down Dext vs Synder.

Обзор

We looked closely at both Dext and Synder.

Мы протестировали их, чтобы посмотреть, как они работают.

Это помогло нам провести справедливое сравнение.

Теперь мы можем показать вам, на что способен каждый из них.

Готовы сэкономить более 10 часов в месяц? Узнайте, как Dext автоматизирует ввод данных, отслеживание расходов и оптимизирует ваши финансы.

Цены: Доступен бесплатный пробный период. Премиум-план стоит от 24 долларов в месяц.

Основные характеристики:

- Сканирование чеков

- Отчеты о расходах

- Сверка банковских счетов

Synder автоматизирует ваш бухгалтерский учет, обеспечивая бесшовную синхронизацию данных о продажах с QuickBooks, Xero и другими программами. Ознакомьтесь с ним уже сегодня!

Цены: Доступен бесплатный пробный период. Премиум-план начинается от 52 долларов в месяц.

Основные характеристики:

- Синхронизация многоканальных продаж

- Автоматическая сверка

- Подробная отчетность

Что такое Dext?

Итак, что же такое Dext?

Воспринимайте это как суперумного помощника для ваших работ.

В основном, это касается таких вещей, как счета и квитанции.

Вы просто делаете снимок, и Декст получает всю важную информацию.

Раскройте его потенциал с помощью нашего Альтернативы Дексту…

Наше мнение

Готовы сэкономить более 10 часов в месяц? Узнайте, как автоматизированный ввод данных, отслеживание расходов и отчетность Dext могут оптимизировать ваши финансы.

Основные преимущества

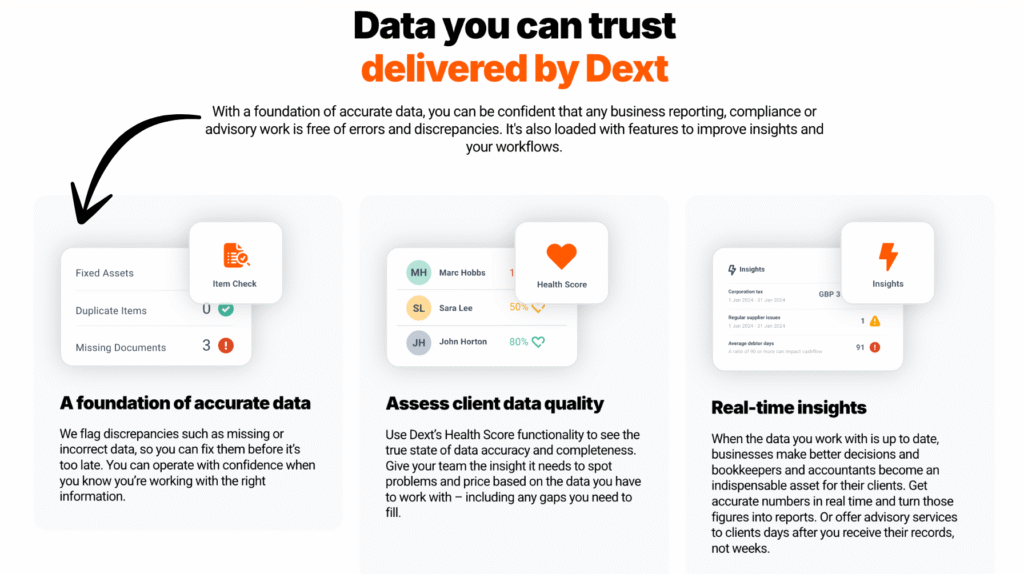

Dext действительно превосходно справляется с задачей упрощения управления расходами.

- 90% пользователей отмечают значительное уменьшение количества бумажных документов.

- Его точность превышает 98%. при извлечении данных из документов.

- Создание отчетов о расходах становится невероятно быстрым и простым.

- Беспроблемно интегрируется с популярными бухгалтерскими платформами, такими как QuickBooks и Xero.

- Помогает гарантировать, что вы никогда не потеряете важные финансовые документы.

Цены

- Годовая подписка: $24

Плюсы

Минусы

Что такое Снайдер?

Давайте поговорим о Снайдере.

Это инструмент, который помогает вам в различных ситуациях. бизнес Приложения взаимодействуют друг с другом.

Представьте это как помощника, который перемещает вашу финансовую информацию туда, куда нужно.

Это может сэкономить вам много времени.

Раскройте его потенциал с помощью нашего альтернативы Снайдеру…

Наше мнение

Synder автоматизирует ваш бухгалтерский учет, обеспечивая бесшовную синхронизацию данных о продажах с QuickBooks. Ксерои многое другое. Компании, использующие Synder, сообщают об экономии в среднем более 10 часов в неделю.

Основные преимущества

- Автоматическая синхронизация данных о продажах

- Отслеживание продаж по нескольким каналам

- Сверка платежей

- Интеграция системы управления запасами

- Подробная отчетность о продажах

Цены

Все планы будут Оплата производится ежегодно..

- Базовый: 52 доллара в месяц.

- Существенный: 92 доллара в месяц.

- Плюсы: 220 долларов в месяц.

- Премиум: Индивидуальное ценообразование.

Плюсы

Минусы

Сравнение характеристик

We compare Dext and Synder, two powerful автоматизация инструменты.

Focusing on how each streamlines бухгалтерский учет and bookkeeping workflows to save small business owners time and ensure secure data flow into their accounting systems.

Both platforms aim to reduce the manual entry of financial documents, but they have different areas of expertise and feature sets.

1. Primary Workflow Focus

- Декст (formerly Receipt Bank) concentrates on the effortless данные extraction and management of expenditure documents.

- Its core function is to allow users to quickly capture receipts, bills, and invoices using the dext mobile app or email, automating data entry for expenses.

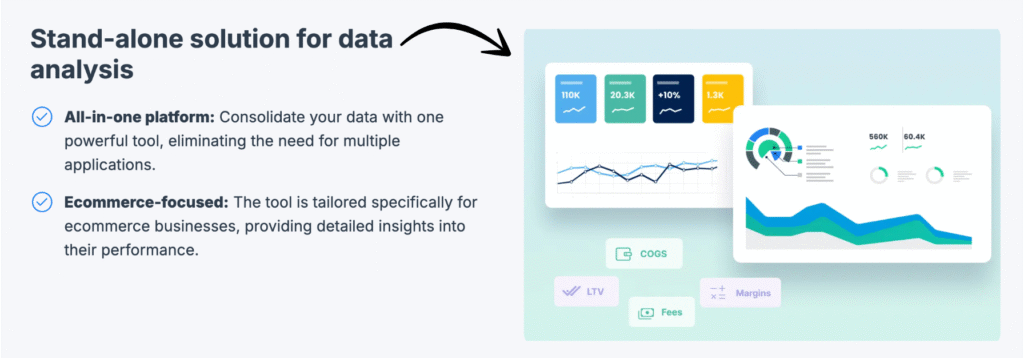

- Снайдер specializes in automated бухгалтерский учет for multi-channel sales, focusing on syncing all your cost and sales data from all your sales channels like Shopify and Stripe.

2. Document/Transaction Submission Methods

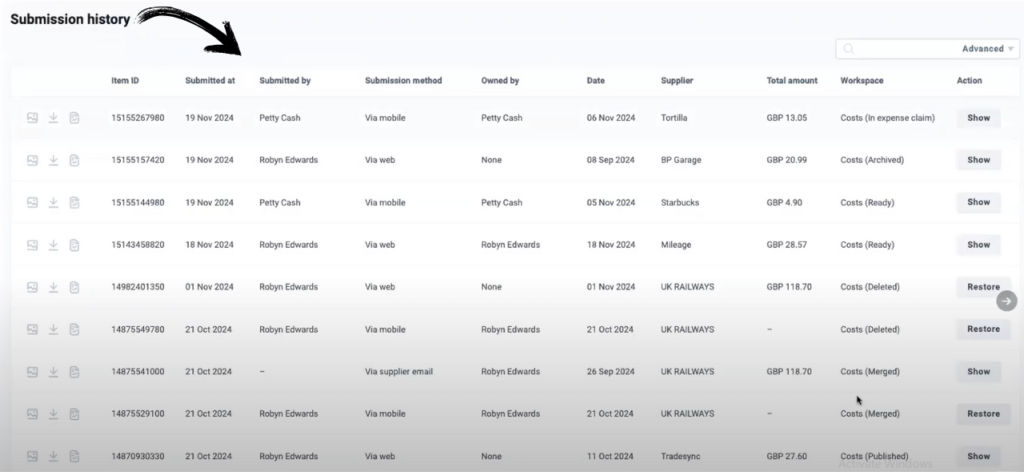

- Декст offers multiple ways for users to submit receipts and financial documents, including the dext mobile app for mobile scanning, email submission, and bank feeds. This simplifies data collection.

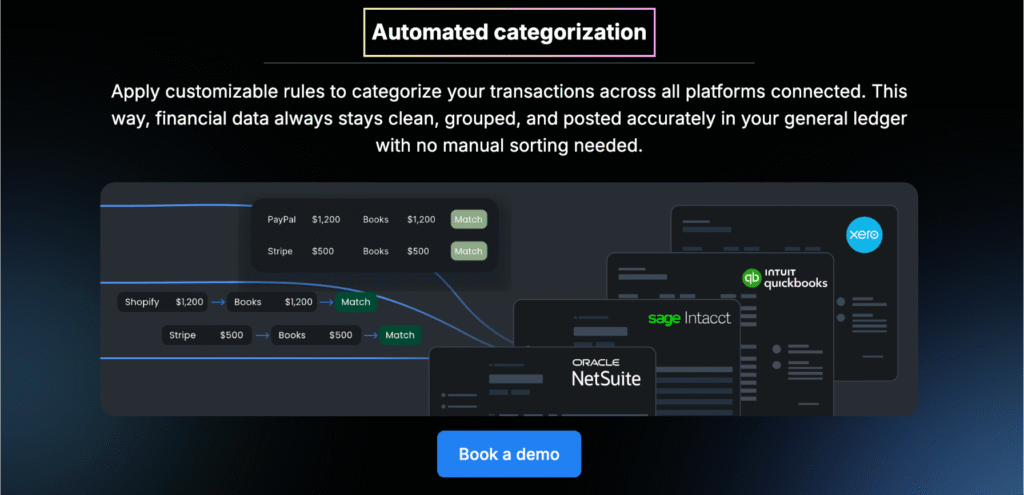

- Synder’s primary method is deep integration with e-commerce platforms and payment processors like PayPal and Square to import and categorize historical transactions and current sales data automatically.

3. Data Extraction Technology

- Dext utilizes advanced optical character recognition (OCR technology) to accurately extract data from photos of receipts, invoices, and other documents, eliminating the need for manual entry.

- Synder focuses on accurately importing and structuring complex multi-channel sales data, including fees, refunds, and discounts, which is a structured API-driven process.

4. E-commerce and Sales Data Handling

- Synder’s key strength lies in its ability to manage high-volume multi-channel sales transactions and ensure GAAP compliance for areas like revenue recognition. It helps get your books balanced by recording granular detail from platforms like Etsy and eBay.

- Декст Commerce also addresses e-commerce, but Synder is more holistically built around the intricate cost and sales data workflow of online retailers.

5. Automated Categorization and Rules

- Both offer automation to streamline бухгалтерский учет workflows. Dext allows the user to set up supplier rules to automatically assign tracking categories and tax details.

- Synder uses a smart sync mode and intelligent categorization for sales and expenses to map all transaction components (e.g., taxes, fees, shipping) correctly into the general ledger.

6. Expense Management and Tracking

- Dext is an award-winning expense management solution, making it easy for малый бизнес owners and their employees to manage expenses and submit receipts for expense claims in just a few minutes, removing hassle. It is ideal for quickly processing and storing evidence for tax details.

- Synder’s expense management is centered on the fees and expenses associated with e-commerce transactions and payment gateways, rather than general employee expense claims.

7. Core Accounting System Integration

- Both tools offer deep integration with major accounting packages like QuickBooks, Xero, and Мудрец Intacct, ensuring a secure data flow of financial information.

- Dext’s strength is seamlessly sending extracted purchase/expense data, while Synder’s strength is its ability to send structured, complex multi-currency sales data, including handling of refunds and payouts, ready for reconciliation.

8. System Dependability and Security

- Both providers emphasize use and system dependability with high-level encryption.

- Dext ensures document безопасность and cloud storage. While technical codes like a Cloudflare Ray ID or Cloudflare Ray ID found are part of a website’s security service against online attacks, both tools employ strong internal security, as a simple SQL command is not a security solution.

9. Цена и масштабируемость

- Both offer tiered pricing plans, often with a free trial today.

- Dext saves bookkeepers’ time by streamlining receipt capture and fetching invoices. Synder’s pricing, typically based on transaction volume, scales effectively for high volume e-commerce sellers needing precise revenue recognition.

10. Missing Document and Data Integrity

- Dext Prepare includes features to help a Dext account user identify missing receipts and chase for required documents. The platform is designed to catch malformed data during the data extraction phase.

- Synder’s focus on historical transactions and automatic multi-platform synchronization helps prevent missing sales data, making it easier for finance teams to resolve discrepancies and ensure accurate reports and balance sheets for бухгалтерский учет and taxes.

What to Look for When Choosing an Automated Accounting Tool?

Choosing the right automated бухгалтерский учет tool, such as Dext or Synder, requires evaluating its core capabilities, ease of use, and compatibility with your existing systems.

- Основные функции: Determine if the tool’s core strength aligns with your primary need. Dext’s strength is helping your accountant collect receipts and other documents, while Synder is best for syncing multi-channel ecommerce data from platforms like Clover to get a clean background of transactions.

- Ease of Use and Onboarding: Look for a solution where the setup is simple and not riddled with mistakes. The platform should be intuitive to use daily to minimize stress. You should feel glad that you chose to try Dext or its alternative.

- Интеграция и совместимость: Ensure the software is compatible with your main accounting system (like QuickBooks, Xero, or NetSuite) and payment processors. Check if the product can bring historical data correctly without causing issues.

- Data Capture Flexibility: The tool should offer several actions for data input, such as one-click submission, to easily store receipts and other purchase orders. Verify if it can process certain word patterns or rules.

- Автоматизация и организация рабочих процессов: The system should be able to process transactions and track expenses automatically. Look for evidence that critical actions are performed, triggered by new data rather than manual intervention.

- E-commerce Specifics: For online sellers, the tool must handle subscriptions, refunds, and platform fees accurately to reduce the need to manually resolve complex payout data.

- Поддержка и ресурсы: Customer support should be helpful. If you’re a site owner or an accountant managing multiple customers, reliable support is non-negotiable, even if the company’s roots are in a tech hub like San Francisco.

- Scalability and Commitment: Choose a tool that can grow with you. The process to switch from an old method or drop a confusing system should be straightforward. Get to the truth of its capabilities during the trial.

Key Insights (No Fluff):

- Dext works best as a pre-accounting tool to digitize expenses for your бухгалтеры.

- Synder excels at consolidating multi-channel ecommerce sales data before sending a summarized journal entry to your books.

- Do not be solely swayed by highlighted features; test for accurate, real-world reconciliation across all your sales channels.

- Verify the tool’s ability to correctly map taxes and fees from platforms like Clover.

Окончательный вердикт

So, we looked at both Dext and Synder.

They both do some cool things to help with business stuff.

If you deal with lots of papers like receipts, Dext is really good at that.

If you sell things online a lot, Synder has some neat tools just for that.

For many businesses, especially those selling online, Synder seems to have more to offer right now, with its strong e-commerce integration and sales workflow automation.

So we think our pick can help you make the right choice to save time and get your business numbers in order.

Больше от Dext

Мы также сравнили Dext с другими инструментами для управления расходами и бухгалтерского учета:

- Dext против Xero: Xero предлагает комплексные решения для бухгалтерского учета с интегрированными функциями управления расходами.

- Декст против Головоломка IO: Компания Puzzle IO преуспевает в предоставлении финансовых аналитических данных и прогнозировании на основе искусственного интеллекта..

- Декст против Снайдера: Компания Synder специализируется на синхронизации данных о продажах в электронной коммерции и обработке платежей.

- Dext против Easy в конце месяца: Easy Month End упрощает процедуру закрытия финансового месяца.

- Декст против Доцита: Docyt использует искусственный интеллект для автоматизации задач бухгалтерского учета и управления документами.

- Dext против RefreshMe: RefreshMe предоставляет информацию о финансовых показателях бизнеса в режиме реального времени.

- Лекст против Сейджа: Компания Sage предлагает широкий спектр бухгалтерских решений с возможностями отслеживания расходов.

- Dext против Zoho Books: Zoho Books предоставляет интегрированную систему бухгалтерского учета с функциями управления расходами.

- Dext против Wave: Wave предлагает бесплатное бухгалтерское программное обеспечение с базовыми функциями отслеживания расходов.

- Dext против Quicken: Quicken популярен для управления личными финансами и отслеживания основных деловых расходов.

- Dext против Hubdoc: Hubdoc специализируется на автоматизированном сборе документов и извлечении данных.

- Dext против Expensify: Expensify предлагает надежные решения для составления отчетов о расходах и управления ими.

- Dext против QuickBooks: QuickBooks — это широко используемая бухгалтерская программа с инструментами для управления расходами.

- Dext против AutoEntry: AutoEntry автоматизирует ввод данных из счетов-фактур, квитанций и банковских выписок.

- Dext против FreshBooks: FreshBooks предназначен для предприятий сферы услуг и включает в себя функции выставления счетов и отслеживания расходов.

- Dext против NetSuite: NetSuite предлагает комплексную ERP-систему с функциями управления расходами.

Ещё немного о Снайдере

- Synder vs Puzzle io: Puzzle.io — это инструмент бухгалтерского учета на основе искусственного интеллекта, созданный для стартапов, с упором на такие показатели, как темпы расходования средств и запас прочности. Synder же больше ориентирован на синхронизацию данных о продажах по нескольким каналам для более широкого круга предприятий.

- Снайдер против Декста: Dext — это инструмент автоматизации, который отлично подходит для сбора и управления данными из счетов и квитанций. Synder, с другой стороны, специализируется на автоматизации потока торговых операций.

- Снайдер против Ксеро: Xero — это полнофункциональная облачная платформа для бухгалтерского учета. Снайдер Она работает в паре с Xero для автоматизации ввода данных из каналов продаж, в то время как Xero выполняет все задачи бухгалтерского учета, такие как выставление счетов и составление отчетов.

- Снайдер против Easy Month End: Easy Month End — это инструмент, разработанный для того, чтобы помочь компаниям организовать и оптимизировать процесс закрытия месяца. Synder же больше ориентирован на автоматизацию ежедневного потока данных о транзакциях.

- Снайдер против Доцита: Docyt использует ИИ для широкого спектра бухгалтерских задач, включая оплату счетов и управление расходами. Synder же больше ориентирован на автоматическую синхронизацию данных о продажах и платежах из различных каналов.

- Снайдер против RefreshMe: RefreshMe — это приложение для управления личными финансами и задачами. Это не прямой конкурент, поскольку Synder — это инструмент автоматизации бухгалтерского учета для бизнеса.

- Снайдер против Сейджа: Sage — это давно существующая, комплексная система бухгалтерского учета с расширенными функциями, такими как управление запасами. Synder — это специализированный инструмент, который автоматизирует ввод данных в бухгалтерские системы, такие как Sage.

- Снайдер против Zoho Books: Zoho Books — это комплексное решение для ведения бухгалтерского учета. Снайдер Дополняет Zoho Books, автоматизируя процесс импорта данных о продажах с различных платформ электронной коммерции.

- Снайдер против Вейва: Wave — это бесплатное, удобное в использовании программное обеспечение для бухгалтерского учета, часто используемое фрилансерами и очень малыми предприятиями. Synder — это платный инструмент автоматизации, разработанный для предприятий с большим объемом продаж по нескольким каналам.

- Снайдер против Квикена: Quicken — это в первую очередь программное обеспечение для управления личными финансами, хотя оно также имеет некоторые функции для малого бизнеса. Synder же разработан специально для автоматизации бухгалтерского учета в бизнесе.

- Снайдер против Хабдока: Hubdoc — это инструмент для управления документами и сбора данных, похожий на Dext. Он ориентирован на оцифровку счетов и квитанций. Synder же специализируется на синхронизации данных о онлайн-продажах и платежах.

- Снайдер против Экспенсайфи: Expensify — это инструмент для управления отчетами о расходах и квитанциями. Synder предназначен для автоматизации обработки данных о продажах.

- Снайдер против Квикбукса: QuickBooks — это комплексное программное обеспечение для бухгалтерского учета. Снайдер Интегрируется с QuickBooks для автоматизации процесса импорта подробных данных о продажах, что делает его ценным дополнением, а не прямой альтернативой.

- Снайдер против АвтоВвода: AutoEntry — это инструмент автоматизации ввода данных, который собирает информацию из счетов-фактур, квитанций и чеков. Компания Synder специализируется на автоматизации данных о продажах и платежах с платформ электронной коммерции.

- Снайдер против Фрешбукс: FreshBooks — это бухгалтерское программное обеспечение, разработанное для фрилансеров и малых предприятий, предоставляющих услуги, с упором на выставление счетов. Synder предназначен для предприятий с большим объемом продаж через множество онлайн-каналов.

- Снайдер против NetSuite: NetSuite — это комплексная система планирования ресурсов предприятия (ERP). Synder — это специализированный инструмент, который синхронизирует данные электронной коммерции с более широкими платформами, такими как NetSuite.

Часто задаваемые вопросы

What is the main difference between Dext and Synder?

Dext is best for managing receipts and bills, as well as pulling key data for accounting. Synder focuses on automating sales data entry and syncing from e-commerce platforms and payment systems directly into your бухгалтерское программное обеспечение.

Which is better for e-commerce businesses, Dext or Synder?

Synder is generally better for e-commerce businesses. It offers direct integrations with platforms like Shopify and automates the syncing of sales, payments, and even inventory data, streamlining your workflow.

Can Dext or Synder integrate with QuickBooks Online (QBO)?

Yes, both Dext and Synder can integrate with QuickBooks Online (QBO). This allows for a smoother flow of financial data into your accounting system, reducing the need for manual data entry.

Is there a free trial available for Dext and Synder?

Yes, typically both Dext and Synder offer a free trial period. This lets you test their features and see which one best fits your business needs before committing to a paid plan.

Which tool is more suitable for an accounting firm?

Accounting firms often favor Dext due to its efficient handling of client paperwork like receipts and invoices. Synder can also be valuable for firms with e-commerce clients, simplifying their sales data management.